Telecom Cloud Market Report

Published Date: 31 January 2026 | Report Code: telecom-cloud

Telecom Cloud Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive overview of the Telecom Cloud market from 2023 to 2033, including insights on market size, growth trends, regional analysis, and competitive landscape. It aims to equip readers with the latest data for informed decision-making.

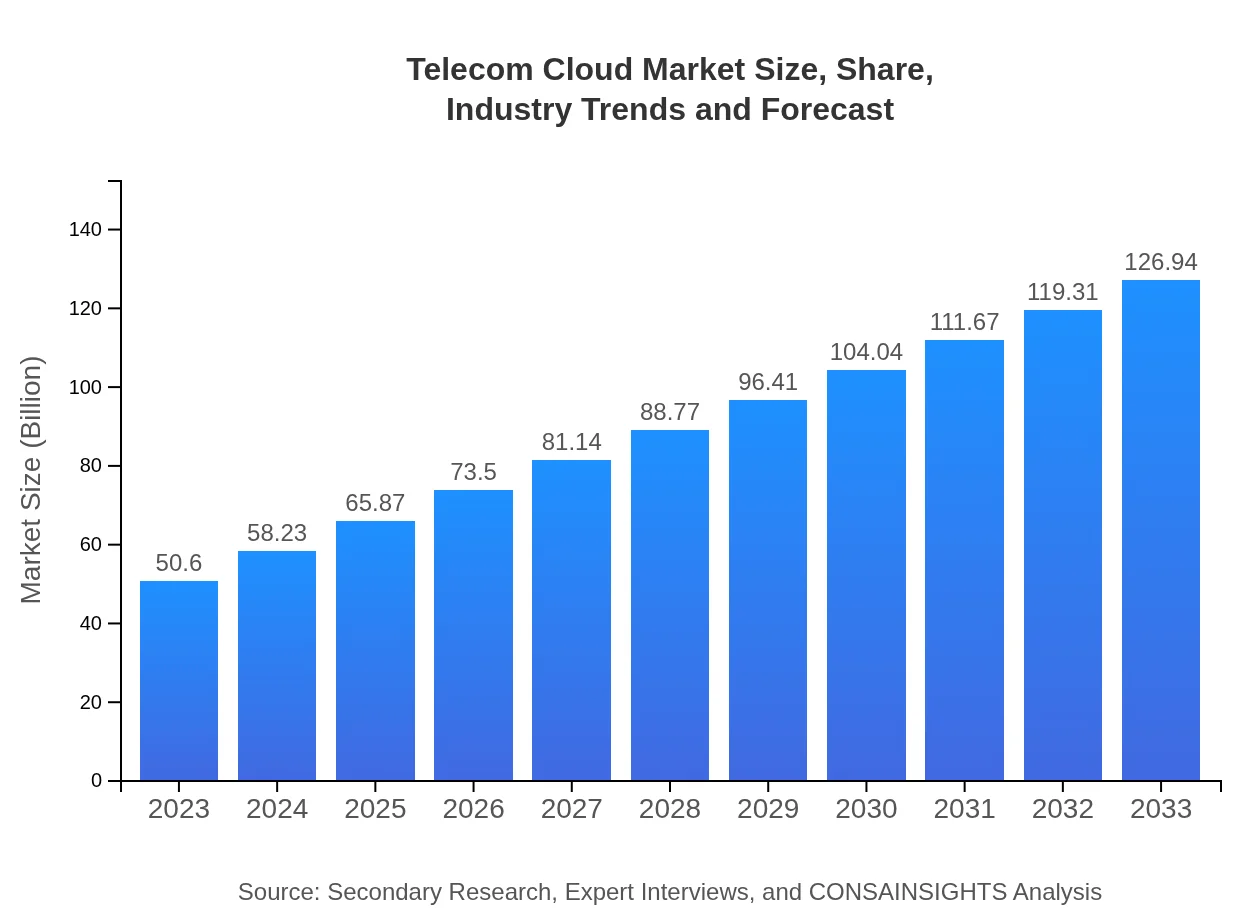

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $50.60 Billion |

| CAGR (2023-2033) | 9.3% |

| 2033 Market Size | $126.94 Billion |

| Top Companies | Amazon Web Services (AWS), Microsoft Azure, Google Cloud, IBM Cloud, Cisco Systems |

| Last Modified Date | 31 January 2026 |

Telecom Cloud Market Overview

Customize Telecom Cloud Market Report market research report

- ✔ Get in-depth analysis of Telecom Cloud market size, growth, and forecasts.

- ✔ Understand Telecom Cloud's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Telecom Cloud

What is the Market Size & CAGR of Telecom Cloud market in 2023?

Telecom Cloud Industry Analysis

Telecom Cloud Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Telecom Cloud Market Analysis Report by Region

Europe Telecom Cloud Market Report:

The European market, valued at $13.92 billion in 2023, is anticipated to grow to $34.91 billion by 2033. Key growth drivers include stringent regulations around data protection and increasing demands for digital transformation in various sectors, urging telecom companies to adopt innovative cloud solutions.Asia Pacific Telecom Cloud Market Report:

The Asia Pacific region, valued at $10.23 billion in 2023, is projected to reach $25.67 billion by 2033, benefiting from rapid urbanization, digitalization initiatives, and government investments in telecom infrastructure. The market is characterized by increasing mobile penetration and the expansion of digital services across countries like China, India, and Japan, driving demand for telecom cloud solutions.North America Telecom Cloud Market Report:

North America holds the largest market share, valued at $18.63 billion in 2023 and forecasted to reach $46.73 billion by 2033. The region's growth is propelled by mature telecom infrastructures and high adoption rates of cloud services by enterprises and telecom operators looking for enhanced operational efficiencies.South America Telecom Cloud Market Report:

In South America, the telecom cloud market is expected to grow from $1.34 billion in 2023 to $3.36 billion by 2033. This growth is attributed to expanding internet accessibility, mobile connectivity, and the regional shift toward digital business models, though challenges such as varying regulatory environments remain.Middle East & Africa Telecom Cloud Market Report:

The Middle East and Africa are projected to see growth from $6.49 billion in 2023 to $16.27 billion by 2033, influenced by governmental initiatives to enhance digital connectivity and investments in telecom infrastructure driven by the ongoing expansion of telecommunications services in the region.Tell us your focus area and get a customized research report.

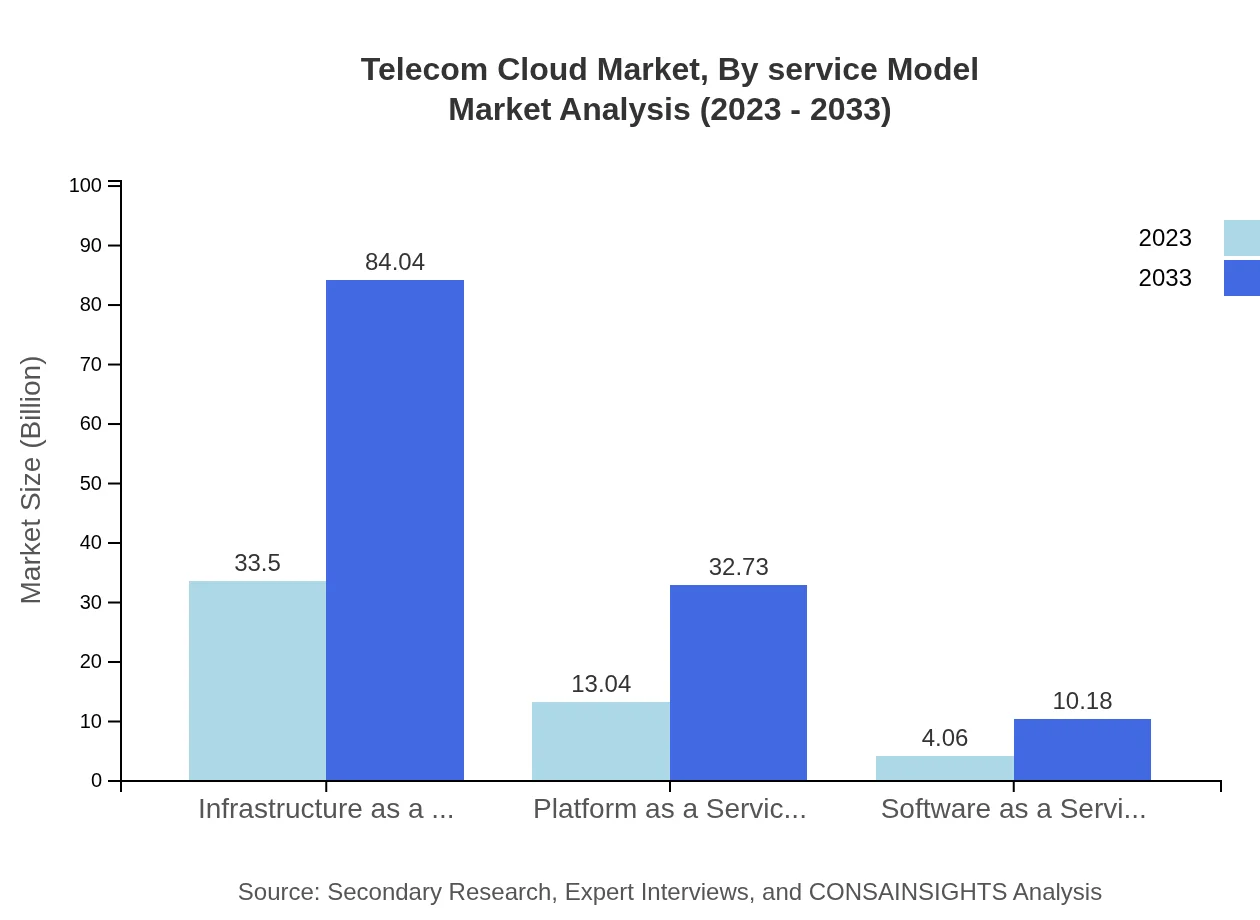

Telecom Cloud Market Analysis By Service Model

The Telecom Cloud market is heavily driven by the IaaS segment, which will grow from $33.50 billion in 2023 to $84.04 billion in 2033, reflecting a continuous shift towards cloud infrastructure. PaaS and SaaS segments are also gaining ground, expected to reach $32.73 billion and $10.18 billion, respectively, showcasing their growing importance in providing development and operational solutions to telecom operators.

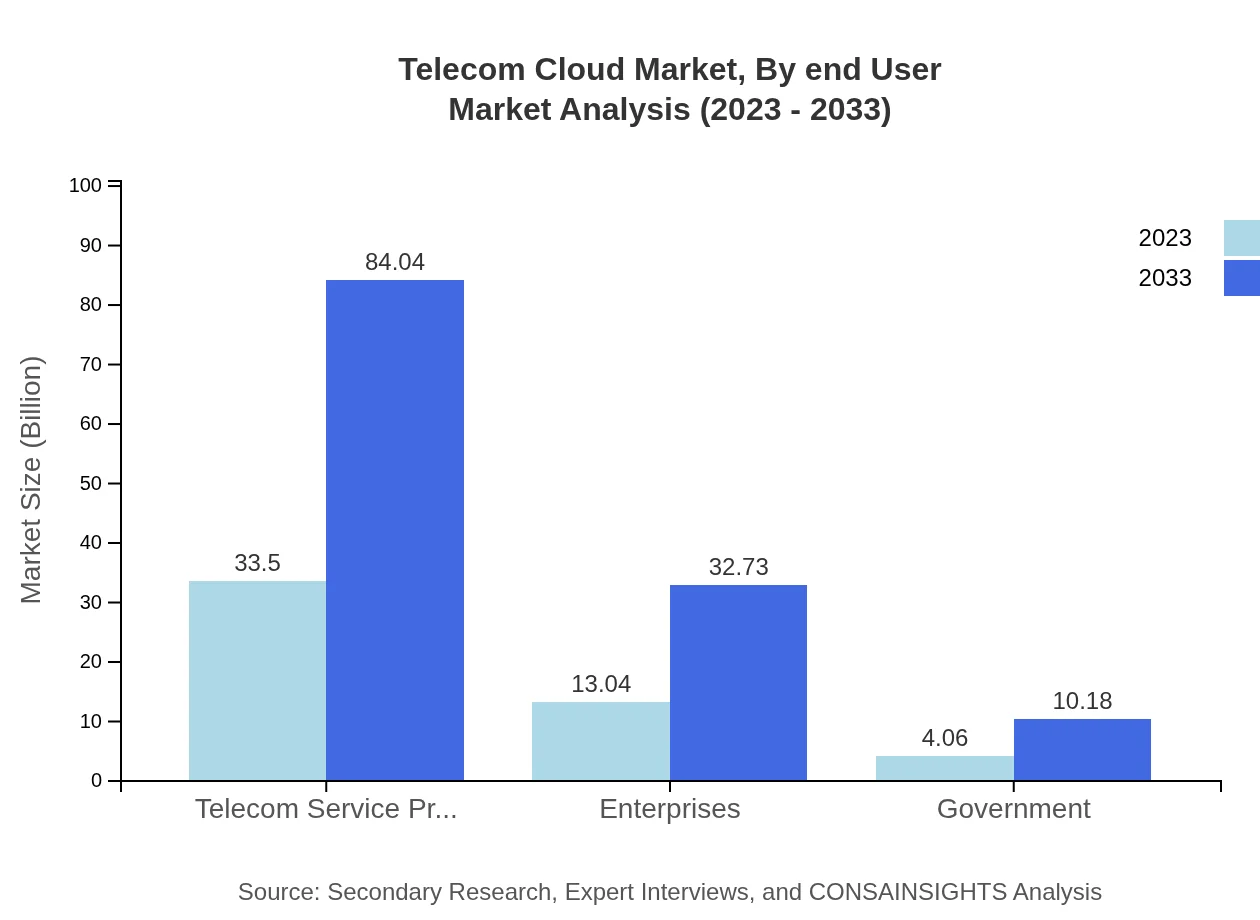

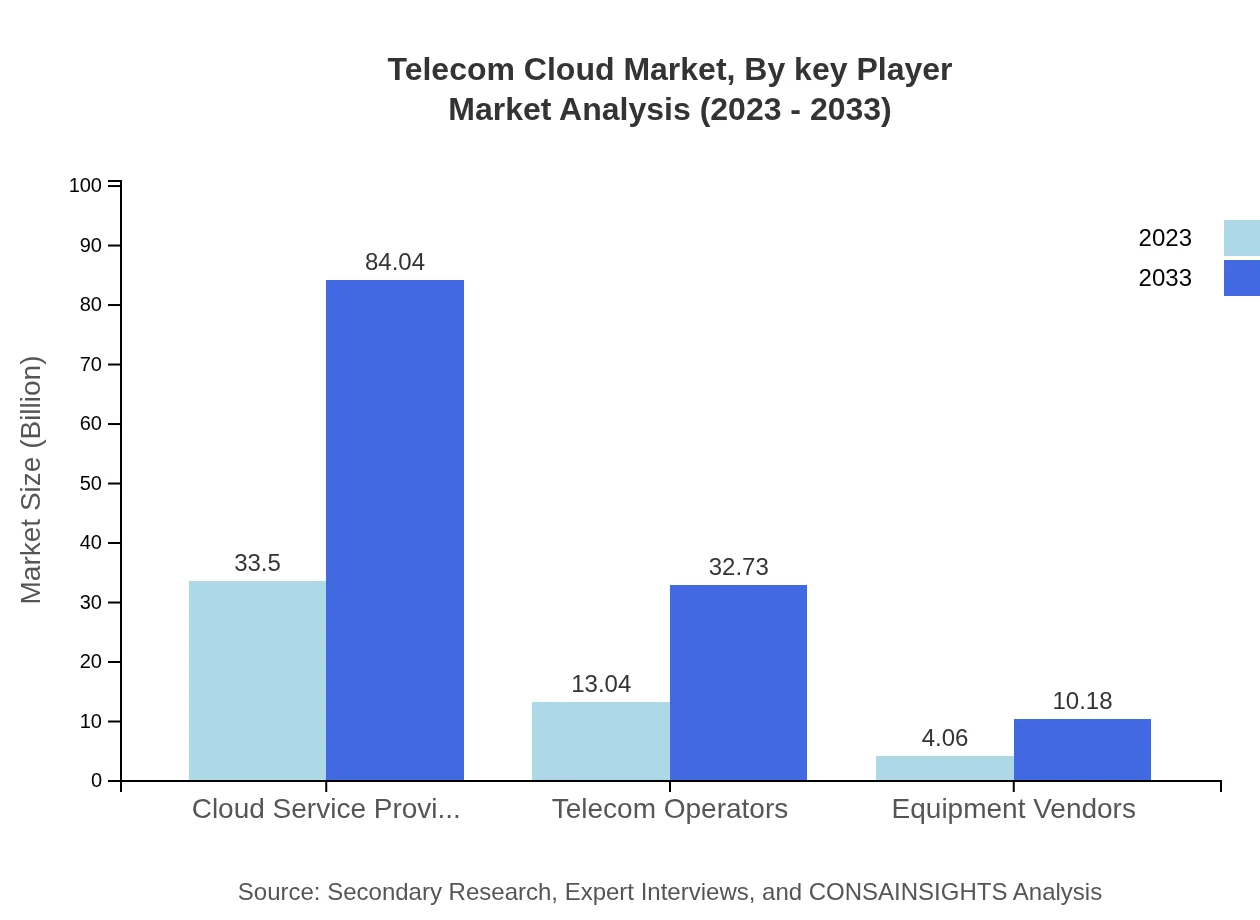

Telecom Cloud Market Analysis By End User

The greatest market share is held by telecom service providers, which will see a rise from $33.50 billion to $84.04 billion by 2033. Enterprises and government sectors will also experience growth, from $13.04 billion to $32.73 billion and $4.06 billion to $10.18 billion, respectively, indicating diversification in the end-user adoption of telecom cloud services.

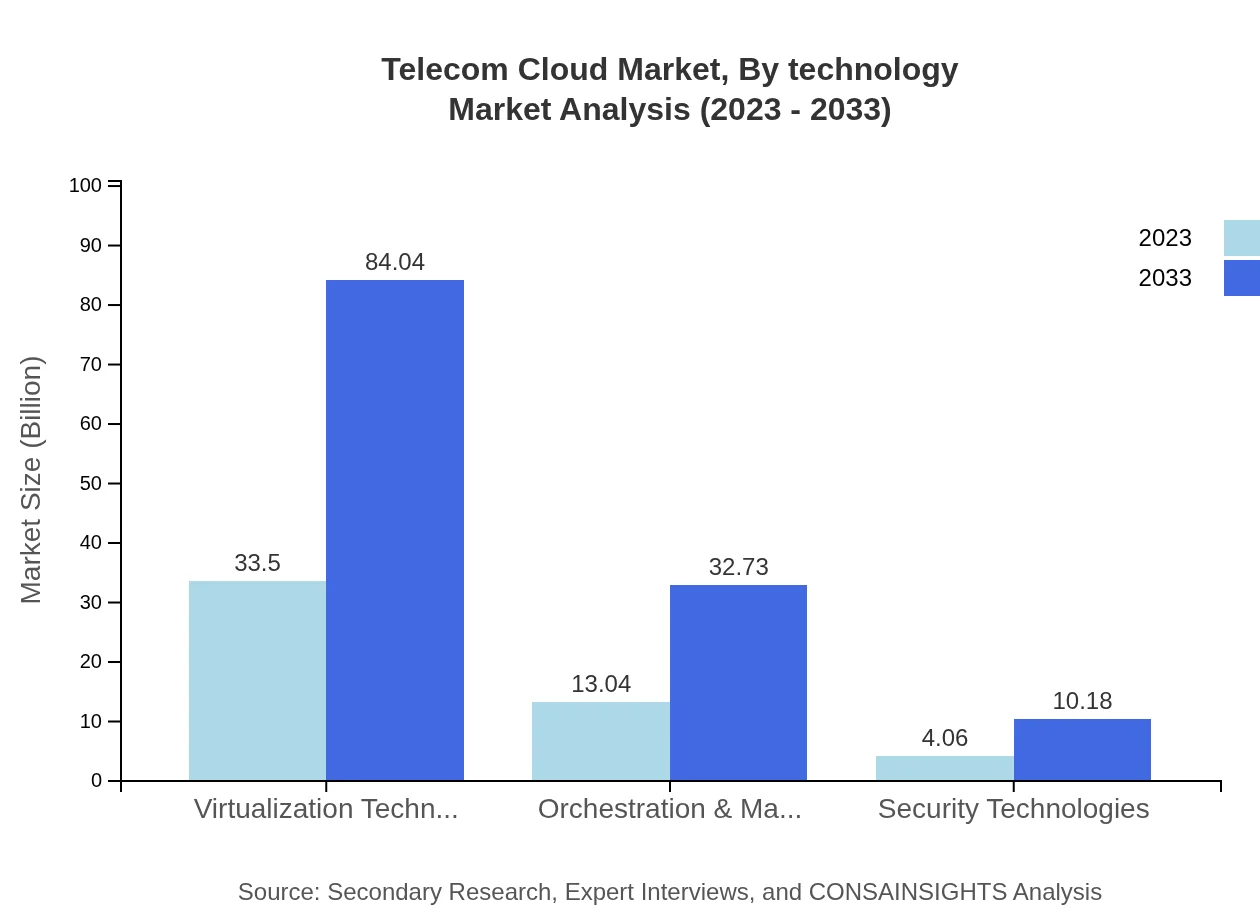

Telecom Cloud Market Analysis By Technology

Virtualization technology is a key area within the Telecom Cloud market, expected to grow from $33.50 billion to $84.04 billion over the next decade. Orchestration and management technologies are essential too, with a projected increase to $32.73 billion, highlighting the growing complexity and need for effective management in cloud operations.

Telecom Cloud Market Analysis By Key Player

Leading players dominating the Telecom Cloud market will include renowned service providers and equipment vendors that drive innovation and competition. Their collective efforts in enhancing service delivery and technological advancements will continue to reshape the industry and cater to the evolving market demands.

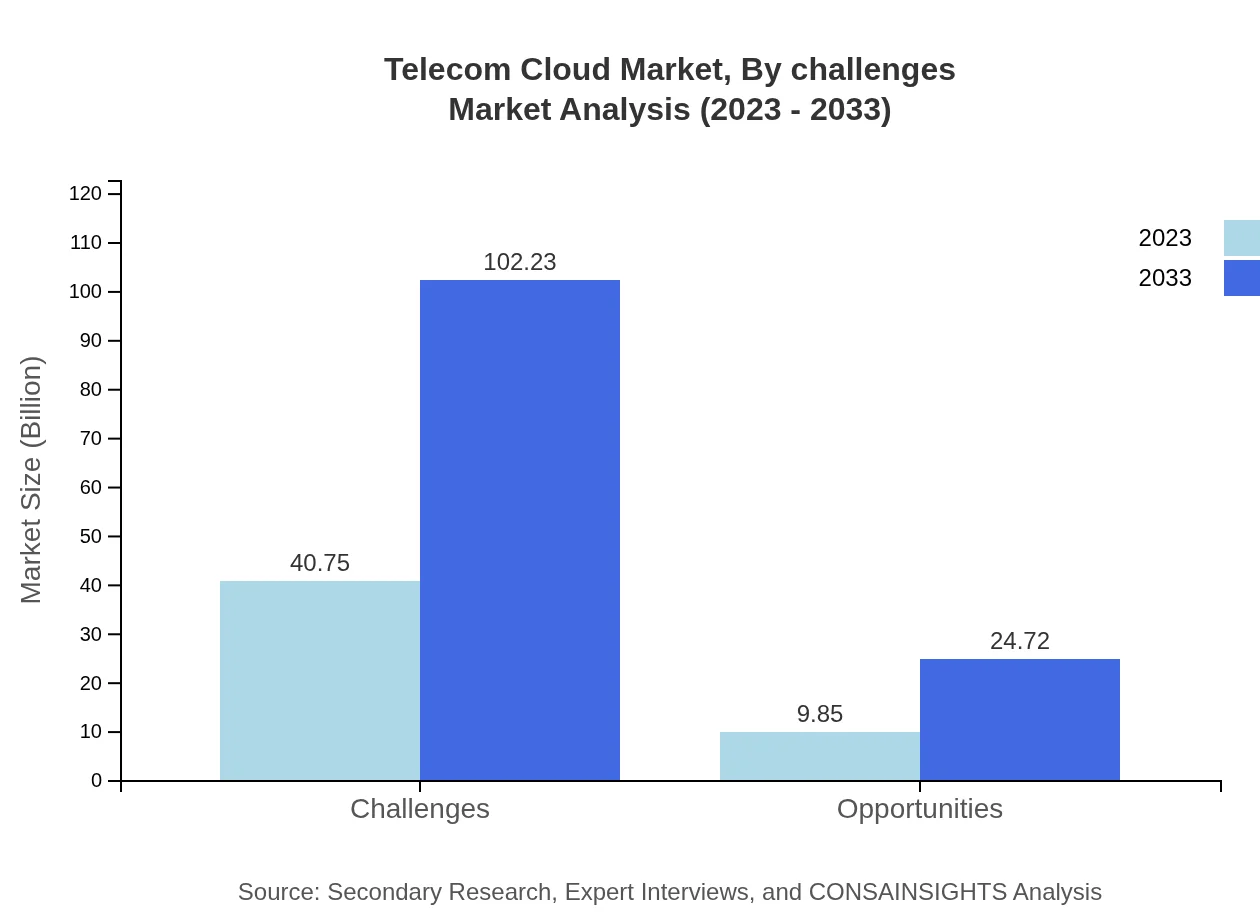

Telecom Cloud Market Analysis By Challenges

While substantial growth opportunities exist for the Telecom Cloud market, challenges such as cybersecurity threats, data privacy concerns, and compliance with regulations remain prevalent. Companies are expected to focus on mitigating these challenges while leveraging emerging technologies and growing digital markets, aiming to unlock further potential.

Telecom Cloud Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Telecom Cloud Industry

Amazon Web Services (AWS):

AWS provides a comprehensive suite of cloud services and infrastructure for telecom companies, enabling them to reduce costs and improve efficiencies with advanced data analytics and machine learning capabilities.Microsoft Azure:

Azure offers a robust cloud platform facilitating telecom operators to optimize their services with innovative solutions like IoT integration, AI-driven insights, and advanced analytics.Google Cloud:

Google Cloud provides tailored services for telecom businesses, emphasizing collaboration tools and AI to enhance customer experiences and operational efficiencies.IBM Cloud:

IBM Cloud specializes in hybrid cloud solutions, focusing on security and integrated systems that help telecom operators manage complex workloads and data privacy effectively.Cisco Systems:

Cisco, known for its networking solutions, has expanded into cloud services, focusing on secure and reliable cloud architecture for communication service providers.We're grateful to work with incredible clients.

FAQs

What is the market size of Telecom Cloud?

The Telecom Cloud market size is projected to reach $50.6 billion by 2033, with a CAGR of 9.3%. This indicates rapid growth as telecom services increasingly shift towards cloud-based solutions to enhance efficiency and scalability.

What are the key market players or companies in the Telecom Cloud industry?

Key players in the Telecom Cloud industry include major Telecom Service Providers and Cloud Service Providers. These entities are crucial to driving innovation and maintaining competitive advantage in a rapidly evolving telecom landscape.

What are the primary factors driving the growth in the Telecom Cloud industry?

The growth in the Telecom Cloud industry is driven by increasing demand for enhanced bandwidth, the rise in IoT applications, and the need for operational efficiency. Additionally, cloud adoption for scalability and flexibility continues to motivate investments in this sector.

Which region is the fastest Growing in the Telecom Cloud?

The fastest-growing region in the Telecom Cloud market is North America, with projected market growth from $18.63 billion in 2023 to $46.73 billion by 2033, representing significant adoption of cloud technologies among telecom operators.

Does ConsaInsights provide customized market report data for the Telecom Cloud industry?

Yes, ConsaInsights offers customized market report data tailored to the Telecom Cloud industry, ensuring clients receive insights that align with their specific business needs and strategic objectives.

What deliverables can I expect from this Telecom Cloud market research project?

From this Telecom Cloud market research project, you can expect comprehensive reports, data sets on market size and trends, analysis of key competitors, and regional insights that inform strategic planning and investment decisions.

What are the market trends of Telecom Cloud?

Current market trends in Telecom Cloud include the rise of virtualization technologies, increasing investment in IaaS and PaaS models, and a focus on security protocols. These trends highlight the telecom industry's shift towards total cloud integration.