Synthetic Rubber Market Report

Published Date: 02 February 2026 | Report Code: synthetic-rubber

Synthetic Rubber Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the synthetic rubber market, covering key insights, market developments, and forecasts from 2023 to 2033. It aims to equip stakeholders with crucial data and trends to navigate this dynamic industry effectively.

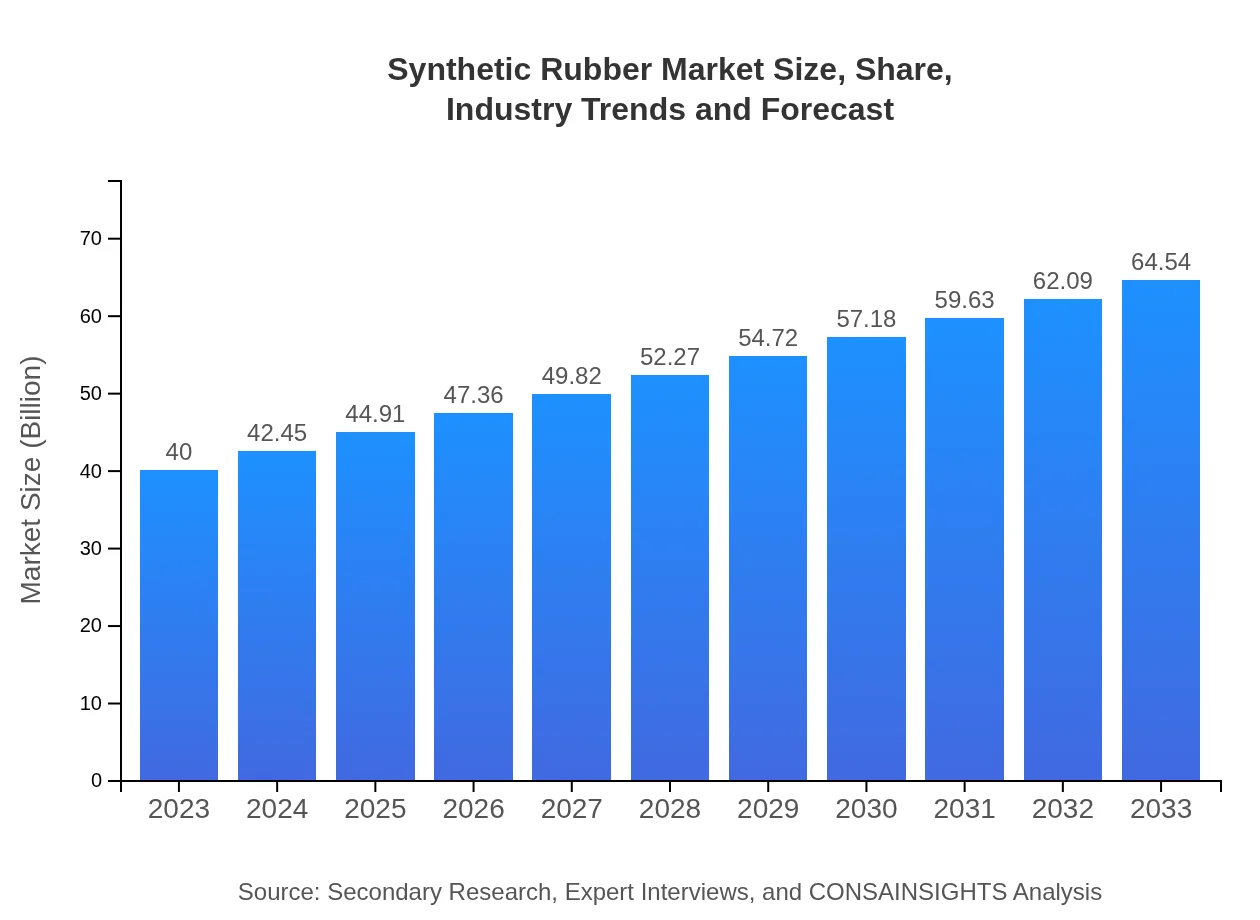

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $40.00 Billion |

| CAGR (2023-2033) | 4.8% |

| 2033 Market Size | $64.54 Billion |

| Top Companies | Goodyear Tire & Rubber Company, Bridgestone Corporation, Continental AG, BASF SE, China National Petroleum Corporation |

| Last Modified Date | 02 February 2026 |

Synthetic Rubber Market Overview

Customize Synthetic Rubber Market Report market research report

- ✔ Get in-depth analysis of Synthetic Rubber market size, growth, and forecasts.

- ✔ Understand Synthetic Rubber's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Synthetic Rubber

What is the Market Size & CAGR of Synthetic Rubber market in 2023?

Synthetic Rubber Industry Analysis

Synthetic Rubber Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Synthetic Rubber Market Analysis Report by Region

Europe Synthetic Rubber Market Report:

Europe’s synthetic rubber market is projected to grow from $12.55 billion in 2023 to approximately $20.25 billion by 2033. The European market is characterized by stringent regulatory frameworks focused on sustainability and environmental protection, driving innovation in bio-synthetic rubber. Furthermore, the auto industry is increasingly adopting advanced rubber solutions.Asia Pacific Synthetic Rubber Market Report:

The Asia Pacific region is a major hub for synthetic rubber production, with a market size of $7.48 billion in 2023, projected to increase to $12.07 billion by 2033. Rapid industrialization, along with growing automotive production in countries like China and India, is driving this growth. Furthermore, increasing demand for eco-friendly rubber products is causing significant market evolution.North America Synthetic Rubber Market Report:

North America has a strong synthetic rubber market with a valuation of $14.43 billion in 2023, expected to reach $23.28 billion by 2033. This growth is fueled by advanced industry capabilities, significant automotive sector growth, and increased investment in research and development for synthetic rubber technologies.South America Synthetic Rubber Market Report:

In South America, the synthetic rubber market was valued at $3.46 billion in 2023, with an estimated growth to $5.58 billion by 2033. The region is witnessing growth primarily due to improving automotive and construction industries, albeit at a slower rate compared to other regions. The focus on local production and environmental sustainability could further enhance market prospects.Middle East & Africa Synthetic Rubber Market Report:

In the Middle East and Africa, the market currently stands at $2.08 billion, expected to expand to $3.36 billion by 2033. Growth in this region is slower, attributed to economic variability and lower automotive sector robustness. However, initiatives to improve infrastructure and develop manufacturing capabilities may foster future market expansion.Tell us your focus area and get a customized research report.

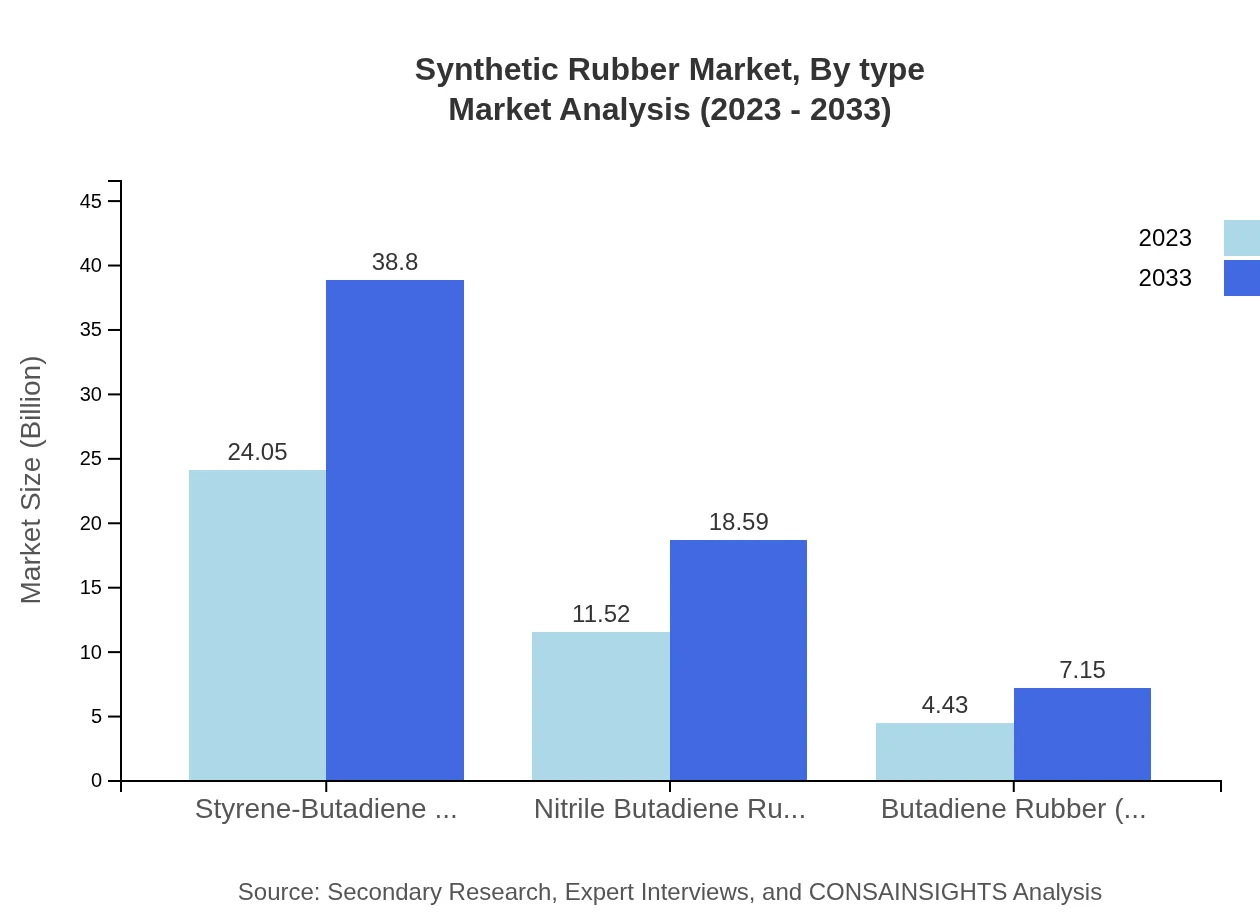

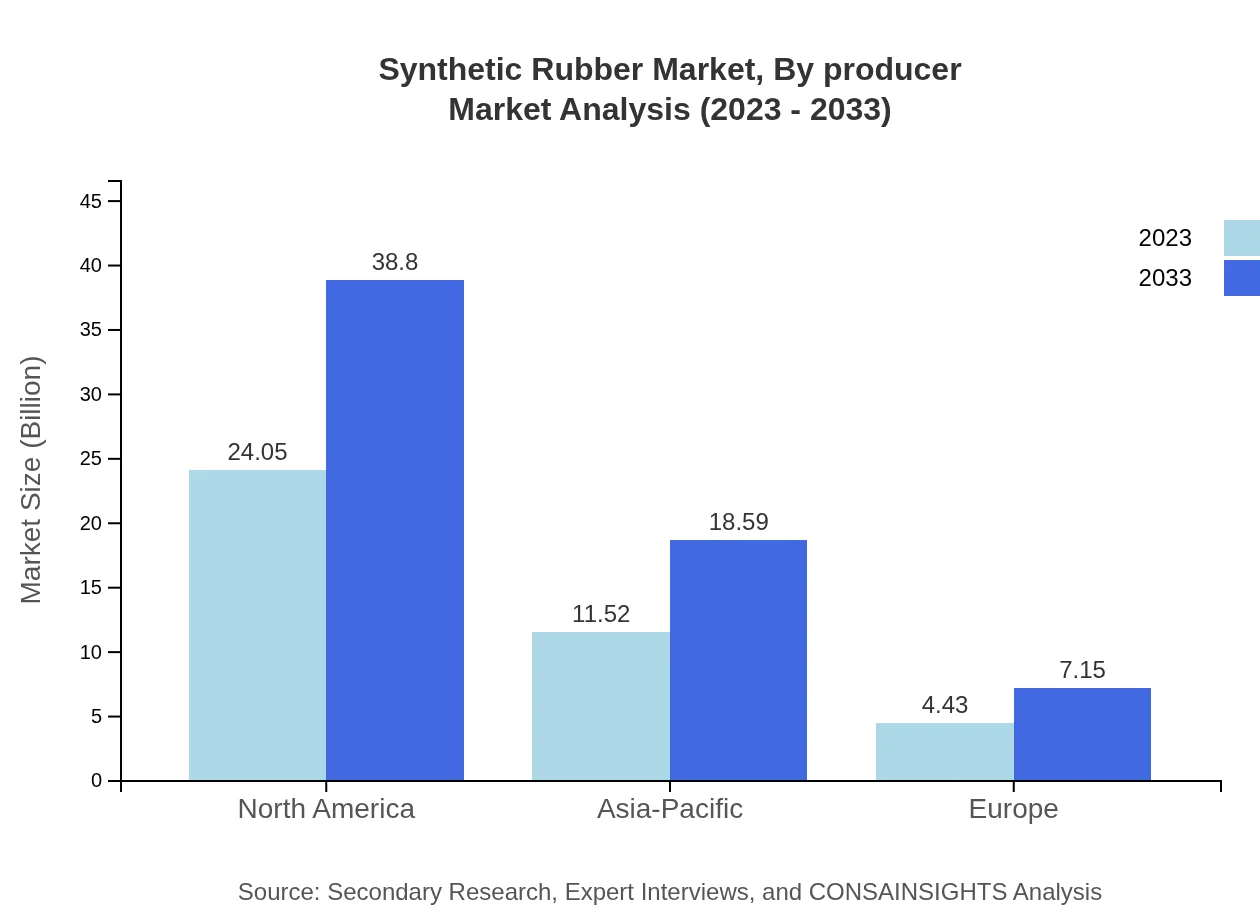

Synthetic Rubber Market Analysis By Type

The Synthetic Rubber Market can be classified into several types: Styrene-Butadiene Rubber (SBR), Nitrile Butadiene Rubber (NBR), and Butadiene Rubber (BR). SBR holds a dominant market share, contributing significantly to tire manufacturing due to its excellent wear resistance, expected to grow from $24.05 billion in 2023 to $38.80 billion by 2033. NBR, on the other hand, focuses on applications requiring oil and chemical resistance, with a market size advancing from $11.52 billion to $18.59 billion over the same period.

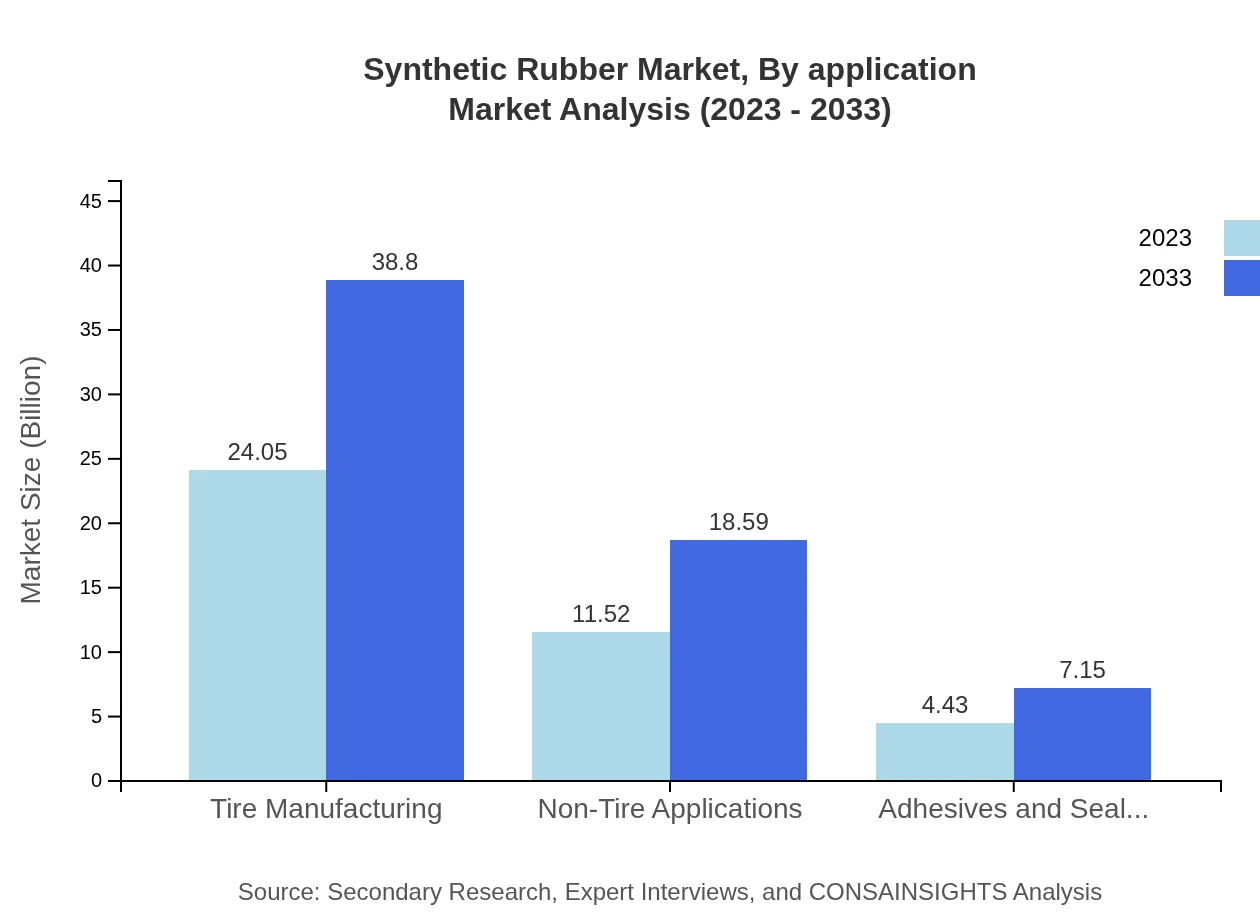

Synthetic Rubber Market Analysis By Application

Applications of synthetic rubber are wide-ranging, including automotive, construction, consumer goods, and adhesives. The automotive sector remains the largest application area, with a share of 60.12% in 2023, driven by the rising production of vehicles. The construction industry is also a significant user, particularly for flooring and insulation applications. Consumer goods utilize materials like NBR for various products, enhancing the market diversification.

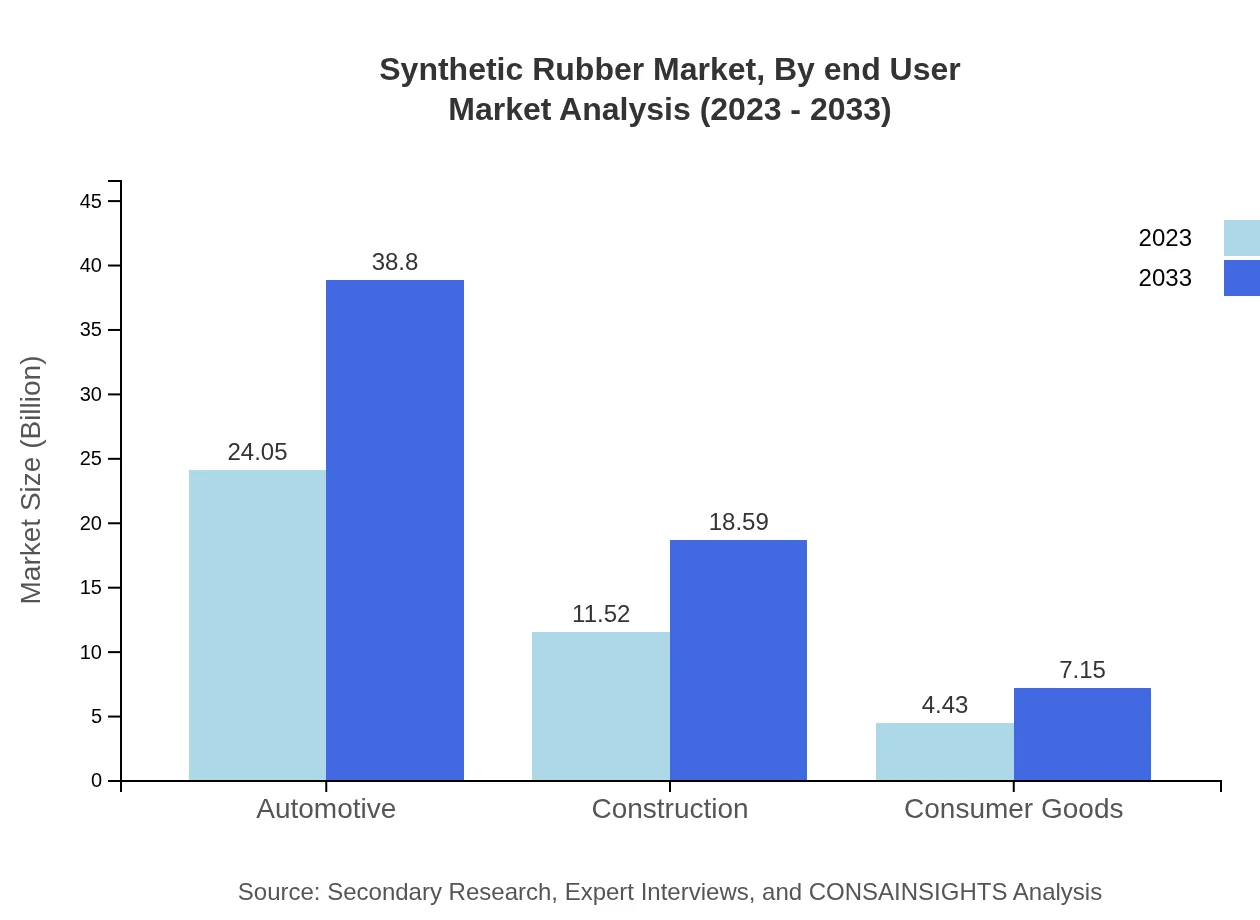

Synthetic Rubber Market Analysis By End User

End-user segments in the synthetic rubber market span automotive, industrial, consumer goods, and pharmaceuticals. The automotive sector leads the market, primarily due to tire manufacturing, with expectations of strong growth in the next decade. Industrial and commercial applications, including construction and manufacturing, also represent crucial end-user segments, further diversifying market demand.

Synthetic Rubber Market Analysis By Producer

Key producers in the synthetic rubber market include major chemical companies and specialized manufacturers. Their strategies focus on technological advancements and sustainability, seeking to improve production processes and reduce environmental impacts. The competition among these producers drives further innovation within the industry, supporting its growth and adaptation to market demands.

Synthetic Rubber Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Synthetic Rubber Industry

Goodyear Tire & Rubber Company:

A prominent player in the synthetic rubber market, Goodyear is known for its high-performance tire products and innovation in rubber technology, focusing on sustainability.Bridgestone Corporation:

As one of the largest tire manufacturers globally, Bridgestone applies advanced synthetic rubber materials in its tire production, ensuring durability and performance.Continental AG:

Located at the forefront of the automotive industry, Continental focuses on developing innovative synthetic rubber solutions that enhance vehicle performance and safety.BASF SE:

BASF is a major chemical company producing a wide range of synthetic rubbers, emphasizing research and sustainability in its product offerings.China National Petroleum Corporation:

A significant contributor to synthetic rubber supply, CNPC employs advanced technology to enhance production efficiency and product quality.We're grateful to work with incredible clients.

FAQs

What is the market size of synthetic rubber?

The global synthetic rubber market is projected to reach approximately $40 billion by 2033, growing at a CAGR of 4.8%. The increasing demand in automotive and construction sectors significantly contributes to this growth.

What are the key market players or companies in the synthetic rubber industry?

Prominent players in the synthetic rubber market include Goodyear Tire and Rubber Company, Continental AG, and Michelin, among others. These companies are pivotal in driving innovation and meeting the rising demand for synthetic rubber.

What are the primary factors driving the growth in the synthetic rubber industry?

Key growth drivers include rising automotive production, increasing construction activities, and the demand for high-performance materials across various applications, contributing to the robust expansion of the synthetic rubber market.

Which region is the fastest Growing in the synthetic rubber market?

The Asia-Pacific region exhibits the fastest growth in the synthetic rubber market, projected to increase from $7.48 billion in 2023 to $12.07 billion by 2033, driven by significant industrial and manufacturing expansion.

Does ConsaInsights provide customized market report data for the synthetic rubber industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs in the synthetic rubber industry, providing in-depth analysis and insights tailored to individual business requirements.

What deliverables can I expect from this synthetic rubber market research project?

Deliverables include comprehensive market analysis, forecast data, regional insights, and segment-specific reports, ensuring that stakeholders have everything needed for informed decision-making.

What are the market trends of synthetic rubber?

Current trends include a shift towards sustainable production methods and the rising use of synthetic rubber in electric vehicles, influencing research and innovation within the industry.