Tactical Inertial Systems Market Report

Published Date: 22 January 2026 | Report Code: tactical-inertial-systems

Tactical Inertial Systems Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Tactical Inertial Systems market, showcasing key insights, market size, segmentation, regional dynamics, trends, and future forecasts from 2023 to 2033.

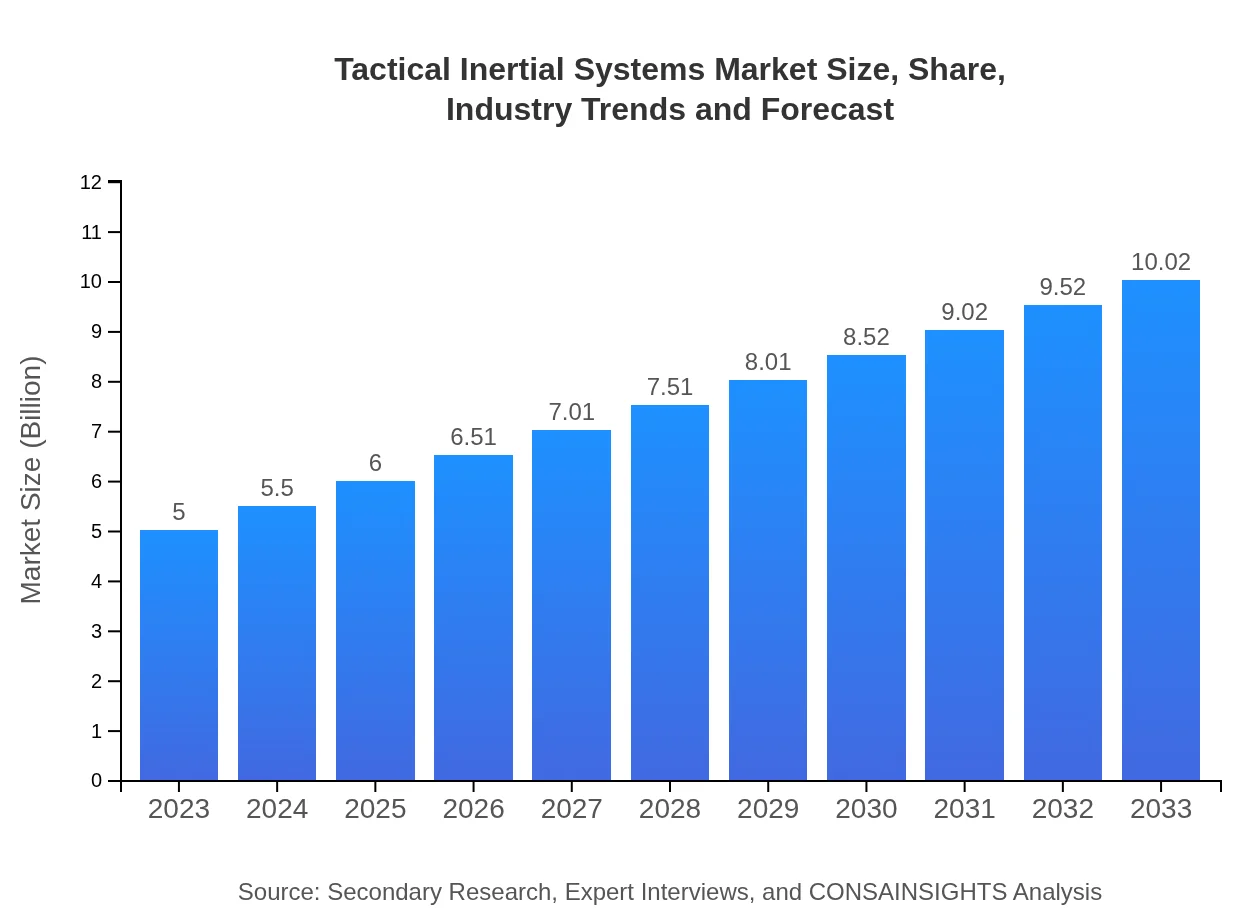

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.00 Billion |

| CAGR (2023-2033) | 7% |

| 2033 Market Size | $10.02 Billion |

| Top Companies | Honeywell International Inc., Northrop Grumman Corporation, Thales Group, Lockheed Martin Corporation |

| Last Modified Date | 22 January 2026 |

Tactical Inertial Systems Market Overview

Customize Tactical Inertial Systems Market Report market research report

- ✔ Get in-depth analysis of Tactical Inertial Systems market size, growth, and forecasts.

- ✔ Understand Tactical Inertial Systems's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Tactical Inertial Systems

What is the Market Size & CAGR of Tactical Inertial Systems market in 2023?

Tactical Inertial Systems Industry Analysis

Tactical Inertial Systems Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Tactical Inertial Systems Market Analysis Report by Region

Europe Tactical Inertial Systems Market Report:

The European market is slated to grow from $1.62 billion in 2023 to $3.24 billion by 2033, aided by increased defense cooperation among EU nations and a focus on technological advancements in military systems.Asia Pacific Tactical Inertial Systems Market Report:

In Asia Pacific, the market size reached $0.92 billion in 2023 and is expected to grow to $1.85 billion by 2033, primarily driven by an increase in defense spending, particularly in countries like India and Japan.North America Tactical Inertial Systems Market Report:

North America, with a market size of $1.72 billion in 2023, is expected to double to $3.44 billion by 2033, driven by the U.S. military's significant investment in advanced tactical technologies and modernization of existing systems.South America Tactical Inertial Systems Market Report:

The South American market size stood at $0.41 billion in 2023, projected to reach $0.83 billion by 2033, fueled by regional developments in defense capabilities and economic growth in nations such as Brazil and Argentina.Middle East & Africa Tactical Inertial Systems Market Report:

In the Middle East and Africa, the market is projected to rise from $0.33 billion in 2023 to $0.66 billion by 2033 due to heightened geopolitical tensions and consequent military investments.Tell us your focus area and get a customized research report.

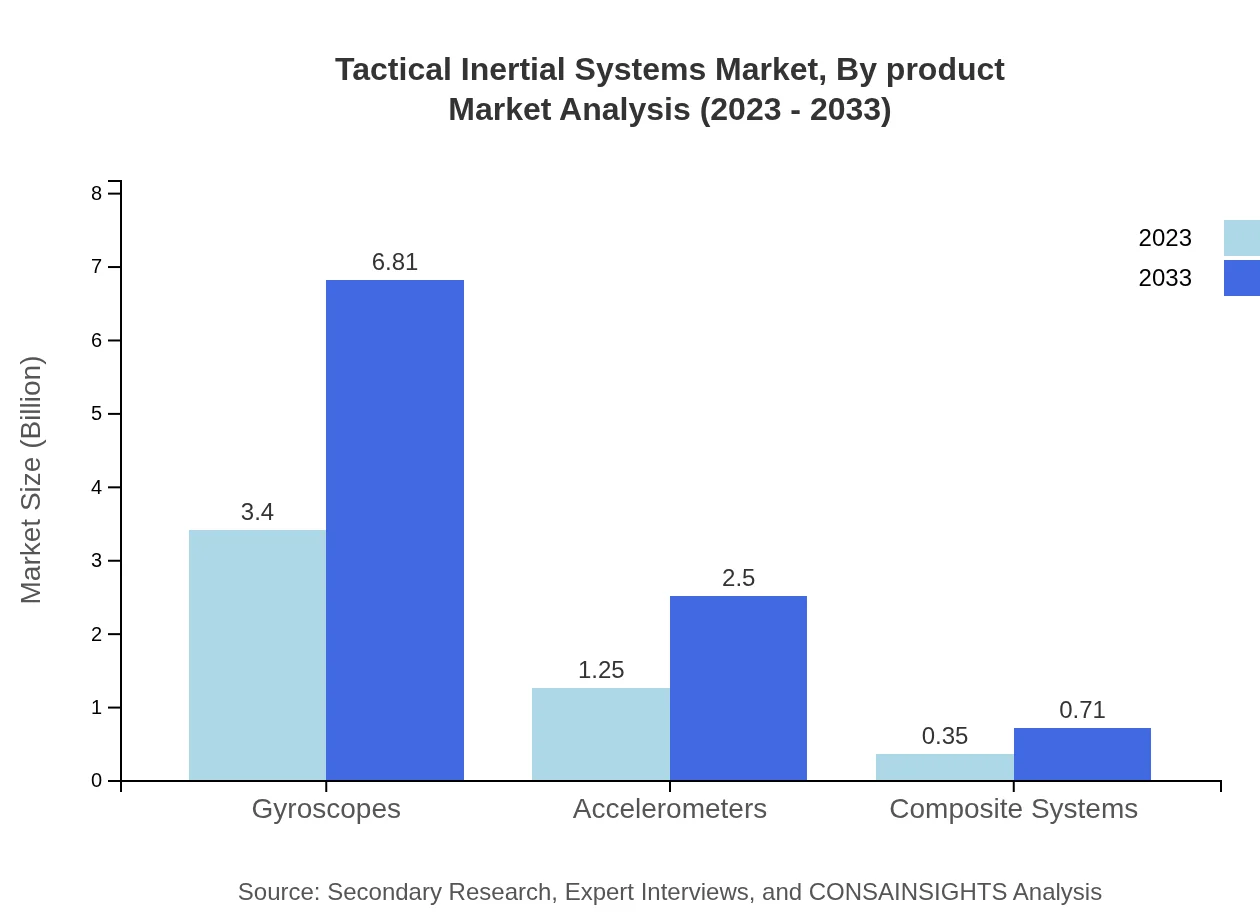

Tactical Inertial Systems Market Analysis By Product

In 2023, the Gyroscopes segment leads the market with a size of $3.40 billion, expected to grow to $6.81 billion by 2033. Accelerometers follow closely, growing from $1.25 billion in 2023 to $2.50 billion in 2033. Composite systems, while smaller at $0.35 billion, are also anticipated to grow, highlighting their niche applications in modern systems.

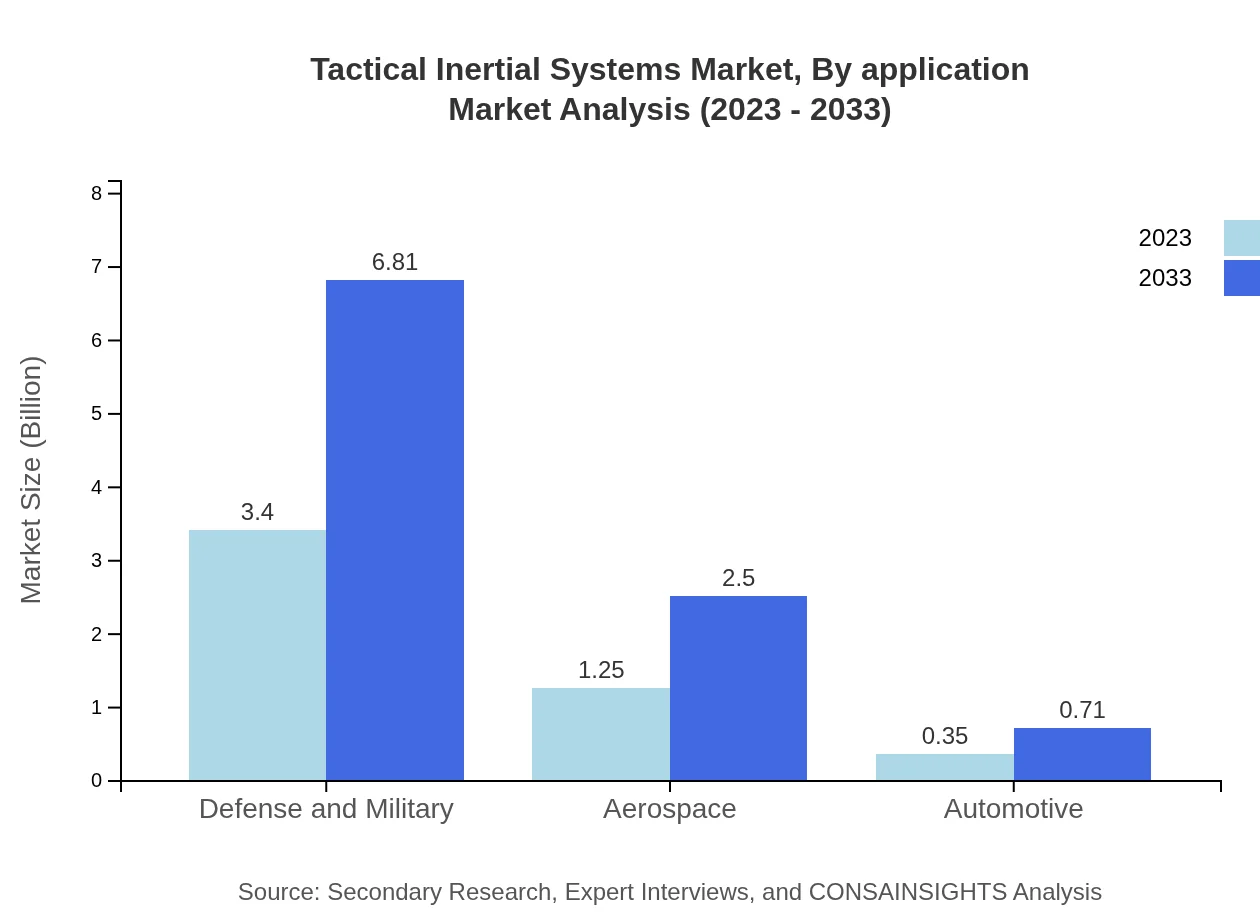

Tactical Inertial Systems Market Analysis By Application

The Military and Defense applications dominate with a market size reaching $3.40 billion in 2023, anticipated to grow to $6.81 billion by 2033. Civil aviation applications also show strong growth potential, expanding from $1.25 billion to $2.50 billion during the same period, underlining the strategic importance of precision navigation.

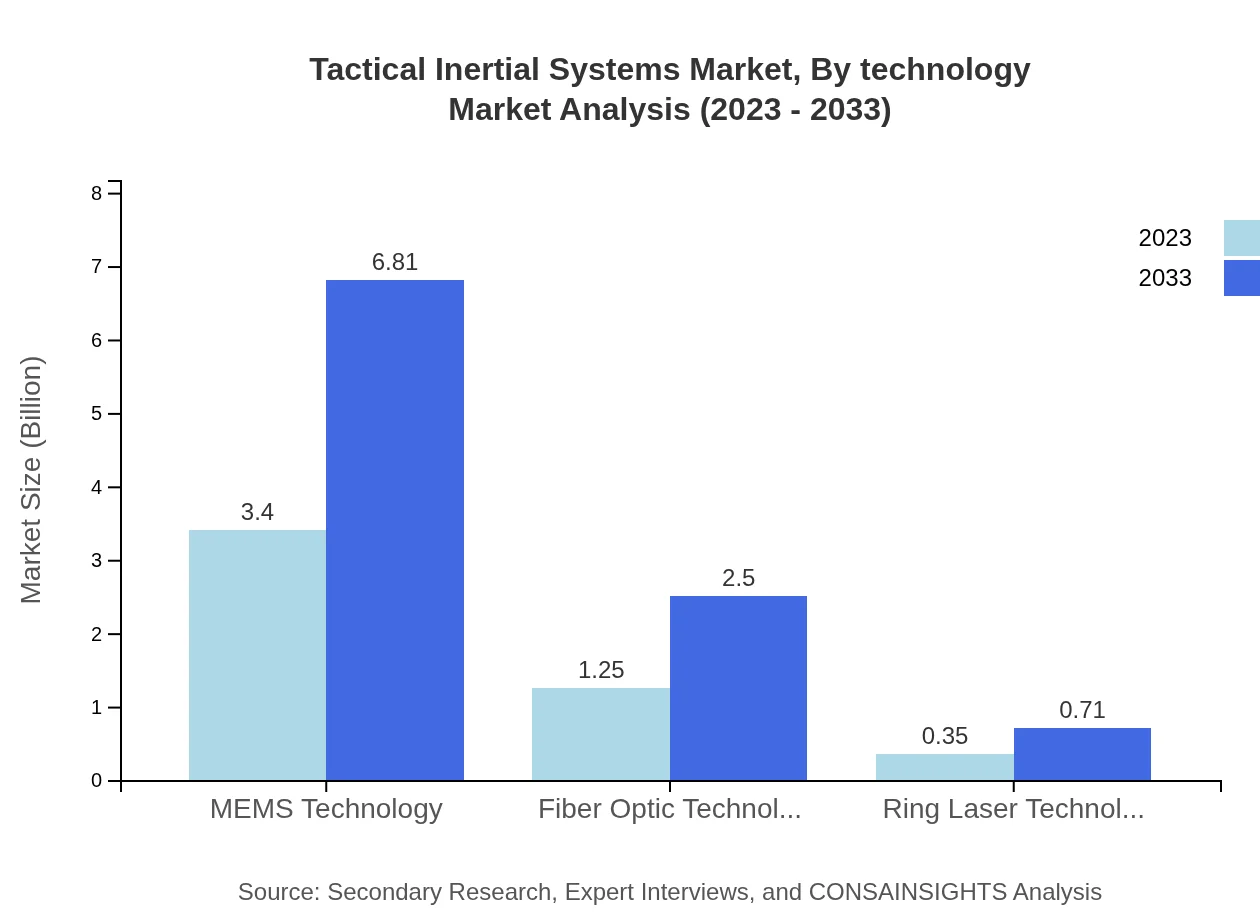

Tactical Inertial Systems Market Analysis By Technology

MEMS technology is set to maintain significant market share, reaching $3.40 billion in 2023 and forecasted to double by 2033. Fiber optic technology is expanding rapidly due to its high precision levels, while ring laser technology remains pivotal for applications requiring superior performance.

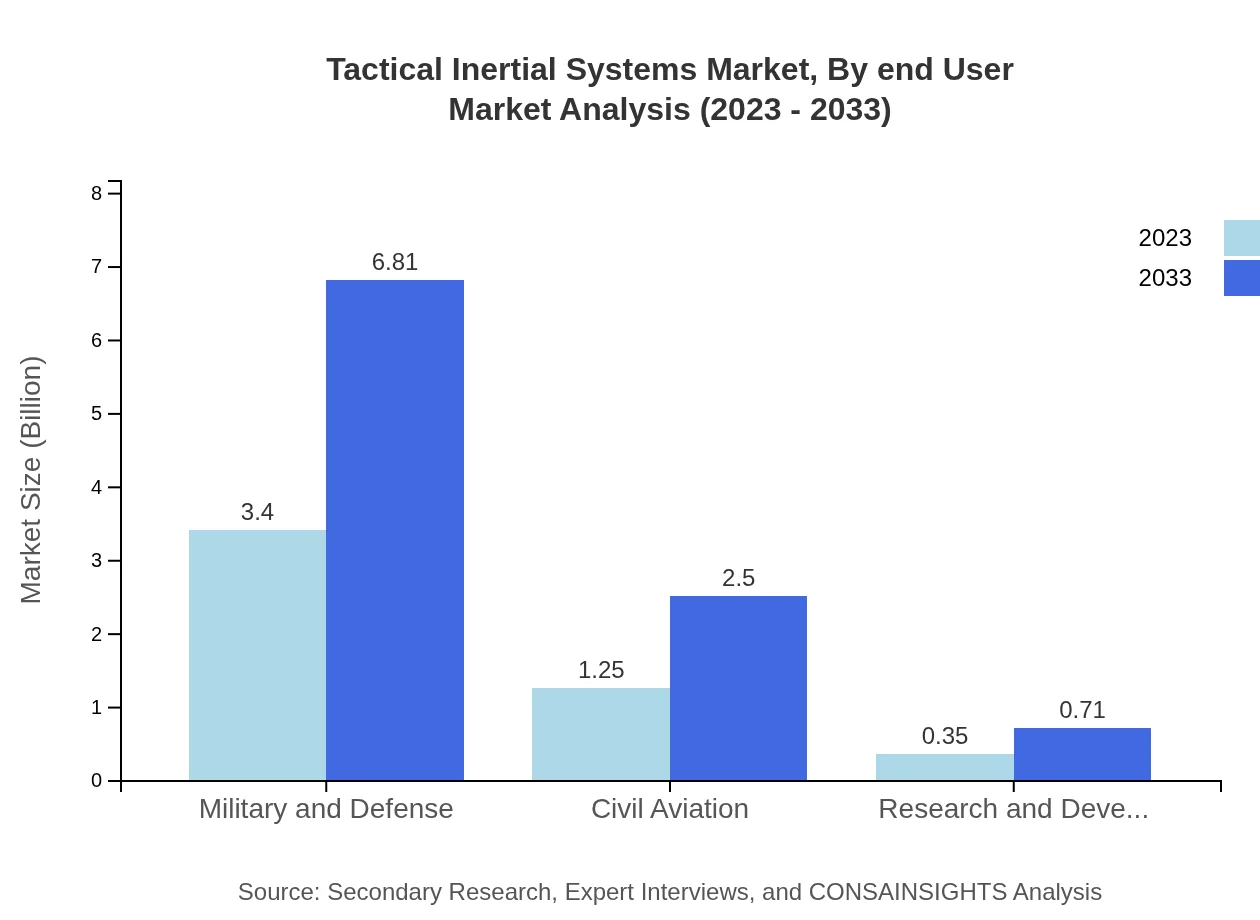

Tactical Inertial Systems Market Analysis By End User

The Defense and Military sector continues to dominate, with a market size of $3.40 billion in 2023, poised to grow to $6.81 billion by 2033. The Aerospace and Automotive sectors are also significant contributors, reflecting the need for high-precision navigation solutions across applications.

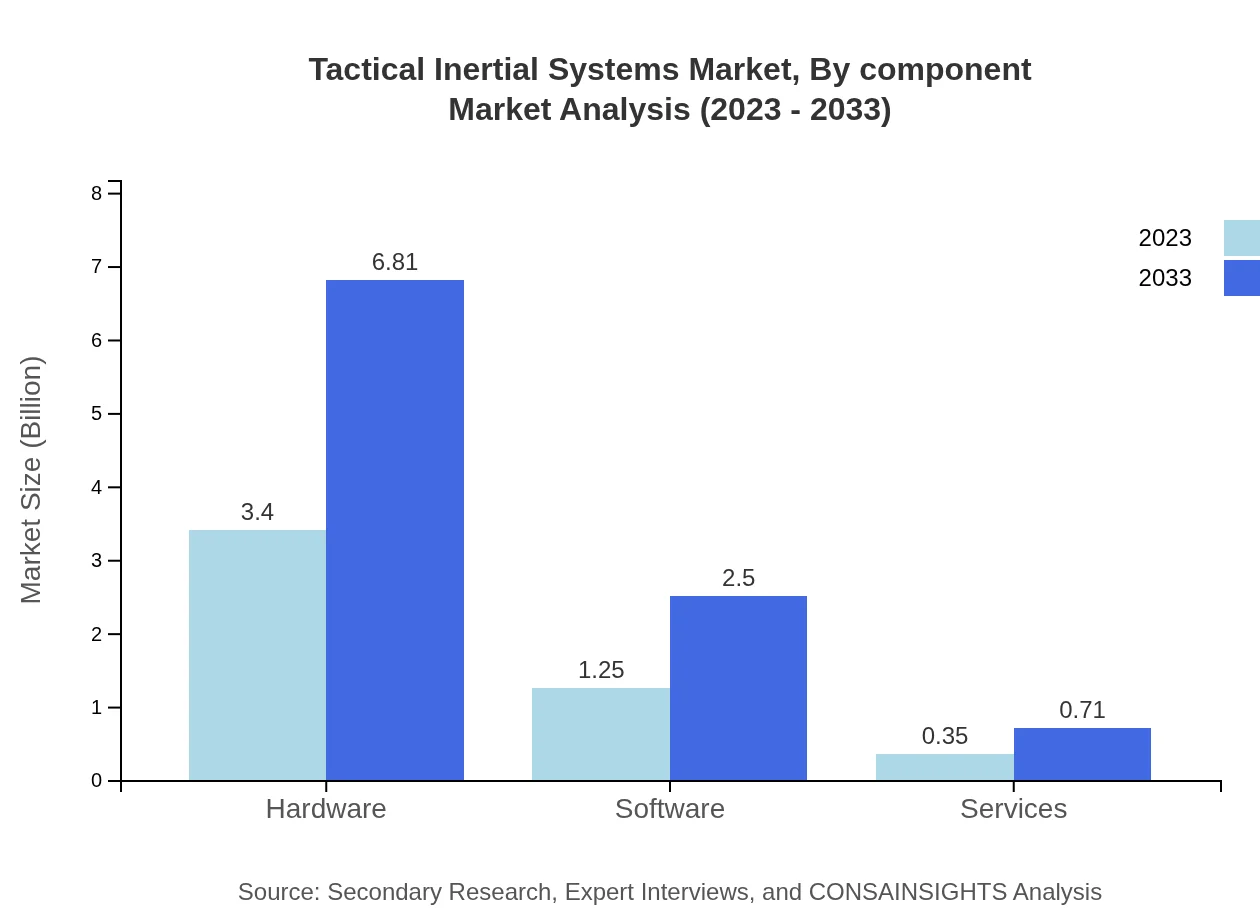

Tactical Inertial Systems Market Analysis By Component

Hardware components, particularly sensors, represent a major share of the market, reaching $3.40 billion in 2023. Software solutions are also crucial for system operation and analysis, growing from $1.25 billion in 2023 to $2.50 billion by 2033, underscoring the importance of integrated technological solutions in tactical systems.

Tactical Inertial Systems Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Tactical Inertial Systems Industry

Honeywell International Inc.:

Honeywell is a leading manufacturer of inertial sensors and navigation systems, providing innovative solutions for aerospace and defense applications.Northrop Grumman Corporation:

A key player in defense systems, Northrop Grumman offers advanced tactical inertial systems known for their high reliability and performance in military operations.Thales Group:

Thales is recognized for its state-of-the-art inertial navigation systems, serving various sectors including aerospace, security, and transportation.Lockheed Martin Corporation:

Lockheed Martin is a major player in defense and aerospace technologies, with a robust portfolio of tactical inertial systems integrated into its advanced platforms.We're grateful to work with incredible clients.

FAQs

What is the market size of Tactical Inertial Systems?

The Tactical Inertial Systems market is valued at approximately $5 billion in 2023 and is projected to grow at a CAGR of 7%, reaching significant expansion by 2033.

What are the key market players or companies in this Tactical Inertial Systems industry?

Key players in the Tactical Inertial Systems market include leading technology firms involved in defense and aerospace solutions. This includes companies specializing in gyroscopic and accelerometer technologies, which are essential for accurate motion sensing.

What are the primary factors driving the growth in the Tactical Inertial Systems industry?

Driving factors for growth in the Tactical Inertial Systems industry include increasing demand for advanced navigation systems, defense budget allocations, and technological advancements in inertial sensors, enhancing the reliability and precision of military applications.

Which region is the fastest Growing in the Tactical Inertial Systems?

North America is currently the fastest-growing region in the Tactical Inertial Systems market, projected to expand from $1.72 billion in 2023 to $3.44 billion by 2033, driven by significant investments in military technologies.

Does ConsaInsights provide customized market report data for the Tactical Inertial Systems industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs of clients within the Tactical Inertial Systems industry, enabling stakeholders to gain detailed insights and strategies.

What deliverables can I expect from this Tactical Inertial Systems market research project?

From the Tactical Inertial Systems market research project, expect comprehensive reports including market analysis, regional breakdowns, competitive landscapes, and segment-specific data, along with actionable insights for strategic planning.

What are the market trends of Tactical Inertial Systems?

Current trends in the Tactical Inertial Systems market include increased adoption of MEMS and fiber optic technologies, enhanced integration of systems for improved data accuracy, and a rising focus on miniaturization to fit various military applications.