Telecom Service Assurance Market Report

Published Date: 31 January 2026 | Report Code: telecom-service-assurance

Telecom Service Assurance Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Telecom Service Assurance market from 2023 to 2033, covering market size, growth trends, industry analysis, segmentation, regional insights, technology advancements, and competitive landscape.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

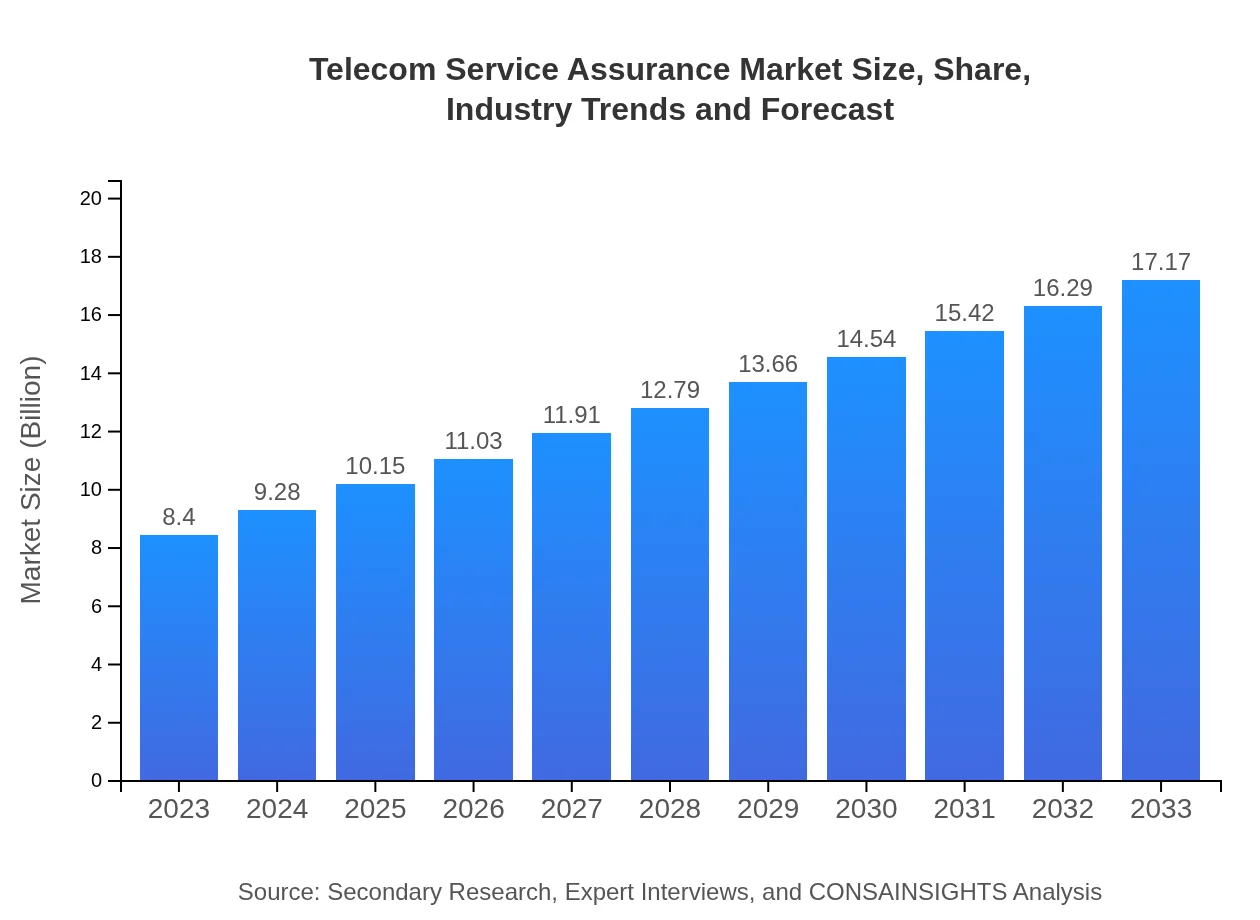

| 2023 Market Size | $8.40 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $17.17 Billion |

| Top Companies | Cisco Systems, Inc., Nokia Corporation, NetScout Systems, Inc., IBM Corporation, Huawei Technologies Co., Ltd. |

| Last Modified Date | 31 January 2026 |

Telecom Service Assurance Market Overview

Customize Telecom Service Assurance Market Report market research report

- ✔ Get in-depth analysis of Telecom Service Assurance market size, growth, and forecasts.

- ✔ Understand Telecom Service Assurance's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Telecom Service Assurance

What is the Market Size & CAGR of Telecom Service Assurance market in 2023?

Telecom Service Assurance Industry Analysis

Telecom Service Assurance Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Telecom Service Assurance Market Analysis Report by Region

Europe Telecom Service Assurance Market Report:

Europe's market for Telecom Service Assurance will grow from $2.37 billion in 2023 to $4.84 billion in 2033. The push for regulatory compliance and enhancement of user experiences is creating opportunities for innovative service assurance solutions.Asia Pacific Telecom Service Assurance Market Report:

The Asia Pacific region is set to witness robust growth in the Telecom Service Assurance market, with an estimated market value of $3.45 billion by 2033, up from $1.69 billion in 2023. Key drivers include the rapid adoption of 5G technology and the growing demand for improved user experience in emerging economies.North America Telecom Service Assurance Market Report:

North America holds a significant share of the Telecom Service Assurance market, projected to grow from $2.73 billion in 2023 to $5.59 billion by 2033. The presence of major telecom companies and high demand for advanced service assurance solutions are key factors in this growth.South America Telecom Service Assurance Market Report:

In South America, the market is expected to grow from $0.68 billion in 2023 to $1.40 billion by 2033. Increased telecommunications infrastructure investments and greater focus on digital transformation initiatives will drive market growth.Middle East & Africa Telecom Service Assurance Market Report:

The Middle East and Africa are expected to see growth from $0.92 billion in 2023 to $1.89 billion by 2033, driven by expanding telecom infrastructures and increasing digital service demand.Tell us your focus area and get a customized research report.

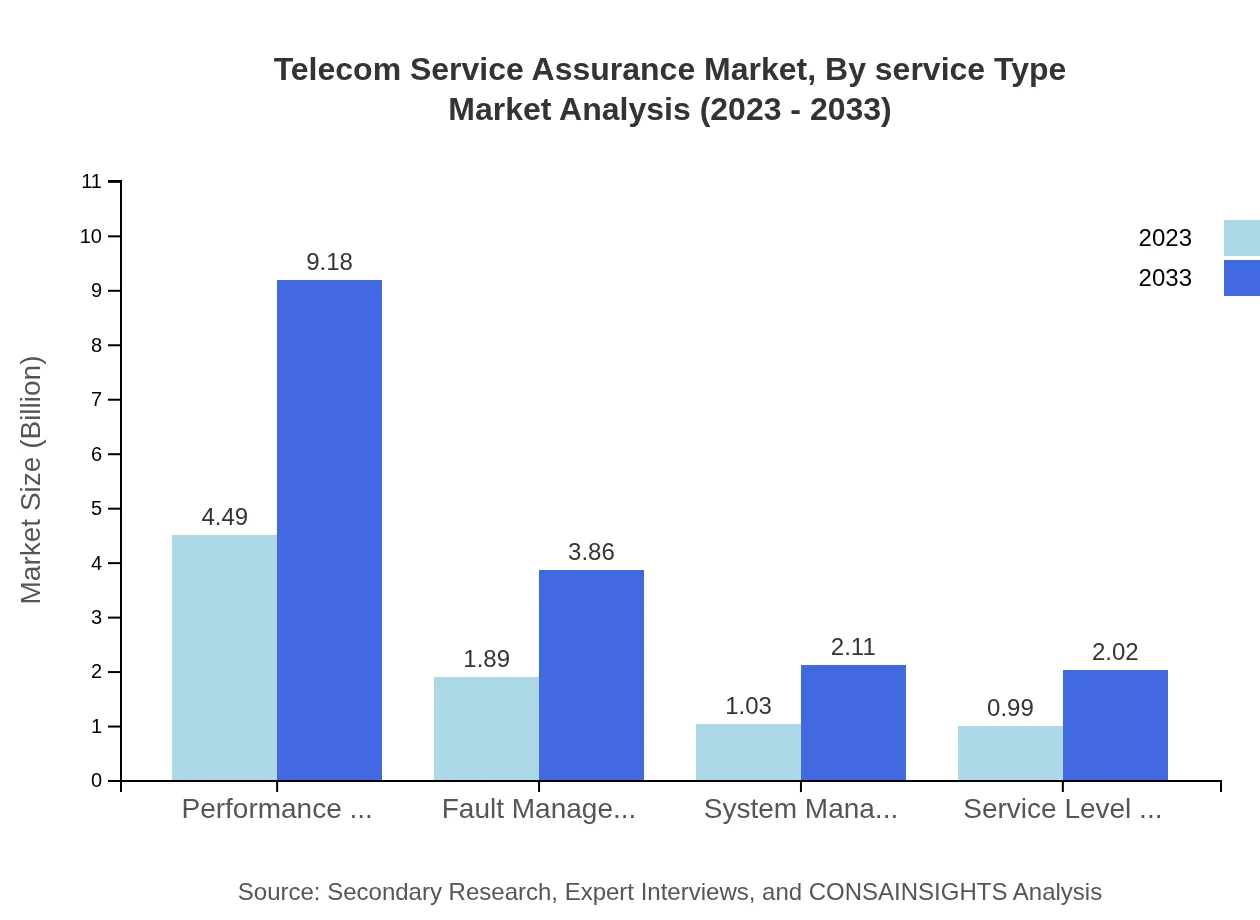

Telecom Service Assurance Market Analysis By Service Type

The service type segment is dominated by Performance Management, which will grow from $4.49 billion in 2023 to $9.18 billion by 2033, holding a 53.49% market share. Fault Management also plays a crucial role, growing to $3.86 billion by 2033. Service level and system management solutions are expected to contribute increasingly to the overall market as telecom companies focus on maintaining compliance and ensuring service uptime.

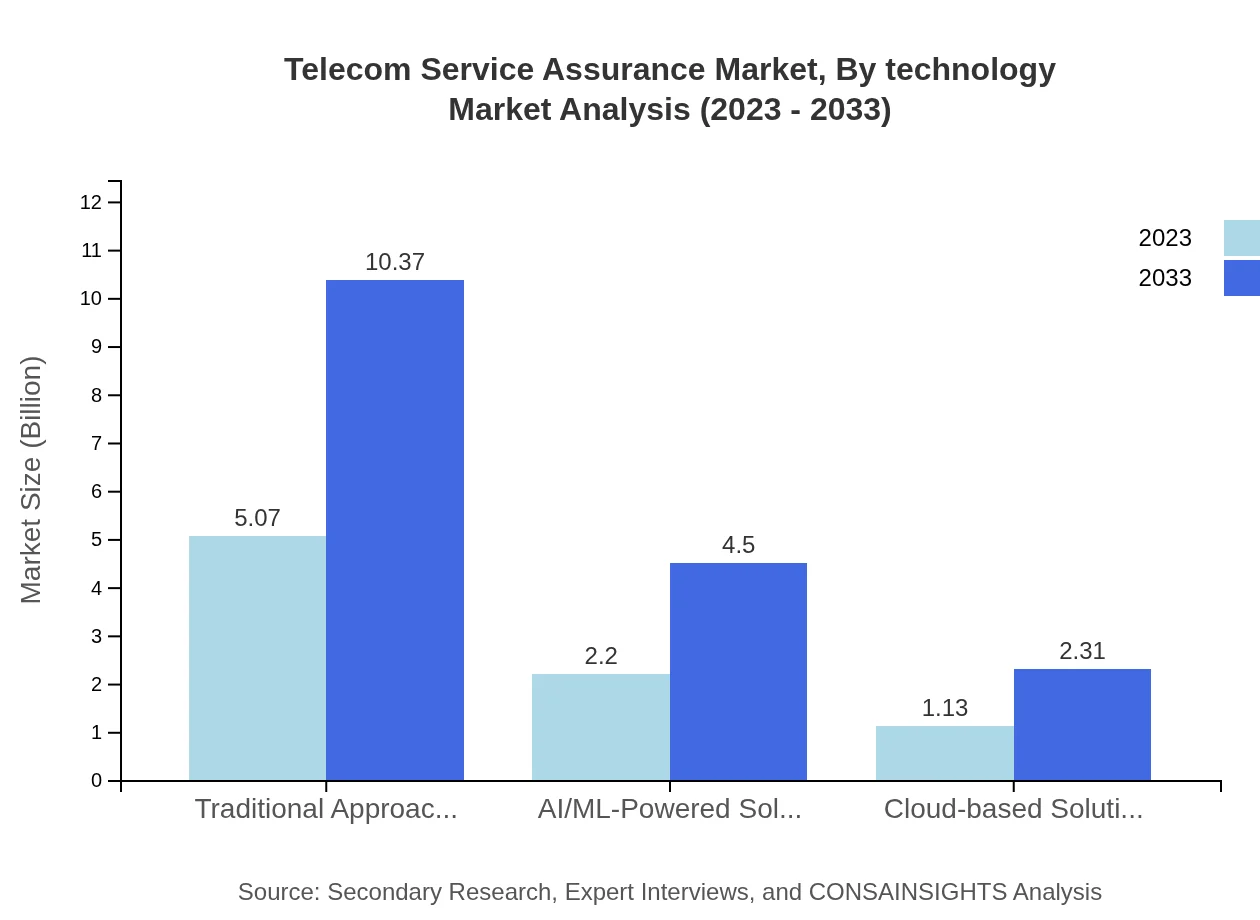

Telecom Service Assurance Market Analysis By Technology

Innovative technologies such as AI/ML-powered solutions are gaining traction, with a growth projection from $2.20 billion in 2023 to $4.50 billion by 2033. On the other hand, traditional approaches remain prominent, holding a stable market share of approximately 60.38%. The push towards automation and predictive analytics illustrates the technological transition taking place in service assurance.

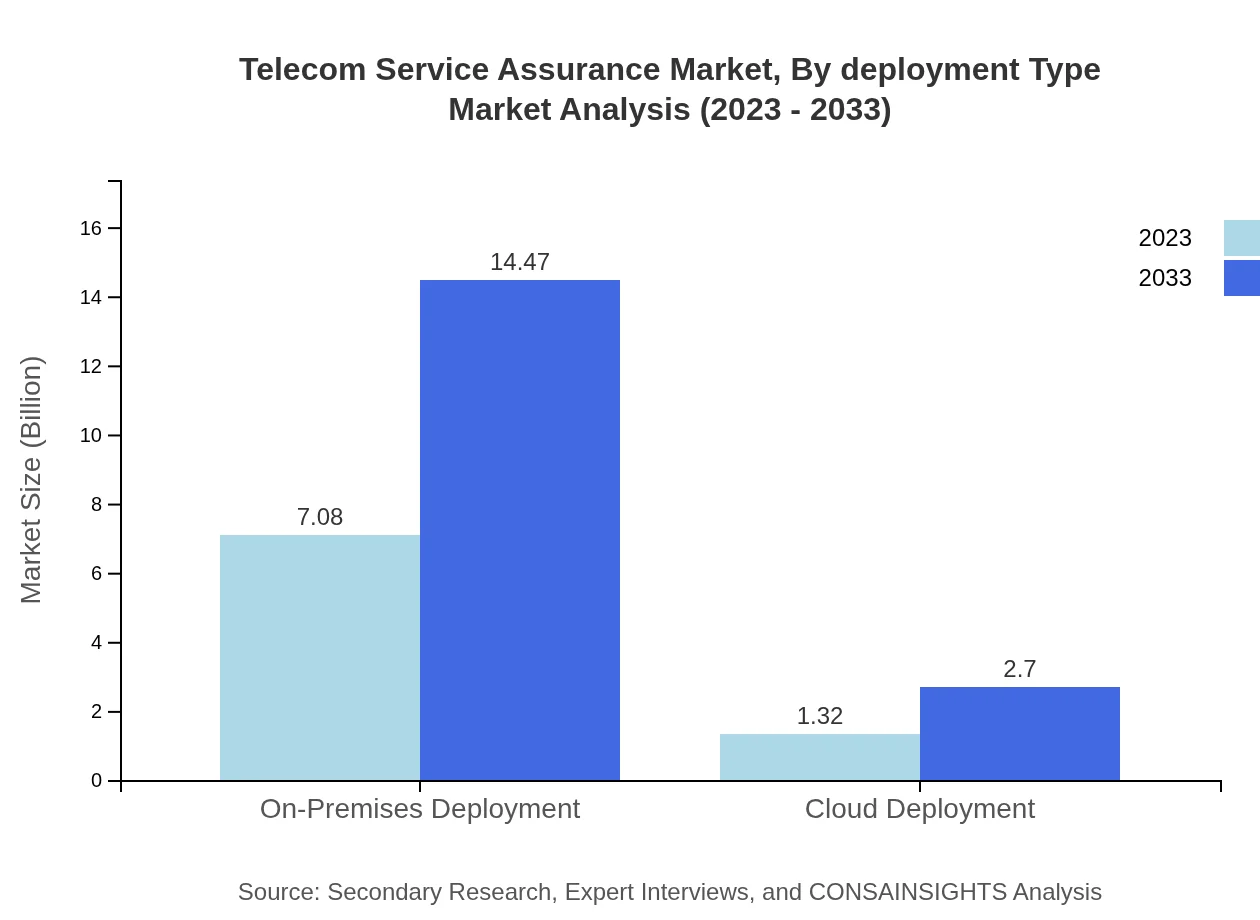

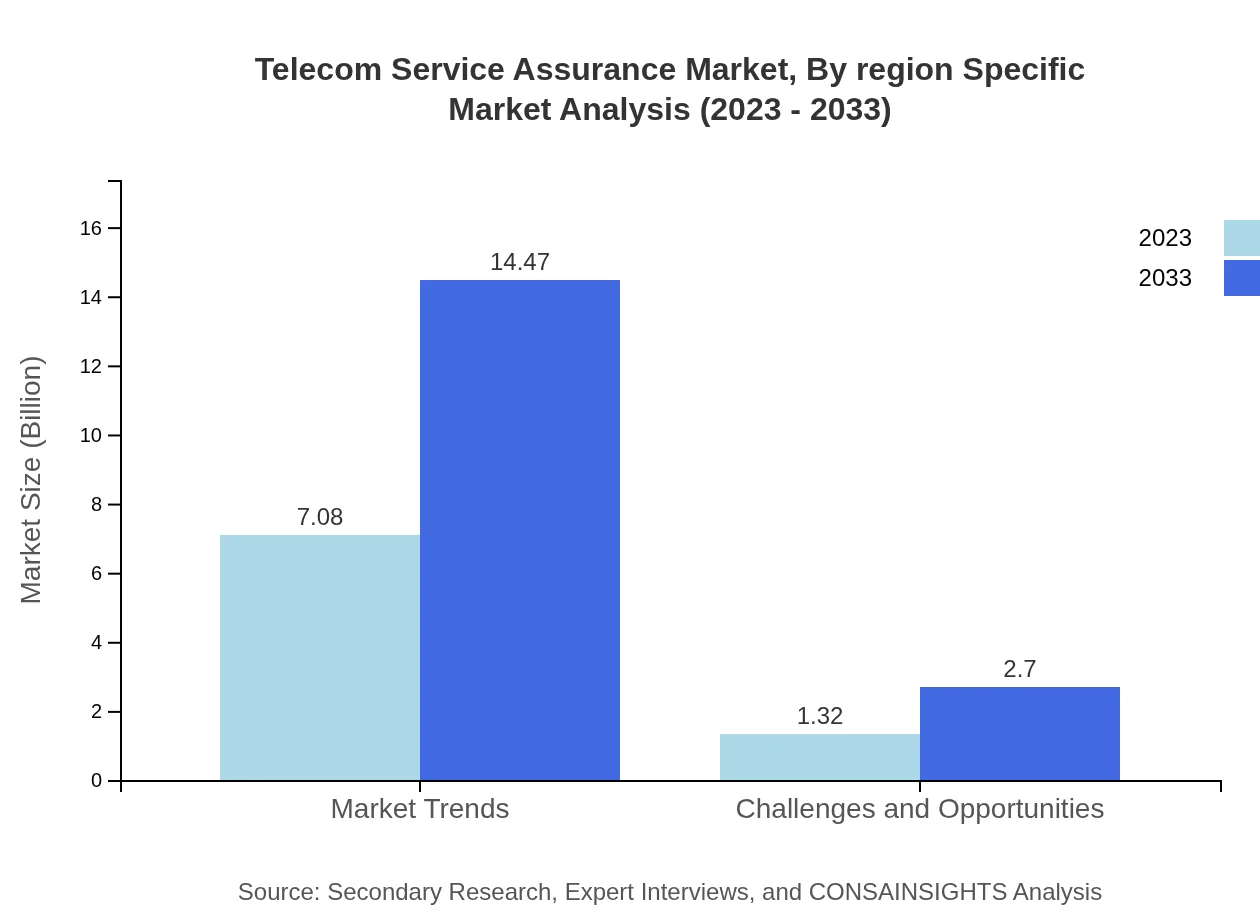

Telecom Service Assurance Market Analysis By Deployment Type

The deployment type analysis reveals that on-premises models are still leading, with a projected value of $14.47 billion by 2033, representing 84.29% of the market share. However, cloud deployment solutions are gradually gaining popularity, expected to reach $2.70 billion by 2033, indicating a shift towards flexibility and scalability.

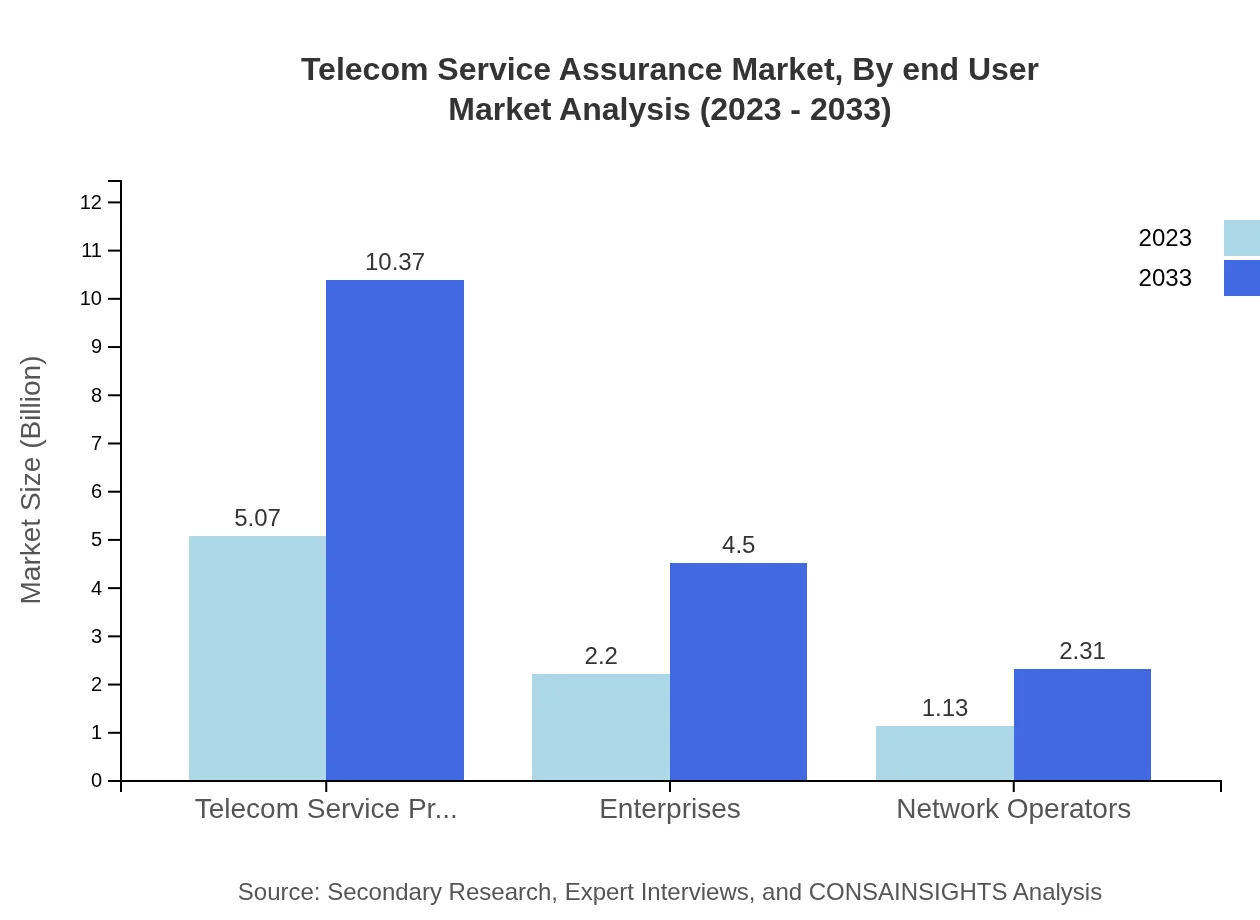

Telecom Service Assurance Market Analysis By End User

Telecom service providers represent the largest share in the end-user segment, expected to grow from $5.07 billion in 2023 to $10.37 billion by 2033, maintaining a market share of 60.38%. Enterprises are also significant consumers, with a need for service reliability in their telecom horizons.

Telecom Service Assurance Market Analysis By Region Specific

The overall trend across regions underscores a growing necessity for robust service assurance solutions, driven by consumer demands for quality experiences, regulatory pressures, and the move towards comprehensive digital services. Each region showcases unique challenges and opportunities dictated by their specific market dynamics.

Telecom Service Assurance Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Telecom Service Assurance Industry

Cisco Systems, Inc.:

Cisco provides comprehensive service assurance solutions leveraging its extensive portfolio, including network monitoring and performance management tools.Nokia Corporation:

Nokia offers advanced analytics and service level management tools designed to ensure high-quality user experiences across networks.NetScout Systems, Inc.:

NetScout specializes in performance and fault management tools that help telecom operators maintain service quality and resilience.IBM Corporation:

IBM's AI-driven analytics platforms improve service assurance governance, enabling telecom companies to predict and resolve issues efficiently.Huawei Technologies Co., Ltd.:

Huawei offers integrated service assurance solutions that enhance operational efficiency and service quality for telecom operators.We're grateful to work with incredible clients.

FAQs

What is the market size of telecom Service Assurance?

The global telecom service assurance market size is approximately $8.4 billion as of 2023, with a projected compound annual growth rate (CAGR) of 7.2% over the next decade, indicating a strong demand for service assurance solutions in the telecom sector.

What are the key market players or companies in this telecom Service Assurance industry?

Key players in the telecom service assurance industry include major telecom operators, technology providers, and software companies focused on network performance and reliability solutions. Their innovations drive competition and enhance customer satisfaction in telecommunication services.

What are the primary factors driving the growth in the telecom Service Assurance industry?

Growth in the telecom service assurance industry is driven by the increasing demand for enhanced network performance, the need for real-time monitoring solutions, and the adoption of AI and ML technologies to improve operational efficiencies and customer experiences.

Which region is the fastest Growing in the telecom Service Assurance?

Currently, North America is the fastest-growing region, with its market expected to increase from $2.73 billion in 2023 to $5.59 billion in 2033. Europe and Asia Pacific are also showing significant growth potential in the telecom service assurance market.

Does ConsaInsights provide customized market report data for the telecom Service Assurance industry?

Yes, ConsaInsights offers customized market report data tailored to specific requirements in the telecom service assurance sector, ensuring that clients receive insights relevant to their areas of interest, market segments, and geographic focus.

What deliverables can I expect from this telecom Service Assurance market research project?

Deliverables for a telecom service assurance market research project include comprehensive market analysis reports, key player evaluations, segmented data insights, trend forecasts, and actionable recommendations tailored to client strategies and requirements.

What are the market trends of telecom Service Assurance?

Current market trends in telecom service assurance emphasize the shift towards AI/ML-powered solutions and cloud deployments. There is a noticeable growth in on-premises solutions, reflecting varying market needs across different segments.