Telecom Operations Management Market Report

Published Date: 31 January 2026 | Report Code: telecom-operations-management

Telecom Operations Management Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Telecom Operations Management market, exploring trends, segmentation, regional insights, and forecasts for the period from 2023 to 2033.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

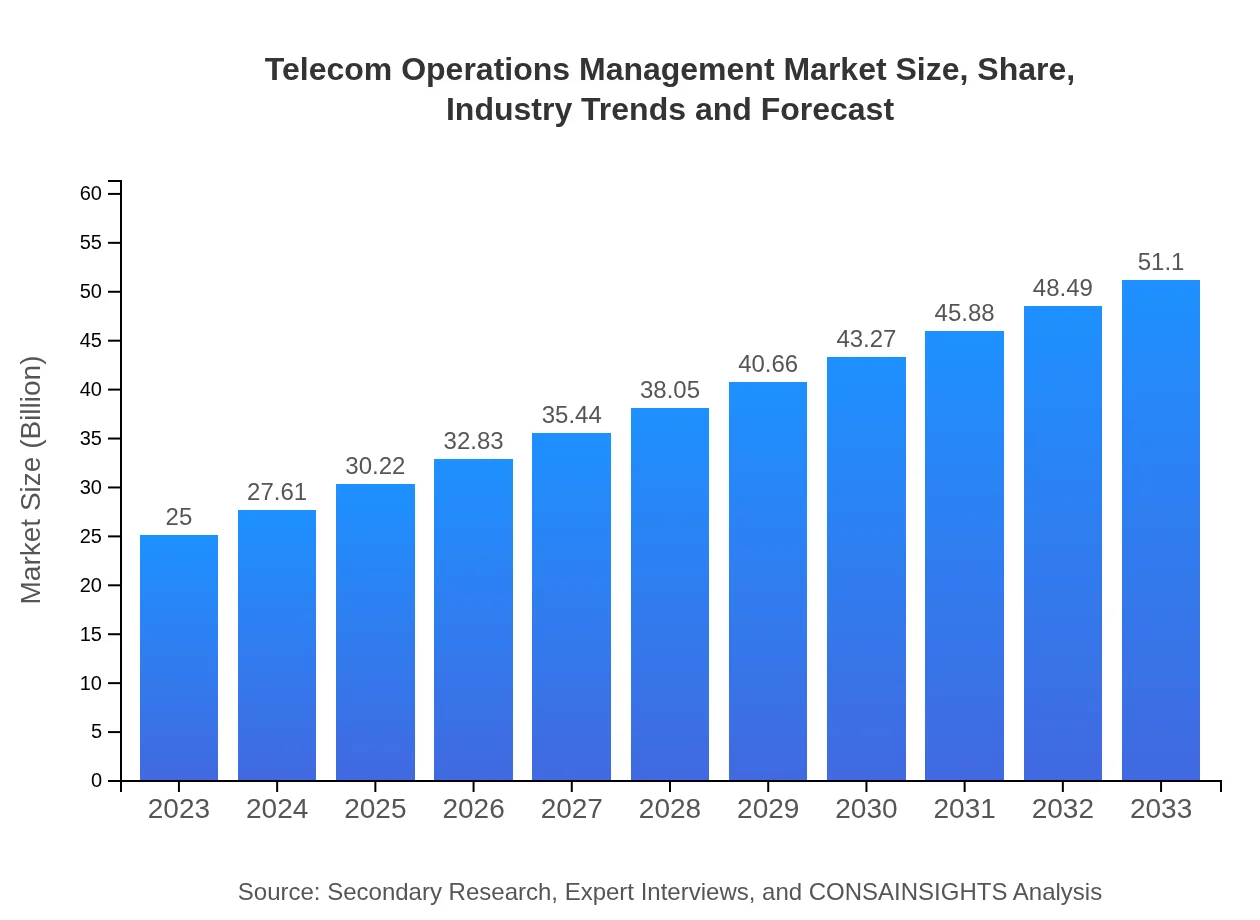

| 2023 Market Size | $25.00 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $51.10 Billion |

| Top Companies | Nokia Corporation, Ericsson , Cisco Systems, Hewlett Packard Enterprise, IBM |

| Last Modified Date | 31 January 2026 |

Telecom Operations Management Market Overview

Customize Telecom Operations Management Market Report market research report

- ✔ Get in-depth analysis of Telecom Operations Management market size, growth, and forecasts.

- ✔ Understand Telecom Operations Management's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Telecom Operations Management

What is the Market Size & CAGR of Telecom Operations Management market in 2033?

Telecom Operations Management Industry Analysis

Telecom Operations Management Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Telecom Operations Management Market Analysis Report by Region

Europe Telecom Operations Management Market Report:

Europe is estimated to see substantial growth in the Telecom Operations Management market, increasing from USD 7.71 billion in 2023 to USD 15.76 billion by 2033. The adoption of 5G technologies and AI-powered solutions across European telecom operators is a major contributor to this growth.Asia Pacific Telecom Operations Management Market Report:

In the Asia Pacific region, the Telecom Operations Management market has grown from USD 5.24 billion in 2023 to an anticipated USD 10.71 billion in 2033. This growth is driven by the increasing digitization efforts and the rise of 5G technology across several countries. The region's focus on improving telecommunications infrastructure, coupled with a large customer base, is propelling robust market growth.North America Telecom Operations Management Market Report:

The North American Telecom Operations Management market is anticipated to rise significantly, from USD 8.26 billion in 2023 to approximately USD 16.87 billion by 2033. The region exhibits a strong uptake of advanced telecom solutions, driven by the presence of leading telecom giants and a highly competitive market.South America Telecom Operations Management Market Report:

The South American market is expected to grow from USD 1.22 billion in 2023 to USD 2.49 billion by 2033. The gradual enhancement of telecom networks, along with government initiatives to improve digital services in several countries, is poised to stimulate growth in this market.Middle East & Africa Telecom Operations Management Market Report:

In the Middle East and Africa, the market is projected to grow from USD 2.58 billion in 2023 to USD 5.27 billion by 2033. The region's investments in digital infrastructure and efforts to modernize telecom services are helping to accelerate this growth.Tell us your focus area and get a customized research report.

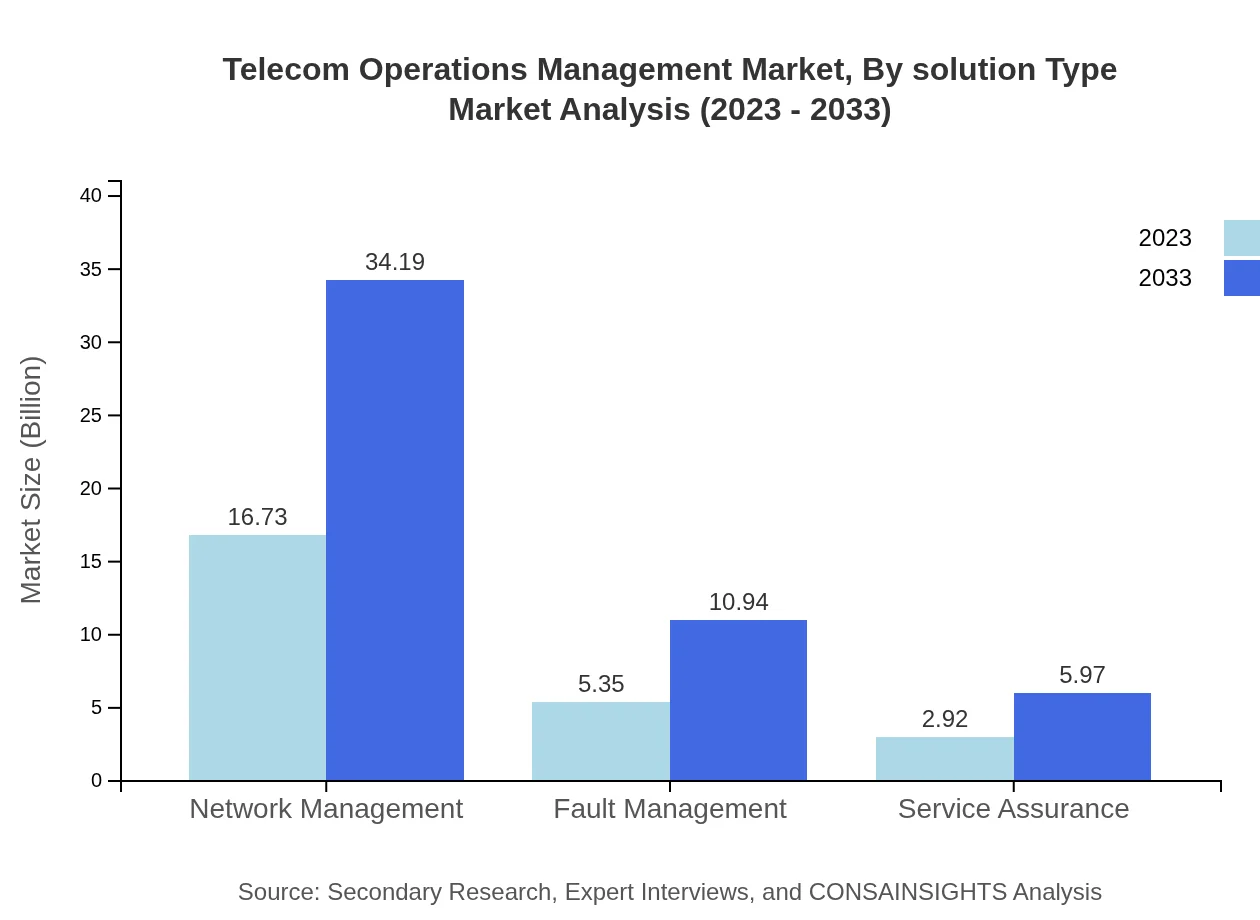

Telecom Operations Management Market Analysis By Solution Type

Among the various solution types, network management remains dominant, projected to grow from USD 16.73 billion in 2023 to USD 34.19 billion by 2033, maintaining a significant market share of 66.91% throughout the decade. Solution areas like fault management and service assurance are also expected to show growth, indicating the critical need for reliability and customer satisfaction within telecom services.

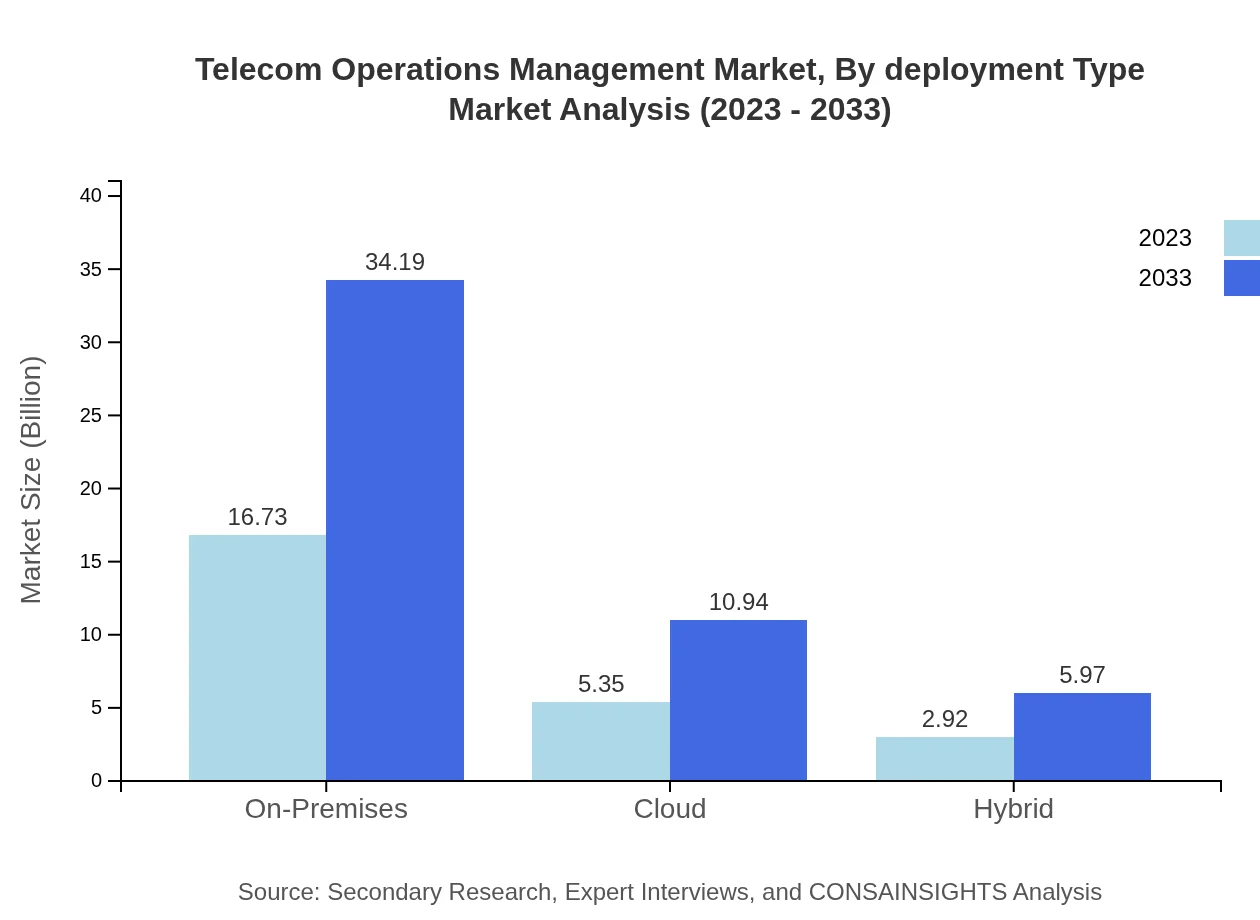

Telecom Operations Management Market Analysis By Deployment Type

In deployment types, on-premises solutions continue to account for the largest share at 66.91%, reflecting the preference of traditional telecom providers for robust, customizable systems. However, cloud deployments are gaining traction, growing from USD 5.35 billion in 2023 to USD 10.94 billion by 2033, as more companies adopt flexible, cost-effective solutions.

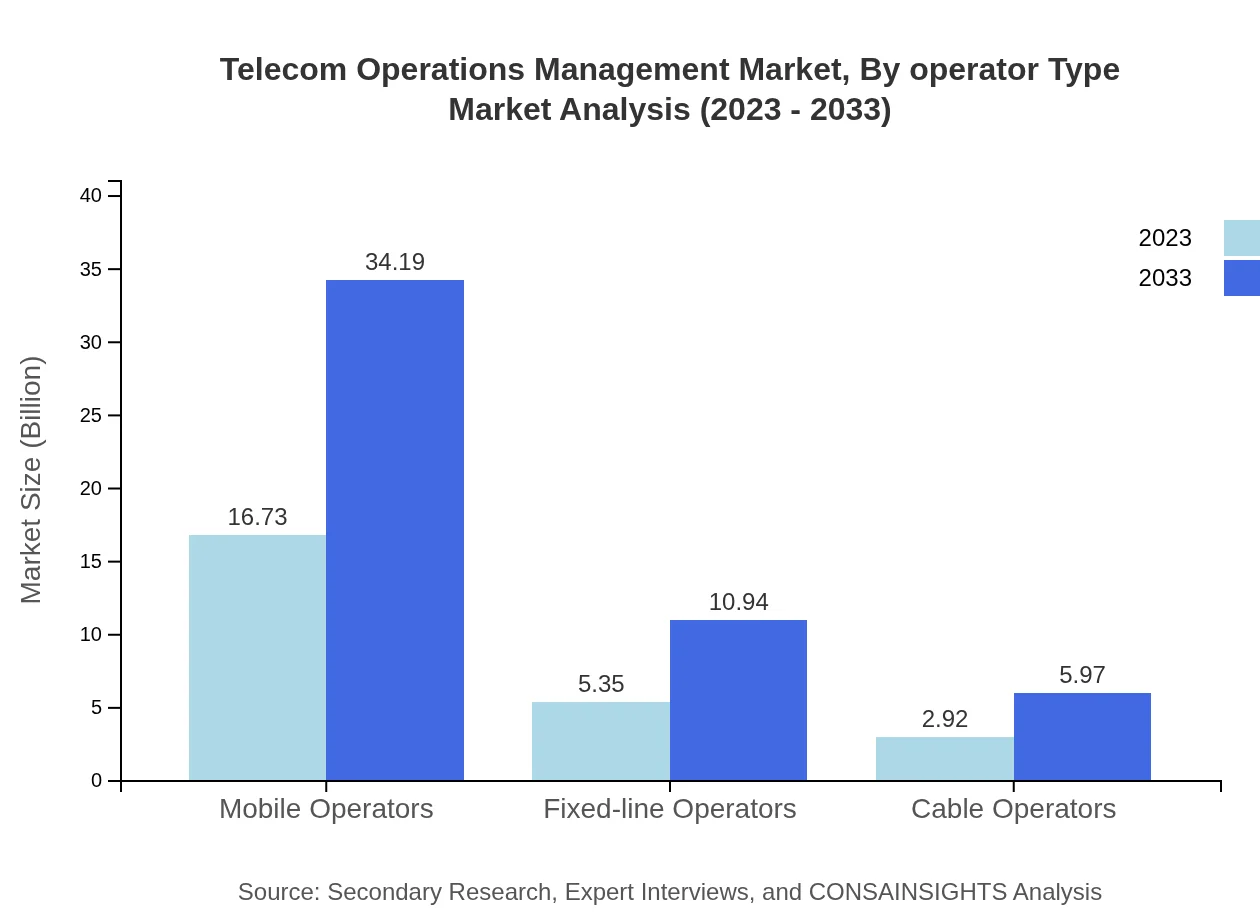

Telecom Operations Management Market Analysis By Operator Type

The segment of mobile operators is the largest in the Telecom Operations Management market, valued at USD 16.73 billion in 2023 and projected to reach USD 34.19 billion by 2033. The growing reliance on mobile technologies and applications fuels this demand, while fixed-line and cable operators also maintain a steady presence in the market.

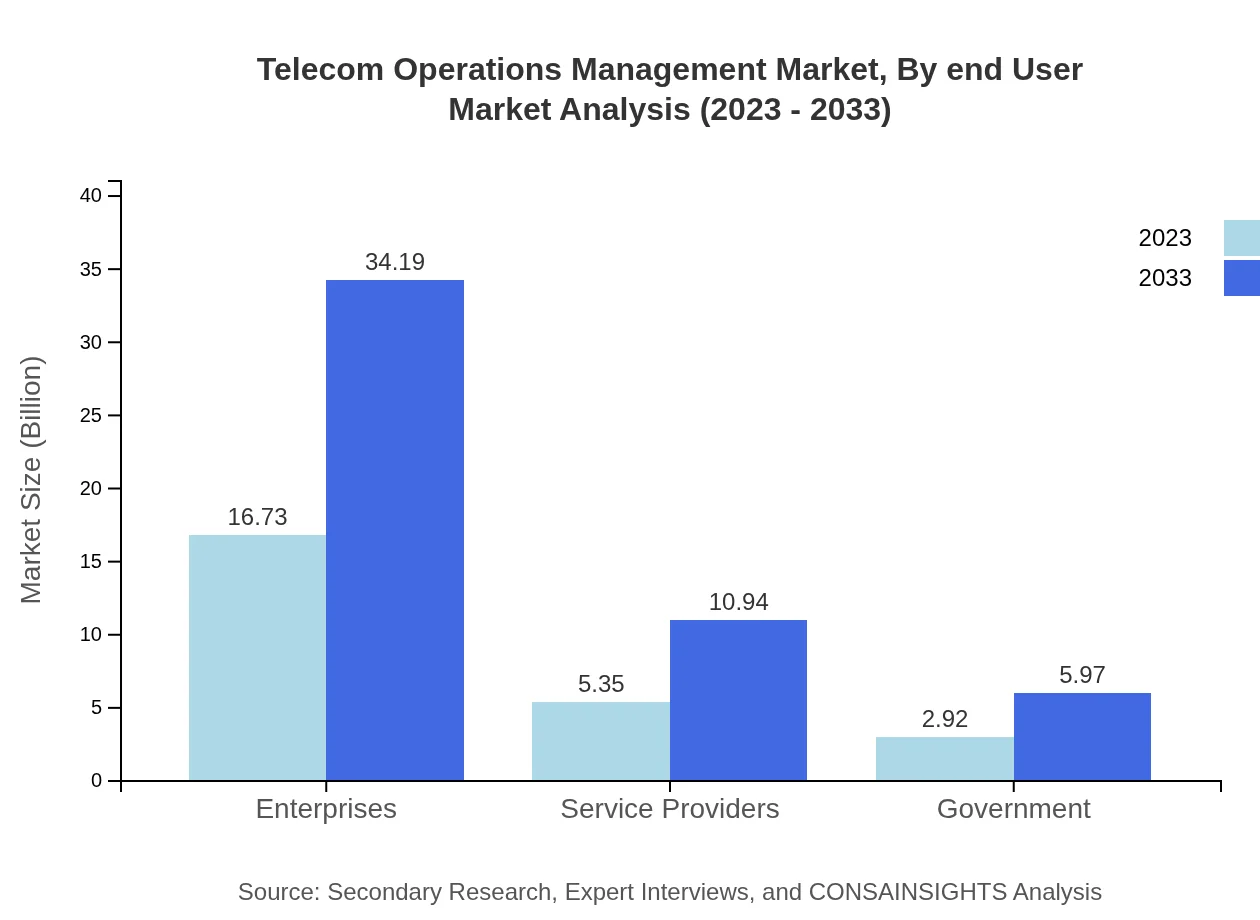

Telecom Operations Management Market Analysis By End User

Enterprises dominate market utilization, with their expenditure projected to rise from USD 16.73 billion in 2023 to USD 34.19 billion by 2033. Service providers and government sectors follow, indicating that stakeholders across various industries increasingly prioritize operational efficiency and improved service delivery.

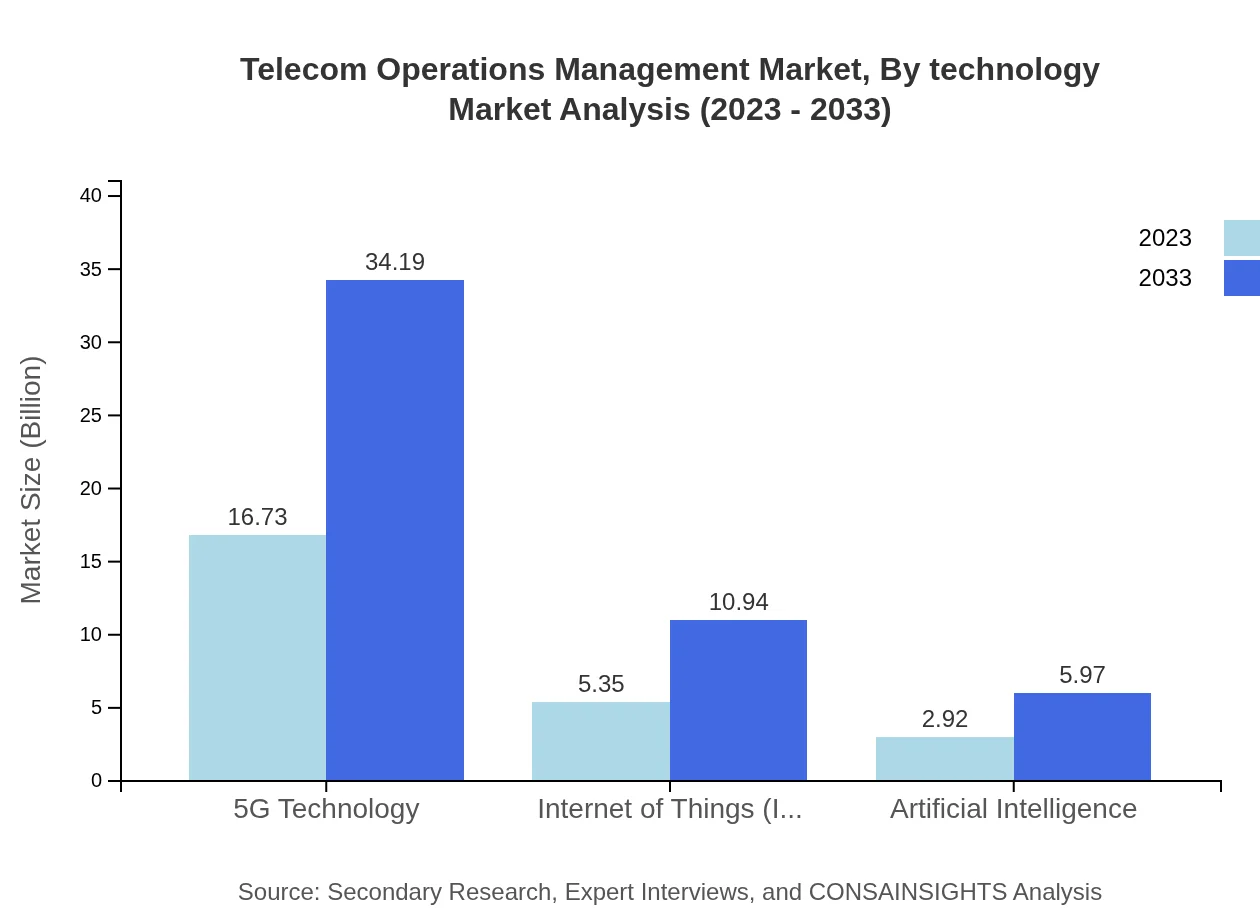

Telecom Operations Management Market Analysis By Technology

In terms of technologies, 5G represents a significant growth segment, maintaining a share of 66.91% as it evolves. The Internet of Things (IoT) and artificial intelligence also show promising trends, expected to grow at significant rates as operational demands necessitate more intelligent management systems.

Telecom Operations Management Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Telecom Operations Management Industry

Nokia Corporation:

Nokia provides advanced telecommunications infrastructure and manages various telecom operations, enhancing digital transformation across networks globally.Ericsson :

Ericsson specializes in delivering cutting-edge communication and networking solutions, focusing on automating processes within the telecom operations framework.Cisco Systems:

Cisco leads the charge in network management solutions, offering innovative technologies that streamline and secure telecom operations.Hewlett Packard Enterprise:

HP Enterprise is committed to providing integrated solutions that enhance operational efficiency, particularly in the use of cloud technologies for telecom management.IBM:

IBM’s solutions in artificial intelligence and data analytics empower telecom operators to make informed decisions and continuously optimize their operational management.We're grateful to work with incredible clients.

FAQs

What is the market size of telecom operations management?

The global Telecom Operations Management market is valued at $25 billion in 2023, with an anticipated CAGR of 7.2%. It is expected to grow significantly by the end of 2033, reflecting the rising demand for efficient telecom solutions.

What are the key market players or companies in this telecom operations management industry?

Key market players in the telecom operations management industry include leading firms such as Ericsson, IBM, and Huawei. These companies contribute significantly to the advancements in technology and management solutions used by telecom operators globally.

What are the primary factors driving the growth in the telecom operations management industry?

Growth in the telecom operations management industry is driven by increasing complexity in telecom networks, demand for better customer experience, and the need for effective management solutions in the face of emerging technologies like 5G and IoT.

Which region is the fastest Growing in telecom operations management?

The fastest-growing region in the telecom operations management market is Europe, projected to grow from $7.71 billion in 2023 to $15.76 billion by 2033. North America follows closely, indicating robust growth in telecom expenditure.

Does ConsaInsights provide customized market report data for the telecom operations management industry?

Yes, ConsaInsights offers customized market report data for the telecom operations management industry. Tailored reports include in-depth analyses of trends, forecasts, and specific regional or segment insights based on client's requirements.

What deliverables can I expect from this telecom operations management market research project?

Deliverables from the telecom operations management market research project typically include comprehensive reports, trend analysis, market forecasts, competitive landscape assessments, and tailored data specific to your business needs.

What are the market trends of telecom operations management?

Key market trends in telecom operations management include increasing automation in operations, a shift towards cloud-based solutions, and the growing importance of AI and IoT in enhancing operational efficiencies and customer engagement.