Tallow Fatty Acids Market Report

Published Date: 31 January 2026 | Report Code: tallow-fatty-acids

Tallow Fatty Acids Market Size, Share, Industry Trends and Forecast to 2033

This report offers a comprehensive analysis of the Tallow Fatty Acids market, including insights on market size, trends, segmentation, and forecasts from 2023 to 2033. It provides valuable data for stakeholders to make informed decisions in this growing market.

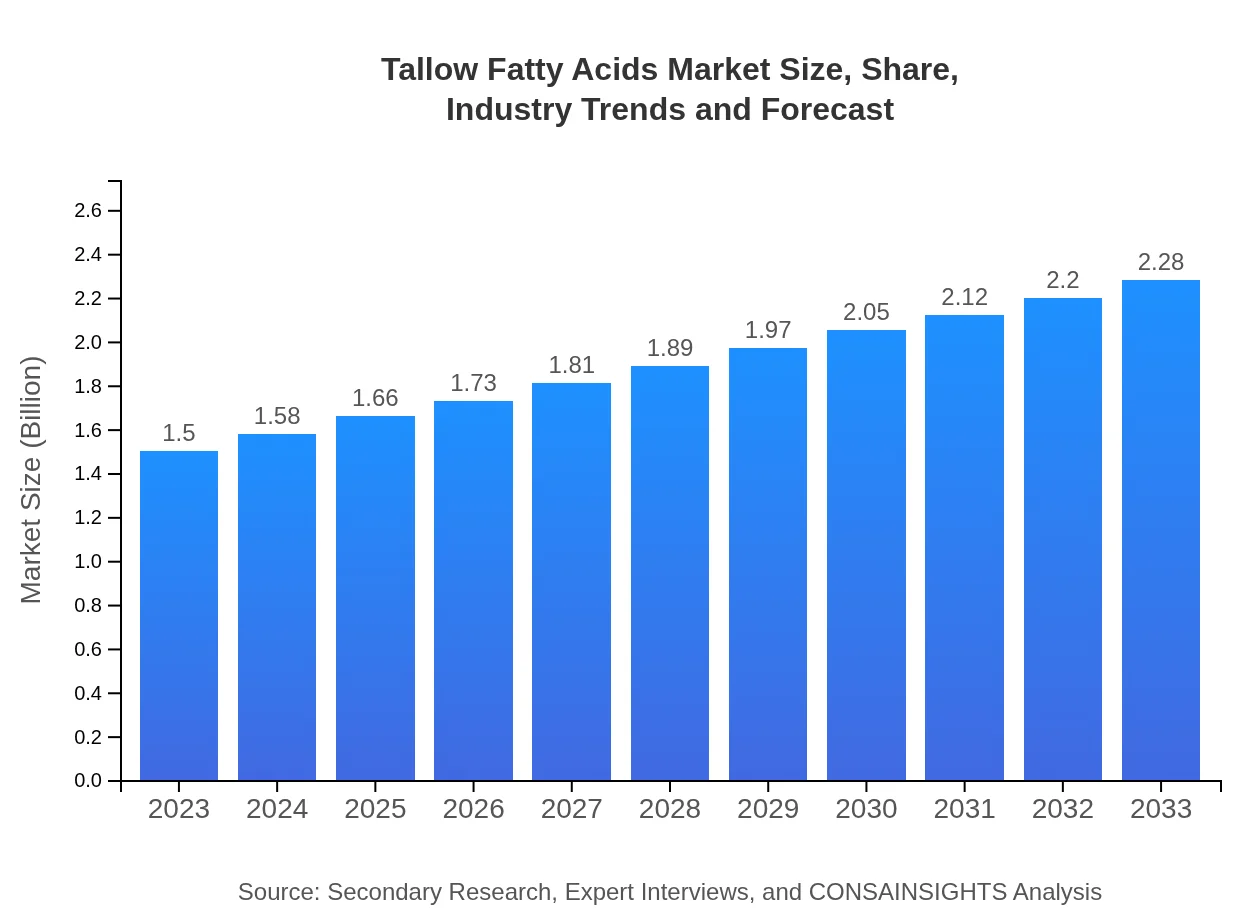

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.50 Billion |

| CAGR (2023-2033) | 4.2% |

| 2033 Market Size | $2.28 Billion |

| Top Companies | Kraton Corporation, BASF SE, Savita Oil Technologies, Maine Pointe |

| Last Modified Date | 31 January 2026 |

Tallow Fatty Acids Market Overview

Customize Tallow Fatty Acids Market Report market research report

- ✔ Get in-depth analysis of Tallow Fatty Acids market size, growth, and forecasts.

- ✔ Understand Tallow Fatty Acids's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Tallow Fatty Acids

What is the Market Size & CAGR of Tallow Fatty Acids market in 2023?

Tallow Fatty Acids Industry Analysis

Tallow Fatty Acids Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Tallow Fatty Acids Market Analysis Report by Region

Europe Tallow Fatty Acids Market Report:

The European market for tallow fatty acids stands at $0.48 billion in 2023 and is forecasted to grow to $0.73 billion by 2033. Regulatory pressures concerning sustainability and the European Union's stringent guidelines on biodiesel are catalyzing the market, alongside rising consumer demand for cleaner, natural products.Asia Pacific Tallow Fatty Acids Market Report:

In 2023, the Asia Pacific region is set to be valued at $0.28 billion, with expectations to reach $0.43 billion by 2033. This growth is driven by rising agricultural activity and increasing demand for personal care products and food applications. Countries like China and India are contributing significantly to market expansion due to their growing populations and expanding industrial sectors.North America Tallow Fatty Acids Market Report:

North America is expected to witness significant growth, with a market size of $0.51 billion in 2023 projected to expand to $0.78 billion by 2033. The region's robust pharmaceutical and personal care industries, coupled with a growing consumer preference for natural ingredients, are driving this upward trajectory in the tallow fatty acids market.South America Tallow Fatty Acids Market Report:

The South American market for tallow fatty acids is projected to grow from $0.08 billion in 2023 to $0.13 billion by 2033. The growth in this region is fueled by the increasing use of tallow fatty acids in biodiesel production and food industries, alongside a shift towards more sustainable farming practices.Middle East & Africa Tallow Fatty Acids Market Report:

In the Middle East and Africa, the market is projected to grow from $0.14 billion in 2023 to $0.21 billion by 2033. The rise of the cosmetics and personal care industries in this region and the increasing adoption of tallow derivatives in food production are essential factors driving growth.Tell us your focus area and get a customized research report.

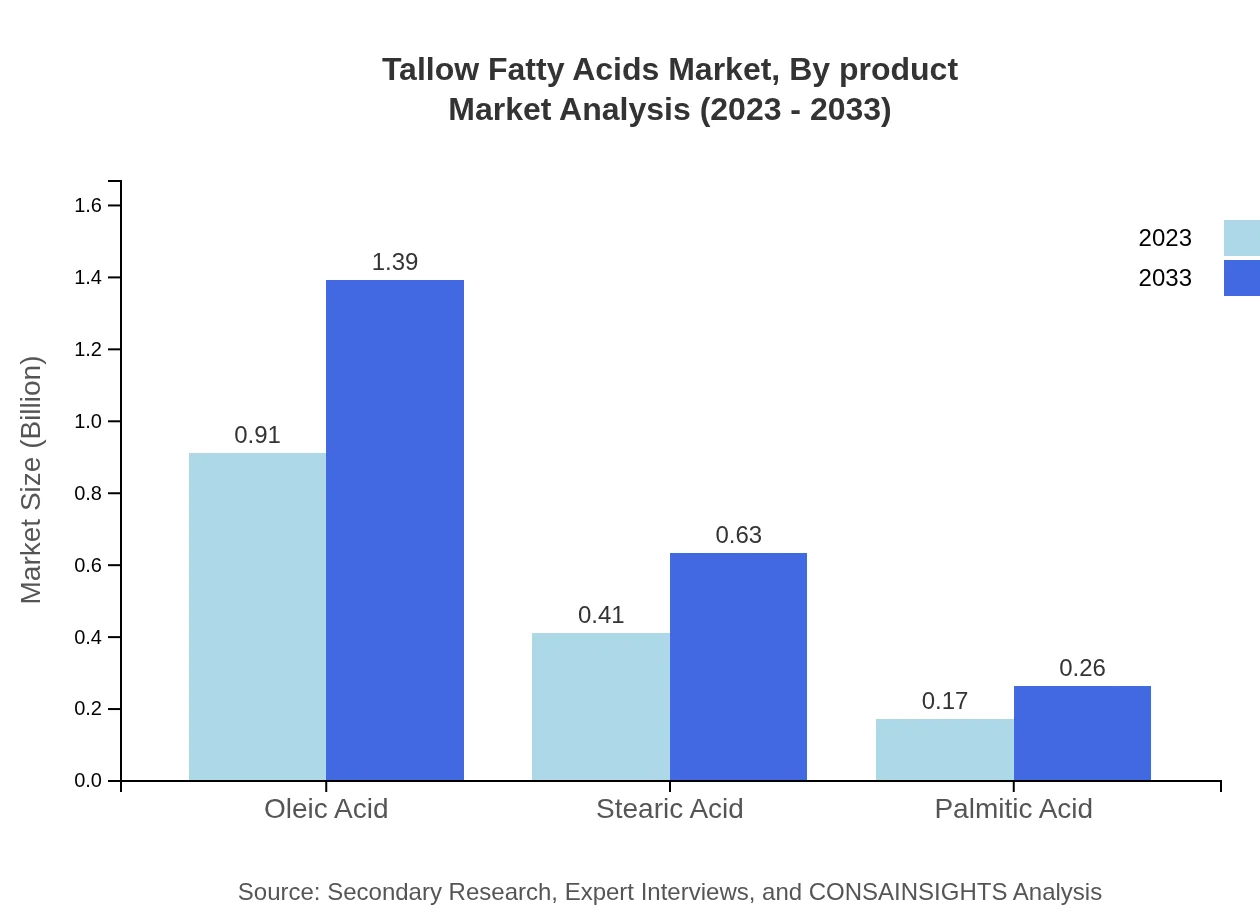

Tallow Fatty Acids Market Analysis By Product

The Tallow Fatty Acids market can be analyzed based on various product types including oleic acid, stearic acid, and palmitic acid. In 2023, oleic acid holds a significant market share ($0.91 billion) and is expected to reach $1.39 billion by 2033. Stearic acid shows promising growth from $0.41 billion to $0.63 billion in the same period, while palmitic acid is expected to increase from $0.17 billion to $0.26 billion.

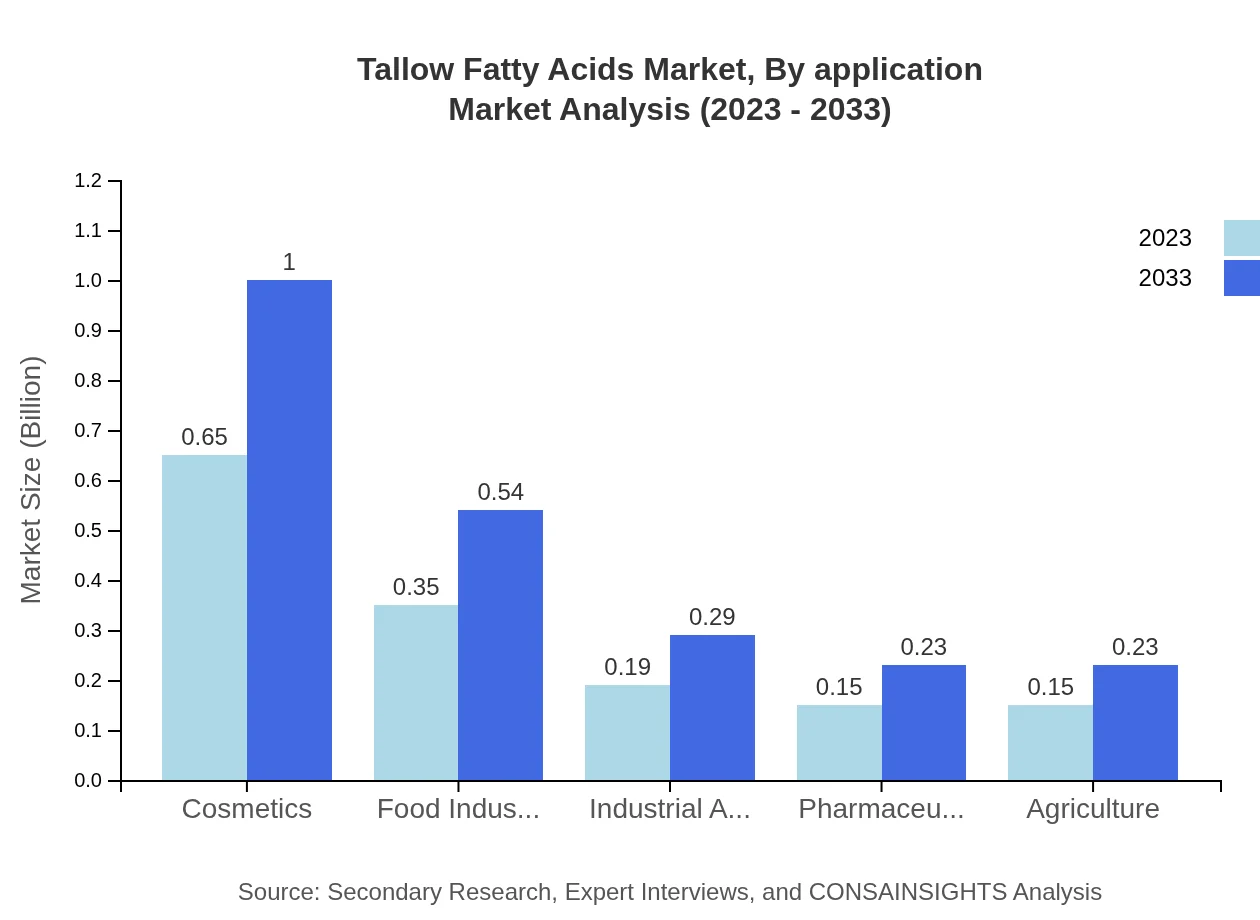

Tallow Fatty Acids Market Analysis By Application

Applications of tallow fatty acids are diverse, spanning food, cosmetics, industrial applications, and pharmaceuticals. In 2023, cosmetics are estimated to comprise $0.65 billion, projected to grow to $1.00 billion by 2033. The food industry is anticipated to see growth from $0.35 billion to $0.54 billion within the same period, reflecting the rising demand for natural ingredients in various personal care and food products.

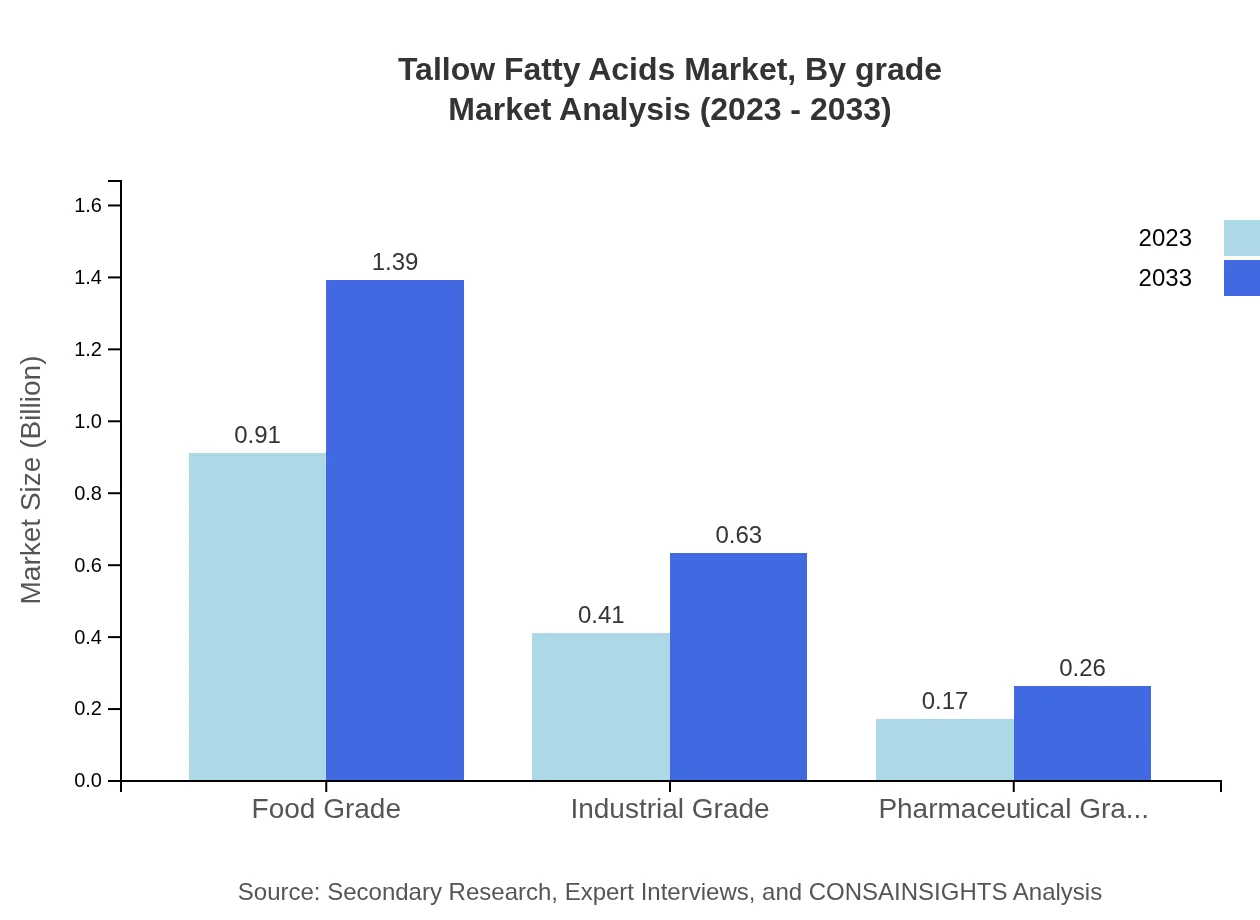

Tallow Fatty Acids Market Analysis By Grade

The market segments by grade include food grade, industrial grade, and pharmaceutical grade, where food grade fatty acids are leading the market with an estimated size of $0.91 billion in 2023, growing to $1.39 billion by 2033. The industrial grade segment is expected to rise from $0.41 billion to $0.63 billion, while pharmaceutical grade fatty acids are projected to increase from $0.17 billion to $0.26 billion, catering to the growing health and wellness trends.

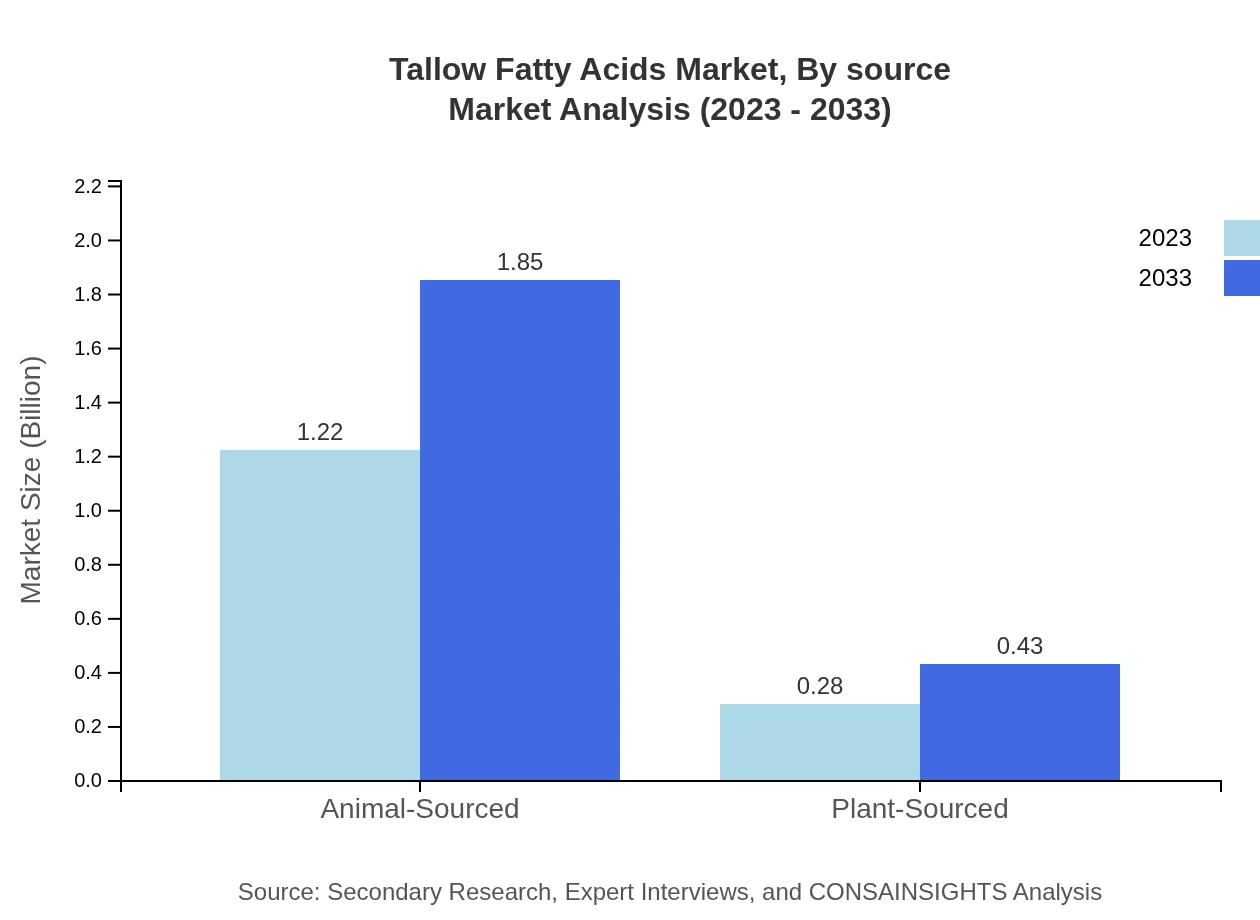

Tallow Fatty Acids Market Analysis By Source

The Tallow Fatty Acids market is categorized into animal-sourced and plant-sourced products. Animal-sourced fatty acids are dominant, valued at $1.22 billion in 2023 and projected to rise to $1.85 billion by 2033. Plant-sourced fatty acids stand at $0.28 billion in 2023 and are expected to grow to $0.43 billion, reflecting the increasing interest in sustainable and health-conscious alternatives.

Tallow Fatty Acids Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Tallow Fatty Acids Industry

Kraton Corporation:

Kraton Corporation is a leading global supplier of biobased products and a prominent player in the tallow fatty acids market, known for its innovation in sustainable chemical applications.BASF SE:

BASF SE is one of the largest chemical producers globally, offering a wide range of tallow derivatives for various applications, focusing on sustainability and resource efficiency.Savita Oil Technologies:

Savita Oil Technologies is a key player in the Indian market, producing tallow-based products and contributing to the green chemistry movement.Maine Pointe:

Maine Pointe is an operations consultancy that helps organizations in the fatty acids sector streamline their production while enhancing their sustainability measures.We're grateful to work with incredible clients.

FAQs

What is the market size of tallow Fatty Acids?

The global tallow fatty acids market was valued at $1.5 billion in 2023, with a projected CAGR of 4.2%. By 2033, it is expected to expand significantly, indicating steady growth in demand across various sectors.

What are the key market players or companies in the tallow Fatty Acids industry?

Key players in the tallow fatty acids market include major manufacturers and suppliers focusing on sustainable sourcing and innovative applications. Their competitive strategies significantly impact market dynamics and consumer preferences within this industry.

What are the primary factors driving the growth in the tallow Fatty Acids industry?

Growth in the tallow fatty acids industry is driven by rising demand in food, cosmetics, and industrial applications. Additionally, growing awareness of sustainable practices and the shift towards bio-based chemicals support further market expansion.

Which region is the fastest Growing in the tallow Fatty Acids market?

The Asia Pacific region is currently the fastest-growing market for tallow fatty acids, with a projected increase from $0.28 billion in 2023 to $0.43 billion by 2033, reflecting a growing demand in emerging economies.

Does ConsaInsights provide customized market report data for the tallow Fatty Acids industry?

Yes, ConsaInsights offers customized market research reports tailored to specific needs within the tallow fatty acids industry. Clients can obtain detailed insights and analyze trends that suit their strategic objectives.

What deliverables can I expect from this tallow Fatty Acids market research project?

Deliverables include comprehensive reports detailing market size, segmentation, regional analysis, competitive landscape, and future forecasts, enabling stakeholders to make informed decisions in the tallow fatty acids sector.

What are the market trends of tallow Fatty Acids?

Current trends include a focus on sustainable sourcing, increased adoption in bio-based applications, and strong growth in the cosmetic and food sectors. These factors are shaping the future of the tallow fatty acids market.