Telemetric Devices Market Report

Published Date: 31 January 2026 | Report Code: telemetric-devices

Telemetric Devices Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Telemetric Devices market, including insights on market size, growth rates, industry dynamics, and regional performances from 2023 to 2033. It highlights key trends, segmentations, and forecasts to equip stakeholders with valuable information for strategic decision-making.

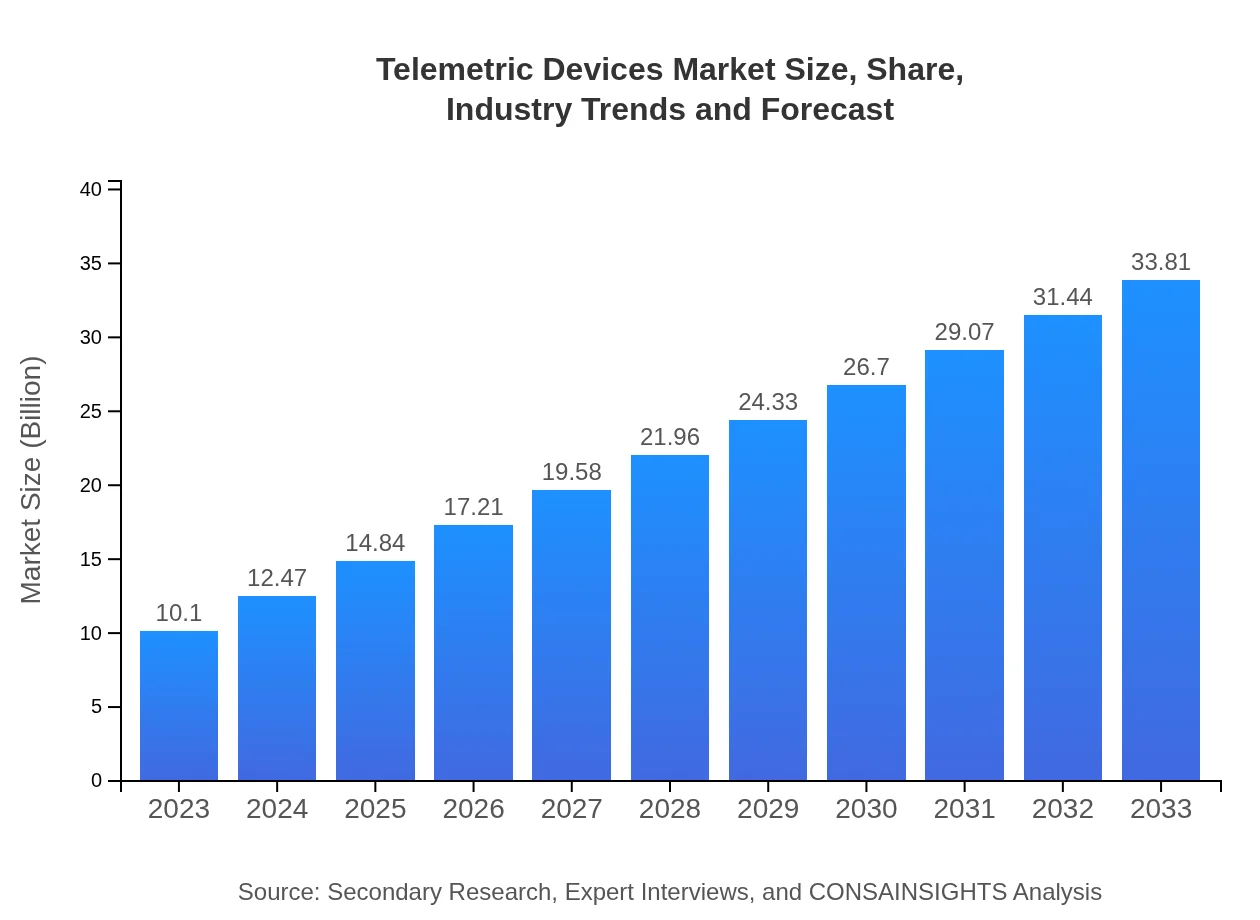

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.10 Billion |

| CAGR (2023-2033) | 12.3% |

| 2033 Market Size | $33.81 Billion |

| Top Companies | Siemens AG, Honeywell International Inc., Verizon Communications Inc., IBM Corporation, Cisco Systems, Inc. |

| Last Modified Date | 31 January 2026 |

Telemetric Devices Market Overview

Customize Telemetric Devices Market Report market research report

- ✔ Get in-depth analysis of Telemetric Devices market size, growth, and forecasts.

- ✔ Understand Telemetric Devices's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Telemetric Devices

What is the Market Size & CAGR of Telemetric Devices market in 2033?

Telemetric Devices Industry Analysis

Telemetric Devices Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Telemetric Devices Market Analysis Report by Region

Europe Telemetric Devices Market Report:

Europe's market is projected to grow from $2.43 billion in 2023 to $8.14 billion by 2033. The EU's focus on digital transformation and sustainability enhances the telemetric devices' growth prospects in the region.Asia Pacific Telemetric Devices Market Report:

In the Asia Pacific region, the Telemetric Devices market was valued at $2.15 billion in 2023 and is forecasted to reach $7.21 billion by 2033. The region is witnessing a surge in tech adoption, largely driven by countries like China and India, which focus on smart city initiatives and IoT infrastructure.North America Telemetric Devices Market Report:

North America leads the market with a valuation of $3.94 billion in 2023, expected to grow to $13.18 billion by 2033. The robust presence of tech giants and increased healthcare initiatives drive this region's growth.South America Telemetric Devices Market Report:

South America's market is estimated at $0.66 billion in 2023, projected to rise to $2.22 billion by 2033. Growing investments in telemedicine and smart agriculture are pushing the demand in this region, particularly post-pandemic.Middle East & Africa Telemetric Devices Market Report:

The market in the Middle East and Africa is expected to rise from $0.92 billion in 2023 to $3.07 billion by 2033, driven by enhanced connectivity solutions and the increasing relevance of telematics in resource management strategies.Tell us your focus area and get a customized research report.

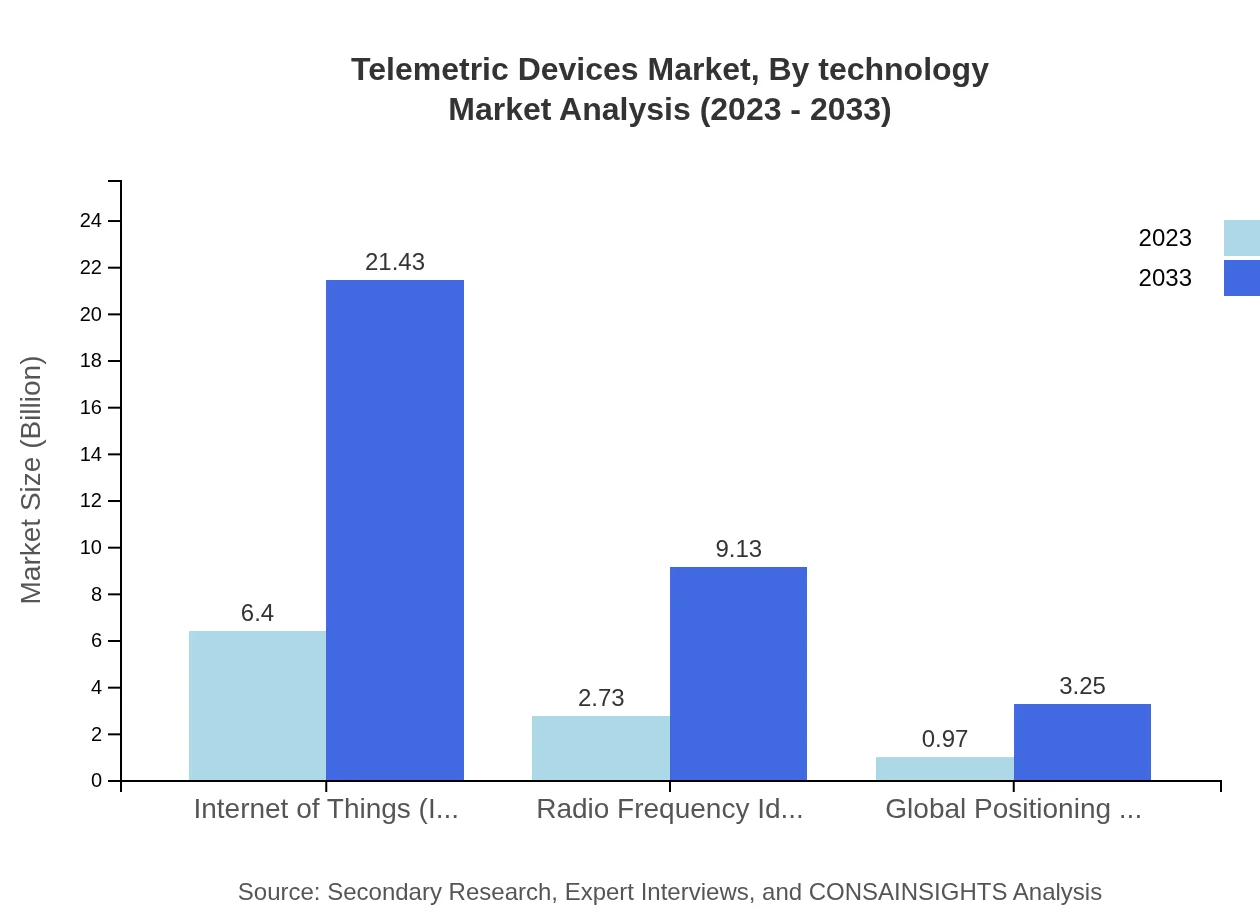

Telemetric Devices Market Analysis By Technology

The market, classified by technology, indicates that the Internet of Things (IoT) segment dominates with a market size of $6.40 billion in 2023, growing to $21.43 billion by 2033. RFID technology follows, valued at $2.73 billion in 2023 with growth to $9.13 billion anticipated by 2033. GPS technology holds a smaller share but remains essential for applications in transportation monitoring.

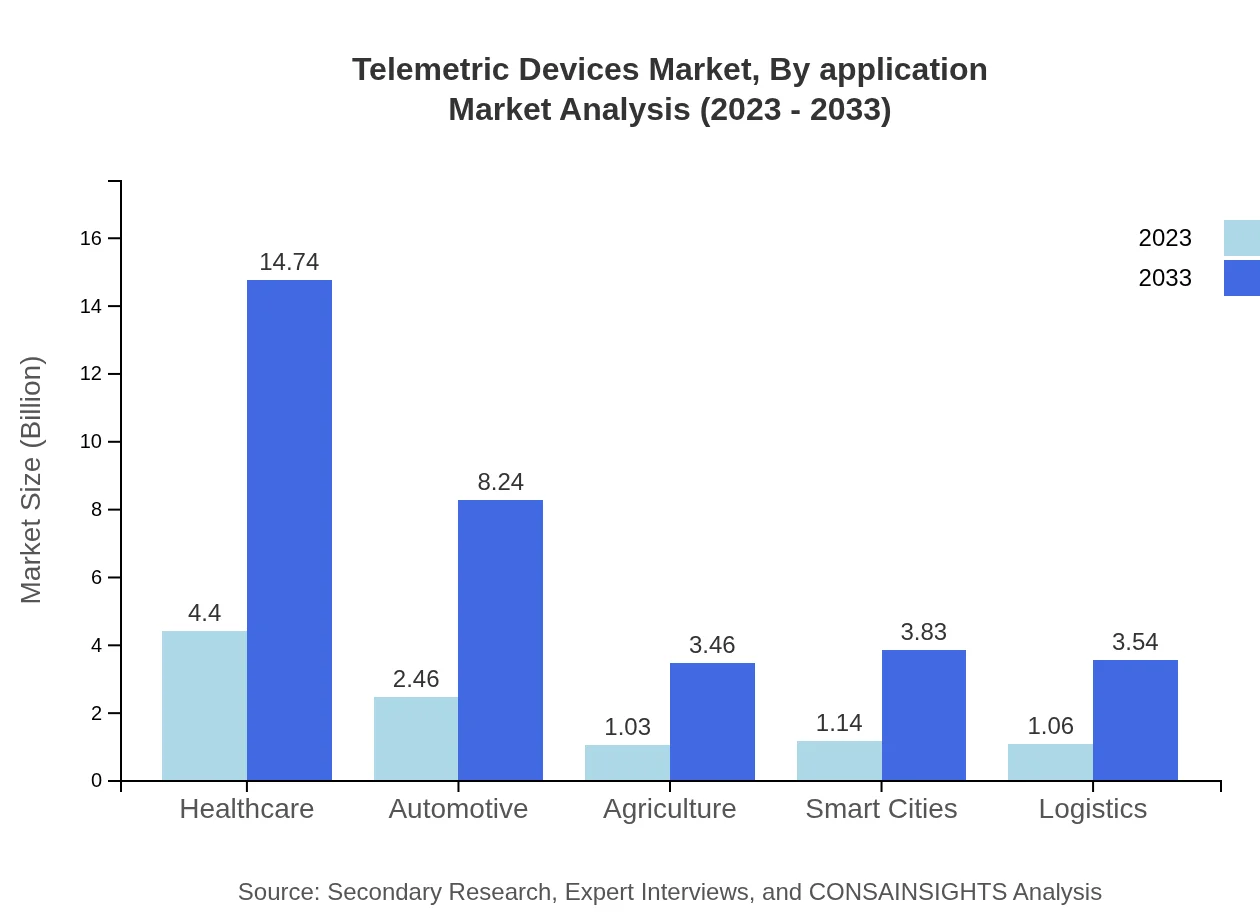

Telemetric Devices Market Analysis By Application

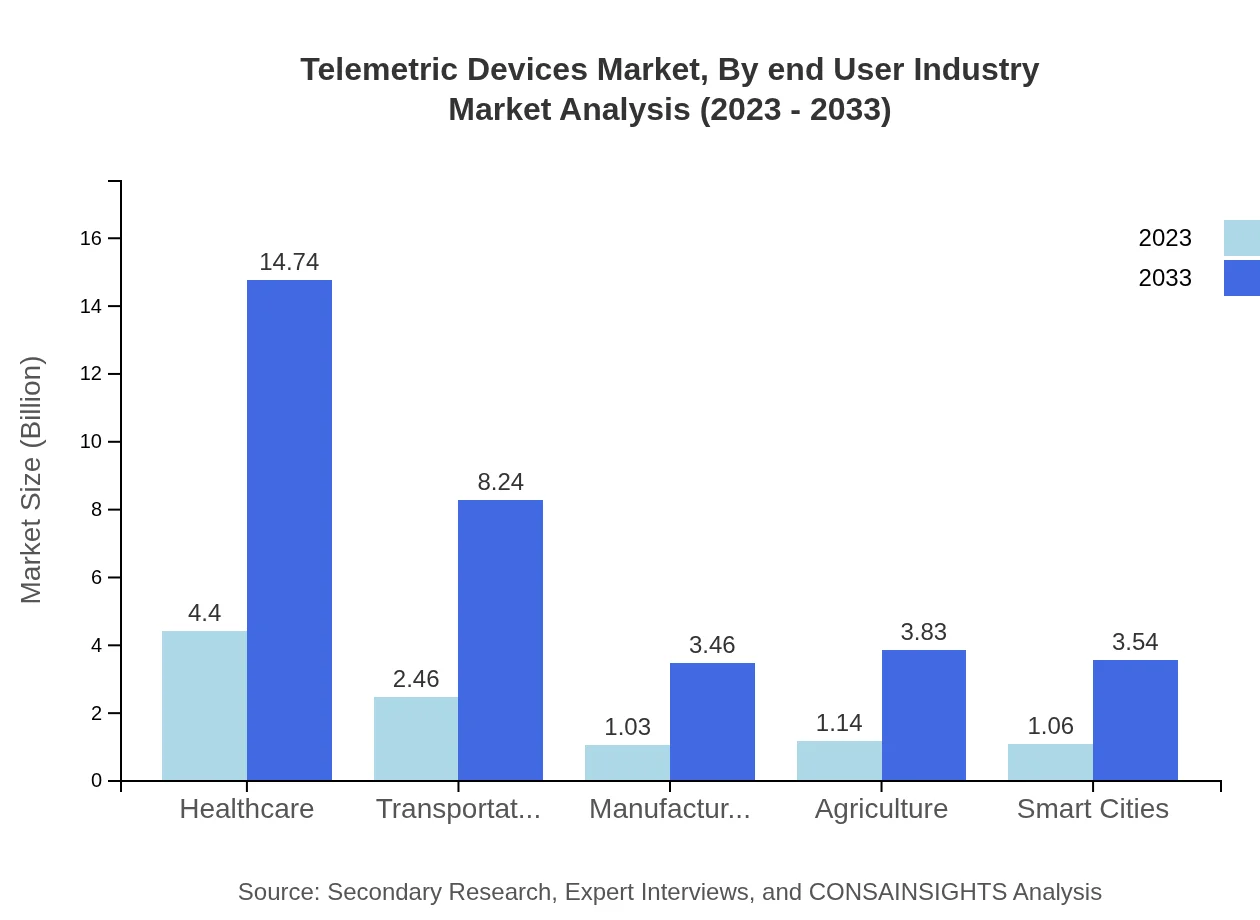

By application, healthcare leads the market, projected to grow from $4.40 billion in 2023 to $14.74 billion by 2033. IoT applications in wearables and health monitoring devices are significantly contributing to this growth. Other notable applications with strong potentials include automotive tracking and smart city solutions.

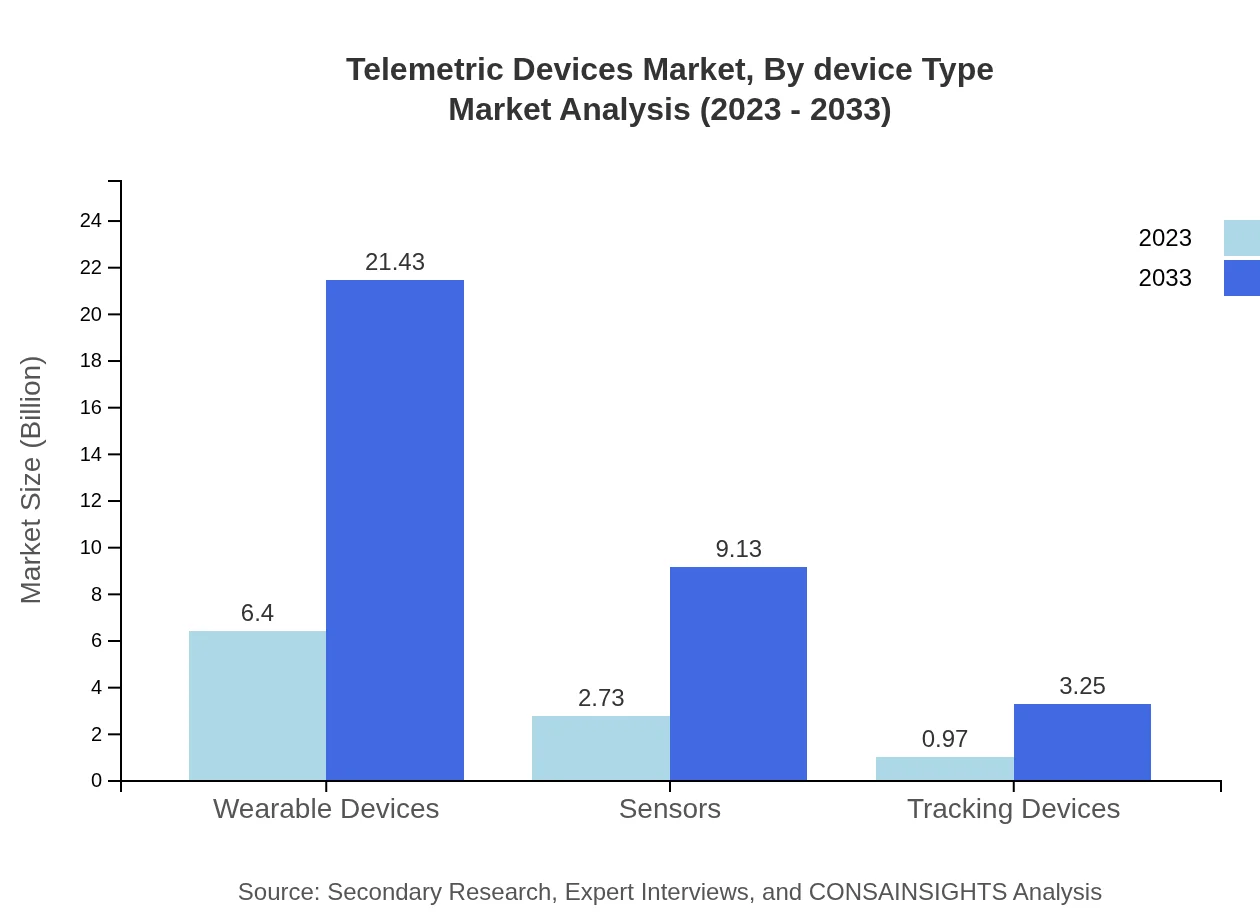

Telemetric Devices Market Analysis By Device Type

Device types within the market show that wearable devices dominate with $6.40 billion in 2023, expected to reach $21.43 billion by 2033, highlighting a strong consumer preference for health and activity monitoring technologies. Sensors and GPS tracking devices also play critical roles in various applications across industries.

Telemetric Devices Market Analysis By End User Industry

The key end-user industries include healthcare, automotive, manufacturing, and logistics. In healthcare, the market is expected to grow from $4.40 billion in 2023 to $14.74 billion by 2033, demonstrating the critical need for telemetric solutions for patient care and management.

Telemetric Devices Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Telemetric Devices Industry

Siemens AG:

A leading global technology company that has significantly invested in IoT solutions and telemetric technologies to enhance manufacturing and urban smart solutions.Honeywell International Inc.:

Honeywell is recognized for its innovations in connectivity, offering telemetric devices that serve in diverse sectors from aerospace to building management.Verizon Communications Inc.:

Verizon leverages its extensive telecommunications network to provide robust telemetric solutions, particularly focused on logistics and fleet management.IBM Corporation:

IBM's integration of AI and cognitive computing into telemetric devices offers advanced data analytics capabilities, enhancing operational effectiveness across industries.Cisco Systems, Inc.:

Cisco specializes in telemetric network solutions and provides technologies facilitating seamless data collection and smart device integration.We're grateful to work with incredible clients.

FAQs

What is the market size of telemetric devices?

The telemetric devices market is projected to reach $10.1 billion by 2033, expanding at a CAGR of 12.3% from a current size in 2023. This growth is fueled by increasing demand for real-time data across various sectors.

What are the key market players or companies in this telemetric devices industry?

Key players in the telemetric devices industry include firms specializing in IoT technologies, healthcare applications, automotive tracking, and agricultural monitoring. These companies drive innovation and competitive dynamics within the market, ensuring diverse solutions.

What are the primary factors driving the growth in the telemetric devices industry?

The growth of the telemetric devices industry is driven by the increasing adoption of IoT solutions, advancements in wireless technologies, and rising demand for real-time monitoring and analytics across multiple sectors including healthcare and transportation.

Which region is the fastest Growing in the telemetric devices market?

North America is the fastest-growing region in the telemetric devices market, expected to grow from $3.94 billion in 2023 to $13.18 billion by 2033. Other rapidly expanding regions include Europe and Asia Pacific, showing significant growth potentials.

Does ConsaInsights provide customized market report data for the telemetric devices industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the telemetric devices industry. Clients can receive insights and analysis focused on unique segments, regional trends, and competitive landscapes in the market.

What deliverables can I expect from this telemetric devices market research project?

From this telemetric devices market research project, you can expect comprehensive analysis reports, regional breakdowns, segmentation data, market forecasts, and insights into key players, trends, and emerging technologies impacting market growth.

What are the market trends of telemetric devices?

Market trends in telemetric devices include the integration of AI with IoT, increasing use of wearable technology, growth in smart cities initiatives, and heightened focus on sustainable and efficient transportation solutions.