System Basis Chip Market Report

Published Date: 31 January 2026 | Report Code: system-basis-chip

System Basis Chip Market Size, Share, Industry Trends and Forecast to 2033

This report offers a comprehensive analysis of the System Basis Chip market, projecting trends and market dynamics from 2023 to 2033. Our insights encompass market size, regional analysis, industry trends, and forecasts to aid stakeholders in strategic decision-making.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

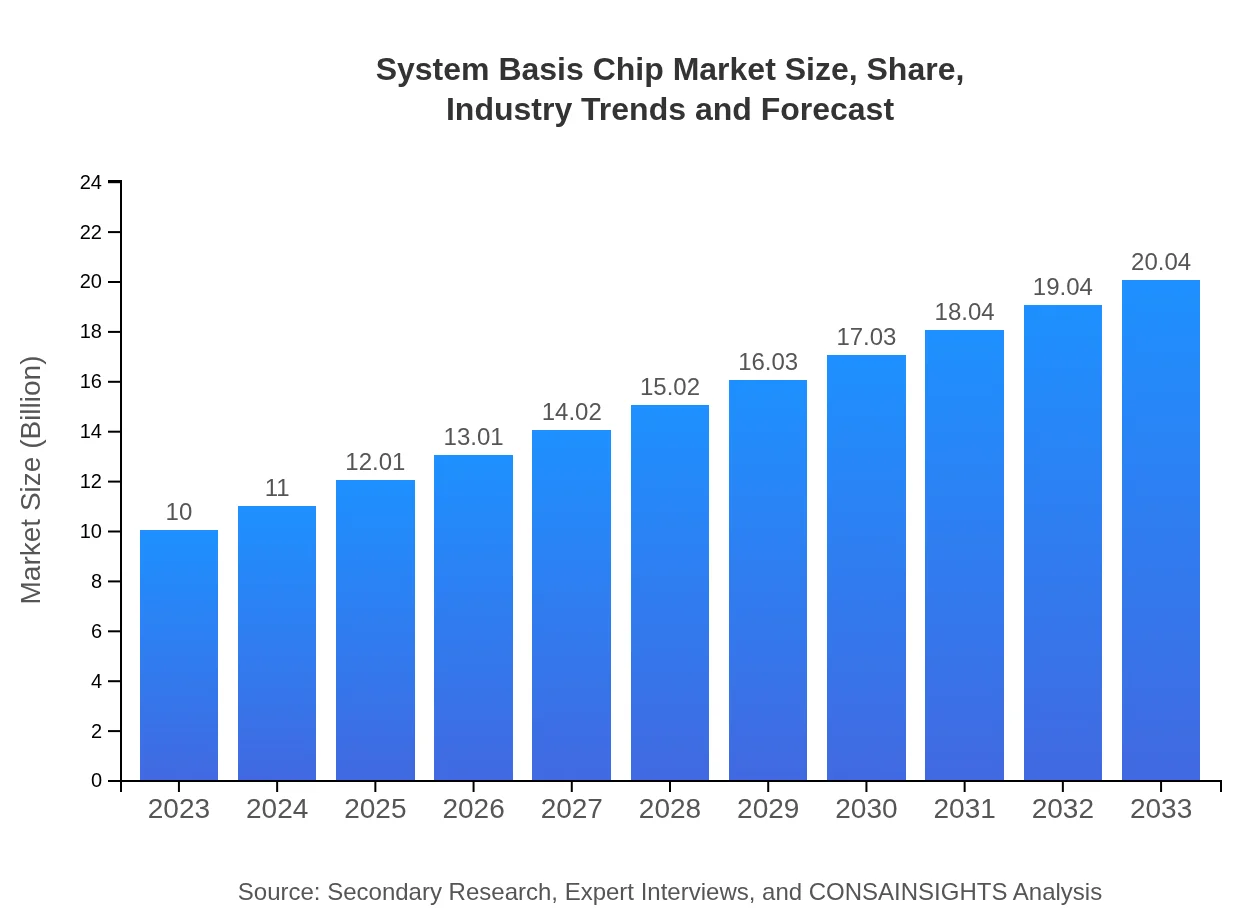

| 2023 Market Size | $10.00 Billion |

| CAGR (2023-2033) | 7% |

| 2033 Market Size | $20.04 Billion |

| Top Companies | Infineon Technologies, NXP Semiconductors, Texas Instruments, STMicroelectronics |

| Last Modified Date | 31 January 2026 |

System Basis Chip Market Overview

Customize System Basis Chip Market Report market research report

- ✔ Get in-depth analysis of System Basis Chip market size, growth, and forecasts.

- ✔ Understand System Basis Chip's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in System Basis Chip

What is the Market Size & CAGR of System Basis Chip market in 2023?

System Basis Chip Industry Analysis

System Basis Chip Market Segmentation and Scope

Tell us your focus area and get a customized research report.

System Basis Chip Market Analysis Report by Region

Europe System Basis Chip Market Report:

Europe's SBC market is projected to grow from $2.96 billion in 2023 to $5.94 billion by 2033. The push for electric vehicles and stringent emissions regulations are key factors driving adoption. Countries like Germany and France are leading the way in advancing SBC applications within the automotive industry.Asia Pacific System Basis Chip Market Report:

The Asia Pacific region is expected to experience significant growth in the System Basis Chip market, with an estimated market size of $2.02 billion in 2023 and projected to grow to $4.05 billion by 2033. The demand is primarily driven by the rapid expansion of the automotive sector in countries like China and Japan, coupled with advancements in industrial automation.North America System Basis Chip Market Report:

North America holds a robust position in the System Basis Chip market, with a valuation of $3.46 billion in 2023 anticipated to reach $6.93 billion by 2033. The region benefits from strong automotive industry presence, continuous technological innovations, and early adoption of electric vehicles and autonomous systems.South America System Basis Chip Market Report:

In South America, the SBC market is currently valued at $0.61 billion in 2023, expected to double to $1.22 billion by 2033. The region's growth is supported by increasing investments in automotive manufacturing and the adoption of smart technology in consumer electronics.Middle East & Africa System Basis Chip Market Report:

The Middle East and Africa's System Basis Chip market is estimated at $0.95 billion in 2023 and is expected to reach $1.90 billion by 2033. The growth can be attributed to increasing government initiatives in smart cities and the rising demand for automation in energy and utility sectors.Tell us your focus area and get a customized research report.

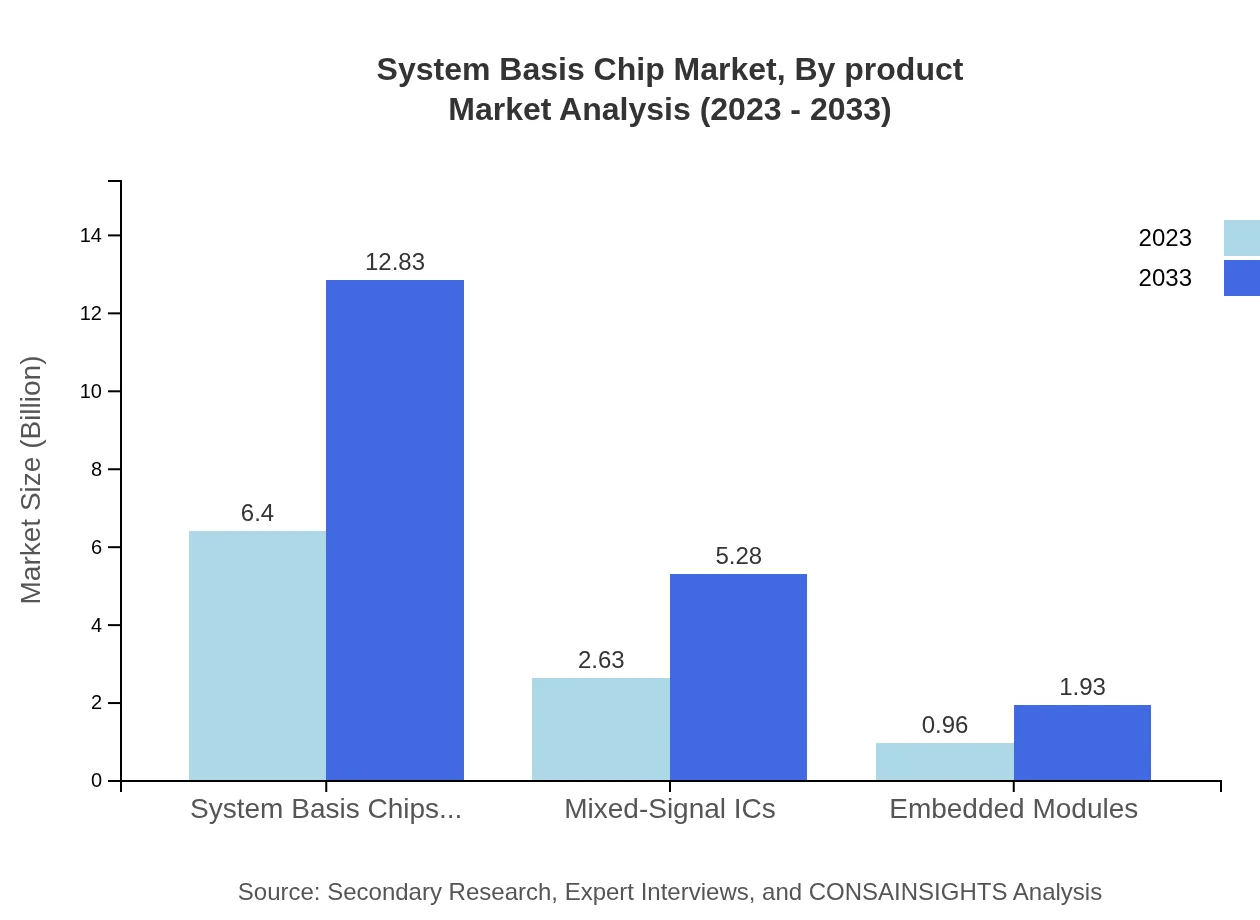

System Basis Chip Market Analysis By Product

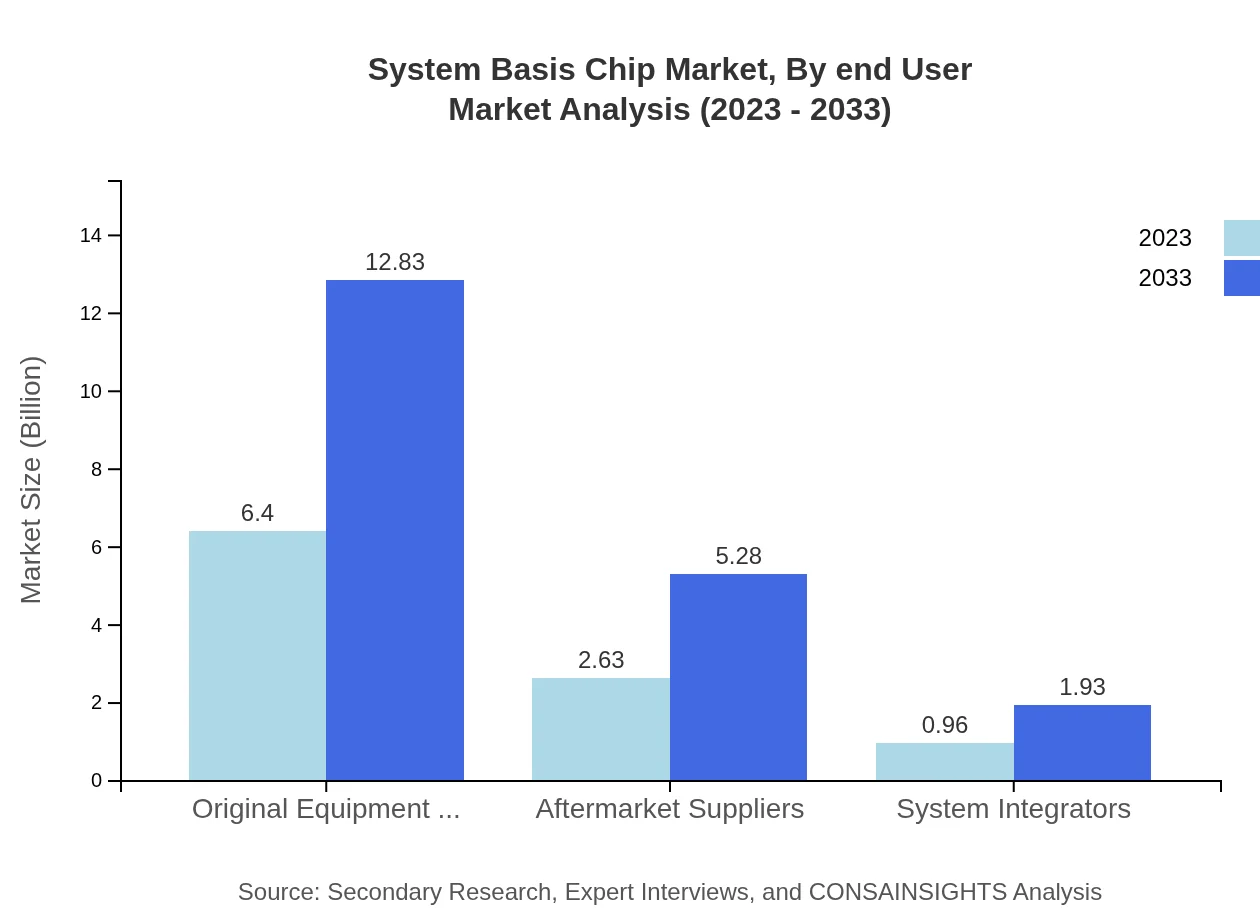

The performance of System Basis Chips (SD-IC) is critical, with a market size projected to grow from $6.40 billion in 2023 to $12.83 billion by 2033. Similarly, Mixed-Signal ICs are expected to increase from $2.63 billion to $5.28 billion in the same period. Embedded modules also show potential growth from $0.96 billion to $1.93 billion, highlighting the varying impacts of different SBC products.

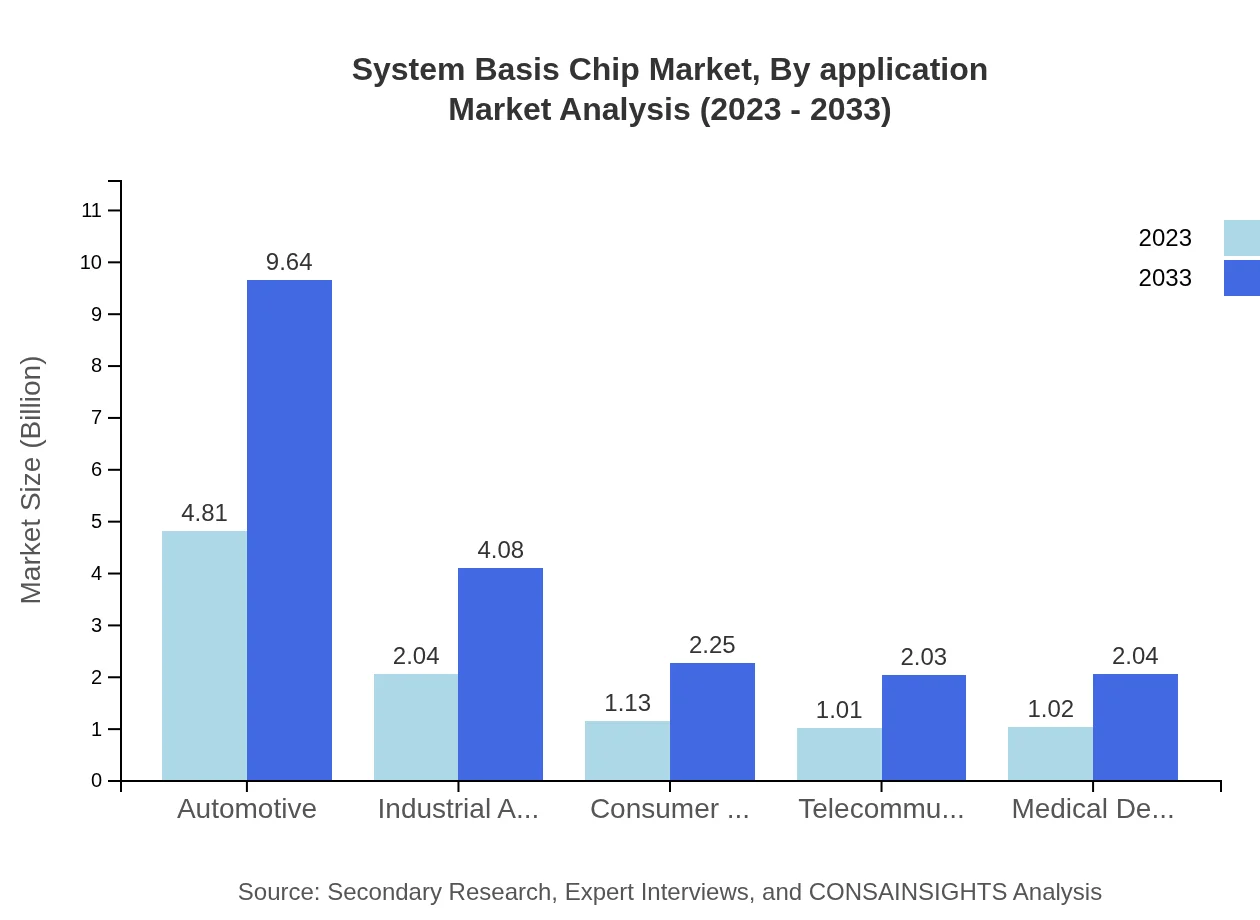

System Basis Chip Market Analysis By Application

The automotive sector leads with a substantial market size, anticipated to rise from $4.81 billion in 2023 to $9.64 billion by 2033, representing 48.11% market share. The industrial automation application segment is also significant, with projections moving from $2.04 billion to $4.08 billion, indicating the increasing reliance on SBCs for automation technologies.

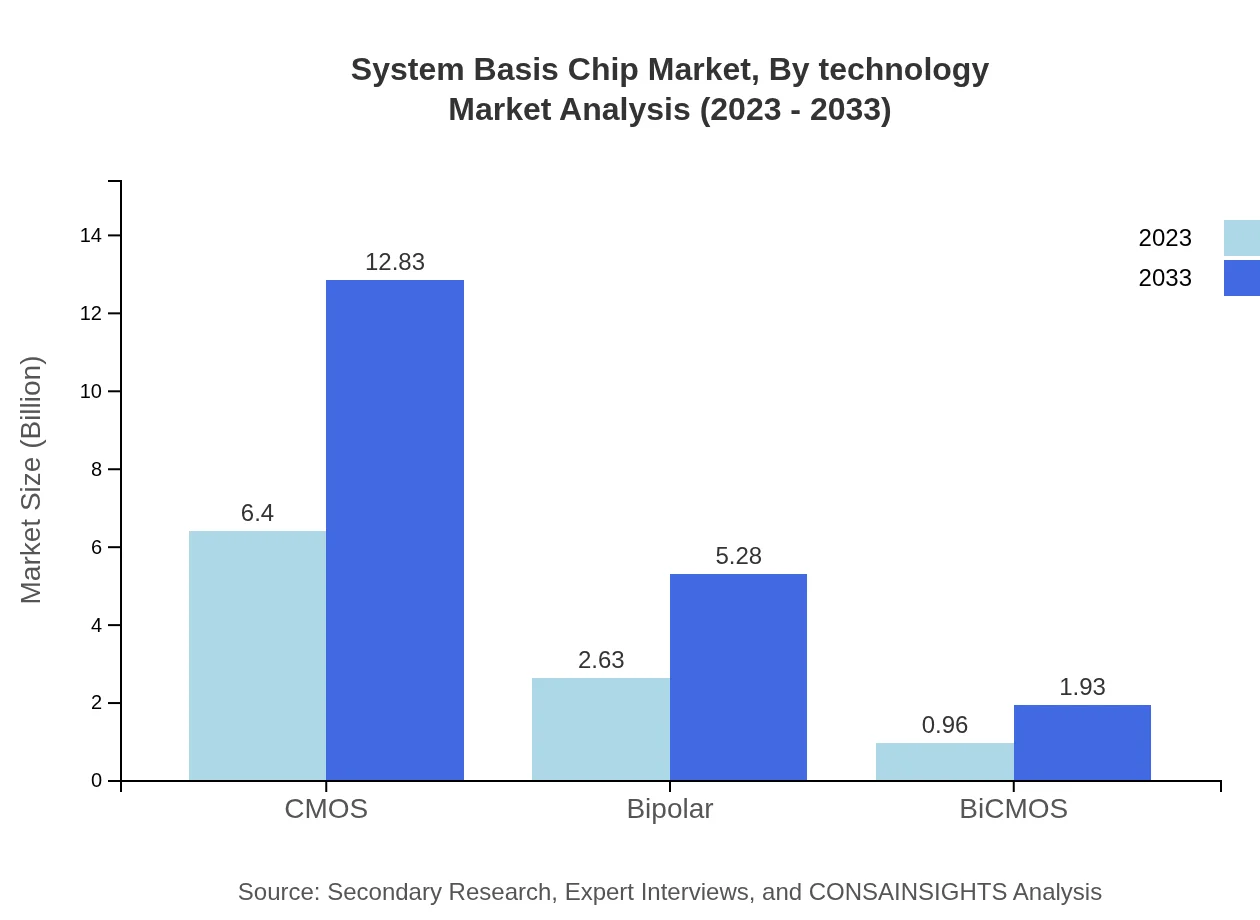

System Basis Chip Market Analysis By Technology

CMOS technology dominates with a projected size increase from $6.40 billion in 2023 to $12.83 billion by 2033, while Bipolar technology is also significant, expected to grow from $2.63 billion to $5.28 billion. The advancements in technology are central to enhancing performance and efficiency in System Basis Chips.

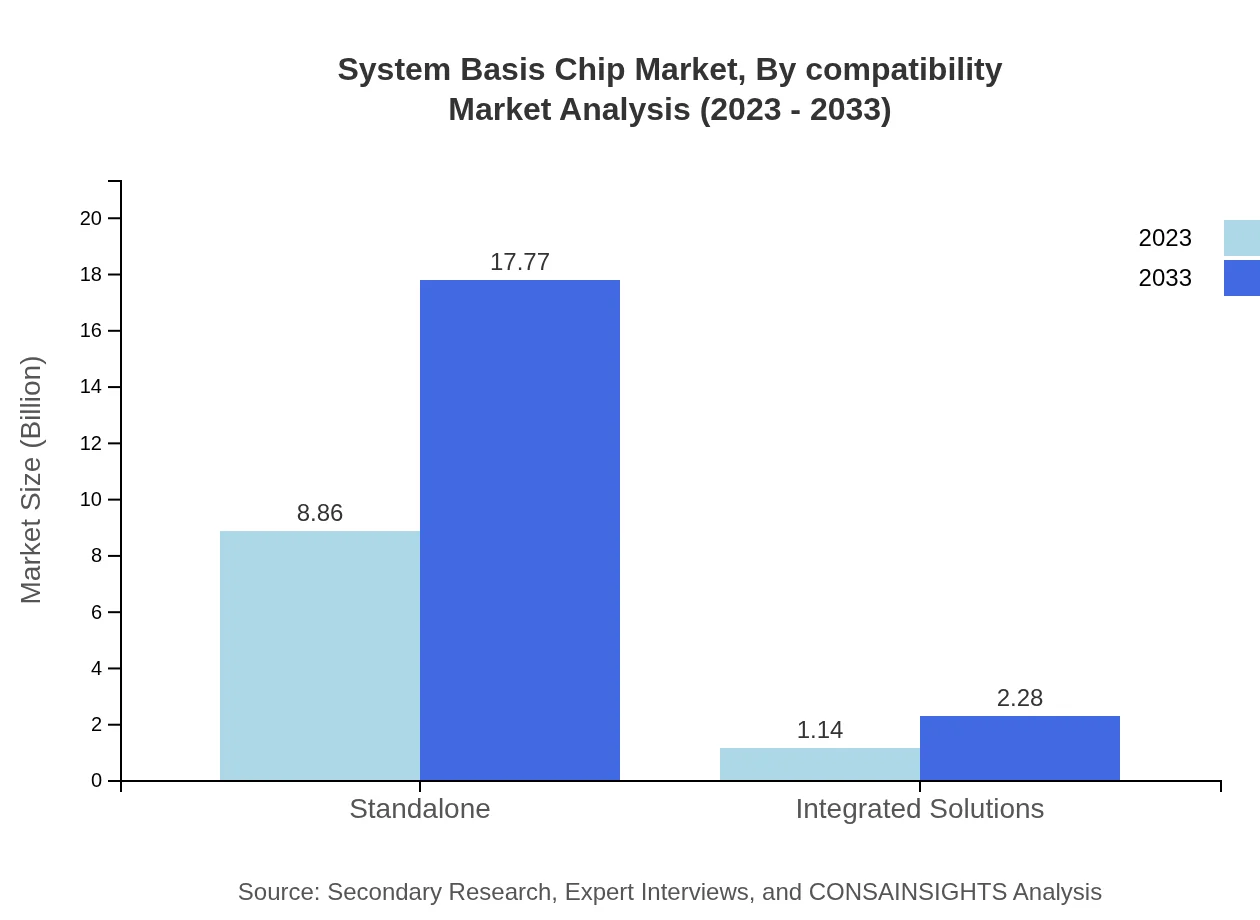

System Basis Chip Market Analysis By Compatibility

The compatibility focus mainly revolves around standalone and integrated solutions, with standalone products showing strong growth from $8.86 billion to $17.77 billion, reflecting the demand for versatile SBCs. Integrated solutions are also projected to grow from $1.14 billion to $2.28 billion.

System Basis Chip Market Analysis By End User

End-users in the automotive segment are leading, with a market share of about 48.11%, expected to continue dominating through 2033. Consumer electronics and medical devices also represent important segments, with respective CAGR values indicating growing applications in high-tech environments.

System Basis Chip Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in System Basis Chip Industry

Infineon Technologies:

A leading semiconductor manufacturer, Infineon specializes in power management and automotive solutions, driving significant advancements in SBC technology.NXP Semiconductors:

NXP is known for its mixed-signal and embedded processing capabilities, delivering innovative System Basis Chips for automotive and industrial applications.Texas Instruments:

Texas Instruments offers a diverse portfolio of SBCs optimized for performance in automotive systems, enhancing integrated circuit functionalities.STMicroelectronics:

A major player in the microelectronics industry, STMicroelectronics focuses on energy-efficient SBCs facilitating the transition to smart mobility.We're grateful to work with incredible clients.

FAQs

What is the market size of System Basis Chip?

The System Basis Chip market is projected to reach a size of $10 billion by 2033, growing at a CAGR of 7% from 2023, where it currently stands at approximately $10 billion.

What are the key market players or companies in the System Basis Chip industry?

Key players in the System Basis Chip market include major semiconductor manufacturers like Infineon Technologies, NXP Semiconductors, Texas Instruments, and STMicroelectronics, who dominate the market with innovative chip solutions.

What are the primary factors driving the growth in the System Basis Chip industry?

The growth in the System Basis Chip industry is primarily driven by the increasing demand for automotive electronics, advancements in industrial automation, and the rising adoption of consumer electronics across the globe.

Which region is the fastest Growing in the System Basis Chip market?

The Asia Pacific region is the fastest-growing in the System Basis Chip market, projected to grow from a market size of $2.02 billion in 2023 to $4.05 billion in 2033, showcasing significant growth potential.

Does ConsaInsights provide customized market report data for the System Basis Chip industry?

Yes, ConsaInsights offers customized market report data for the System Basis Chip industry, tailored to meet specific client needs, ensuring relevant insights and strategic recommendations.

What deliverables can I expect from this System Basis Chip market research project?

Expect comprehensive market analysis reports, segmented data, regional insights, competitive landscape assessments, and actionable recommendations as part of the System Basis Chip market research project.

What are the market trends of System Basis Chip?

Current market trends in the System Basis Chip industry include the rise of integrated solutions, increasing demand for electric vehicles, and a notable shift towards more sustainable electronics in automotive applications.