Tablet Application Processor Market Report

Published Date: 31 January 2026 | Report Code: tablet-application-processor

Tablet Application Processor Market Size, Share, Industry Trends and Forecast to 2033

This report delves into the Tablet Application Processor market from 2023 to 2033, providing insights into market conditions, size, trends, and forecasts. It addresses key segments and regional analyses to understand the competitive landscape and growth opportunities in this industry.

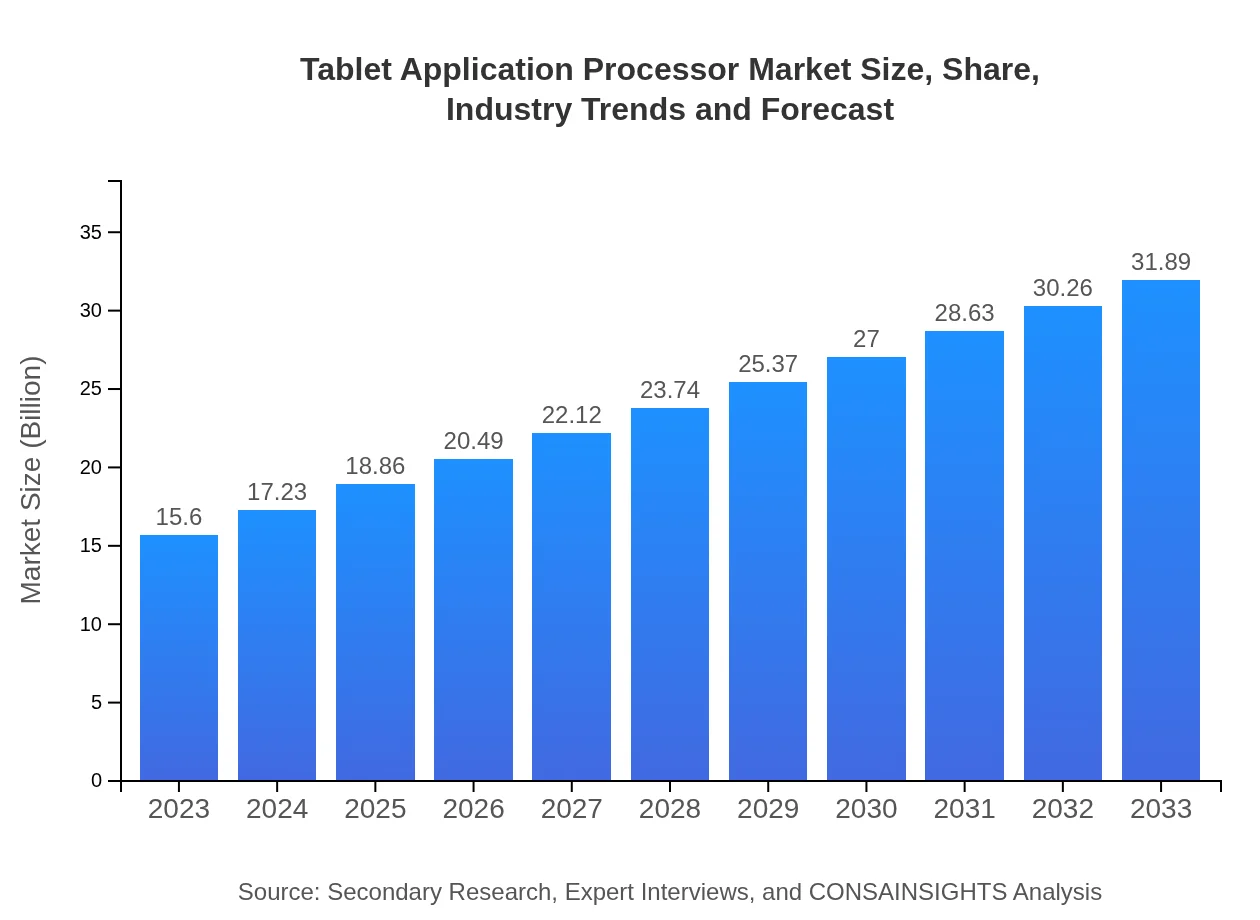

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.60 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $31.89 Billion |

| Top Companies | Qualcomm , Apple , MediaTek, Samsung |

| Last Modified Date | 31 January 2026 |

Tablet Application Processor Market Overview

Customize Tablet Application Processor Market Report market research report

- ✔ Get in-depth analysis of Tablet Application Processor market size, growth, and forecasts.

- ✔ Understand Tablet Application Processor's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Tablet Application Processor

What is the Market Size & CAGR of Tablet Application Processor market in 2023?

Tablet Application Processor Industry Analysis

Tablet Application Processor Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Tablet Application Processor Market Analysis Report by Region

Europe Tablet Application Processor Market Report:

Europe’s Tablet Application Processor market is expected to expand from $5.17 billion in 2023 to $10.56 billion by 2033. The rise in demand is fostered by increasing tablet use in both professional sectors and consumer markets, alongside governmental initiatives promoting digitization.Asia Pacific Tablet Application Processor Market Report:

In 2023, the Asia Pacific region is expected to witness a market size of approximately $2.58 billion, which is projected to grow to about $5.27 billion by 2033. This growth can be attributed to the rapid digitalization across countries like China and India, coupled with a burgeoning consumer electronics market driving demand for tablets.North America Tablet Application Processor Market Report:

In North America, the market size stands at $5.70 billion in 2023, projected to grow to $11.65 billion by 2033. This growth correlates with the increasing use of tablets in educational institutions and remote work setups, bolstered by innovations in application processor technologies.South America Tablet Application Processor Market Report:

The South American market is relatively stagnant, with a size of $0.00 billion in 2023, remaining unchanged through 2033. Economic fluctuations and lower tablet penetration in this region account for the lack of growth.Middle East & Africa Tablet Application Processor Market Report:

The Middle East and Africa market is expected to grow from $2.15 billion in 2023 to $4.40 billion by 2033, as increased investments in technology and rising consumer electronics purchases drive improvements in tablet sales.Tell us your focus area and get a customized research report.

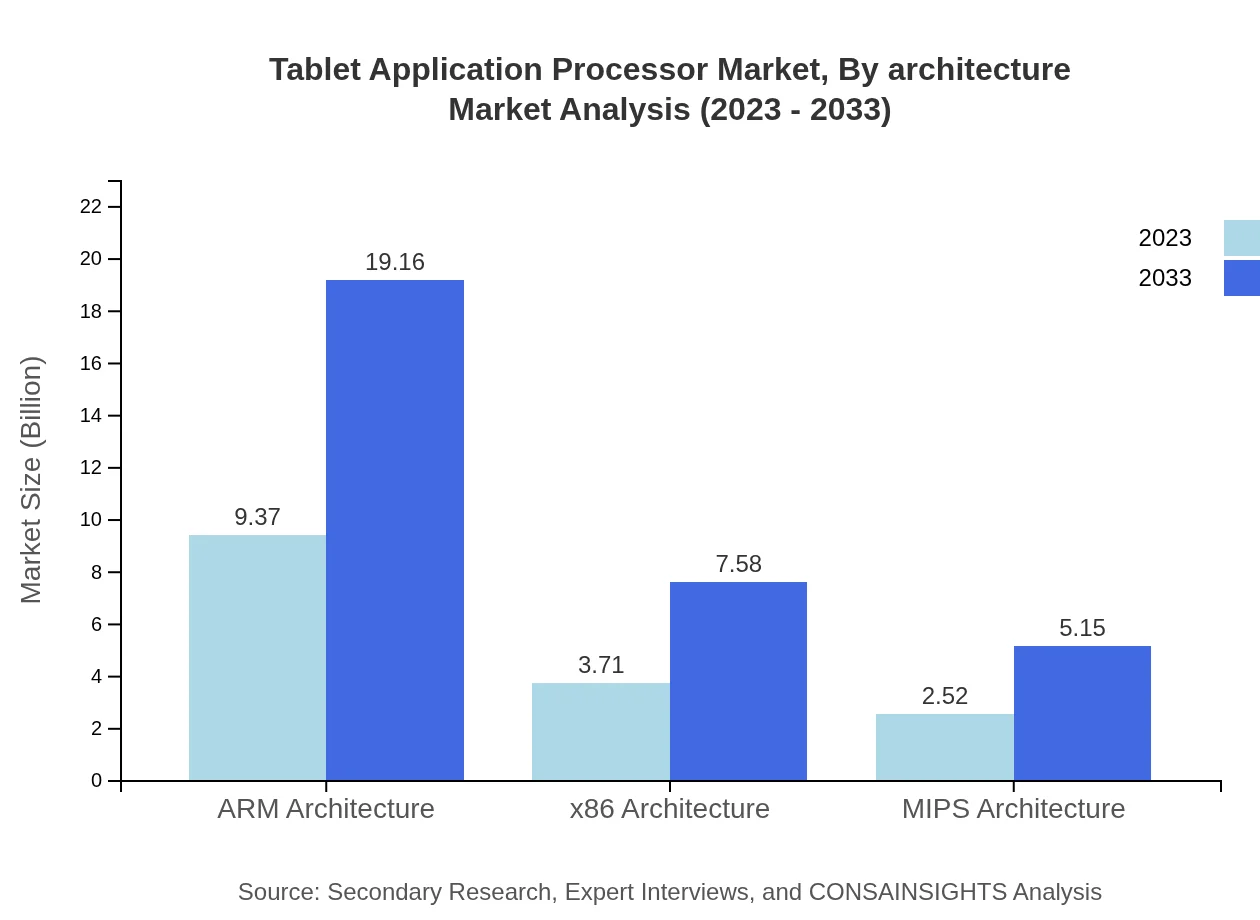

Tablet Application Processor Market Analysis By Architecture

The architecture segment represents critical performance determinants for tablet application processors. ARM architecture holds the largest market share at 60.07% in 2023, driven by its energy efficiency and performance. x86 architecture, representing 23.77%, complements applications requiring high performance, while MIPS architecture also maintains a significant presence with a share of 16.16%.

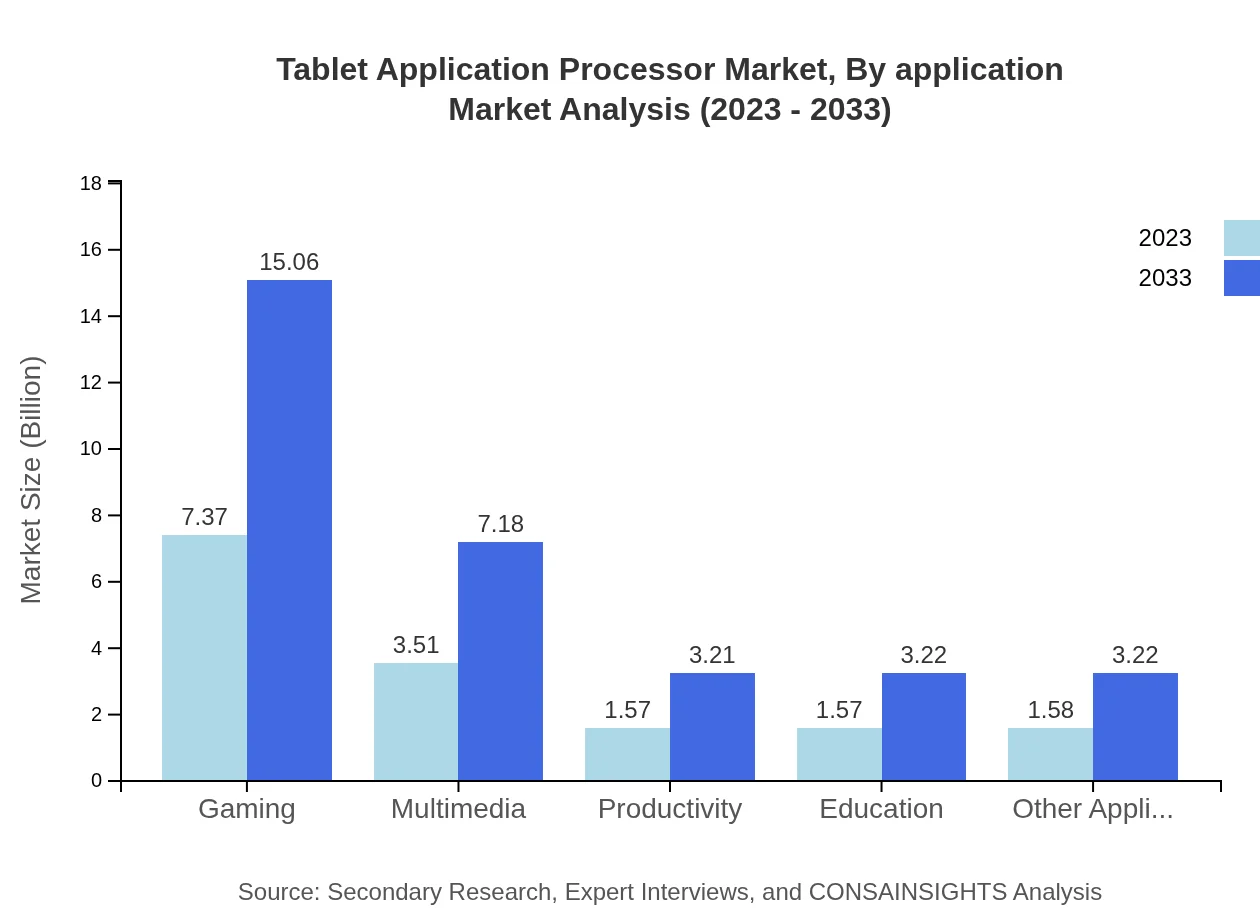

Tablet Application Processor Market Analysis By Application

Gaming applications are a leading segment, accounting for 47.22% of the market share in 2023, mainly due to high-performance demands from gaming enthusiasts. Other notable segments include multimedia (22.51%), productivity (10.07%), education (10.09%), while other applications constitute the remaining market.

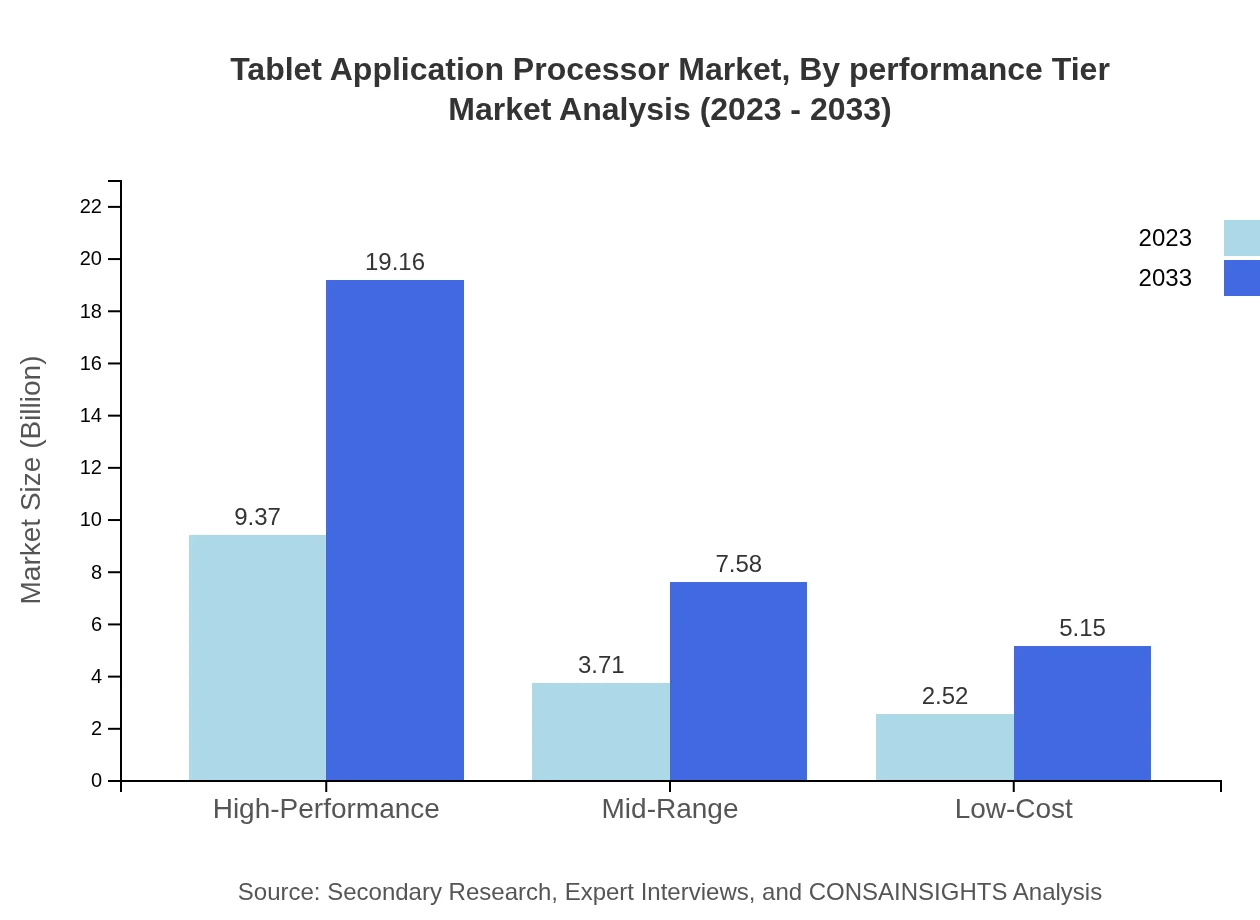

Tablet Application Processor Market Analysis By Performance Tier

High-performance processors dominate the market, with a share of 60.07% in 2023. Mid-range processors account for 23.77%, appealing to consumers seeking a balance between cost and performance, while low-cost processors hold a 16.16% share, catering to budget-conscious customers.

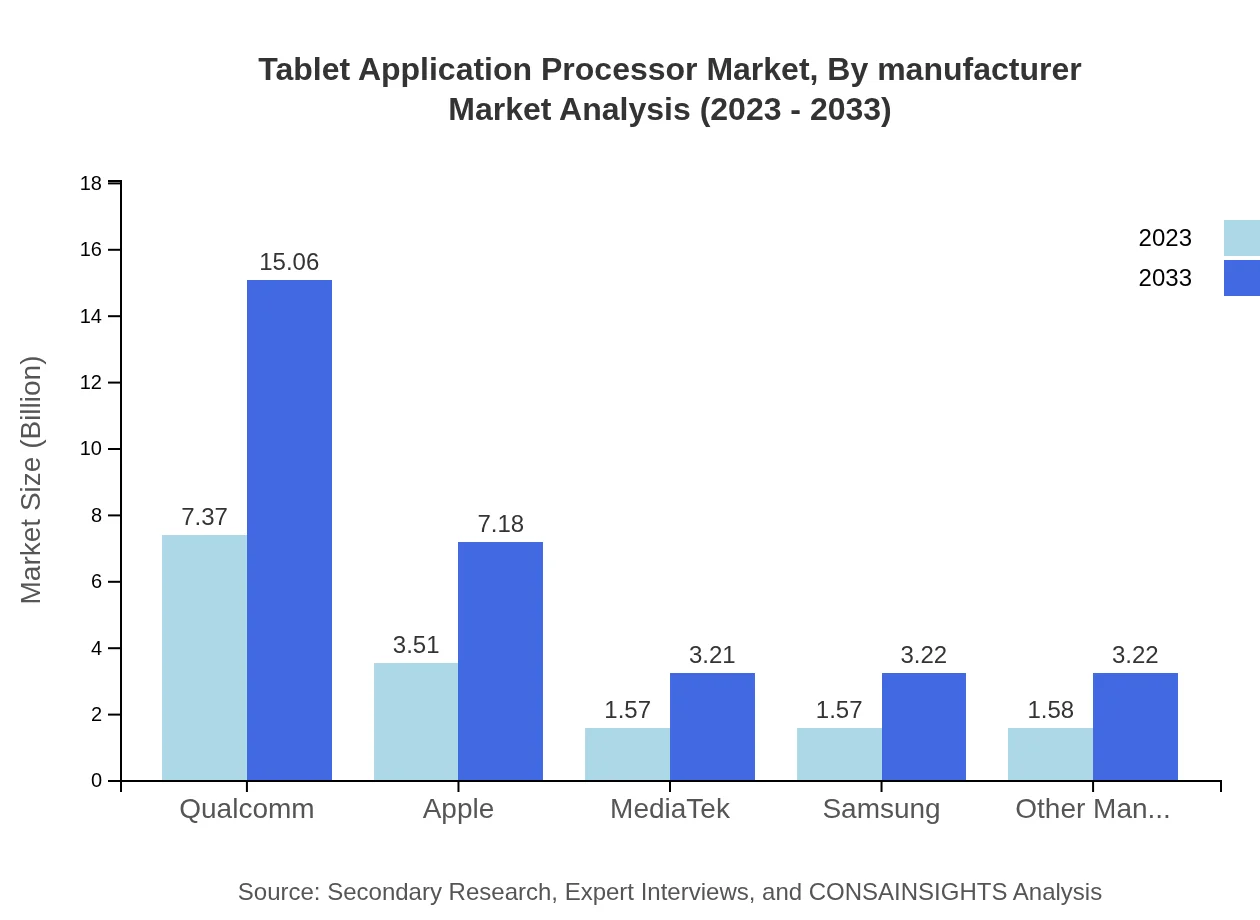

Tablet Application Processor Market Analysis By Manufacturer

Qualcomm leads the market at 47.22% in 2023, followed by Apple at 22.51%. MediaTek and Samsung contribute 10.07% and 10.09% respectively, while other manufacturers maintain a small, yet notable presence in the market, indicating a competitive landscape driven by innovation.

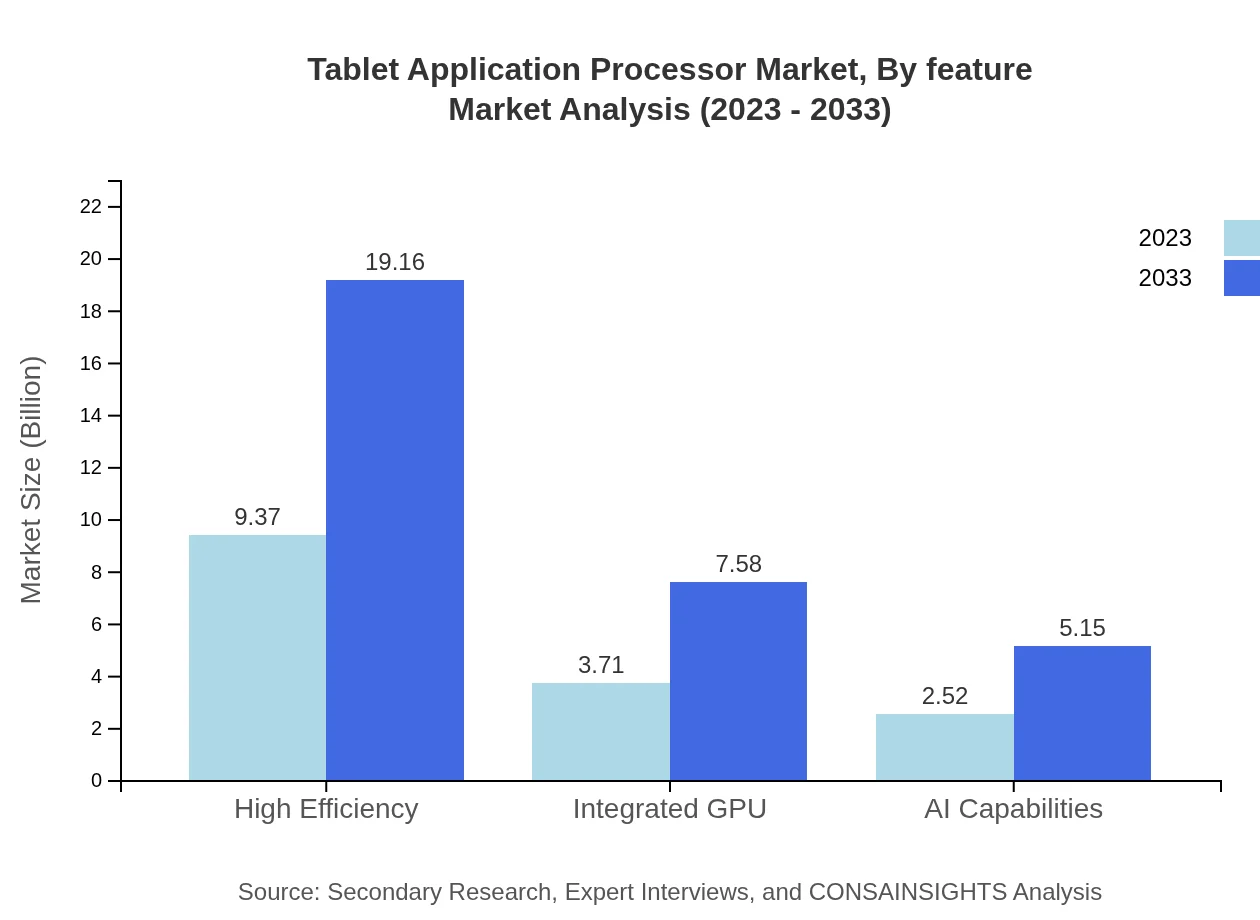

Tablet Application Processor Market Analysis By Feature

High Efficiency processors are the most prominent category, holding a significant 60.07% market share. Integrated GPUs are crucial too, representing 23.77%, while AI capabilities grow in demand, constituting 16.16% of the market share, indicative of trends towards advanced computational technologies.

Tablet Application Processor Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Tablet Application Processor Industry

Qualcomm :

A leader in wireless technology and semiconductor solutions, Qualcomm designs and markets chips that power mobile devices, including tablets, enabling connectivity and advanced user experiences.Apple :

Known for its innovation in consumer electronics, Apple manufactures high-performance processors for its iPad range, setting industry standards in processing power and efficiency.MediaTek:

A significant player in the global semiconductor industry, MediaTek offers integrated solutions for a wide array of applications, including tablets, contributing to affordable yet powerful computing experiences.Samsung :

Samsung’s Exynos processors have made notable inroads in the tablet market, focusing on balancing performance and power consumption to meet modern user demands.We're grateful to work with incredible clients.

FAQs

What is the market size of tablet Application Processor?

The global market size for the tablet application processor is projected to reach $15.6 billion by 2033, with a CAGR of 7.2%. This growth reflects increasing demand for high-performance tablets with advanced processing capabilities.

What are the key market players or companies in this tablet application processor industry?

Key market players include Qualcomm, Apple, MediaTek, and Samsung. Their innovation in high-performance CPU designs and integration of AI capabilities significantly influences the competitive landscape of the tablet application processor market.

What are the primary factors driving the growth in the tablet application processor industry?

Factors driving growth include the rise in demand for mobile computing, advancements in processor technology, and increasing use of tablets in various sectors such as education, entertainment, and productivity.

Which region is the fastest Growing in the tablet application processor market?

North America is the fastest-growing region, projected to expand from $5.70 billion in 2023 to $11.65 billion by 2033. Asia Pacific also shows significant growth, reaching $5.27 billion in the same period.

Does ConsaInsights provide customized market report data for the tablet application processor industry?

Yes, ConsaInsights offers customized market report data tailored to client-specific needs, ensuring that businesses can obtain insights that specifically align with their strategic goals within the tablet application processor market.

What deliverables can I expect from this tablet application processor market research project?

Expect comprehensive reports containing market size analysis, segment breakdowns, competitive landscape assessments, growth forecasts, and strategic recommendations to help guide investment decisions in the tablet application processor market.

What are the market trends of tablet application processors?

Current market trends include the integration of AI capabilities into processors, growth in ARM architecture adoption, and increasing consumer preference for high-efficiency processors tailored for gaming and multimedia applications.