Terminal Management System Market Report

Published Date: 22 January 2026 | Report Code: terminal-management-system

Terminal Management System Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Terminal Management System market, including its current state, growth forecasts, and insights into segmentation and regional performance from 2023 to 2033.

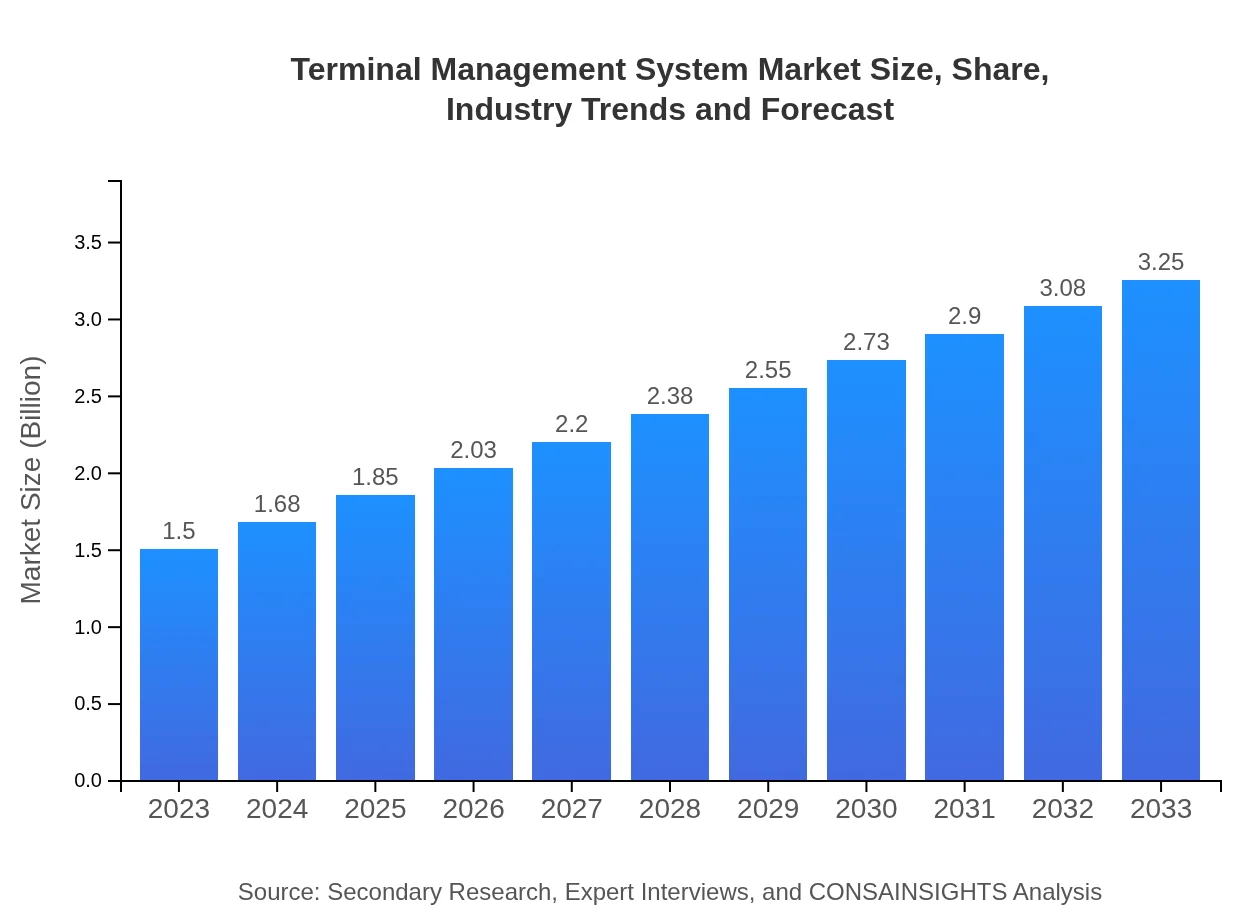

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.50 Billion |

| CAGR (2023-2033) | 7.8% |

| 2033 Market Size | $3.25 Billion |

| Top Companies | Oracle Corporation, SAP SE, Siemens AG, IBM Corporation, C3S |

| Last Modified Date | 22 January 2026 |

Terminal Management System Market Overview

Customize Terminal Management System Market Report market research report

- ✔ Get in-depth analysis of Terminal Management System market size, growth, and forecasts.

- ✔ Understand Terminal Management System's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Terminal Management System

What is the Market Size & CAGR of Terminal Management System market in 2023?

Terminal Management System Industry Analysis

Terminal Management System Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Terminal Management System Market Analysis Report by Region

Europe Terminal Management System Market Report:

The European market is set to rise from $0.38 billion in 2023 to $0.83 billion by 2033, aided by regulatory compliance requirements and sustainability initiatives fostering the adoption of modern Terminal Management Systems.Asia Pacific Terminal Management System Market Report:

In the Asia Pacific region, the Terminal Management System market is projected to grow from $0.32 billion in 2023 to $0.69 billion by 2033, reflecting the rapid infrastructure development and rising logistics needs driven by industrialization and urbanization.North America Terminal Management System Market Report:

North America, the largest market in 2023 with a size of $0.55 billion, is anticipated to grow to $1.18 billion by 2033. The region benefits from advanced technology adoption and the need for improved efficiency in terminal operations, driven by a robust logistics sector.South America Terminal Management System Market Report:

South America presents a growing market for Terminal Management Systems with expected growth from $0.14 billion in 2023 to $0.30 billion by 2033, primarily due to increasing trade activities and investments in logistics infrastructure to support economic growth.Middle East & Africa Terminal Management System Market Report:

The market in the Middle East and Africa is projected to increase from $0.12 billion in 2023 to $0.25 billion by 2033, encouraged by infrastructural development and the rising importance of efficient supply chain and logistics management.Tell us your focus area and get a customized research report.

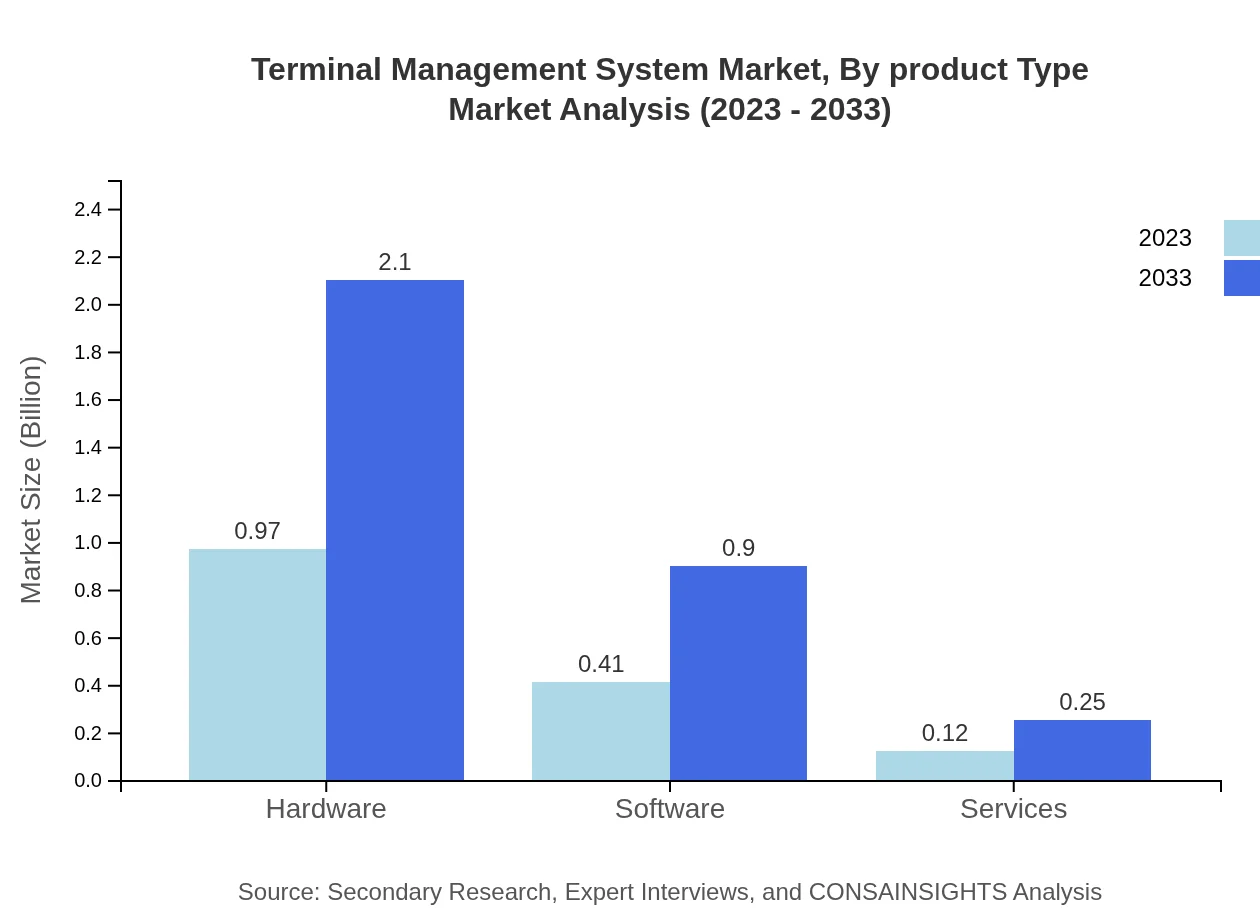

Terminal Management System Market Analysis By Product Type

The Terminal Management System market by product type includes solutions such as hardware, software, and services. Hardware held a significant market share of 64.69% in 2023, estimated to grow to 64.69% by 2033. Software and services are expected to experience steady growth as well, reflecting the increasing complexity and requirement for integrated systems.

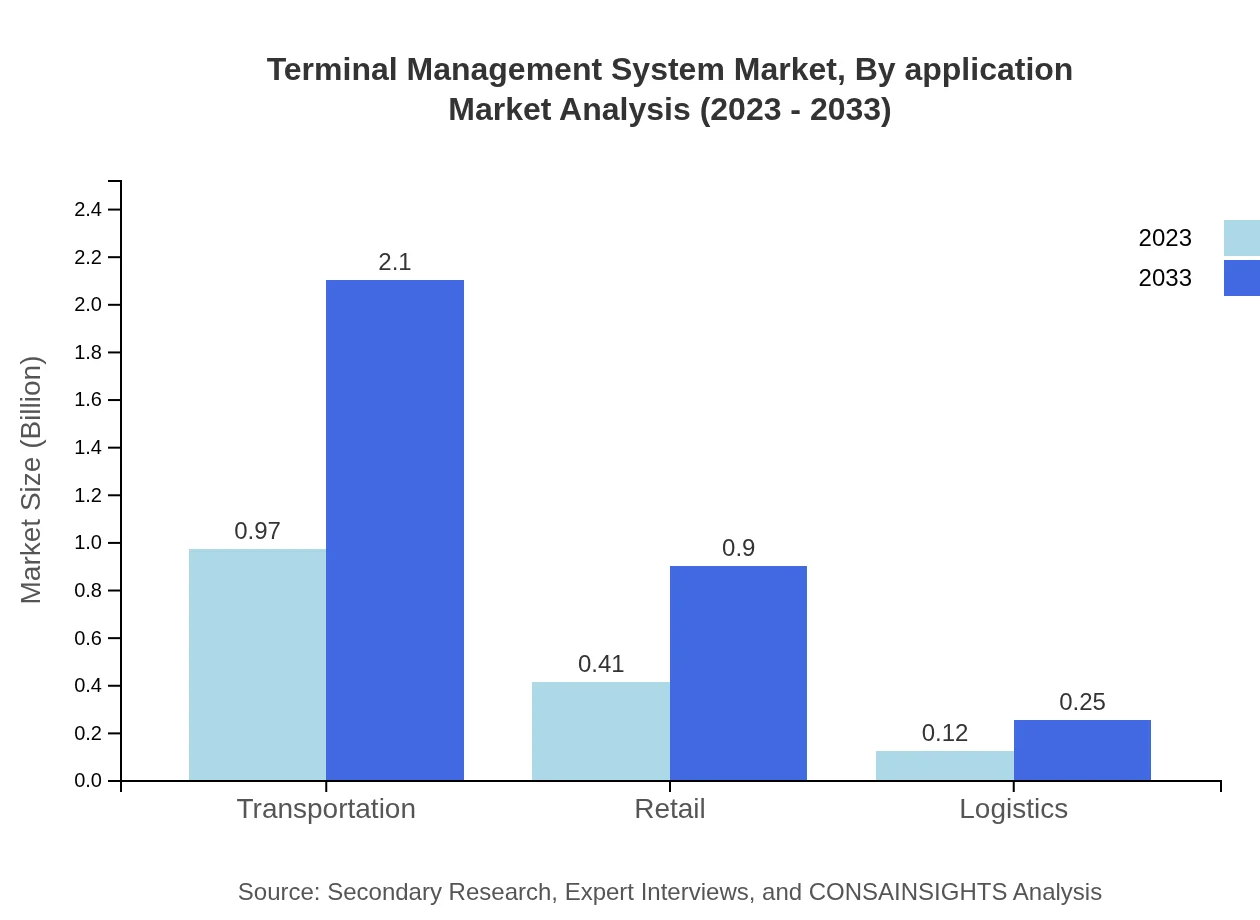

Terminal Management System Market Analysis By Application

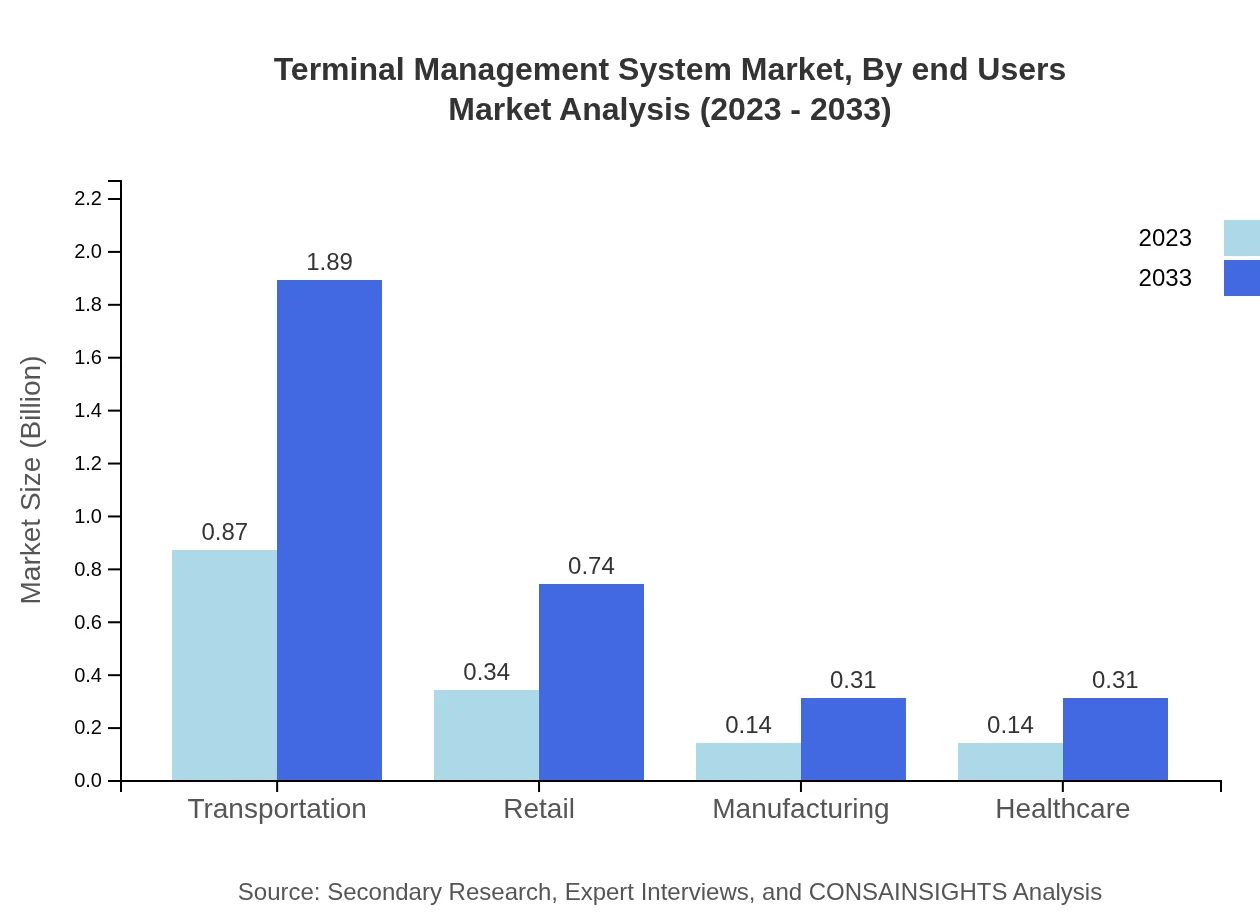

In terms of applications, the transportation sector accounted for a market size of $0.87 billion in 2023, with a projection to grow to $1.89 billion by 2033, representing a 58.21% share. Retail follows with a $0.34 billion size, growing to $0.74 billion, highlighting the essential role of TMS in inventory management.

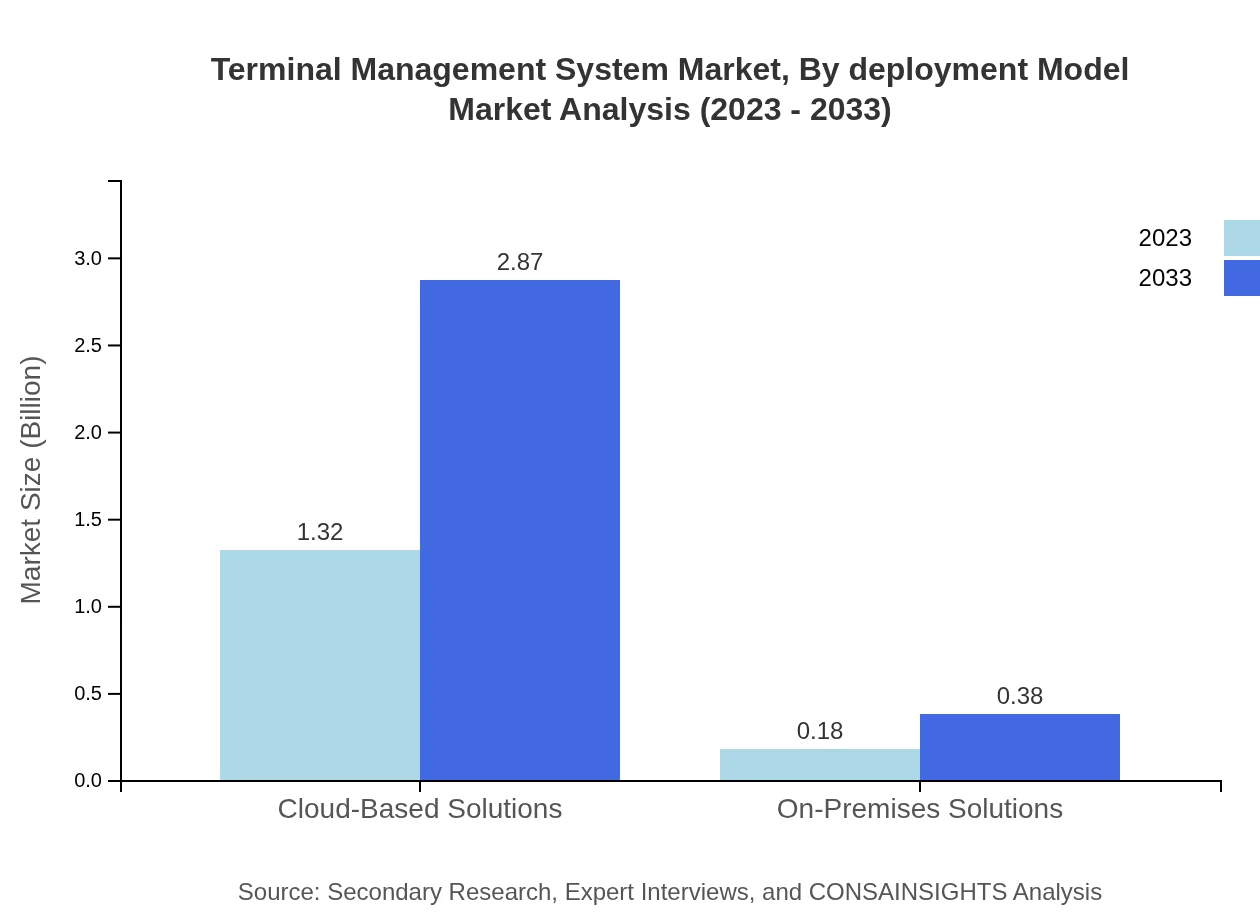

Terminal Management System Market Analysis By Deployment Model

The market is primarily segmented into cloud-based and on-premises deployment models. Cloud-based solutions dominate the market with an 88.25% share in 2023 and a forecasted growth to 88.25% in 2033, driven by the increasing demand for flexibility and scalability.

Terminal Management System Market Analysis By End Users

End-user analysis reveals sectors including retail, manufacturing, and healthcare, each harnessing TMS for enhanced operational efficiency. The retail segment is significant with a 22.74% share, impacting how goods are managed throughout the supply chain.

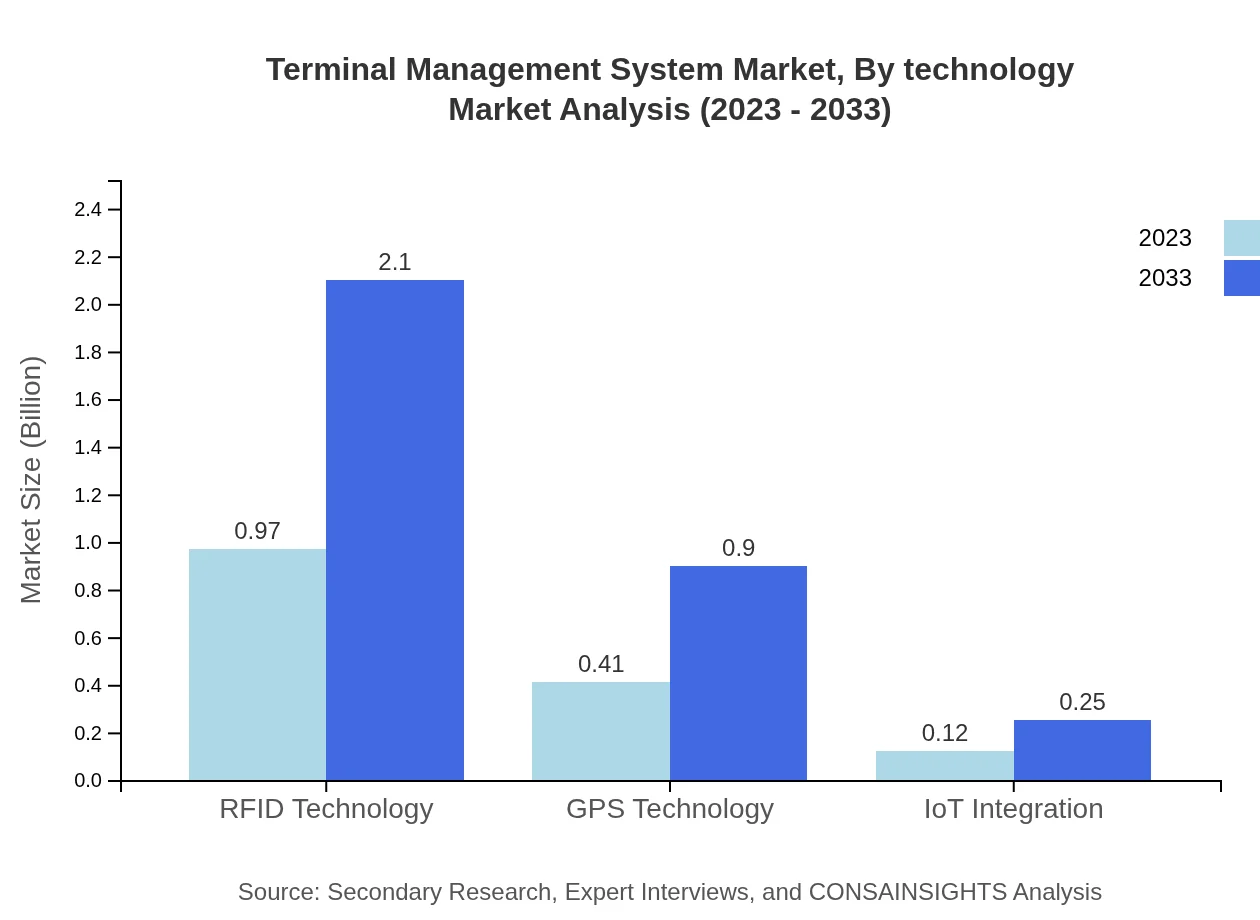

Terminal Management System Market Analysis By Technology

Advancements in technologies such as IoT, RFID, and GPS are propelling the TMS market forward. RFID technology alone is projected to grow from $0.97 billion in 2023 to $2.10 billion by 2033, indicating its vital role in the automation of terminal operations and inventory tracking.

Terminal Management System Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Terminal Management System Industry

Oracle Corporation:

Oracle Corporation provides comprehensive TMS solutions that enable organizations to manage their terminal operations effectively, thereby reducing costs and improving service quality.SAP SE:

SAP offers integrated TMS solutions that optimize logistics processes, facilitating greater visibility and control over terminal operations, especially in complex supply chains.Siemens AG:

Siemens is a leading player specializing in automation and digitalization solutions for terminal management, focusing on innovation and efficiency.IBM Corporation:

IBM leverages advanced analytics and AI to enhance TMS functionality, helping clients optimize their terminal operations.C3S:

C3S offers cutting-edge software solutions designed for terminal management, ensuring efficient operations and seamless integration with existing systems.We're grateful to work with incredible clients.

FAQs

What is the market size of terminal Management System?

The terminal management system market is currently valued at approximately $1.5 billion, with a projected compound annual growth rate (CAGR) of 7.8%. By 2033, the market size is expected to significantly expand, reflecting ongoing advancements and demands in the industry.

What are the key market players or companies in this terminal Management System industry?

Key players in the terminal management system industry include major technology providers that specialize in logistics and tracking solutions. These companies are pivotal in driving innovations and providing comprehensive solutions to meet growing demands across various sectors.

What are the primary factors driving the growth in the terminal Management System industry?

The growth of the terminal management system industry is driven by increasing automation and digitization of logistics. Additionally, the need for efficient supply chain management and improved asset visibility are key factors contributing to market expansion.

Which region is the fastest Growing in the terminal Management System?

The fastest-growing region in the terminal management system market is North America. The market in North America is projected to grow from $0.55 billion in 2023 to $1.18 billion by 2033, driven by technological advancements and increased adoption of automation in logistics.

Does ConsaInsights provide customized market report data for the terminal Management System industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the terminal management system industry. This allows businesses to gain insights that align closely with their unique strategic goals and market conditions.

What deliverables can I expect from this terminal Management System market research project?

From the terminal management system market research project, you can expect comprehensive analysis reports, market forecasts, strategic recommendations, and data-driven insights encompassing regional performance and segment trends.

What are the market trends of terminal Management System?

Current market trends in the terminal management system industry include heightened reliance on cloud-based solutions, increased integration of IoT technology, and an emphasis on enhancing logistical efficiency through technology innovation.