Syrup Market Report

Published Date: 31 January 2026 | Report Code: syrup

Syrup Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Syrup market, detailing market size, growth prospects, segmentation, regional insights, and industry trends from 2023 to 2033.

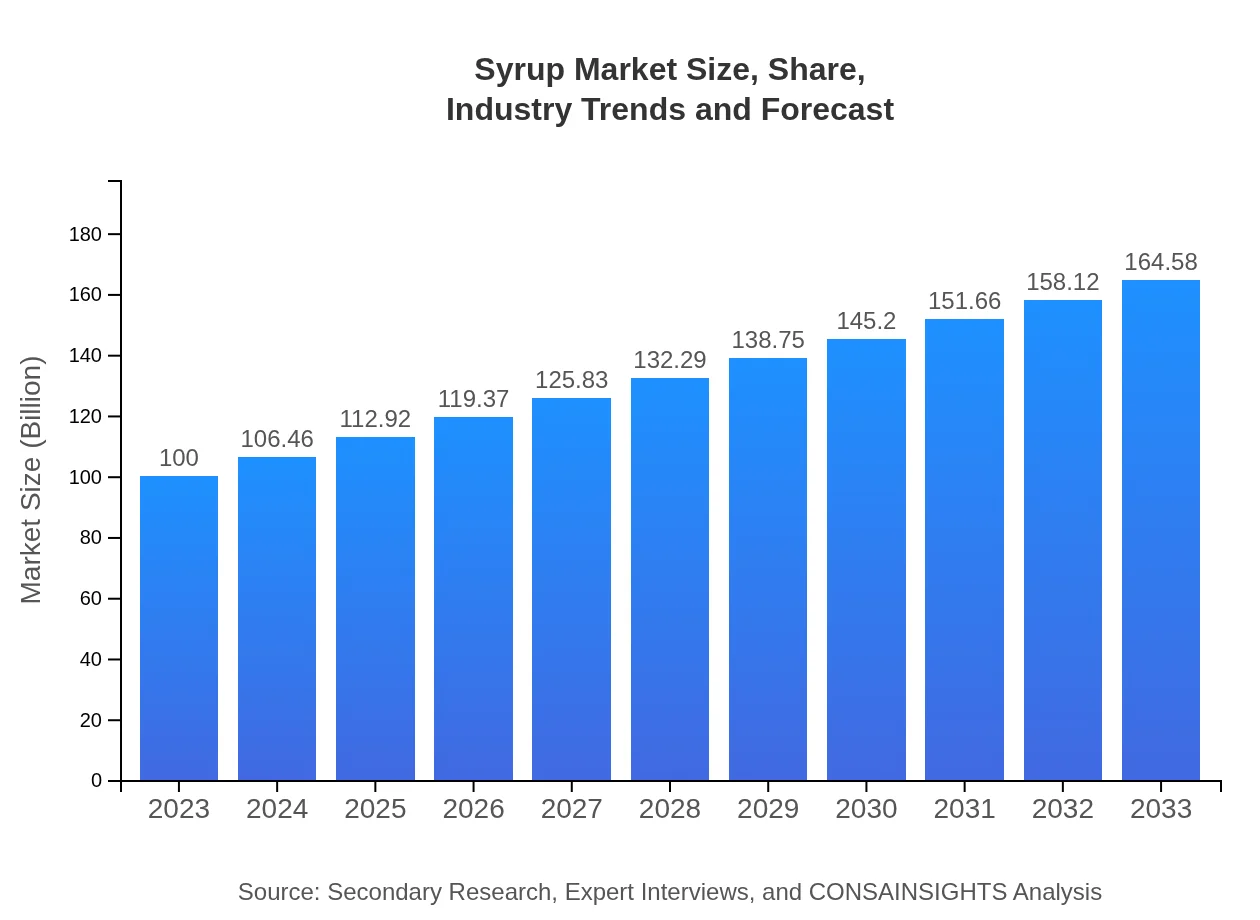

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $100.00 Million |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $164.58 Million |

| Top Companies | Maple Grove Farms, Smoky Maple, Nature's Way, Torani |

| Last Modified Date | 31 January 2026 |

Syrup Market Overview

Customize Syrup Market Report market research report

- ✔ Get in-depth analysis of Syrup market size, growth, and forecasts.

- ✔ Understand Syrup's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Syrup

What is the Market Size & CAGR of Syrup market in 2023?

Syrup Industry Analysis

Syrup Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Syrup Market Analysis Report by Region

Europe Syrup Market Report:

The European syrup market is anticipated to grow significantly, moving from $25.71 billion in 2023 to $42.31 billion by 2033. The region's inclination towards natural sweeteners and the increasing popularity of fruit and honey syrups among consumers are key growth drivers.Asia Pacific Syrup Market Report:

The Asia Pacific syrup market is poised for rapid growth, projected to increase from $20.26 billion in 2023 to $33.34 billion in 2033. Growth is driven by urbanization, rising disposable incomes, and an expanding food service industry, particularly in countries like China and India, where traditional syrup consumption is being adopted in modern culinary practices.North America Syrup Market Report:

North America represents the largest market for syrup, estimated at $34.08 billion in 2023 and projected to reach $56.09 billion by 2033. The region's strong preference for maple syrup, coupled with the rising trend of organic products, is driving substantial market growth.South America Syrup Market Report:

In South America, the syrup market is expected to grow from $8.79 billion in 2023 to $14.47 billion by 2033. This growth is facilitated by emerging economies and a burgeoning food and beverage sector that increasingly utilizes a variety of syrups for flavor enhancement and sweetening applications.Middle East & Africa Syrup Market Report:

In the Middle East and Africa, the syrup market is expected to increase from $11.16 billion in 2023 to $18.37 billion by 2033. Factors contributing to this growth include a rise in food and beverage consumption and the increasing use of syrups in traditional desserts and culinary applications.Tell us your focus area and get a customized research report.

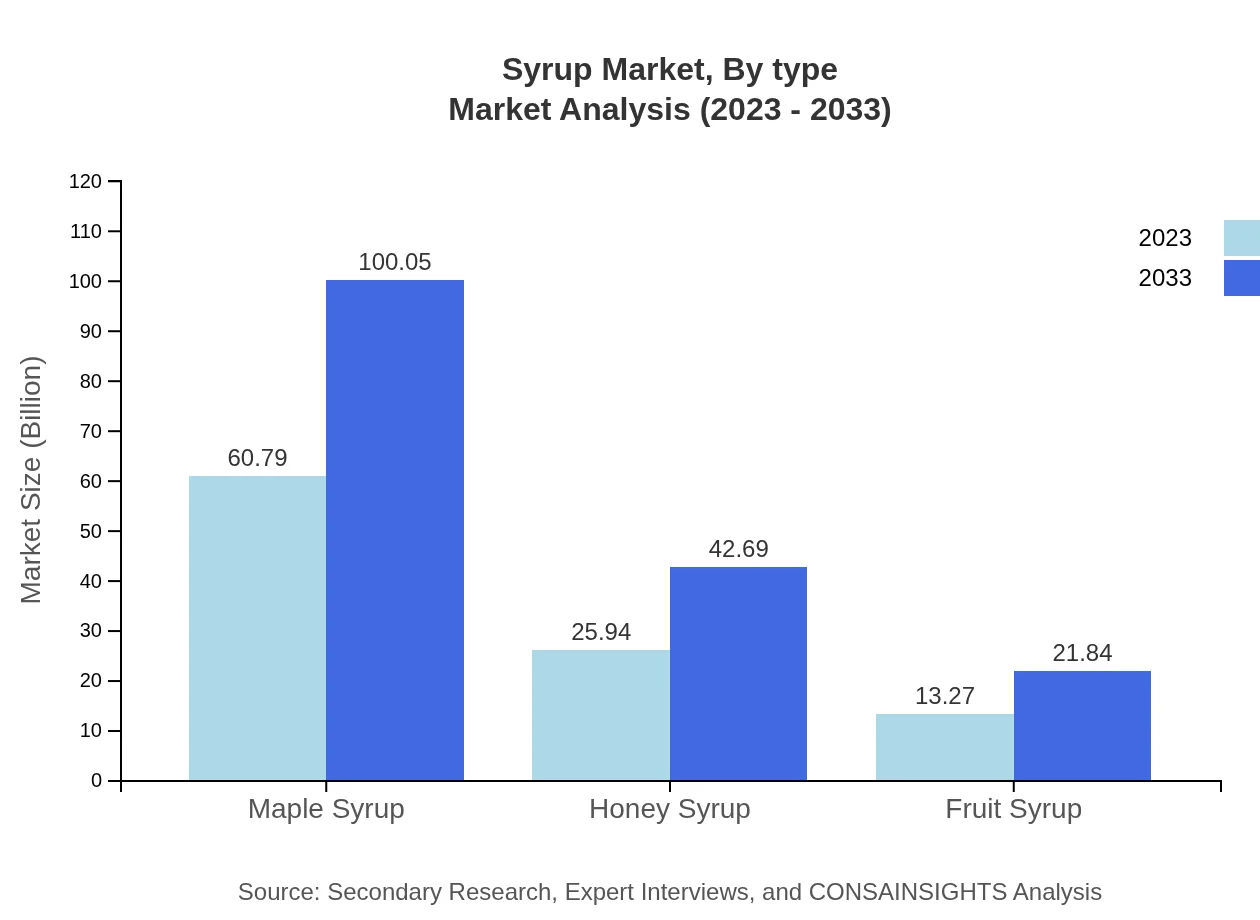

Syrup Market Analysis By Type

The syrup market by type includes various categories such as maple syrup, honey syrup, and fruit syrup. Maple syrup is expected to experience significant growth, increasing from $60.79 billion in 2023 to $100.05 billion by 2033, while honey syrup is also projected to grow from $25.94 billion to $42.69 billion during the same period.

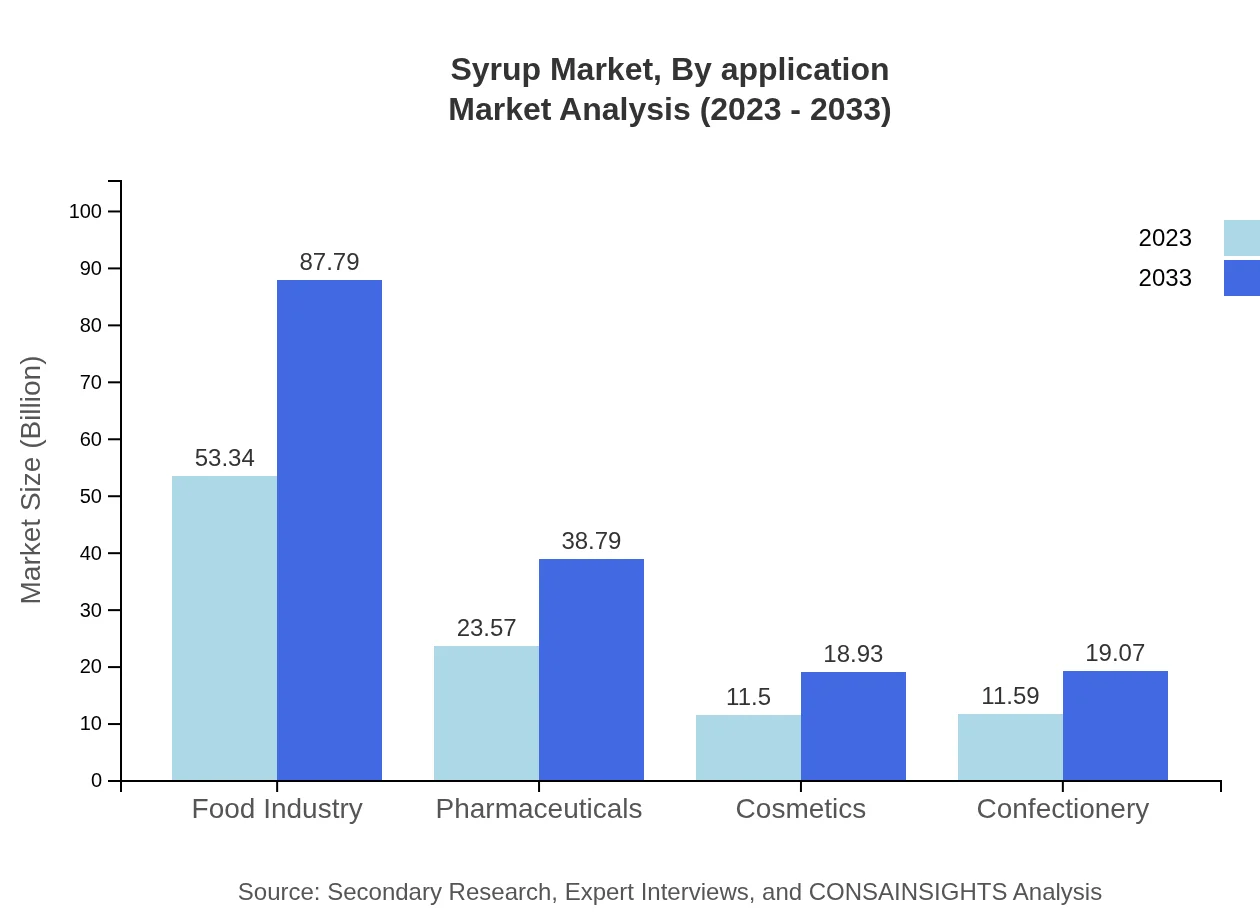

Syrup Market Analysis By Application

Applications of syrups span several industries, including food and beverages, pharmaceuticals, cosmetics, and confectionery. The food industry dominates, expected to grow from $53.34 billion in 2023 to $87.79 billion by 2033, while pharmaceuticals and cosmetics are also notable segments with consistent growth.

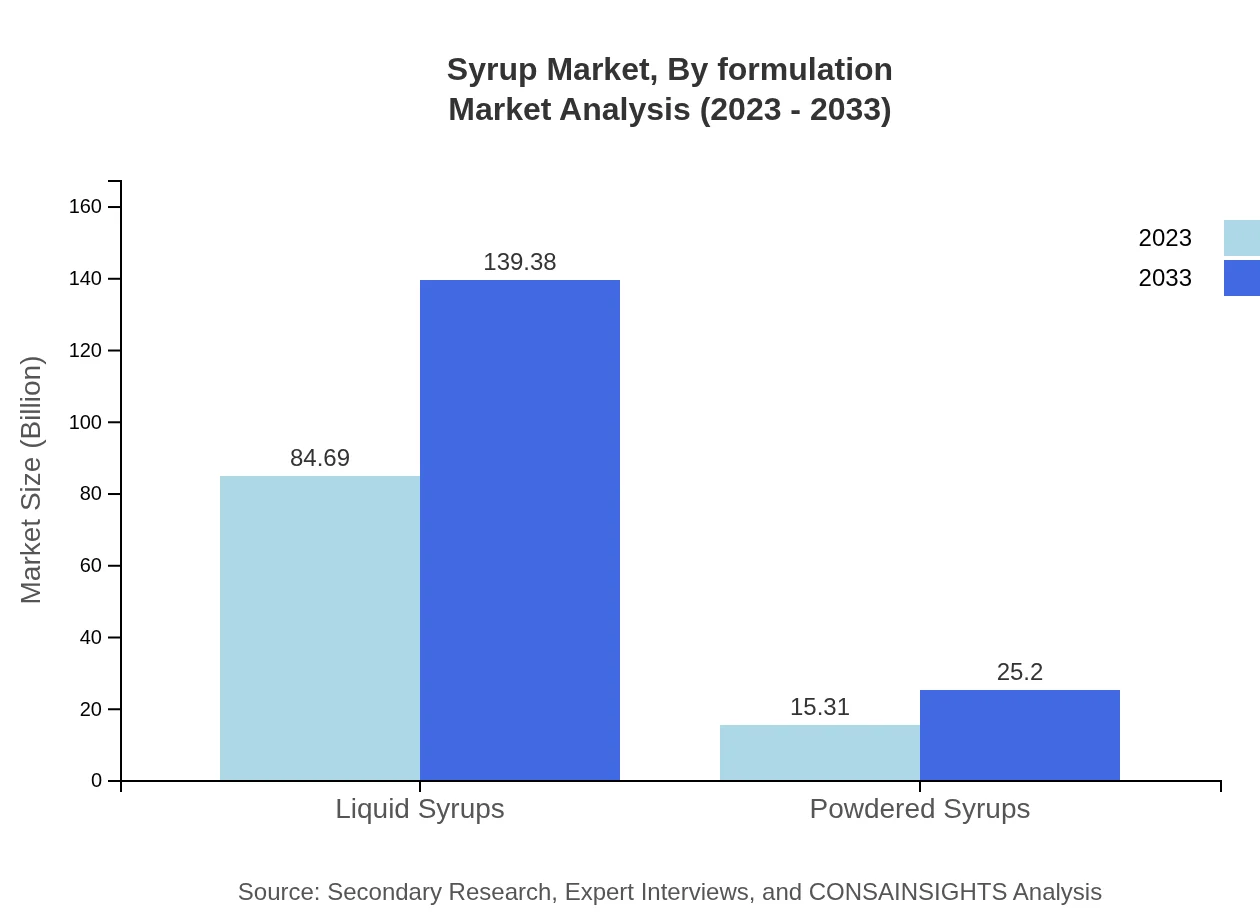

Syrup Market Analysis By Formulation

Syrups are available in liquid and powdered forms. Liquid syrups are prevalent, estimated to account for $84.69 billion in 2023 and forecasted to expand to $139.38 billion by 2033. Powdered syrups, while smaller in market share, are seeing growth from $15.31 billion to $25.20 billion.

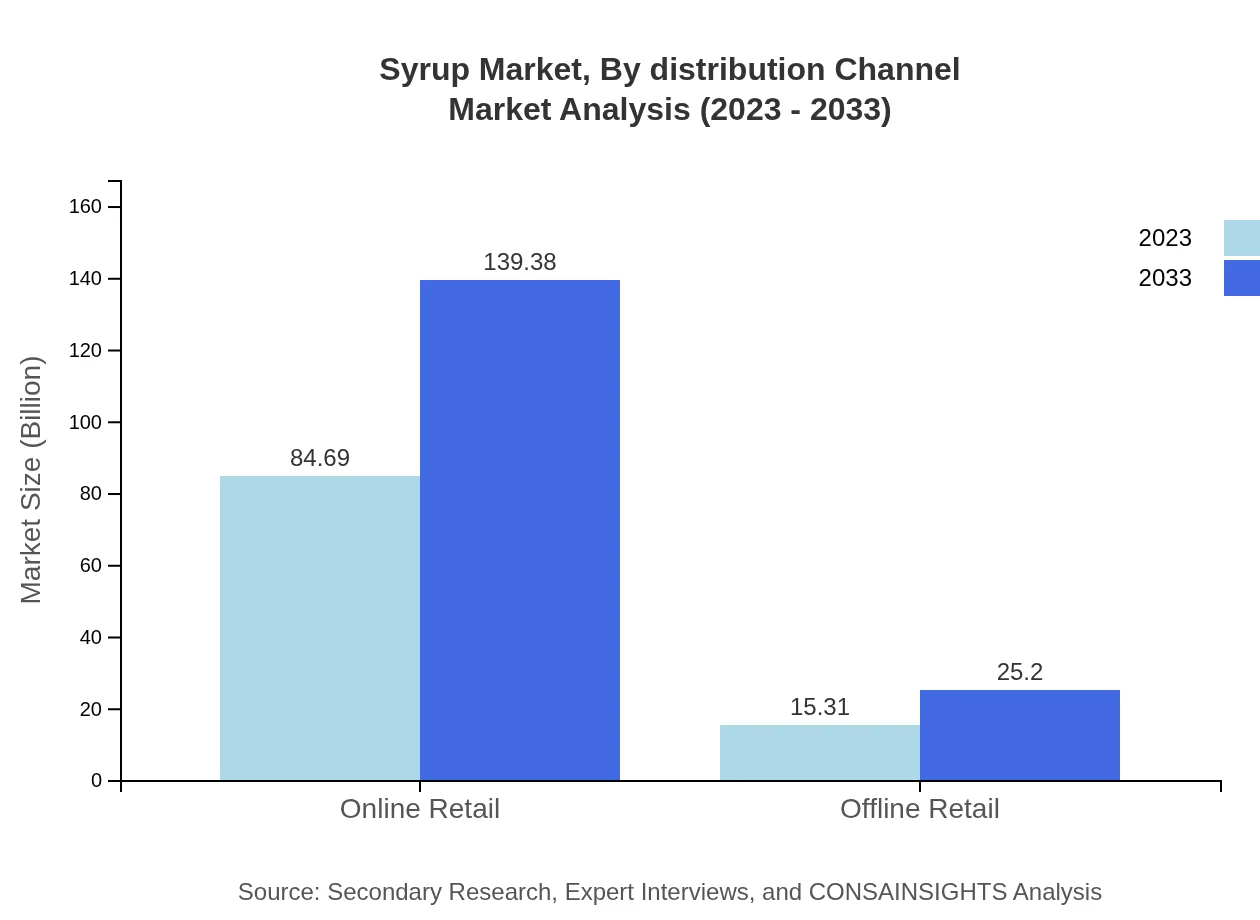

Syrup Market Analysis By Distribution Channel

The distribution of syrups occurs mainly through online and offline retail channels. Online retail is becoming increasingly popular, expected to grow from $84.69 billion in 2023 to $139.38 billion by 2033, reflecting a shift in consumer shopping habits towards e-commerce.

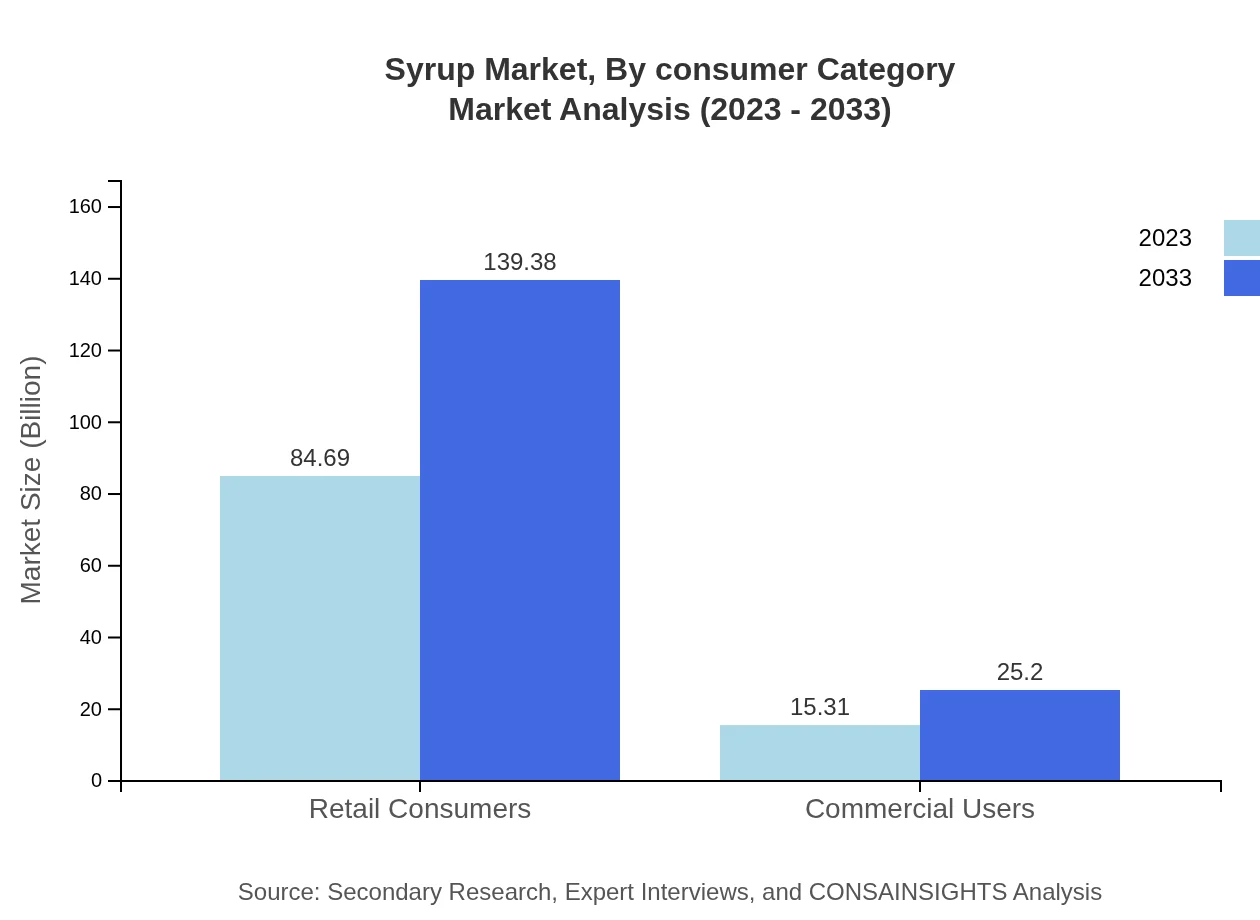

Syrup Market Analysis By Consumer Category

The consumer category in the syrup market includes retail consumers and commercial users. Retail consumers are projected to maintain a substantial share, increasing from $84.69 billion to $139.38 billion, while commercial users will grow from $15.31 billion to $25.20 billion.

Syrup Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Syrup Industry

Maple Grove Farms:

A leading producer of maple syrup, known for its sustainable practices and high-quality products, catering to both retail and commercial segments.Smoky Maple:

Recognized for its premium line of maple syrups and unique flavored options, Smoky Maple is targeting gourmet food enthusiasts.Nature's Way:

A significant player in the honey syrup category, offering a variety of organic and natural syrup products to health-conscious consumers.Torani:

Famous for its flavored syrups used in beverages, Torani holds a strong market position in both retail and food service channels.We're grateful to work with incredible clients.

FAQs

What is the market size of syrup?

As of 2023, the global syrup market is valued at approximately $100 million, with a projected CAGR of 5% through 2033. This growth reflects increasing demand across various sectors from culinary uses to pharmaceuticals.

What are the key market players or companies in this syrup industry?

Leading companies in the syrup industry include well-established brands specializing in both liquid and powdered products. Collaboration and innovation among these players contribute significantly to market dynamics and competitive advantage.

What are the primary factors driving the growth in the syrup industry?

Growth in the syrup industry is propelled by rising consumer preference for natural sweeteners, the widespread use in food and beverages, and increasing health consciousness, prompting the shift towards organic syrup options.

Which region is the fastest Growing in the syrup market?

North America currently leads with a market size of $34.08 million in 2023 and is expected to reach $56.09 million by 2033, driven by strong consumer demand and a growing retail sector.

Does ConsaInsights provide customized market report data for the syrup industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the syrup industry, enabling businesses to make informed decisions based on detailed regional and segment analysis.

What deliverables can I expect from this syrup market research project?

Clients can expect comprehensive reports detailing market size, growth projections, competitive landscape, regional breakdowns, and insights into key consumer trends within the syrup industry.

What are the market trends of syrup?

Current trends indicate a shift towards natural and organic syrups, innovation in flavors, and increased penetration in health-focused food products, with significant growth observed in liquid syrup segments.