Telecom Managed Services Market Report

Published Date: 31 January 2026 | Report Code: telecom-managed-services

Telecom Managed Services Market Size, Share, Industry Trends and Forecast to 2033

This report covers a comprehensive analysis of the Telecom Managed Services market, including insights on market size, trends, and forecasts between 2023 and 2033. Key factors driving growth and regional dynamics are also highlighted.

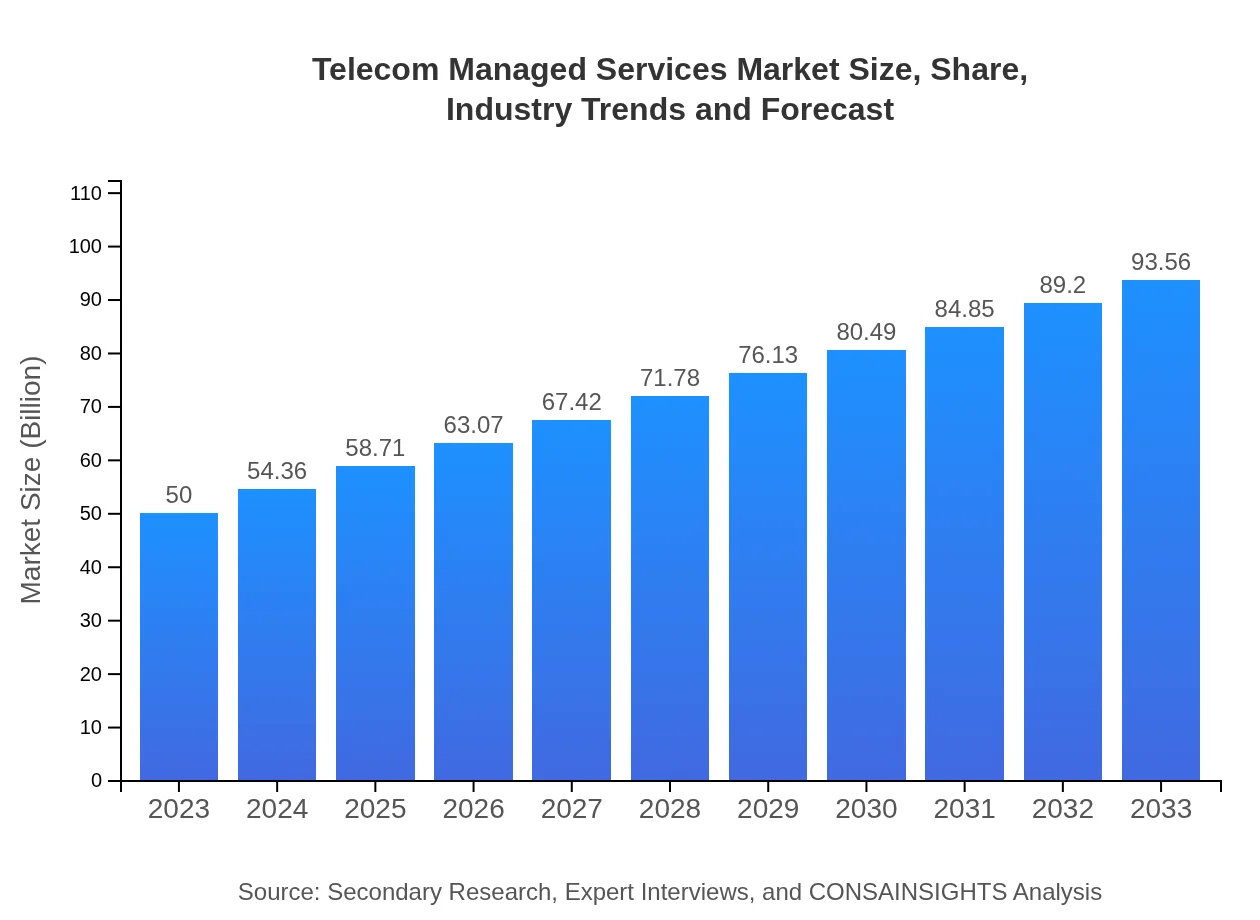

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $50.00 Billion |

| CAGR (2023-2033) | 6.3% |

| 2033 Market Size | $93.56 Billion |

| Top Companies | IBM, Cisco Systems, Ericsson , Accenture, AT&T |

| Last Modified Date | 31 January 2026 |

Telecom Managed Services Market Overview

Customize Telecom Managed Services Market Report market research report

- ✔ Get in-depth analysis of Telecom Managed Services market size, growth, and forecasts.

- ✔ Understand Telecom Managed Services's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Telecom Managed Services

What is the Market Size & CAGR of Telecom Managed Services market in 2023?

Telecom Managed Services Industry Analysis

Telecom Managed Services Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Telecom Managed Services Market Analysis Report by Region

Europe Telecom Managed Services Market Report:

The European Telecom Managed Services market is expected to grow from USD 12.47 billion in 2023 to USD 23.34 billion by 2033. Driven by stringent regulatory frameworks and high consumer demand for bandwidth-intensive applications, service providers in Europe are increasingly relying on managed services for operational efficiency.Asia Pacific Telecom Managed Services Market Report:

The Asia Pacific region is witnessing rapid growth in the Telecom Managed Services market, with a projected size of USD 9.61 billion in 2023, expected to rise to USD 17.97 billion by 2033. The increasing penetration of mobile communications and the growing demand for high-speed internet are driving investments in managed services across this region, especially in countries like China and India.North America Telecom Managed Services Market Report:

North America remains the largest market for Telecom Managed Services, with an anticipated size of USD 17.80 billion in 2023, escalating to USD 33.32 billion by 2033. The region's significant investments in cloud computing, cybersecurity, and AI technologies, combined with the high demand for advanced telecom applications, contribute to this dominant growth.South America Telecom Managed Services Market Report:

In South America, the Telecom Managed Services market is estimated at USD 3.98 billion in 2023, with projections to reach USD 7.44 billion by 2033. The region's market is influenced by investments in digital transformation initiatives and the adoption of new communication technologies aimed at enhancing connectivity in evolving economies.Middle East & Africa Telecom Managed Services Market Report:

The Telecom Managed Services market in the Middle East and Africa region shows considerable growth potential, with a projected size of USD 6.14 billion in 2023, destined to reach USD 11.49 billion by 2033. The need for enhanced telecommunications infrastructure and a growing digital economy in countries within this region play a substantial role in market expansion.Tell us your focus area and get a customized research report.

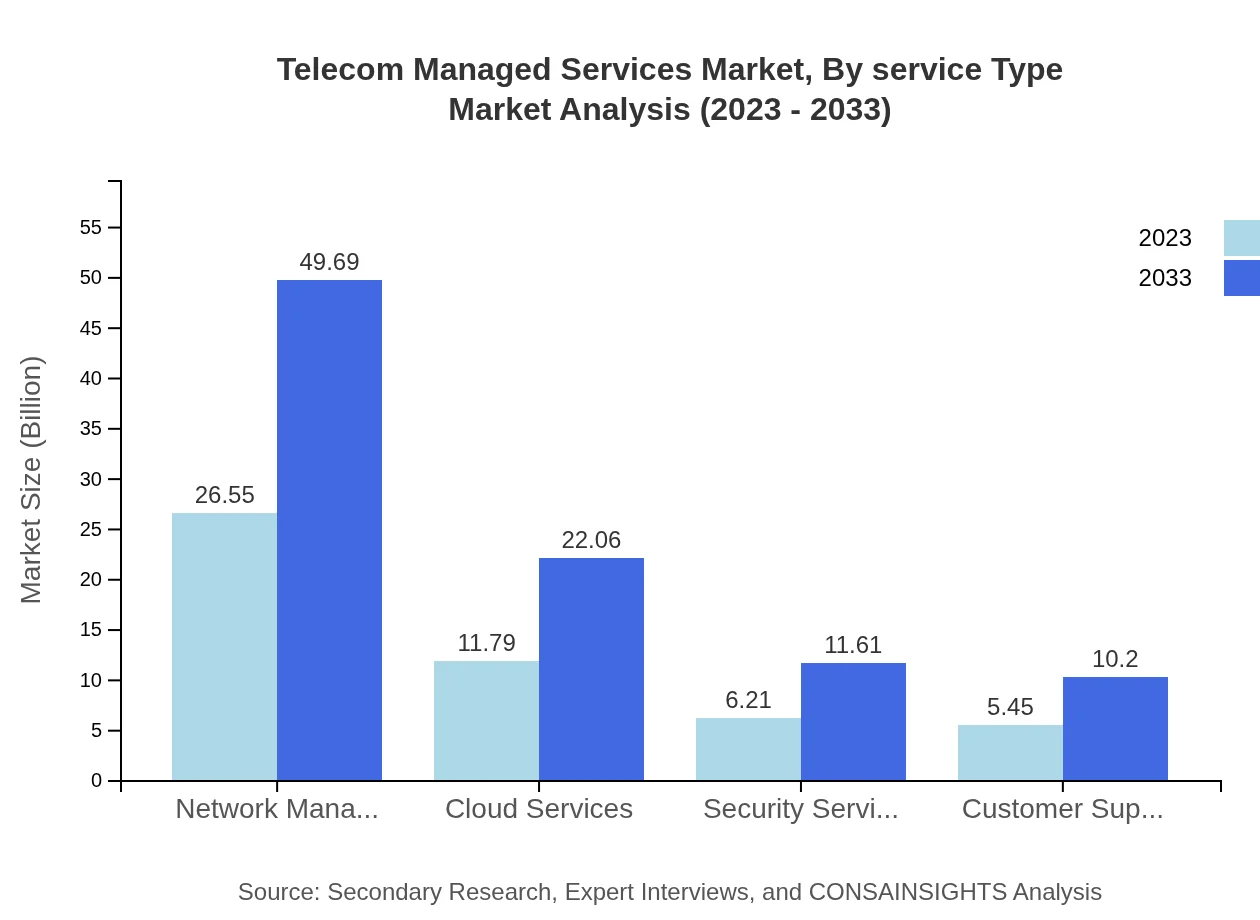

Telecom Managed Services Market Analysis By Service Type

The Telecom Managed Services market by service type is significantly dominated by network management solutions, accounting for USD 26.55 billion in 2023, with expectations to rise to USD 49.69 billion in 2033. Other important segments include cloud services, which are expected to grow from USD 11.79 billion to USD 22.06 billion within the forecast period, driven by enterprises' ongoing transition to digital platforms.

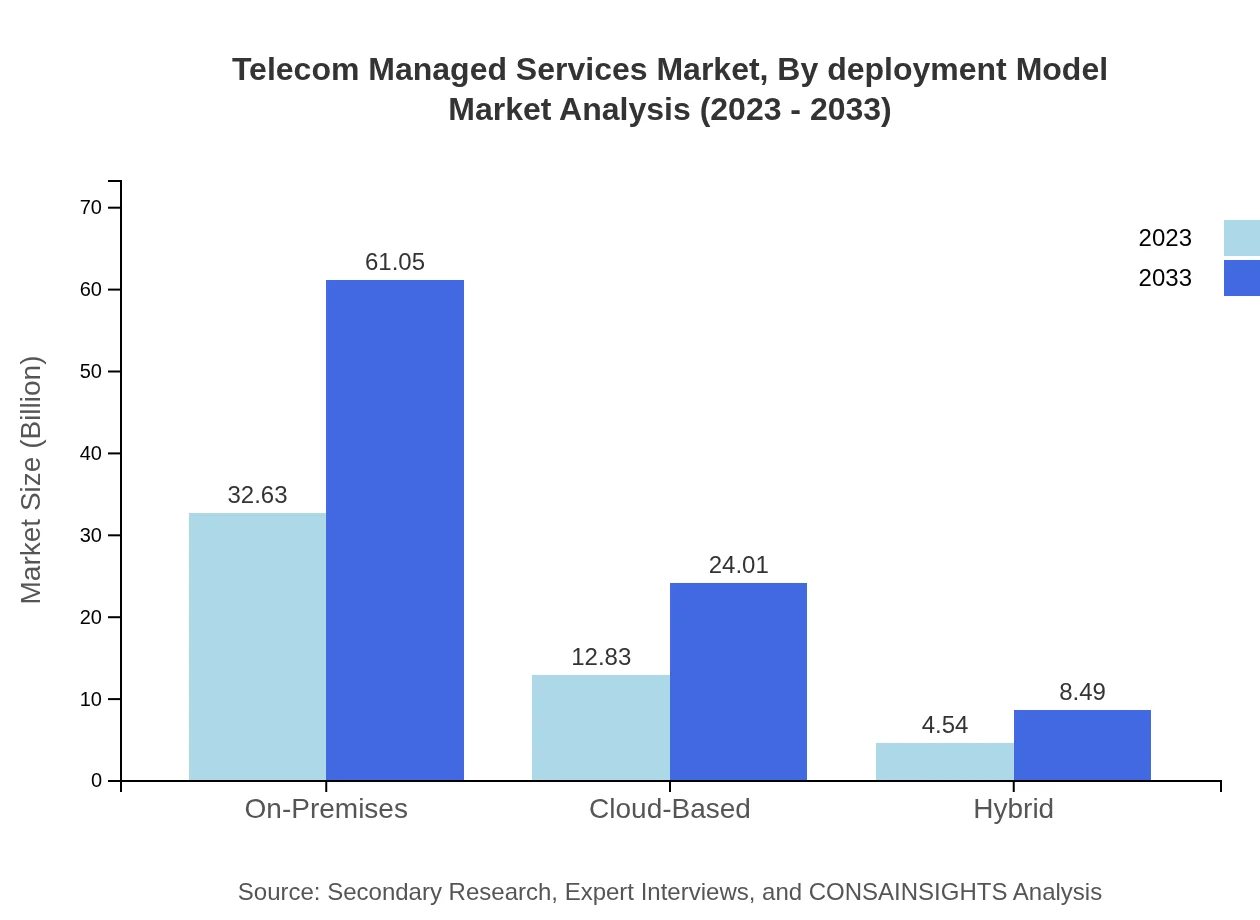

Telecom Managed Services Market Analysis By Deployment Model

Telecom Managed Services are identified with various deployment models, including on-premises, cloud-based, and hybrid models. The on-premises segment is expected to remain the largest, growing from USD 32.63 billion in 2023 to USD 61.05 billion by 2033, while cloud-based services will also maintain significant growth potential, increasing from USD 12.83 billion to USD 24.01 billion.

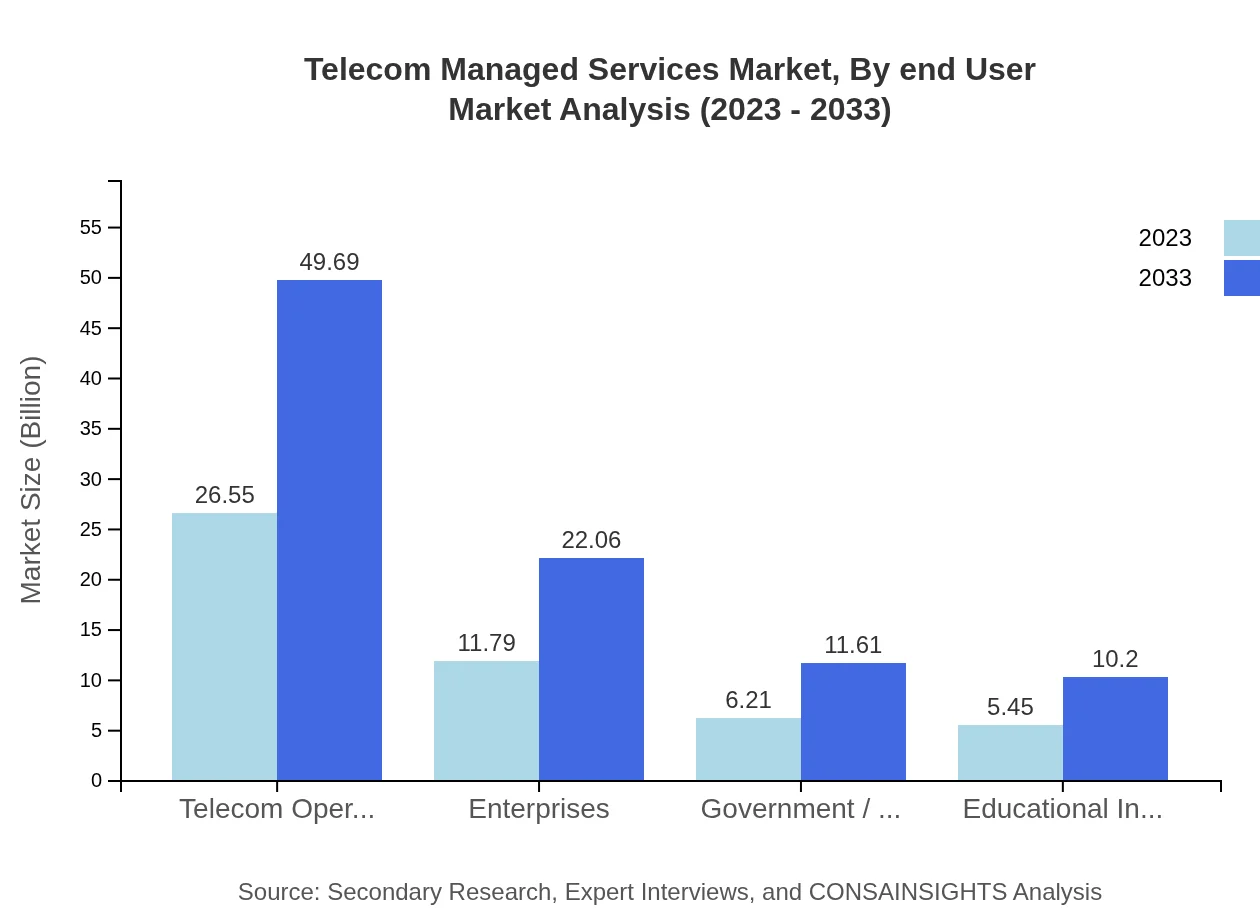

Telecom Managed Services Market Analysis By End User

The end-user segment reveals the prominent role of telecom operators, which brought in USD 26.55 billion in 2023 and is projected to climb to USD 49.69 billion by 2033. Enterprises also represent a substantial market share, growing from USD 11.79 billion to USD 22.06 billion, as sectors such as healthcare and finance increasingly adopt managed services.

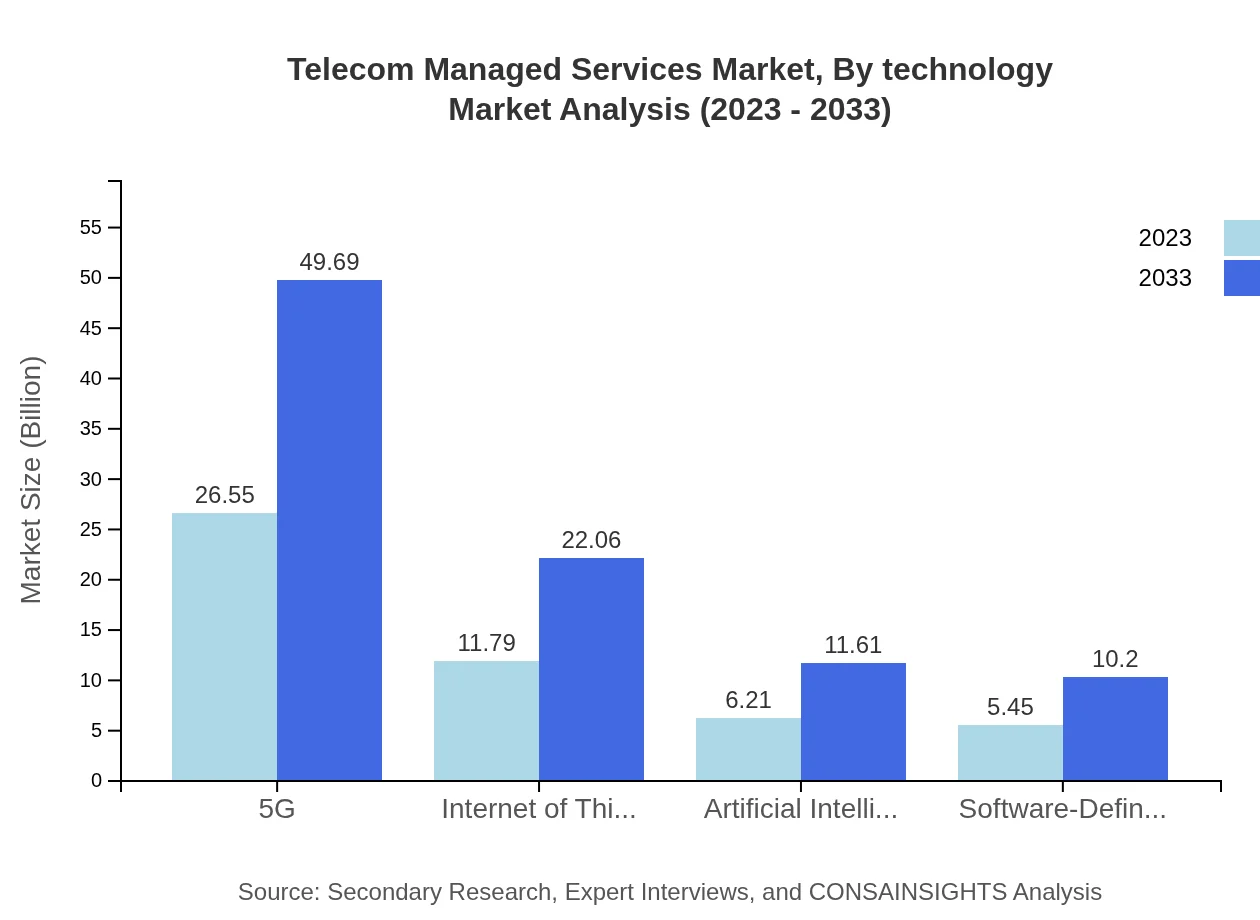

Telecom Managed Services Market Analysis By Technology

Technology plays a pivotal role in the Telecom Managed Services market, with major advancements noted in AI and machine learning technologies. These innovations are expected to elevate the market from USD 6.21 billion in 2023 to USD 11.61 billion by 2033. It's anticipated that the integration of IoT will also continue to enhance the market's growth trajectory, increasing from USD 11.79 billion to USD 22.06 billion.

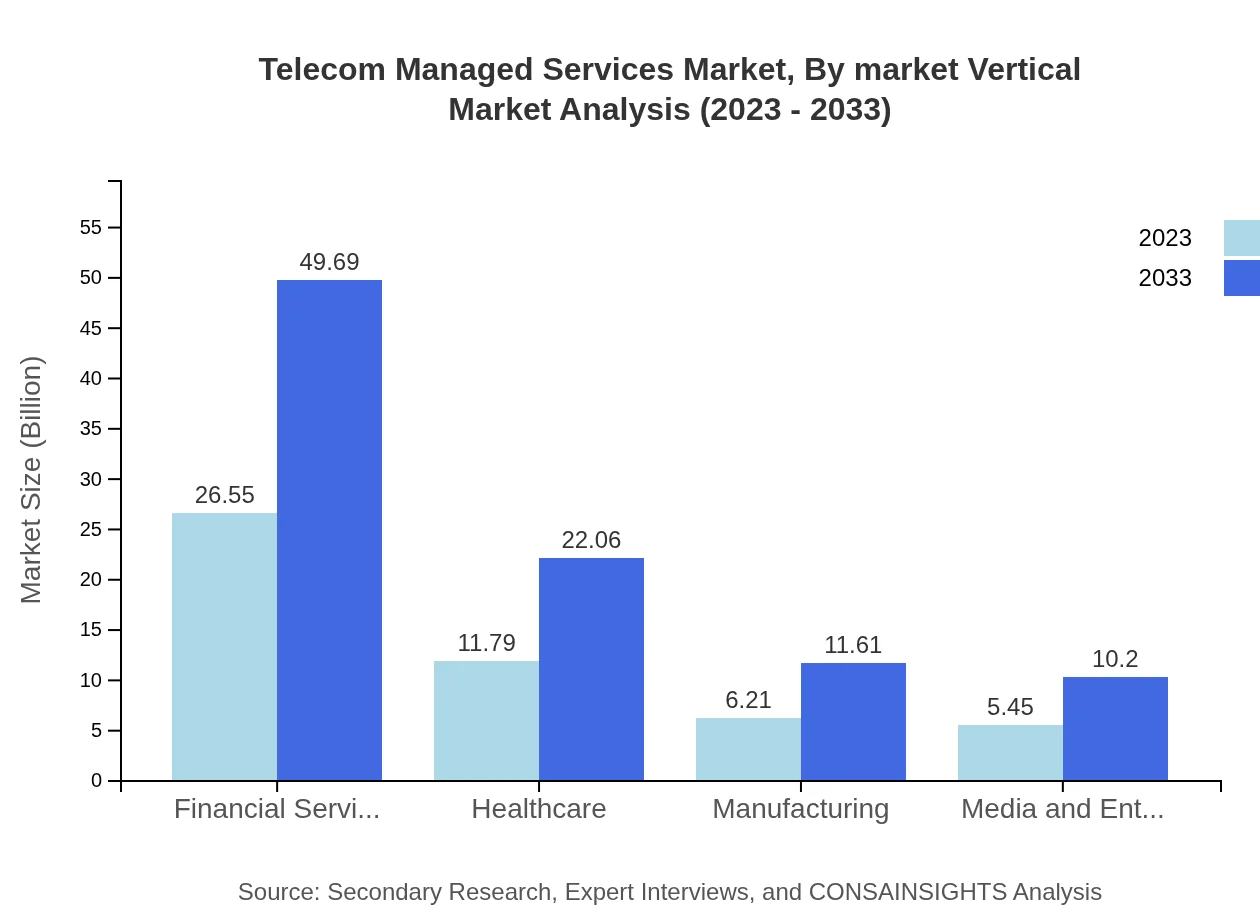

Telecom Managed Services Market Analysis By Market Vertical

The Telecom Managed Services market shows diverse vertical applications, with significant growth anticipated in the financial services sector, scaling from USD 26.55 billion in 2023 to USD 49.69 billion by 2033. The healthcare vertical too is poised for strong growth, expanding from USD 11.79 billion to USD 22.06 billion, driven by regulatory requirements for better data management.

Telecom Managed Services Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Telecom Managed Services Industry

IBM:

IBM is a leading provider of telecom managed services, leveraging its cloud and AI capabilities to help telecom companies optimize their operations and improve customer experiences.Cisco Systems:

Cisco is a renowned player in telecom infrastructure, offering managed services focused on network security, performance optimization, and operational scalability.Ericsson :

Ericsson provides comprehensive managed services to telecom operators, emphasizing network management, operational support, and digital transformation solutions.Accenture:

Accenture integrates advanced technology with consulting to deliver end-to-end managed services, supporting telecom companies' digital journeys.AT&T:

AT&T offers Telecom Managed Services focusing on connectivity and integrated solutions, delivering client-focused services across multiple sectors.We're grateful to work with incredible clients.

FAQs

What is the market size of Telecom Managed Services?

The Telecom Managed Services market is projected to reach approximately $50 billion by 2033, growing at a CAGR of 6.3%. This growth reflects increasing demand for efficient telecommunications management solutions.

What are the key market players or companies in the Telecom Managed Services industry?

Key players in the Telecom Managed Services industry include major telecommunications operators, technology providers, and emerging startups specializing in managed services. Their strategic partnerships and innovations drive competition and effectiveness in the market.

What are the primary factors driving the growth in the Telecom Managed Services industry?

Growth factors include the increasing adoption of cloud services and IoT technologies, demand for cost efficiency, network security needs, and enhanced customer support offerings. These factors encourage businesses to outsource telecom services.

Which region is the fastest Growing in the Telecom Managed Services market?

The fastest-growing region is North America, with a market size forecast rising from $17.80 billion in 2023 to $33.32 billion by 2033. This growth is driven by technological advancements and increasing telecom expenditures.

Does ConsaInsights provide customized market report data for the Telecom Managed Services industry?

Yes, ConsaInsights offers customized market report data tailored to client needs in the Telecom Managed Services industry, ensuring insights address specific market dynamics, trends, and competitive landscapes.

What deliverables can I expect from this Telecom Managed Services market research project?

Deliverables include a comprehensive report detailing market trends, forecasts, competitive analysis, and regional insights. Additionally, customized presentations and strategic recommendations will be provided based on client goals.

What are the market trends of Telecom Managed Services?

Key market trends include the shift towards cloud-based solutions, growing demand for security services, and the integration of AI in telecom management. Companies are increasingly focusing on customer experience and operational efficiency.