System Integrator Market Report

Published Date: 22 January 2026 | Report Code: system-integrator

System Integrator Market Size, Share, Industry Trends and Forecast to 2033

This report delves into the System Integrator market, providing insights into key trends, market size, segmentation, and growth forecasts from 2023 to 2033.

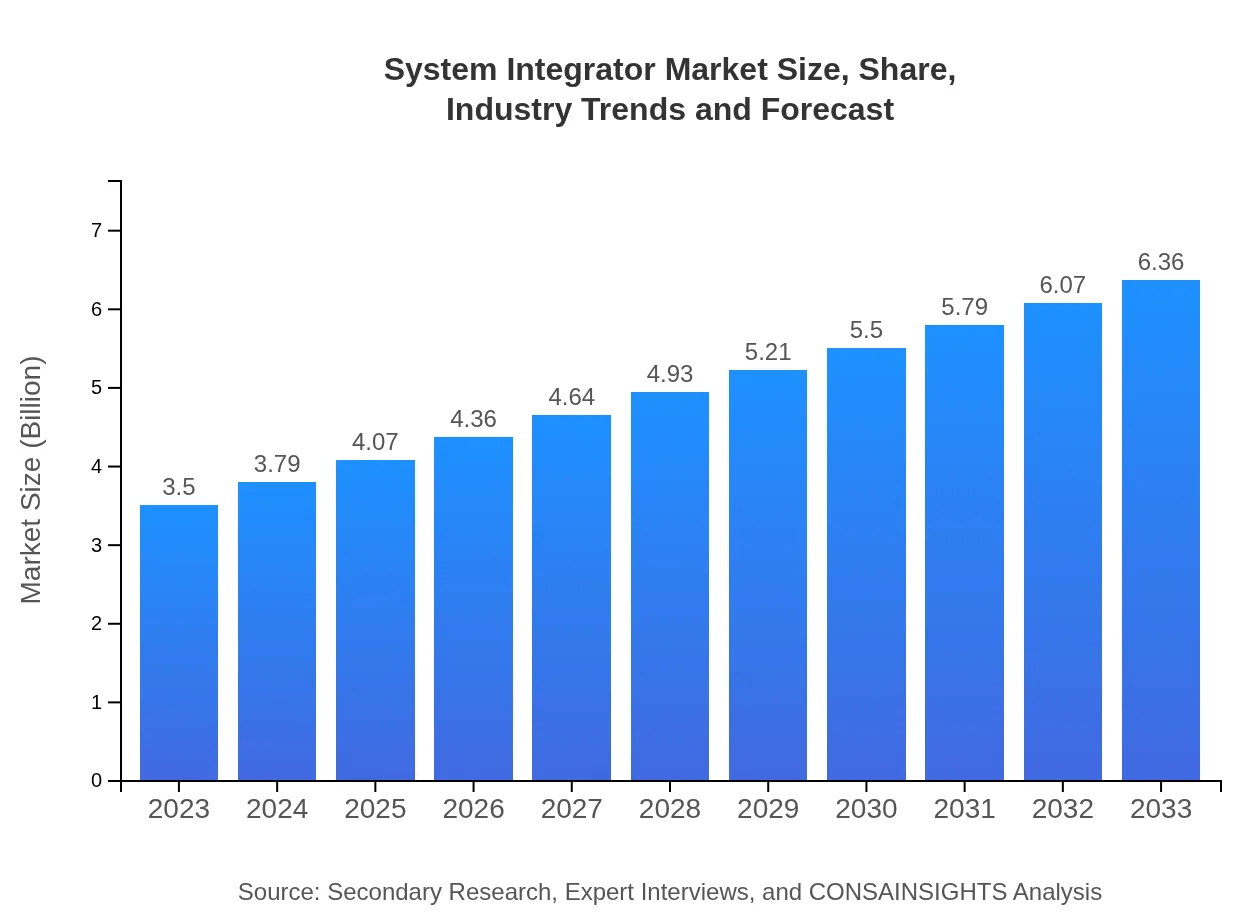

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $3.50 Billion |

| CAGR (2023-2033) | 6.0% |

| 2033 Market Size | $6.36 Billion |

| Top Companies | Accenture, IBM Corporation, Capgemini, Tata Consultancy Services, Cognizant |

| Last Modified Date | 22 January 2026 |

System Integrator Market Overview

Customize System Integrator Market Report market research report

- ✔ Get in-depth analysis of System Integrator market size, growth, and forecasts.

- ✔ Understand System Integrator's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in System Integrator

What is the Market Size & CAGR of System Integrator market in 2023?

System Integrator Industry Analysis

System Integrator Market Segmentation and Scope

Tell us your focus area and get a customized research report.

System Integrator Market Analysis Report by Region

Europe System Integrator Market Report:

The European market is valued at $0.89 billion in 2023, predicted to increase to $1.62 billion by 2033, fueled by regulatory compliance mandates and a growing emphasis on cybersecurity.Asia Pacific System Integrator Market Report:

In the Asia Pacific region, the System Integrator market is valued at $0.68 billion in 2023 and is projected to reach $1.24 billion by 2033, driven by rapid industrialization, smart city initiatives, and increasing technology investments.North America System Integrator Market Report:

North America leads the market with a size of $1.23 billion in 2023, expected to grow to $2.24 billion by 2033. The presence of major technology firms and a strong inclination towards advanced technology adoption bolster this growth.South America System Integrator Market Report:

The South American market is expected to grow from $0.31 billion in 2023 to $0.56 billion by 2033. This growth is propelled by the need for digital transformation in various sectors, especially in Brazil and Argentina.Middle East & Africa System Integrator Market Report:

The Middle East and Africa region shows steady growth from $0.39 billion in 2023 to $0.70 billion by 2033, influenced by significant investments in infrastructure and technology integration in sectors like energy and telecommunications.Tell us your focus area and get a customized research report.

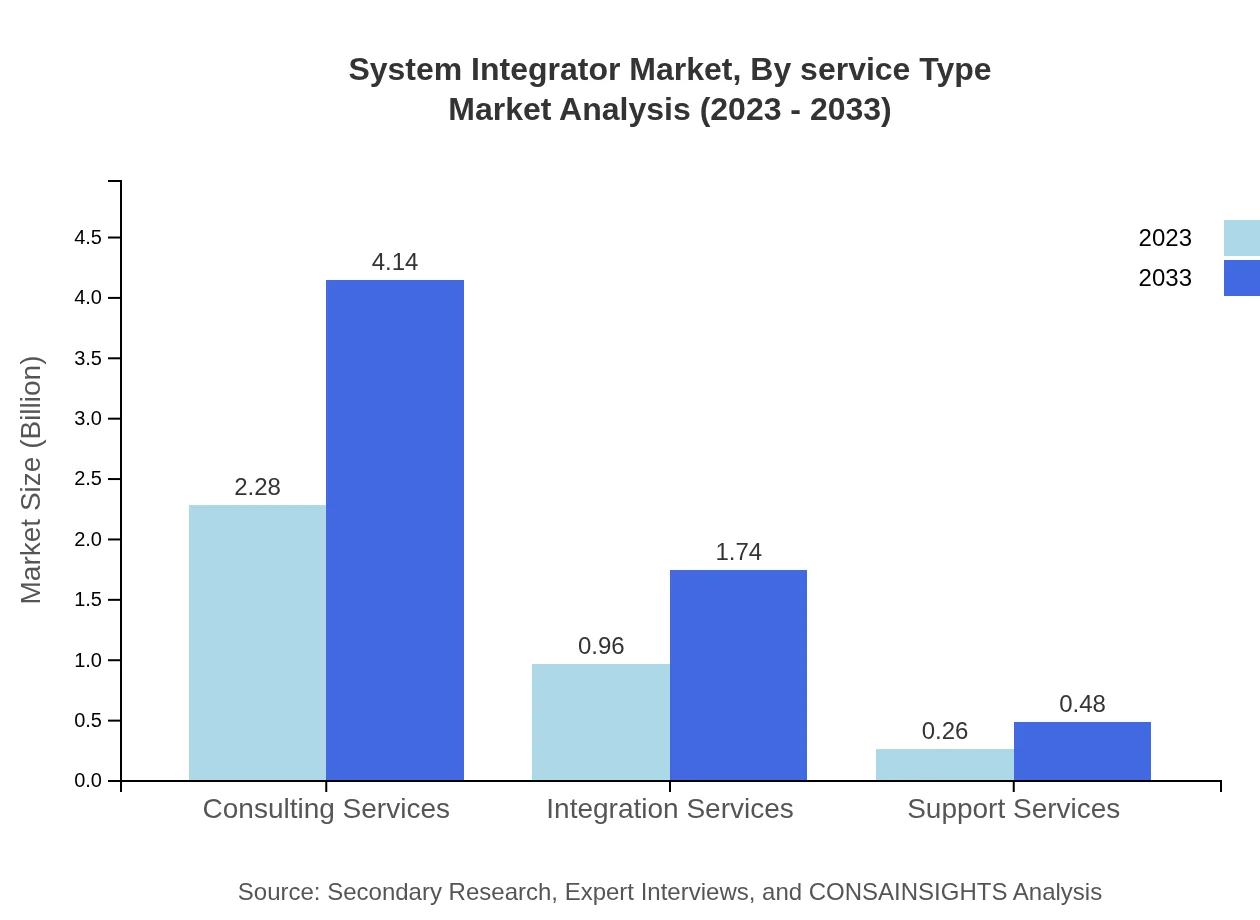

System Integrator Market Analysis By Service Type

The Service Type segment of the System Integrator market includes consulting services, integration services, and support services. Consulting services accounted for a significant share in 2023, valued at $2.28 billion (65.08%), while integration services follow closely at $0.96 billion (27.41%). Support services comprise a smaller share, valued at $0.26 billion (7.51%). Each service type contributes uniquely to the overall market growth through specialized offerings.

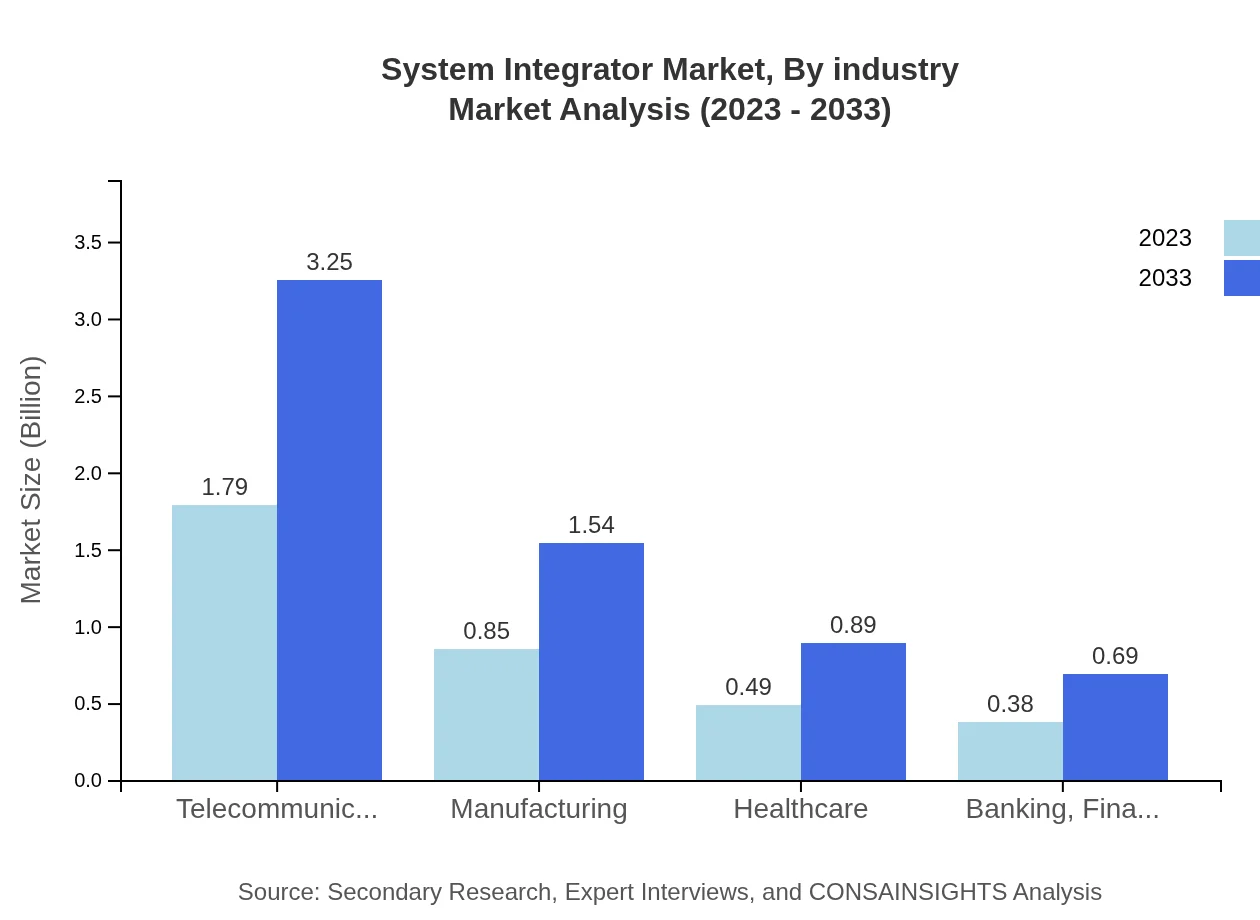

System Integrator Market Analysis By Industry

Systems integrators cater to various industries including Telecommunications, Manufacturing, Healthcare, Banking, and Financial Services. The Telecommunications sector holds the largest market share at $1.79 billion (51.04%) in 2023, followed by Manufacturing at $0.85 billion (24.16%). Healthcare stands at $0.49 billion (13.98%), and Banking services recorded $0.38 billion (10.82%). These segments illustrate the diverse applications and integration requirements across industries.

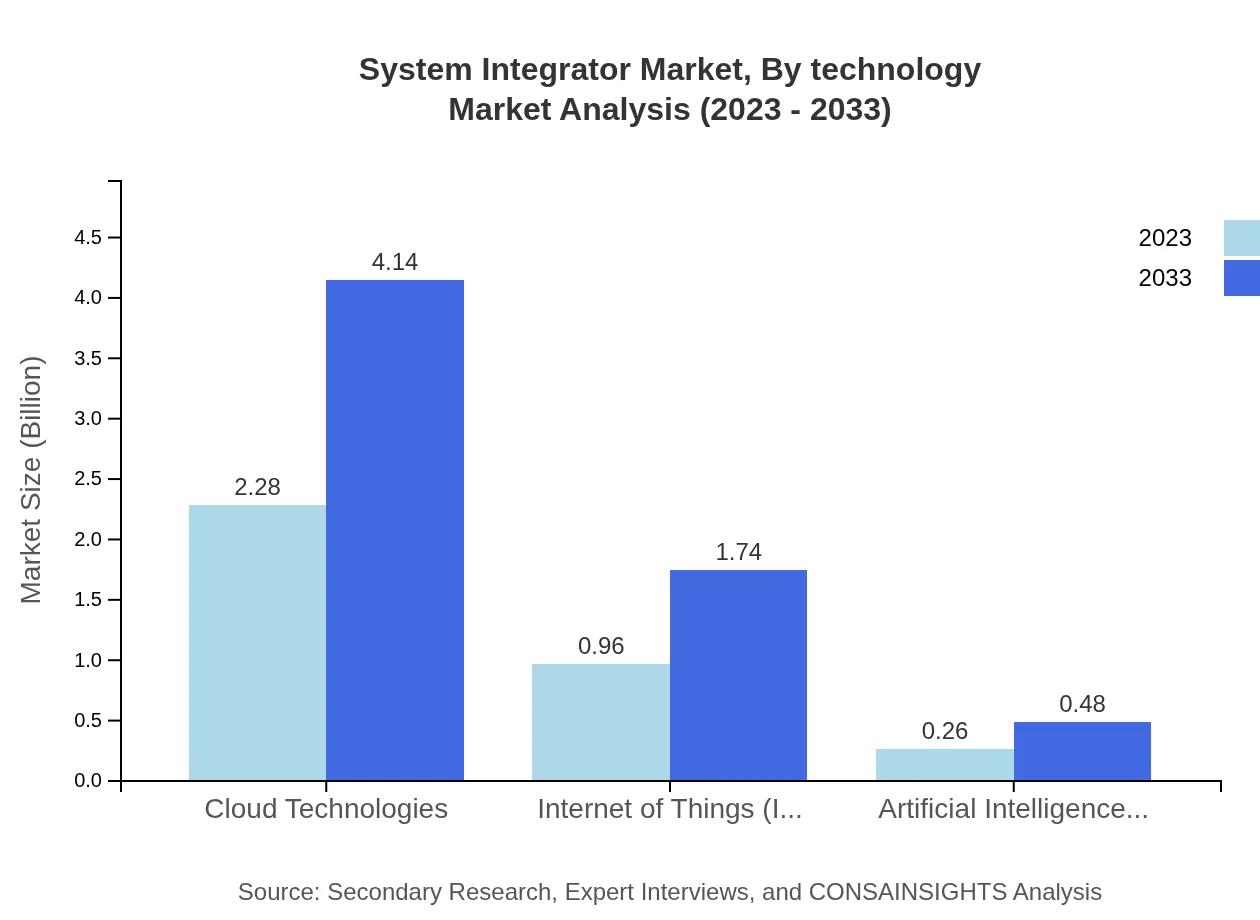

System Integrator Market Analysis By Technology

The technology segment highlights the significant role of innovations driving the System Integrator market. Key technologies include Cloud Technologies, which dominate the market at $2.28 billion (65.08%), followed by Internet of Things (IoT) at $0.96 billion (27.41%), and Artificial Intelligence and Machine Learning at $0.26 billion (7.51%). The trends indicate increasing reliance on cloud integration and IoT solutions to facilitate smarter operations.

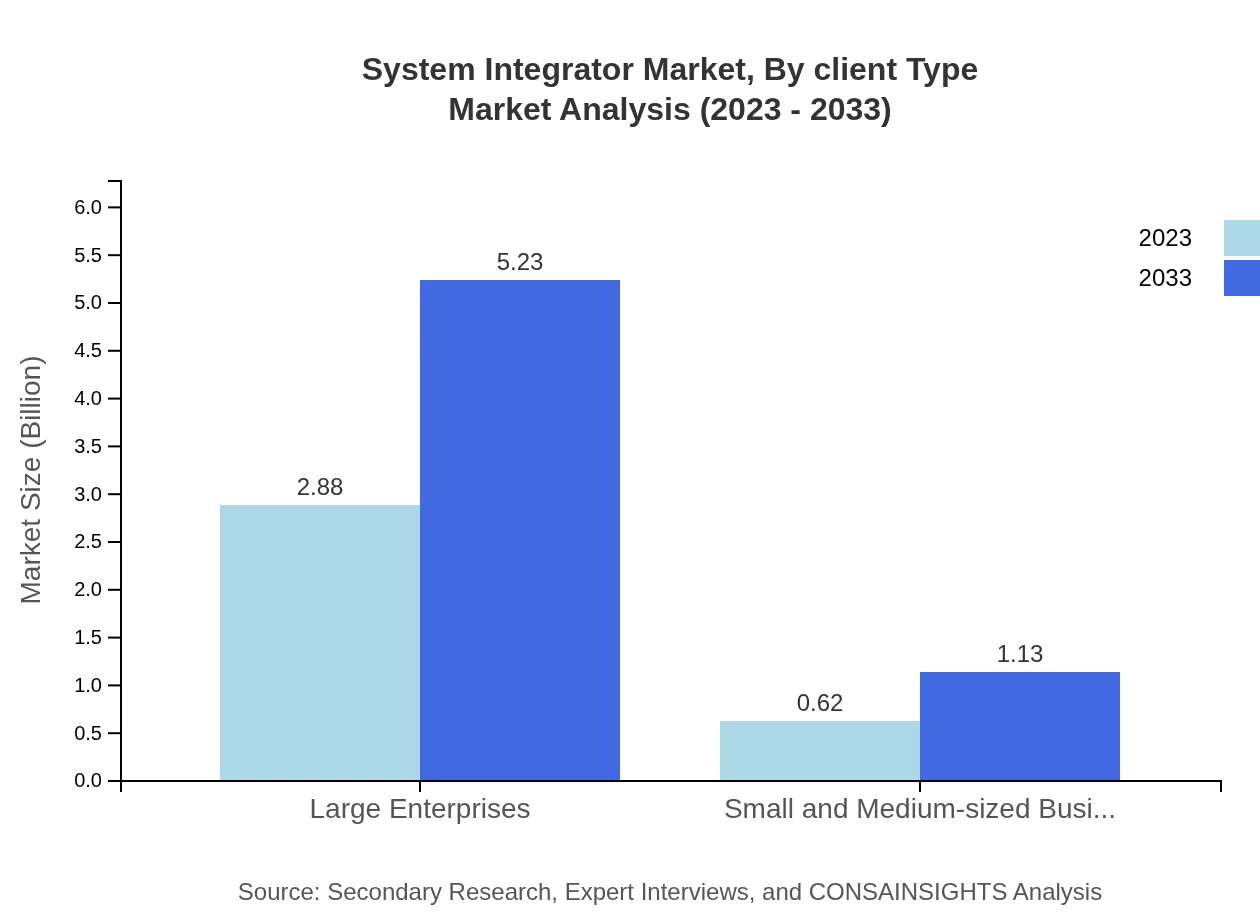

System Integrator Market Analysis By Client Type

Market segmentation by client type categorizes users as Large Enterprises or Small and Medium-sized Businesses (SMBs). Large enterprises emerge as the leading client type, holding an $2.88 billion share (82.26%) in 2023. Conversely, SMBs represent a growing market segment, valued at $0.62 billion (17.74%). As more SMBs embrace digital solutions, their impact on market dynamics is expected to rise remarkably.

System Integrator Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in System Integrator Industry

Accenture:

Accenture is a leading global professional services company specializing in IT and consulting services, offering innovative system integration solutions tailored to various industries.IBM Corporation:

IBM is a leading technology provider that delivers integrated solutions through advanced artificial intelligence, analytics, and cloud services, significantly impacting the System Integrator market.Capgemini:

Capgemini is a multinational corporation specialized in consulting and technology services, known for its commitment to digital transformation and effective system integration.Tata Consultancy Services:

TCS is a leading IT services, consulting, and business solutions organization that delivers technology solutions including system integration across varied sectors.Cognizant:

Cognizant provides IT services and solutions, focusing on delivering system integration services that enable businesses to optimize operations through technology.We're grateful to work with incredible clients.

FAQs

What is the market size of System Integrator?

The global System Integrator market is currently valued at $3.5 billion, with an expected CAGR of 6.0% from 2023 to 2033. This growth reflects the increasing demand for integrated solutions across various industries.

What are the key market players or companies in this System Integrator industry?

Key players in the System Integrator industry include major technology firms and specialized integration service providers. These companies collectively drive innovation and market growth, ensuring competitive advances in system integration technologies.

What are the primary factors driving the growth in the System Integrator industry?

The growth in the System Integrator industry is driven by technological advancements, increased automation, and the growing demand for integrated solutions. Factors like cloud computing and IoT further propel market dynamics, enhancing efficiency and functionality.

Which region is the fastest Growing in the System Integrator?

The North American region is the fastest-growing in the System Integrator market, projected to grow from $1.23 billion in 2023 to $2.24 billion in 2033. Following closely are the European and Asia-Pacific regions, indicating robust growth.

Does ConsaInsights provide customized market report data for the System Integrator industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs within the System Integrator industry. Clients can access detailed insights and analytics based on unique market segments and parameters.

What deliverables can I expect from this System Integrator market research project?

Deliverables from the System Integrator market research project typically include comprehensive reports, analytical data, market trends analysis, competitive landscape insights, and forecasts, all tailored to client specifications.

What are the market trends of System Integrator?

Current trends in the System Integrator market include the rise of cloud technologies, increasing reliance on IoT systems, and advancements in industrial automation. These trends are critical for understanding the industry's direction over the next decade.