Tactical Communications Market Report

Published Date: 03 February 2026 | Report Code: tactical-communications

Tactical Communications Market Size, Share, Industry Trends and Forecast to 2033

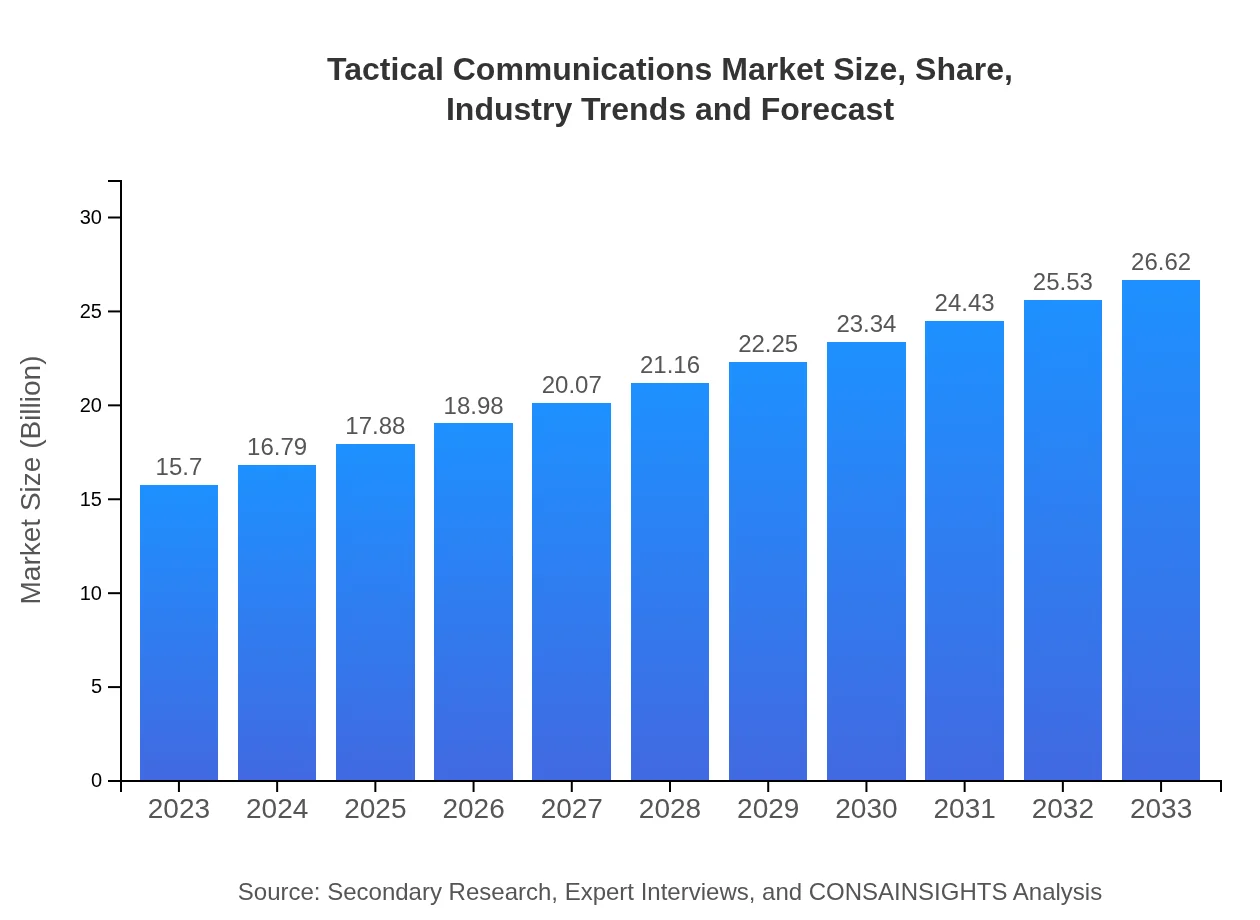

This report presents a comprehensive analysis of the Tactical Communications market, including insights on market size, growth projections, segmentation, regional dynamics, and key players. Covering the forecast period from 2023 to 2033, it aims to provide valuable data for stakeholders.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.70 Billion |

| CAGR (2023-2033) | 5.3% |

| 2033 Market Size | $26.62 Billion |

| Top Companies | Harris Corporation, Thales Group, Raytheon Technologies, General Dynamics, Lockheed Martin |

| Last Modified Date | 03 February 2026 |

Tactical Communications Market Overview

Customize Tactical Communications Market Report market research report

- ✔ Get in-depth analysis of Tactical Communications market size, growth, and forecasts.

- ✔ Understand Tactical Communications's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Tactical Communications

What is the Market Size & CAGR of Tactical Communications market in 2023?

Tactical Communications Industry Analysis

Tactical Communications Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Tactical Communications Market Analysis Report by Region

Europe Tactical Communications Market Report:

The European Tactical Communications market is expected to grow from $5.37 billion in 2023 to $9.10 billion by 2033. European nations are prioritizing upgrading their defense communication capabilities amidst evolving security threats, resulting in increased investments in tactical communication systems across military and civilian sectors.Asia Pacific Tactical Communications Market Report:

The Asia Pacific region holds a significant share of the Tactical Communications market, valued at around $2.91 billion in 2023 and projected to reach approximately $4.93 billion by 2033. Heightened defense spending by countries like India and China, coupled with increasing security concerns, are propelling market growth in this region. Furthermore, the demand for advanced communication solutions among military and law enforcement agencies is driving innovations and deployments in tactical systems.North America Tactical Communications Market Report:

North America is a dominant force in the Tactical Communications market, valued at $5.14 billion in 2023 with expectations to reach $8.71 billion by 2033. The presence of key defense contractors, substantial military spending, and advancements in communication technologies contribute to this region's market leadership. Additionally, increased focus on homeland security and disaster management is amplifying demand.South America Tactical Communications Market Report:

In South America, the Tactical Communications market is relatively smaller but is projected to grow from $0.52 billion in 2023 to $0.89 billion by 2033. Factors such as improving national security measures and the need for modern law enforcement capabilities are boosting investments in tactical communication technologies across this region.Middle East & Africa Tactical Communications Market Report:

The Middle East and Africa market is projected to grow from $1.76 billion in 2023 to $2.99 billion by 2033. The region's focus on defense modernization efforts and addressing security challenges has led to a surge in demand for tactical communication technologies, enhancing operational efficiency in both military and security agencies.Tell us your focus area and get a customized research report.

Tactical Communications Market Analysis Defense_forces

Global Tactical Communications Market, By User Type - Defense Forces (2023 - 2033)

Defense forces constitute the largest segment in the Tactical Communications market. In 2023, the market size for defense forces is approximately $8.93 billion, expected to grow to $15.13 billion by 2033. This segment represents 56.86% of the total market share, underscoring the critical need for reliable communication in military operations.

Tactical Communications Market Analysis Law_enforcement_agencies

Global Tactical Communications Market, By User Type - Law Enforcement Agencies (2023 - 2033)

Law enforcement agencies play a significant role in the Tactical Communications market, with a size of $3.24 billion in 2023, projected to rise to $5.50 billion by 2033. This segment holds a 20.66% market share, emphasizing the increasing reliance on advanced communication systems to enhance public safety and operational coordination.

Tactical Communications Market Analysis Private_security

Global Tactical Communications Market, By User Type - Private Security (2023 - 2033)

The private security sector is witnessing growth with a market size of $1.59 billion in 2023, estimated to reach $2.69 billion by 2033. This segment accounts for 10.12% of the total share, reflecting the emphasis on improved communication infrastructure in security operations.

Tactical Communications Market Analysis Civil_emergency_services

Global Tactical Communications Market, By User Type - Civil Emergency Services (2023 - 2033)

Civil emergency services also hold substantial importance in the Tactical Communications market. Projected at $1.94 billion in 2023, expected to grow to $3.29 billion by 2033, this segment captures a 12.36% market share, showcasing the need for effective communication during crisis management.

Tactical Communications Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Tactical Communications Industry

Harris Corporation:

A leading provider of communication systems and electronic equipment, Harris Corporation focuses on mission-critical communications for defense and public safety.Thales Group:

Thales is known for its advanced digital communication solutions and offers a wide range of products for military, security, and aerospace applications.Raytheon Technologies:

Raytheon specializes in defense technologies, providing innovative solutions for communication, sensing, and electronic warfare.General Dynamics:

As a major defense contractor, General Dynamics develops advanced communication systems tailored to military and security operational needs.Lockheed Martin:

Lockheed Martin is a global leader in aerospace and defense, known for creating integrated communication systems for tactical military applications.We're grateful to work with incredible clients.

FAQs

What is the market size of tactical Communications?

The tactical communications market was valued at approximately $15.7 billion in 2023, with a projected growth rate of 5.3% CAGR leading to significant expansion over the next decade.

What are the key market players or companies in the tactical communications industry?

Key players in the tactical communications market include companies like Harris Corporation, Thales Group, L3 Technologies, and Rockwell Collins, who play pivotal roles in providing innovative communication solutions.

What are the primary factors driving the growth in the tactical communications industry?

Growth in the tactical communications industry is driven by increasing demand for secure communication systems, technological advancements, and rising military expenditures globally, alongside enhanced cyber-security measures.

Which region is the fastest Growing in the tactical communications market?

The fastest-growing region in the tactical communications market is Europe, anticipated to grow from $5.37 billion in 2023 to $9.10 billion by 2033, indicating strong market dynamics in the region.

Does ConsaInsights provide customized market report data for the tactical communications industry?

Yes, ConsaInsights offers customized market report data tailored to specific queries and needs within the tactical communications industry, ensuring comprehensive and relevant insights.

What deliverables can I expect from this tactical communications market research project?

Deliverables from the tactical communications market research project include in-depth market analysis, segmented data reports, competitive landscape assessments, and comprehensive trend evaluations.

What are the market trends of tactical communications?

Current trends in the tactical communications market include the integration of advanced technologies like AI, increased venture capital investments, and a shift towards more resilient communication systems amid growing threats.