Synthetic Monitoring Market Report

Published Date: 31 January 2026 | Report Code: synthetic-monitoring

Synthetic Monitoring Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Synthetic Monitoring market from 2023 to 2033, including insights on market dynamics, size, trends, segmentation, and regional forecasts for strategic decision-making.

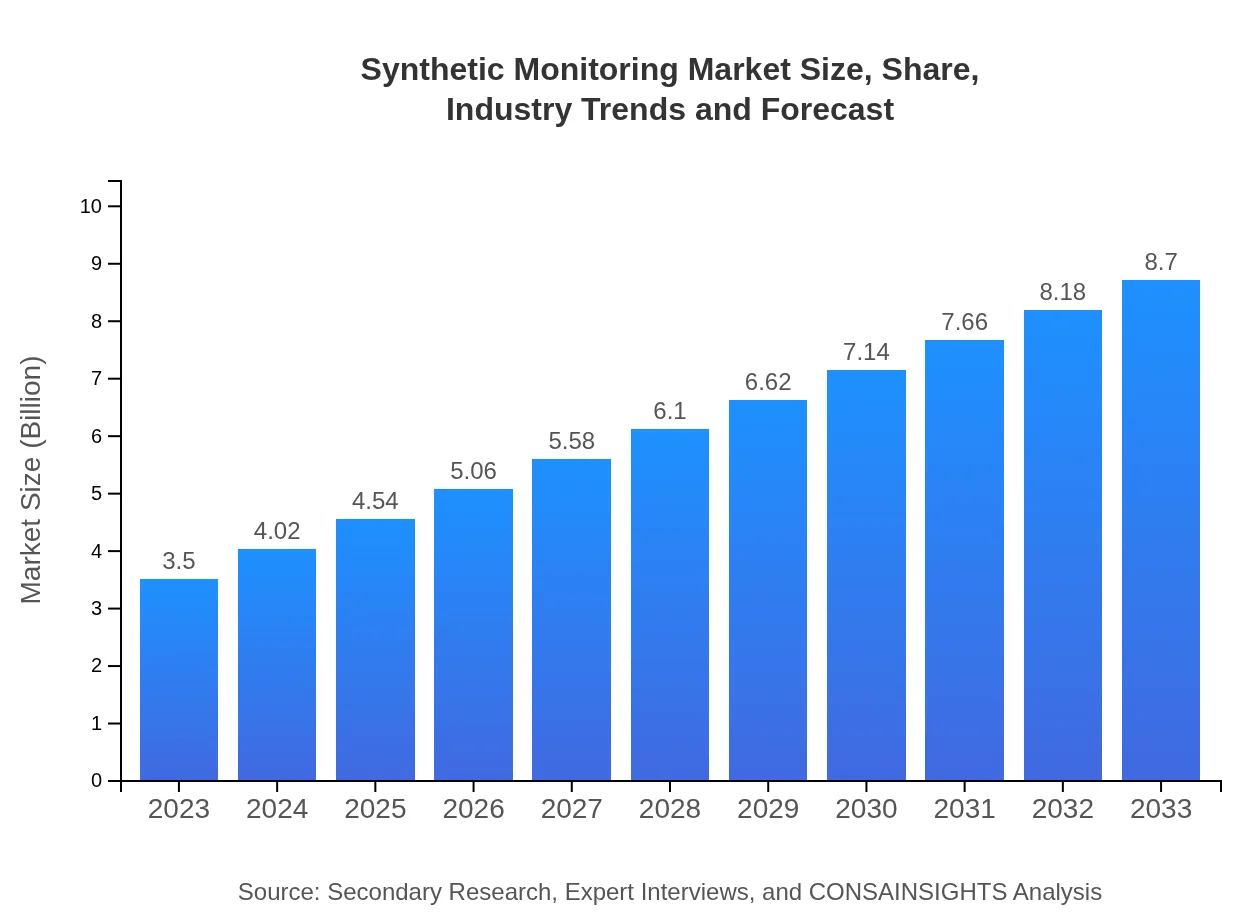

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $3.50 Billion |

| CAGR (2023-2033) | 9.2% |

| 2033 Market Size | $8.70 Billion |

| Top Companies | Dynatrace, New Relic, Broadcom (CA Technologies), Checkly |

| Last Modified Date | 31 January 2026 |

Synthetic Monitoring Market Overview

Customize Synthetic Monitoring Market Report market research report

- ✔ Get in-depth analysis of Synthetic Monitoring market size, growth, and forecasts.

- ✔ Understand Synthetic Monitoring's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Synthetic Monitoring

What is the Market Size & CAGR of Synthetic Monitoring market in 2023-2033?

Synthetic Monitoring Industry Analysis

Synthetic Monitoring Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Synthetic Monitoring Market Analysis Report by Region

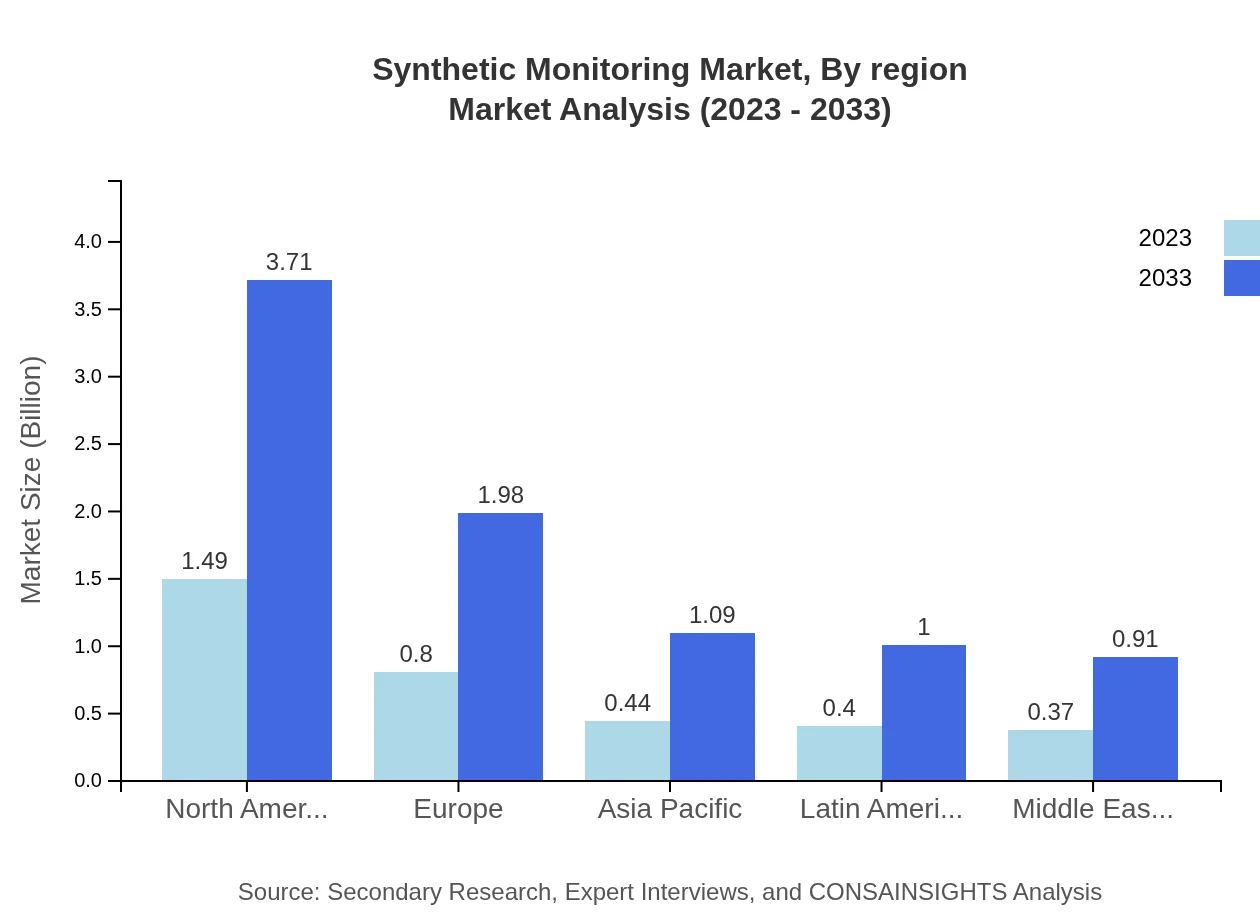

Europe Synthetic Monitoring Market Report:

In Europe, the market is anticipated to expand from $0.84 billion in 2023 to $2.09 billion by 2033. Growing regulatory requirements and increasing emphasis on cybersecurity and user experience are key drivers of demand. Additionally, the market is witnessing advancements in monitoring technologies, pushing organizations to adopt synthetic monitoring for compliance and performance improvement.Asia Pacific Synthetic Monitoring Market Report:

In the Asia Pacific region, the synthetic monitoring market is expected to grow from $0.73 billion in 2023 to $1.82 billion by 2033. Increasing mobile and internet penetration facilitates rapid adoption of digital platforms, pushing businesses to invest in monitoring solutions to enhance performance and user experience. Furthermore, rising awareness among organizations regarding the importance of application performance monitoring will further boost market growth in this region.North America Synthetic Monitoring Market Report:

North America holds the largest share of the synthetic monitoring market, valued at $1.24 billion in 2023 and expected to reach $3.08 billion by 2033. The region's advanced technology adoption and significant investments in IT and digital transformation initiatives are driving the demand for synthetic monitoring tools. Companies in the U.S. and Canada are at the forefront, leveraging these solutions for enhanced customer experience and operational efficiency.South America Synthetic Monitoring Market Report:

The South American market is projected to grow from $0.25 billion in 2023 to $0.61 billion by 2033. Factors contributing to this growth include the increasing digitalization of businesses and the nascent stage of e-commerce, which is prompting companies to implement monitoring solutions at an early stage. Investment in IT infrastructure improvements is expected to support the growth of synthetic monitoring in this region.Middle East & Africa Synthetic Monitoring Market Report:

The Middle East and Africa market is set to grow from $0.44 billion in 2023 to $1.09 billion by 2033. Rapid digital transformation across various sectors, including finance and retail, is prompting organizations to prioritize the implementation of monitoring solutions. Additionally, increasing investments in technological innovation and cloud adoption strategies contribute to the expansion of the synthetic monitoring market in this region.Tell us your focus area and get a customized research report.

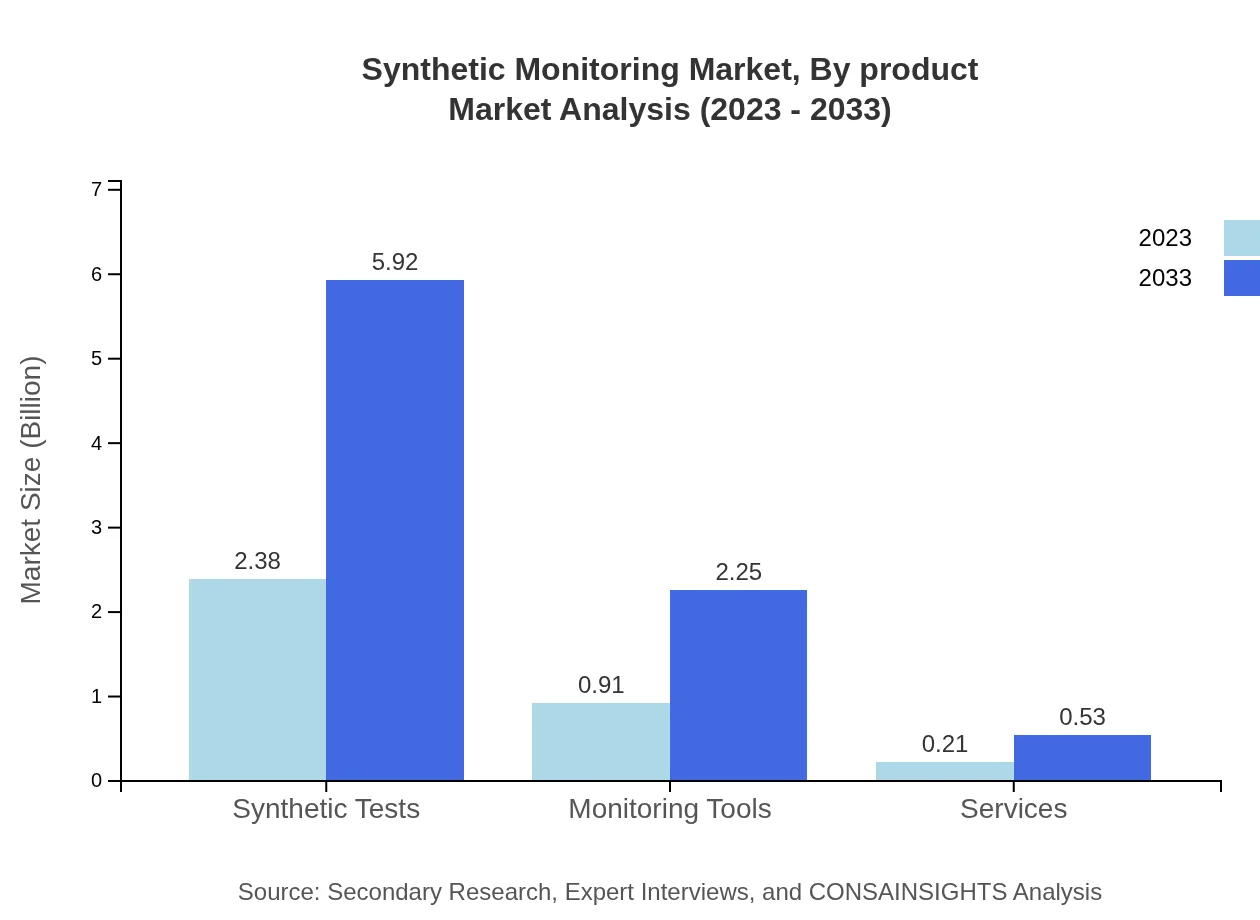

Synthetic Monitoring Market Analysis By Product

The product segments of the synthetic monitoring market include synthetic tests, monitoring tools, and services. Synthetic tests dominate the market with revenues expected to rise from $2.38 billion in 2023 to $5.92 billion by 2033, capturing 68.04% of the market share. Monitoring tools follow closely, projected to expand from $0.91 billion in 2023 to $2.25 billion by 2033, holding a 25.86% market share. Services account for a smaller segment, expected to rise from $0.21 billion to $0.53 billion during the same period, representing 6.1% market share.

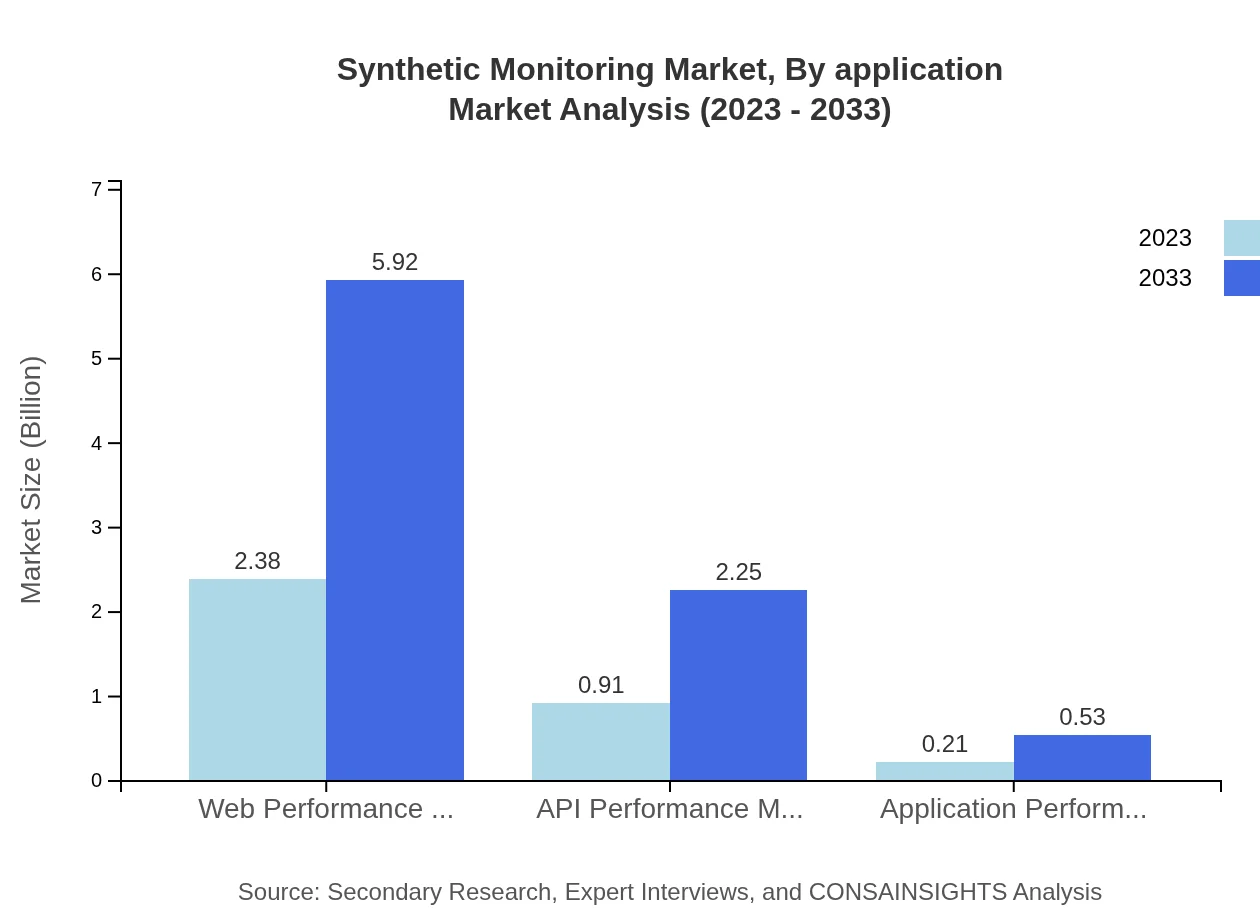

Synthetic Monitoring Market Analysis By Application

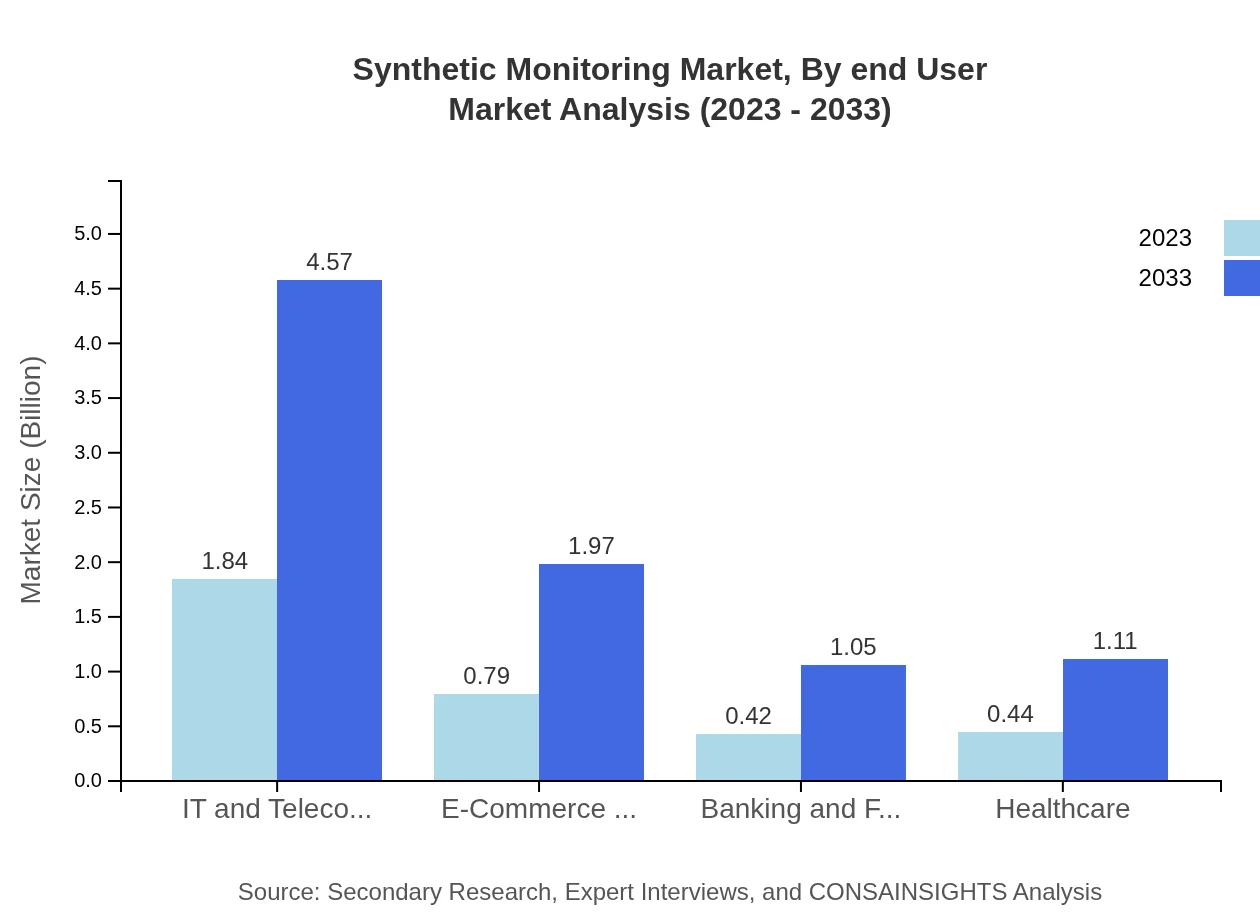

The major application segments for synthetic monitoring include IT and telecommunications, e-commerce, banking and financial services, healthcare, and web performance monitoring. IT and telecommunications is expected to record a revenue growth from $1.84 billion in 2023 to $4.57 billion by 2033, maintaining a 52.58% share. E-commerce is projected to grow from $0.79 billion to $1.97 billion, capturing 22.66% of the market, while the banking sector will grow from $0.42 billion to $1.05 billion, holding a 12.05% share.

Synthetic Monitoring Market Analysis By End User

In terms of end-user industries, the synthetic monitoring market extends across various sectors such as healthcare, finance, and e-commerce. The healthcare segment alone is projected to grow from $0.44 billion to $1.11 billion, reflecting a 12.71% market share, emphasizing the industry's focus on ensuring service availability. Moreover, the financial services sector shows strong growth prospects reflecting their critical need for reliable monitoring due to regulatory compliance mandates.

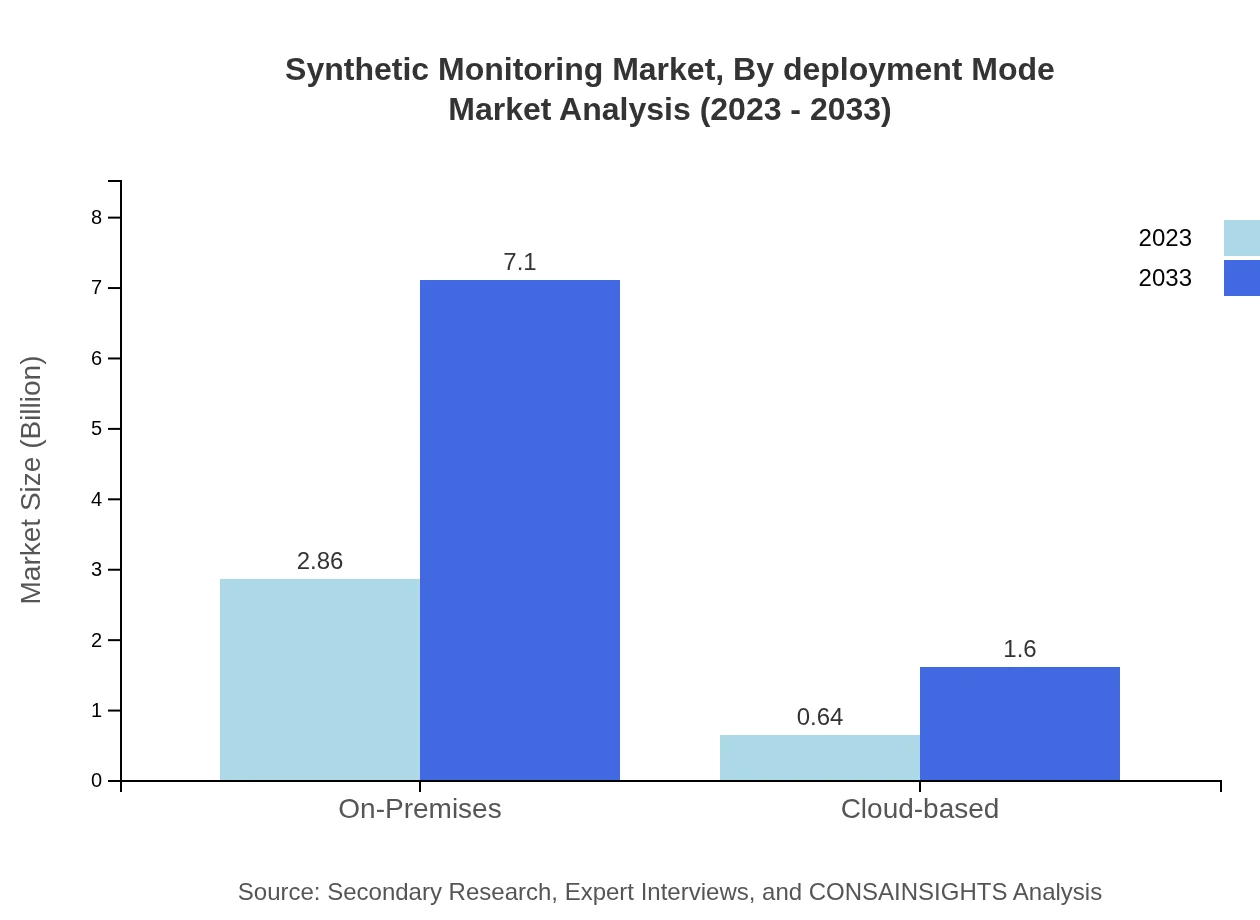

Synthetic Monitoring Market Analysis By Deployment Mode

The synthetic monitoring market is divided into on-premises and cloud-based deployment modes. The on-premises segment currently leads with a revenue expectation of $2.86 billion in 2023, forecasted to increase to $7.10 billion by 2033, capturing 81.65% market share. However, cloud-based solutions are gaining traction, expanding from $0.64 billion to $1.60 billion, representing an 18.35% share as organizations increasingly opt for flexibility and scalability.

Synthetic Monitoring Market Analysis By Region

The synthetic monitoring market is influenced by regional dynamics. North America leads with the largest market share, driven by advanced technology adoption and significant IT investments. Europe is also expanding rapidly due to regulatory pressure and cybersecurity concerns. The Asia Pacific region is witnessing the fastest growth due to the rise in digital services, while South America and the Middle East and Africa are emerging markets with significant growth potential as businesses prioritize digital infrastructure and performance monitoring solutions.

Synthetic Monitoring Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Synthetic Monitoring Industry

Dynatrace:

Dynatrace leads the synthetic monitoring industry with its powerful AI-driven monitoring solutions that provide real-time insights into application performance, enabling organizations to enhance user experience significantly.New Relic:

New Relic offers a comprehensive suite of monitoring solutions that include synthetic monitoring tools designed to help developers and IT teams ensure application performance across various environments.Broadcom (CA Technologies):

Broadcom provides sophisticated synthetic monitoring capabilities as part of its CA APM suite, empowering companies to manage application performance and proactively address issues.Checkly:

Checkly specializes in synthetic monitoring for APIs and websites, providing developers with the tools needed to ensure services are reliable and performant under diverse conditions.We're grateful to work with incredible clients.

FAQs

What is the market size of synthetic Monitoring?

The synthetic monitoring market is projected to grow from $3.5 billion in 2023 to significant heights by 2033, with a robust CAGR of 9.2%. This growth signifies a strong demand for effective monitoring solutions across industries.

What are the key market players or companies in the synthetic Monitoring industry?

Key players in the synthetic monitoring industry include major tech firms specializing in IT services and monitoring solutions. These players drive innovation and competitive edge in the market, leveraging advanced analytics and machine learning.

What are the primary factors driving the growth in the synthetic monitoring industry?

The primary factors include increased digitalization, a surge in e-commerce, and the need for optimizing user experience. Additionally, enterprises recognize the importance of proactive monitoring to ensure service reliability and uptime.

Which region is the fastest Growing in the synthetic monitoring market?

The Asia Pacific region stands out as the fastest-growing market, expected to reach $1.82 billion by 2033, reflecting significant digital transformation and increased investment in technology solutions within emerging economies.

Does ConsaInsights provide customized market report data for the synthetic monitoring industry?

Yes, ConsaInsights offers tailored market reports that cater to specific needs within the synthetic monitoring industry, providing deep insights and data that align with unique business objectives.

What deliverables can I expect from this synthetic monitoring market research project?

Clients can expect comprehensive reports including market analysis, growth forecasts, competitive landscape profiles, segmented market insights, and actionable recommendations tailored to their strategic needs.

What are the market trends of synthetic monitoring?

Market trends indicate a shift towards cloud-based solutions, emphasis on user experience, and integration of AI capabilities in monitoring tools to enhance data insights and predictive analytics across sectors.