Tanning Agents Market Report

Published Date: 02 February 2026 | Report Code: tanning-agents

Tanning Agents Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Tanning Agents market, including insights on current trends, future forecasts up to 2033, and detailed segmentation of the market by region and application. The report aims to equip stakeholders with essential data to make informed decisions.

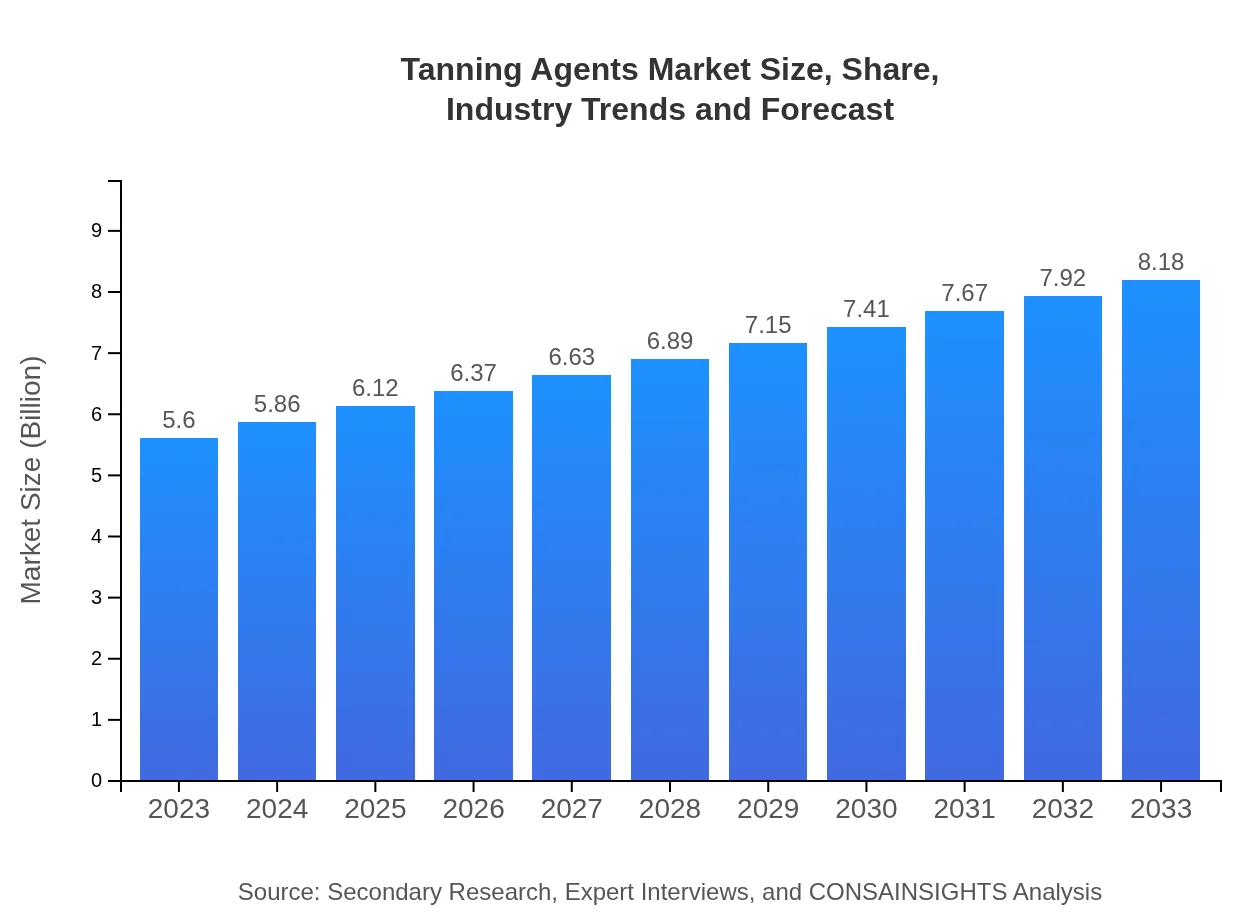

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 3.8% |

| 2033 Market Size | $8.18 Billion |

| Top Companies | TFL Ledertechnik GmbH, BASF SE, Huntsman Corporation, Clariant AG |

| Last Modified Date | 02 February 2026 |

Tanning Agents Market Overview

Customize Tanning Agents Market Report market research report

- ✔ Get in-depth analysis of Tanning Agents market size, growth, and forecasts.

- ✔ Understand Tanning Agents's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Tanning Agents

What is the Market Size & CAGR of Tanning Agents market in 2023?

Tanning Agents Industry Analysis

Tanning Agents Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Tanning Agents Market Analysis Report by Region

Europe Tanning Agents Market Report:

In Europe, the Tanning Agents market is projected to increase from USD 1.84 billion in 2023 to USD 2.69 billion by 2033. The European market is highly regulated with strict environmental standards, driving the demand for innovative and sustainable tanning solutions.Asia Pacific Tanning Agents Market Report:

In 2023, the Asia Pacific market for Tanning Agents is valued at USD 0.94 billion, projected to reach USD 1.37 billion by 2033. The growth in this region is driven by the rising manufacture of leather goods and increased production capabilities in countries like China and India. The emphasis on sustainable practices is also shaping trends in the region.North America Tanning Agents Market Report:

The Tanning Agents market in North America is estimated at USD 2.02 billion in 2023, expanding to USD 2.95 billion by 2033. This growth is supported by a strong presence of major leather manufacturers and advancements in technology, emphasizing sustainable tanning solutions.South America Tanning Agents Market Report:

The South American Tanning Agents market is valued at USD 0.26 billion in 2023, with expectations to grow to USD 0.39 billion by 2033. Growth factors include increased demand for leather and a burgeoning automotive industry, although market penetration remains slower than in other regions.Middle East & Africa Tanning Agents Market Report:

The market in the Middle East and Africa stands at USD 0.54 billion in 2023 and is set to grow to USD 0.79 billion by 2033. Continuous industrialization and growing awareness about sustainable leather production methods are vital growth contributors in this region.Tell us your focus area and get a customized research report.

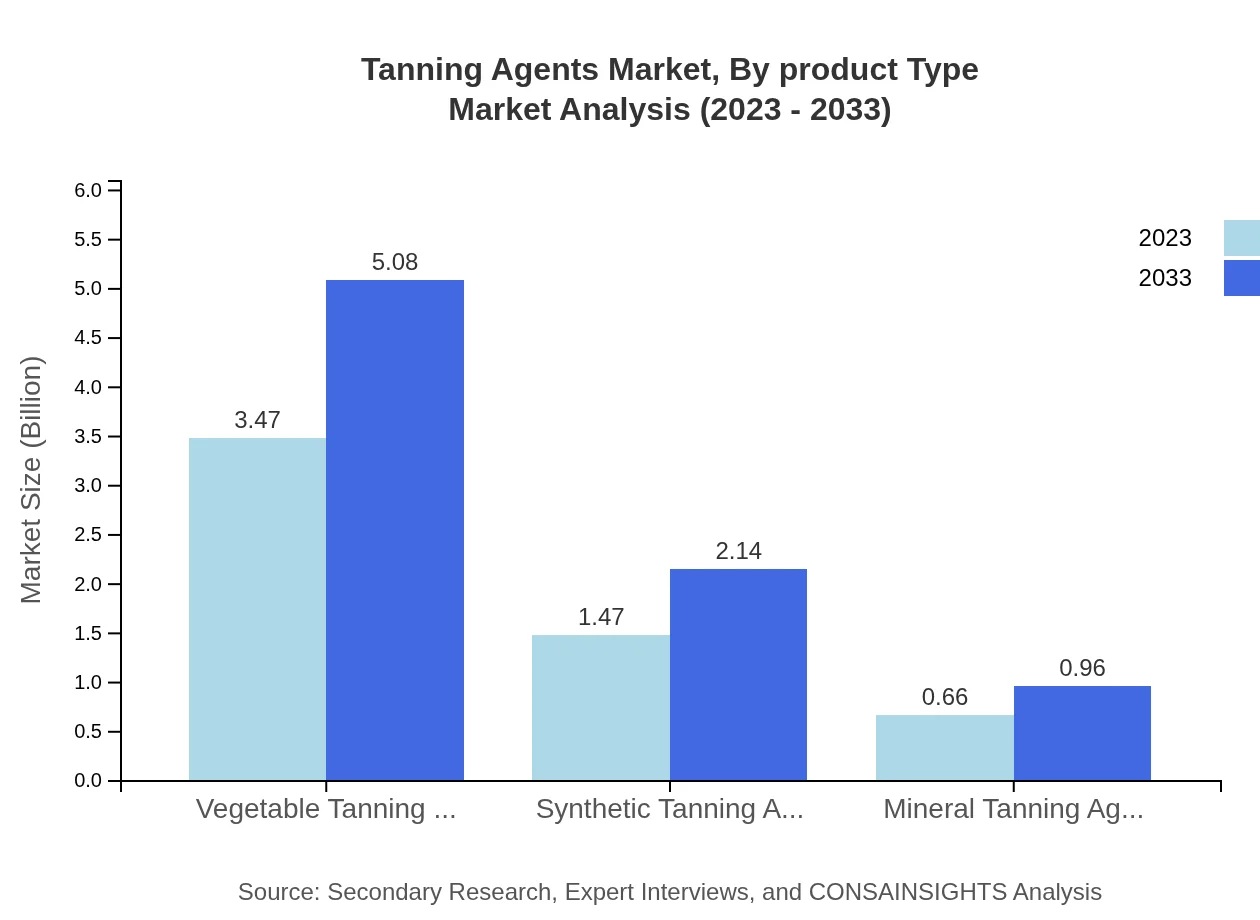

Tanning Agents Market Analysis By Product Type

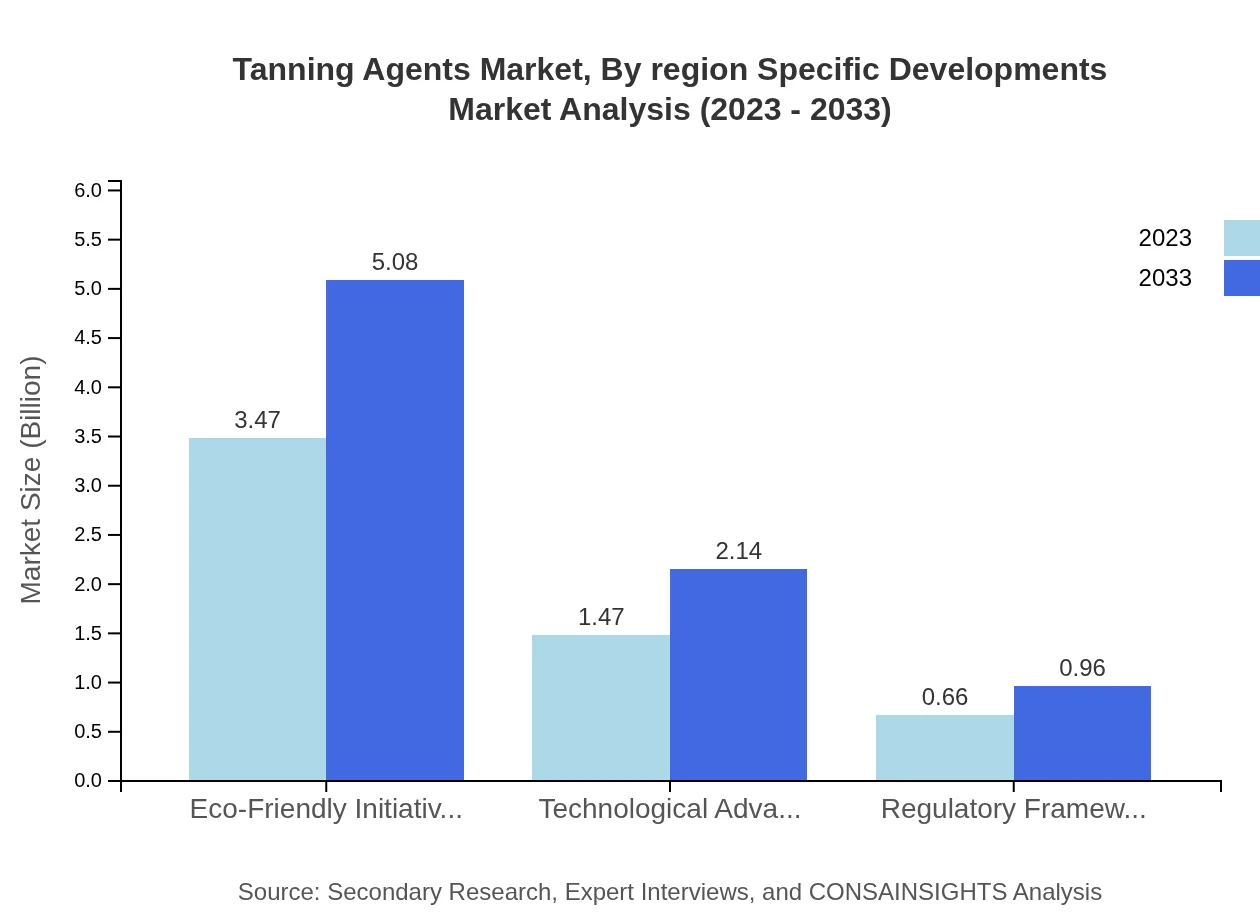

The product type segment shows significant potential, currently led by vegetable tanning agents, which commanded a market value of USD 3.47 billion in 2023 and is expected to reach USD 5.08 billion by 2033, maintaining a 62.05% share. Synthetic tanning agents hold a 26.21% share, valued at USD 1.47 billion in 2023, and set to rise to USD 2.14 billion by 2033. The mineral tanning agents, though smaller in size, play a critical role with an 11.74% share.

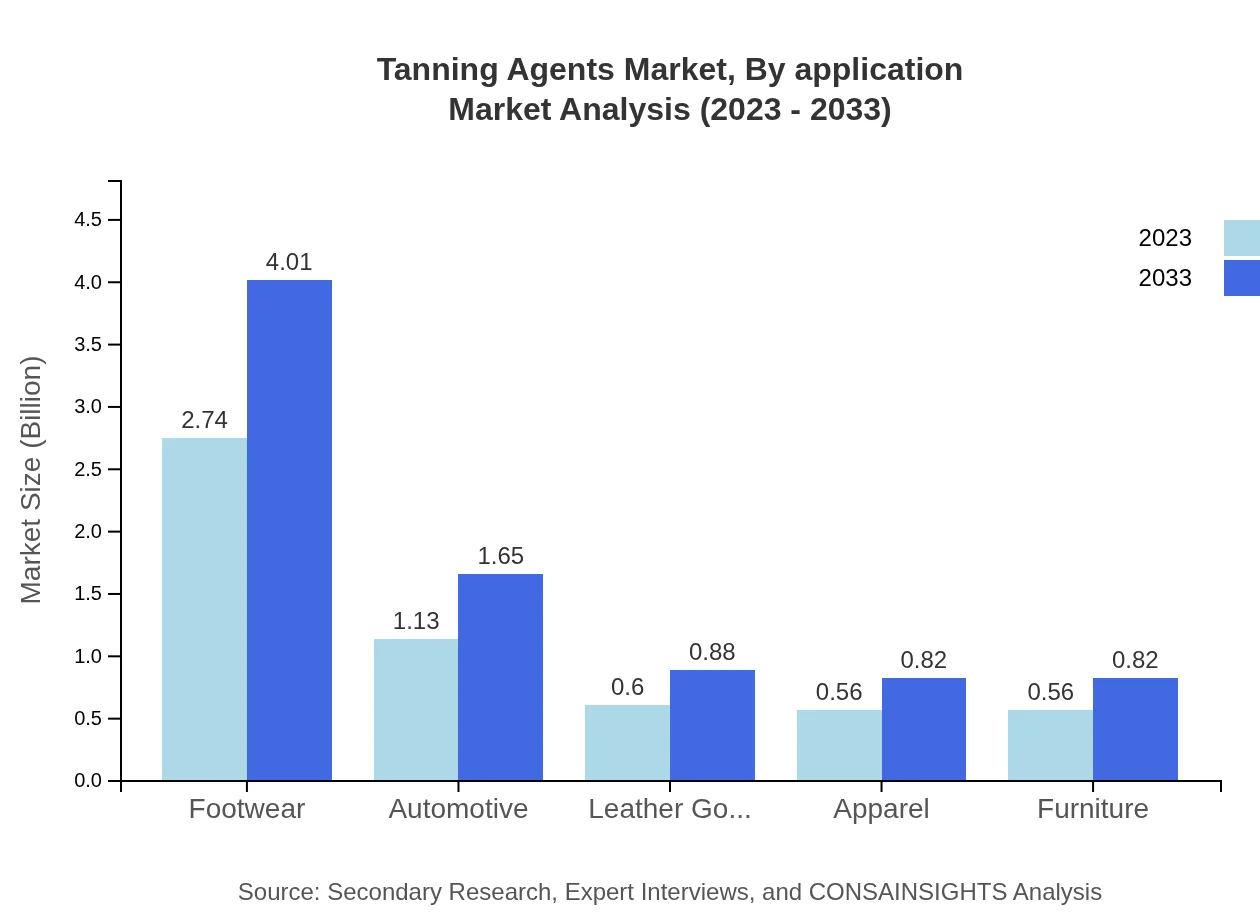

Tanning Agents Market Analysis By Application

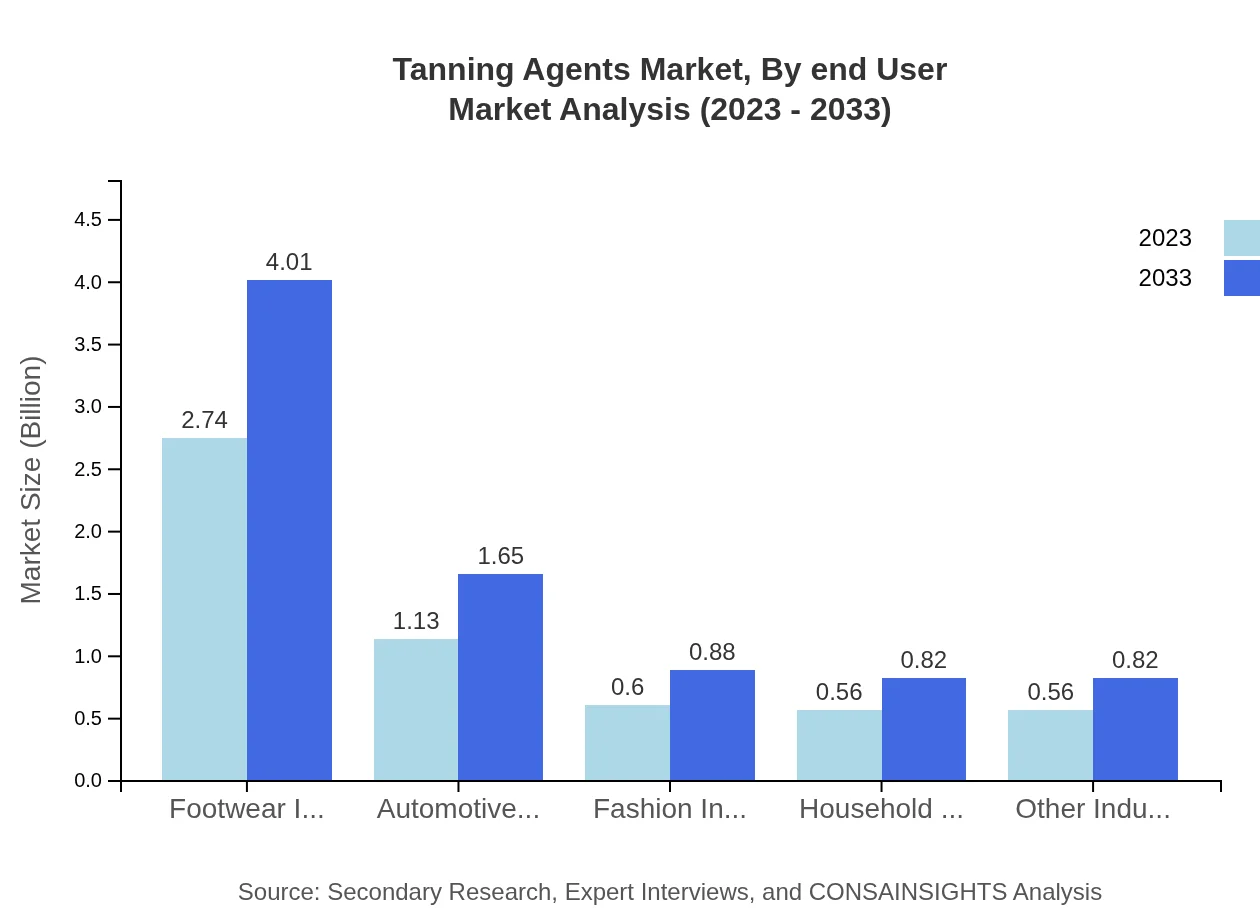

The application segment reveals that the footwear industry dominates the market with a size of USD 2.74 billion in 2023 and projected to grow to USD 4.01 billion by 2033, retaining a 48.96% share. The automotive segment is valued at USD 1.13 billion, while fashion and household goods applications contribute significantly with projected values of USD 0.60 billion and USD 0.56 billion respectively by 2033.

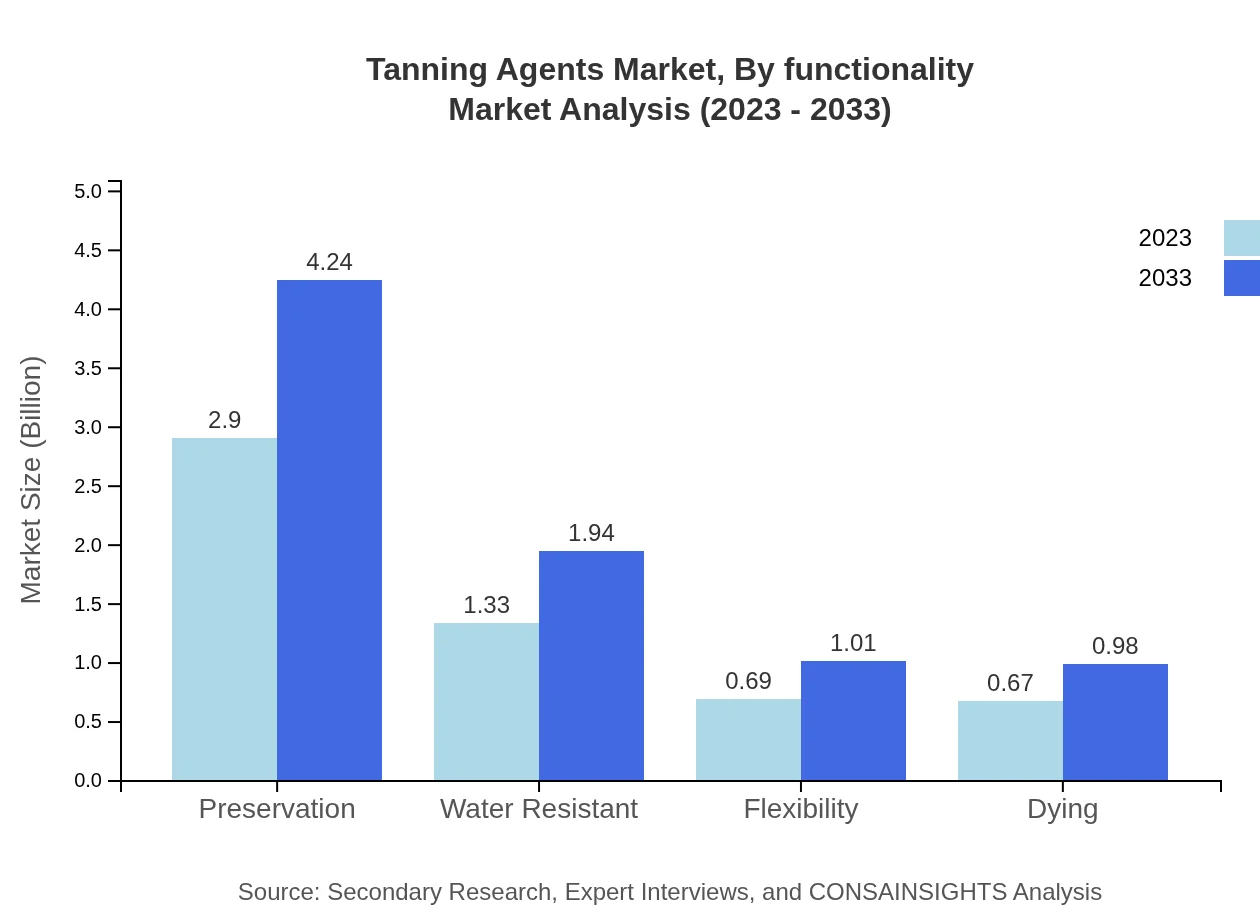

Tanning Agents Market Analysis By Functionality

The functionality segment shows diverse applications including preservation (51.85% share), water resistance (23.74% share), and flexibility (12.38% share). In 2023, preservation agents are valued at USD 2.90 billion, increasing to USD 4.24 billion by 2033, showcasing the growing need for innovative preservation methods.

Tanning Agents Market Analysis By End User

In terms of end-user industries, the leather goods sector leads with a size of USD 3.20 billion and is projected to grow significantly by 2033. The fashion sector also shows solid growth with innovative tanning products, while automotive and household goods contribute significantly to overall demand.

Tanning Agents Market Analysis By Region Specific Developments

Regionally, innovations and sustainability trends vary. The Asia-Pacific region sees rapid industrial growth, with significant investments in eco-friendly practices. North America emphasizes advanced technology and compliance, while Europe leads with stringent regulations driving sustainable tanning products.

Tanning Agents Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Tanning Agents Industry

TFL Ledertechnik GmbH:

A leading manufacturer specializing in the production of tanning agents, TFL boasts a robust portfolio and focuses on sustainable leather production practices.BASF SE:

BASF is a significant player providing chemical solutions, including innovative synthetic tanning agents, focusing on sustainability and regulatory compliance.Huntsman Corporation:

Known for their broad range of textile and leather chemicals, Huntsman is committed to advancing eco-friendly tanning solutions.Clariant AG:

Clariant specializes in chemical products, including a variety of tanning agents, emphasizing eco-sustainable production.We're grateful to work with incredible clients.

FAQs

What is the market size of tanning Agents?

The global tanning agents market is currently valued at approximately $5.6 billion, with a projected compound annual growth rate (CAGR) of 3.8% over the next decade. This growth is influenced by increasing demand across various industries, including footwear and automotive.

What are the key market players or companies in this tanning Agents industry?

Key players in the tanning agents market include major chemical producers and suppliers that dominate the market with innovative solutions. While specific company names are proprietary, notable market participants typically focus on sustainability and product diversification.

What are the primary factors driving the growth in the tanning agents industry?

The growth of the tanning agents industry is primarily driven by rising consumer demand for leather products, increased sustainability awareness, and advancements in tanning technology. Additionally, the expansion of the footwear and automotive sectors contributes significantly to market growth.

Which region is the fastest Growing in the tanning agents market?

The fastest-growing region in the tanning agents market is Europe, projected to expand from $1.84 billion in 2023 to $2.69 billion by 2033. This growth is driven by strong automotive and fashion industries that rely heavily on high-quality leather.

Does ConsaInsights provide customized market report data for the tanning agents industry?

Yes, ConsaInsights provides customized market report data tailored to the specific needs of clients in the tanning agents industry. These reports are designed to address particular market segments, geographic regions, and emerging trends.

What deliverables can I expect from this tanning agents market research project?

Deliverables from the tanning agents market research project include comprehensive market analysis, segmentation data, consumer insights, competitive benchmarking, and trend identification to support strategic decisions across various applications.

What are the market trends of tanning agents?

Current market trends in tanning agents emphasize eco-friendly initiatives and technological innovations. The shift towards sustainable materials and methods is increasingly important, as seen through the growth of vegetable tanning agents, which make up 62.05% of the market share.