Tavr Market Report

Published Date: 31 January 2026 | Report Code: tavr

Tavr Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Tavr market, covering insights on market size, growth rates, trends, and regional analysis from 2023 to 2033, helping stakeholders make informed decisions.

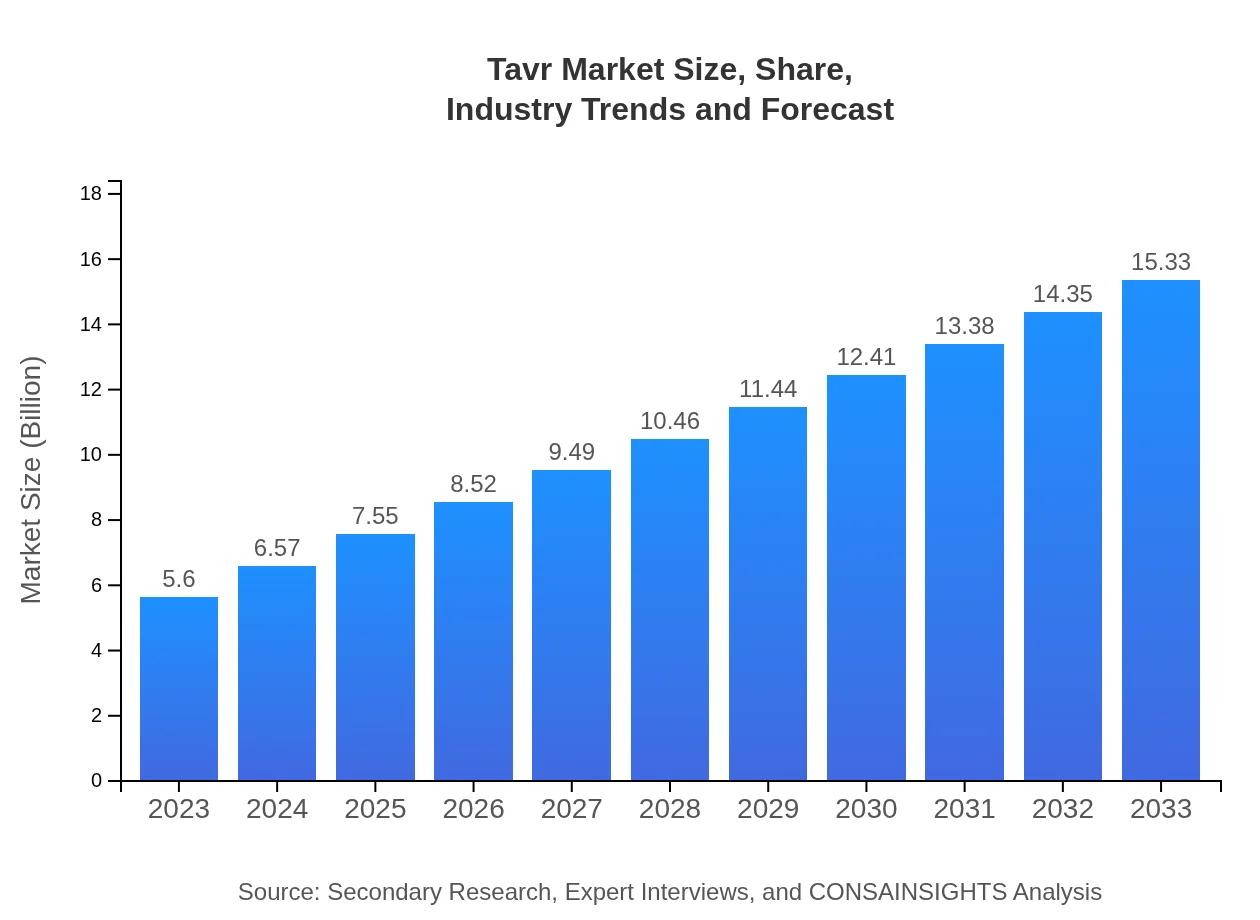

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 10.2% |

| 2033 Market Size | $15.33 Billion |

| Top Companies | Edwards Lifesciences Corporation, Medtronic plc, Boston Scientific Corporation |

| Last Modified Date | 31 January 2026 |

Tavr Market Overview

Customize Tavr Market Report market research report

- ✔ Get in-depth analysis of Tavr market size, growth, and forecasts.

- ✔ Understand Tavr's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Tavr

What is the Market Size & CAGR of Tavr market in 2023?

Tavr Industry Analysis

Tavr Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Tavr Market Analysis Report by Region

Europe Tavr Market Report:

Europe is anticipated to see growth from $1.71 billion in 2023 to $4.68 billion by 2033. The focus on innovative healthcare solutions and ongoing investments in health technology are key factors driving market expansion in the region. Countries like Germany, France, and the UK are at the forefront of Tavr adoption.Asia Pacific Tavr Market Report:

In the Asia Pacific region, the Tavr market is set to grow from $1.06 billion in 2023 to approximately $2.91 billion by 2033. The increasing adoption of advanced healthcare technology and growing pharmaceutical sectors contribute significantly to this growth, especially in countries like Japan and China where healthcare infrastructures are rapidly improving.North America Tavr Market Report:

In North America, the market is expected to experience substantial growth from $1.99 billion in 2023 to $5.44 billion in 2033. The region's well-established healthcare systems, combined with high prevalence rates of aortic stenosis and increased awareness of Tavr benefits, underpin this positive trend.South America Tavr Market Report:

The South American Tavr market is projected to rise from $0.17 billion in 2023 to $0.45 billion in 2033, driven by a growing middle class that is increasingly able to afford advanced medical procedures. Despite challenges in healthcare delivery, investments in healthcare facilities are opening new avenues for Tavr adoption.Middle East & Africa Tavr Market Report:

The Middle East and Africa region is poised to grow from $0.67 billion in 2023 to $1.84 billion by 2033. Although facing economic and regulatory challenges, increasing healthcare investments and the rising burden of cardiovascular diseases are boosting the Tavr market here.Tell us your focus area and get a customized research report.

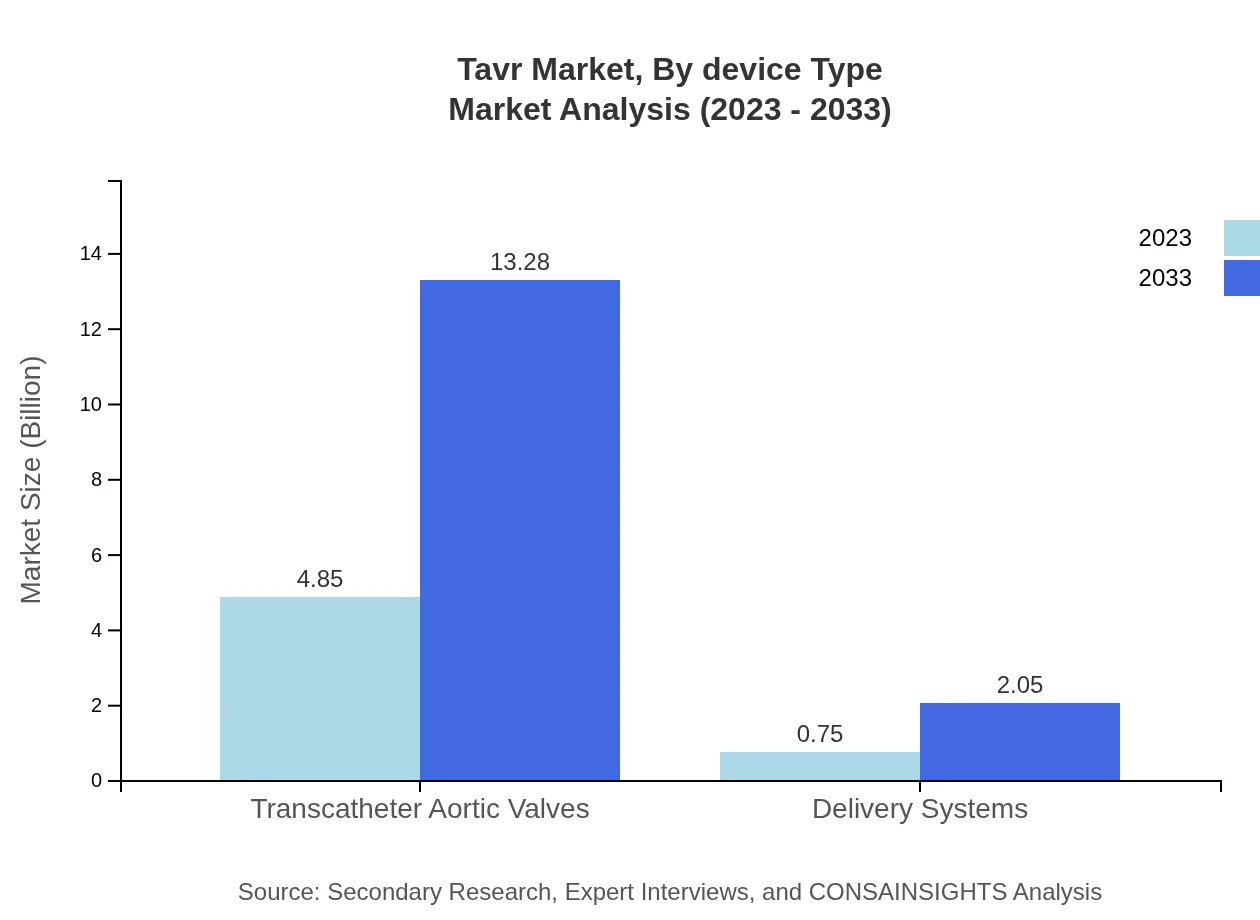

Tavr Market Analysis By Device Type

The Tavr market, segmented by device type, primarily consists of transcatheter aortic valves and delivery systems. Each type plays a crucial role, with the transcatheter aortic valves leading the market due to their key safety and efficacy advantages. The segment's size is projected to grow from $4.85 billion in 2023 to $13.28 billion by 2033, showcasing a consistent demand for the technology driven by enhanced patient outcomes.

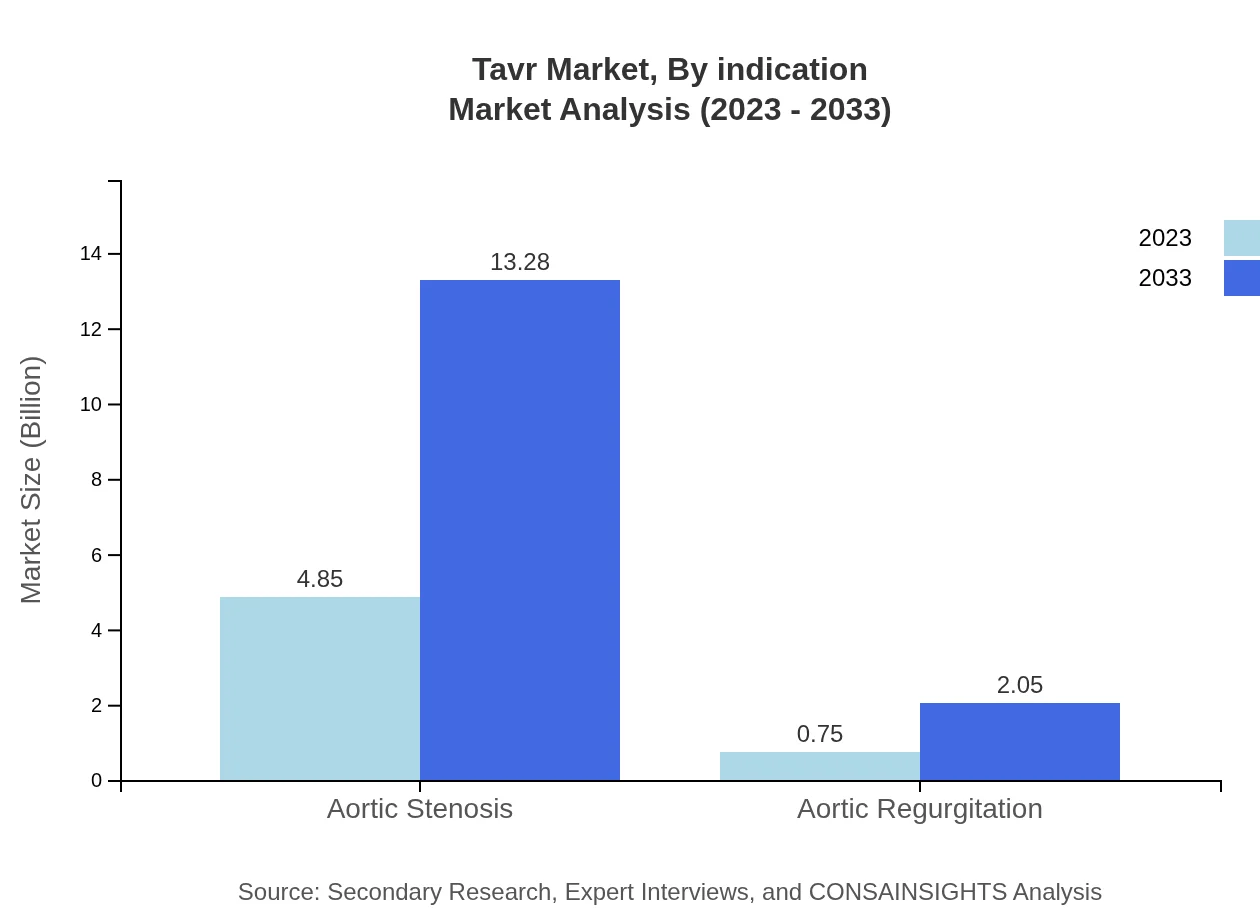

Tavr Market Analysis By Indication

The indication segmentation reveals a significant focus on aortic stenosis, which commands a large market share of 86.63% in 2023, indicating a strong preference for Tavr in treating this prevalent condition. Growth in the aortic regurgitation segment is also expected, rising from $0.75 billion to $2.05 billion over the same period.

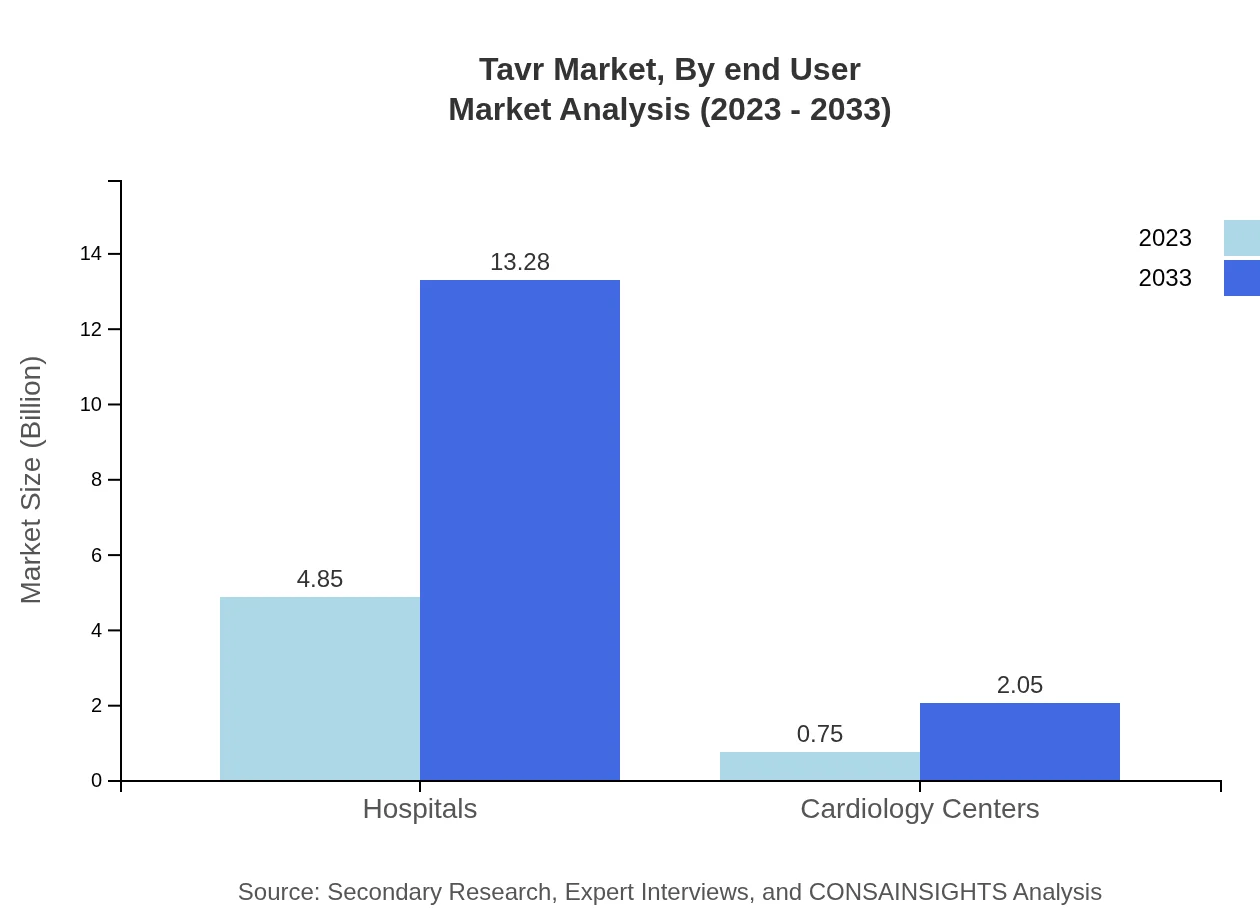

Tavr Market Analysis By End User

The Tavr market by end-user primarily includes hospitals and cardiology centers. Hospitals take the lead with a share of 86.63% in 2023, supported by their advanced capabilities and infrastructure for conducting complex procedures. Cardiology centers, while having a smaller share of 13.37%, are emerging as specialized providers catering to specific patient needs.

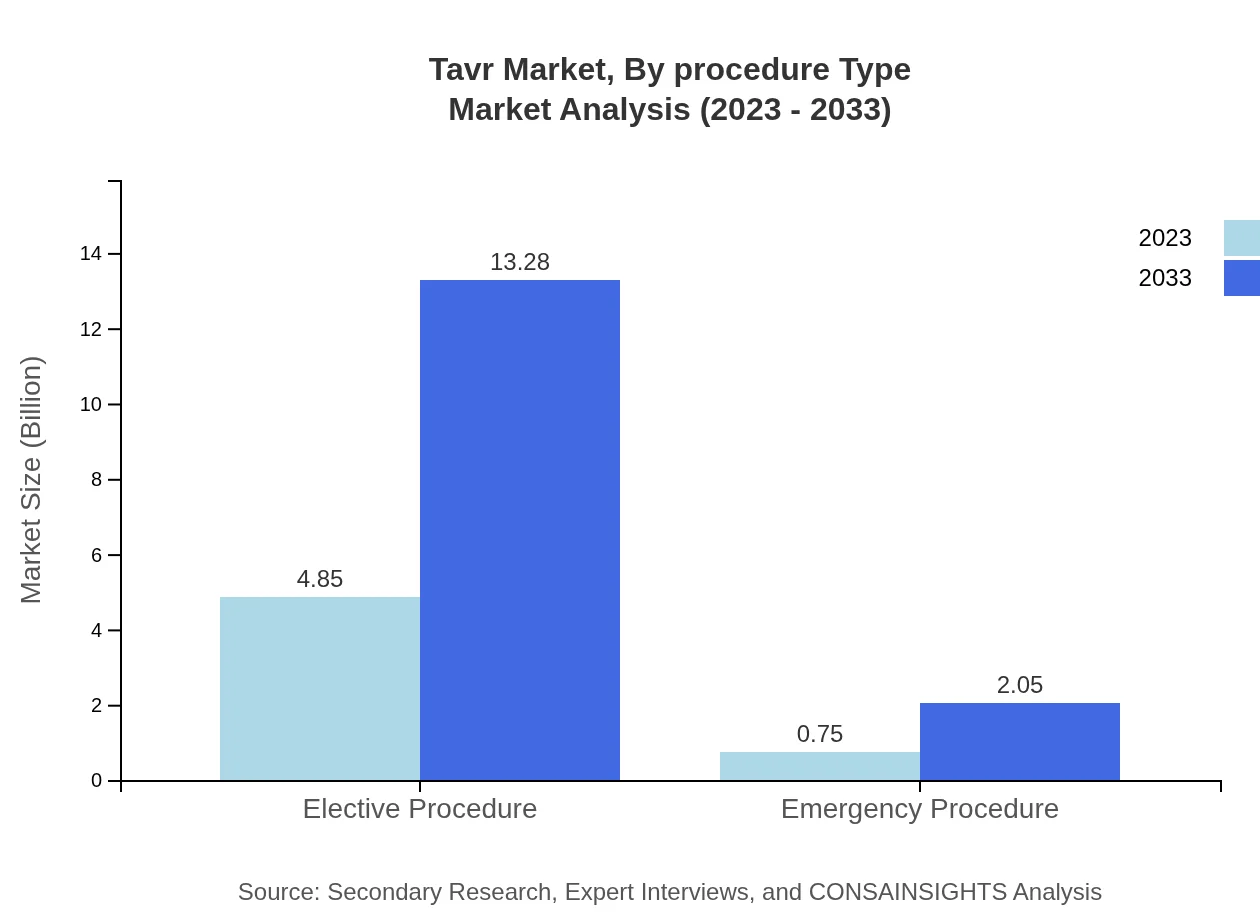

Tavr Market Analysis By Procedure Type

The market segmented by procedure type indicates a strong performance for elective procedures, constituting a large segment with 86.63% market share in 2023. Emergency procedures represent a smaller segment but are essential, with expected growth driven by rising emergency cases related to heart conditions.

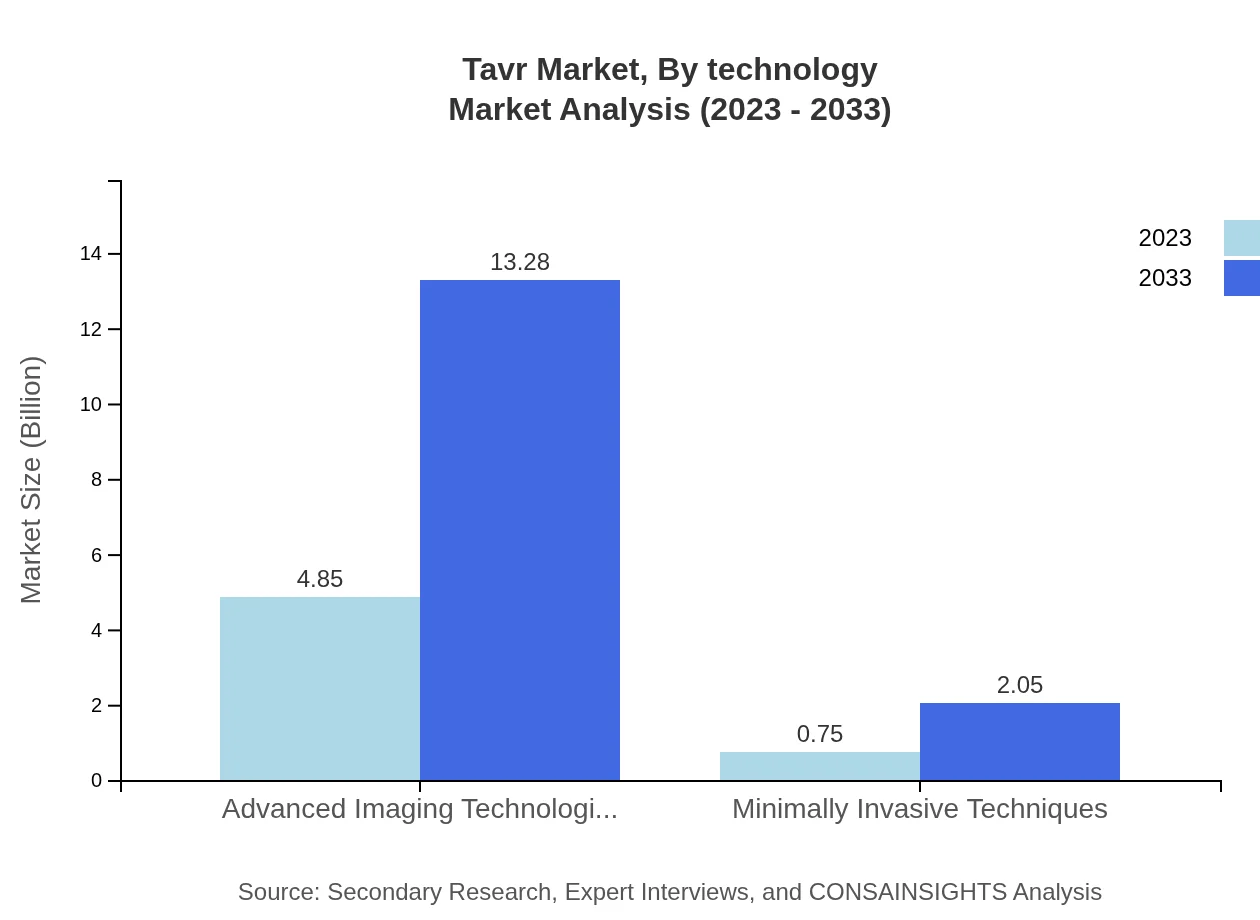

Tavr Market Analysis By Technology

Technological advancements in the Tavr market include innovations in imaging technologies and minimally invasive techniques. These technologies are integral to producing better surgical outcomes and have spurred growth, with the corresponding segments projected to expand significantly by 2033.

Tavr Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Tavr Industry

Edwards Lifesciences Corporation:

A leader in the Tavr market, Edwards is known for its innovative valve technologies and high-quality patient care. The company significantly impacts the market with its extensive research and successful product launches.Medtronic plc:

Medtronic is a prominent player with diversified products focusing on heart valves and related technologies. Its commitment to innovation and clinical research supports the growing needs of the Tavr market.Boston Scientific Corporation:

Boston Scientific engages in the development of cutting-edge medical devices. Its robust portfolio in cardiovascular health aids in driving competition and technological advancements in the Tavr segment.We're grateful to work with incredible clients.

FAQs

What is the market size of TAVR?

The TAVR market was valued at approximately $5.6 billion in 2023, with a projected CAGR of 10.2%. By 2033, the market is expected to significantly grow, driven by technological advancements and increasing prevalence of aortic stenosis.

What are the key market players or companies in this TAVR industry?

Key players in the TAVR market include leading medical device manufacturers such as Edwards Lifesciences, Medtronic, Boston Scientific, and St. Jude Medical, who are involved in innovations related to transcatheter heart valve technologies.

What are the primary factors driving the growth in the TAVR industry?

The TAVR industry's growth is driven by an increasing aging population, the rise in cardiovascular diseases, advancements in minimally invasive techniques, and the growing acceptance of TAVR procedures among healthcare professionals and patients for aortic valve replacements.

Which region is the fastest Growing in the TAVR?

North America is the fastest-growing region in the TAVR market. Its market size is expected to increase from $1.99 billion in 2023 to $5.44 billion by 2033, supported by a robust healthcare infrastructure and increasing adoption of TAVR procedures.

Does ConsaInsights provide customized market report data for the TAVR industry?

Yes, ConsaInsights offers customized market report data for the TAVR industry. Clients can obtain tailored insights focusing on specific regions, segments, or trends to enhance their decision-making processes.

What deliverables can I expect from this TAVR market research project?

Deliverables from the TAVR market research project include a comprehensive report with market analysis, growth forecasts, regional insights, competitive landscape, key trends, and detailed segmentation data for informed strategic planning.

What are the market trends of TAVR?

Current trends in the TAVR market include the increasing use of advanced imaging technologies, rising popularity of minimally invasive procedures, and innovations in transcatheter heart valves, which are enhancing clinical outcomes and safety profiles.