System In Package Market Report

Published Date: 31 January 2026 | Report Code: system-in-package

System In Package Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the System In Package (SiP) market, including size, trends, and forecasts from 2023 to 2033. It highlights key segments, industry analysis, regional insights, and profiles of leading companies in the market.

| Metric | Value |

|---|---|

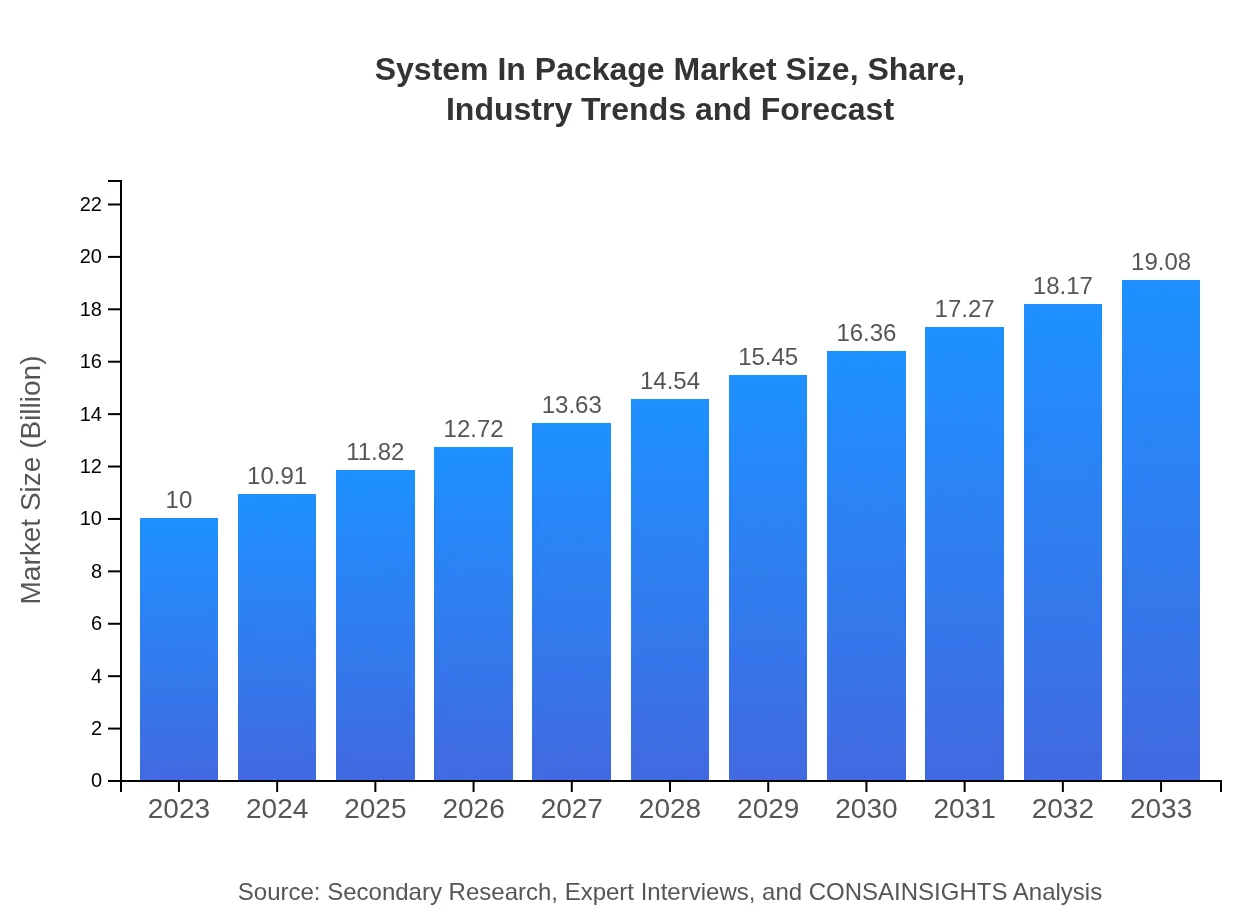

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.00 Billion |

| CAGR (2023-2033) | 6.5% |

| 2033 Market Size | $19.08 Billion |

| Top Companies | Intel Corporation, Qualcomm Technologies, Inc., Texas Instruments Incorporated, Amkor Technology, Inc., STMicroelectronics |

| Last Modified Date | 31 January 2026 |

System In Package Market Overview

Customize System In Package Market Report market research report

- ✔ Get in-depth analysis of System In Package market size, growth, and forecasts.

- ✔ Understand System In Package's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in System In Package

What is the Market Size & CAGR of System In Package market in 2023?

System In Package Industry Analysis

System In Package Market Segmentation and Scope

Tell us your focus area and get a customized research report.

System In Package Market Analysis Report by Region

Europe System In Package Market Report:

The European market for System In Package is anticipated to rise from $3.48 billion in 2023 to $6.65 billion by 2033. This growth is supported by advancements in IoT and healthcare applications, alongside the emphasis on developing energy-efficient solutions.Asia Pacific System In Package Market Report:

The Asia Pacific region holds the largest share of the System In Package market, valued at approximately $1.81 billion in 2023, with expected growth to $3.46 billion by 2033. This growth is driven by leading electronics manufacturers in countries like China, Japan, and South Korea, who are heavily investing in technology and innovation.North America System In Package Market Report:

North America is expected to experience steady growth in the System In Package market, starting at $3.23 billion in 2023 and increasing to $6.17 billion by 2033. The presence of major electronics companies and strong investment in technology R&D are key factors influencing this growth.South America System In Package Market Report:

In South America, the System In Package market is relatively smaller, with a valuation of $0.65 billion in 2023, projected to grow to $1.24 billion by 2033. Growth drivers include increased adoption of consumer electronics and the expansion of mobile network infrastructures.Middle East & Africa System In Package Market Report:

The Middle East and Africa show growth potential in the System In Package market, valued at $0.82 billion in 2023 and expected to reach $1.57 billion by 2033. Increasing urbanization and technological adoption in various sectors, especially telecommunications, will drive this growth.Tell us your focus area and get a customized research report.

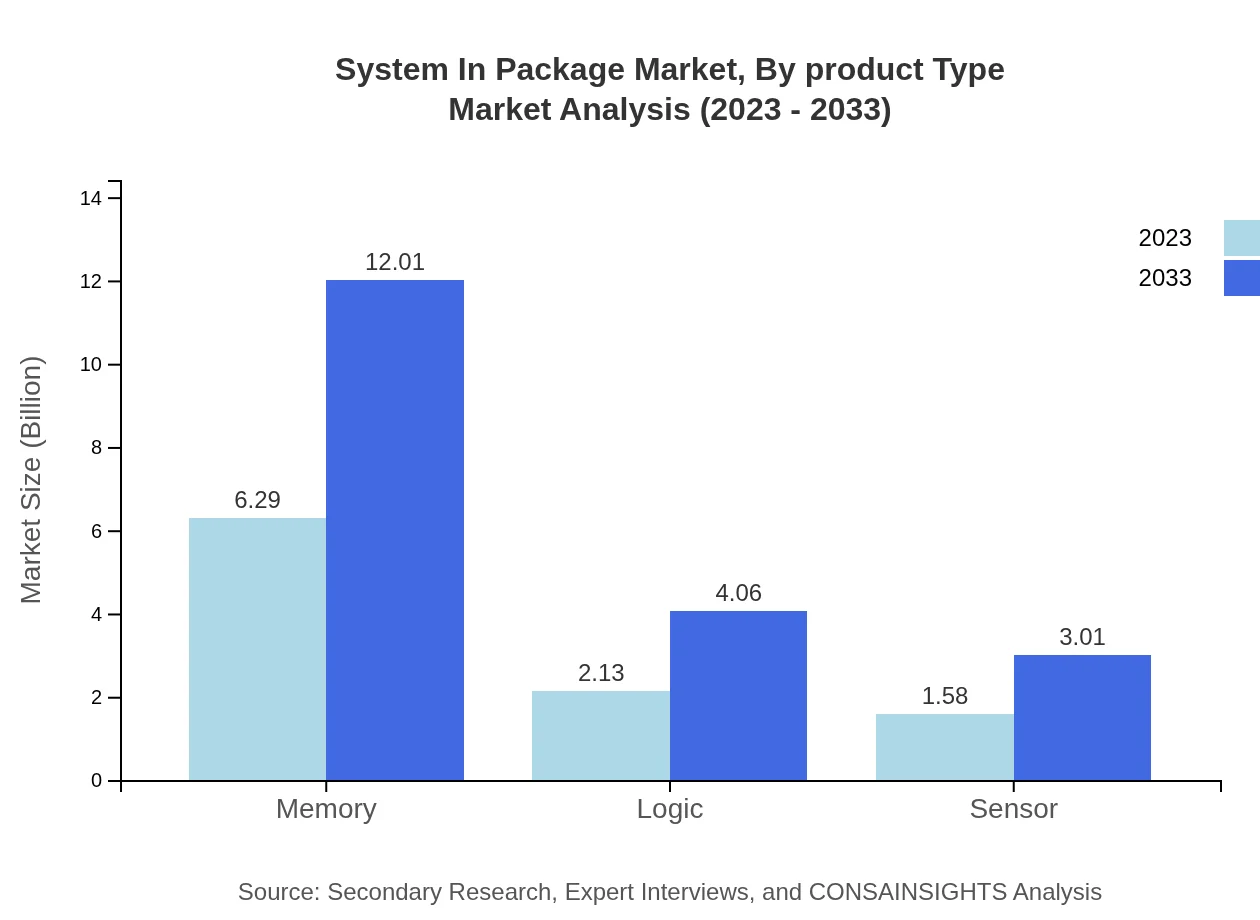

System In Package Market Analysis By Product Type

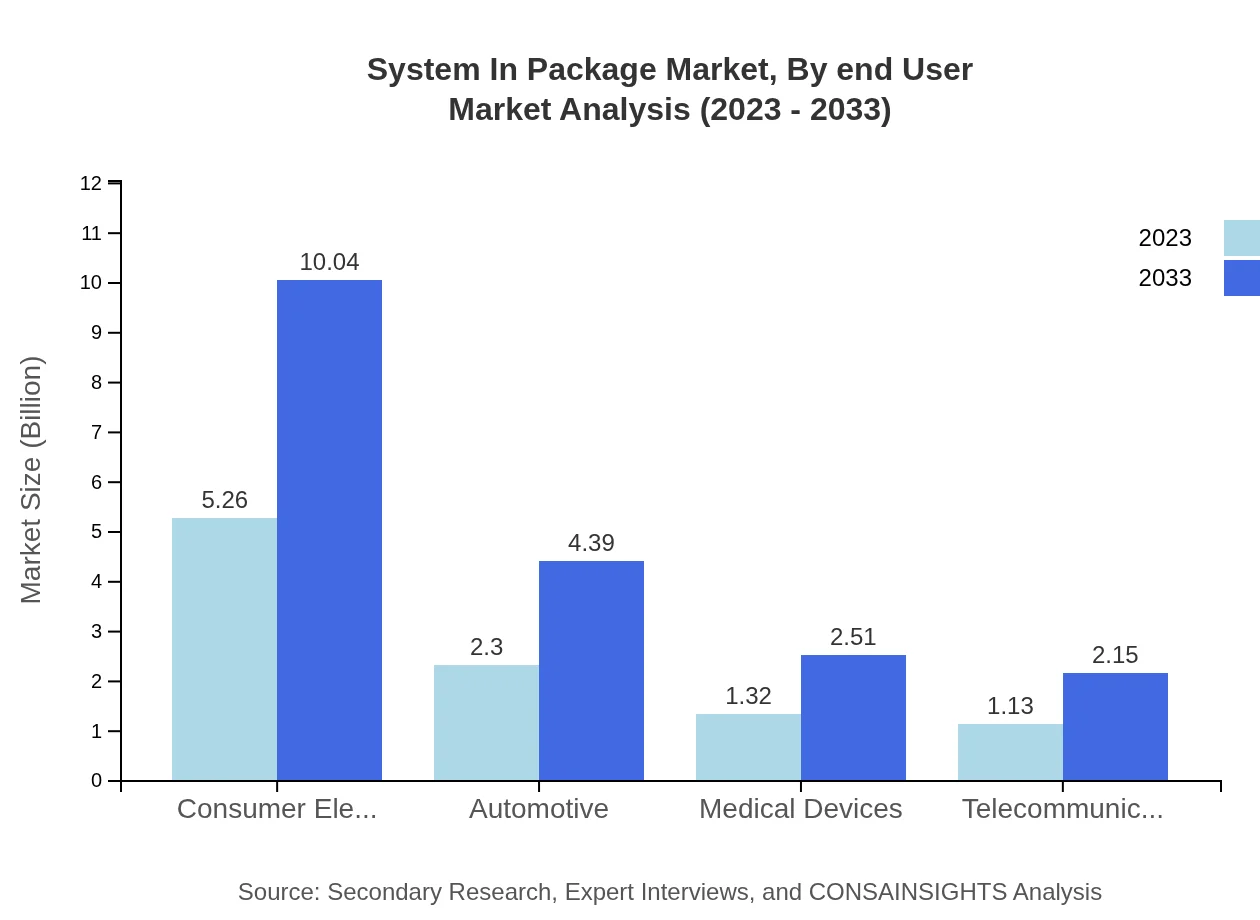

Consumer Electronics remains the largest product type segment, projected to grow from $5.26 billion in 2023 to $10.04 billion in 2033, holding a share of 52.59% throughout this period. The Automotive segment is also significant, growing from $2.30 billion to $4.39 billion and retaining 22.99% market share. Other notable segments include Medical Devices and Telecommunications, emphasizing their critical roles in expanding SiP applications.

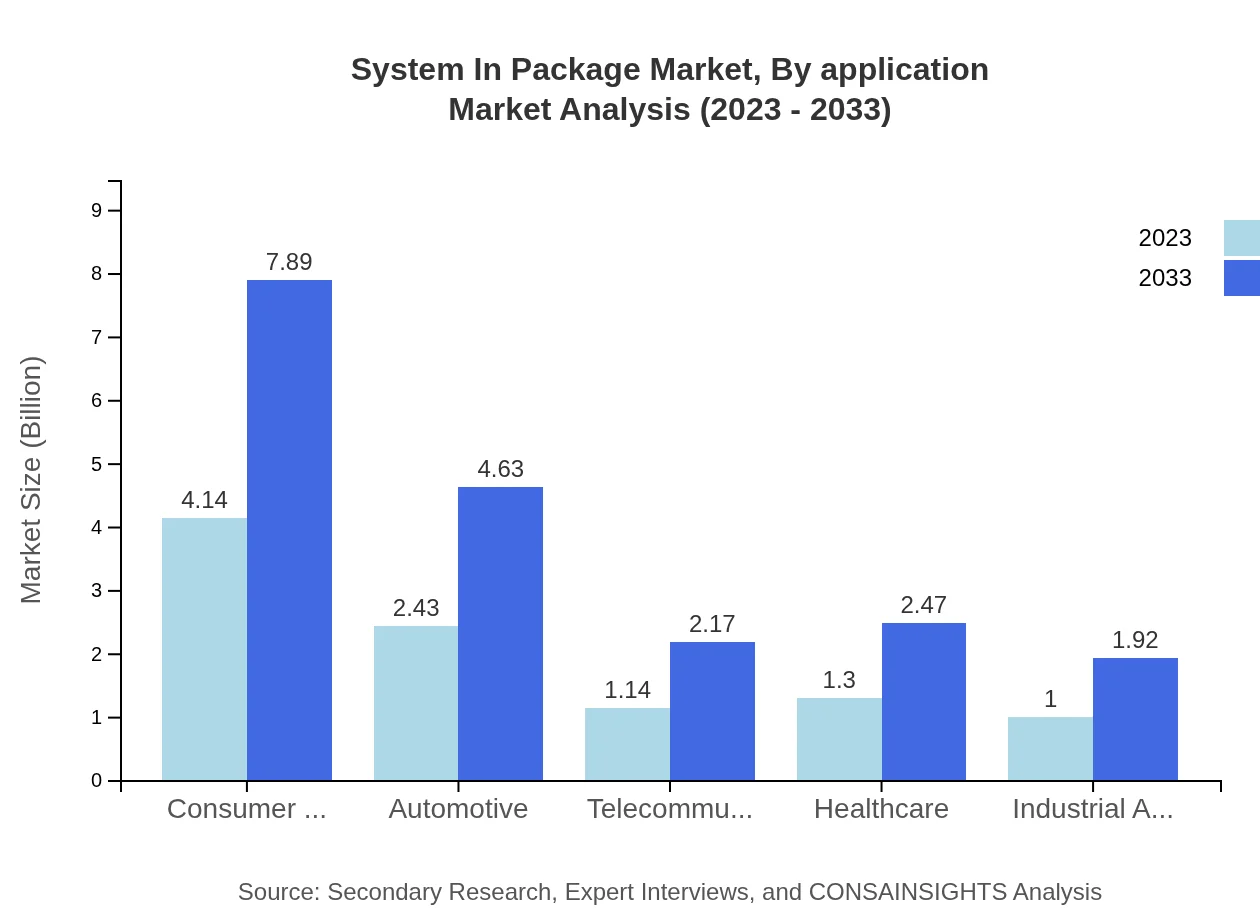

System In Package Market Analysis By Application

The applications for System In Package technology extend across various fields, including consumer electronics, automotive, telecommunications, and medical devices. The consumer electronics application is dominant, contributing significantly to overall revenue, while the automotive sector is gaining traction due to the increasing demand for smart vehicle technologies.

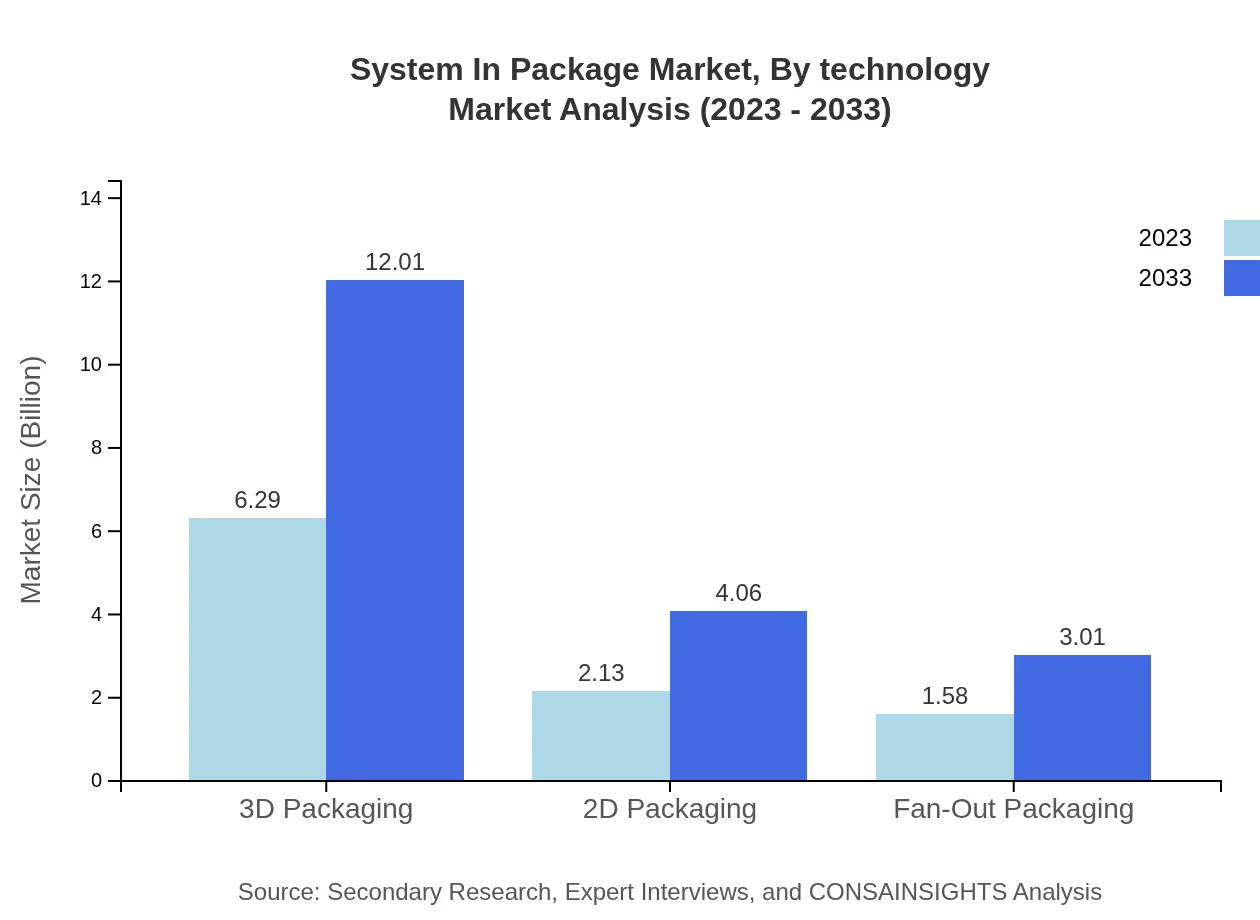

System In Package Market Analysis By Technology

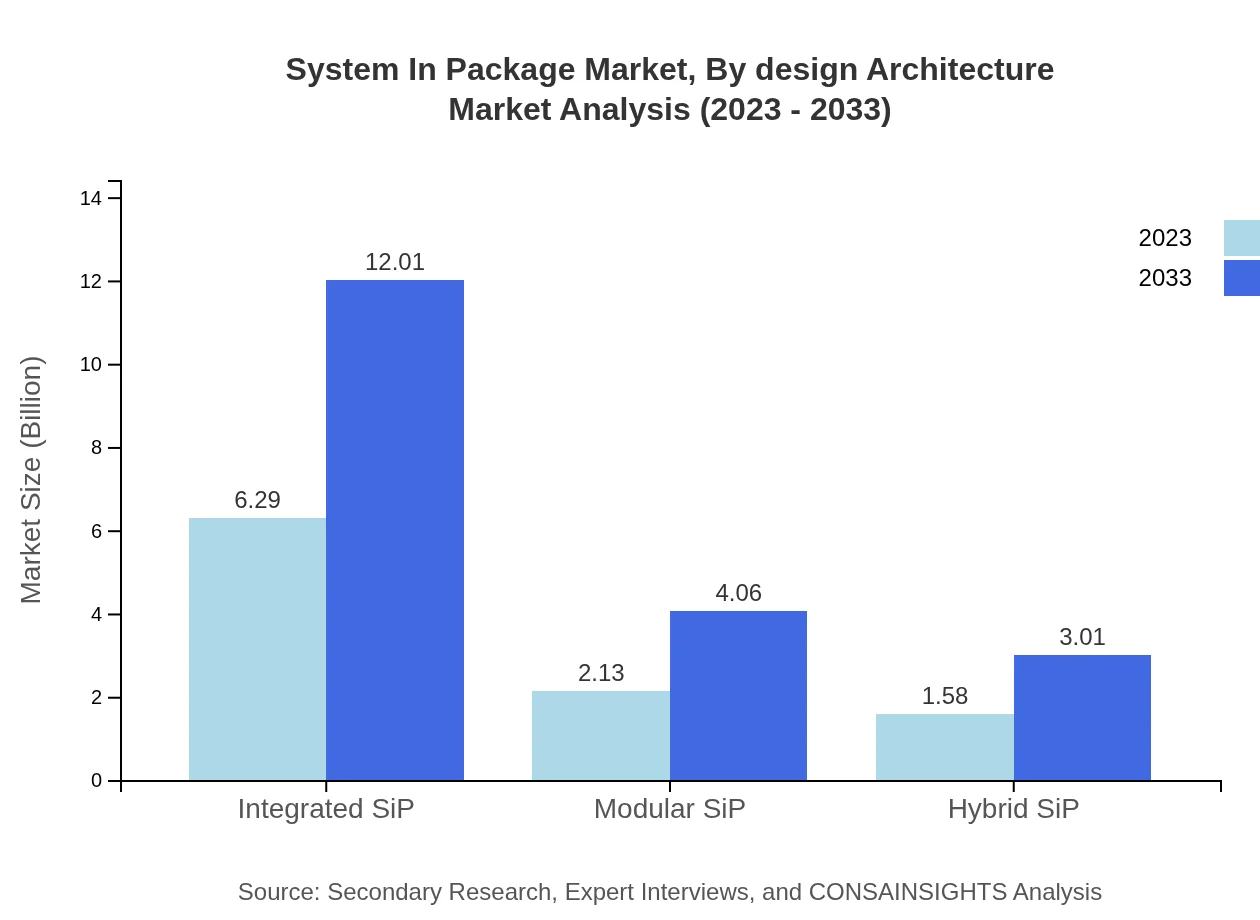

Advancements in 3D packaging technologies are pivotal in driving overall market growth. 3D packaging is expected to retain a market size of $6.29 billion in 2023, expected to hit $12.01 billion by 2033, driven by consumer electronics applications that require higher performance with compact designs.

System In Package Market Analysis By End User

Key end-users include consumer electronics manufacturers, automotive suppliers, and healthcare companies. The demand for compact and reliable SiP solutions in these sectors is crucial, as they look to enhance device performance while maintaining cost-efficiency. Healthcare applications see increased attention due to the rising need for advanced medical devices.

System In Package Market Analysis By Design Architecture

Different design architectures in SiP technology, including Integrated, Modular, and Hybrid SiP, play specialized roles in the market. Integrated SiP technologies lead, contributing to 62.94% market share in 2023, while Modular and Hybrid SiP architectures account for significant market segments, providing flexibility in applications.

System In Package Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in System In Package Industry

Intel Corporation:

Intel is a leading manufacturer of semiconductor products, including SiP solutions, focusing on high-performance and energy-efficient integrated circuits fitted for various applications.Qualcomm Technologies, Inc.:

Qualcomm specializes in the development of advanced SiP technologies, particularly for mobile communication devices, significantly enhancing performance and connectivity.Texas Instruments Incorporated:

Texas Instruments offers an extensive range of SiP products aimed at automotive and industrial applications, driving innovation in embedded systems.Amkor Technology, Inc.:

Amkor is a leading provider of semiconductor packaging and test services, offering advanced SiP solutions tailored for consumer electronics and telecommunications.STMicroelectronics:

STMicroelectronics develops advanced packaging solutions, focusing on IoT and automotive applications, which are essential for achieving higher integration and performance.We're grateful to work with incredible clients.

FAQs

What is the market size of System In-Package?

The global System-in-Package market is valued at approximately $10 billion in 2023. It is projected to grow at a CAGR of 6.5%, expected to reach around $18.1 billion by 2033.

What are the key market players or companies in the System In-Package industry?

Key players in the System-in-Package industry include major semiconductor manufacturers like Intel, Samsung, TSMC, and Qualcomm, alongside specialized companies such as ASE Group and STMicroelectronics that focus on packaging technologies.

What are the primary factors driving the growth in the System In-Package industry?

The growth of the System-in-Package industry is driven by increasing demand for miniaturization in electronics, high-performance computing needs, and rising applications in consumer electronics, automotive, and healthcare sectors.

Which region is the fastest Growing in the System In-Package market?

The Asia-Pacific region is the fastest-growing market for System-in-Package, with growth projections increasing from $1.81 billion in 2023 to $3.46 billion by 2033, driven by the booming electronics sector.

Does ConsaInsights provide customized market report data for the System In-Package industry?

Yes, ConsaInsights provides customized market report data tailored to specific needs, allowing businesses to receive insights that align perfectly with their strategic goals and market dynamics.

What deliverables can I expect from this System In-Package market research project?

Expect detailed reports including market size analysis, growth forecasts, regional breakdowns, competitive landscape overviews, and insights into consumer trends and technological advancements in the System-in-Package space.

What are the market trends of System In-Package?

Market trends in System-in-Package include advancements in 3D packaging technologies, growing integration of IoT devices, increasing utilization in automotive applications, and heightened focus on energy efficiency in packaging solutions.