Telematics Control Unit Market Report

Published Date: 31 January 2026 | Report Code: telematics-control-unit

Telematics Control Unit Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Telematics Control Unit market for the forecast period 2023-2033, featuring critical insights into market size, growth trends, segmentation, and the competitive landscape of the industry.

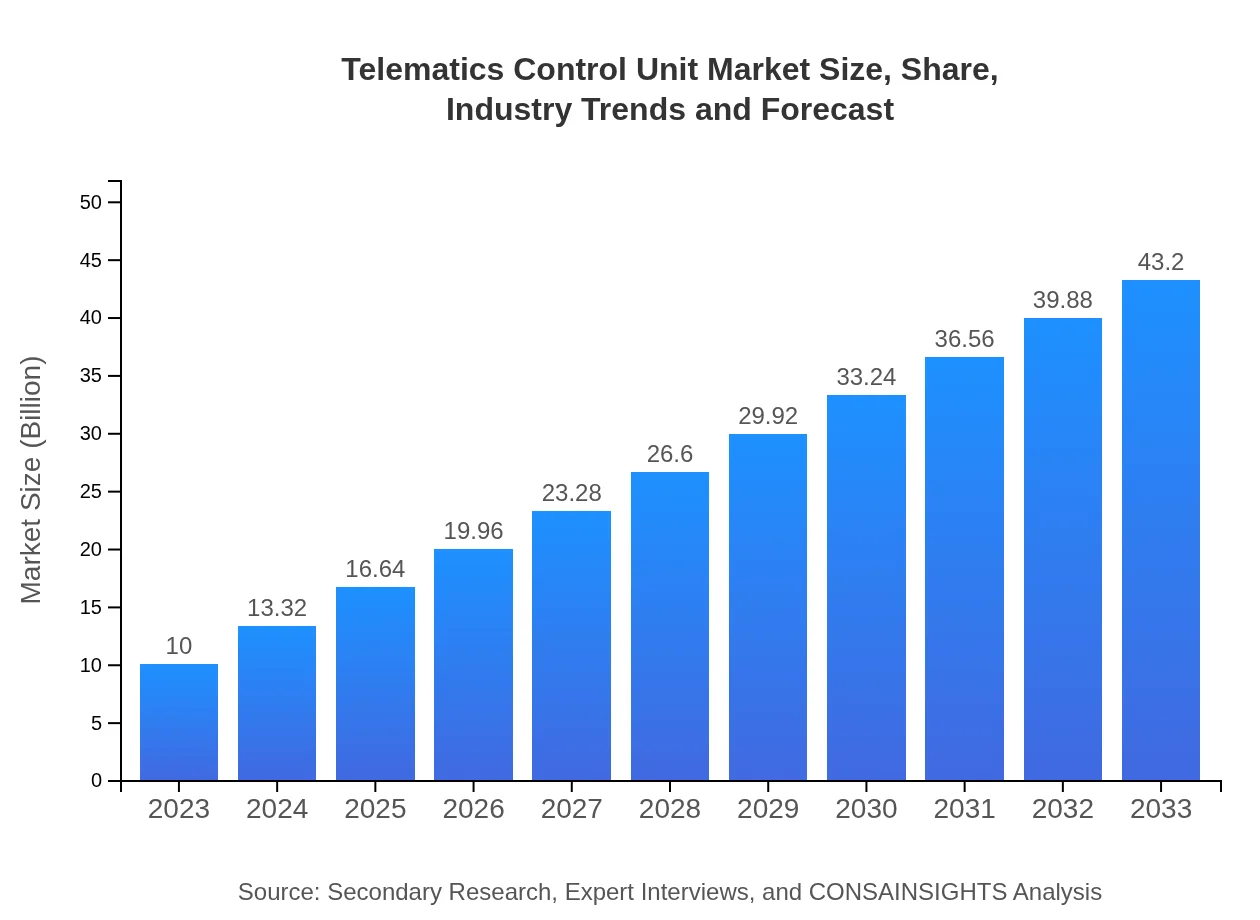

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.00 Billion |

| CAGR (2023-2033) | 15% |

| 2033 Market Size | $43.20 Billion |

| Top Companies | Continental AG, Bosch, Qualcomm , Verizon Connect |

| Last Modified Date | 31 January 2026 |

Telematics Control Unit Market Overview

Customize Telematics Control Unit Market Report market research report

- ✔ Get in-depth analysis of Telematics Control Unit market size, growth, and forecasts.

- ✔ Understand Telematics Control Unit's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Telematics Control Unit

What is the Market Size & CAGR of Telematics Control Unit Market in 2023?

Telematics Control Unit Industry Analysis

Telematics Control Unit Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Telematics Control Unit Market Analysis Report by Region

Europe Telematics Control Unit Market Report:

The European market is anticipated to grow from $2.56 billion in 2023 to approximately $11.06 billion by 2033, propelled by government initiatives promoting sustainable transportation and the integration of advanced telematics in new vehicle models.Asia Pacific Telematics Control Unit Market Report:

In 2023, the Telematics Control Unit market in Asia Pacific is valued at $2.00 billion, projected to grow to $8.63 billion by 2033. The growth is primarily driven by the booming automotive industry in countries like China and India, coupled with a rising demand for connected vehicles.North America Telematics Control Unit Market Report:

North America, valued at $3.80 billion in 2023, is anticipated to grow to $16.41 billion by 2033. The region leads in telematics adoption, driven by stringent regulations and a high emphasis on vehicle safety and automation.South America Telematics Control Unit Market Report:

The South American market for TCUs is initially valued at $0.33 billion in 2023, with expectations to reach $1.40 billion by 2033. The region's growth is influenced by increasing vehicle ownership and expanding automotive markets.Middle East & Africa Telematics Control Unit Market Report:

The Middle East and Africa region holds a market value of $1.32 billion in 2023, expected to rise to $5.70 billion by 2033. The region's growth is fueled by rising investments in smart transportation solutions and increasing vehicle connectivity.Tell us your focus area and get a customized research report.

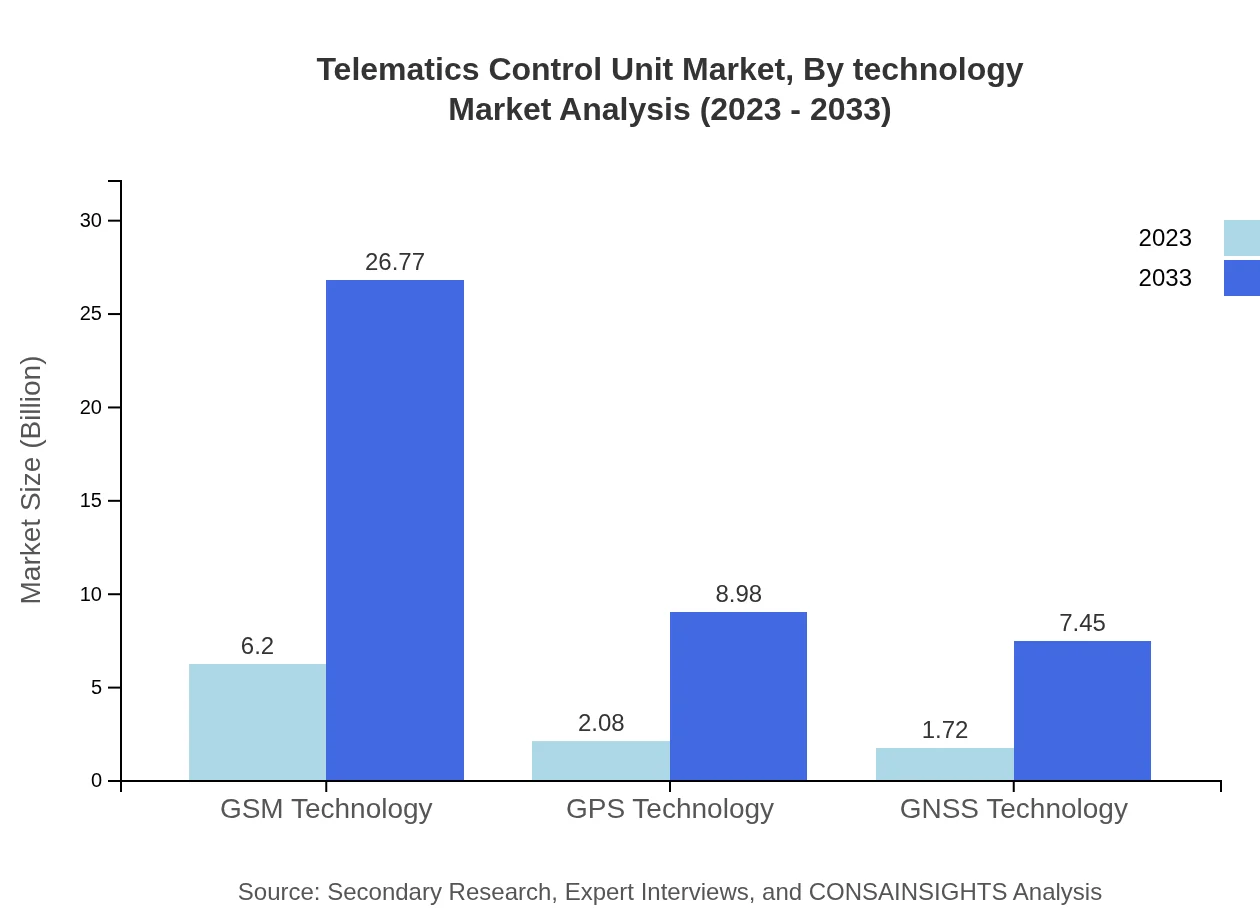

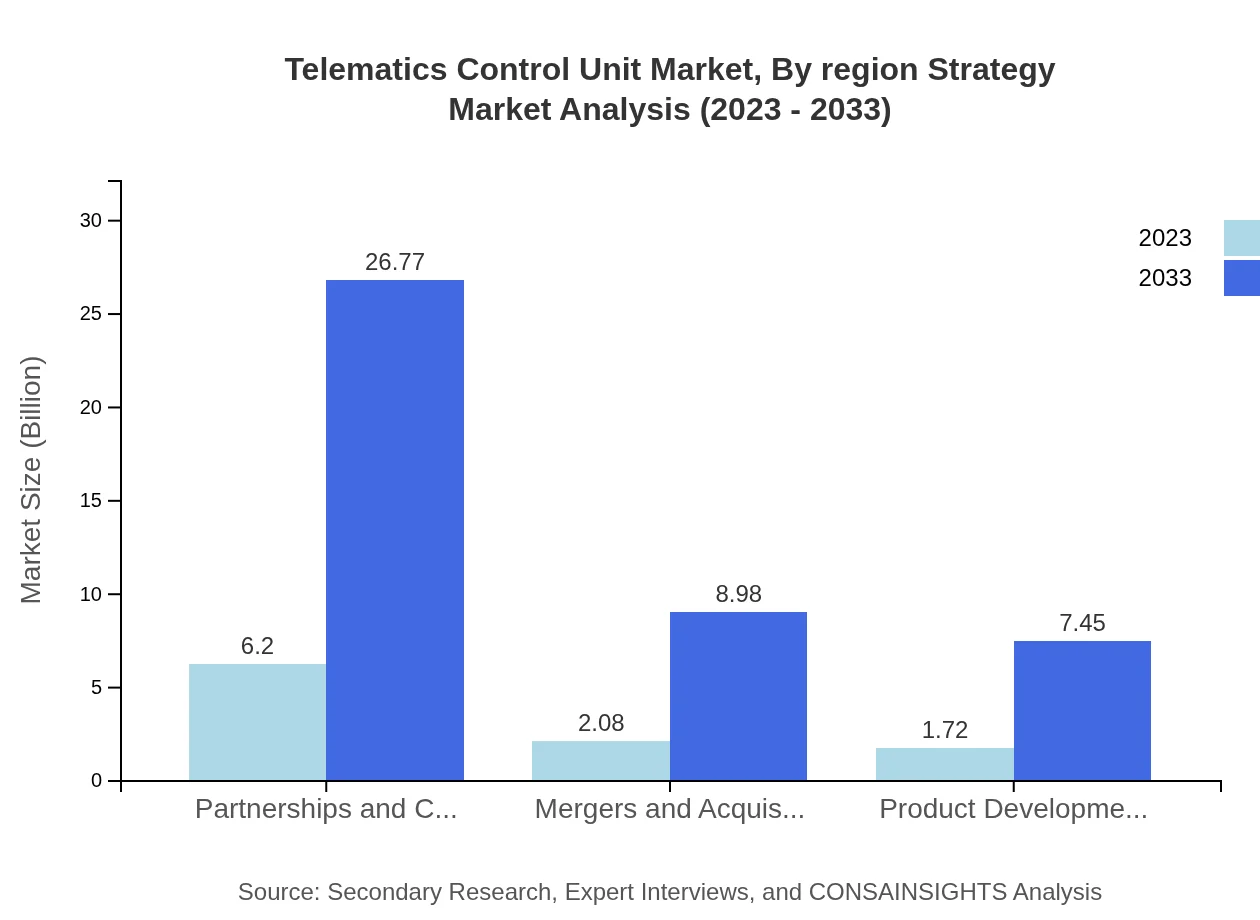

Telematics Control Unit Market Analysis By Technology

The Telematics Control Unit market is primarily segmented by technology types including GSM, GPS, and GNSS technologies. GSM technology dominates the market with a projected market size of $6.20 billion in 2023 and expected growth to $26.77 billion by 2033. GPS technology follows with a steady increase from $2.08 billion in 2023 to $8.98 billion in 2033, reflecting the rising demand for location-based services in telematics applications.

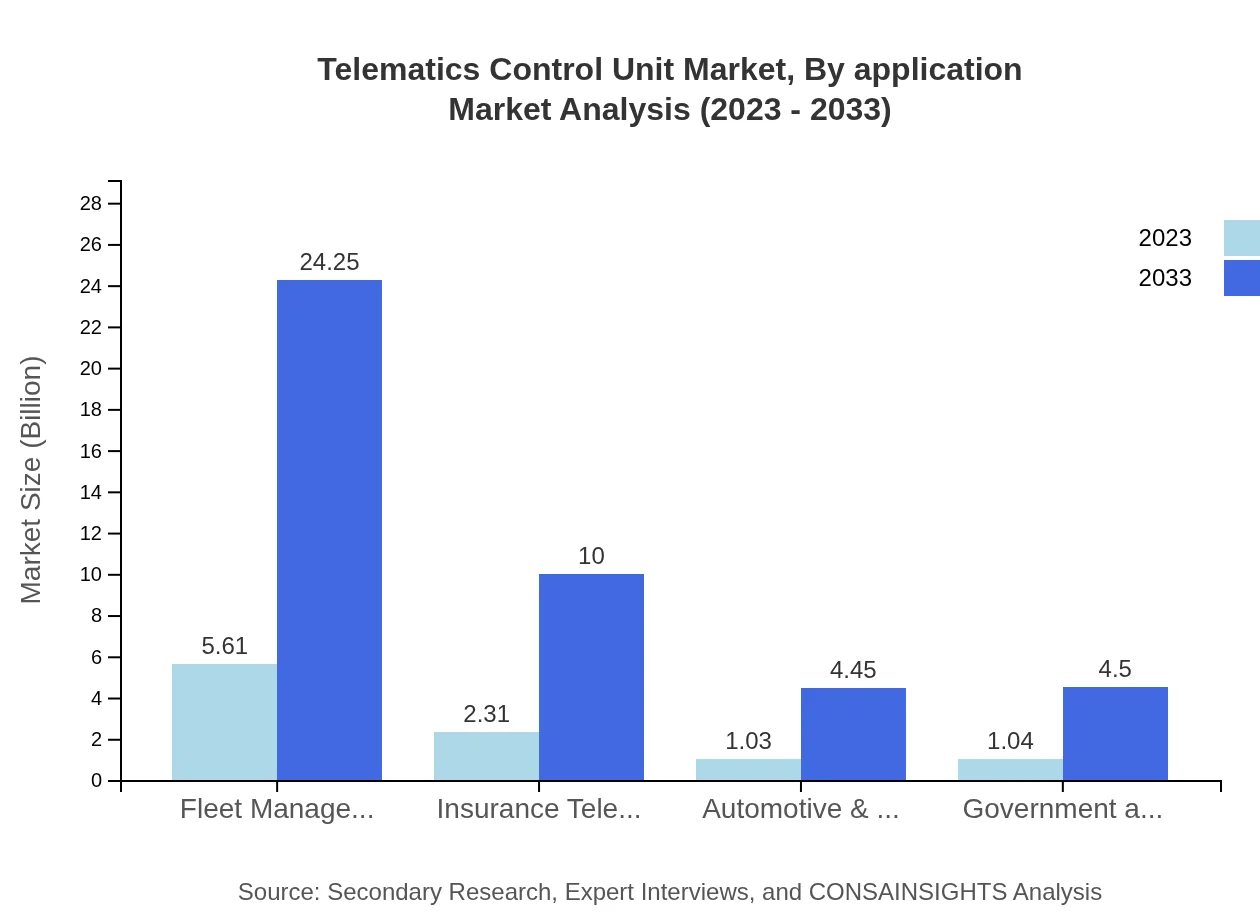

Telematics Control Unit Market Analysis By Application

In this segment, fleet management is a key driver, initially valued at $5.61 billion in 2023 and projected to grow to $24.25 billion by 2033. Insurance telematics is another significant application area, expanding from $2.31 billion in 2023 to $10.00 billion in 2033, reflecting the increasing trend of usage-based insurance models.

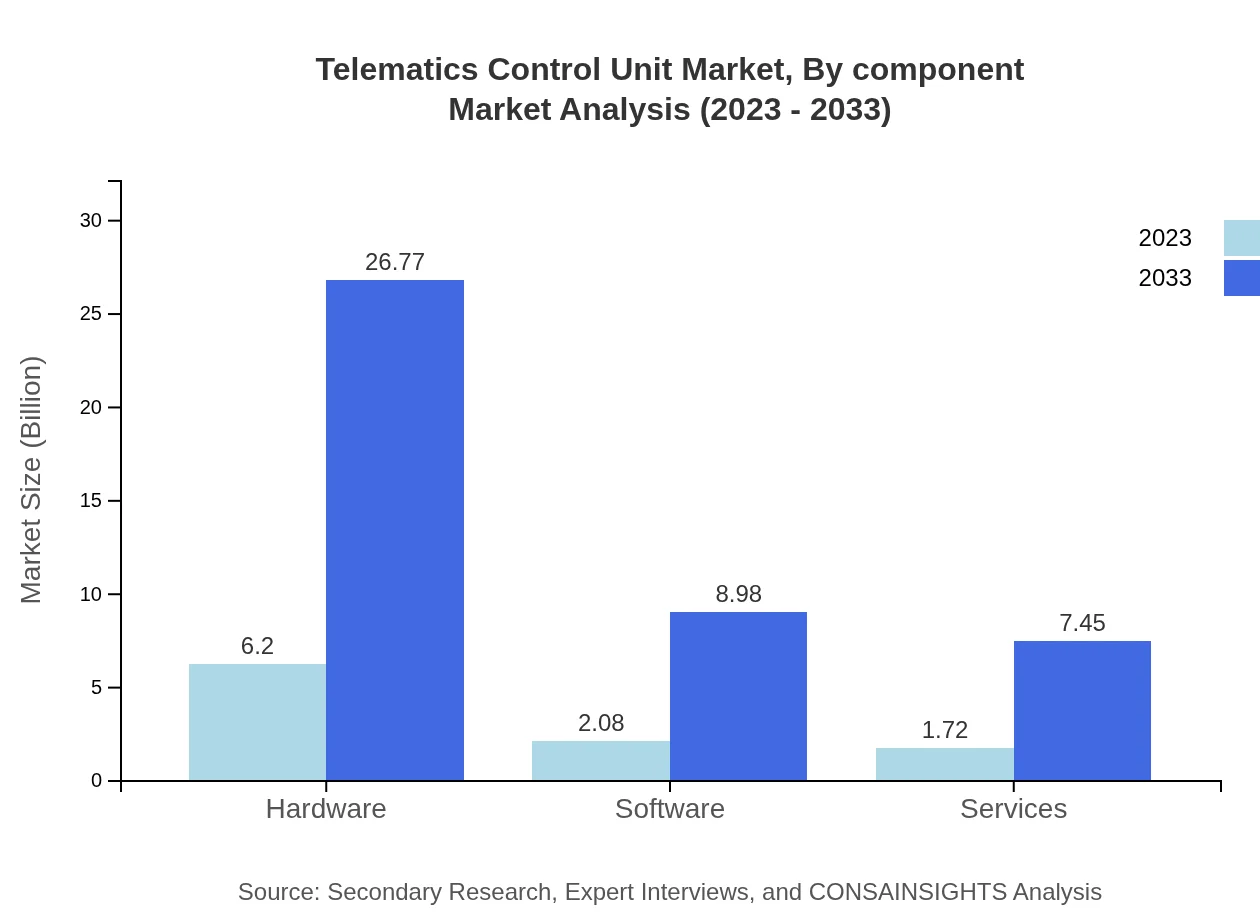

Telematics Control Unit Market Analysis By Component

The components segment includes hardware and software, with hardware leading at $6.20 billion in 2023, growing to $26.77 billion by 2033, as demand for integrated solutions rises. Software solutions account for $2.08 billion in 2023, expected to reach $8.98 billion by 2033, driven by the need for analytics and data processing capabilities.

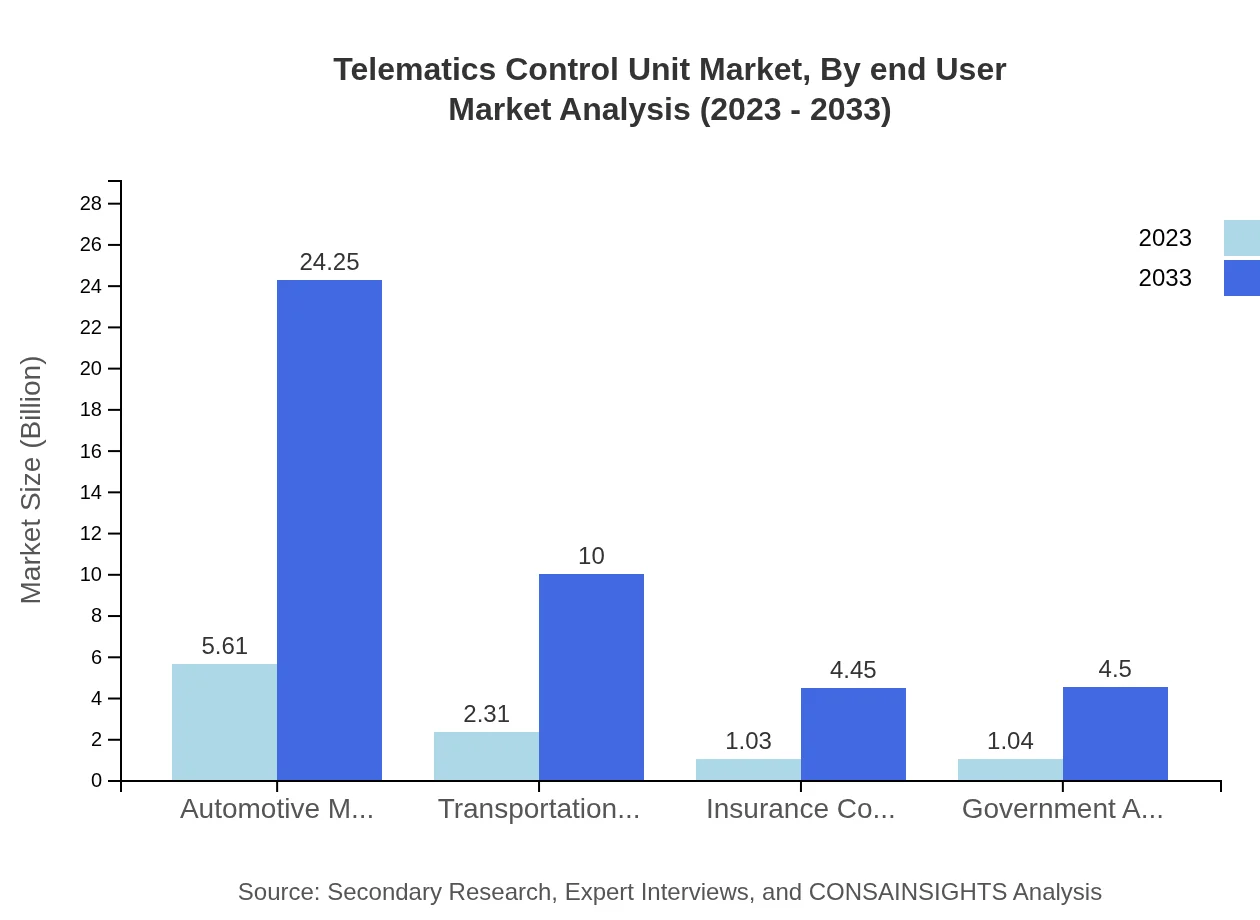

Telematics Control Unit Market Analysis By End User

Automotive manufacturers constitute the largest share of the end-user segment, valued at $5.61 billion in 2023, and forecasted to grow to $24.25 billion by 2033. The transportation and logistics sector also plays a crucial role, with a market size of $2.31 billion expanding to $10.00 billion over the same period.

Telematics Control Unit Market Analysis By Region Strategy

In terms of strategic approaches, partnerships and collaborations take precedence, holding a significant share of the market as companies aim to leverage synergies for innovative telematics solutions, while mergers and acquisitions play a vital role in enhancing technological capabilities to stay competitive.

Telematics Control Unit Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Telematics Control Unit Industry

Continental AG:

A leading technology company providing integrated hardware and software solutions for the automotive industry, specializing in telematics and connectivity.Bosch:

Globally recognized for its automotive components, Bosch is heavily invested in telematics technologies that enhance vehicle safety and connectivity.Qualcomm :

A pioneer in wireless technology, Qualcomm supports telematics innovations through its robust chipsets and connectivity solutions for automotive applications.Verizon Connect:

Offers fleet management and telematics solutions, promoting efficiency and safety for transportation sectors through advanced connectivity.We're grateful to work with incredible clients.

FAQs

What is the market size of telematics Control Unit?

The telematics control unit market is currently valued at approximately $10 billion in 2023, with an anticipated CAGR of 15%. By 2033, the market is projected to grow substantially, reflecting increasing adoption in automotive applications.

What are the key market players or companies in this telematics Control Unit industry?

Key players in the telematics control unit market include major automotive manufacturers, technology firms specializing in telematics solutions, and software providers known for robust fleet management systems, ensuring a competitive landscape.

What are the primary factors driving the growth in the telematics Control Unit industry?

Growth in the telematics control unit industry is driven by advancements in connectivity technologies, rising demand for vehicle safety features, adherence to regulatory standards, and increased focus on fleet optimization by businesses.

Which region is the fastest Growing in the telematics Control Unit?

The fastest-growing region in the telematics control unit market is expected to be North America, projected to grow from $3.80 billion in 2023 to $16.41 billion by 2033, driven by technology integration in vehicles.

Does ConsaInsights provide customized market report data for the telematics Control Unit industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the telematics control unit industry, allowing clients to obtain insights relevant to their particular focus areas.

What deliverables can I expect from this telematics Control Unit market research project?

Deliverables for the telematics control unit market research project typically include comprehensive market analysis reports, segment insights, growth forecasts, and actionable recommendations based on market trends.

What are the market trends of telematics Control Unit?

Current trends in the telematics control unit market include an increasing emphasis on connected car technologies, the integration of IoT for improved data analytics, and heightened investments in infrastructure.