Tax Management Market Report

Published Date: 02 February 2026 | Report Code: tax-management

Tax Management Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Tax Management market, covering key insights from 2023 to 2033, including market size, segmentation, trends, and leading players. It aims to offer valuable perspectives for stakeholders looking to navigate this evolving landscape.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.00 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $19.65 Billion |

| Top Companies | Intuit, SAP SE, Thomson Reuters, Wolters Kluwer, H&R Block, Inc. |

| Last Modified Date | 02 February 2026 |

Tax Management Market Overview

Customize Tax Management Market Report market research report

- ✔ Get in-depth analysis of Tax Management market size, growth, and forecasts.

- ✔ Understand Tax Management's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Tax Management

What is the Market Size & CAGR of Tax Management market in 2023-2033?

Tax Management Industry Analysis

Tax Management Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Tax Management Market Analysis Report by Region

Europe Tax Management Market Report:

Europe represents a significant market, with projections showing growth from USD 3.39 billion in 2023 to USD 6.67 billion by 2033. The complexity of tax regulations and GDPR compliance fuels demand in this region, as businesses seek efficient solutions to navigate these challenges effectively.Asia Pacific Tax Management Market Report:

The Asia Pacific region is witnessing significant growth in the Tax Management market, with an expected increase from USD 1.71 billion in 2023 to USD 3.36 billion by 2033. Rapid economic growth, along with an increase in cross-border investments, is pushing companies to adopt efficient tax management practices, fostering a conducive market environment.North America Tax Management Market Report:

North America commands a substantial share of the market, projected to escalate from USD 3.47 billion in 2023 to USD 6.83 billion by 2033. The region benefits from a mature market landscape characterized by high adoption rates of advanced tax management software, driven by the presence of key players and a robust regulatory framework.South America Tax Management Market Report:

In South America, the market is projected to grow from USD 0.68 billion in 2023 to USD 1.35 billion by 2033. The surge in compliance requirements and the need for streamlined tax processes are critical drivers of growth in this region, particularly among emerging economies looking to improve business operation efficiencies.Middle East & Africa Tax Management Market Report:

The Middle East and Africa market is expected to evolve positively, with size increasing from USD 0.74 billion in 2023 to USD 1.45 billion by 2033. Areas of growth include a rise in local business formation and an increasing emphasis on enhancing tax governance in governmental and corporate sectors.Tell us your focus area and get a customized research report.

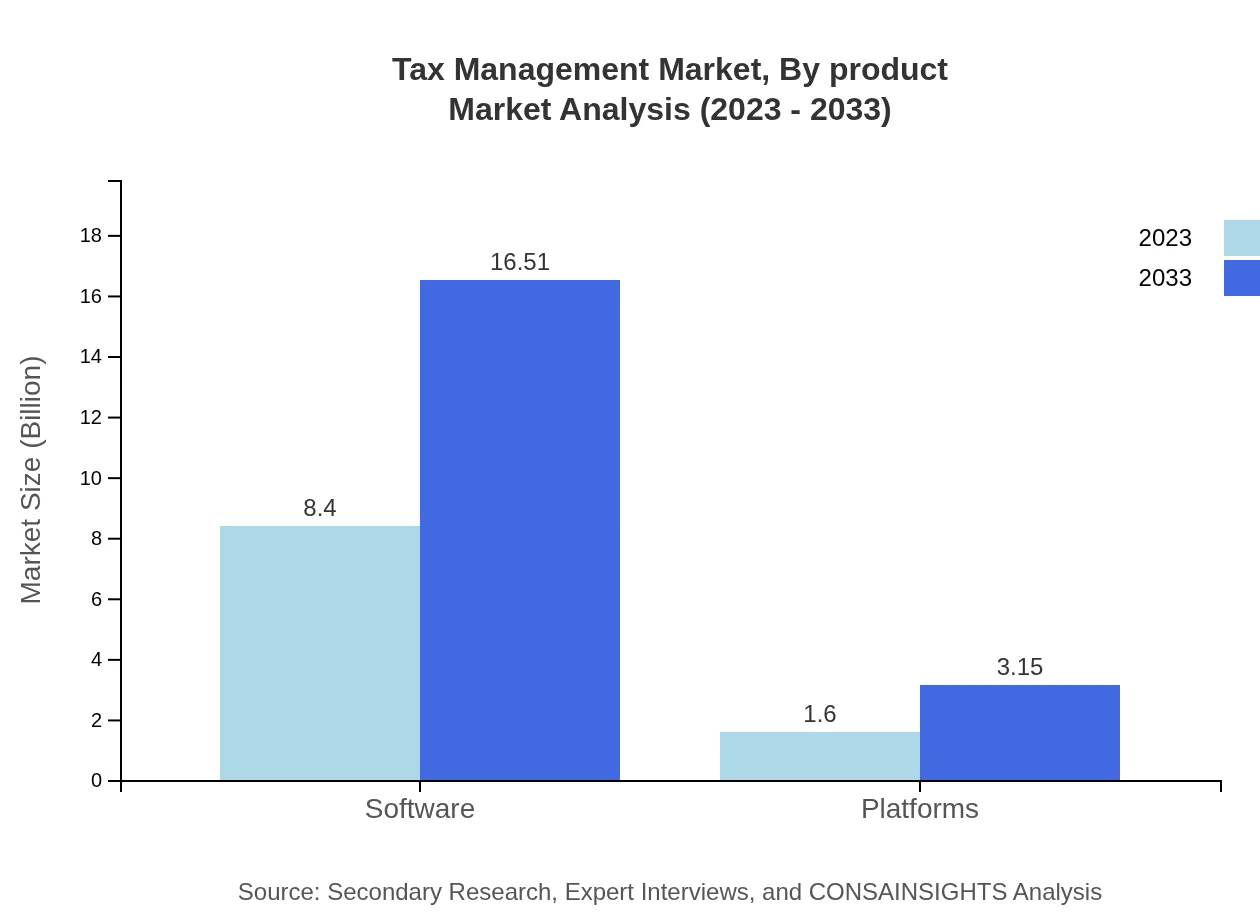

Tax Management Market Analysis By Product

Within the product segments, software solutions constitute the largest share, with a market size moving from USD 8.40 billion in 2023 to USD 16.51 billion by 2033. Cloud-based solutions are also notably growing, with size projected to rise from USD 1.60 billion to USD 3.15 billion. This shift is fueled by the demand for scalable and flexible tax management options that require less infrastructure investment.

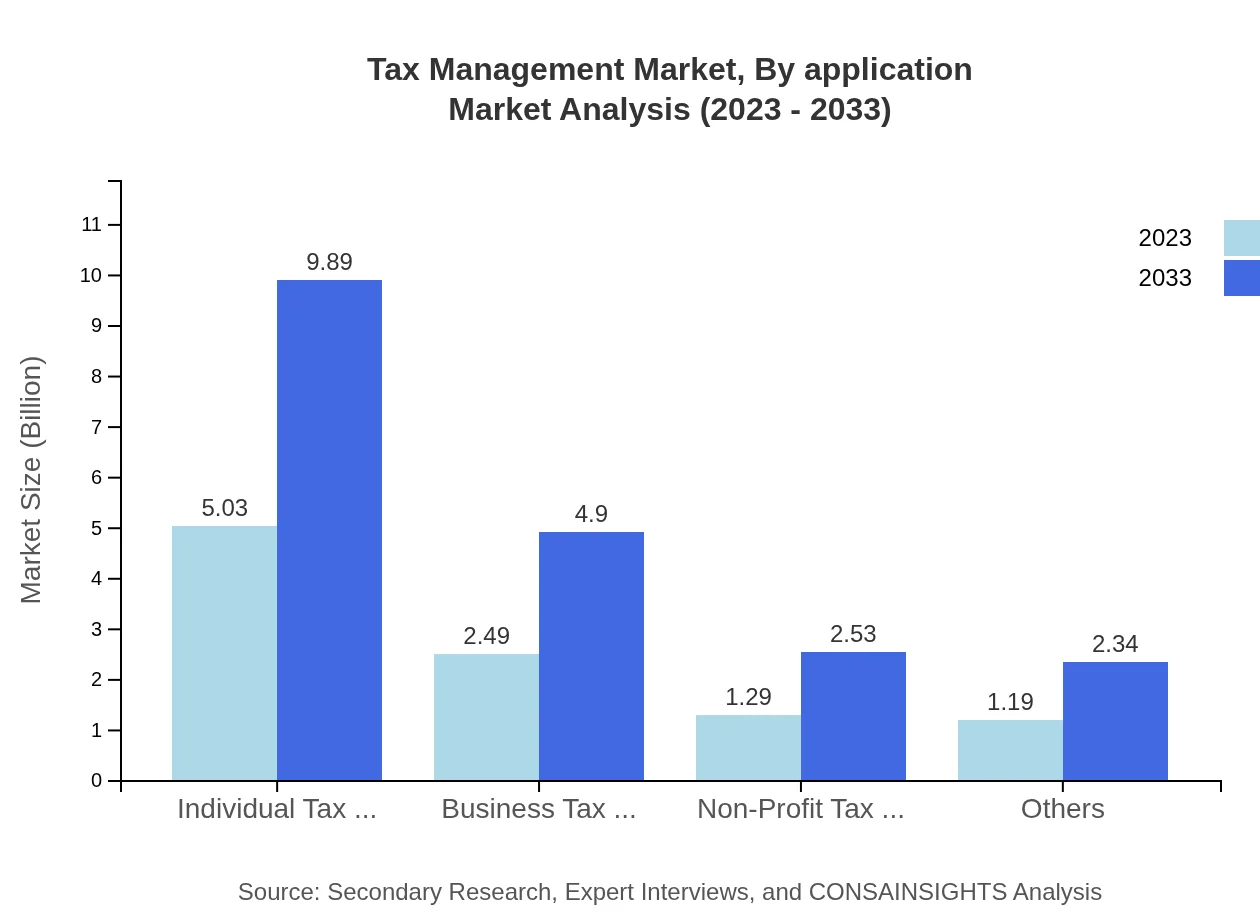

Tax Management Market Analysis By Application

In application analysis, individual tax filing significantly dominates the market, expected to grow from USD 5.03 billion in 2023 to USD 9.89 billion by 2033. Businesses are increasingly focusing on compliance-oriented applications, anticipating the rise of business tax filing applications from USD 2.49 billion to USD 4.90 billion, reflecting companies' growing needs for accurate and timely financial reporting.

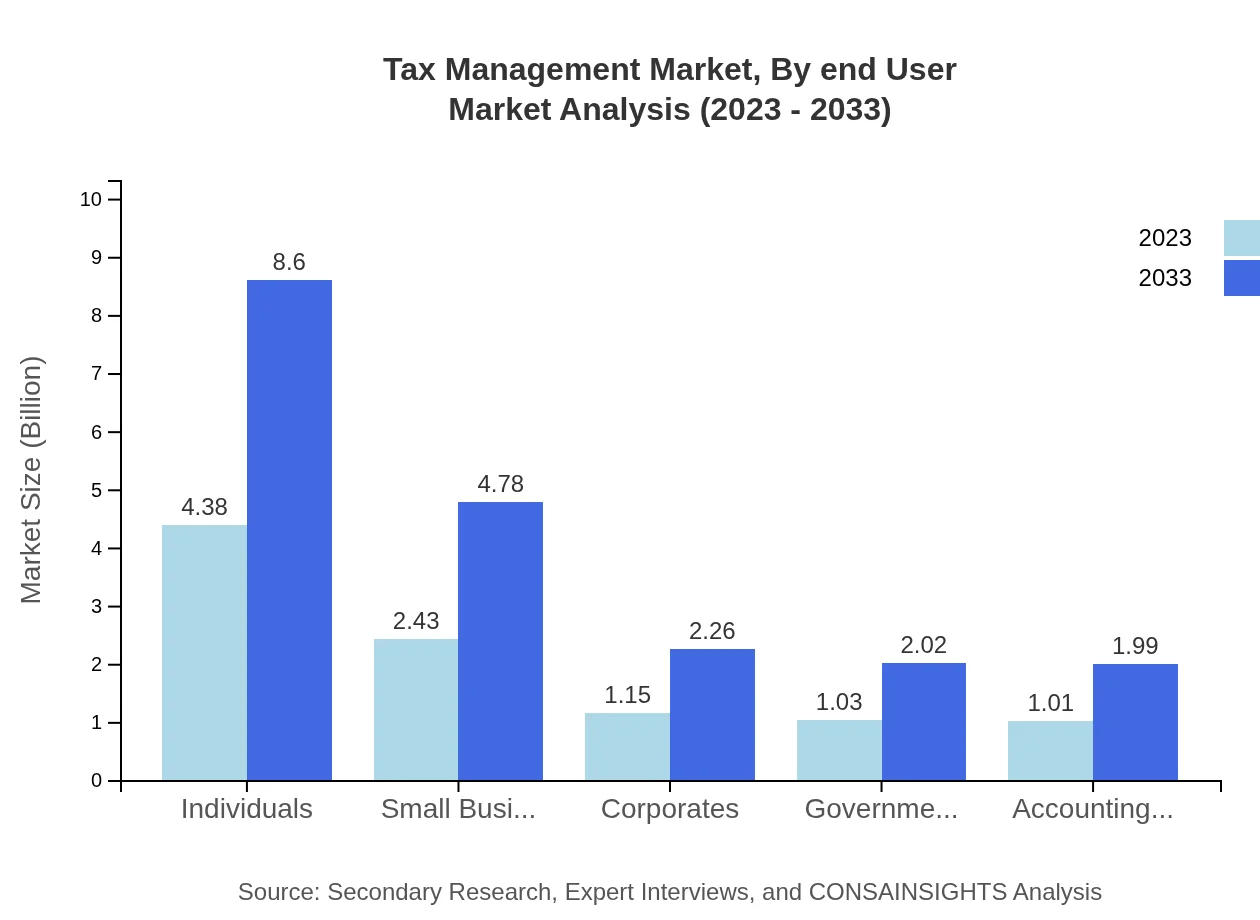

Tax Management Market Analysis By End User

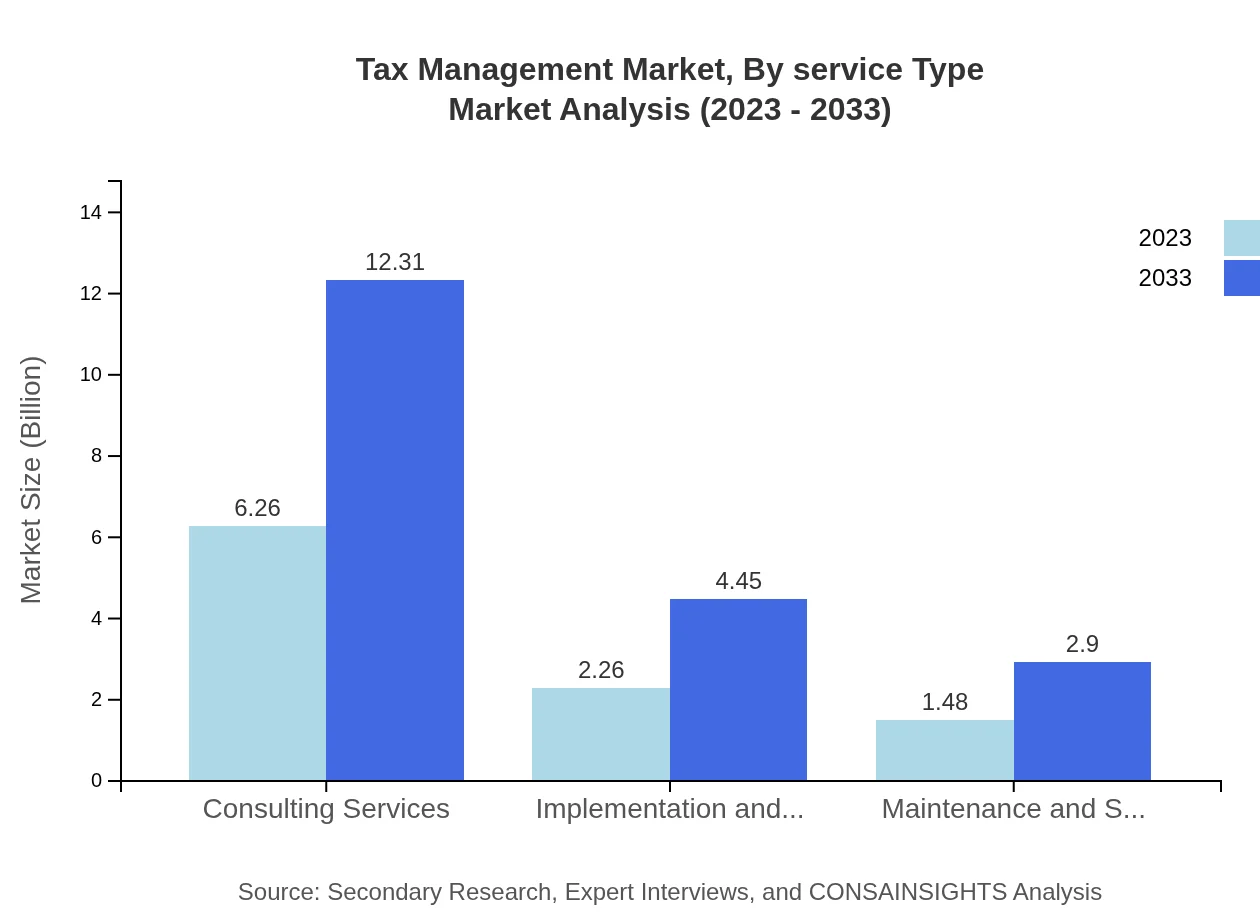

End-user segmentation indicates that the consulting services sector leads, with market size anticipated to rise from USD 6.26 billion to USD 12.31 billion. Notably, the small business segment is also expected to grow, moving from USD 2.43 billion in 2023 to USD 4.78 billion by 2033 as more SMEs seek professional tax management solutions to enhance compliance.

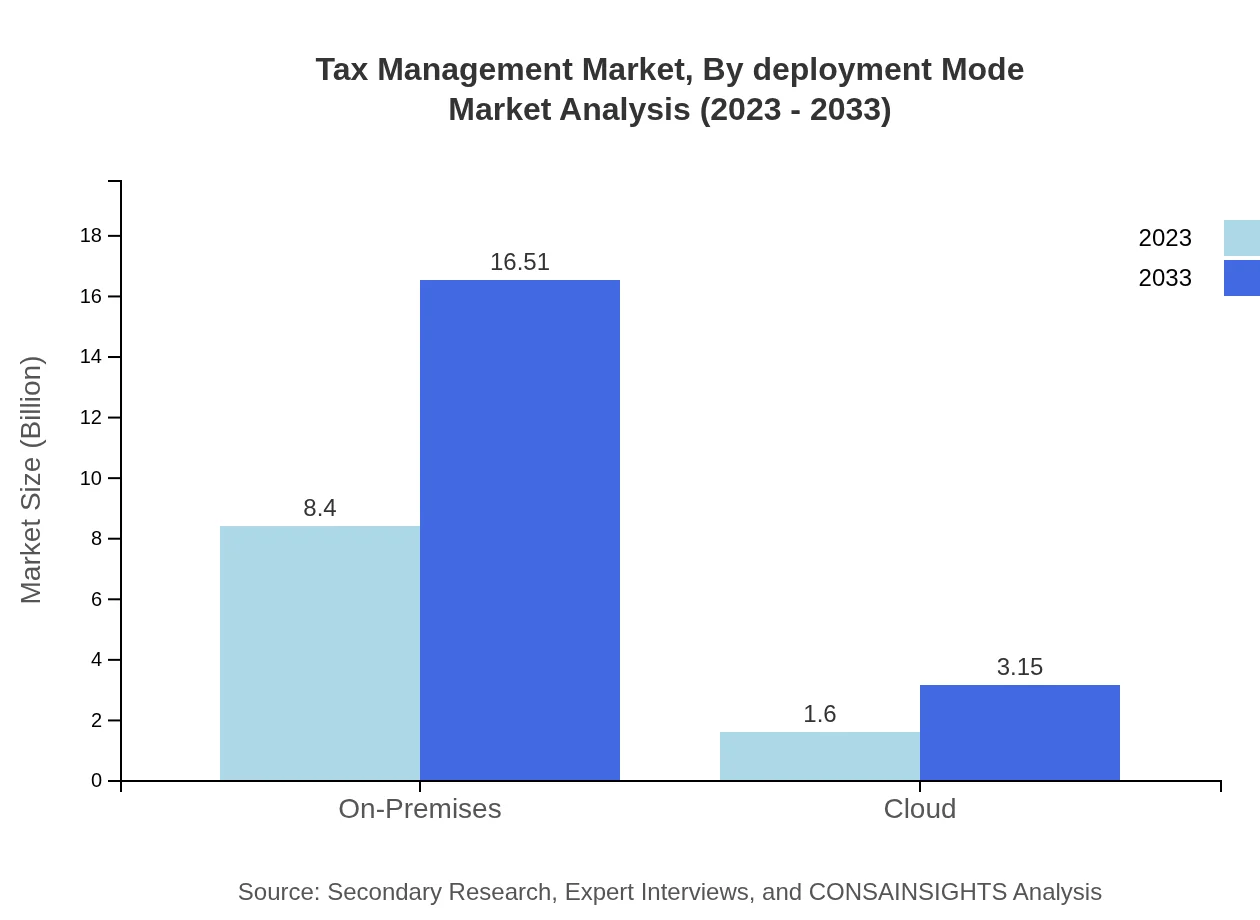

Tax Management Market Analysis By Deployment Mode

Deployment mode insights show on-premises software solutions maintaining a significant market share, expected to grow from USD 8.40 billion in 2023 to USD 16.51 billion by 2033. However, cloud deployment is slowly gaining traction, evidenced by the projected rise from USD 1.60 billion to USD 3.15 billion, revealing a shift towards more flexible and accessible solutions.

Tax Management Market Analysis By Service Type

The service type segmentation reveals consulting services at the forefront, expected to grow from USD 6.26 billion to USD 12.31 billion. This increase points to a trend where organizations seek strategic tax consulting to optimize their tax positions, with complementary services such as maintenance and support also experiencing robust growth.

Tax Management Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Tax Management Industry

Intuit:

Intuit is a leading provider of financial software solutions, including TurboTax and QuickBooks, which simplify tax management for individuals and businesses.SAP SE:

SAP SE provides comprehensive financial management and enterprise resource planning (ERP) solutions, incorporating advanced tax management functionalities to enhance compliance for enterprises.Thomson Reuters:

Thomson Reuters delivers advanced tax and compliance solutions that empower professionals to navigate evolving regulatory requirements effectively.Wolters Kluwer:

Wolters Kluwer offers a suite of tax management solutions that streamline compliance, including CCH Axcess Tax, which enhances collaboration and productivity for tax professionals.H&R Block, Inc.:

H&R Block is known primarily for its tax preparation services, delivering online tax filing solutions for both individuals and small businesses, enhancing their tax management capabilities.We're grateful to work with incredible clients.

FAQs

What is the market size of tax management?

The tax management market is projected to reach approximately $10 billion by 2033, growing at a CAGR of 6.8% from its current valuation in 2023. This substantial growth reflects the increasing complexity of tax regulations and the demand for efficient tax solutions.

What are the key market players or companies in the tax management industry?

Key players in the tax management industry include major software companies, specialized tax consultancy firms, and financial institutions that provide tax-related services. Their contributions significantly shape innovations and service offerings within the market.

What are the primary factors driving the growth in the tax management industry?

Driving factors for growth in the tax management industry include increased globalization, complex regulatory environments, the rise of technology solutions such as Software as a Service (SaaS), and a heightened awareness of tax compliance among businesses.

Which region is the fastest Growing in the tax management sector?

The fastest-growing region in the tax management industry is the Asia Pacific, expected to expand from $1.71 billion in 2023 to $3.36 billion by 2033. This growth is fueled by economic expansion and increasing tax compliance needs across emerging economies.

Does ConsaInsights provide customized market report data for the tax management industry?

Yes, ConsaInsights offers customizable market report data tailored to specific requirements and industry parameters in the tax management sector, ensuring that clients receive insights that are most relevant to their strategic decisions.

What deliverables can I expect from this tax management market research project?

From this tax management market research project, clients can expect comprehensive deliverables, including in-depth market analysis, segmented data, competitive landscape reports, and forecasts detailing market trends and growth opportunities.

What are the market trends of tax management?

Current market trends in tax management include an increased adoption of digital tax solutions, a focus on compliance automation, data analytics for strategic tax planning, and the rise of consultancy services that support businesses in navigating regulatory landscapes.