System Infrastructure Software Market Report

Published Date: 31 January 2026 | Report Code: system-infrastructure-software

System Infrastructure Software Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the System Infrastructure Software market, covering market size, growth rates, segmentations, and regional analyses from 2023 to 2033, along with key industry insights and forecasts.

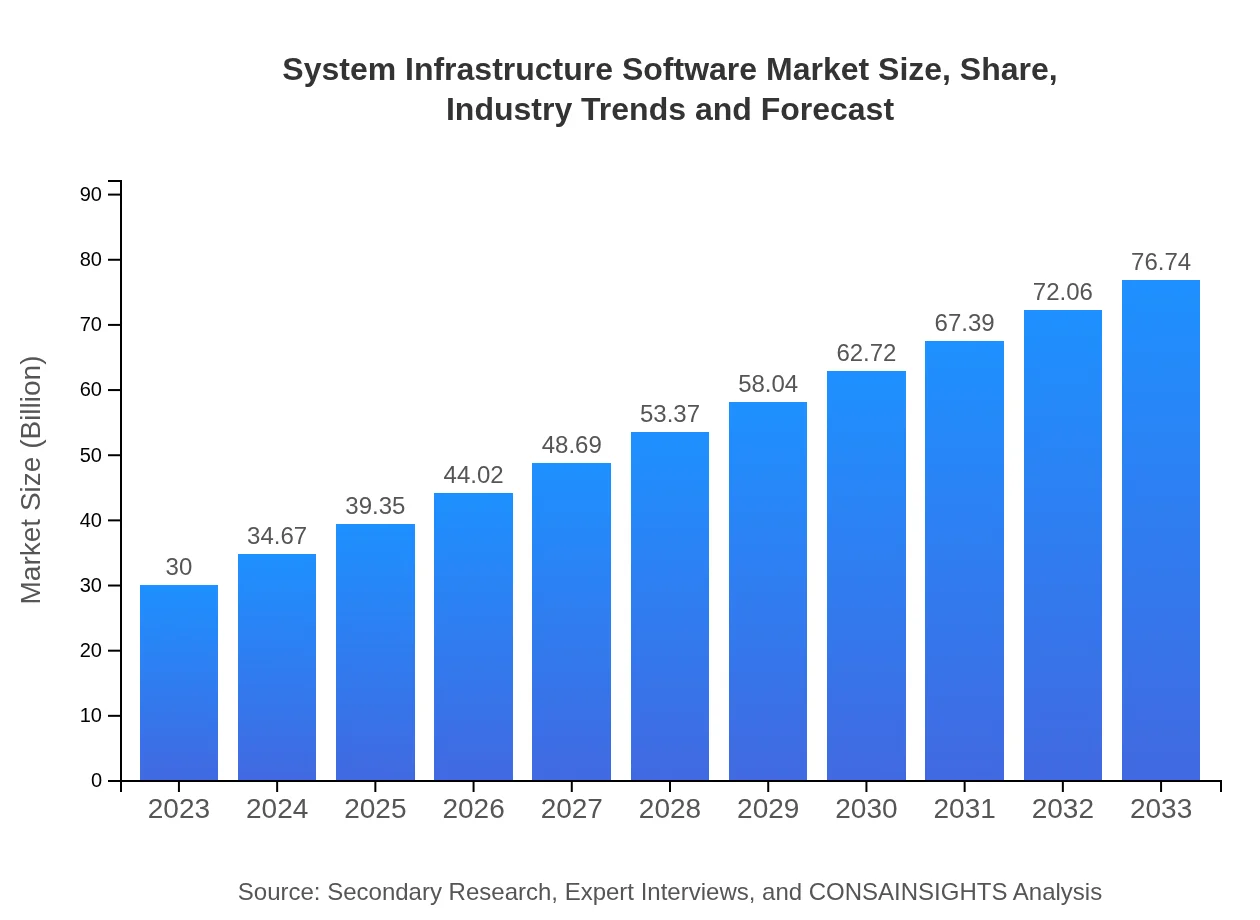

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $30.00 Billion |

| CAGR (2023-2033) | 9.5% |

| 2033 Market Size | $76.74 Billion |

| Top Companies | Microsoft, IBM, Cisco, Oracle, VMware |

| Last Modified Date | 31 January 2026 |

System Infrastructure Software Market Overview

Customize System Infrastructure Software Market Report market research report

- ✔ Get in-depth analysis of System Infrastructure Software market size, growth, and forecasts.

- ✔ Understand System Infrastructure Software's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in System Infrastructure Software

What is the Market Size & CAGR of System Infrastructure Software market in 2023?

System Infrastructure Software Industry Analysis

System Infrastructure Software Market Segmentation and Scope

Tell us your focus area and get a customized research report.

System Infrastructure Software Market Analysis Report by Region

Europe System Infrastructure Software Market Report:

Europe's System Infrastructure Software market is poised to expand from USD 10.59 billion in 2023 to USD 27.08 billion by 2033. European organizations are increasingly prioritizing IT security and regulatory compliance, thus driving demand for sophisticated infrastructure software.Asia Pacific System Infrastructure Software Market Report:

In 2023, the Asia Pacific market for System Infrastructure Software is valued at USD 5.62 billion and expected to grow to USD 14.38 billion by 2033. Countries with burgeoning digital economies, such as India and China, drive this growth through increasing investments in IT infrastructure.North America System Infrastructure Software Market Report:

North America dominates the market with a valuation of USD 10.27 billion in 2023, expected to reach USD 26.27 billion by 2033. The region's robust IT sector and continuous innovation in automation and software solutions are significant growth contributors.South America System Infrastructure Software Market Report:

The Latin American market is growing steadily, with a size of USD 0.17 billion in 2023 projected to increase to USD 0.42 billion by 2033. A key driver is the growing adoption of cloud services among enterprises seeking modernization.Middle East & Africa System Infrastructure Software Market Report:

The Middle East and Africa market is expected to grow from USD 3.36 billion in 2023 to USD 8.59 billion by 2033. Increased investment in digital transformation and smart city initiatives across the region are key growth drivers.Tell us your focus area and get a customized research report.

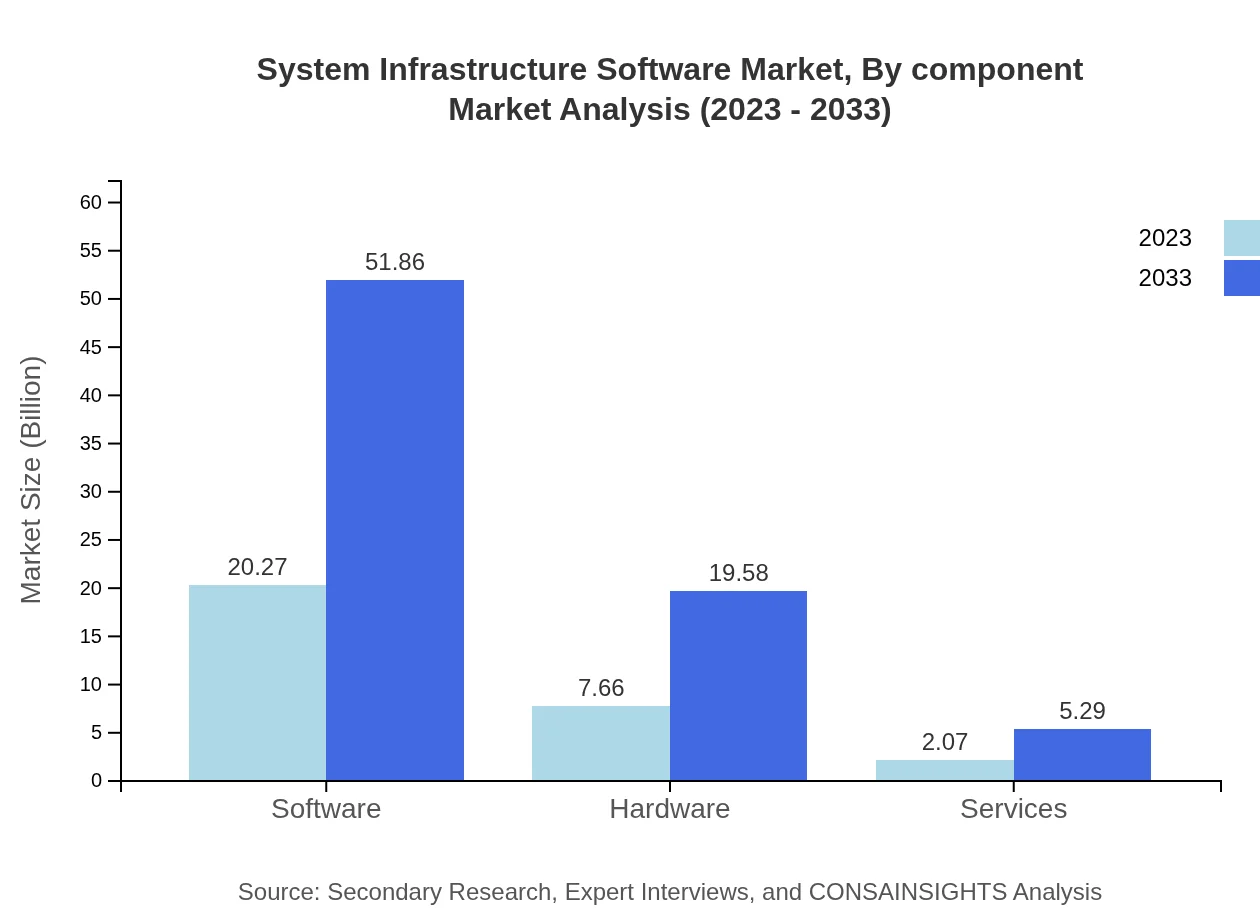

System Infrastructure Software Market Analysis By Component

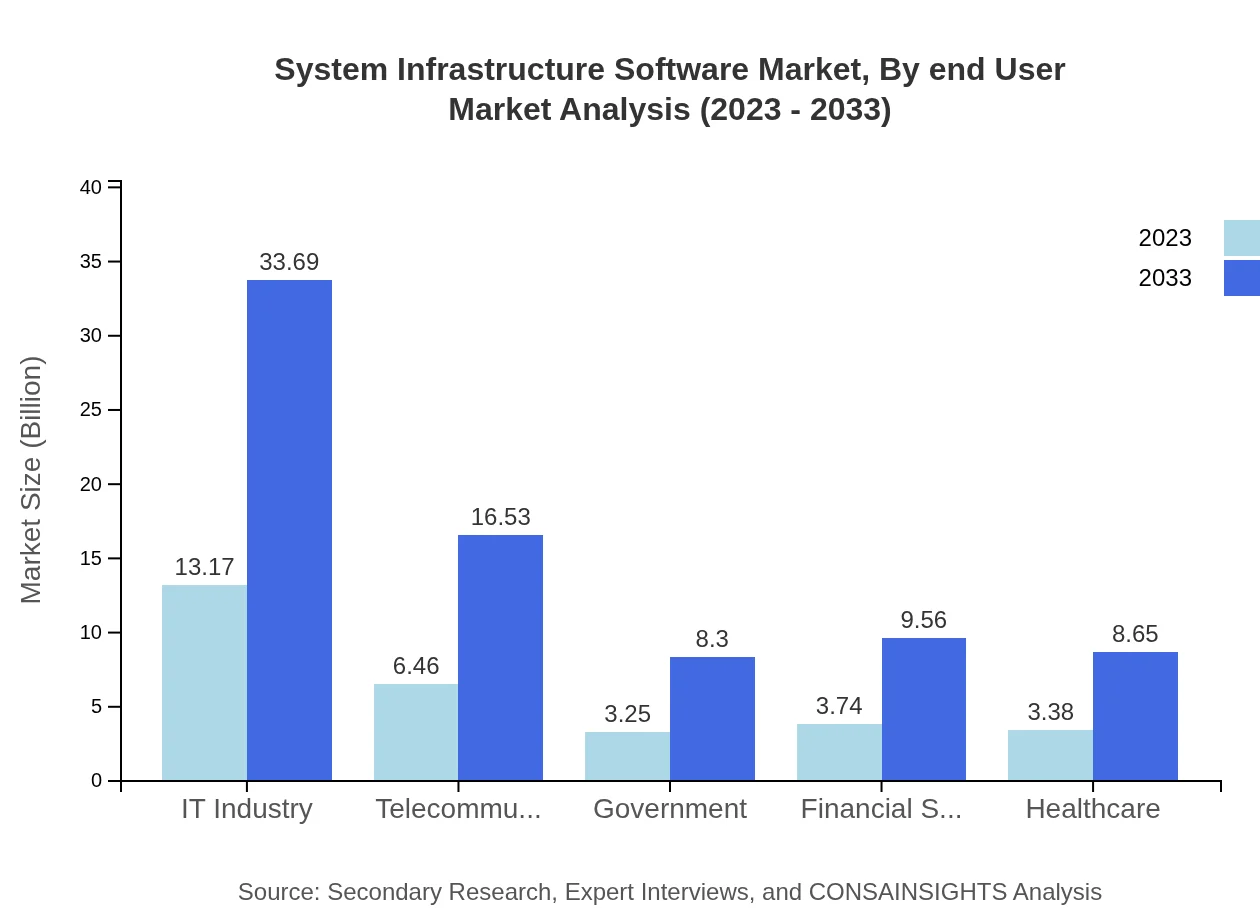

In 2023, the market size from the IT Industry component stands at USD 13.17 billion, projected to reach USD 33.69 billion by 2033. The Telecommunications sector contributes USD 6.46 billion this year, growing to USD 16.53 billion. Other notable segments include Government with USD 3.25 billion, Financial Services at USD 3.74 billion, and Healthcare at USD 3.38 billion, all expected to grow steadily through 2033.

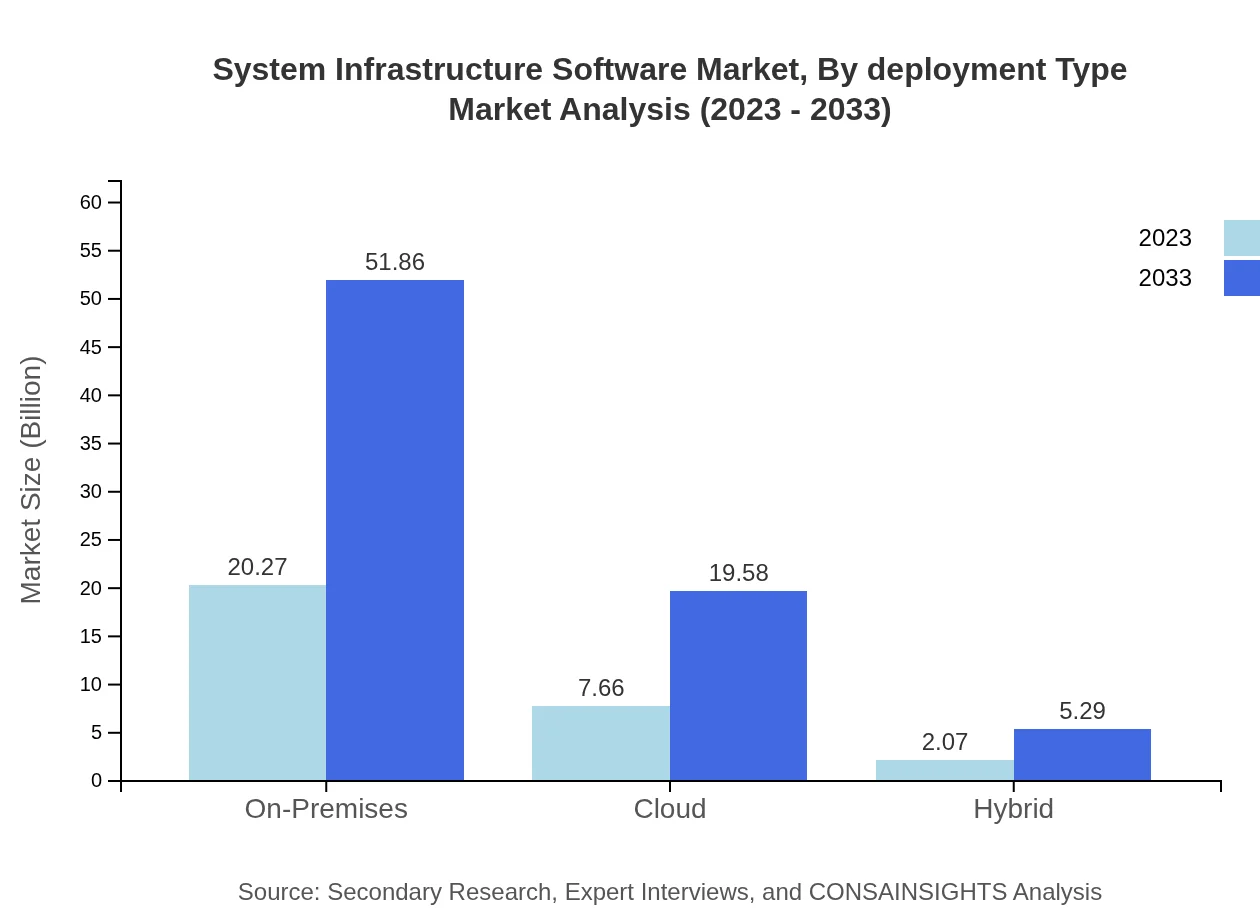

System Infrastructure Software Market Analysis By Deployment Type

The on-premises segment, valued at USD 20.27 billion in 2023, is expected to grow to USD 51.86 billion by 2033. Conversely, the cloud-based deployment type is projected to rise from USD 7.66 billion to USD 19.58 billion, reflecting the industry's migration toward more flexible solutions.

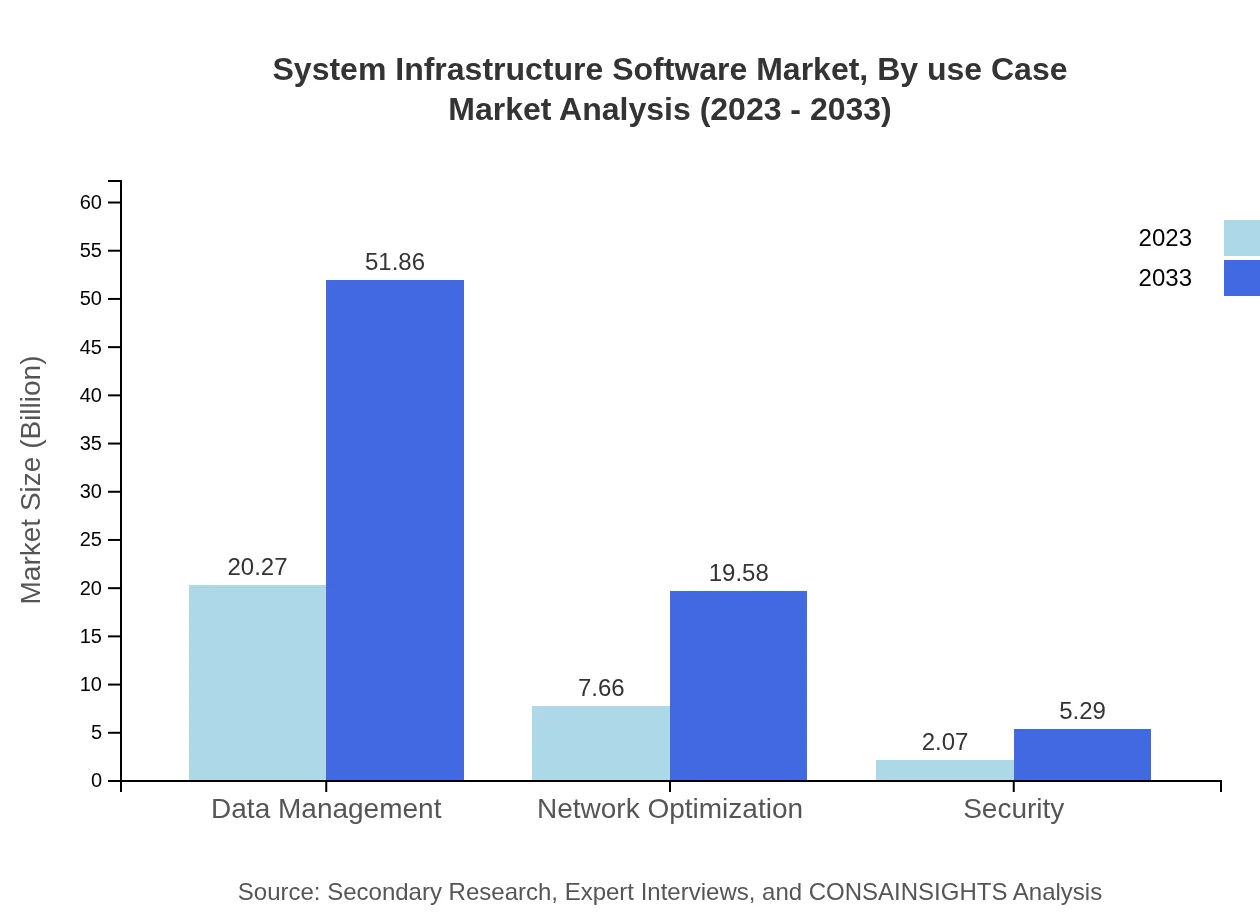

System Infrastructure Software Market Analysis By Use Case

Data Management captures the largest market share, reaching USD 20.27 billion in 2023 and likely to grow significantly to USD 51.86 billion by 2033. Network Optimization is also a key use case, expanding from USD 7.66 billion to USD 19.58 billion.

System Infrastructure Software Market Analysis By End User

The IT sector leads the market, with a size of USD 13.17 billion in 2023 and projected to hit USD 33.69 billion by 2033. Notably, the telecommunications sector is growing rapidly, driven by increased networking needs.

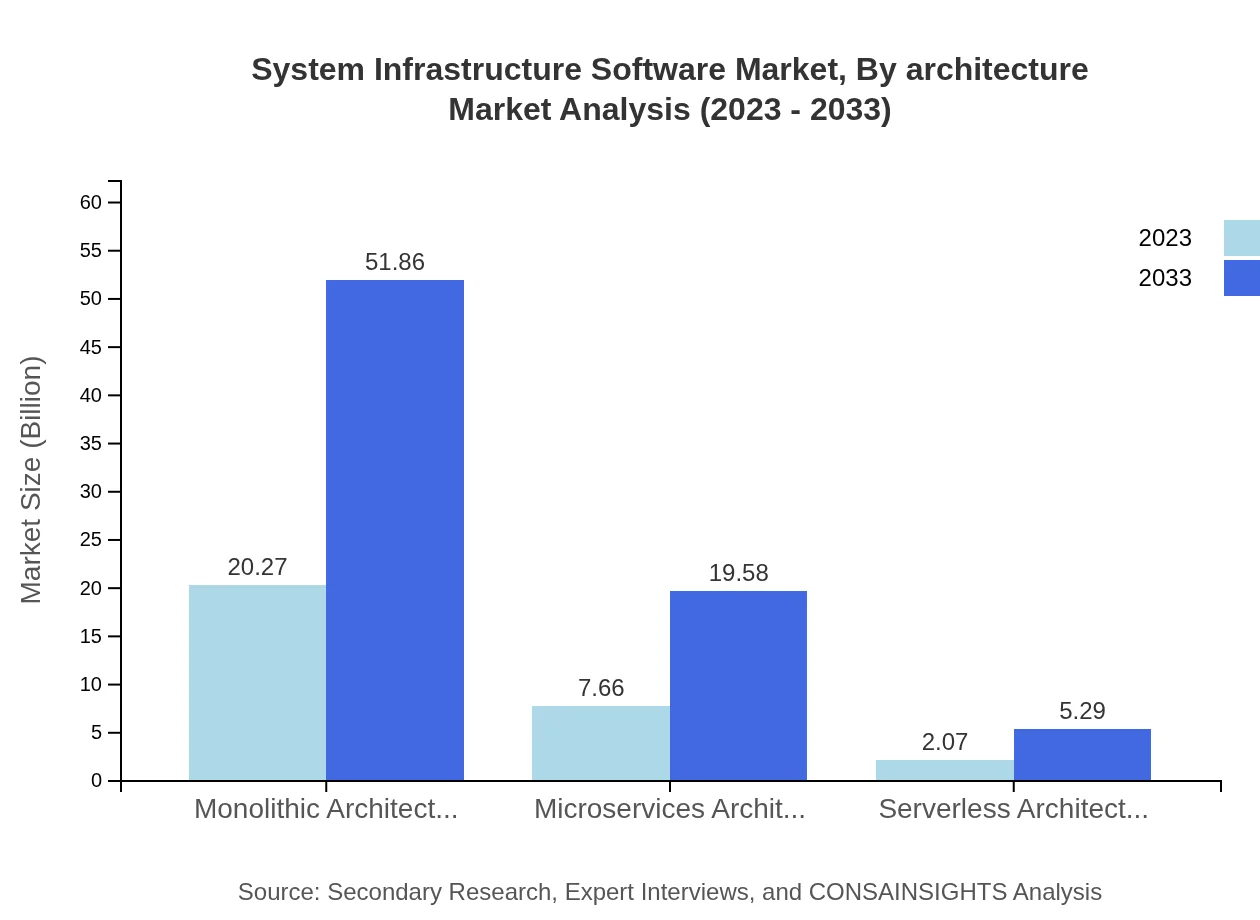

System Infrastructure Software Market Analysis By Architecture

Monolithic architecture dominates the architecture segment, accounting for USD 20.27 billion in 2023, projected to grow to USD 51.86 billion. Microservices architecture and serverless architecture are also gaining traction, showing significant growth potential through 2033.

System Infrastructure Software Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in System Infrastructure Software Industry

Microsoft:

Microsoft offers a comprehensive suite of infrastructure software solutions, including Azure and Azure Stack, facilitating cloud computing and data management.IBM:

IBM's infrastructure software offerings focus on enterprise solutions that enhance security and automation in IT environments, particularly for hybrid cloud infrastructures.Cisco:

Cisco specializes in network optimization, delivering robust software that ensures efficient management and security of network infrastructures.Oracle:

Oracle provides software solutions that integrate seamlessly with its cloud services, optimizing data management and enterprise resource planning.VMware:

VMware focuses on virtualization software solutions, enabling organizations to manage resources effectively and enhance operational efficiency.We're grateful to work with incredible clients.

FAQs

What is the market size of System Infrastructure Software?

The System Infrastructure Software market is valued at $30 billion in 2023, with a projected CAGR of 9.5%, indicating robust growth and expanding opportunities within the industry through 2033.

What are the key market players or companies in the System Infrastructure Software industry?

Key players in the System Infrastructure Software industry include major technology firms like IBM, Microsoft, Oracle, VMware, and Cisco, each offering a variety of solutions that contribute significantly to the market growth.

What are the primary factors driving the growth in the System Infrastructure Software industry?

Growth drivers include increasing demand for cloud computing, the need for automation and efficiency in IT processes, rising cybersecurity concerns, and significant investment in digital transformation across various sectors.

Which region is the fastest Growing in the System Infrastructure Software market?

The Asia Pacific region is the fastest-growing in the System Infrastructure Software market, expanding from $5.62 billion in 2023 to $14.38 billion by 2033, fueled by rapid technological advancements and investments.

Does ConsaInsights provide customized market report data for the System Infrastructure Software industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs of clients in the System Infrastructure Software industry, ensuring relevant insights and strategic guidance.

What deliverables can I expect from this System Infrastructure Software market research project?

Deliverables from the market research project include comprehensive reports, trend analysis, competitive landscape assessments, and customized insights tailored to client-specific business requirements.

What are the market trends of System Infrastructure Software?

Key market trends include the growth of virtualization solutions, adoption of hybrid cloud technologies, increasing importance of data management, and the shift towards more scalable and secure system architectures.