Telecom System Integration Market Report

Published Date: 31 January 2026 | Report Code: telecom-system-integration

Telecom System Integration Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Telecom System Integration market, covering market size, trends, segmentation, and regional insights for the forecast period from 2023 to 2033.

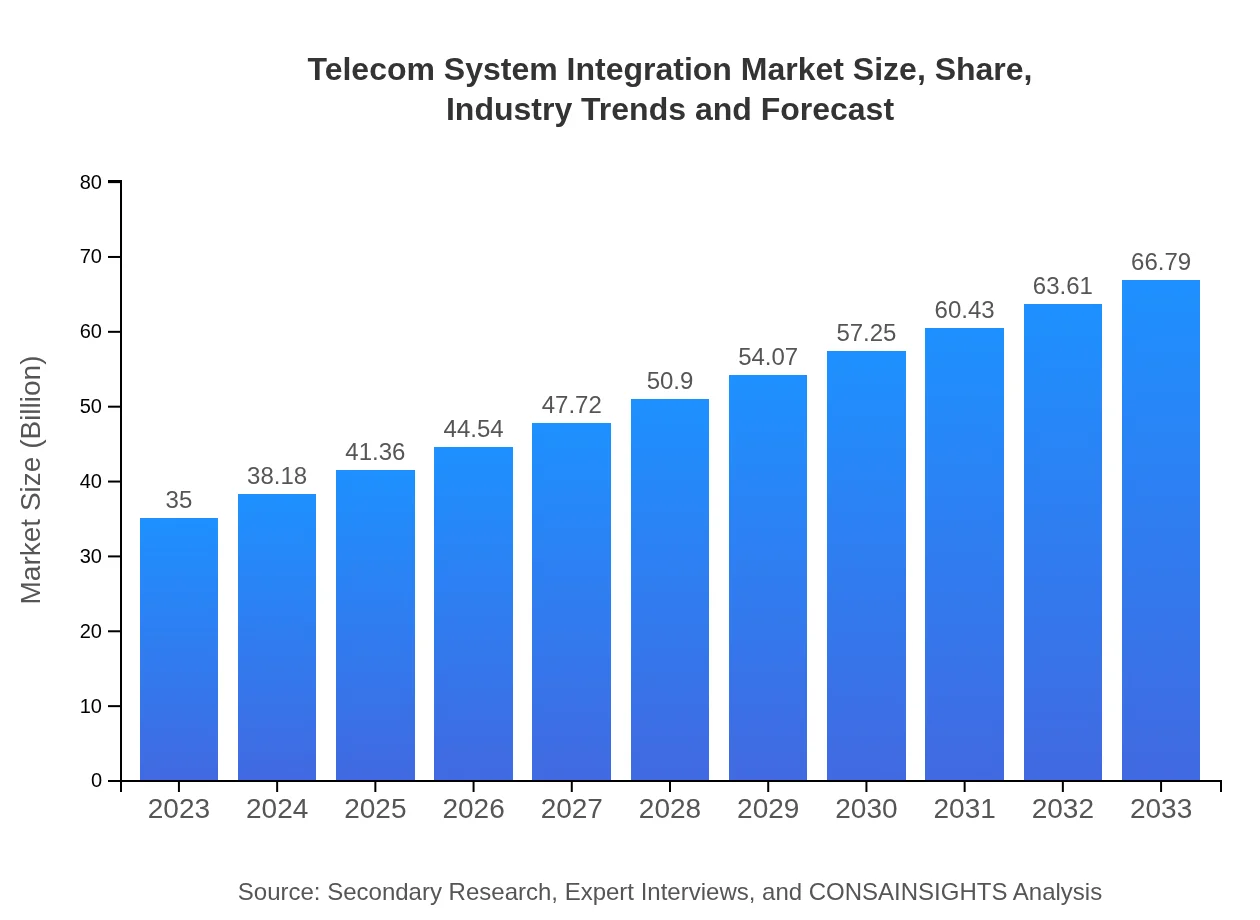

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $35.00 Billion |

| CAGR (2023-2033) | 6.5% |

| 2033 Market Size | $66.79 Billion |

| Top Companies | Cisco Systems, Inc., IBM Corporation, Accenture, Oracle Corporation |

| Last Modified Date | 31 January 2026 |

Telecom System Integration Market Overview

Customize Telecom System Integration Market Report market research report

- ✔ Get in-depth analysis of Telecom System Integration market size, growth, and forecasts.

- ✔ Understand Telecom System Integration's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Telecom System Integration

What is the Market Size & CAGR of Telecom System Integration market in Year?

Telecom System Integration Industry Analysis

Telecom System Integration Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Telecom System Integration Market Analysis Report by Region

Europe Telecom System Integration Market Report:

The European Telecom System Integration market is valued at $10.45 billion in 2023, projected to grow to $19.94 billion by 2033. The region exhibits strong regulatory frameworks and collaborative initiatives amongst EU countries to push for digital transformation and ensure seamless telecom operations across borders.Asia Pacific Telecom System Integration Market Report:

In 2023, the Asia Pacific Telecom System Integration market is valued at $6.60 billion, and it's expected to grow to $12.60 billion by 2033. The region's growth can be attributed to the rapid urbanization, the proliferation of mobile subscriptions, and investment in telecommunication infrastructure by both private and public sectors. Countries such as India and China are leading in 5G deployment, which further propels the demand for integrated telecom solutions.North America Telecom System Integration Market Report:

North America has one of the largest markets for Telecom System Integration, notably at $12.73 billion in 2023, expected to rise to $24.29 billion by 2033. The demand is largely driven by advancements in technology, aggressive 5G rollout, and a strong regulatory environment that encourages innovation and investment.South America Telecom System Integration Market Report:

The South American market is currently valued at $3.35 billion in 2023 and projected to reach $6.39 billion by 2033. The need for enhanced connectivity and adoption of new telecom technologies among emerging economies is pushing growth. Brazil and Argentina are at the forefront of this transformation, with investments in ICT infrastructure to improve connectivity.Middle East & Africa Telecom System Integration Market Report:

In 2023, the Middle East and Africa market size stands at $1.87 billion, expected to reach $3.56 billion by 2033. Key growth factors in this region include expanding investments in telecom infrastructure and increasing mobile service demands, amid challenges posed by political and economic instability.Tell us your focus area and get a customized research report.

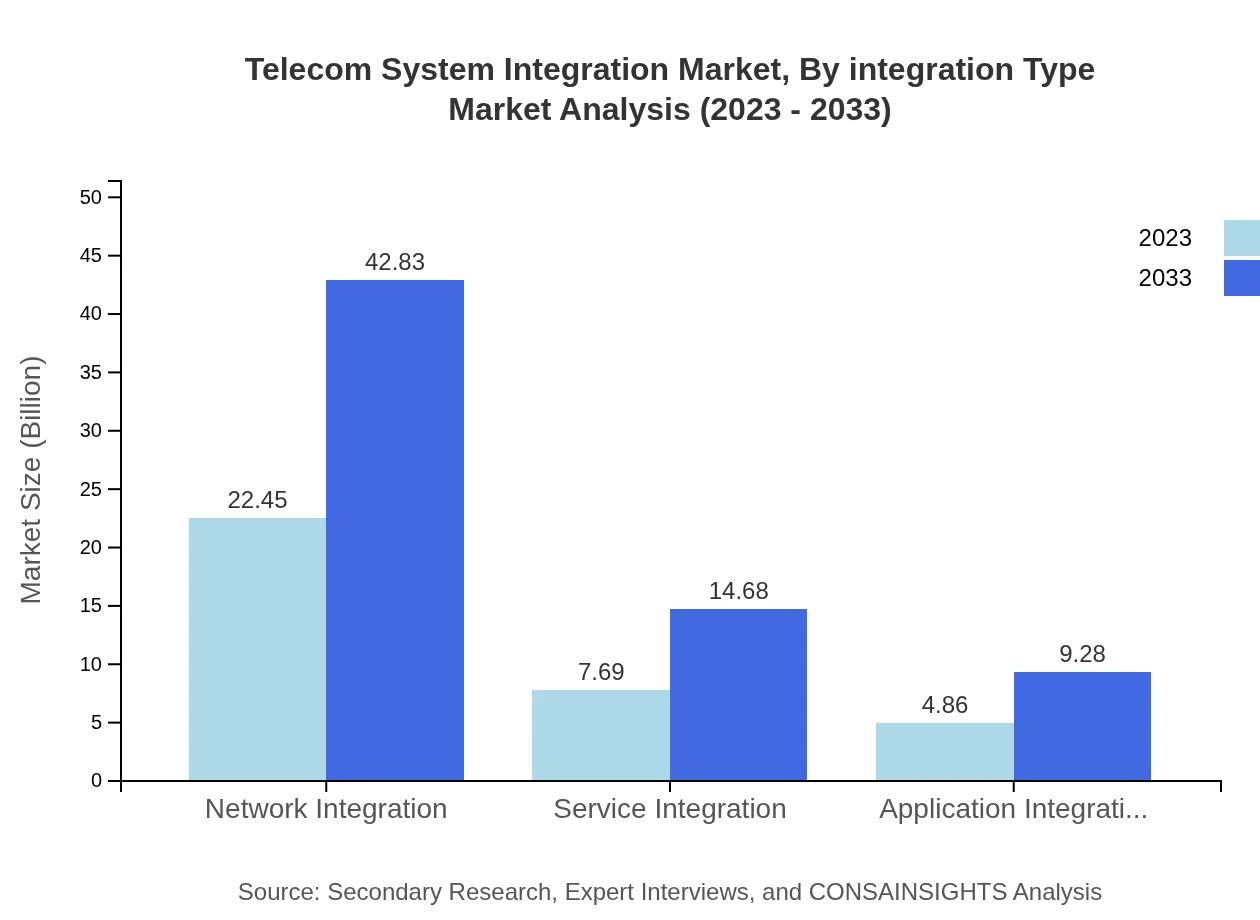

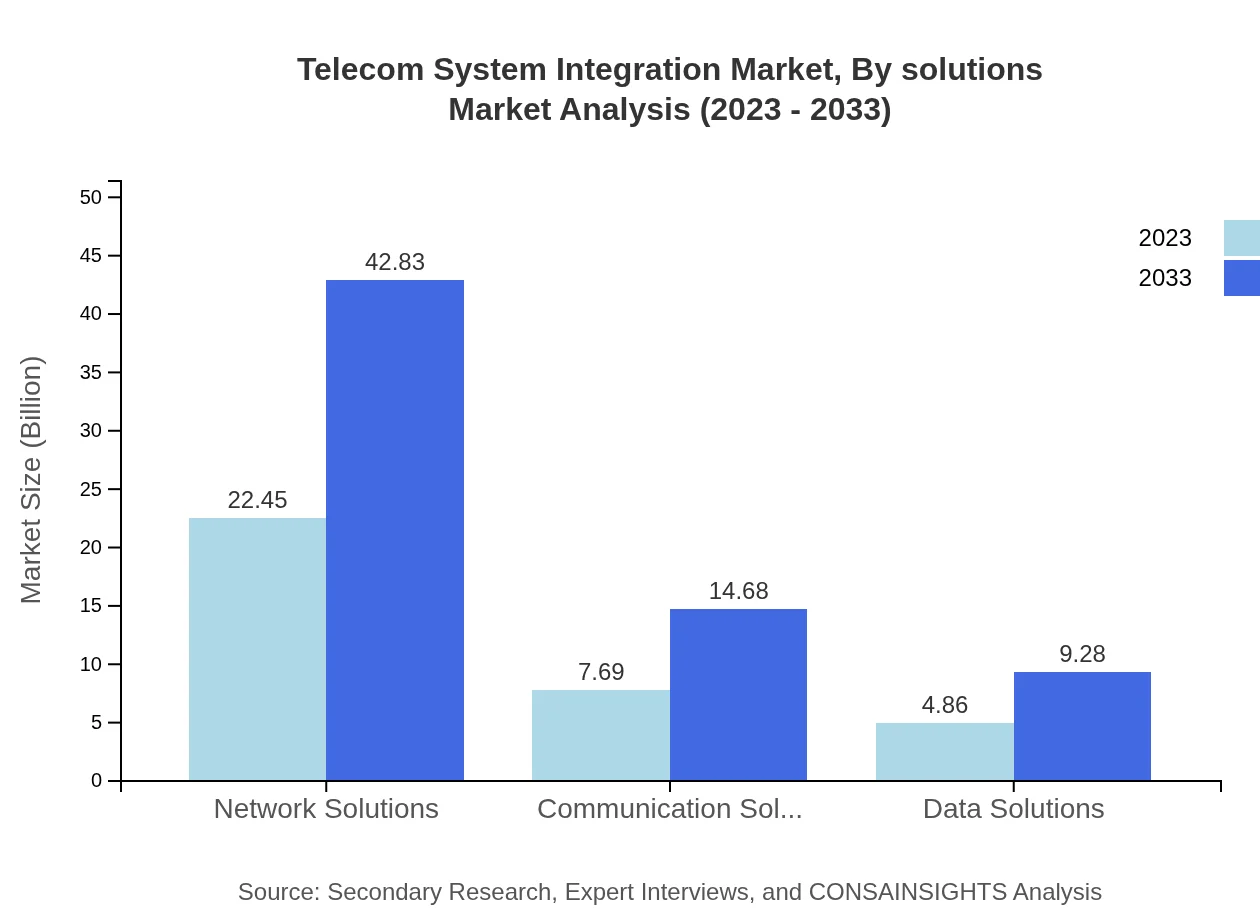

Telecom System Integration Market Analysis By Integration Type

Within the Telecom System Integration Market, Network Solutions dominate, valued at $22.45 billion in 2023, growing to $42.83 billion by 2033. This segment represents 64.13% share in 2023, remaining stable at the same share by 2033. Communication Solutions and Data Solutions follow, also showcasing significant growth with respective 2023 sizes of $7.69 billion (21.98% share) and $4.86 billion (13.89% share), expected to achieve $14.68 billion and $9.28 billion respectively by 2033.

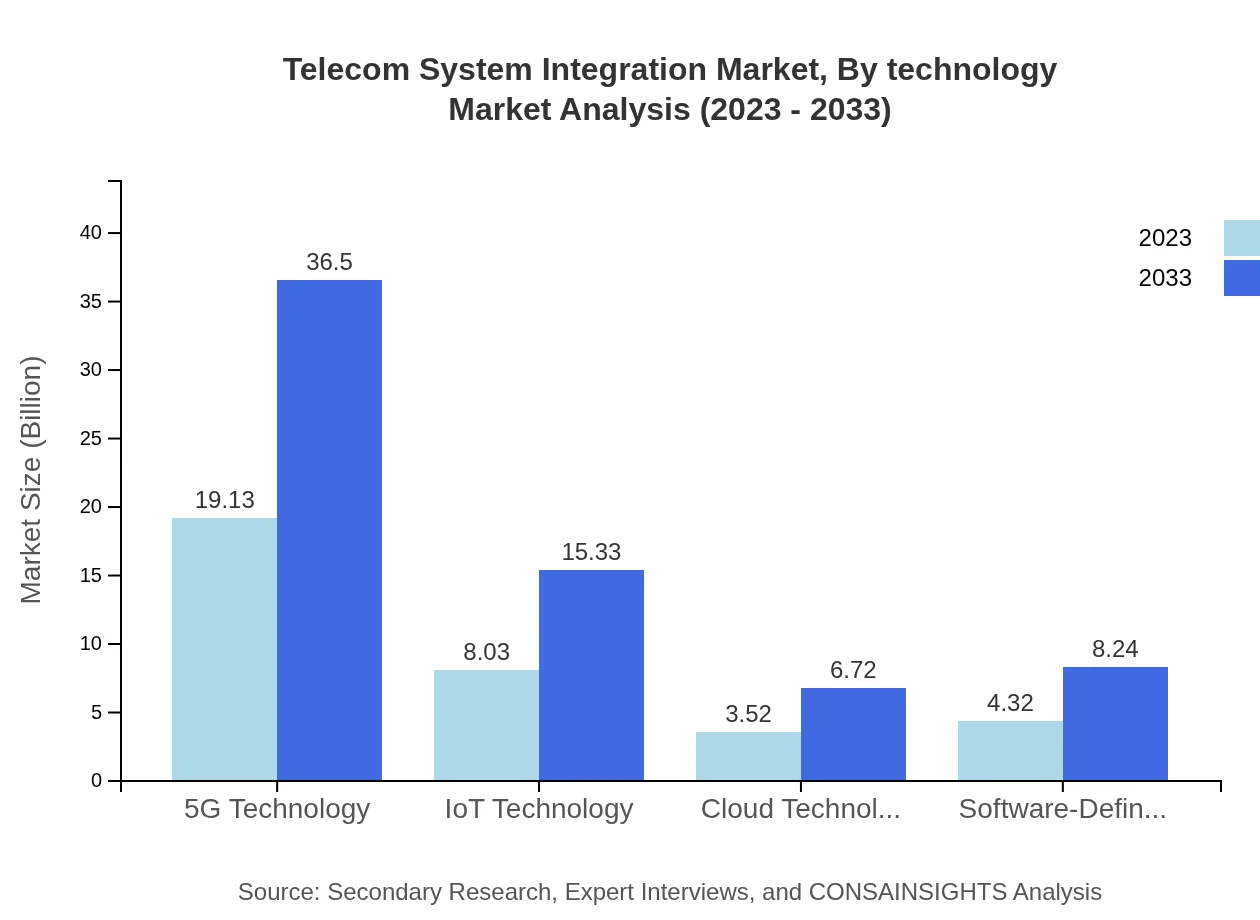

Telecom System Integration Market Analysis By Technology

The technology segment lists 5G Technology as a leading segment, at $19.13 billion in 2023 with a 54.65% market share, projected to expand to $36.50 billion by 2033. IoT Technology and Cloud Technology also form vital parts of the market, growing from $8.03 billion and $3.52 billion respectively in 2023 to $15.33 billion and $6.72 billion by 2033, maintaining their shares at 22.95% and 10.06%.

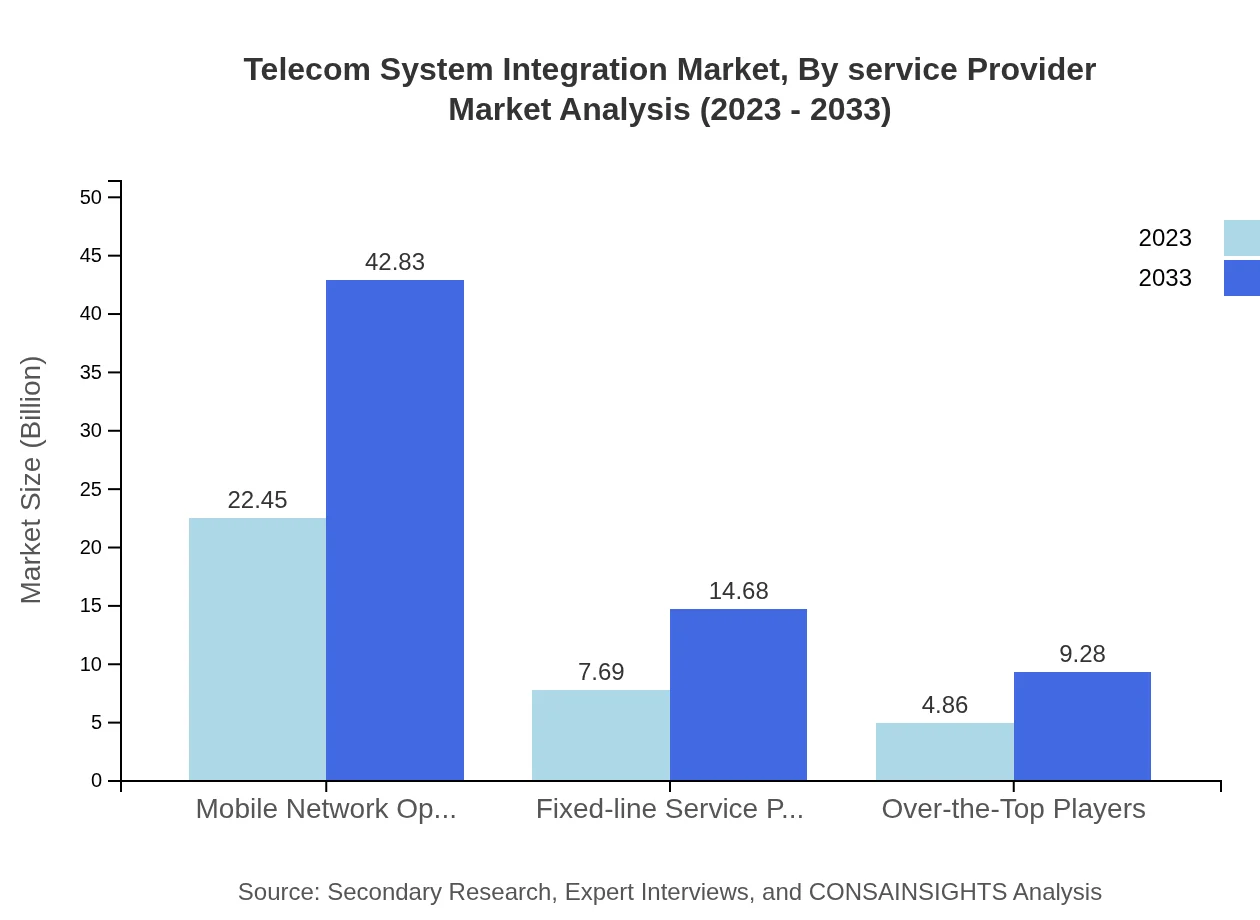

Telecom System Integration Market Analysis By Service Provider

The service provider landscape highlights Mobile Network Operators as a significant contributor, with a market size of $22.45 billion in 2023 and steady share of 64.13% alongside comparable growth to $42.83 billion by 2033. Other players, including Fixed-line Service Providers, showcased competitive growth moving from $7.69 billion in 2023 to $14.68 billion in 2033.

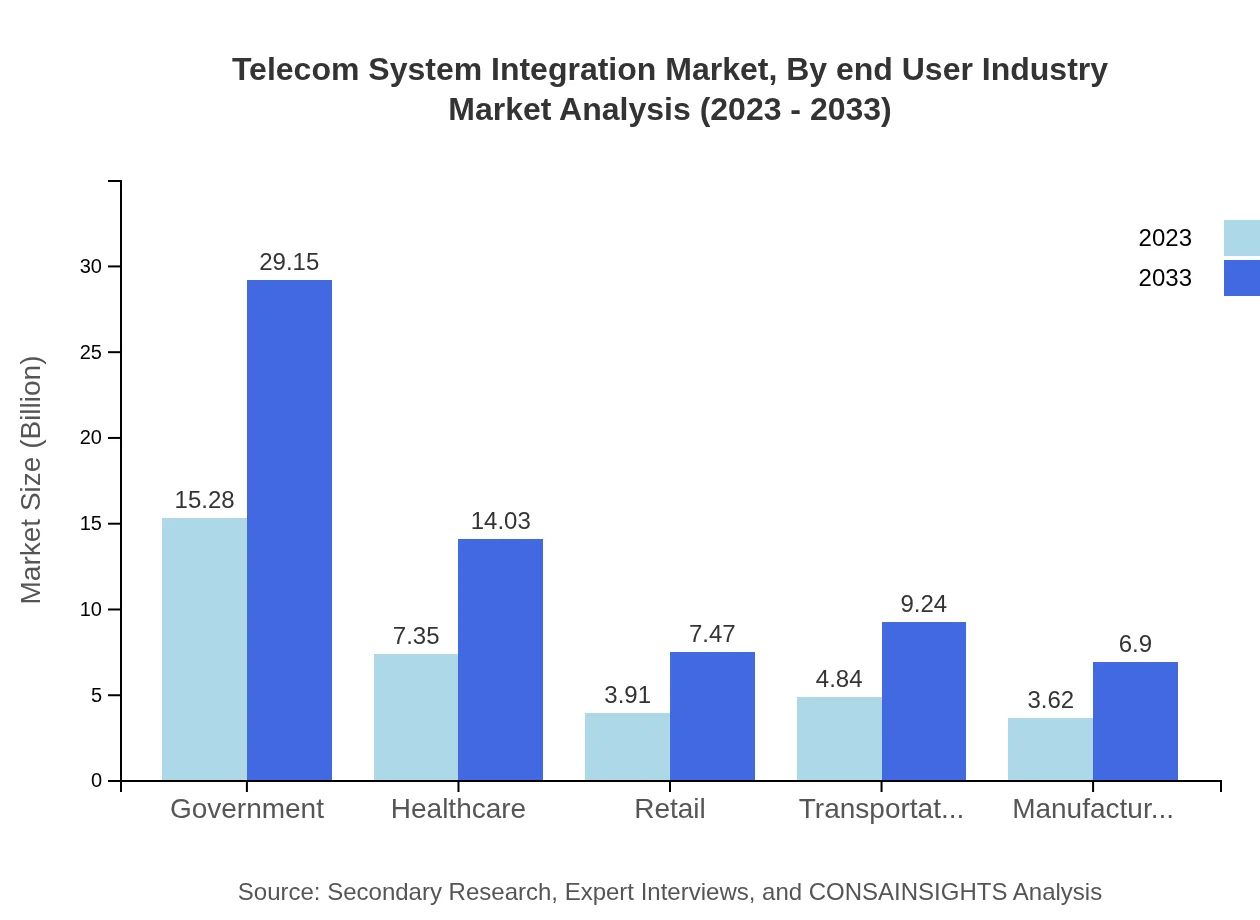

Telecom System Integration Market Analysis By End User Industry

The end-user segments reveal substantial market size across various industries. The Government sector, valued at $15.28 billion in 2023 (43.65% share), is projected to reach $29.15 billion by 2033. Other sectors such as Healthcare ($7.35 billion in 2023) and Transportation ($4.84 billion in 2023) also demonstrate steady growth driven by their increased reliance on integrated telecom systems.

Telecom System Integration Market Analysis By Solutions

The section detailing solutions indicates that Mobile Network Operators continue to capture the largest share of the market. Emerging solutions such as SDN and Service Integration are also evolving rapidly, though not yet surpassing the prominence of traditional network solutions but showing high growth rates in the coming years.

Telecom System Integration Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Telecom System Integration Industry

Cisco Systems, Inc.:

Cisco is a global leader in IT and networking solutions, providing tailoring solutions that help telecommunications companies integrate and streamline their operations, with a strong focus on security and data integration.IBM Corporation:

IBM offers comprehensive telecom system integration solutions, leveraging advanced AI analytics and cloud platforms to enable telecom operators to transform and enhance user experiences.Accenture:

Accenture provides an array of integration solutions tailored for the telecom industry, strategically focusing on modernization and digital transformation to increase efficiency and customer engagement.Oracle Corporation:

Oracle delivers innovative solutions targeted towards telecom clients for streamlined operations and integrated cloud services, enhancing customer relations and operational efficiencies.We're grateful to work with incredible clients.

FAQs

What is the market size of telecom System Integration?

The global telecom system integration market is valued at $35 billion in 2023, with expectations to grow at a CAGR of 6.5% over the next decade. Significant growth is anticipated, reflecting increasing demand for advanced telecom solutions and integration services.

What are the key market players or companies in the telecom System Integration industry?

Key players in the telecom system integration industry include major technology firms, telecom operators, and specialized integration service providers. These companies drive innovation, improve operational efficiencies, and enhance service delivery within the telecom sector.

What are the primary factors driving the growth in the telecom System Integration industry?

The growth in the telecom system integration market is driven by increasing mobile data traffic, rising demand for advanced network infrastructure, and the proliferation of IoT devices requiring robust integration solutions. Additionally, the transition to 5G technology plays a pivotal role.

Which region is the fastest Growing in the telecom System Integration?

The North America region is the fastest-growing in the telecom system integration market, with growth from $12.73 billion in 2023 to $24.29 billion by 2033. This growth is fueled by technological advancements and a high concentration of telecom companies.

Does ConsaInsights provide customized market report data for the telecom System Integration industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs of clients in the telecom system integration industry. This includes insights into market size, growth trends, and competitive landscape tailored to business requirements.

What deliverables can I expect from this telecom System Integration market research project?

Clients can expect comprehensive deliverables, including detailed market analysis reports, segment breakdowns, growth forecasts, competitive assessments, and strategic recommendations, all designed to aid in making informed business decisions.

What are the market trends of telecom System Integration?

Key trends in the telecom system integration market include increasing cloud adoption, the rise of 5G technology, and the growing importance of security in network integration. These factors are reshaping how telecom services are delivered and integrated globally.