Textile Chemicals Market Report

Published Date: 02 February 2026 | Report Code: textile-chemicals

Textile Chemicals Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Textile Chemicals market, covering market size, trends, competitive landscape, and future forecasts from 2023 to 2033. Key insights into regional performances, segmentation, and leading companies are also included.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

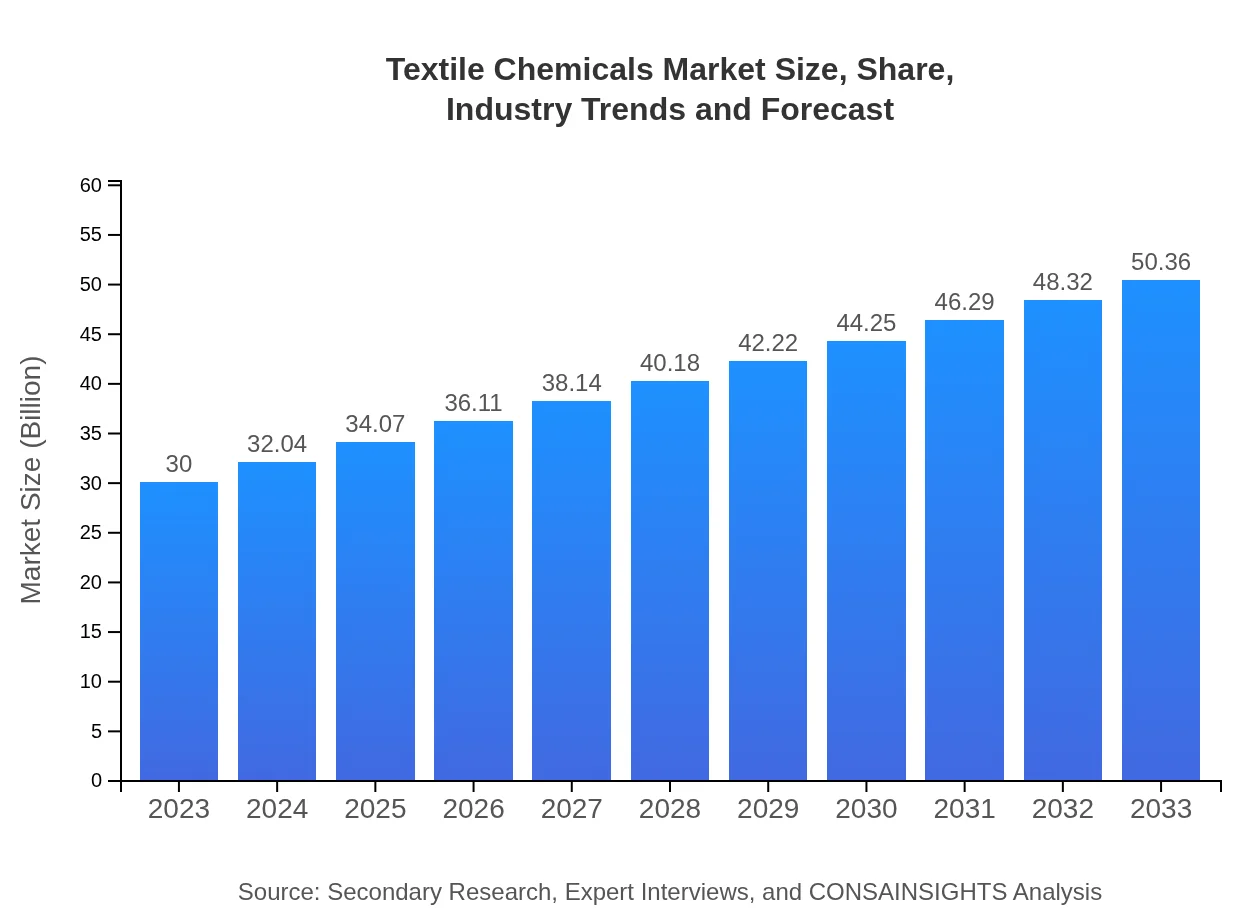

| 2023 Market Size | $30.00 Billion |

| CAGR (2023-2033) | 5.2% |

| 2033 Market Size | $50.36 Billion |

| Top Companies | BASF, Dystar, Huntsman Corporation, Textile Chemical Group |

| Last Modified Date | 02 February 2026 |

Textile Chemicals Market Overview

Customize Textile Chemicals Market Report market research report

- ✔ Get in-depth analysis of Textile Chemicals market size, growth, and forecasts.

- ✔ Understand Textile Chemicals's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Textile Chemicals

What is the Market Size & CAGR of Textile Chemicals market in 2023?

Textile Chemicals Industry Analysis

Textile Chemicals Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Textile Chemicals Market Analysis Report by Region

Europe Textile Chemicals Market Report:

Europe's Textile Chemicals market is estimated at $9.25 billion in 2023 and is projected to grow to $15.52 billion by 2033. The market is driven by stringent regulatory frameworks requiring sustainable production practices, combined with the presence of several established textile manufacturers that demand innovative chemical solutions.Asia Pacific Textile Chemicals Market Report:

The Asia-Pacific region is the largest market for textile chemicals, estimated at $5.16 billion in 2023, with projections to grow to $8.66 billion by 2033. This growth is driven by increased textile manufacturing activities in countries like China and India, alongside rising consumer demand for textiles and apparel. Moreover, the growing focus on textile exports and investments in sustainable production methods further bolsters market expansion.North America Textile Chemicals Market Report:

North America has a significant share of the Textile Chemicals market, with a value of $11.64 billion in 2023, projected to reach $19.54 billion by 2033. The region benefits from technological advancements in textile manufacturing and a high focus on sustainable practices, which is integrating green chemistry into chemical formulations.South America Textile Chemicals Market Report:

In South America, the Textile Chemicals market is relatively smaller, with a size of $0.69 billion in 2023, expected to expand to $1.16 billion by 2033. The growth in this region is largely influenced by the increasing textile production capacities and the rising demand for fashionable clothing and home textiles from local markets.Middle East & Africa Textile Chemicals Market Report:

The Middle East and Africa region holds a market size of $3.26 billion in 2023, anticipated to increase to $5.48 billion by 2033. Growth factors include increasing investment in textile production infrastructure and a rising focus on product differentiation within the textile sector, leading to higher demand for specialty textile chemicals.Tell us your focus area and get a customized research report.

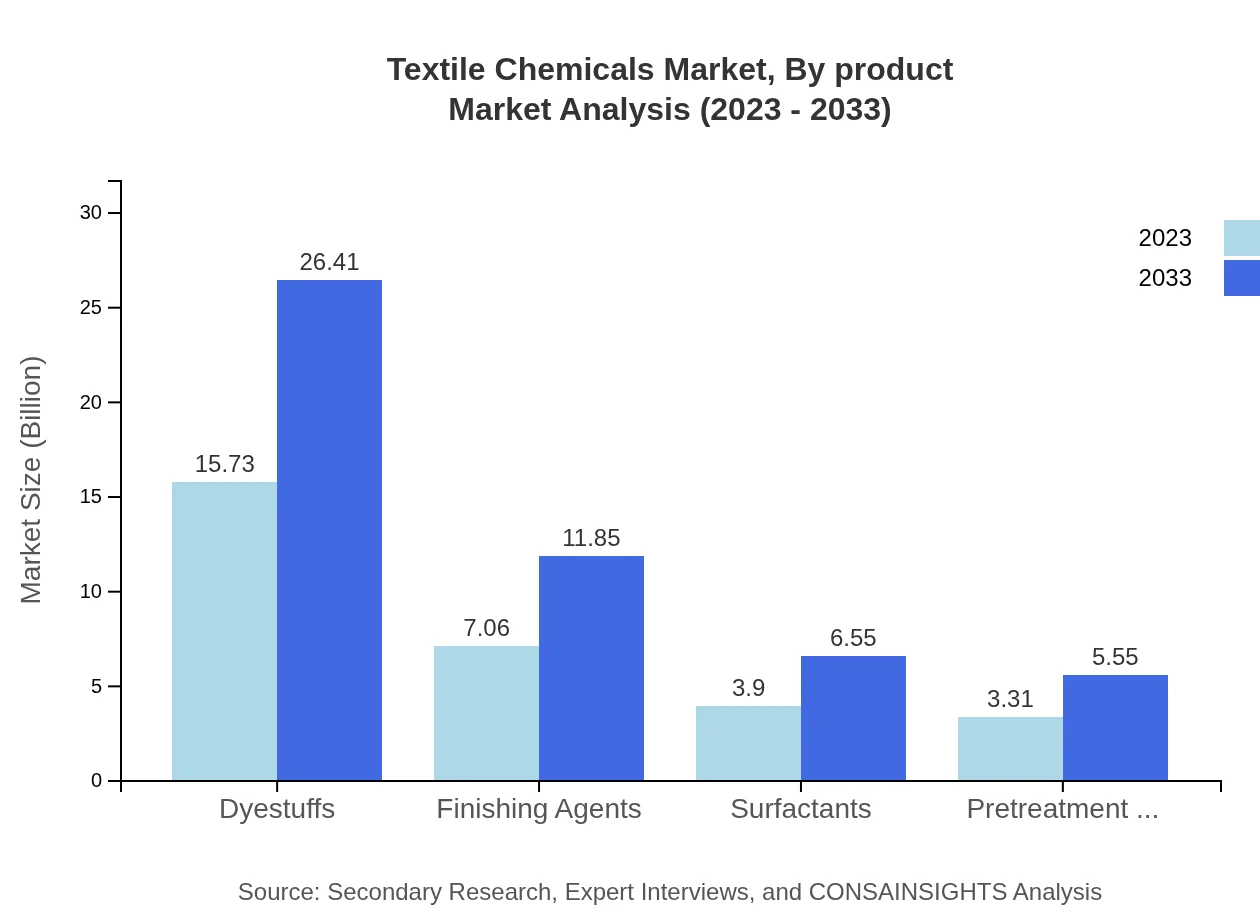

Textile Chemicals Market Analysis By Product

The market is heavily directed by the dyestuff segment, projected to grow from $15.73 billion in 2023 to $26.41 billion by 2033, holding a significant market share of 52.44%. Finishing agents follow with an anticipated growth from $7.06 billion to $11.85 billion, retaining about 23.53% of the market. Surfactants and pretreatment chemicals also show growth potential, with surfactants reaching $6.55 billion from $3.90 billion and representing 13.01% of the market share.

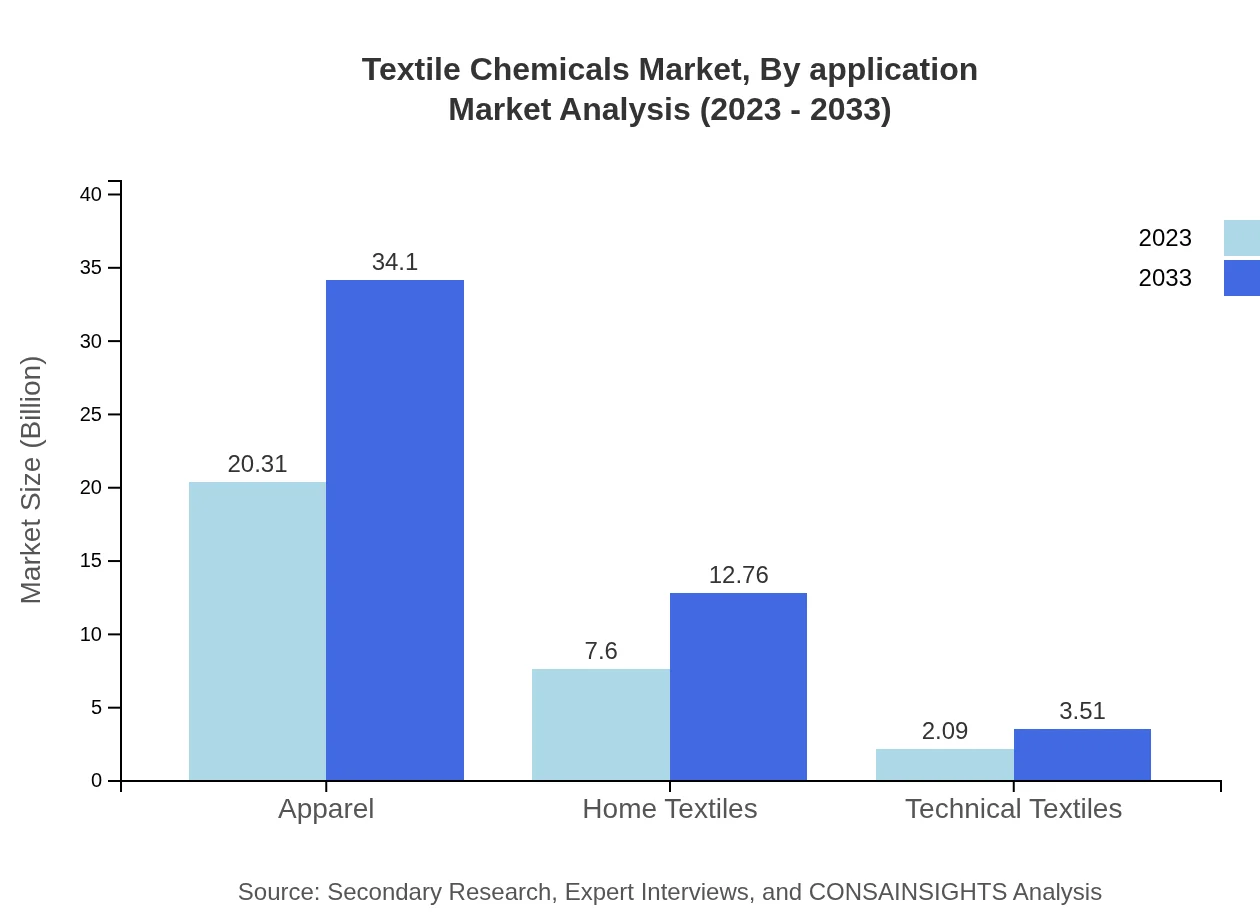

Textile Chemicals Market Analysis By Application

In terms of application, the apparel sector dominates the market with an expected growth from $20.31 billion in 2023 to $34.10 billion by 2033, holding 67.71% share. Home textiles follow with market size expanding from $7.60 billion to $12.76 billion (25.33% share), while technical textiles are expected to grow from $2.09 billion to $3.51 billion (6.96% share), reflecting the shifting focus towards functional applications.

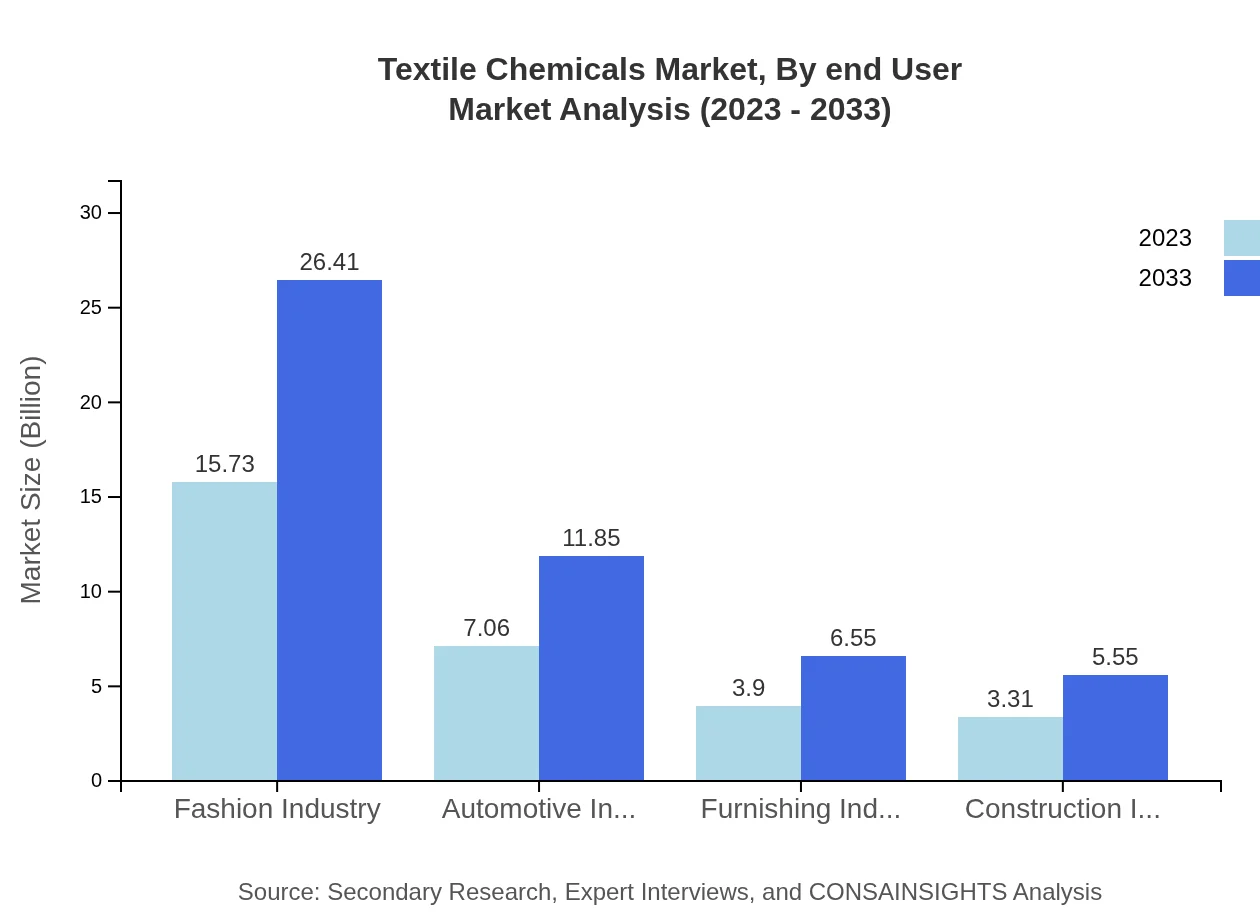

Textile Chemicals Market Analysis By End User

The major end-user industries for textile chemicals include apparel, furnishings, and automotive, with apparel being the largest segment. The automotive and furnishing sectors are also showing promising growth due to increasing application of textiles in automotive interiors and home furnishings. This diversification into multiple sectors demonstrates the adaptability of textile chemicals in meeting varied market needs.

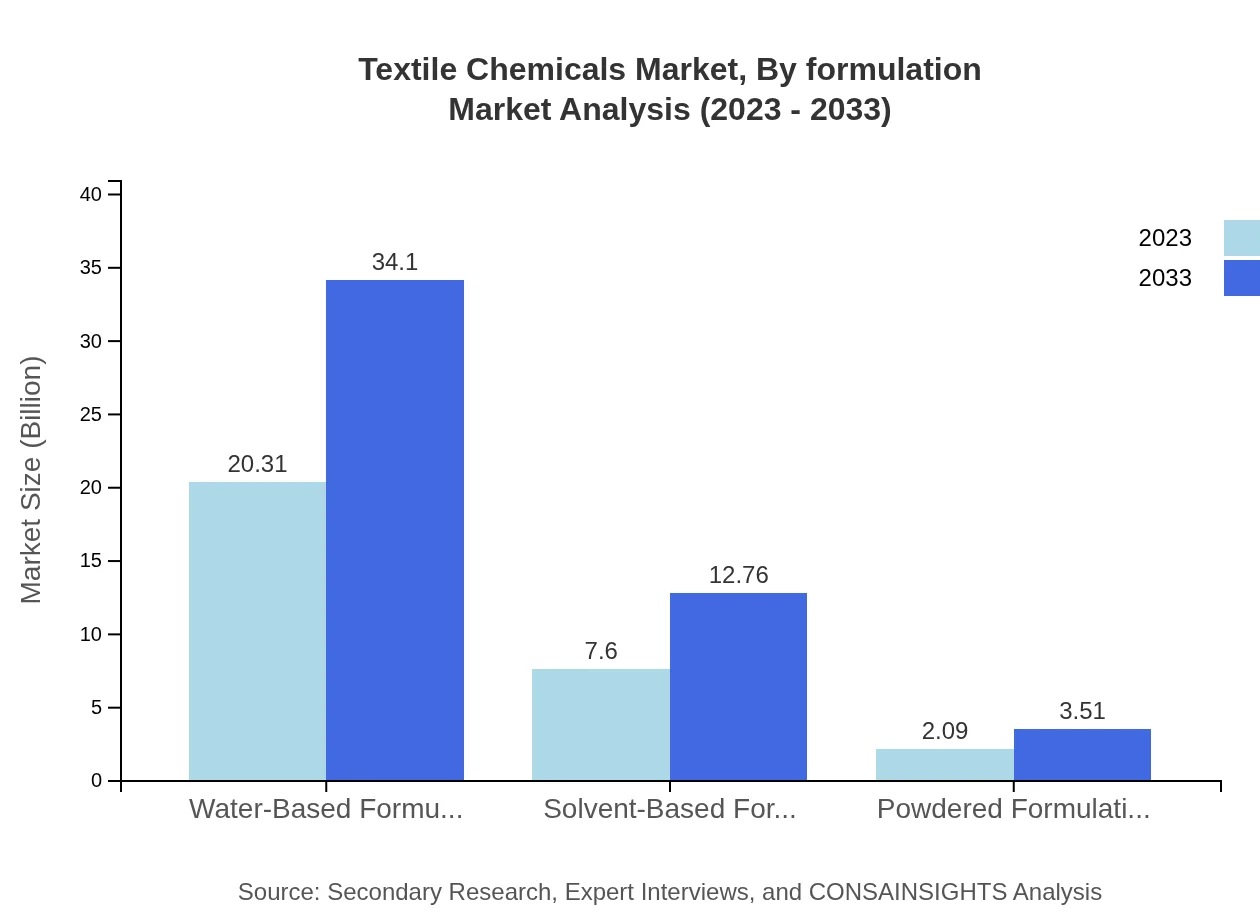

Textile Chemicals Market Analysis By Formulation

Market formulations include water-based, solvent-based, and powdered applications. Water-based formulations are dominating the market with sizes of $20.31 billion in 2023 and projected at $34.10 billion by 2033 (67.71% share). Solvent-based followed at $7.60 billion in 2023, reaching $12.76 billion by 2033. These formulations emphasize environmental safety and are essential in modern textile production.

Textile Chemicals Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Textile Chemicals Industry

BASF:

As a leading chemical company, BASF produces a comprehensive range of textile chemicals that include dyes, pigments, and finishing agents, emphasizing sustainable practices and innovation in textile solutions.Dystar:

Dystar is a renowned supplier of specialty chemical products, focusing primarily on dyeing and finishing chemicals for textiles with a commitment to sustainable development and high-performance standards.Huntsman Corporation:

Huntsman provides a wide variety of chemical products for the textile industry, specializing in colorants and finishing agents, recognized for its innovative solutions and environmental stewardship.Textile Chemical Group:

A diversified player in the textile chemical space, Textile Chemical Group develops comprehensive solutions for textile processing that are tailored to meet the demand for sustainable and efficient production practices.We're grateful to work with incredible clients.

FAQs

What is the market size of textile Chemicals?

The global textile chemicals market is projected to reach around $30 billion by 2033, growing at a CAGR of 5.2%. In 2023, the market size indicates a robust sector poised for continuous growth over the next decade.

What are the key market players or companies in the textile Chemicals industry?

Key players in the textile chemicals industry include major global corporations focused on innovation and sustainable practices. Companies like Huntsman Corporation, BASF SE, and Archroma are recognized for their significant contributions and product development in this field.

What are the primary factors driving the growth in the textile chemicals industry?

Growth in the textile chemicals industry is primarily driven by rising demand for technical textiles, environmental regulations promoting sustainable processes, and increased consumption in emerging markets. Innovation in eco-friendly chemicals is also a key factor.

Which region is the fastest Growing in the textile chemicals?

Asia Pacific is the fastest-growing region in the textile chemicals market, with significant growth expected from $5.16 billion in 2023 to $8.66 billion by 2033. Other regions like North America and Europe follow closely in growth trajectories.

Does ConsaInsights provide customized market report data for the textile chemicals industry?

Yes, ConsaInsights offers customized market report data for the textile chemicals industry to meet specific client needs. Clients can request tailored insights about market trends, regional analyses, and competitive landscapes.

What deliverables can I expect from this textile chemicals market research project?

From this textile chemicals market research project, you can expect comprehensive market insights, detailed analysis reports, segmentation data, and regional growth forecasts. Delivery includes both summary and in-depth reports tailored to your needs.

What are the market trends of textile chemicals?

Current trends in the textile chemicals market include a shift towards sustainability, increased demand for innovative formulations, and a growing focus on performance textiles. Automation and digital transformation within the industry are also significant.