Technical Ceramics Market Report

Published Date: 02 February 2026 | Report Code: technical-ceramics

Technical Ceramics Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis and insights into the Technical Ceramics market, including market size, growth forecasts, segmentation, and regional dynamics from 2023 to 2033.

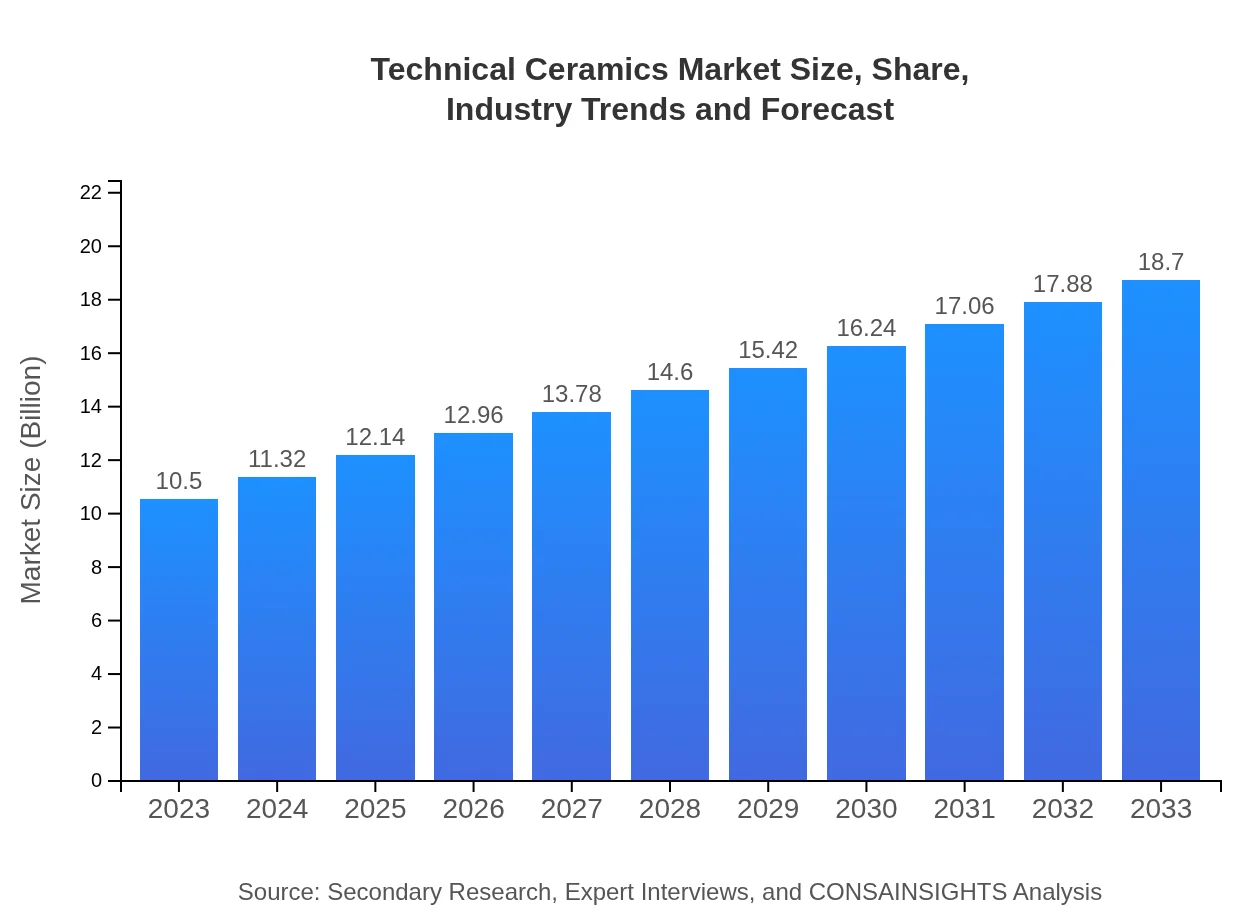

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 5.8% |

| 2033 Market Size | $18.70 Billion |

| Top Companies | Kyocera Corporation, CeramTec GmbH, Morgan Advanced Materials |

| Last Modified Date | 02 February 2026 |

Technical Ceramics Market Overview

Customize Technical Ceramics Market Report market research report

- ✔ Get in-depth analysis of Technical Ceramics market size, growth, and forecasts.

- ✔ Understand Technical Ceramics's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Technical Ceramics

What is the Market Size & CAGR of Technical Ceramics market in 2023?

Technical Ceramics Industry Analysis

Technical Ceramics Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Technical Ceramics Market Analysis Report by Region

Europe Technical Ceramics Market Report:

The European Technical Ceramics market is poised to increase from $2.54 billion in 2023 to $4.52 billion in 2033. Strong regulations supporting safety and performance in industries such as automotive and medical devices contribute significantly to this trend. Countries like Germany and the UK remain key players in this market.Asia Pacific Technical Ceramics Market Report:

The Asia-Pacific region is set to witness robust growth in the Technical Ceramics market, expanding from $2.18 billion in 2023 to $3.88 billion in 2033. The region's rapid industrialization, coupled with increased demand for electronic components and medical devices, drives this growth. Countries like China, Japan, and India are significant contributors to this expansion, fueled by innovation and skilled labor.North America Technical Ceramics Market Report:

North America is projected to grow from $3.47 billion in 2023 to $6.17 billion in 2033, propelled by advancements in technologies and strong growth in sectors like aerospace and defense. The presence of key players and a focus on innovative solutions drive the market's expansion.South America Technical Ceramics Market Report:

In South America, the Technical Ceramics market is expected to grow from $1.00 billion in 2023 to $1.79 billion by 2033. Brazil leads the market due to its developing industrial sector. Increased investments in infrastructure and medical technology are further bolstering demand in the region.Middle East & Africa Technical Ceramics Market Report:

The Middle East and Africa region will see growth from $1.31 billion in 2023 to $2.34 billion by 2033. Rising investments in the construction and manufacturing sectors, along with a growing focus on technological advancements in ceramics, are expected to drive market growth.Tell us your focus area and get a customized research report.

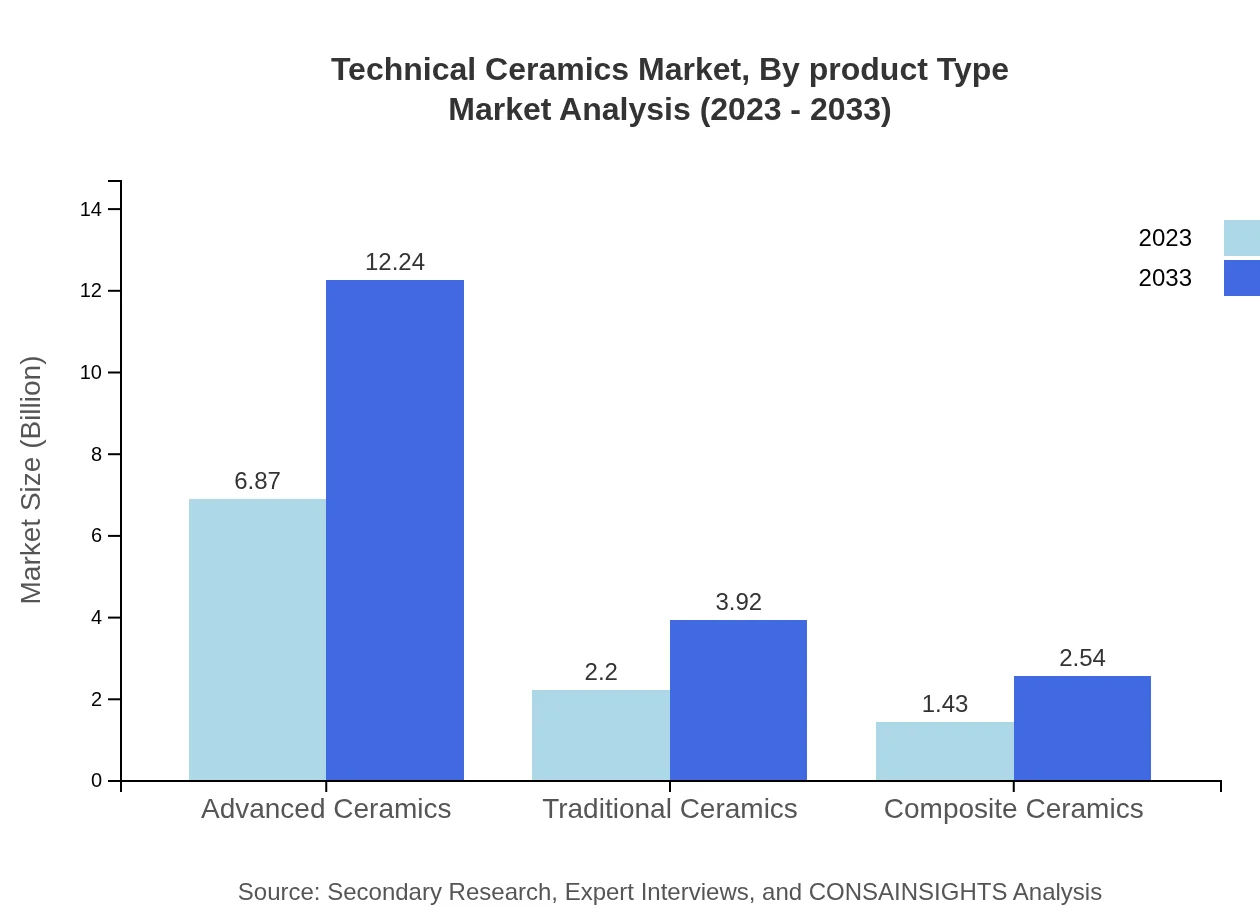

Technical Ceramics Market Analysis By Product Type

The Technical Ceramics market by product type includes advanced ceramics, traditional ceramics, and composite ceramics. Advanced ceramics, valued at $6.87 billion in 2023 and expected to reach $12.24 billion by 2033, dominate the market primarily due to their application in high-tech sectors such as electronics and aerospace. Traditional ceramics also hold a significant market share and are projected to grow from $2.20 billion in 2023 to $3.92 billion by 2033.

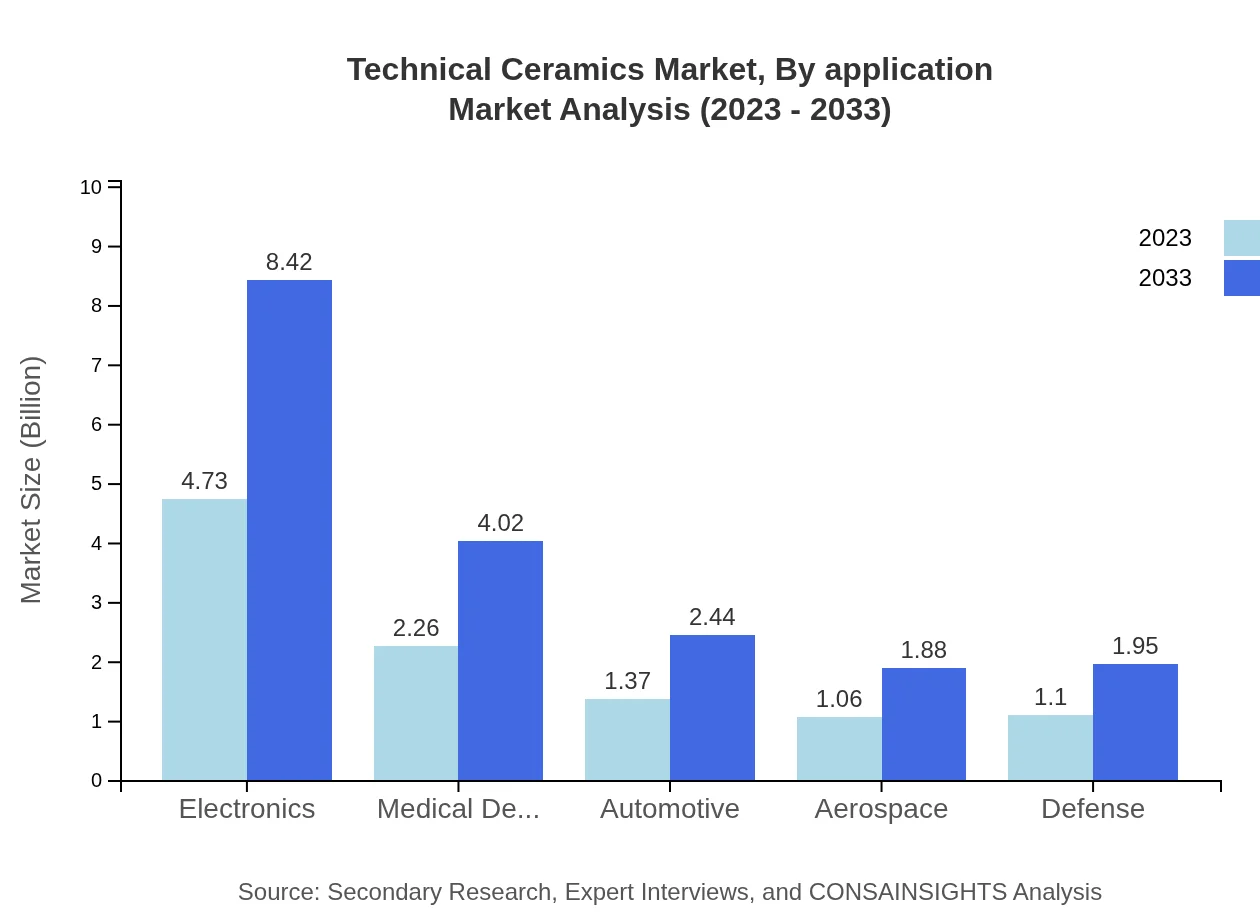

Technical Ceramics Market Analysis By Application

The market by application is primarily segmented into electronics, medical devices, automotive, and aerospace. The electronics industry leads with a market size of $6.07 billion in 2023, growing to $10.81 billion by 2033, holding a 57.78% market share. The medical devices segment is also substantial, expanding from $2.24 billion to $3.99 billion over the same period.

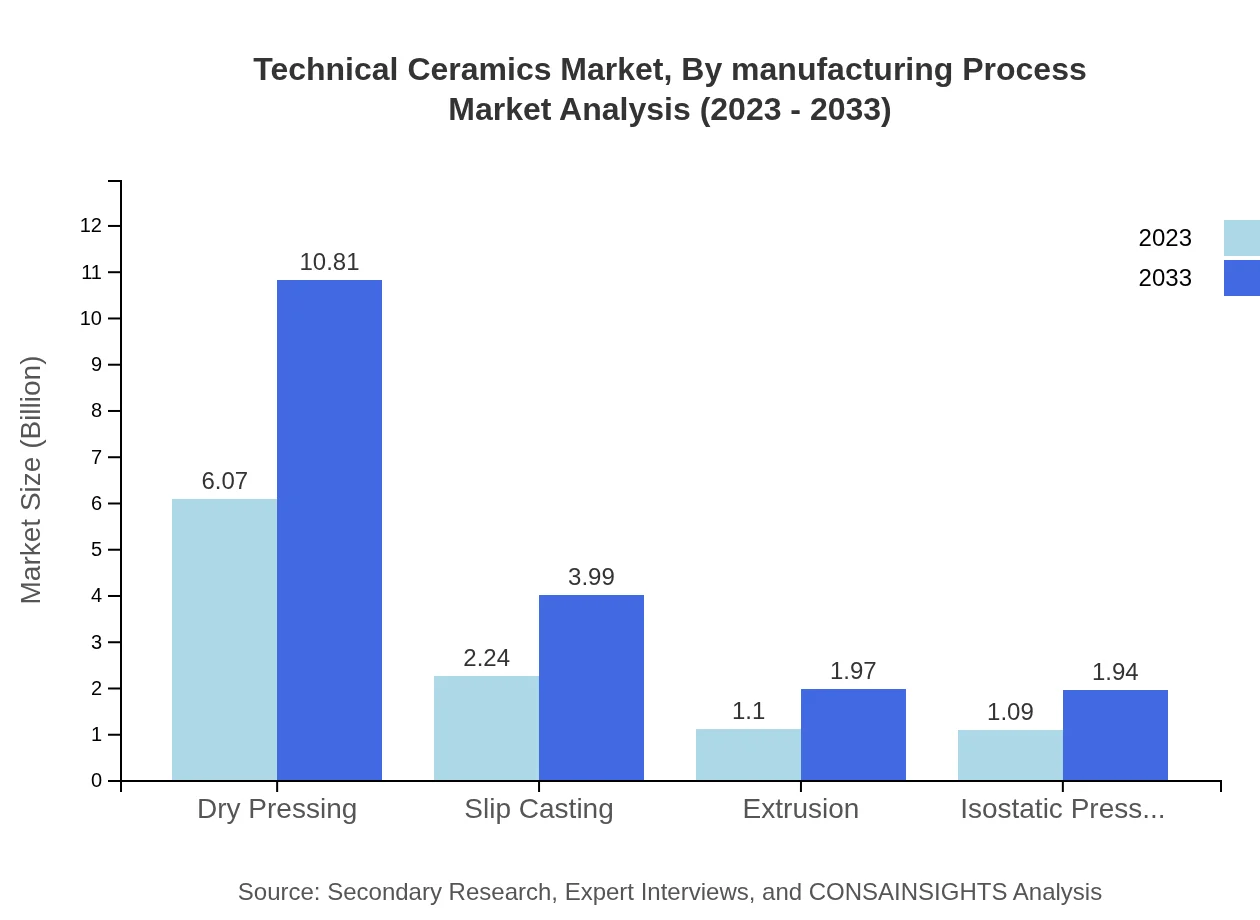

Technical Ceramics Market Analysis By Manufacturing Process

Manufacturing processes within the Technical Ceramics market include dry pressing, slip casting, extrusion, and isostatic pressing. Dry pressing dominates with a market size of $6.07 billion in 2023, expected to reach $10.81 billion by 2033. Each process has its advantages and applications, influencing overall production efficiency and cost.

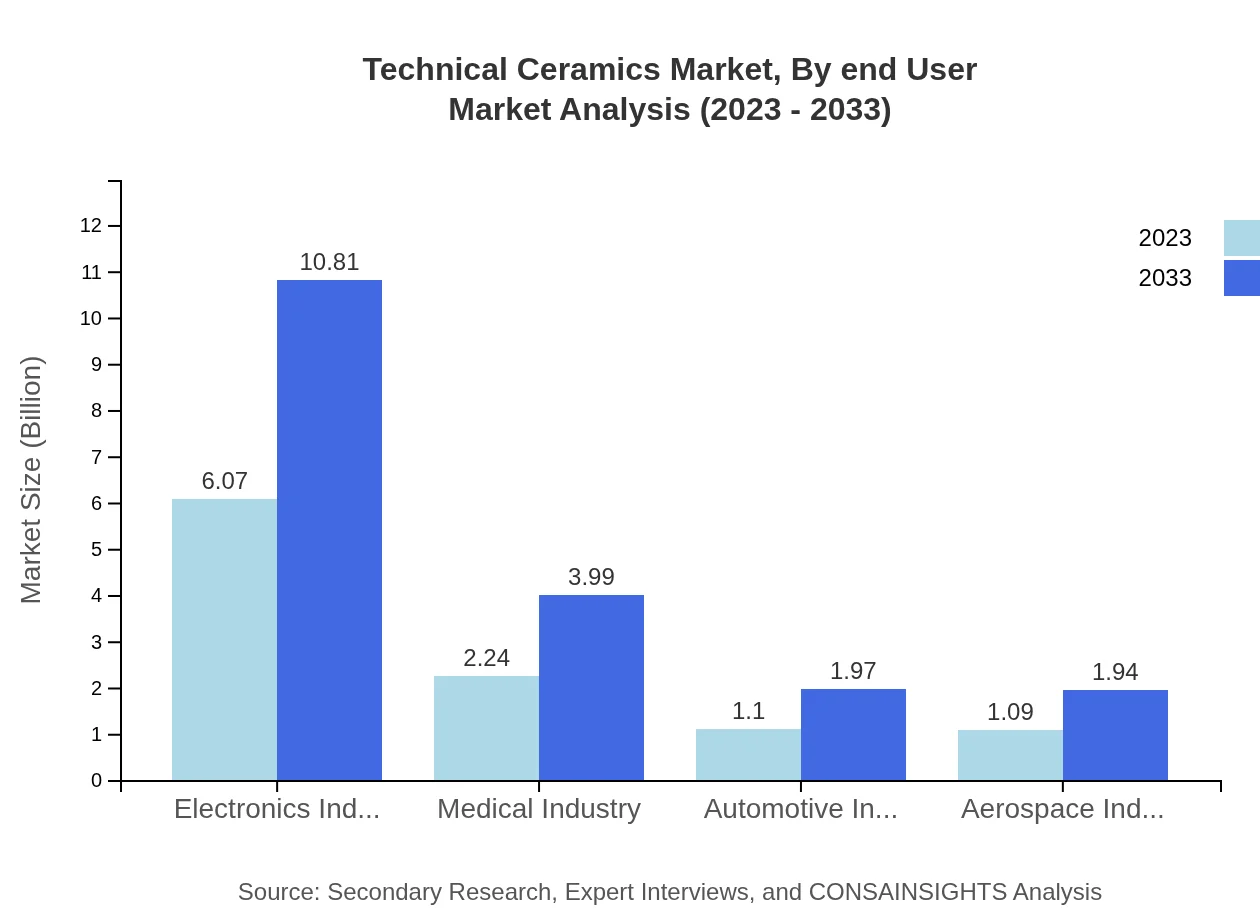

Technical Ceramics Market Analysis By End User

The key end-user industries for technical ceramics include electronics, medical, automotive, aerospace, and defense. The electronics segment leads with significant demand in chip and insulator manufacturing, and is projected to hold around 45% of the market share in 2023.

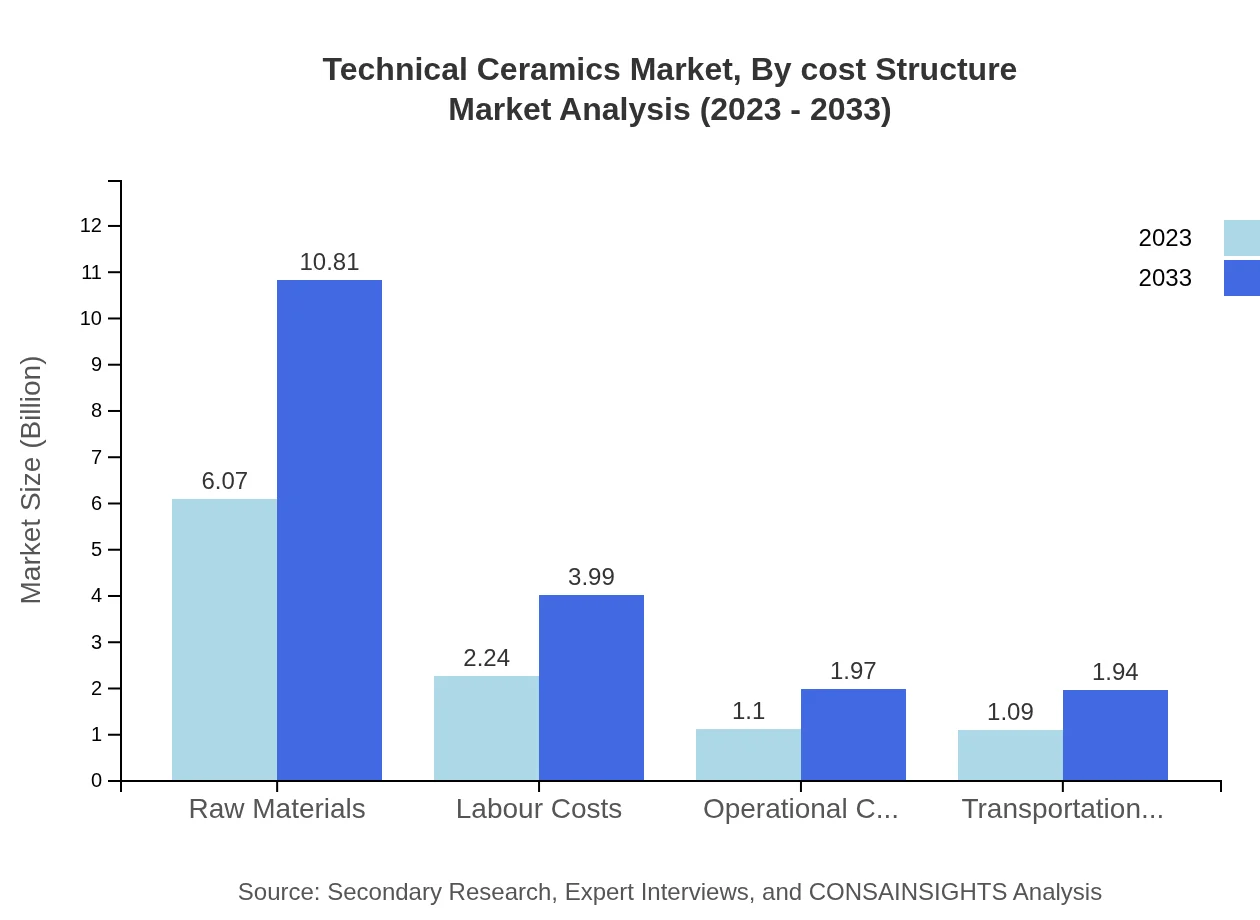

Technical Ceramics Market Analysis By Cost Structure

Cost structures in the Technical Ceramics market encompass raw materials, labor costs, operational expenses, and transportation costs. Raw materials account for the largest share and are expected to remain integral to overall market dynamics, with size predictions of $6.07 billion in 2023 and $10.81 billion by 2033.

Technical Ceramics Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Technical Ceramics Industry

Kyocera Corporation:

Kyocera is a leading manufacturer of advanced ceramics, specializing in electronic components and devices that enhance productivity and performance.CeramTec GmbH:

CeramTec is known for high-performance technical ceramics and focuses on providing solutions across various sectors, particularly in medical and automotive applications.Morgan Advanced Materials:

Morgan Advanced Materials manufactures engineered ceramics and provides innovative solutions to industries such as defense, healthcare, and energy.We're grateful to work with incredible clients.

FAQs

What is the market size of technical Ceramics?

The technical ceramics market is valued at approximately $10.5 billion in 2023, with an expected CAGR of 5.8%. This growth reflects increasing demand across various industries, projected to rise significantly by 2033.

What are the key market players or companies in the technical Ceramics industry?

The key players in the technical ceramics market include industry leaders like CeramTec, Morgan Advanced Materials, and CoorsTek, among others. These companies drive innovation and market expansion by offering diverse ceramic solutions.

What are the primary factors driving the growth in the technical Ceramics industry?

Factors fueling the technical-ceramics market include technological advancements, increased demand from electronics and aerospace sectors, and a shift towards high-performance materials. Environmental regulations also promote the use of sustainable materials.

Which region is the fastest Growing in the technical Ceramics market?

The fastest-growing region in the technical ceramics market is North America, projected to grow from $3.47 billion in 2023 to $6.17 billion by 2033. Europe and Asia Pacific also show significant growth rates.

Does ConsaInsights provide customized market report data for the technical Ceramics industry?

Yes, ConsaInsights offers tailored market reports for the technical-ceramics industry, allowing clients to gain insights specific to their needs, whether focusing on geographical regions, market segments, or competitive analysis.

What deliverables can I expect from this technical Ceramics market research project?

Deliverables from a technical-ceramics market research project include comprehensive market analysis, segmentation data, competitive landscape insights, and actionable recommendations tailored to your strategic goals.

What are the market trends of technical Ceramics?

Current market trends in technical ceramics include a growing inclination towards advanced ceramics in electronics, increased investment in research and development, and rising demand for customized ceramic components across industries.