Terrestrial Laser Scanning Market Report

Published Date: 31 January 2026 | Report Code: terrestrial-laser-scanning

Terrestrial Laser Scanning Market Size, Share, Industry Trends and Forecast to 2033

This report offers a comprehensive analysis of the Terrestrial Laser Scanning market from 2023 to 2033, detailing market trends, size, growth forecasts, and regional insights. The data and strategic insights provided will equip stakeholders to make informed decisions in this evolving industry.

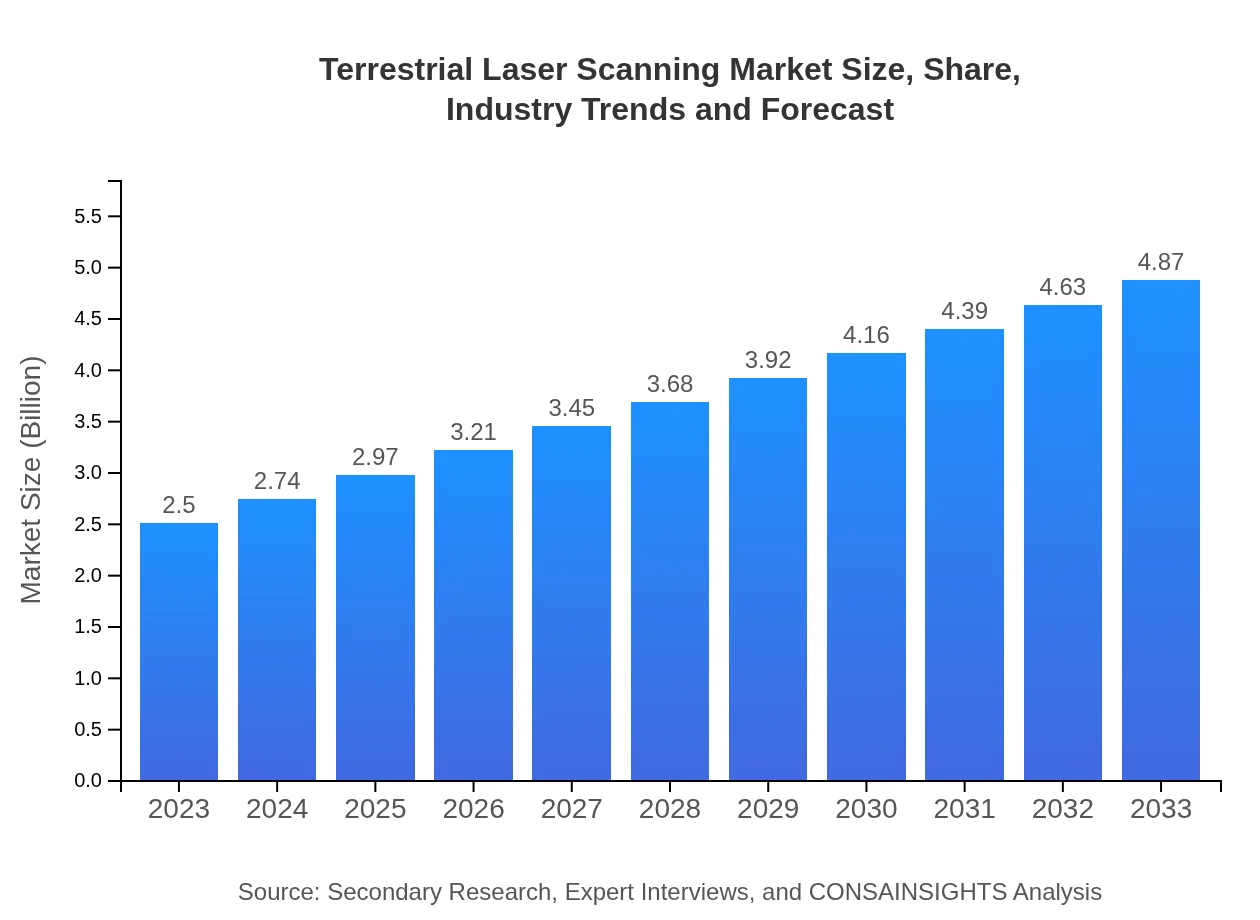

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 6.7% |

| 2033 Market Size | $4.87 Billion |

| Top Companies | Leica Geosystems, Faro Technologies, Trimble Inc., RIEGL Laser Measurement Systems |

| Last Modified Date | 31 January 2026 |

Terrestrial Laser Scanning Market Overview

Customize Terrestrial Laser Scanning Market Report market research report

- ✔ Get in-depth analysis of Terrestrial Laser Scanning market size, growth, and forecasts.

- ✔ Understand Terrestrial Laser Scanning's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Terrestrial Laser Scanning

What is the Market Size & CAGR of Terrestrial Laser Scanning market in 2023?

Terrestrial Laser Scanning Industry Analysis

Terrestrial Laser Scanning Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Terrestrial Laser Scanning Market Analysis Report by Region

Europe Terrestrial Laser Scanning Market Report:

In Europe, the market size was $0.67 billion in 2023, with projections of $1.30 billion by 2033. The growth is largely driven by stringent regulations on construction quality and the increasing application of digital twin technology across industries.Asia Pacific Terrestrial Laser Scanning Market Report:

In the Asia Pacific region, the Terrestrial Laser Scanning market witnessed a value of $0.49 billion in 2023, projected to rise to $0.95 billion by 2033. This growth is fueled by rapid urbanization and increased construction activities across countries like China and India, where investments in smart city projects are significant.North America Terrestrial Laser Scanning Market Report:

North America led the Terrestrial Laser Scanning market with an estimated market size of $0.97 billion in 2023, anticipated to reach $1.88 billion by 2033. The strong presence of key players, government initiatives for infrastructure enhancements, and robust demand from engineering firms contribute to this growth.South America Terrestrial Laser Scanning Market Report:

The South America market was valued at $0.23 billion in 2023 and expected to grow to $0.44 billion by 2033. Emerging economies in the region are adopting advanced surveying technologies to enhance their mining and construction sectors, propelling this market forward.Middle East & Africa Terrestrial Laser Scanning Market Report:

The Middle East and Africa market had a size of $0.15 billion in 2023, likely to grow to $0.29 billion by 2033. The ongoing infrastructural developments in GCC countries are propelling the adoption of TLS technology.Tell us your focus area and get a customized research report.

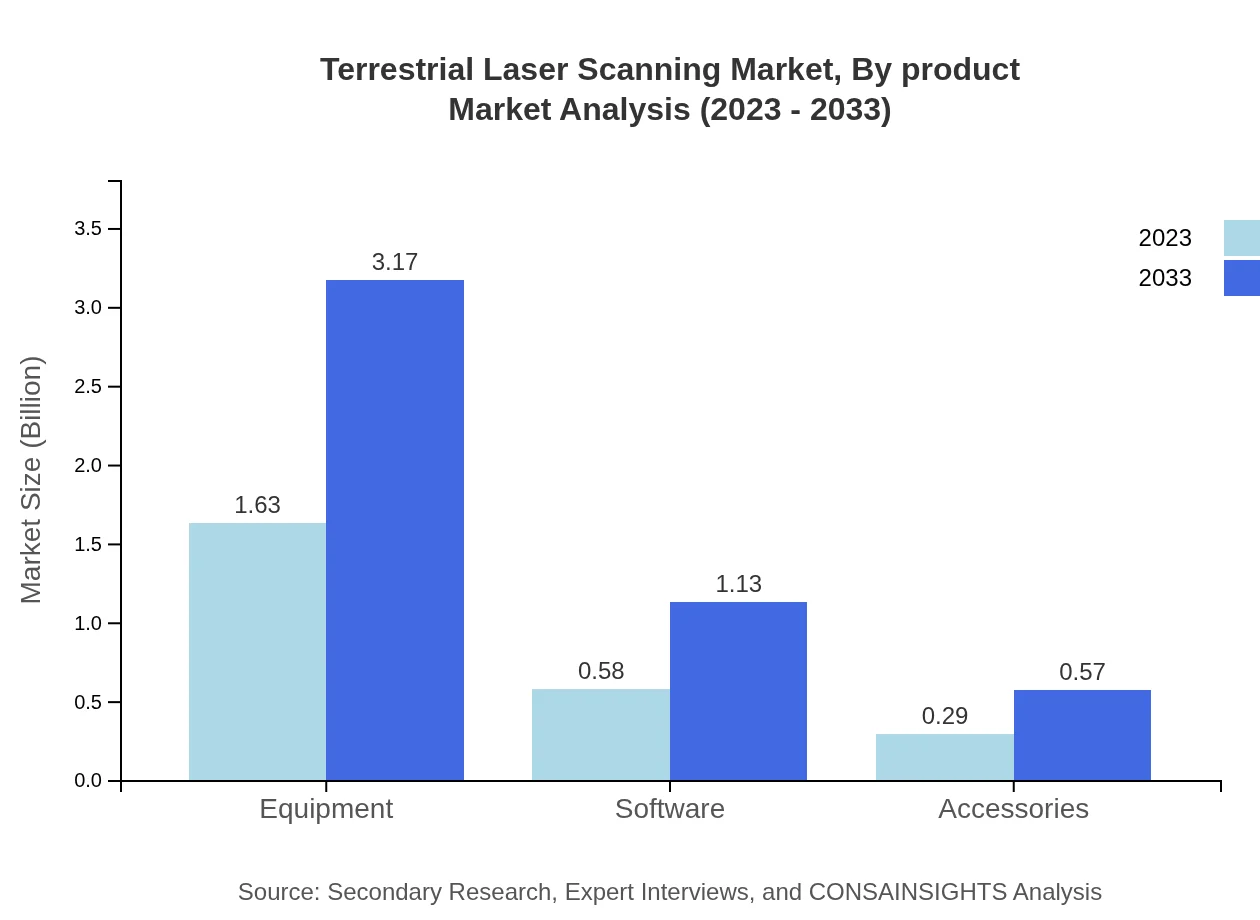

Terrestrial Laser Scanning Market Analysis By Product

The Terrestrial Laser Scanning market by products is mainly categorized into equipment, software, and accessories. Equipment, which includes laser scanners and related systems, accounted for a substantial market share of 65.1% in 2023, expected to maintain this share with a projected market of $3.17 billion by 2033. Software solutions measured at $0.58 billion in 2023, will grow to $1.13 billion by 2033, while accessories will expand from $0.29 billion to $0.57 billion.

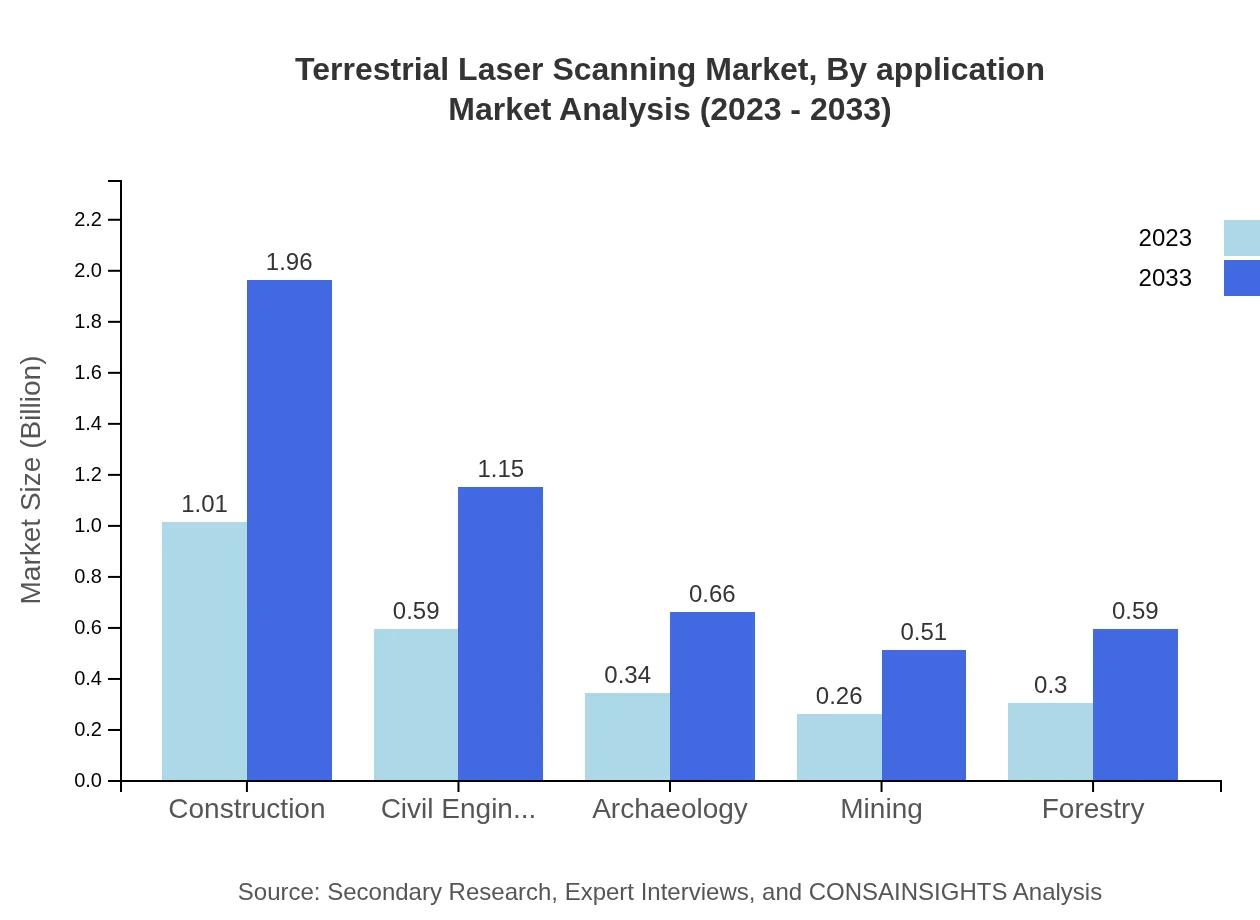

Terrestrial Laser Scanning Market Analysis By Application

The application segment includes construction, civil engineering, archaeology, mining, and forestry. Construction and civil engineering sectors accounted for approximately 40.31% and 23.56% of the market shares respectively in 2023. As infrastructure projects increase, these sectors are projected to grow significantly, reaching $1.96 billion and $1.15 billion respectively by 2033, highlighting their critical roles in TLS adoption.

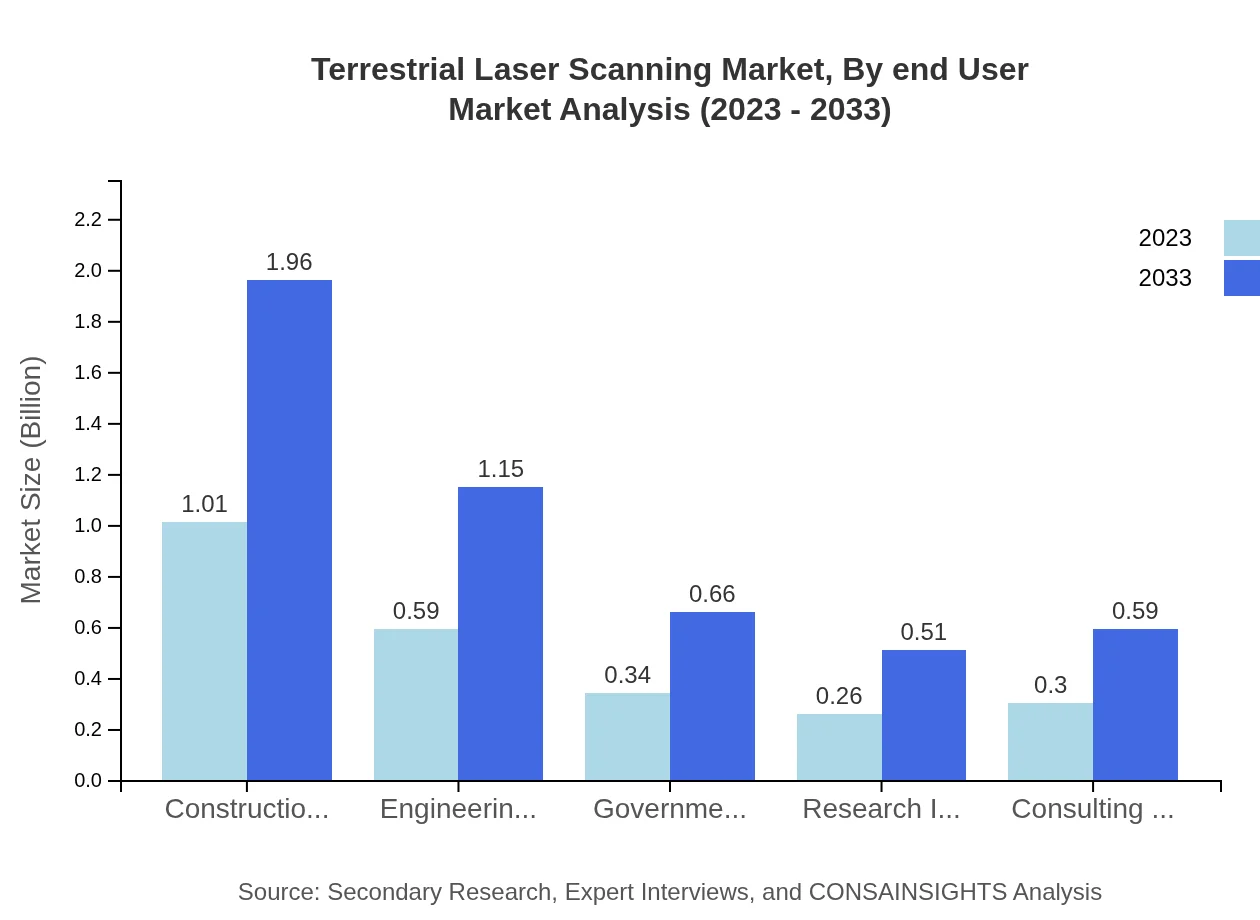

Terrestrial Laser Scanning Market Analysis By End User

Key end-users of the Terrestrial Laser Scanning market include construction companies, engineering firms, government agencies, and research institutions. Construction companies represented around 40.31% market share in 2023 and is expected to sustain its growth trajectory through 2033, reflecting the sector's reliance on TLS for accurate measurements and project efficiency.

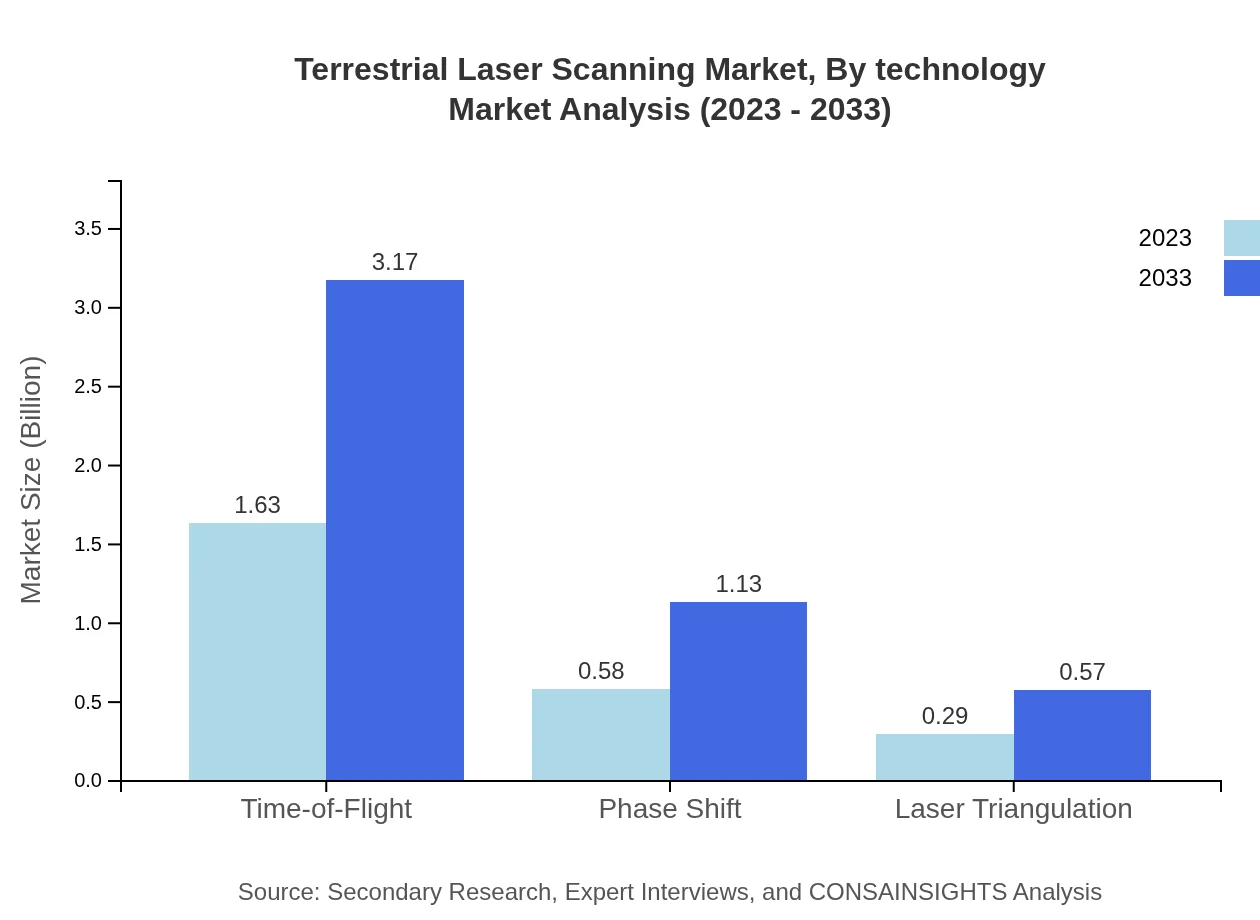

Terrestrial Laser Scanning Market Analysis By Technology

Technological advancements have significantly impacted the TLS market, particularly with Time-of-Flight technology accounting for 65.1% of the overall market share. This technology provides robust solutions in various applications, with a size of $3.17 billion forecasted by 2033. Phase Shift technology and Laser Triangulation follow, contributing substantially as industries look for precise and fast data capture solutions.

Terrestrial Laser Scanning Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Terrestrial Laser Scanning Industry

Leica Geosystems:

A leader in the surveying and geospatial technology sector, Leica Geosystems provides advanced laser scanning solutions, known for their accuracy and efficiency, enhancing surveying practices.Faro Technologies:

Faro Technologies specializes in 3D measurement and imaging solutions, offering innovative laser scanning tools that are widely adopted in construction, manufacturing, and public safety.Trimble Inc.:

Trimble is a significant player in geospatial technologies, providing high-quality laser scanning equipment and integrated software solutions that streamline project workflows.RIEGL Laser Measurement Systems:

RIEGL is renowned for its pioneering laser scanning technology, particularly in challenging environments, providing top-notch solutions for the mapping and environmental surveying sectors.We're grateful to work with incredible clients.

FAQs

What is the market size of terrestrial Laser Scanning?

The terrestrial laser scanning market in 2023 is valued at $2.5 billion and is projected to grow with a CAGR of 6.7%, reaching significant market values by 2033, although specific future figures are not defined.

What are the key market players or companies in the terrestrial Laser Scanning industry?

Major players in the terrestrial laser scanning market include companies specializing in geospatial technology such as Leica Geosystems, Trimble, and Faro Technologies, which are critical for innovation and development within the industry.

What are the primary factors driving the growth in the terrestrial Laser Scanning industry?

Growth in the terrestrial laser scanning market is driven by advancements in technology, increased demand for 3D mapping in construction and civil engineering, and the growing need for precision in various industries including archaeology and environmental monitoring.

Which region is the fastest Growing in the terrestrial Laser Scanning?

North America is currently the fastest-growing region for terrestrial laser scanning, projected to expand from $0.97 billion in 2023 to $1.88 billion by 2033, while Europe and Asia Pacific also show significant growth rates.

Does ConsaInsights provide customized market report data for the terrestrial Laser Scanning industry?

Yes, ConsaInsights offers tailored market report data for the terrestrial laser scanning industry to meet specific business needs and provide insights relevant to various stakeholders within the market.

What deliverables can I expect from this terrestrial Laser Scanning market research project?

Deliverables from the terrestrial laser scanning market research project typically include detailed market analysis, segment insights, competitive landscape evaluations, and regional growth projections, facilitating informed business decisions.

What are the market trends of terrestrial Laser Scanning?

Current trends in the terrestrial laser scanning market include the integration of AI and machine learning for enhanced data analysis, the growing adoption of cloud-based solutions, and increased collaboration between different sectors in leveraging scanning technology.