Tactical Uav Market Report

Published Date: 03 February 2026 | Report Code: tactical-uav

Tactical Uav Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Tactical UAV market, including market size, growth forecasts, segmentation, regional insights, and future trends from 2023 to 2033.

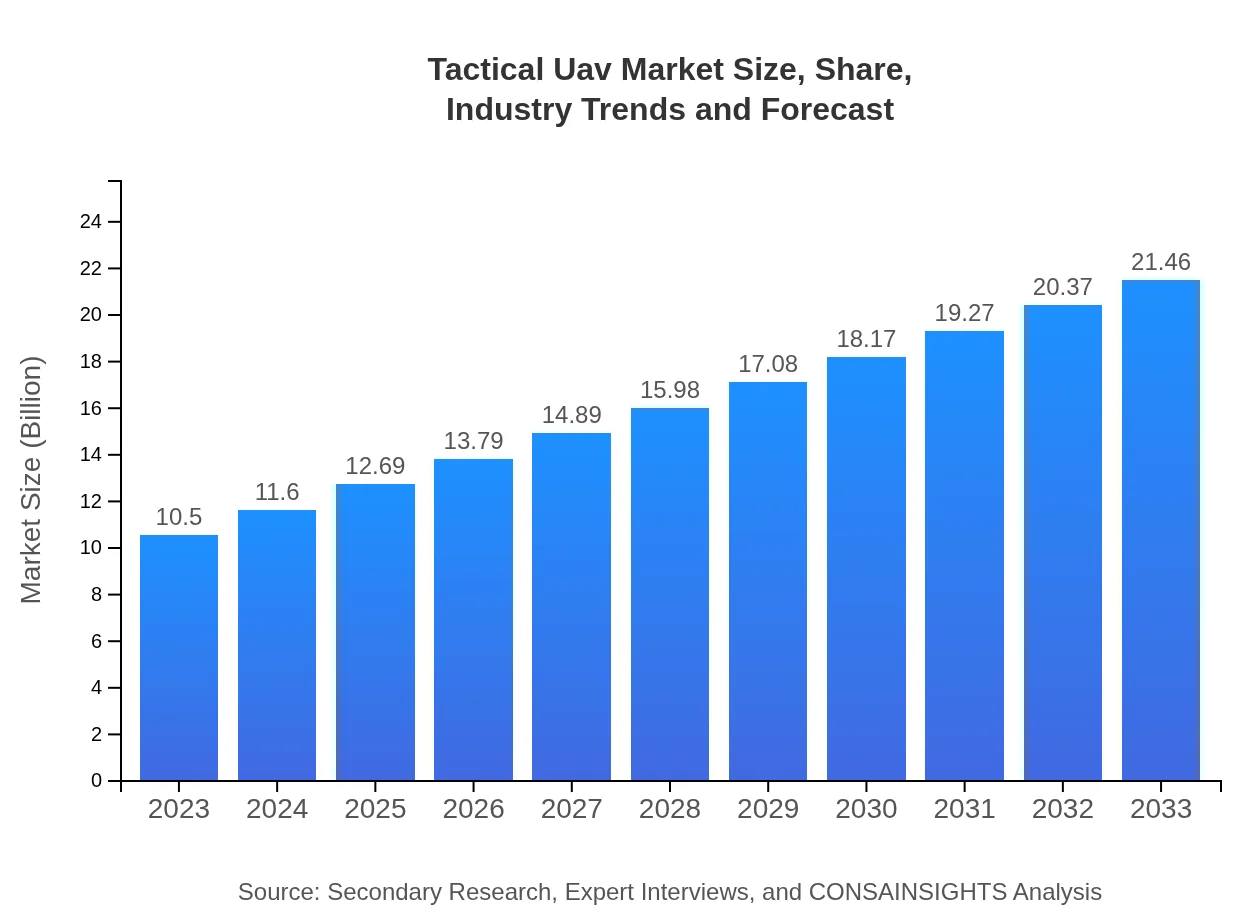

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $21.46 Billion |

| Top Companies | Northrop Grumman, General Atomics, Textron Systems, BAE Systems |

| Last Modified Date | 03 February 2026 |

Tactical UAV Market Overview

Customize Tactical Uav Market Report market research report

- ✔ Get in-depth analysis of Tactical Uav market size, growth, and forecasts.

- ✔ Understand Tactical Uav's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Tactical Uav

What is the Market Size & CAGR of Tactical UAV market in 2023?

Tactical UAV Industry Analysis

Tactical UAV Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Tactical UAV Market Analysis Report by Region

Europe Tactical Uav Market Report:

The European Tactical UAV market is forecasted to increase from $2.97 billion in 2023 to $6.06 billion by 2033. Over the last few years, European nations have been investing heavily in drone technology to meet security demands from both military and civilian applications.Asia Pacific Tactical Uav Market Report:

The Asia Pacific region is expected to experience substantial growth, with the market size projected to grow from $2.21 billion in 2023 to $4.51 billion in 2033. Increased defense budgets in countries like India, China, and Japan, coupled with advancements in UAV technology, are significant growth drivers in this region.North America Tactical Uav Market Report:

North America holds the largest share of the Tactical UAV market, projected to grow from $3.64 billion in 2023 to $7.43 billion in 2033. The surge in military expenditures and rapid technological innovations by key players like the U.S. military form major contributors to this growth.South America Tactical Uav Market Report:

In South America, the Tactical UAV market is on the rise, growing from $0.72 billion in 2023 to $1.47 billion by 2033. The increasing focus on border surveillance and law enforcement applications is driving demand in this region.Middle East & Africa Tactical Uav Market Report:

The market in the Middle East and Africa is also expected to grow, increasing from $0.97 billion in 2023 to $1.99 billion by 2033, driven primarily by rising military and defense spending amidst regional conflicts.Tell us your focus area and get a customized research report.

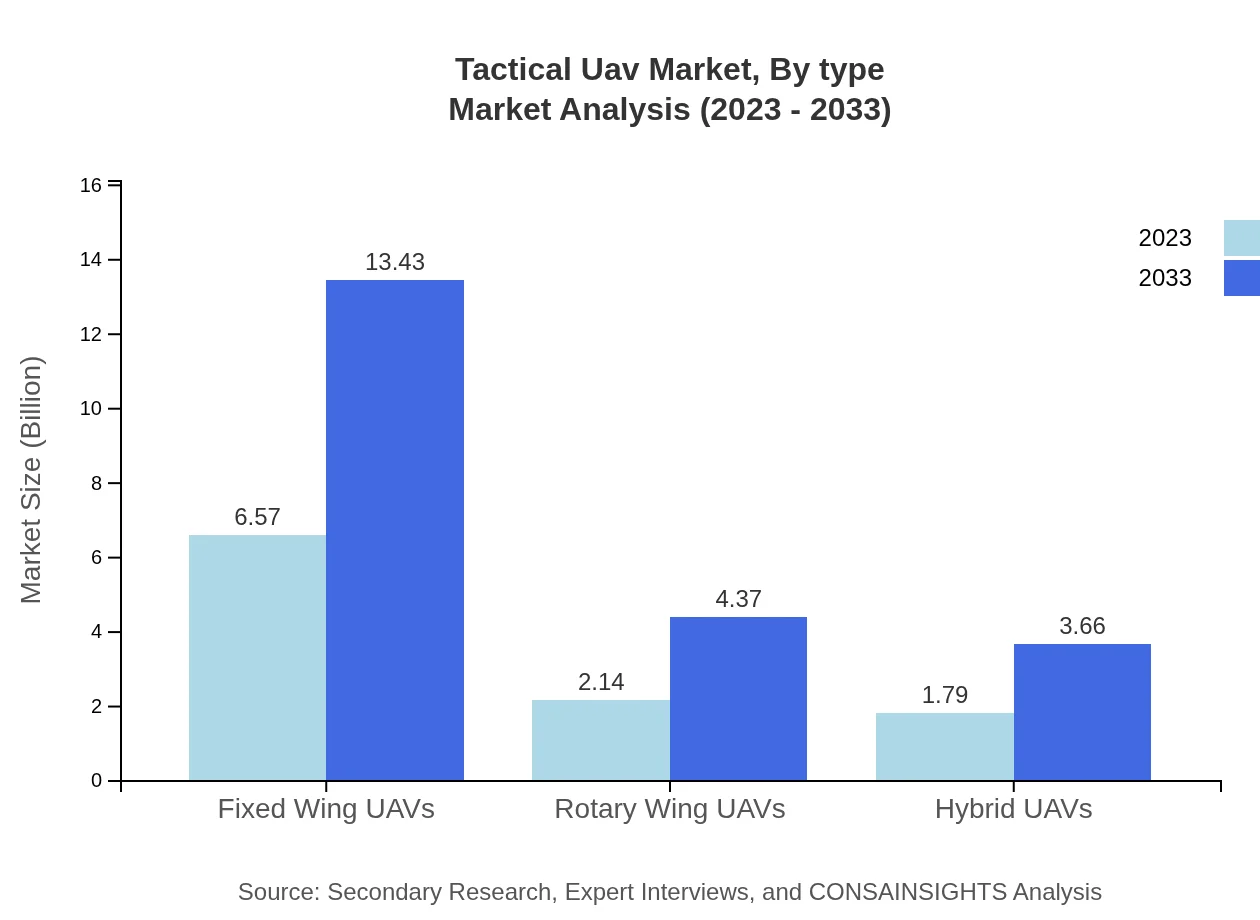

Tactical Uav Market Analysis By Type

Fixed Wing UAVs account for the largest market size of $6.57 billion in 2023 and are projected to reach $13.43 billion in 2033, representing 62.57% of the overall market share. Rotary Wing UAVs and Hybrid UAVs hold $2.14 billion and $1.79 billion markets in 2023, expected to grow to $4.37 billion and $3.66 billion respectively by 2033.

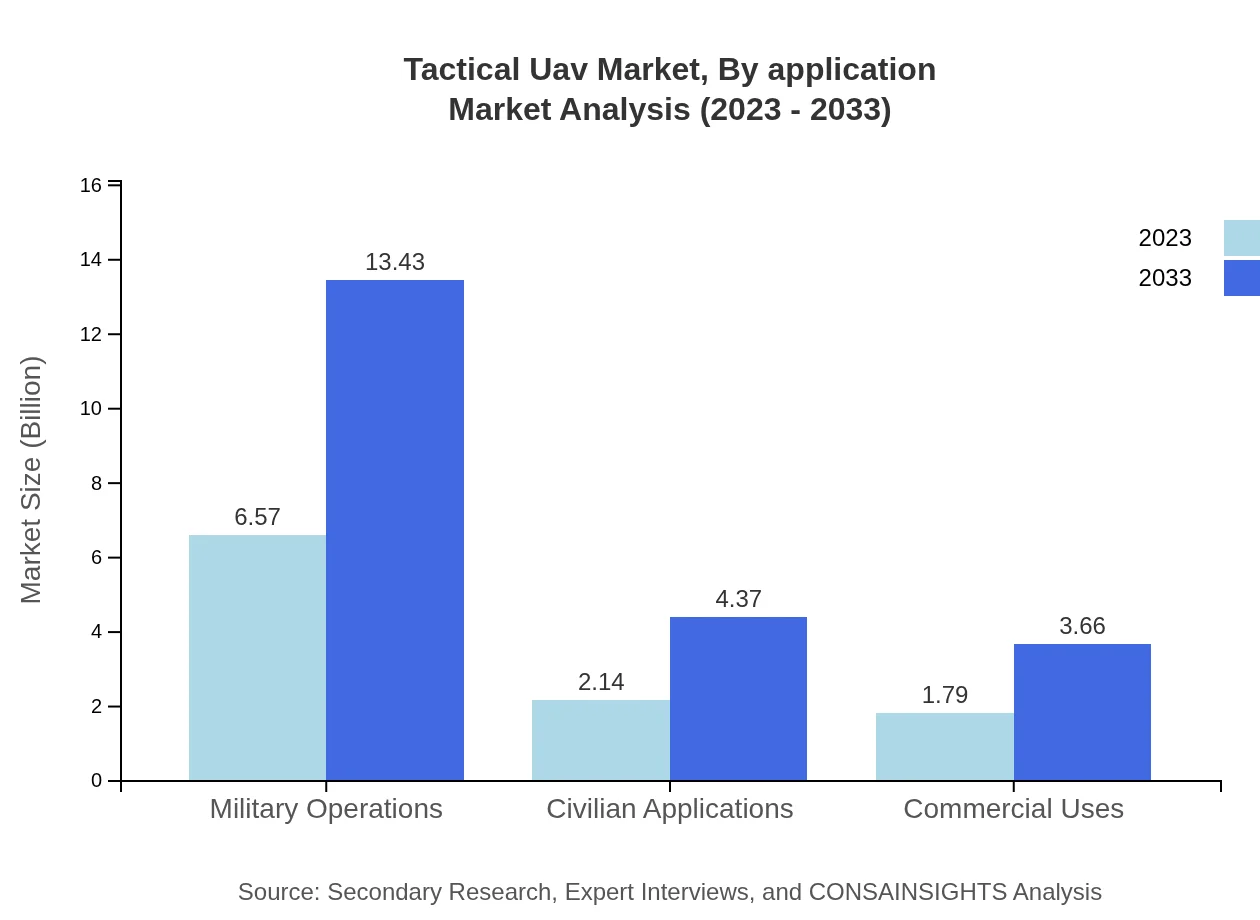

Tactical Uav Market Analysis By Application

The Military Operations segment leads with a market size of $6.57 billion in 2023 and is expected to reach $13.43 billion in 2033, maintaining a share of 62.57%. The Civilian Applications market is projected to grow from $2.14 billion to $4.37 billion over the same period.

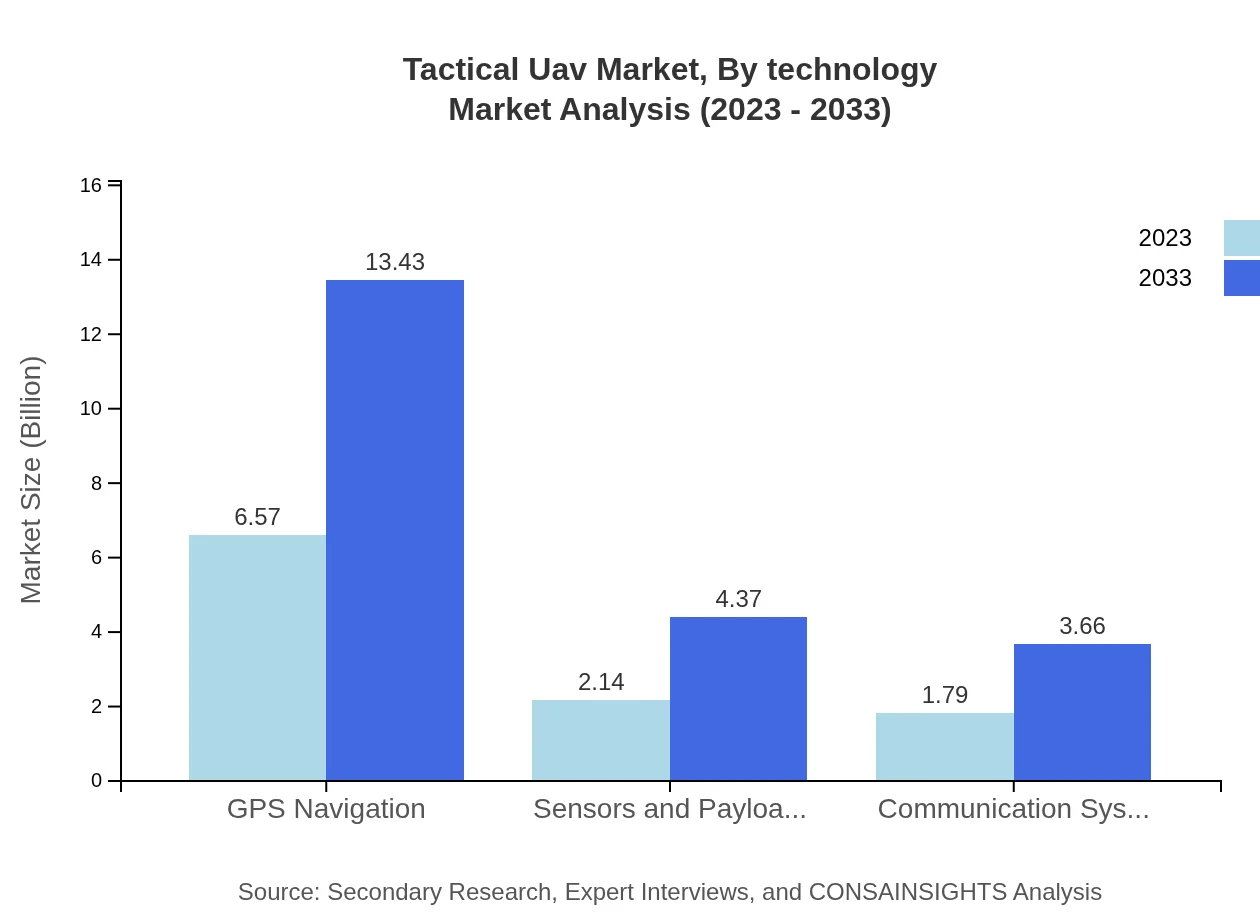

Tactical Uav Market Analysis By Technology

GPS Navigation dominates with a market size of $6.57 billion in 2023 and is anticipated to grow to $13.43 billion by 2033, holding a steady share of 62.57%. Sensors and payloads rank next, showing growth from $2.14 billion to $4.37 billion.

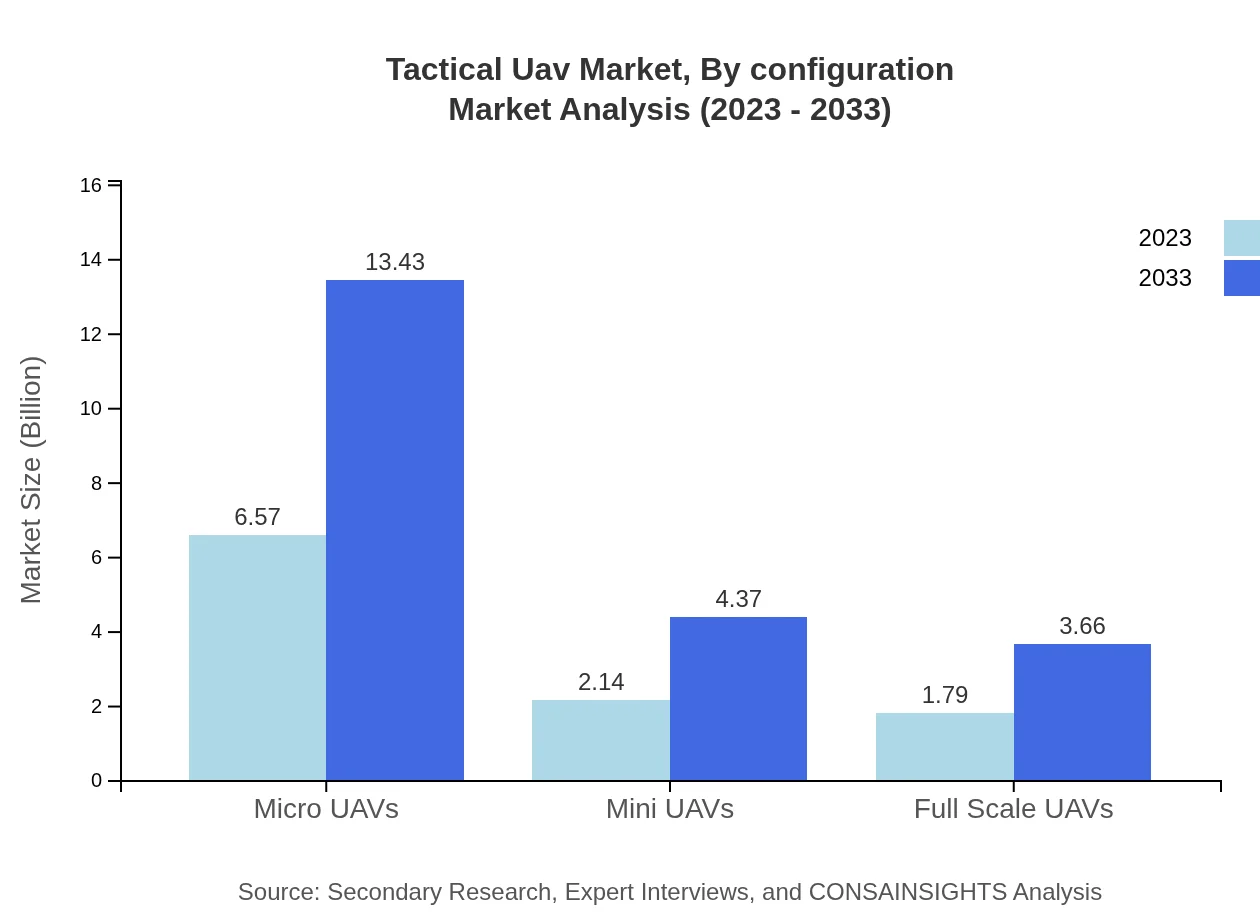

Tactical Uav Market Analysis By Configuration

Micro UAVs represent the largest segment at $6.57 billion in 2023, expected to grow to $13.43 billion by 2033, with a consistent 62.57% market share. Mini UAVs and Full Scale UAVs are also notable segments with steady growth prospects.

Tactical UAV Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Tactical UAV Industry

Northrop Grumman:

A leading aerospace and defense technology company known for its advanced UAV systems for military applications.General Atomics:

Famous for their Predator and Reaper drones, General Atomics plays a significant role in the Tactical UAV market.Textron Systems:

Offers a wide range of UAV products, including the Shadow series, focusing on tactical military operations.BAE Systems:

Involved in developing innovative UAV solutions that enhance operational effectiveness in the Tactical UAV market.We're grateful to work with incredible clients.

FAQs

What is the market size of Tactical UAV?

The Tactical UAV market is projected to reach $10.5 billion by 2033, with a remarkable CAGR of 7.2%. This growth indicates a robust demand for UAV technology across various sectors, including military operations and civilian applications.

What are the key market players or companies in the Tactical UAV industry?

Key players in the Tactical UAV industry include major defense contractors and technology companies. These firms play a vital role in developing innovative UAV technologies, pushing forward advancements in surveillance and reconnaissance capabilities.

What are the primary factors driving the growth in the Tactical UAV industry?

Growth drivers in the Tactical UAV market include increasing military expenditures, advancements in UAV technology, and the rising demand for surveillance applications. Additionally, the integration of UAVs in civilian sectors contributes significantly to market expansion.

Which region is the fastest Growing in the Tactical UAV market?

North America is the fastest-growing region in the Tactical UAV market, expected to grow from $3.64 billion in 2023 to $7.43 billion by 2033. This growth is fueled by high military budgets and technological advancements in UAV capabilities.

Does ConsaInsights provide customized market report data for the Tactical UAV industry?

Yes, ConsaInsights offers customized market research reports tailored to client specifications in the Tactical UAV industry, ensuring data-driven insights that align with specific business needs and strategic objectives.

What deliverables can I expect from this Tactical UAV market research project?

Deliverables include a comprehensive market analysis report, growth forecasts, competitive landscape assessments, and insights into market segments. Each report is designed to help stakeholders make informed decisions.

What are the market trends of Tactical UAV?

Current trends in the Tactical UAV market include increased adoption of fixed-wing UAVs, advancements in sensor technology, and the use of UAVs in both military and commercial applications. This trend reflects a growing integration of UAVs across various sectors.