Telematics Market Report

Published Date: 31 January 2026 | Report Code: telematics

Telematics Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Telematics market, including market size, regional insights, segmentation, and trends from 2023 to 2033, to support strategic business decisions.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

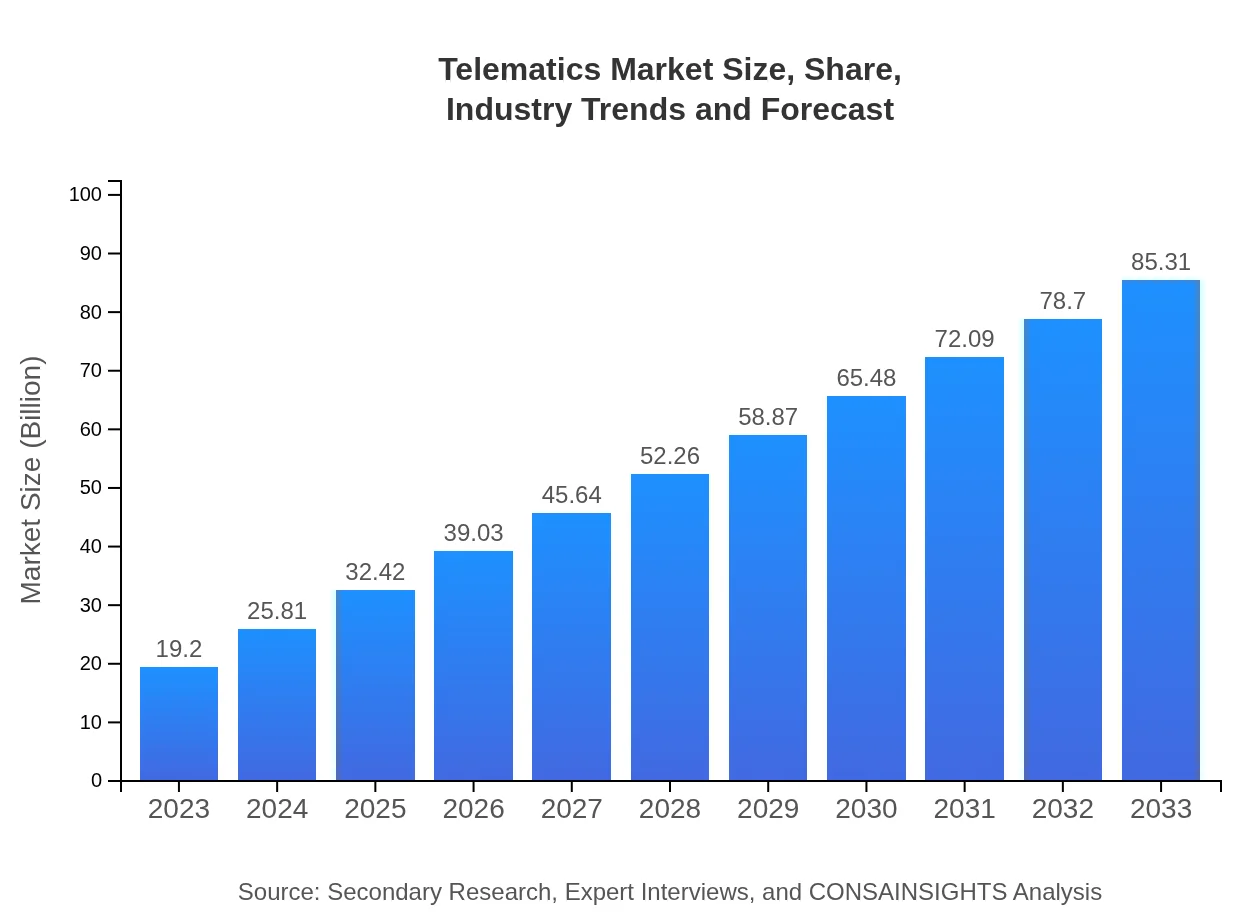

| 2023 Market Size | $19.20 Billion |

| CAGR (2023-2033) | 15.3% |

| 2033 Market Size | $85.31 Billion |

| Top Companies | Verizon Connect, TomTom Telematics, Geotab, Samsara , Zubie |

| Last Modified Date | 31 January 2026 |

Telematics Market Overview

Customize Telematics Market Report market research report

- ✔ Get in-depth analysis of Telematics market size, growth, and forecasts.

- ✔ Understand Telematics's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Telematics

What is the Market Size & CAGR of Telematics market in 2023?

Telematics Industry Analysis

Telematics Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Telematics Market Analysis Report by Region

Europe Telematics Market Report:

European countries are focusing on enhancing vehicle safety regulations, with the market expected to surge from $4.83 billion in 2023 to $21.45 billion by 2033, influenced by government initiatives promoting road safety.Asia Pacific Telematics Market Report:

In the Asia Pacific, the Telematics market value is projected to grow from $3.74 billion in 2023 to $16.63 billion by 2033, driven by increasing urbanization and demand for connected vehicles.North America Telematics Market Report:

North America is a dominant player in the Telematics market, with a value of $7.17 billion in 2023 anticipated to grow to $31.86 billion by 2033, supported by high adoption rates among insurance providers and fleet operations.South America Telematics Market Report:

Latin America anticipates growth in telementary solutions, projected to reach $3.52 billion in market size by 2033, due to rising demands in logistics and transportation sectors.Middle East & Africa Telematics Market Report:

The Middle East and Africa region shows potential for growth, from a market size of $2.67 billion in 2023 to $11.85 billion by 2033, driven by smart city initiatives and investments in intelligent transport systems.Tell us your focus area and get a customized research report.

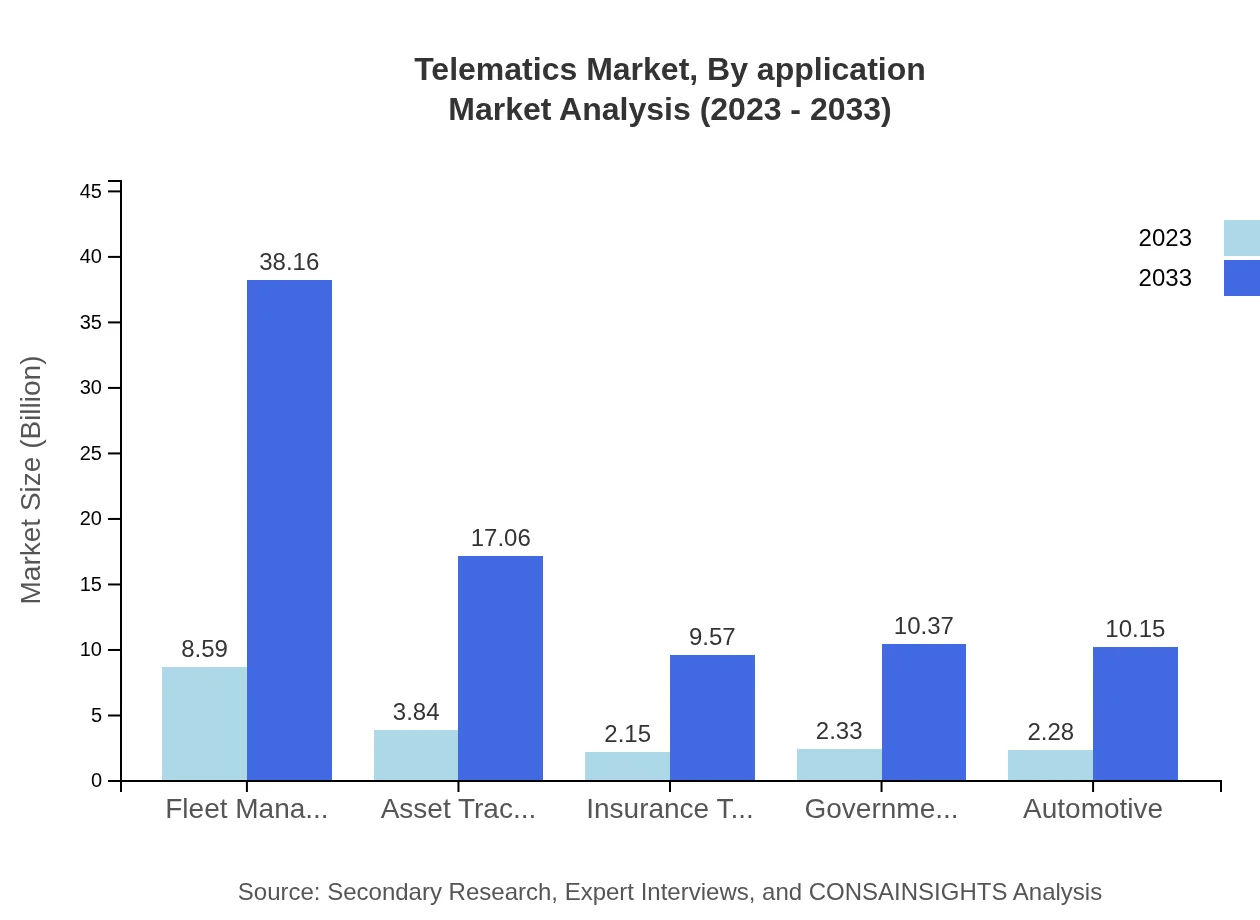

Telematics Market Analysis By Application

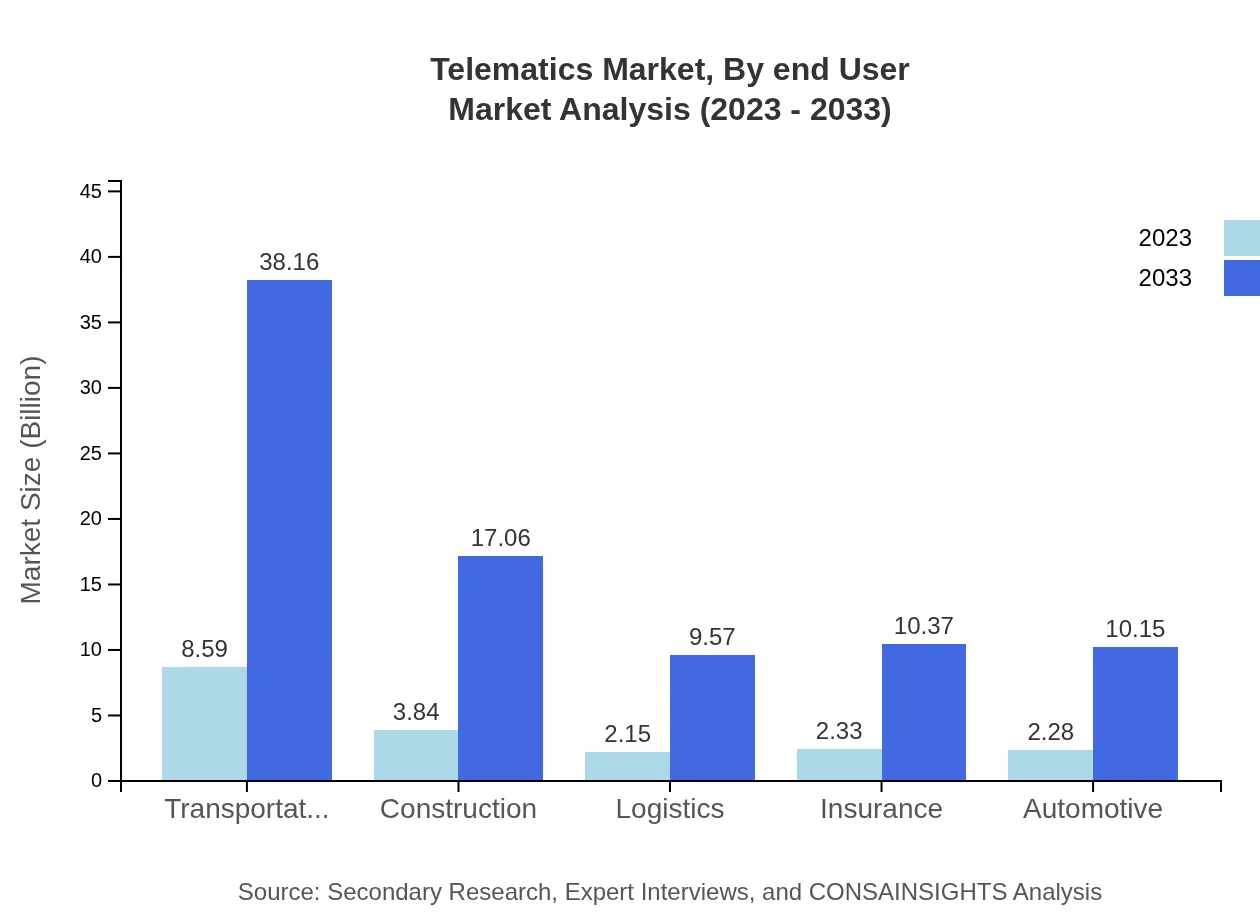

In 2023, the Transportation segment dominates the market, valued at $8.59 billion, with a forecasted growth to $38.16 billion by 2033, accounting for 44.73% of the share. The Construction segment follows closely, growing from $3.84 billion in 2023 to $17.06 billion in 2033. The Logistics segment is also significant, expected to rise from $2.15 billion to $9.57 billion by 2033. Insurance telematics is on a growth trajectory as well, projected to move from $2.33 billion to $10.37 billion, reflecting increasing demand for usage-based insurance models.

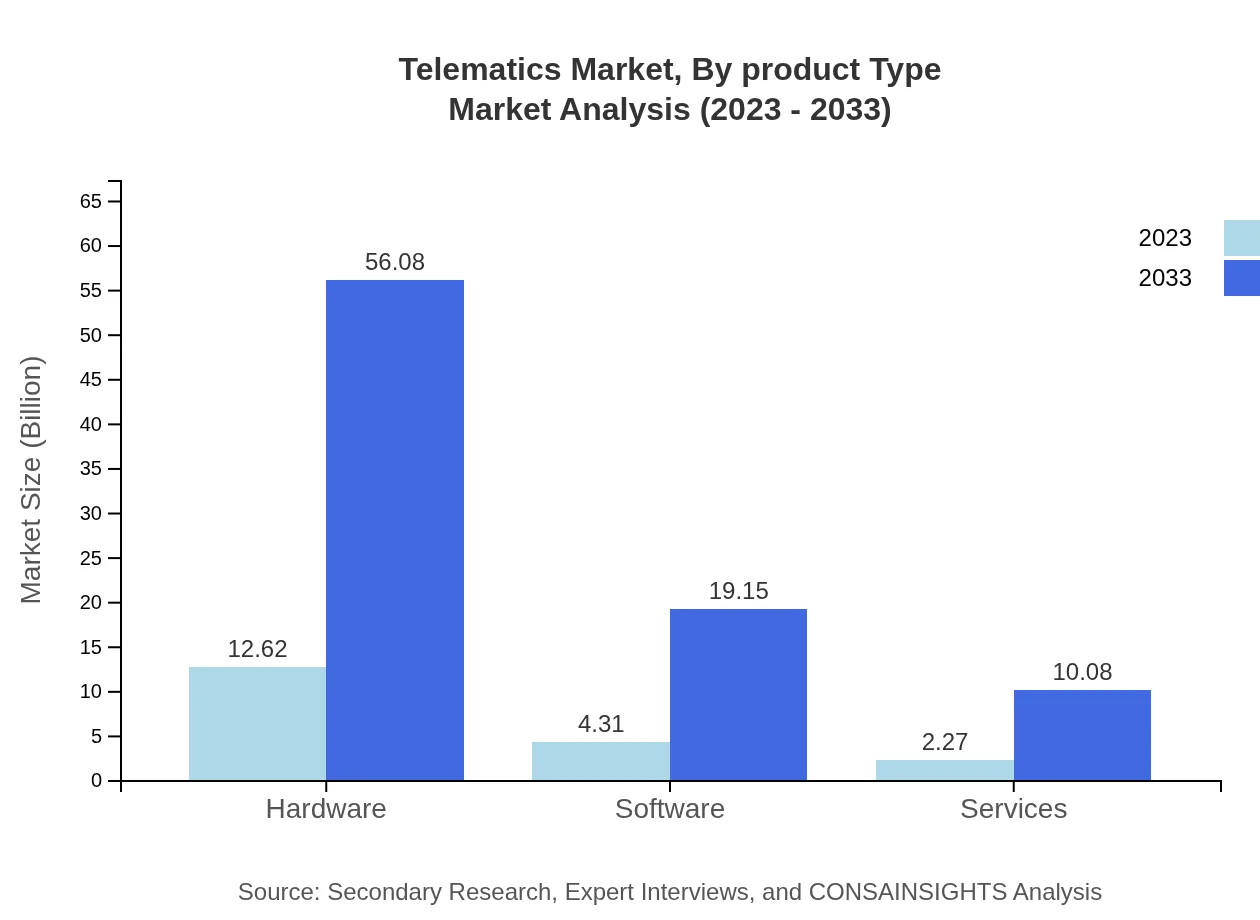

Telematics Market Analysis By Product Type

The hardware segment leads the market, valued at $12.62 billion in 2023, expected to expand to $56.08 billion by 2033, maintaining a share of 65.73%. The software segment is also growing, projected to rise from $4.31 billion to $19.15 billion, while the services segment is estimated to expand from $2.27 billion to $10.08 billion.

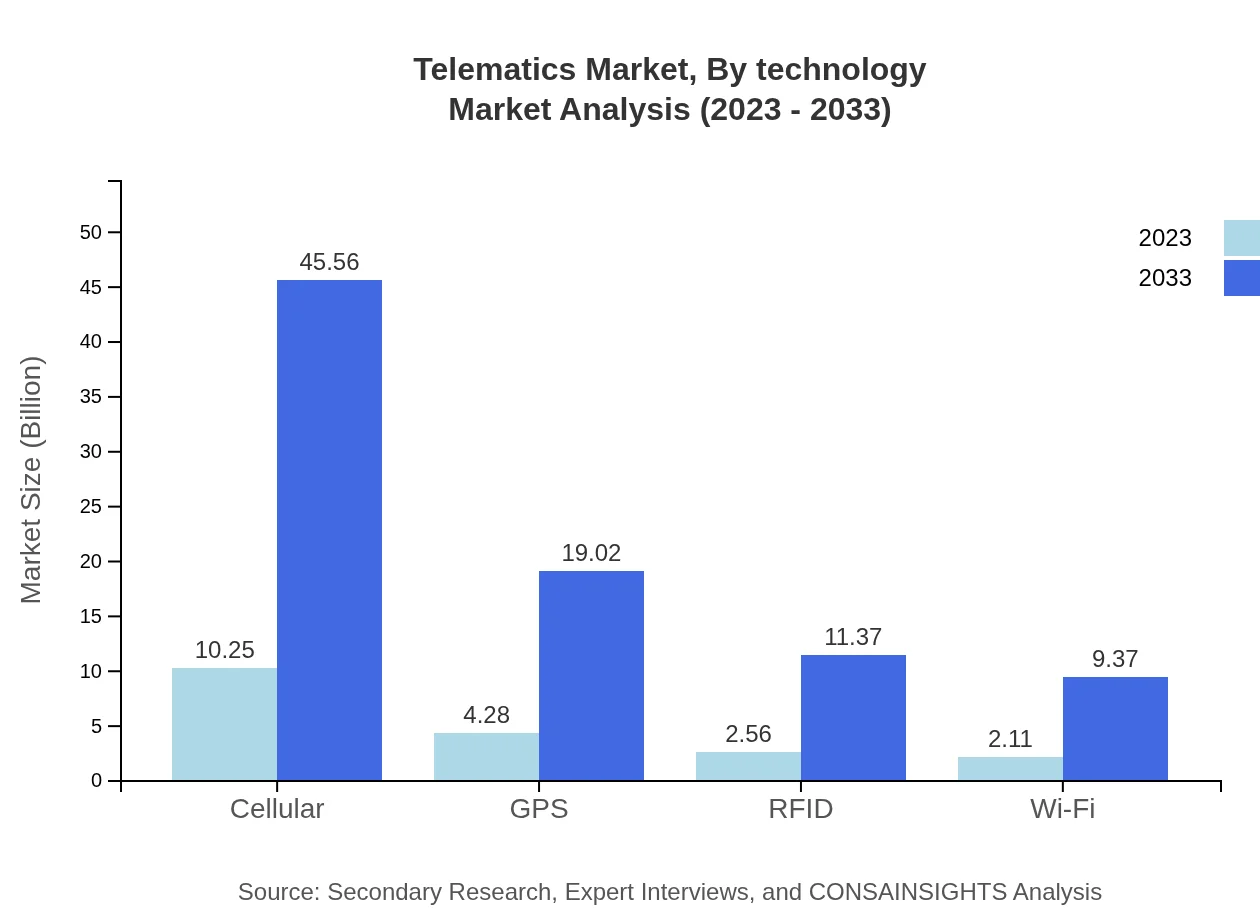

Telematics Market Analysis By Technology

Cellular technology currently holds the largest market share, valued at $10.25 billion, with projections of reaching $45.56 billion by 2033, demonstrating substantial growth driven by the proliferation of 4G and 5G connectivity. GPS technology is also notable, with its market size expected to escalate from $4.28 billion to $19.02 billion by 2033. Other technologies like RFID and Wi-Fi further enhance tracking and communication efficiencies across telematics applications.

Telematics Market Analysis By End User

The automotive sector shows significant market demand, with growth projected from $2.28 billion in 2023 to $10.15 billion by 2033. Fleet management is also crucial, similarly growing in tandem with advances in logistics and transportation services. End-users in government and public safety recognize the importance of telematics for emergency response and resource management, making it an essential area of growth.

Telematics Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Telematics Industry

Verizon Connect:

A leader in fleet management solutions, providing telematics services designed to enhance operational efficiency and safety for businesses.TomTom Telematics:

Provides GPS fleet management software and vehicle tracking solutions for enterprises worldwide.Geotab:

Known for its advanced telematics solutions, Geotab focuses on fleet management and vehicle tracking with a heavy emphasis on data analytics.Samsara :

Offers IoT solutions that include real-time GPS tracking and fleet management, aiming at improving safety and efficiency.Zubie:

Focuses on providing tracking solutions aimed at enhancing vehicle and driver safety through real-time data insights.We're grateful to work with incredible clients.

FAQs

What is the market size of telematics?

The telematics market is projected to grow from $19.2 billion in 2023 to significant heights by 2033, with a CAGR of 15.3%. This growth is driven by increasing demand for connected vehicle technologies and real-time data solutions.

What are the key market players or companies in this telematics industry?

Key players in the telematics industry include prominent companies such as Verizon, Siemens, and TomTom. These organizations lead through innovation and comprehensive offering of technologies and solutions in the streaming data and vehicle tracking sectors.

What are the primary factors driving the growth in the telematics industry?

Major factors driving telematics growth include the rising adoption of IoT technologies, demand for enhanced automotive safety, and the increased focus on fleet management efficiency. Additionally, regulatory mandates for vehicle tracking fuel this growth further.

Which region is the fastest Growing in the telematics?

The fastest-growing region in the telematics market is North America, projected to expand from $7.17 billion in 2023 to $31.86 billion by 2033. This growth is attributed to advanced technological adoption and regulatory support for advanced telematics solutions.

Does ConsaInsights provide customized market report data for the telematics industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs in the telematics industry. Clients can request detailed insights to support strategic decisions and investments in specific sector segments or geographic regions.

What deliverables can I expect from this telematics market research project?

Deliverables from this telematics market research project include comprehensive reports containing market trends, growth forecasts, competitive analysis, and detailed regional and segment insights. This data will assist stakeholders in making informed business decisions.

What are the market trends of telematics?

Current trends in the telematics market include the shift towards artificial intelligence and big data analytics for predictive insights. Furthermore, an increase in cloud-based solutions and partnerships for integrated telematics services are shaping market dynamics.