Testing As A Service Taas Market Report

Published Date: 31 January 2026 | Report Code: testing-as-a-service-taas

Testing As A Service Taas Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Testing as a Service (TaaS) market, covering trends, growth, and opportunities from 2023 to 2033. It includes insights related to market size, CAGR, segments, regional performance, and key players in the industry.

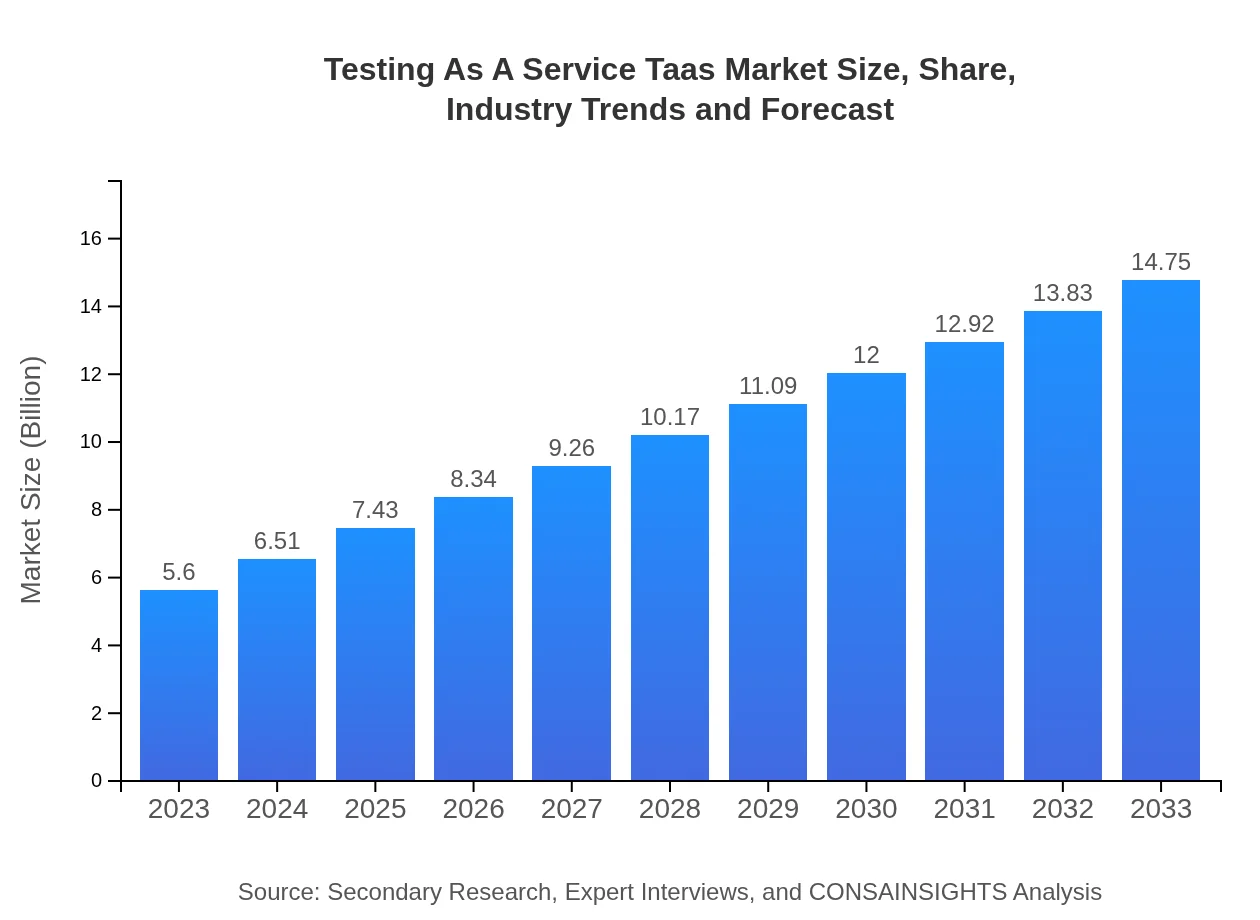

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 9.8% |

| 2033 Market Size | $14.75 Billion |

| Top Companies | IBM, Oracle, Micro Focus, Capgemini |

| Last Modified Date | 31 January 2026 |

Testing As A Service Taas Market Overview

Customize Testing As A Service Taas Market Report market research report

- ✔ Get in-depth analysis of Testing As A Service Taas market size, growth, and forecasts.

- ✔ Understand Testing As A Service Taas's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Testing As A Service Taas

What is the Market Size & CAGR of Testing As A Service Taas market in 2023 and 2033?

Testing As A Service Taas Industry Analysis

Testing As A Service Taas Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Testing As A Service Taas Market Analysis Report by Region

Europe Testing As A Service Taas Market Report:

The European TaaS market size is anticipated to grow from $1.49 billion in 2023 to $3.93 billion by 2033, reflecting a robust inclination towards outsourcing testing processes to improve operational efficiency. The widespread focus on digitalization and stringent regulations in industries like finance and healthcare further propel this growth.Asia Pacific Testing As A Service Taas Market Report:

In the Asia Pacific region, the TaaS market is projected to grow from $1.20 billion in 2023 to $3.16 billion by 2033, driven by increasing adoption of cloud technologies and the demand for agile testing solutions. Countries like India and China are witnessing rapid expansion in their software development sectors, further fueling TaaS demand.North America Testing As A Service Taas Market Report:

North America leads the TaaS market, with a projected growth from $1.98 billion in 2023 to $5.22 billion by 2033. The region's advanced technology infrastructure and high investments in IT solutions contribute significantly to this growth, alongside increasing adoption of DevOps practices.South America Testing As A Service Taas Market Report:

The South American TaaS market is expected to expand from $0.42 billion in 2023 to $1.11 billion by 2033. The growth is spurred by increasing software automation and digital transformation initiatives across various sectors, including retail and banking.Middle East & Africa Testing As A Service Taas Market Report:

In the Middle East and Africa, the TaaS market is forecasted to rise from $0.51 billion in 2023 to $1.34 billion by 2033, as more companies leverage technology to enhance their testing strategies, particularly in sectors such as telecommunications and financial services.Tell us your focus area and get a customized research report.

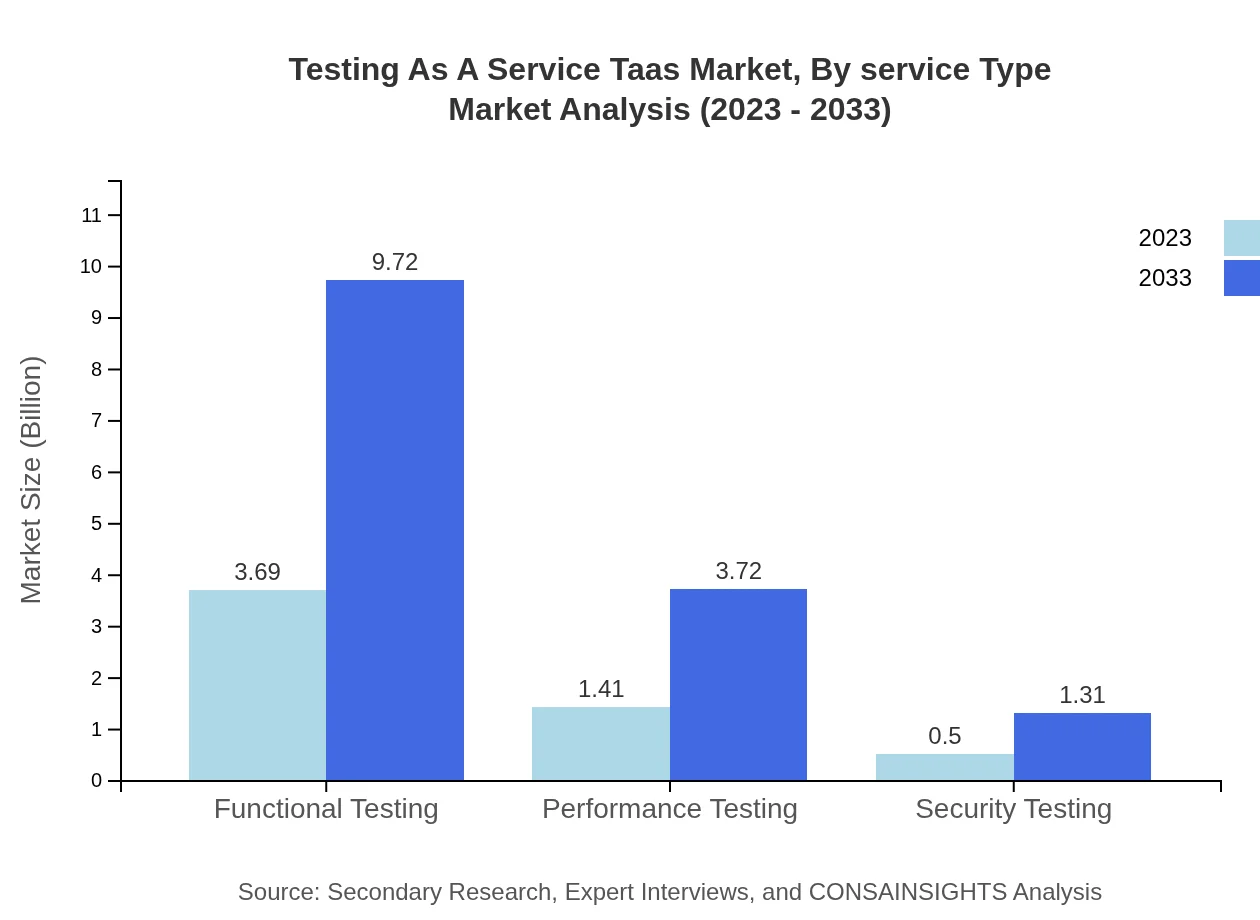

Testing As A Service Taas Market Analysis By Service Type

The TaaS market is segmented into functional testing, performance testing, security testing, automated testing, and manual testing. Functional testing alone accounted for $3.69 billion in 2023, with a projected growth to $9.72 billion by 2033. Automated testing, meanwhile, is gaining traction, expected to rise from $1.41 billion to $3.72 billion during the same period, showcasing the shift towards more efficient testing methodologies.

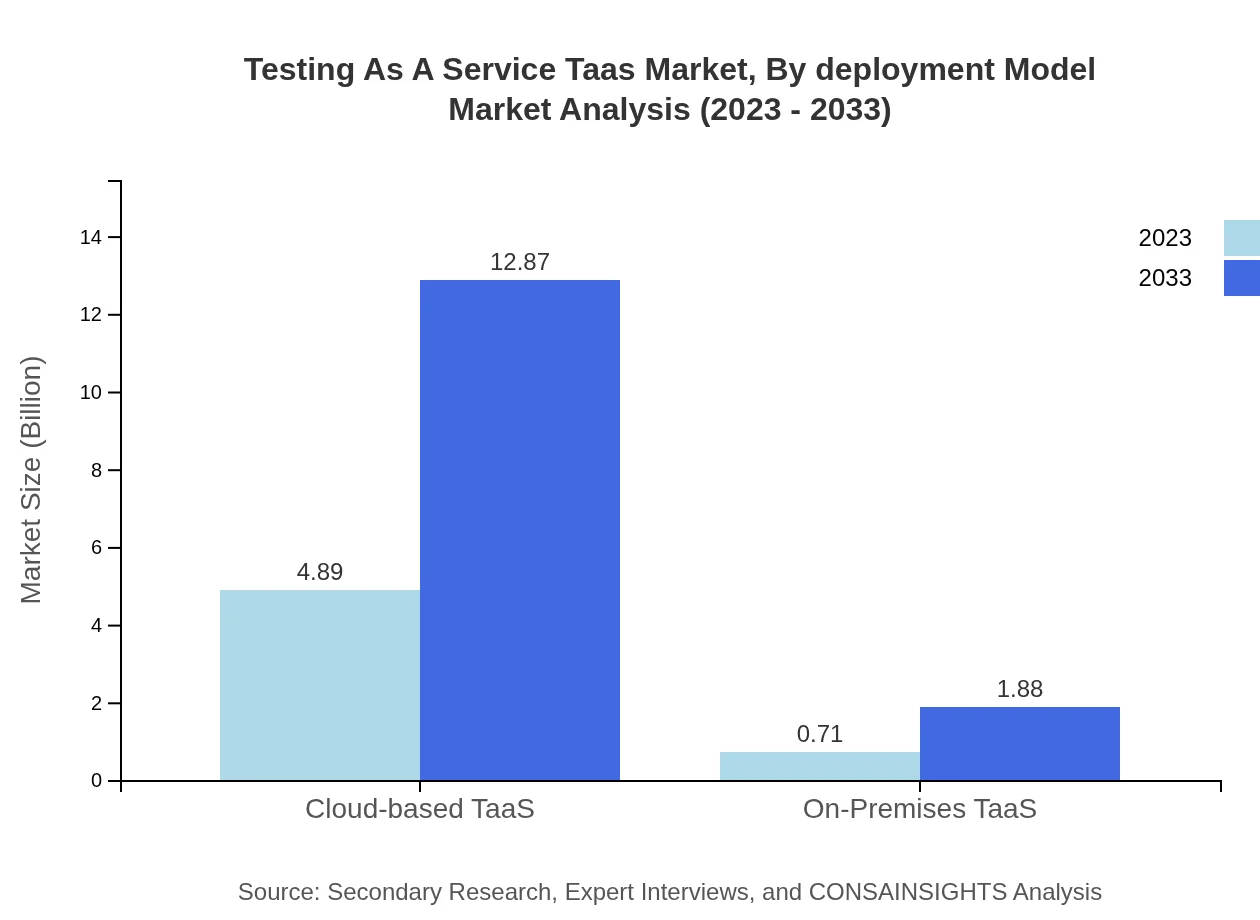

Testing As A Service Taas Market Analysis By Deployment Model

The deployment models in TaaS include cloud-based and on-premises solutions. The cloud-based segment dominates the market, with revenues estimated at $4.89 billion in 2023, climbing to $12.87 billion by 2033. This segment's growth reflects the growing preference for flexible, scalable solutions that align with modern operational demands.

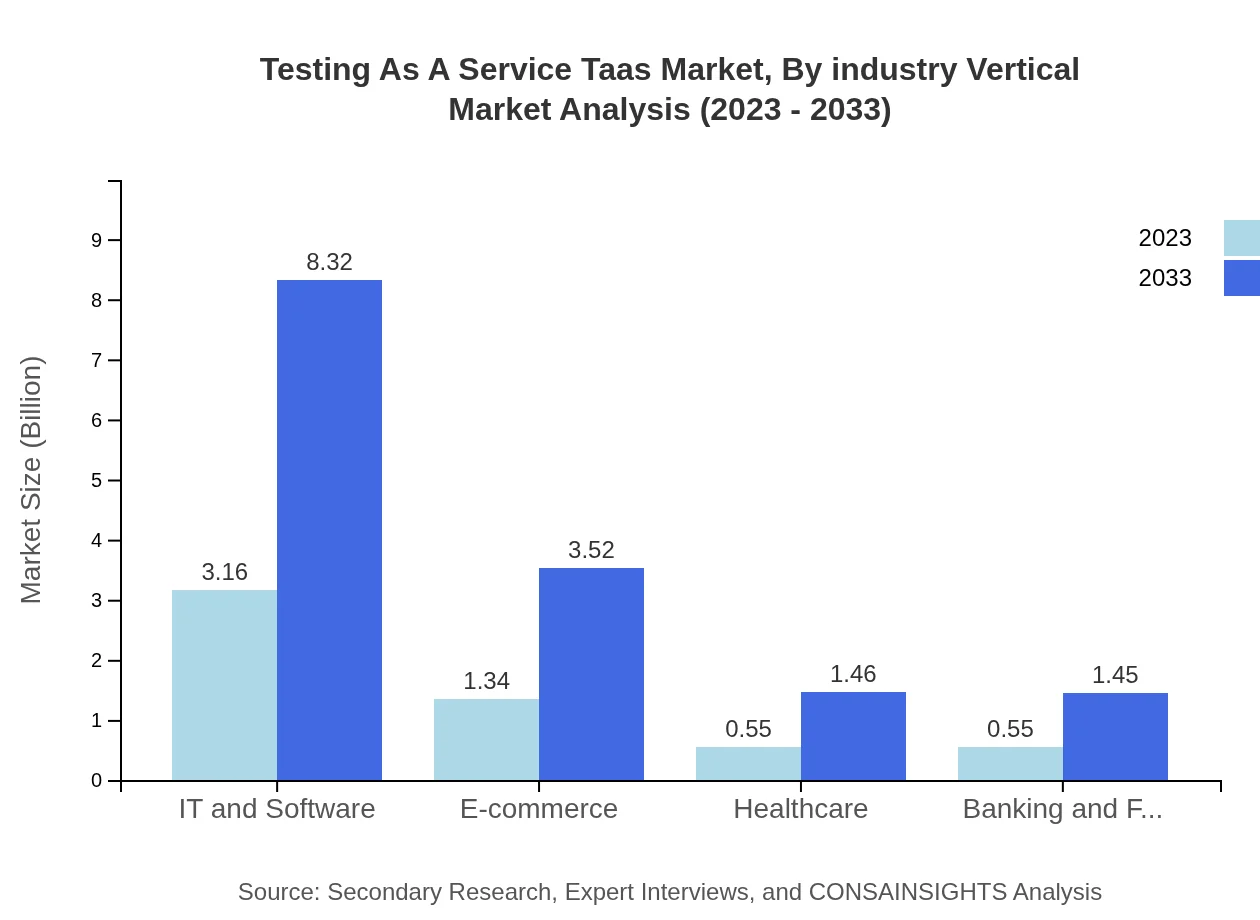

Testing As A Service Taas Market Analysis By Industry Vertical

Key industry verticals leveraging TaaS include IT and Software, e-commerce, healthcare, and banking and financial services. The IT and software sector contributes significantly, with market size projected from $3.16 billion in 2023 to $8.32 billion by 2033, supported by the sector's ongoing digital transformation.

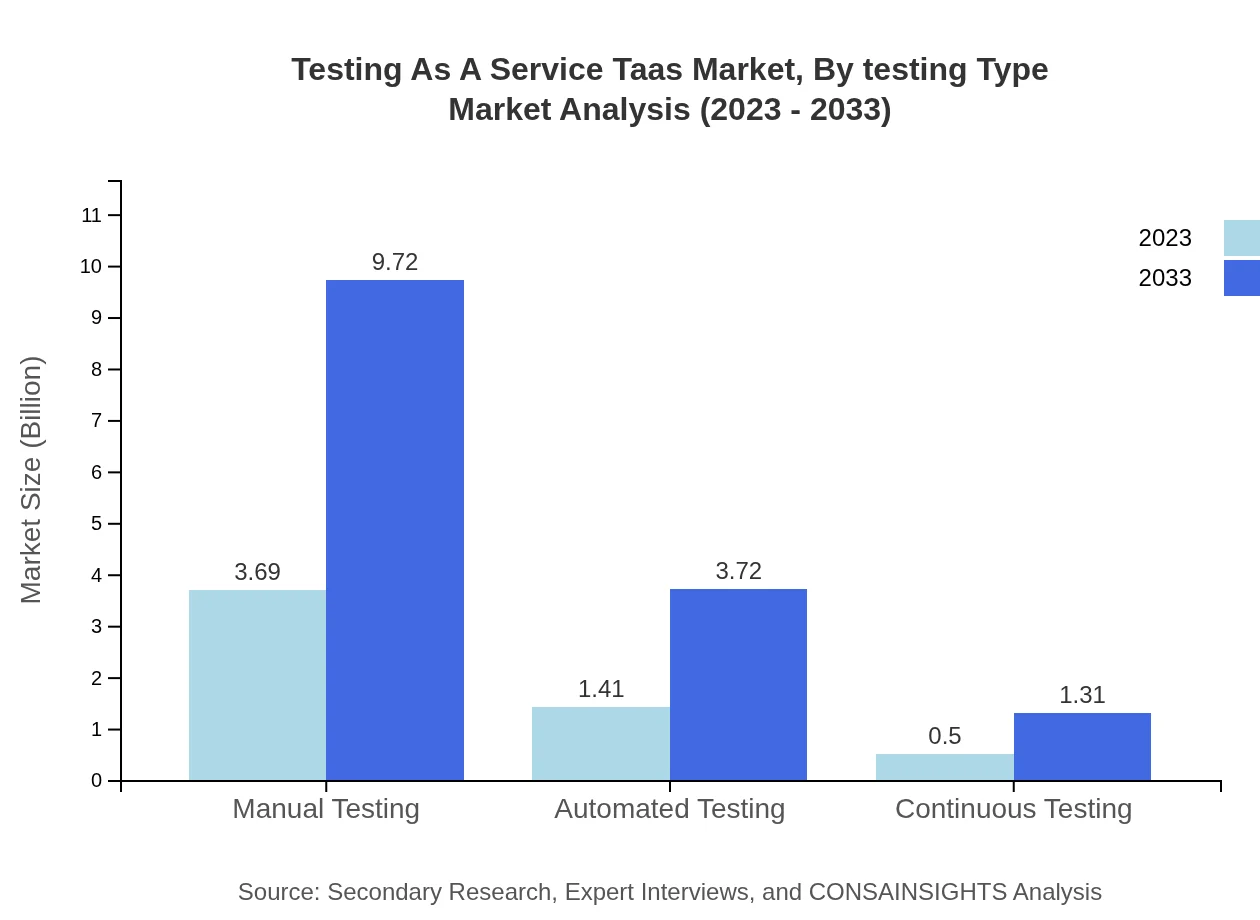

Testing As A Service Taas Market Analysis By Testing Type

TaaS encompasses various testing types including functional, performance, security, and continuous testing. Functional testing remains dominant with a market share of 65.9% in 2023, expected to maintain this share through 2033. Continuous testing is also emerging, driven by the need for agile practices in software development.

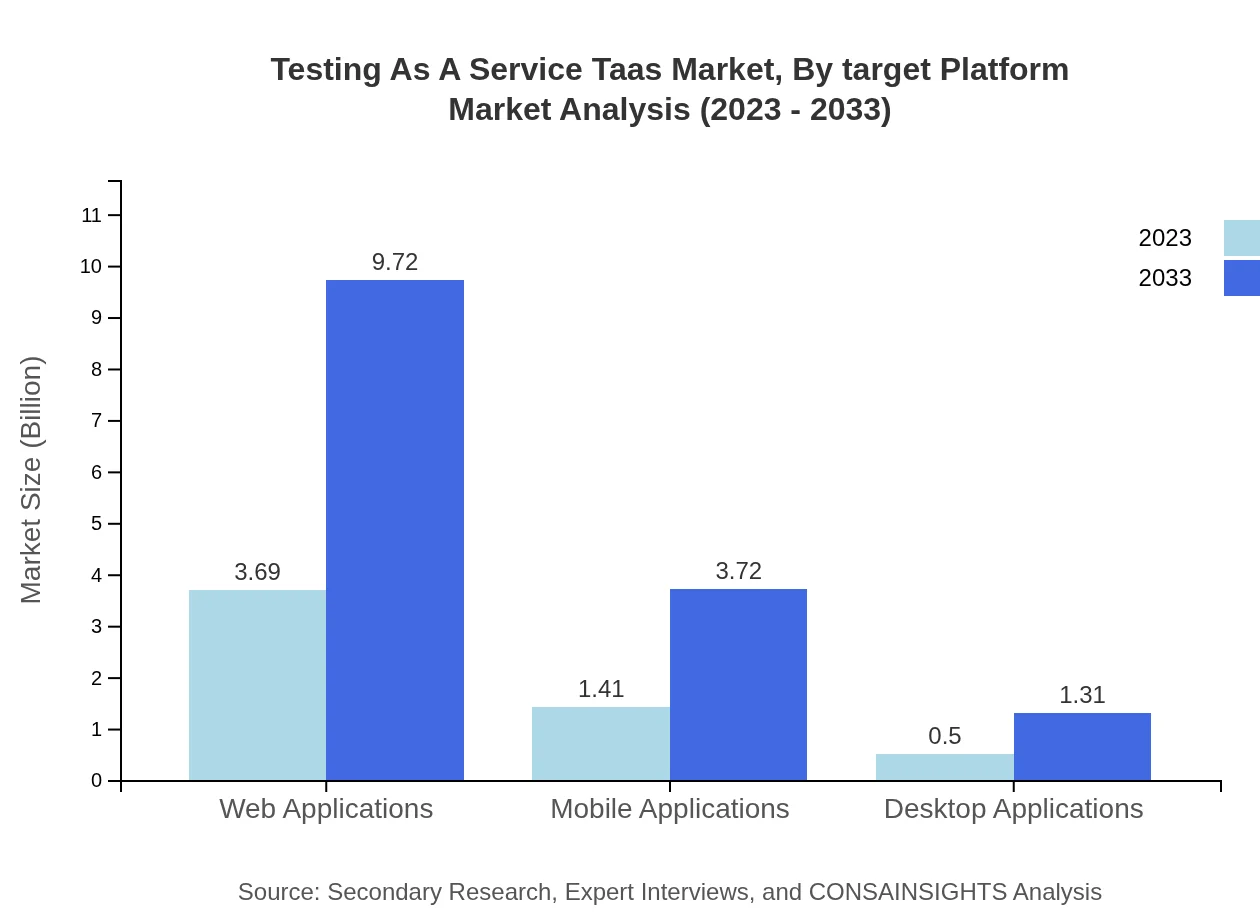

Testing As A Service Taas Market Analysis By Target Platform

The target platforms for TaaS include web applications, mobile applications, and desktop applications. The market for web applications reached $3.69 billion in 2023, expected to grow to $9.72 billion by 2033, underscoring the critical focus on online presence in today's technology landscape.

Testing As A Service Taas Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Testing As A Service Taas Industry

IBM:

A leading technology company offering a comprehensive suite of testing services through its cloud and AI-driven platforms.Oracle:

Known for providing end-to-end solutions in software testing and quality assurance, including TaaS offerings.Micro Focus:

Offers a robust set of testing solutions including automated and functional testing services as part of its TaaS portfolio.Capgemini:

Provides advanced testing services including TaaS, focusing on digital transformation and automation.We're grateful to work with incredible clients.

FAQs

What is the market size of Testing As A-Service (TaaS)?

The global Testing-as-a-Service market is currently valued at approximately $5.6 billion. It is projected to grow at a CAGR of 9.8% from 2023 to 2033, indicating strong demand and expansion in the industry.

What are the key market players or companies in the Testing As A-Service industry?

Key players in the Testing-as-a-Service industry include prominent names like Microsoft, IBM, Accenture, and Cognizant. Their innovations and comprehensive service offerings are crucial for driving the market forward.

What are the primary factors driving the growth in the Testing As A-Service industry?

The growth in the TaaS industry is driven by increasing digital transformation in enterprises, the demand for cloud-based testing solutions, and the need for faster software deployment cycles, allowing companies to remain competitive and agile.

Which region is the fastest Growing in the Testing As A-Service market?

North America stands out as the fastest-growing region in the TaaS market, projected to reach $5.22 billion by 2033. This growth reflects the region's technological advancements and high adoption of testing services in various sectors.

Does ConsaInsights provide customized market report data for the Testing As A-Service industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the TaaS industry, catering to varying preferences and requirements of clients, which can aid in strategic decision-making.

What deliverables can I expect from this Testing As A-Service market research project?

Deliverables include an in-depth market analysis report, data on market trends, segmentation insights, competitive landscape overview, and forecasts to 2033, providing comprehensive intelligence for stakeholders.

What are the market trends of Testing As A-Service?

Current trends in the TaaS market exhibit a shift towards automation, increased focus on cloud-based services, and a growing emphasis on security testing, reflecting evolving client needs and technological advancement.