Tablet Coatings Market Report

Published Date: 02 February 2026 | Report Code: tablet-coatings

Tablet Coatings Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Tablet Coatings market, detailing market trends, size, and forecasts from 2023 to 2033. It covers industry insights, regional analysis, and highlights key players, aiming to equip stakeholders with valuable information for strategic decision-making.

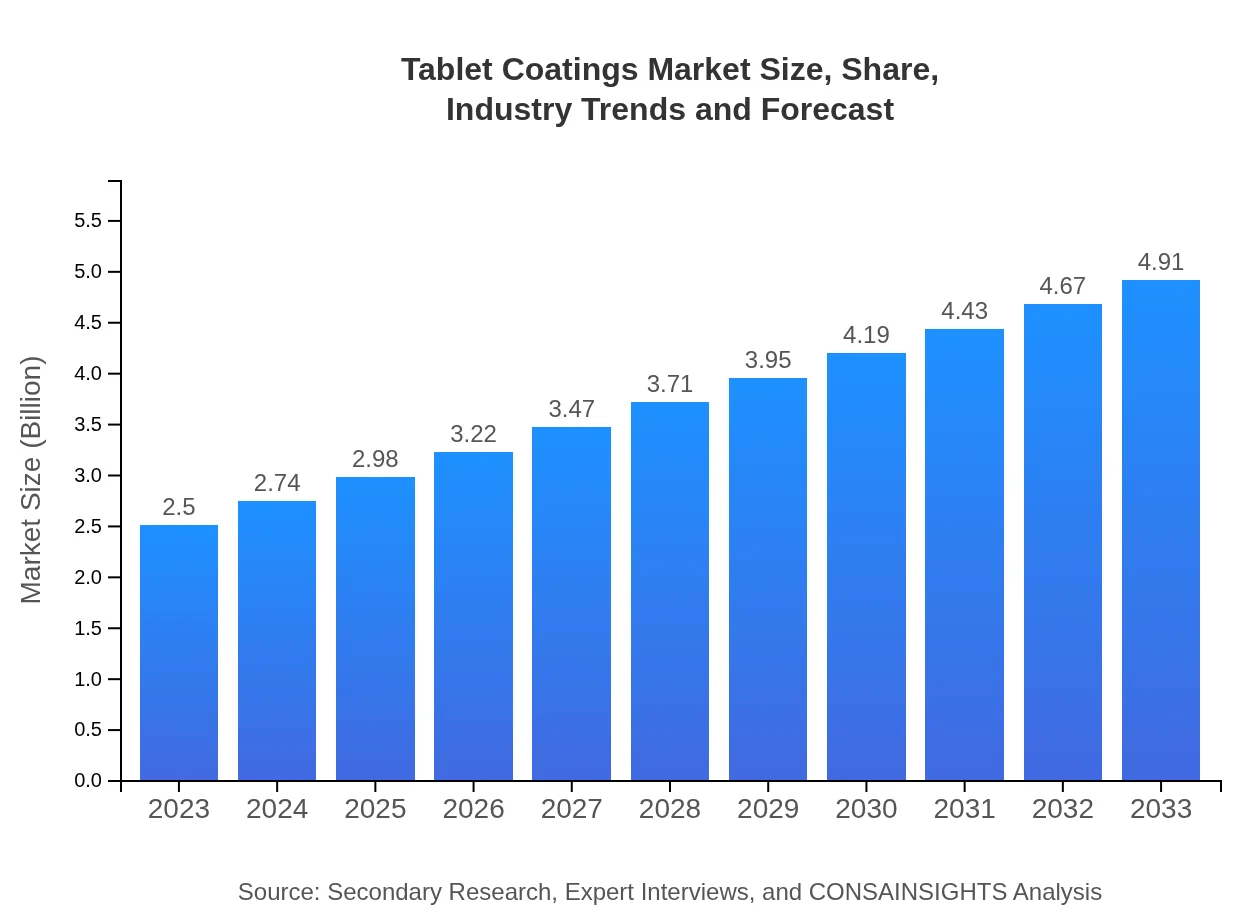

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $4.91 Billion |

| Top Companies | Colorcon, Inc., Evonik Industries AG, BASF SE, Kerry Group, Dow Chemical Company |

| Last Modified Date | 02 February 2026 |

Tablet Coatings Market Overview

Customize Tablet Coatings Market Report market research report

- ✔ Get in-depth analysis of Tablet Coatings market size, growth, and forecasts.

- ✔ Understand Tablet Coatings's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Tablet Coatings

What is the Market Size & CAGR of Tablet Coatings market in 2023?

Tablet Coatings Industry Analysis

Tablet Coatings Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Tablet Coatings Market Analysis Report by Region

Europe Tablet Coatings Market Report:

The European market, valued at USD 0.82 billion in 2023, is expected to achieve USD 1.61 billion by 2033. Stringent regulatory standards and innovative coating solutions drive this growth.Asia Pacific Tablet Coatings Market Report:

The Asia Pacific region accounted for USD 0.47 billion in 2023, expecting to grow to USD 0.93 billion by 2033, driven by robust pharmaceutical manufacturing in countries like India and China.North America Tablet Coatings Market Report:

North America remains a key market, with a size of USD 0.86 billion in 2023, anticipated to reach USD 1.69 billion by 2033 due to advanced healthcare infrastructure and significant pharmaceutical advancements.South America Tablet Coatings Market Report:

In South America, the market is projected to grow from USD 0.20 billion in 2023 to USD 0.40 billion by 2033. Increasing healthcare access and rising demand for pharmaceutical products propel this growth.Middle East & Africa Tablet Coatings Market Report:

The Middle East and Africa region, though smaller, shows growth potential, increasing from USD 0.15 billion in 2023 to USD 0.29 billion by 2033, influenced by expanding healthcare facilities.Tell us your focus area and get a customized research report.

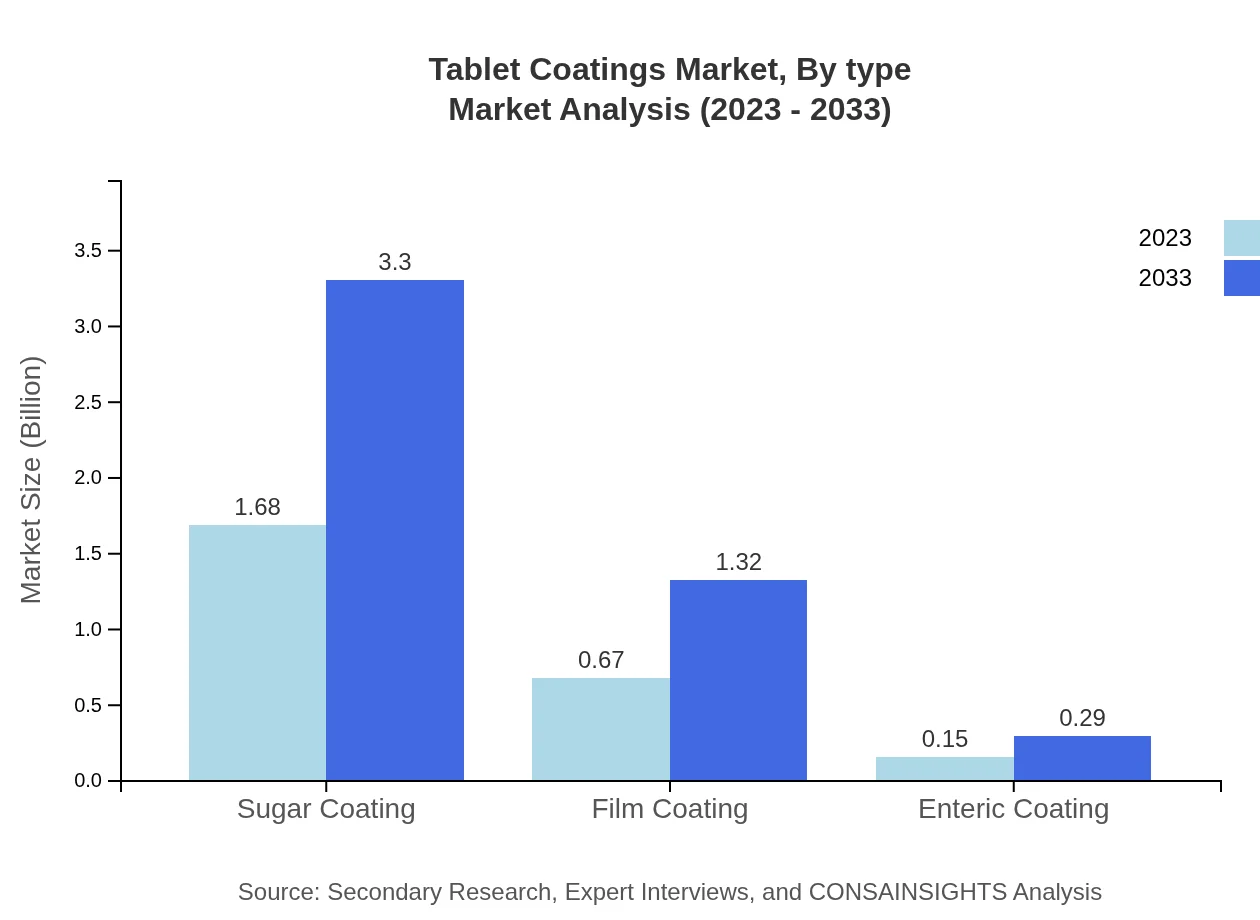

Tablet Coatings Market Analysis By Type

The Tablet Coatings market by type showcases significant diversity. 1. **Sugar Coating:** Valued at USD 1.68 billion in 2023, it is expected to expand to USD 3.30 billion by 2033, dominating the market share at 67.24%. 2. **Film Coating:** In 2023, it holds a market value of USD 0.67 billion, projected to reach USD 1.32 billion by 2033. 3. **Enteric Coating:** Currently valued at USD 0.15 billion, this segment is anticipated to grow to USD 0.29 billion.

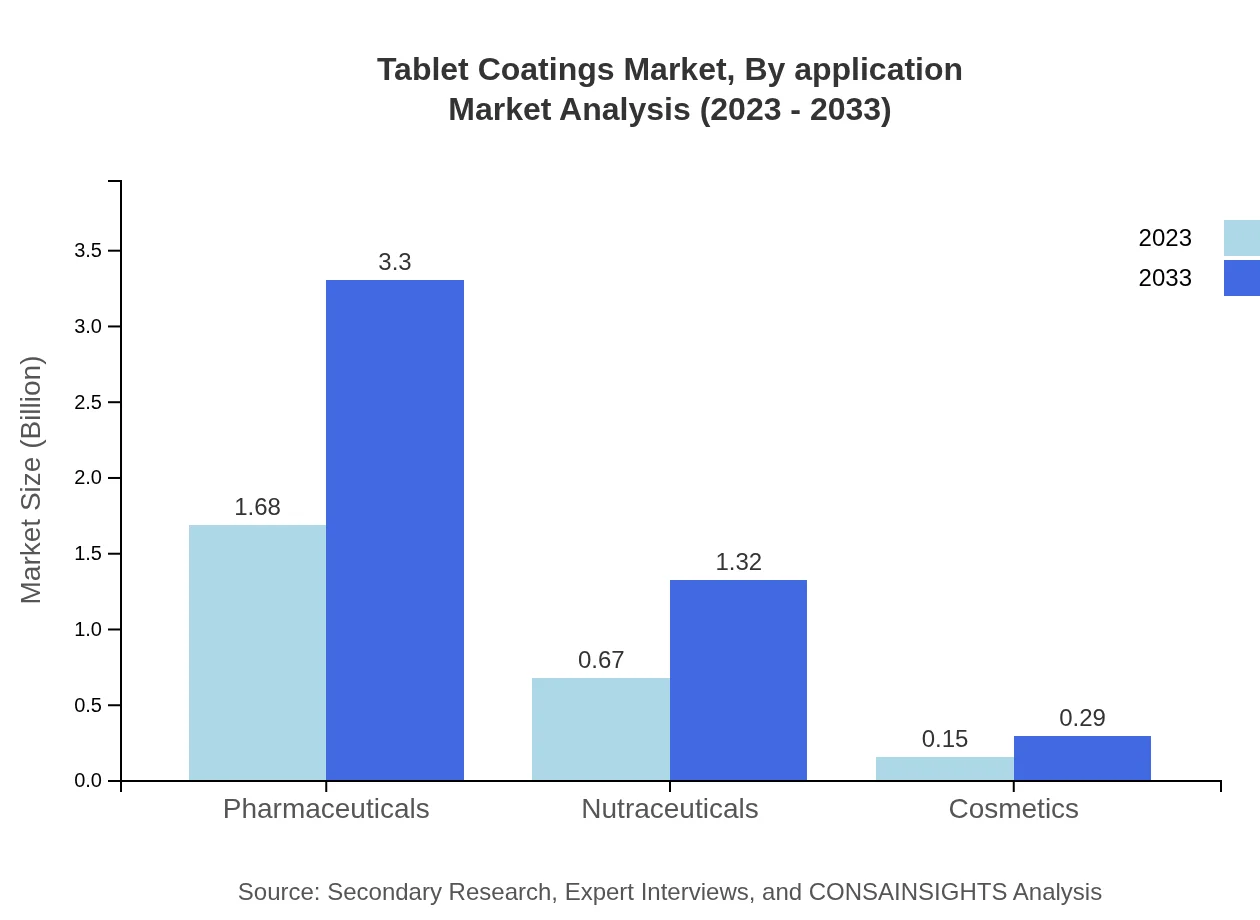

Tablet Coatings Market Analysis By Application

The applications for tablet coatings are broad, spanning across several sectors. Pharmaceutical applications dominate, theoretically holding significant market share. Nutraceuticals and Cosmetics also witness substantial growth, particularly in formulations requiring enhanced aesthetics and stability.

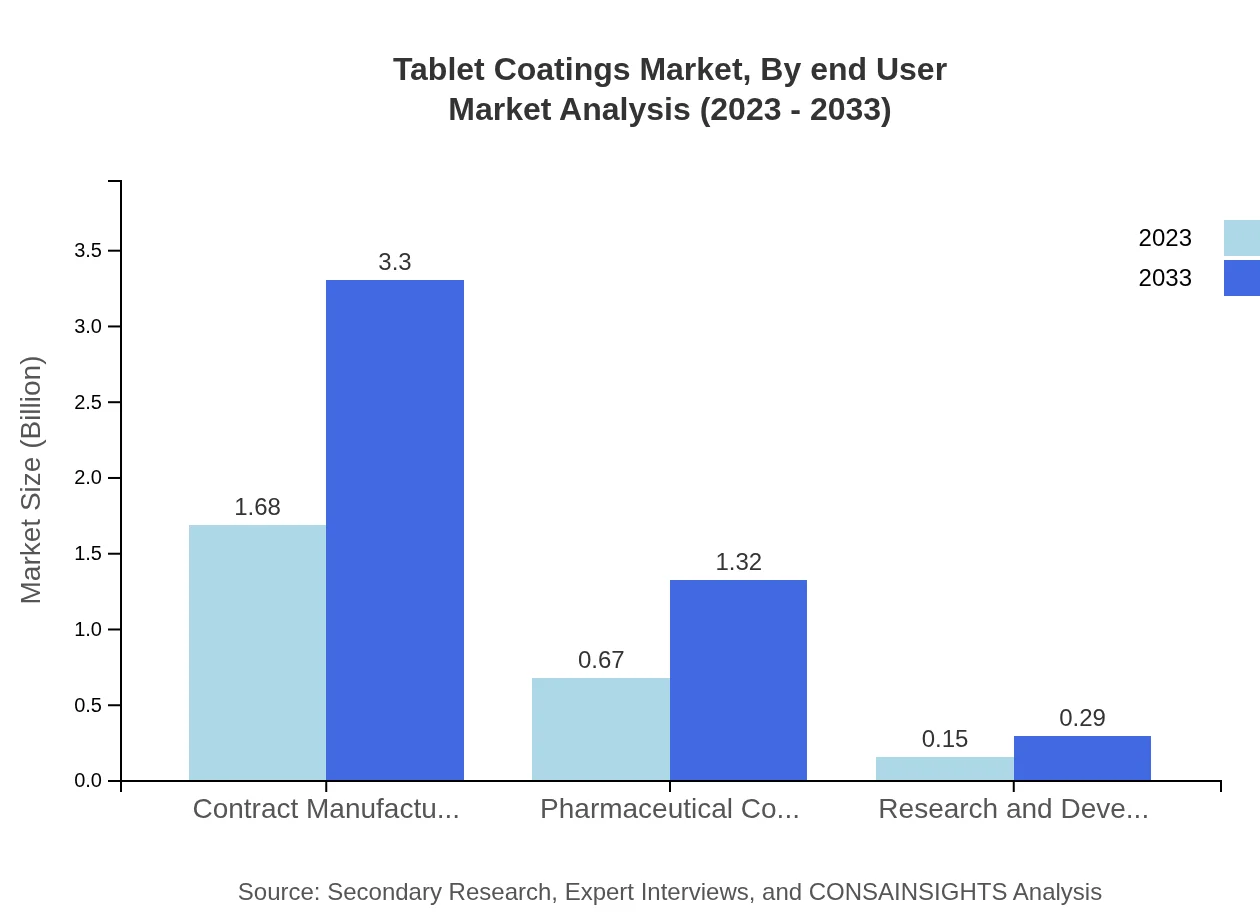

Tablet Coatings Market Analysis By End User

This segment highlights the major contributors to the Tablet Coatings market. Pharmaceutical companies lead the sector, leveraging advancements in coating technologies to furnish drugs with effective coatings. Contract manufacturers are also notable players supporting diverse customer needs.

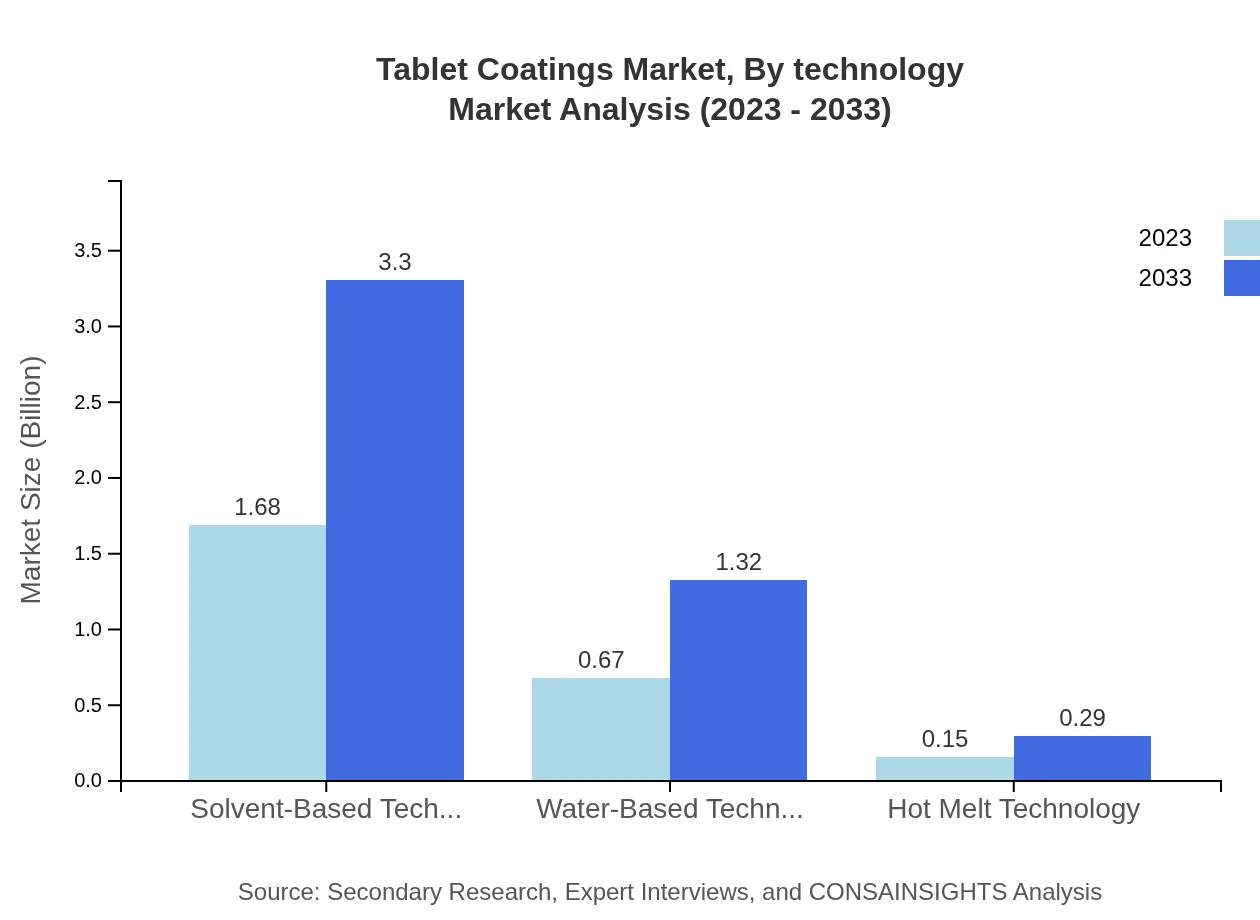

Tablet Coatings Market Analysis By Technology

The technology employed in tablet coatings significantly influences market dynamics: 1. **Solvent-Based Technology:** Forecasted to maintain a leading role, growing from USD 1.68 billion in 2023 to USD 3.30 billion by 2033. 2. **Water-Based Technology:** Expected growth from USD 0.67 billion to USD 1.32 billion. 3. **Hot Melt Technology:** Anticipating modest growth from USD 0.15 billion to USD 0.29 billion.

Tablet Coatings Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Tablet Coatings Industry

Colorcon, Inc.:

A global leader, Colorcon specializes in developing and manufacturing coatings that enhance tablet performance and consumer acceptance.Evonik Industries AG:

Evonik provides a wide range of coating solutions, known for its strong platform in specialty chemicals and innovations in drug delivery systems.BASF SE:

With a robust portfolio in the pharmaceutical and nutraceutical sectors, BASF focuses on developing high-performance coatings.Kerry Group:

Kerry is recognized for its advanced solutions including coating technologies impacting the quality and efficacy of tablets.Dow Chemical Company:

Dow's innovative solutions in tablet coatings highlight its commitment to enhancing drug delivery and patient compliance.We're grateful to work with incredible clients.

FAQs

What is the market size of tablet Coatings?

The global tablet coatings market is valued at approximately $2.5 billion in 2023, with an expected CAGR of 6.8% from 2023 to 2033. This growth reflects increasing demand across various sectors, particularly in pharmaceuticals and nutraceuticals.

What are the key market players or companies in this tablet Coatings industry?

Key players in the tablet coatings market include major pharmaceutical companies and contract manufacturers. This includes firms specializing in sugar coating, film coating, and advanced technologies aimed at enhancing tablet stability and consumer appeal.

What are the primary factors driving the growth in the tablet Coatings industry?

Growth drivers for the tablet coatings industry include rising consumer healthcare awareness, increasing demand for controlled release formulations, and advancements in coating technologies. Additionally, the proliferation of e-commerce has opened new distribution channels.

Which region is the fastest Growing in the tablet Coatings?

North America is the fastest-growing region anticipated to grow from $0.86 billion in 2023 to $1.69 billion by 2033. Europe follows closely, from $0.82 billion to $1.61 billion. These regions are pivotal in shaping market dynamics.

Does ConsaInsights provide customized market report data for the tablet Coatings industry?

Yes, ConsaInsights offers tailored market report data for the tablet coatings industry, ensuring specific insights align with unique business needs. Custom reports can also incorporate regional analysis, segments, and forecasts based on varied parameters.

What deliverables can I expect from this tablet Coatings market research project?

Deliverables include comprehensive market analysis, trend insights, regional assessments, and detailed segmentation reports. Clients will receive actionable data that clarifies market dynamics, key players, and growth opportunities over the forecast period.

What are the market trends of tablet Coatings?

Current trends in the tablet coatings market involve a shift towards biodegradable and environmentally friendly materials. Increased focus on aesthetic appeal and enhanced functionality in coatings is also evident, driven by consumer and regulatory demands.