Telecom Power Systems Market Report

Published Date: 31 January 2026 | Report Code: telecom-power-systems

Telecom Power Systems Market Size, Share, Industry Trends and Forecast to 2033

This report examines the global Telecom Power Systems market, providing insights into current trends, market size, growth forecasts for 2023 - 2033, and detailed analyses of market segmentation and regional performance.

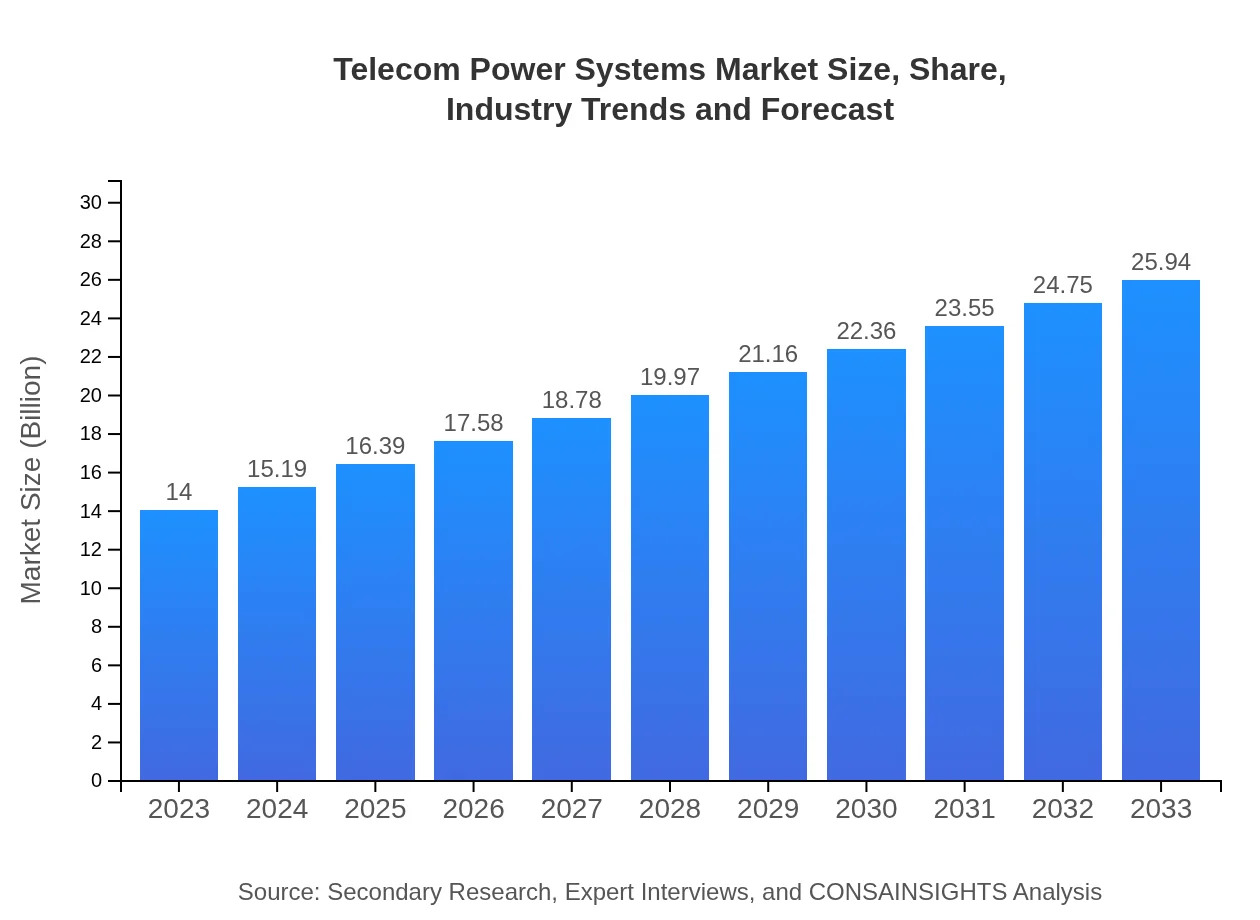

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $14.00 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $25.94 Billion |

| Top Companies | Siemens AG, Schneider Electric, Eaton Corporation, General Electric (GE), ABB Ltd. |

| Last Modified Date | 31 January 2026 |

Telecom Power Systems Market Overview

Customize Telecom Power Systems Market Report market research report

- ✔ Get in-depth analysis of Telecom Power Systems market size, growth, and forecasts.

- ✔ Understand Telecom Power Systems's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Telecom Power Systems

What is the Market Size & CAGR of Telecom Power Systems market in 2023?

Telecom Power Systems Industry Analysis

Telecom Power Systems Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Telecom Power Systems Market Analysis Report by Region

Europe Telecom Power Systems Market Report:

The European Telecom Power Systems market is projected to grow from $3.62 billion in 2023 to $6.72 billion by 2033. The market benefits from stringent environmental regulations and a robust shift towards green technologies. Telecommunications companies are increasingly adopting renewable energy sources and enhancing energy efficiency to meet regulatory requirements.Asia Pacific Telecom Power Systems Market Report:

The Asia Pacific region is a significant contributor to the Telecom Power Systems market, with a value of $3.08 billion in 2023, projected to reach $5.70 billion by 2033. Factors such as increased mobile penetration, urbanization, and ongoing investments in telecom infrastructure fuel this growth. Furthermore, the shift towards renewable energy sources is gaining momentum among telecom operators in this region.North America Telecom Power Systems Market Report:

North America leads with a market size of $4.84 billion in 2023, expected to rise to $8.96 billion by 2033. High demand for efficient power solutions in telecom sectors and investment in next-gen networks such as 5G contribute significantly to this growth. Additionally, strong regulatory frameworks supporting energy-efficient technologies enhance market opportunities.South America Telecom Power Systems Market Report:

In South America, the Telecom Power Systems market is valued at $0.72 billion in 2023 and is expected to grow to $1.34 billion by 2033. The region's growth is driven by improvements in network connectivity and expanding telecom services. Emerging technologies and government incentives promoting renewable energy are anticipated to further impact market dynamics positively.Middle East & Africa Telecom Power Systems Market Report:

The Middle East and Africa market is valued at $1.74 billion in 2023 and is poised to reach $3.22 billion by 2033. Growth in this region is driven by the continuous expansion of telecom infrastructure and increased demand for reliable power solutions in remote areas. Government initiatives aimed at improving energy access further support market growth.Tell us your focus area and get a customized research report.

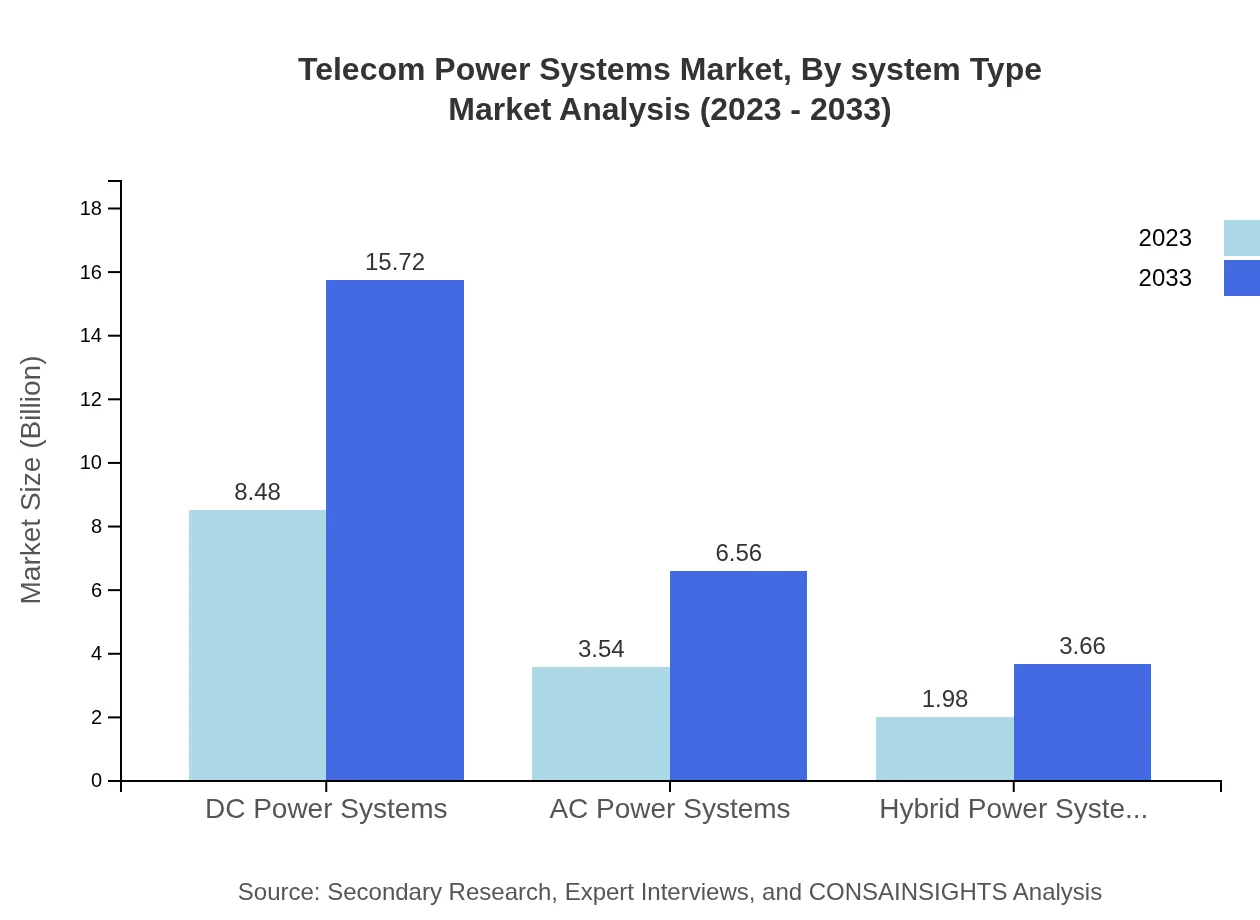

Telecom Power Systems Market Analysis By System Type

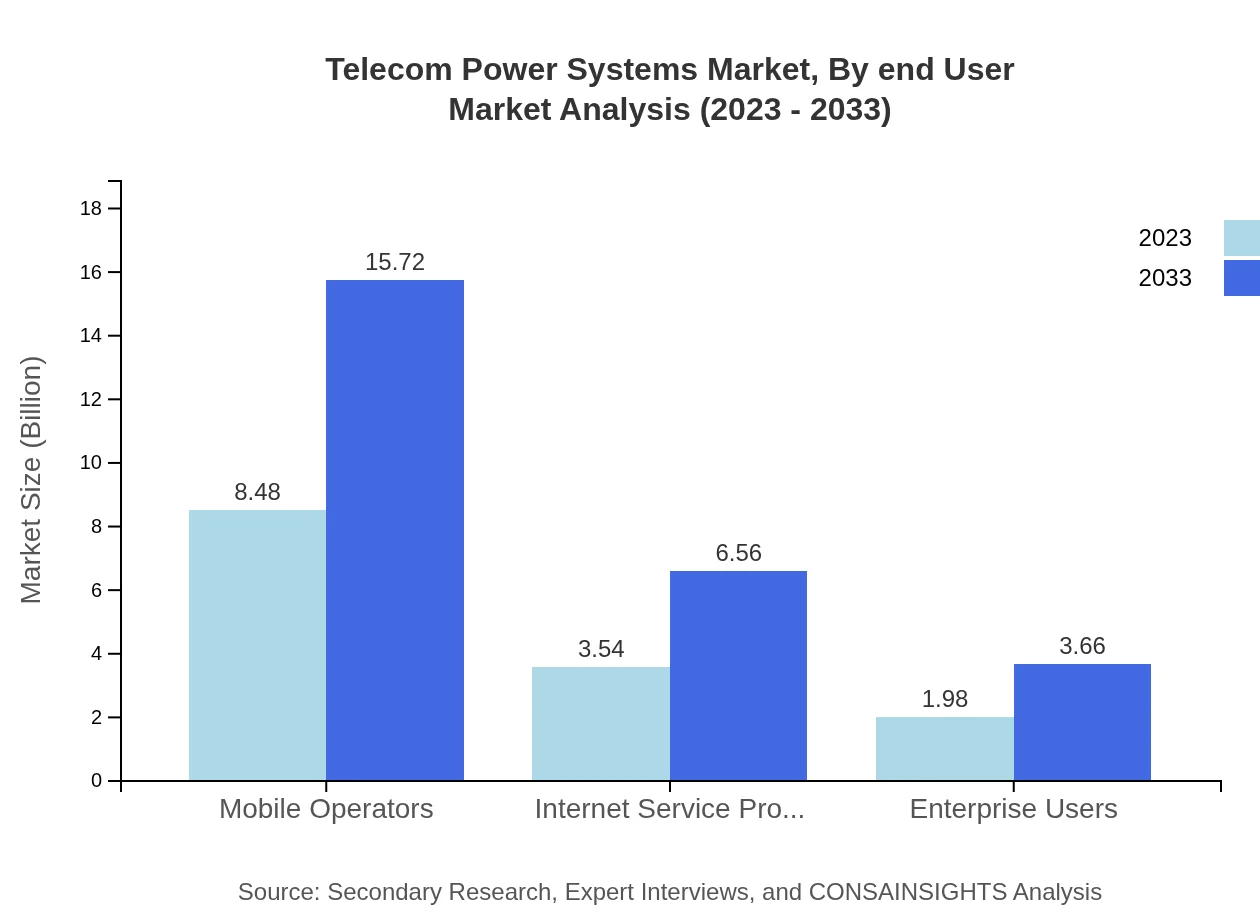

In the Telecom Power Systems market, the primary segment by system type includes Mobile Operators, with a market size of $8.48 billion in 2023, projected to reach $15.72 billion by 2033. Internet Service Providers follow with a growth from $3.54 billion to $6.56 billion in the same period. Enterprise Users contribute significantly with values rising from $1.98 billion to $3.66 billion. Overall, Mobile Networks are expected to maintain a substantial share, with a 60.59% market share held consistently.

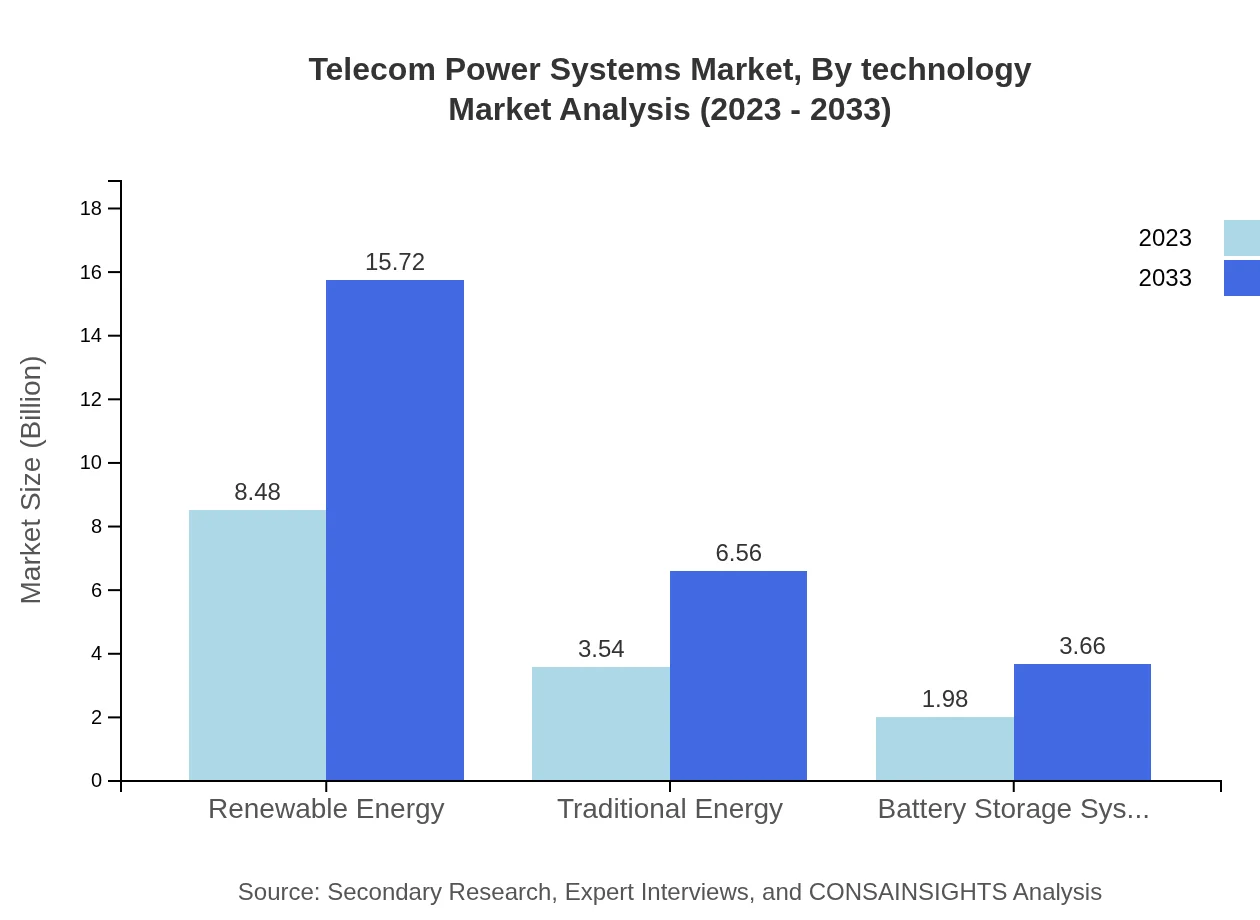

Telecom Power Systems Market Analysis By Technology

The key technologies in the Telecom Power Systems sector include DC Power Systems and AC Power Systems. DC Power Systems dominate the market with a size of $8.48 billion in 2023 and an equal share of 60.59% over the forecast period. In contrast, AC Power Systems, while growing from $3.54 billion to $6.56 billion, holds a 25.29% market share, demonstrating the diversified technological adoption across operators.

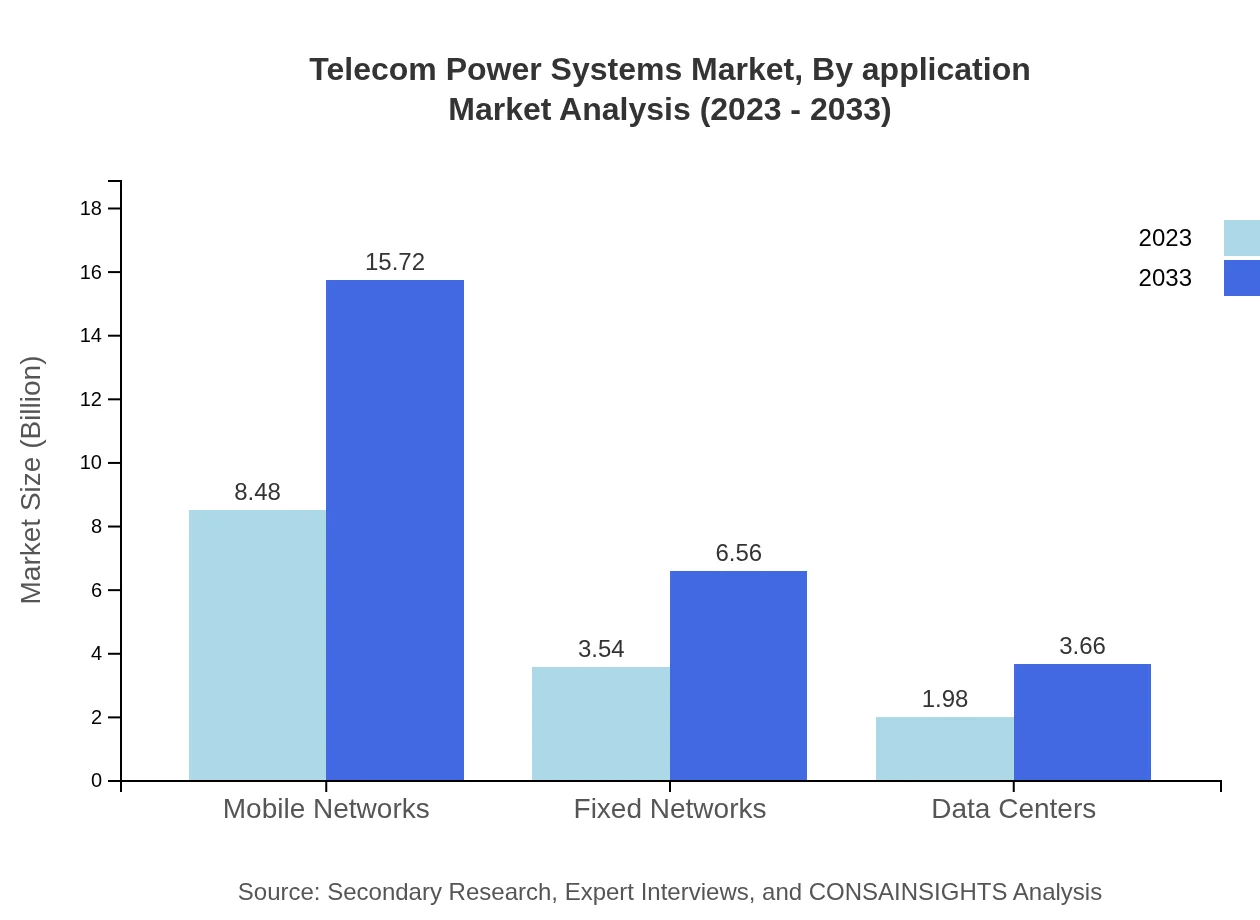

Telecom Power Systems Market Analysis By Application

Mobile Networks lead the market applications with significant revenue generated from $8.48 billion in 2023 to $15.72 billion by 2033. Fixed Networks and Data Centers also play important roles, growing from $3.54 billion to $6.56 billion and $1.98 billion to $3.66 billion respectively, showcasing varied application needs across the telecom sector.

Telecom Power Systems Market Analysis By End User

Key end-users in the Telecom Power Systems market include Mobile Operators, Internet Service Providers, and Enterprise Users. The size of the Mobile Operators segment grows from $8.48 billion to $15.72 billion over the forecast period, holding a consistent market share of 60.59%. Enterprise Users and Internet Service Providers also contribute significantly to market growth, reflecting the sector's diverse customer base.

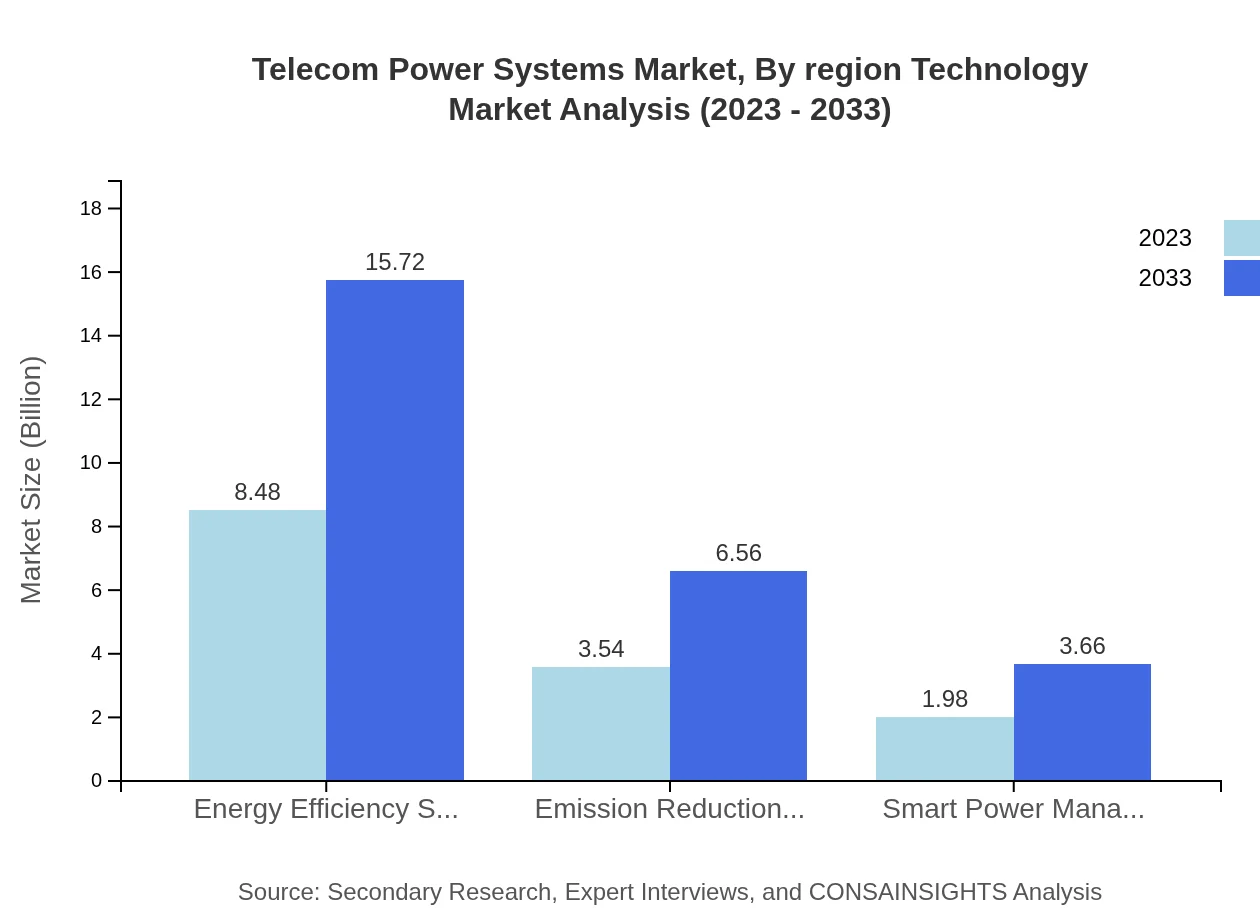

Telecom Power Systems Market Analysis By Region Technology

Current trends in Telecom Power Systems reflect a shift towards renewable energy systems, hybrid solutions, and energy efficiency technologies, enhancing sustainability and operational performance. As telecom companies seek to lower their carbon footprints, significant investments are evident in emissions reduction technologies and smart power management systems, showcasing an overall commitment to sustainability throughout the industry.

Telecom Power Systems Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Telecom Power Systems Industry

Siemens AG:

Siemens AG is a global leader in the Telecom Power Systems segment, providing innovative solutions that integrate energy efficiency and sustainability in network infrastructure.Schneider Electric:

Schneider Electric specializes in energy management and automation solutions, offering robust and resilient telecom power systems that support diverse networks.Eaton Corporation:

Eaton Corporation provides comprehensive power management solutions, focused on delivering high-performance systems for the telecommunications industry.General Electric (GE):

General Electric is involved in providing advanced power solutions for telecom operators, focusing on reliability and efficiency while supporting global connectivity.ABB Ltd.:

ABB Ltd. is a pioneer in power and automation technologies, delivering innovative solutions that enhance energy management in telecommunications.We're grateful to work with incredible clients.

FAQs

What is the market size of telecom Power Systems?

The telecom power systems market is currently valued at approximately $14 billion and is projected to grow at a CAGR of 6.2% over the next decade, indicating robust growth and strong demand for power solutions in the telecom sector.

What are the key market players or companies in this telecom power systems industry?

Key players include major telecommunications equipment manufacturers, energy service providers, and innovative power technology developers that specialize in providing sustainable and efficient power systems tailored for telecom networks.

What are the primary factors driving the growth in the telecom Power Systems industry?

Growth drivers include the increasing demand for sustainable energy solutions, rising mobile network expansions, advancements in energy-efficient technologies, and the need for reliable power sources to support connectivity in emerging markets.

Which region is the fastest Growing in the telecom power systems market?

Asia Pacific is the fastest-growing region, with the market projected to grow from $3.08 billion in 2023 to $5.70 billion by 2033, fueled by rapid digitalization and infrastructure advancements.

Does ConsaInsights provide customized market report data for the telecom power systems industry?

Yes, ConsaInsights offers customized market reports tailored to specific client needs, allowing businesses to gain insights and data that align with their market strategies and investment plans.

What deliverables can I expect from this telecom power systems market research project?

Deliverables include comprehensive market analysis reports, forecasts, competitive landscape assessments, segmented data insights, and strategic recommendations to effectively capitalize on market opportunities.

What are the market trends of telecom power systems?

Current trends include a shift towards renewable energy sources, advancements in battery storage technologies, and integration of smart power management systems for enhanced efficiency and reduced emission levels.