Teleradiology Market Report

Published Date: 31 January 2026 | Report Code: teleradiology

Teleradiology Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Teleradiology market, exploring current trends, growth projections, and market dynamics from 2023 to 2033. Valuable insights on regional performances and leading players in the industry are also discussed.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.30 Billion |

| CAGR (2023-2033) | 12.7% |

| 2033 Market Size | $35.82 Billion |

| Top Companies | Radiology Partners, vRad (Virtual Radiologic), Telemedicine Clinic |

| Last Modified Date | 31 January 2026 |

Teleradiology Market Overview

Customize Teleradiology Market Report market research report

- ✔ Get in-depth analysis of Teleradiology market size, growth, and forecasts.

- ✔ Understand Teleradiology's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Teleradiology

What is the Market Size & CAGR of Teleradiology market in 2023?

Teleradiology Industry Analysis

Teleradiology Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Teleradiology Market Analysis Report by Region

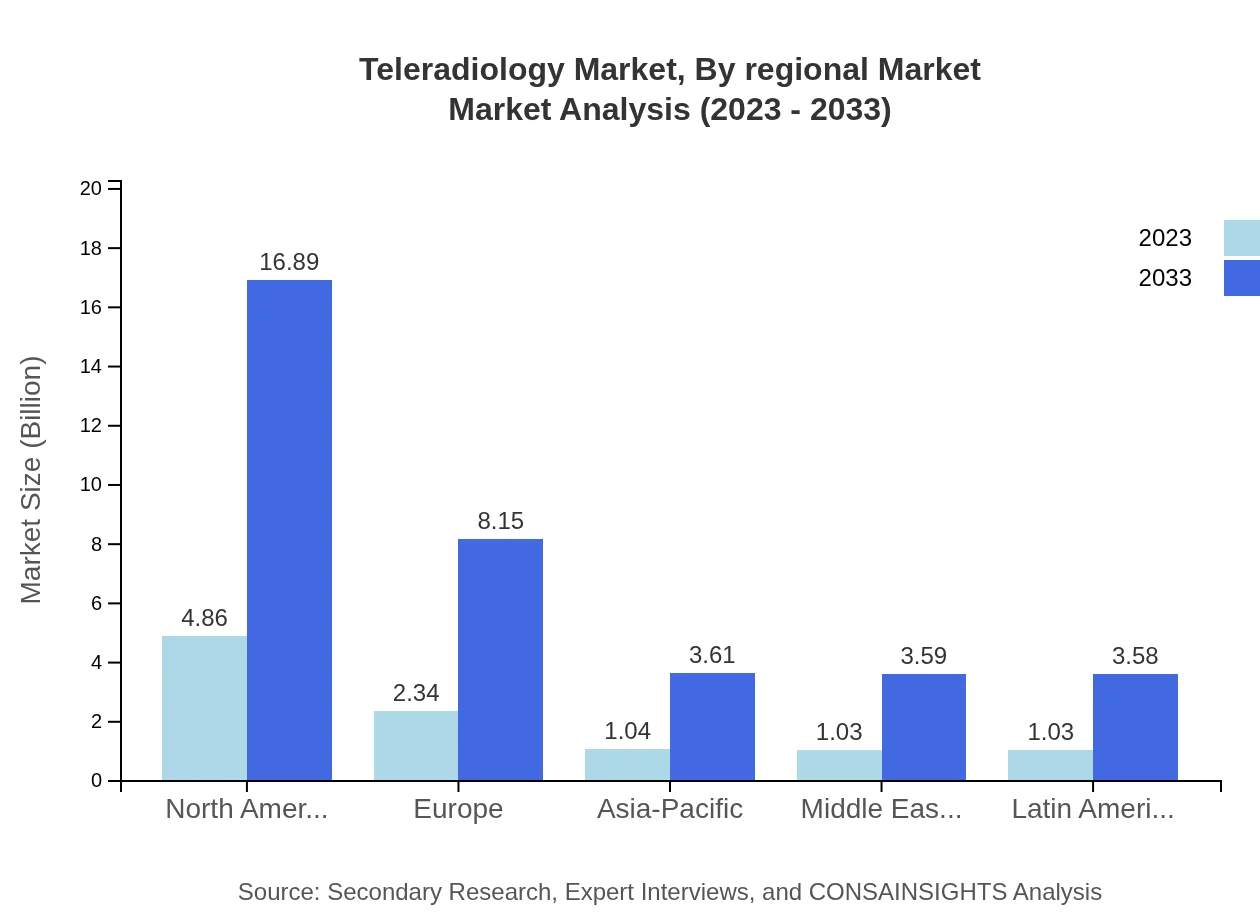

Europe Teleradiology Market Report:

The European Teleradiology market, valued at $2.94 billion in 2023, is expected to grow significantly to $10.22 billion by 2033. The market's expansion is driven by increasing investments in healthcare IT and a substantial rise in diagnostic imaging demand.Asia Pacific Teleradiology Market Report:

Asia-Pacific's Teleradiology market, valued at $2.00 billion in 2023, is expected to reach $6.95 billion by 2033, propelled by increasing healthcare expenditures, technological advancements, and a growing focus on telemedicine initiatives.North America Teleradiology Market Report:

North America holds a substantial market, expected to grow from $3.40 billion in 2023 to $11.82 billion in 2033 due to high adoption rates of digital solutions, an aging population, and a strong healthcare framework that supports teleradiology services.South America Teleradiology Market Report:

In South America, the market is projected to grow from $0.94 billion in 2023 to $3.27 billion in 2033, aided by improvements in healthcare access and rising awareness of teleradiology benefits.Middle East & Africa Teleradiology Market Report:

In the Middle East and Africa, the market stood at $1.02 billion in 2023 and is expected to grow to approximately $3.55 billion by 2033, driven by improving healthcare infrastructure and a rising demand for efficient healthcare delivery models.Tell us your focus area and get a customized research report.

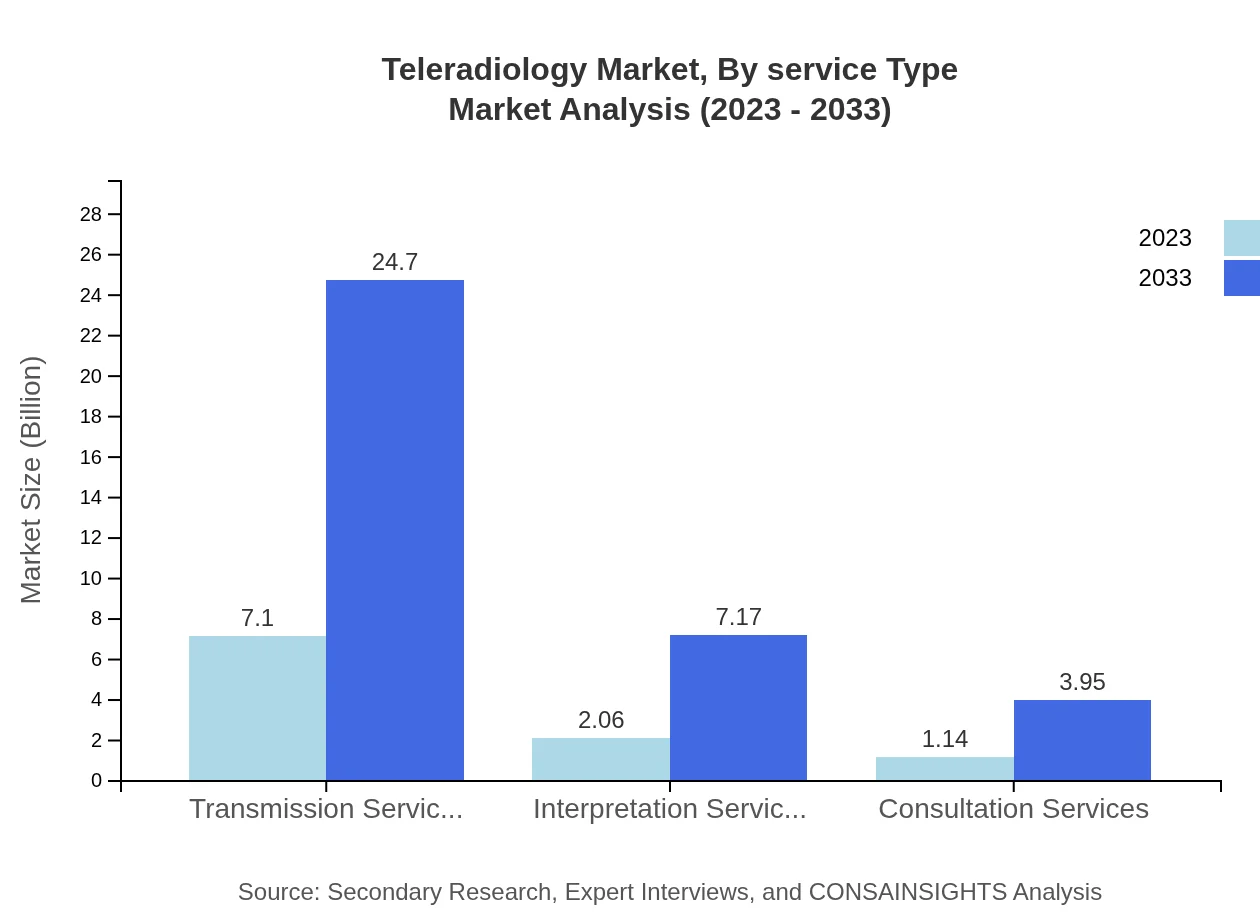

Teleradiology Market Analysis By Service Type

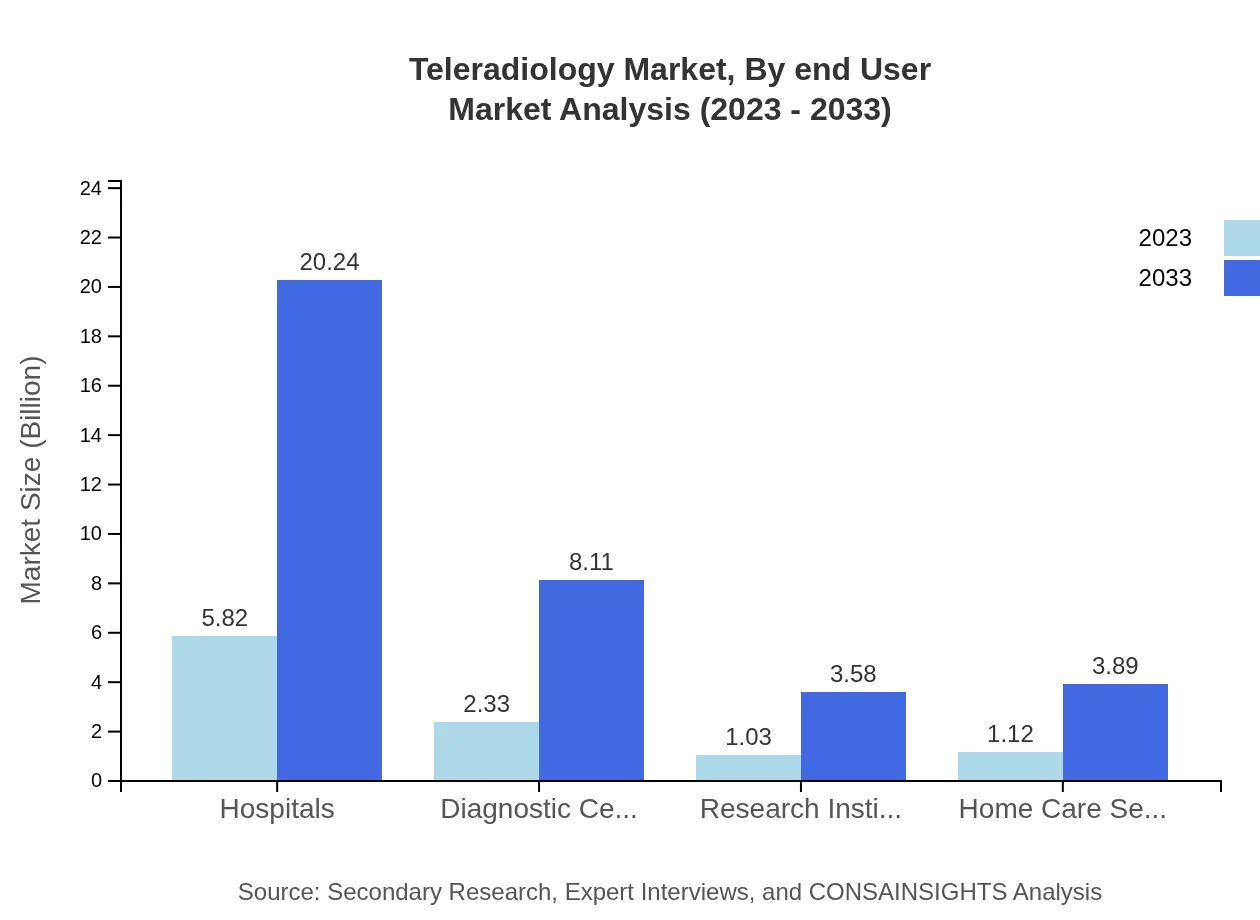

The Teleradiology market by service type includes Hospitals, Diagnostic Centers, Research Institutes, and Home Care Settings. Hospitals dominate this segment, representing $5.82 billion in 2023 and projected to grow to $20.24 billion by 2033. Diagnostic Centers also show strong performance with a market value of $2.33 billion in 2023 and expected growth to $8.11 billion in 2033.

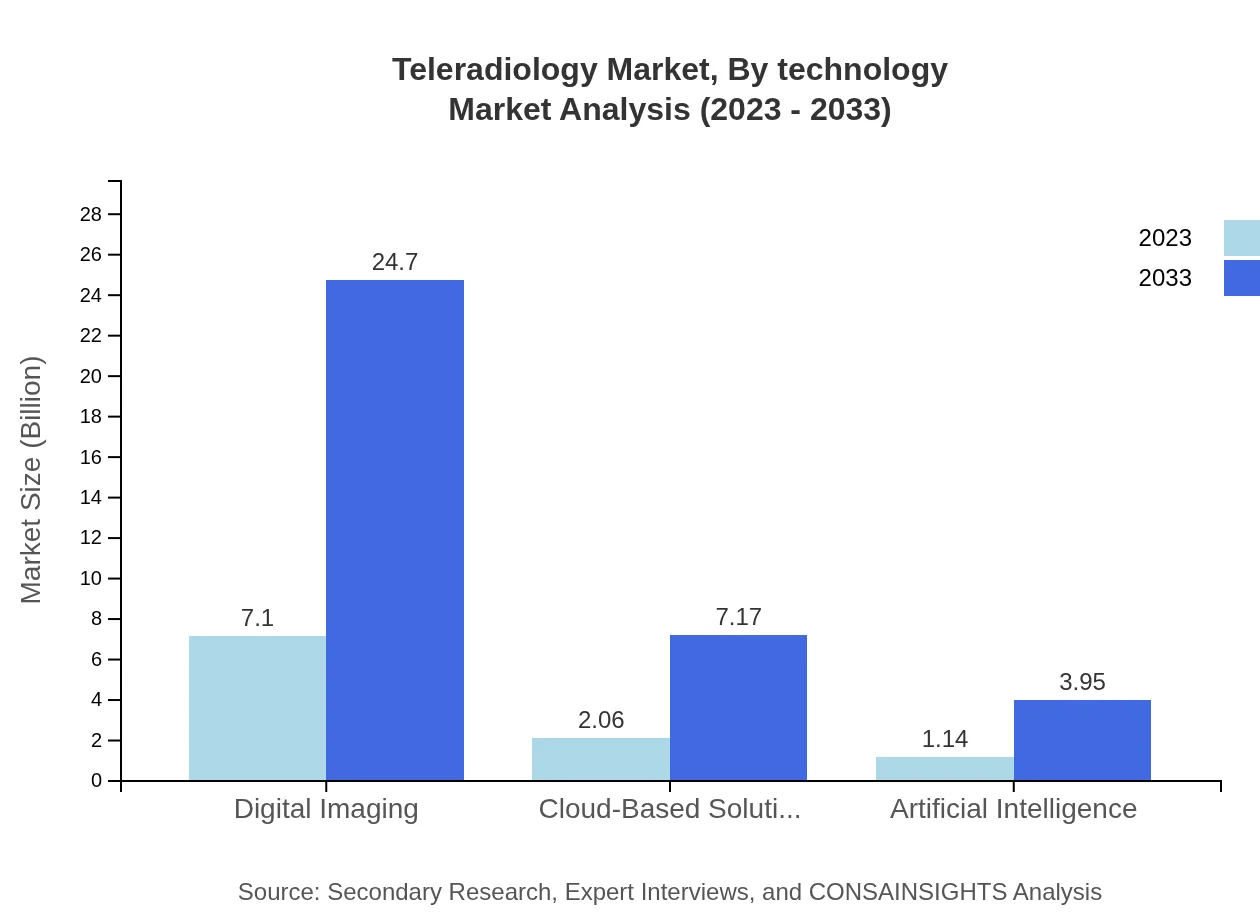

Teleradiology Market Analysis By Technology

The technology segment features Digital Imaging, Cloud-Based Solutions, and Artificial Intelligence. Digital Imaging leads with a market size of $7.10 billion in 2023, projected to reach $24.70 billion by 2033. Cloud-Based Solutions and Artificial Intelligence are also vital, with respective valuations of $2.06 billion and $1.14 billion in 2023, expanding significantly by 2033.

Teleradiology Market Analysis By End User

End-user segmentation reflects the distribution of Teleradiology services across sectors such as hospitals and research institutes. Hospitals represent a significant market share of 56.52% in 2023. Research Institutes are emerging entities with a consistent share of 10%.

Teleradiology Market Analysis By Regional Market

This section evaluates the Teleradiology market from regional perspectives, showcasing unique growth dynamics across North America, Europe, Asia-Pacific, South America, and the Middle East & Africa. North America leads with an approximate size of $4.86 billion in 2023, while Asia-Pacific is growing at a rapid pace, demonstrating a market increase from $1.04 billion to $3.61 billion by 2033.

Teleradiology Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Teleradiology Industry

Radiology Partners:

Radiology Partners is a leading teleradiology provider in the United States, focusing on improving the quality of imaging services and enhancing patient care through innovative technology.vRad (Virtual Radiologic):

vRad is a prominent teleradiology service provider known for its advanced imaging technology and a large team of board-certified radiologists, offering services to healthcare providers across the United States.Telemedicine Clinic:

Telemedicine Clinic specializes in providing remote diagnostic services, connecting patients with certified specialists through their platform, significantly improving healthcare access.We're grateful to work with incredible clients.

FAQs

What is the market size of teleradiology?

The teleradiology market is projected to reach $10.3 billion by 2033, growing at a CAGR of 12.7%. In 2023, the market was valued at approximately $3.3 billion.

What are the key market players or companies in this teleradiology industry?

Key players in the teleradiology market include Cerner Corporation, Siemens Healthineers, GE Healthcare, Fujifilm Holdings Corporation, and Agfa-Gevaert Group, among others, driving innovation and competition.

What are the primary factors driving the growth in the teleradiology industry?

Growth in the teleradiology industry is driven by an increasing demand for radiology services, advancements in telecommunication technology, a growing aging population, and a rising incidence of chronic diseases requiring imaging.

Which region is the fastest Growing in the teleradiology?

The Asia-Pacific region is the fastest-growing market for teleradiology, projected to expand from $2.00 billion in 2023 to $6.95 billion by 2033, reflecting a growing healthcare infrastructure and demand.

Does ConsaInsights provide customized market report data for the teleradiology industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the teleradiology industry, providing insights suited to the unique requirements of businesses and stakeholders.

What deliverables can I expect from this teleradiology market research project?

Deliverables include comprehensive market analysis reports, detailed forecasts, competitive landscape overviews, segmentation data, and insights into trends impacting the teleradiology market.

What are the market trends of teleradiology?

Current trends in teleradiology include a shift towards cloud-based solutions, integration of AI for diagnostics, increasing reliance on remote consultations, and enhanced digital imaging technologies.