System In Package Technology Market Report

Published Date: 31 January 2026 | Report Code: system-in-package-technology

System In Package Technology Market Size, Share, Industry Trends and Forecast to 2033

This report covers a comprehensive analysis of the System In Package (SiP) Technology market, exploring current trends, growth forecasts from 2023 to 2033, and regional insights that help stakeholders understand market dynamics.

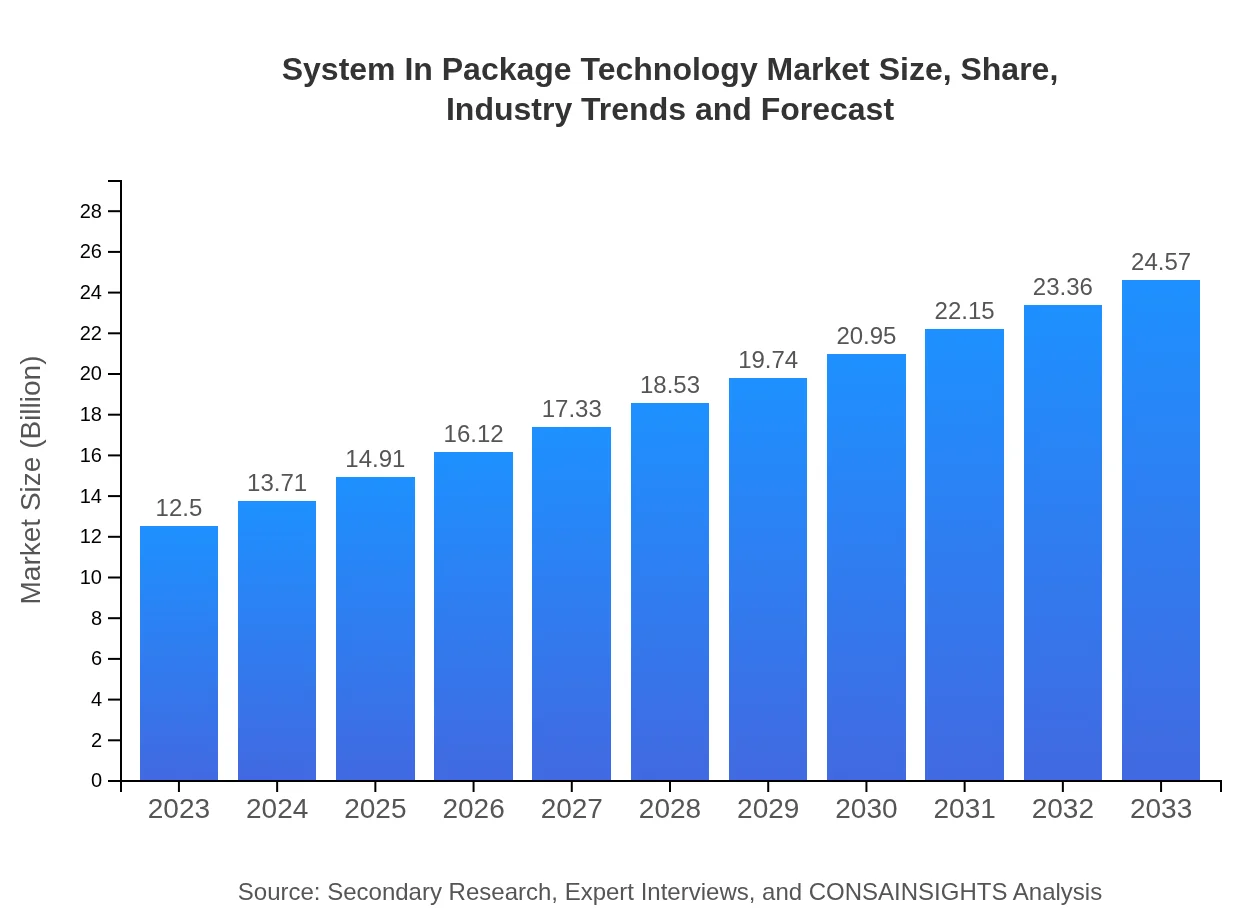

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $12.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $24.57 Billion |

| Top Companies | Intel Corporation, Samsung Electronics, STMicroelectronics, Texas Instruments |

| Last Modified Date | 31 January 2026 |

System In Package Technology Market Overview

Customize System In Package Technology Market Report market research report

- ✔ Get in-depth analysis of System In Package Technology market size, growth, and forecasts.

- ✔ Understand System In Package Technology's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in System In Package Technology

What is the Market Size & CAGR of System In Package Technology market in 2023?

System In Package Technology Industry Analysis

System In Package Technology Market Segmentation and Scope

Tell us your focus area and get a customized research report.

System In Package Technology Market Analysis Report by Region

Europe System In Package Technology Market Report:

The European SiP technology market is projected to increase from $4.12 billion in 2023 to $8.09 billion by 2033. The region is experiencing significant investments in IoT and smart technologies, enhancing the demand for compact and efficient electronic components.Asia Pacific System In Package Technology Market Report:

In the Asia Pacific region, the SiP technology market is expected to grow from $2.13 billion in 2023 to $4.19 billion by 2033. This area is a key manufacturing hub for electronics, with countries like China, Japan, and South Korea leading the adoption of advanced SiP solutions in various applications.North America System In Package Technology Market Report:

North America, estimated to be worth $4.42 billion in 2023, is expected to grow to $8.69 billion by 2033. With a strong focus on innovation and R&D, the region is witnessing increased utilization of SiP technology in automotive and healthcare applications, spurred by advancements in electric vehicles and medical devices.South America System In Package Technology Market Report:

The South American market for SiP technology, while smaller, is projected to double from $0.16 billion in 2023 to $0.32 billion by 2033. Growth will be driven by increasing smartphone penetration and investments in local electronics manufacturing capabilities.Middle East & Africa System In Package Technology Market Report:

In the Middle East and African markets, the SiP technology segment is anticipated to grow from $1.66 billion in 2023 to $3.27 billion by 2033, spurred by rising electronics consumption and development in sectors like telecommunications and healthcare.Tell us your focus area and get a customized research report.

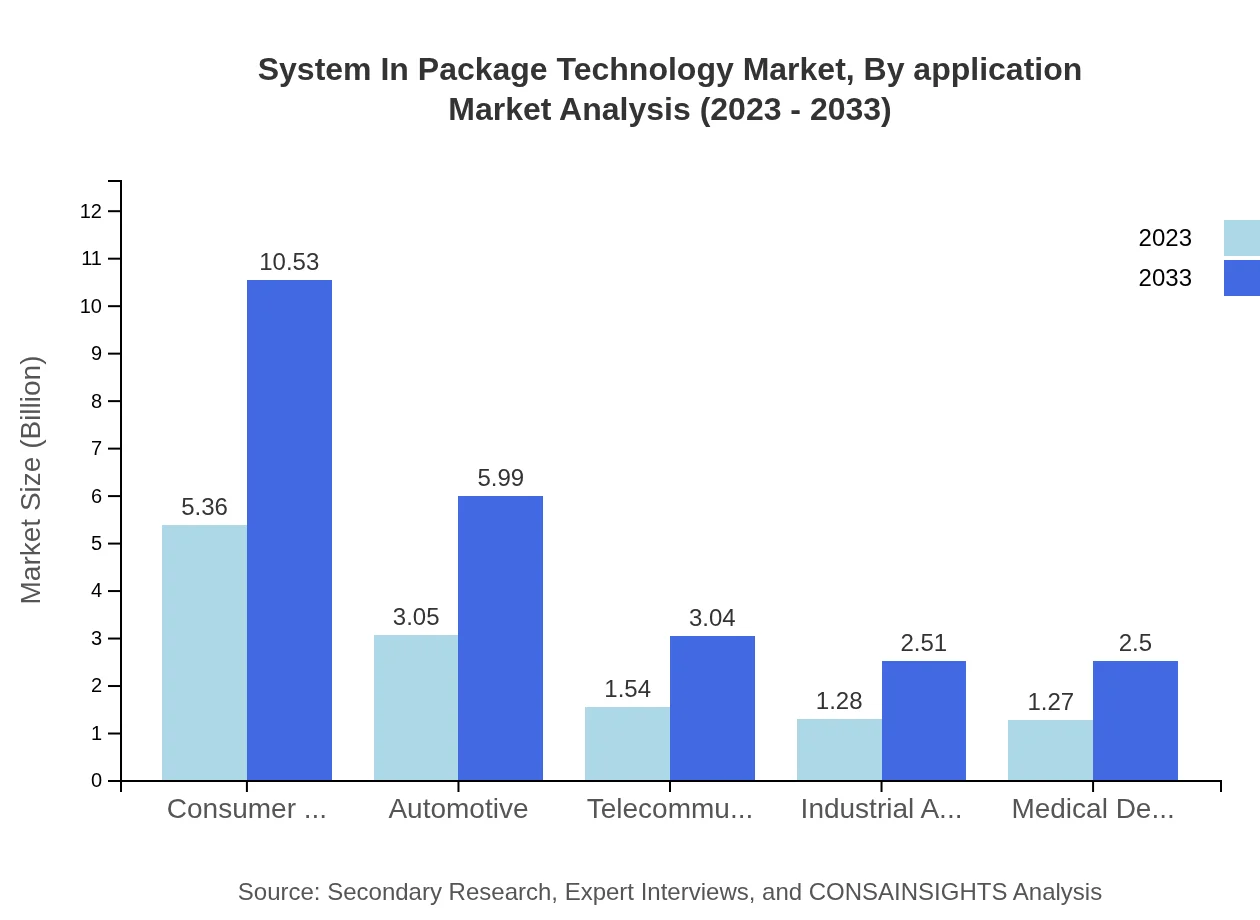

System In Package Technology Market Analysis By Application

The SiP market by application shows strong dominance of consumer electronics, expected to account for about 42.86% of the total market in 2023 with a projected growth rate, supplemented by automotive and telecommunications applications. Automotive applications will grow as vehicle manufacturers seek more efficient electronic solutions.

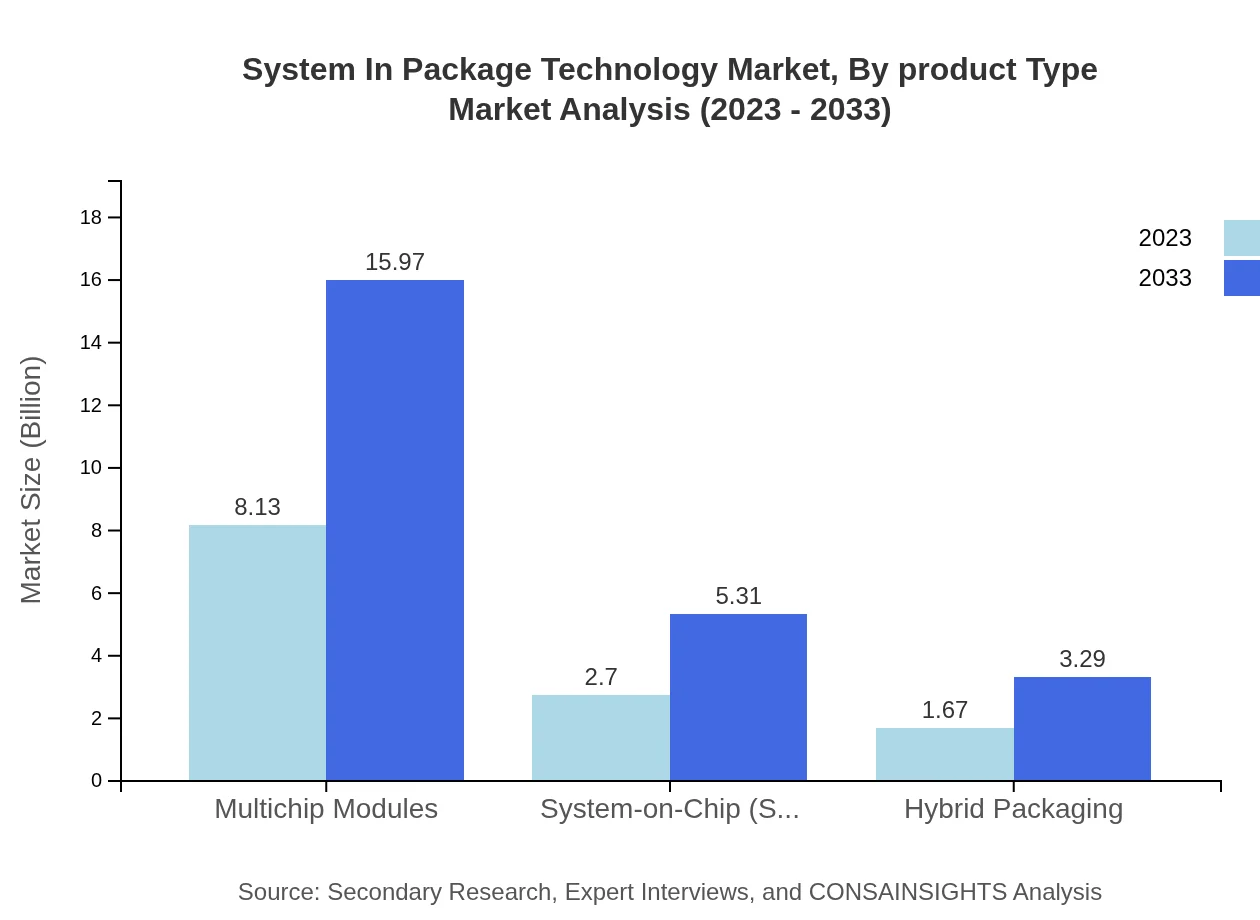

System In Package Technology Market Analysis By Product Type

Product types in the SiP market range from multichip modules to system-on-chip (SoC) applications. Multichip modules dominate with approximately 65% market share in 2023, reflecting demand for integrated solutions in compact designs, especially in mobile and wearable technologies.

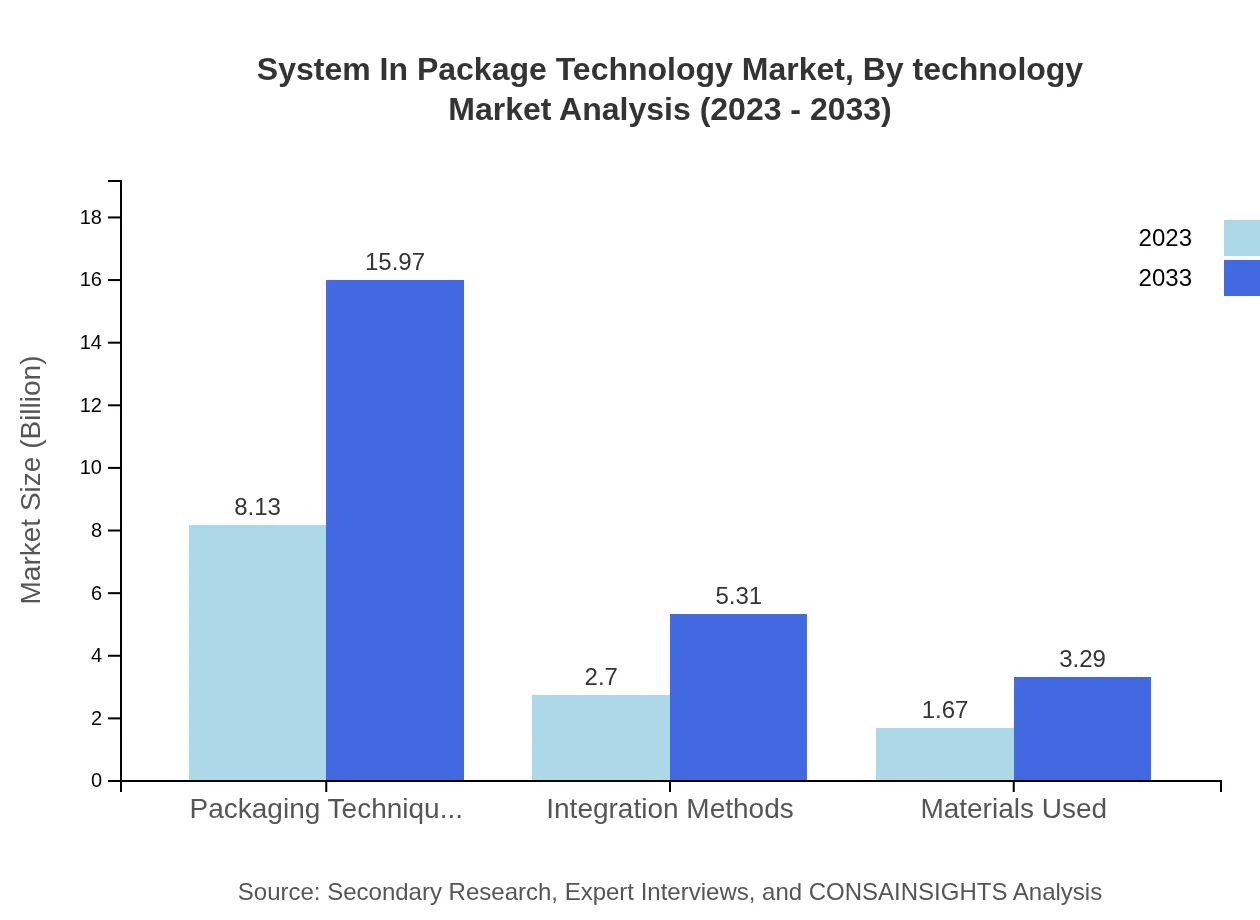

System In Package Technology Market Analysis By Technology

Key technologies in the SiP market include packaging techniques, integration methods, and materials. The packaging technique segment will leverage technologies like 3D packaging. A significant share of the market is expected from advanced materials due to the need for performance optimization.

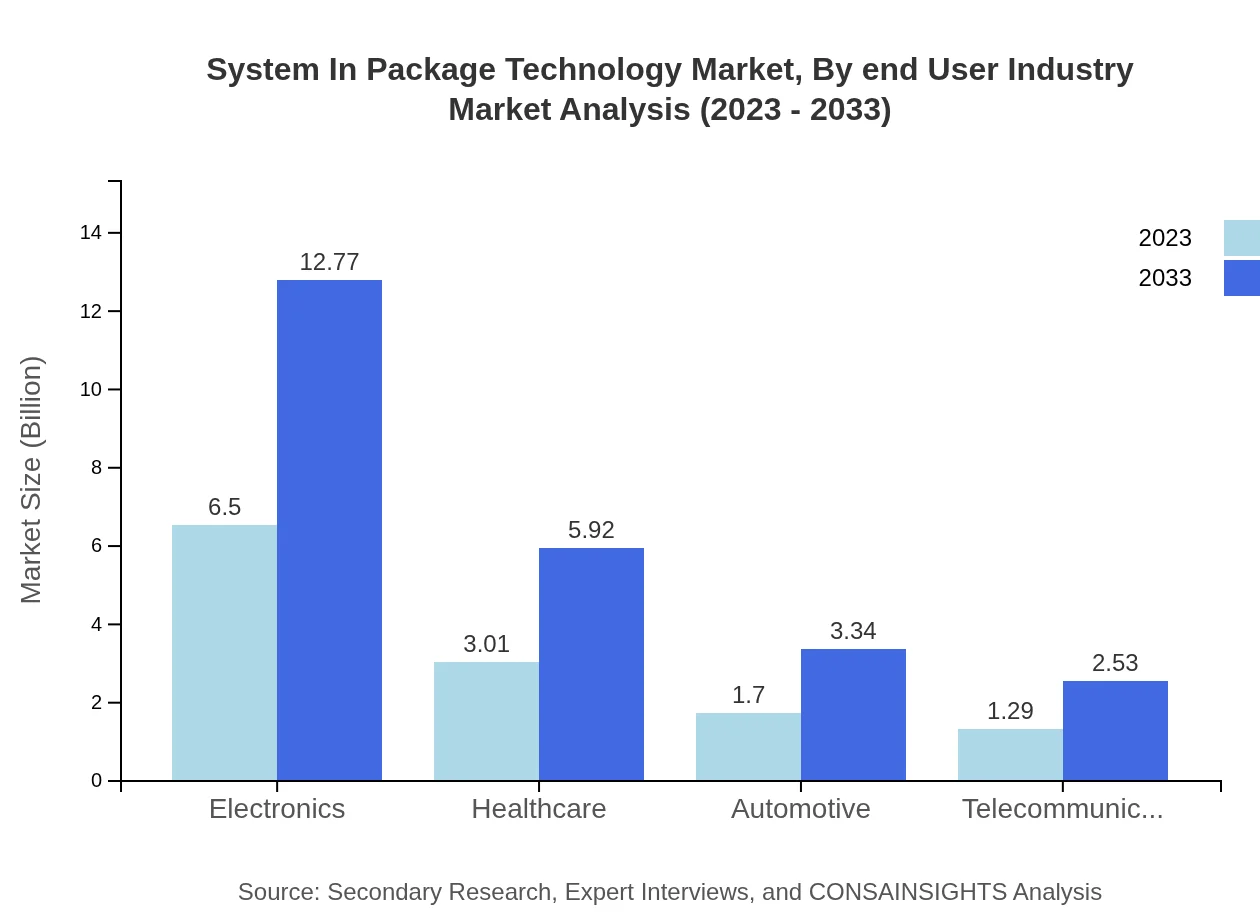

System In Package Technology Market Analysis By End User Industry

End-user industries are diverse, with consumer electronics, automotive, and telecommunications leading the demand for SiP solutions. Consumer electronics segment will account for the largest share of the market, driven by continuous innovation in mobile and smart device sectors.

System In Package Technology Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in System In Package Technology Industry

Intel Corporation:

Intel is a leading provider of semiconductor technology, significantly contributing to the SiP market through innovations in microprocessors and integrated systems.Samsung Electronics:

Samsung is recognized for its advanced packaging technologies, notably in smartphone and consumer electronics applications, driving growth in the SiP sector.STMicroelectronics:

STMicroelectronics specializes in integrated circuits and has made substantial investments in SiP technology for automotive and industrial applications.Texas Instruments:

Texas Instruments focuses on innovation in analog technologies and microcontrollers that leverage SiP technology for enhanced performance.We're grateful to work with incredible clients.

FAQs

What is the market size of System In-Package Technology?

The System-in-Package Technology market size is currently valued at $12.5 billion in 2023, with a projected growth rate of 6.8% CAGR leading to significant market expansion by 2033.

What are the key market players or companies in this System In-Package Technology industry?

Key players in the System-in-Package Technology industry include Intel, Texas Instruments, AMD, and TSMC. These companies are pivotal in driving innovation and establishing market trends within the sector.

What are the primary factors driving the growth in the System In-Package Technology industry?

The growth drivers for the System-in-Package Technology industry include rising demands for miniaturized electronics, increasing usage in consumer electronics, and advancements in semiconductor manufacturing technologies that enhance performance and efficiency.

Which region is the fastest Growing in the System In-Package Technology?

Asia Pacific is the fastest-growing region for System-in-Package Technology, with market size expected to rise from $2.13 billion in 2023 to $4.19 billion by 2033, indicating significant regional growth over the decade.

Does ConsaInsights provide customized market report data for the System In-Package Technology industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the System-in-Package Technology industry, ensuring that clients receive relevant insights and analytics to support their strategic decisions.

What deliverables can I expect from this System In-Package Technology market research project?

Deliverables from the System-in-Package Technology market research project typically include comprehensive market analysis reports, trend analyses, competitor insights, segment data breakdowns, and forecasts to assist in strategic planning.

What are the market trends of System In-Package Technology?

Current market trends in System-in-Package Technology include increasing integration of advanced packaging techniques, heightened focus on consumer electronics, and greater adoption across various sectors including automotive and healthcare.