Thawing System Market Report

Published Date: 31 January 2026 | Report Code: thawing-system

Thawing System Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Thawing System market, covering insights on market size, segmentation, regional trends, and future forecasts from 2023 to 2033.

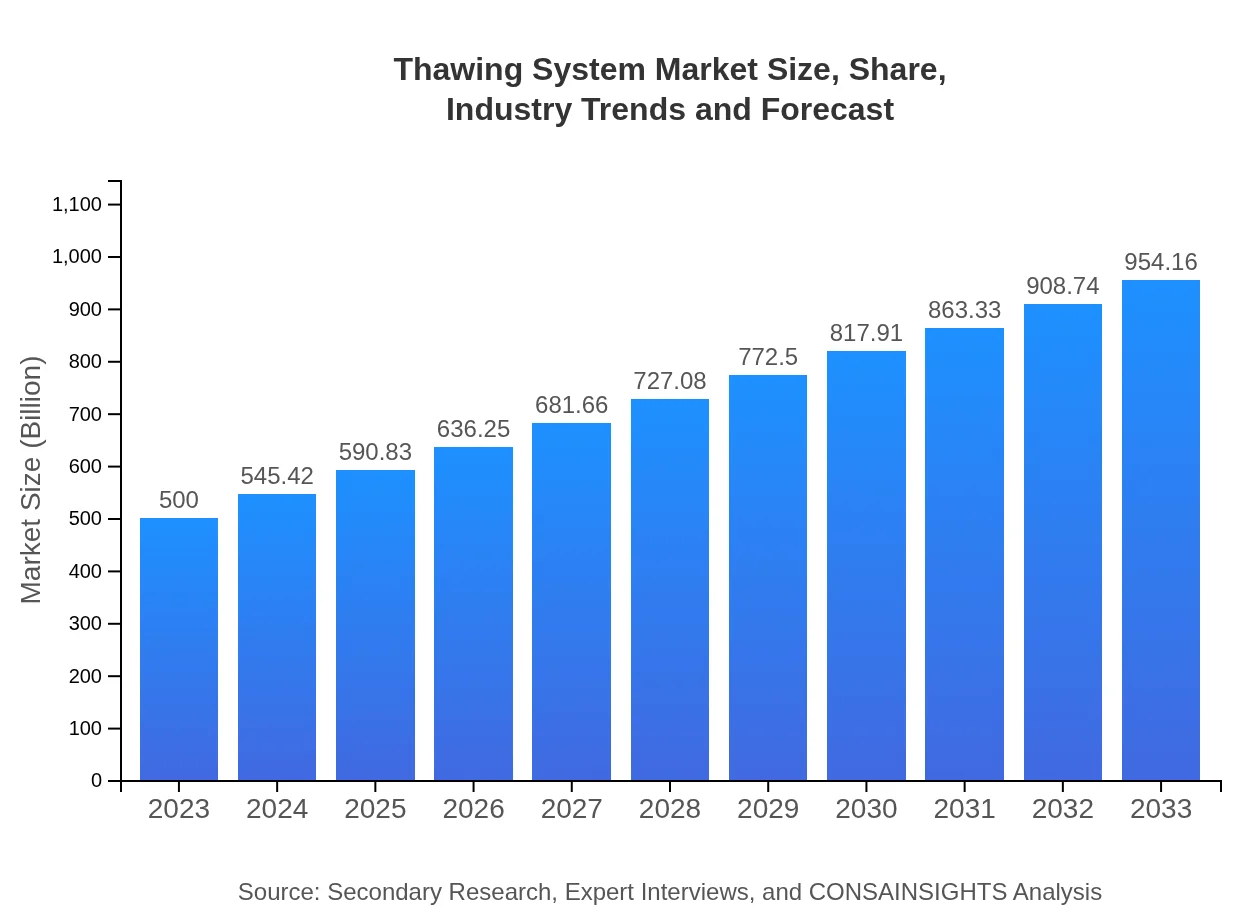

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $500.00 Million |

| CAGR (2023-2033) | 6.5% |

| 2033 Market Size | $954.16 Million |

| Top Companies | Faster, Inc., Thermo Fisher Scientific, Sartorius AG, GELiQ |

| Last Modified Date | 31 January 2026 |

Thawing System Market Overview

Customize Thawing System Market Report market research report

- ✔ Get in-depth analysis of Thawing System market size, growth, and forecasts.

- ✔ Understand Thawing System's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Thawing System

What is the Market Size & CAGR of Thawing System market in 2023?

Thawing System Industry Analysis

Thawing System Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Thawing System Market Analysis Report by Region

Europe Thawing System Market Report:

Europe's market size will expand from $136.40 million in 2023 to $260.29 million in 2033, fueled by stringent regulations in food safety and rising healthcare applications.Asia Pacific Thawing System Market Report:

The Asia Pacific region is anticipated to grow from $96.70 million in 2023 to $184.53 million in 2033, driven by rapid industrialization and increasing food safety standards.North America Thawing System Market Report:

North America is projected to grow from $191.45 million in 2023 to $365.35 million in 2033, supported by technological innovations and a strong focus on food quality and safety.South America Thawing System Market Report:

In South America, the market is expected to grow from $35.60 million in 2023 to $67.94 million in 2033, with food processing and healthcare sectors leading growth.Middle East & Africa Thawing System Market Report:

In the Middle East and Africa, the market is set to grow from $39.85 million in 2023 to $76.05 million in 2033, driven by increasing investments in healthcare and food processing.Tell us your focus area and get a customized research report.

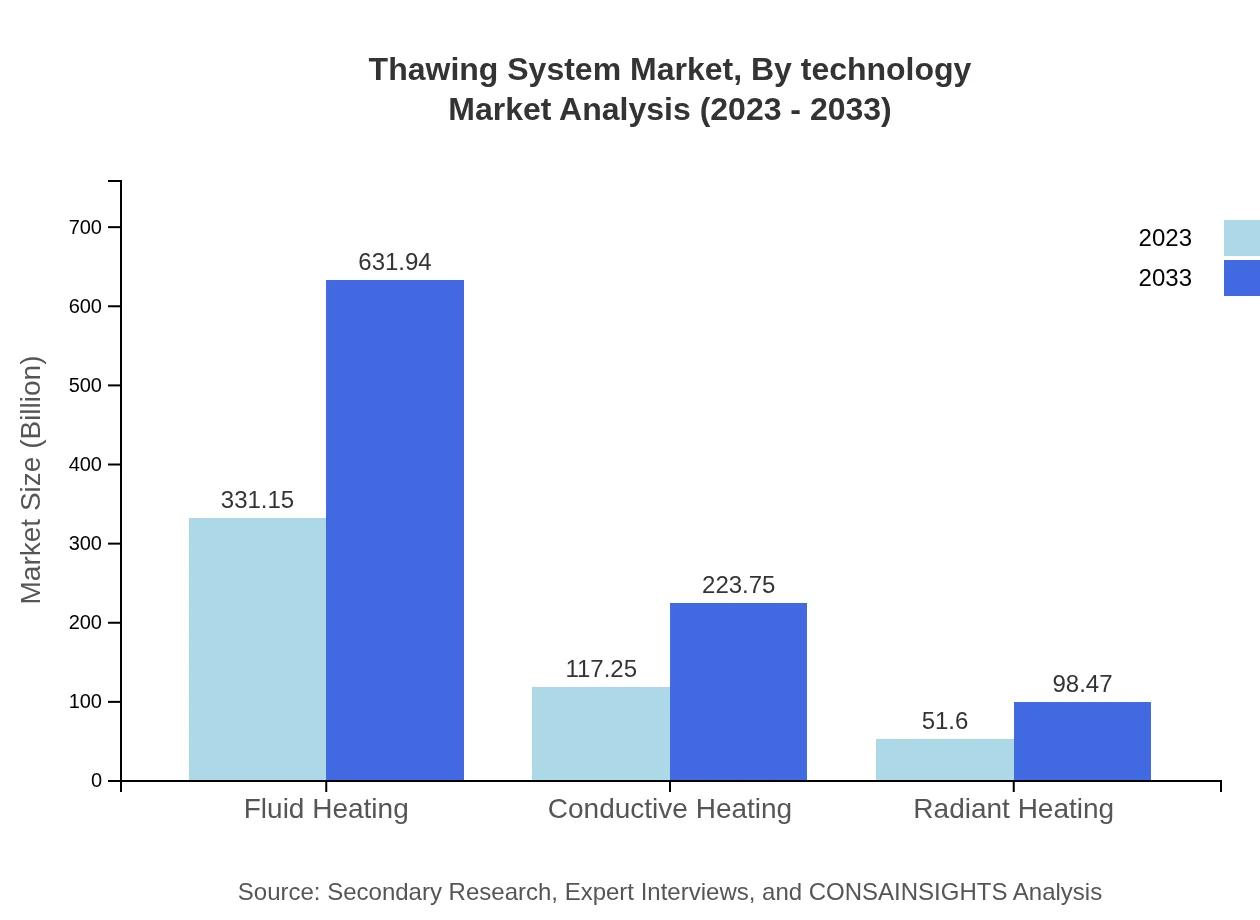

Thawing System Market Analysis By Technology

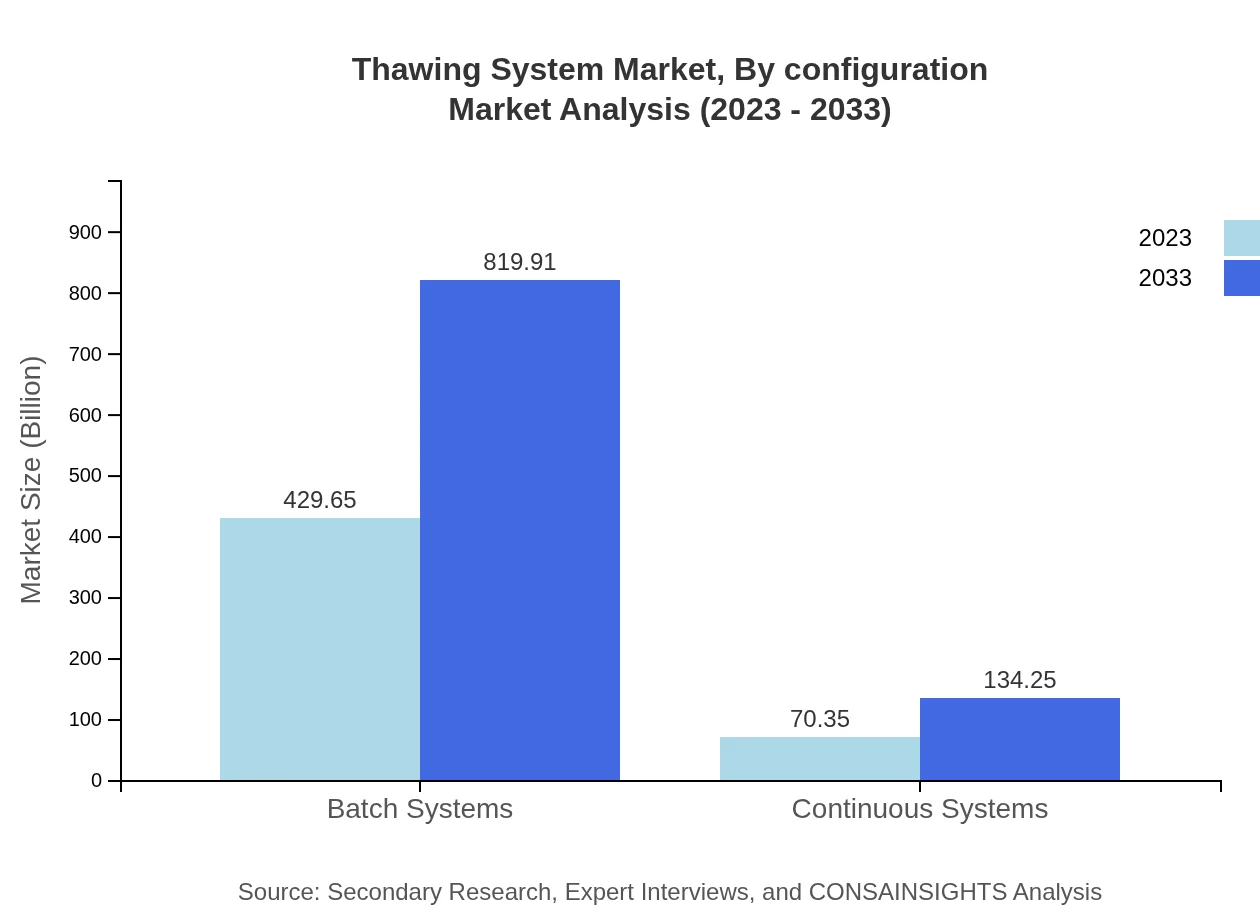

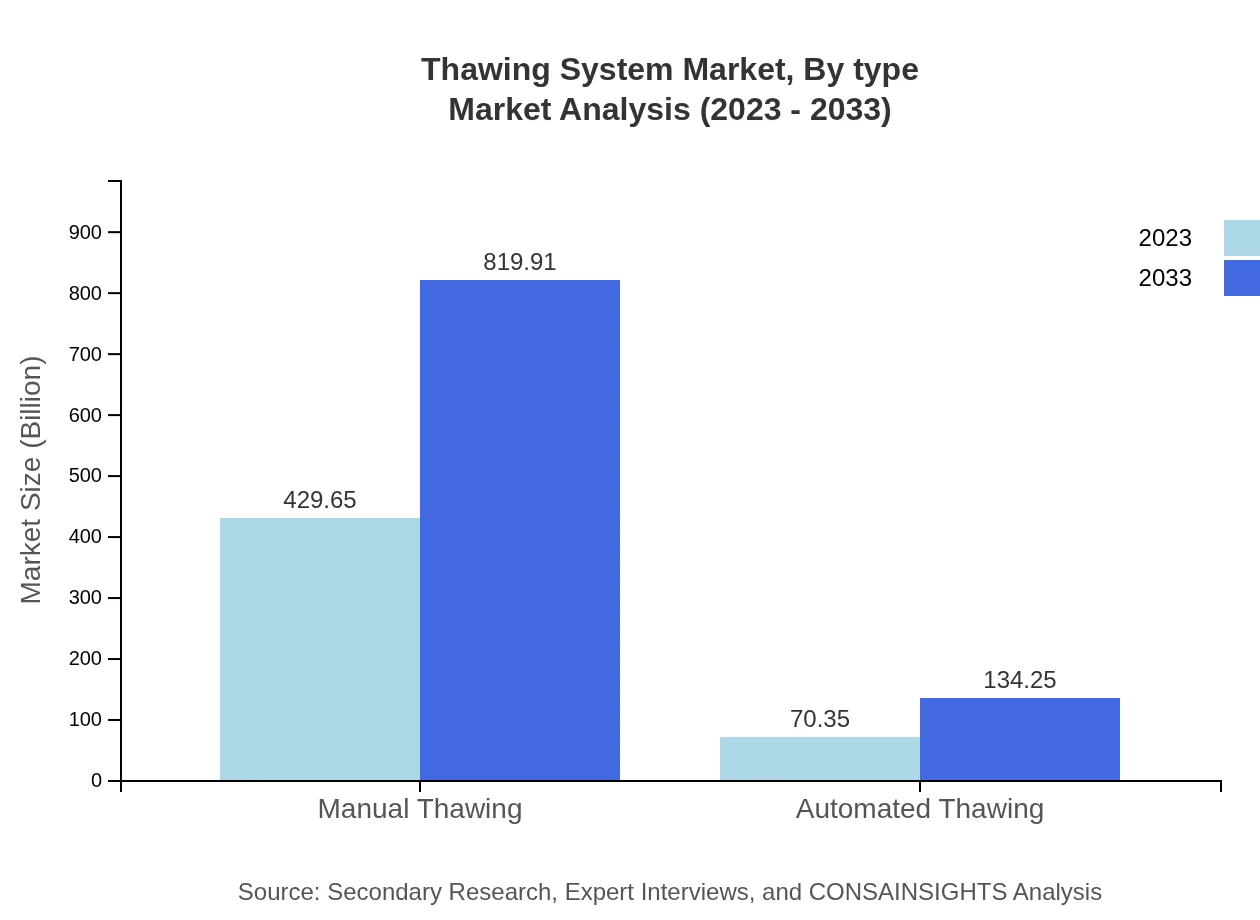

In 2023, manual thawing dominates with a market size of $429.65 million, expected to grow to $819.91 million by 2033, maintaining an 85.93% market share. Automated thawing follows at $70.35 million in 2023, growing to $134.25 million by 2033, with a 14.07% market share.

Thawing System Market Analysis By Application

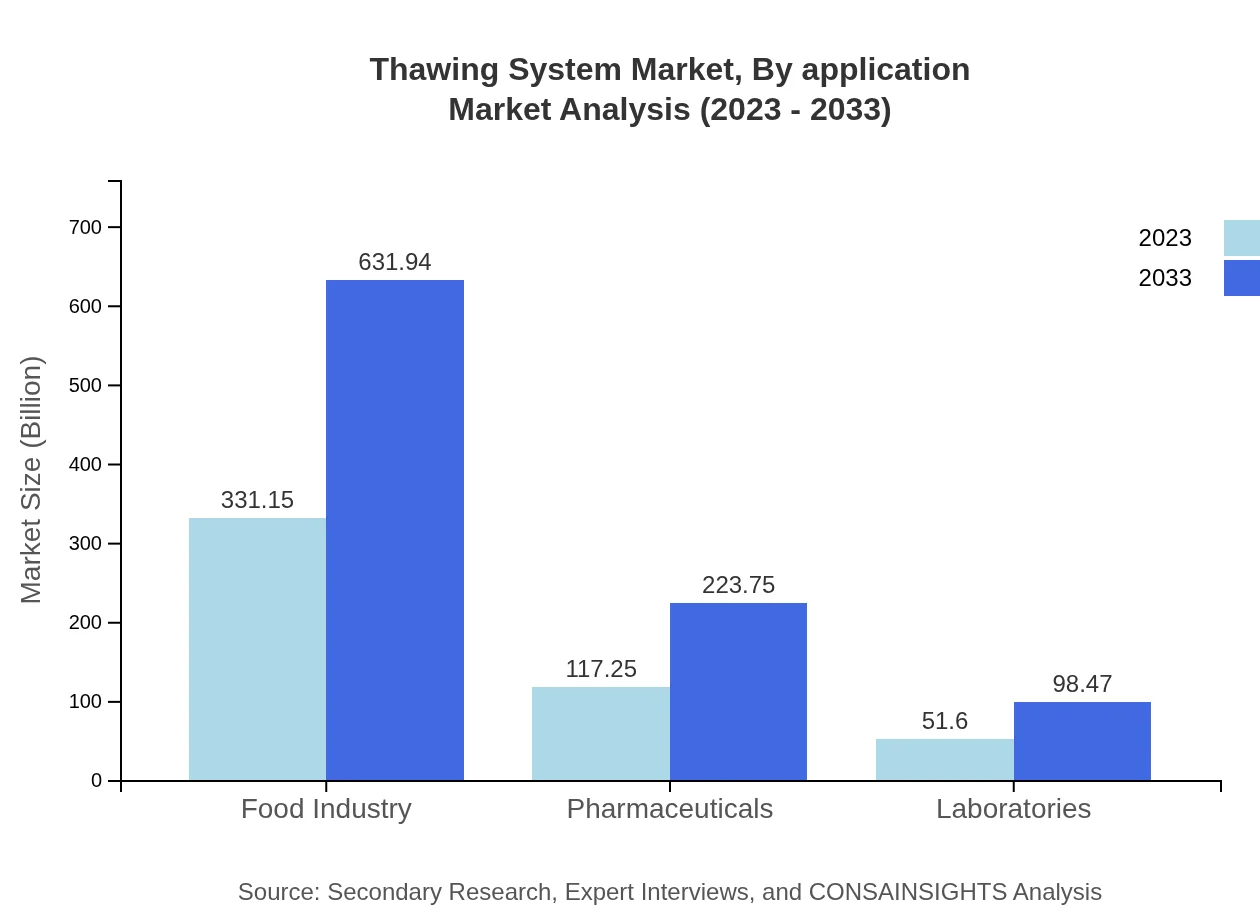

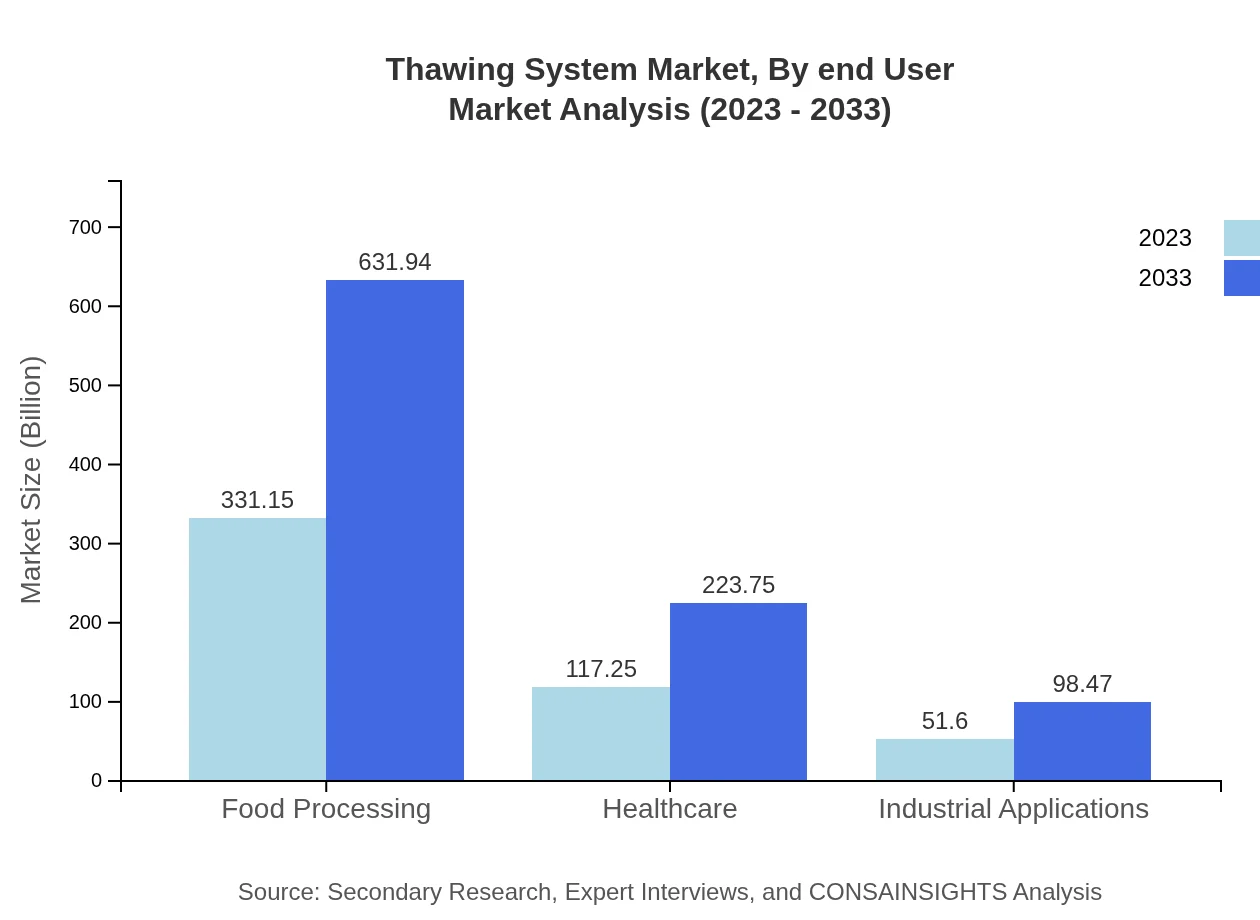

The food processing sector leads with $331.15 million in 2023, projected to double by 2033 at $631.94 million, holding a significant 66.23% market share. Healthcare applications, valued at $117.25 million in 2023, are expected to reach $223.75 million by 2033, representing 23.45% of the market.

Thawing System Market Analysis By Configuration

Batch systems dominate with $429.65 million in 2023, expected to increase to $819.91 million by 2033, retaining an 85.93% market share. Continuous systems are set to grow from $70.35 million in 2023 to $134.25 million in 2033, accounting for 14.07% of the market.

Thawing System Market Analysis By End User

Key end-users include the food industry and healthcare sectors, with food applications leading at $331.15 million in 2023 and reaching $631.94 million by 2033, while healthcare expands from $117.25 million to $223.75 million in the same period.

Thawing System Market Analysis By Type

Fluid heating systems are vital, projected to grow from $331.15 million in 2023 to $631.94 million by 2033, maintaining a 66.23% share. Conductive and radiant heating systems also contribute significantly, with projected growth aligning closely with industry demands.

Thawing System Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Thawing System Industry

Faster, Inc.:

Leading provider of thawing solutions for laboratory and food applications, specializing in manual and automated thawing systems.Thermo Fisher Scientific:

A major player in laboratory technologies, their advanced thawing systems ensure reliable and efficient thawing processes in biobanking and research labs.Sartorius AG:

Known for innovative laboratory equipment, Sartorius manufactures high-performance thawing systems tailored for biotechnology applications.GELiQ:

Focuses on intelligent thawing solutions that enhance the thawing process efficiency and safety for various industries.We're grateful to work with incredible clients.

FAQs

What is the market size of thawing System?

The thawing-system market is estimated to be valued at $500 million in 2023 and is projected to grow at a CAGR of 6.5%, reaching around $1.09 billion by 2033.

What are the key market players or companies in the thawing System industry?

Key players in the thawing-system market include industry leaders who specialize in automated and manual thawing solutions, providing innovative technology tailored for food processing and healthcare applications.

What are the primary factors driving the growth in the thawing system industry?

Growth in the thawing system industry is primarily driven by increasing demand in food processing, healthcare sectors, and advancements in thawing technologies, ensuring efficiency and safety in thawing processes.

Which region is the fastest Growing in the thawing system?

The Asia-Pacific region is the fastest-growing in the thawing system market, with market growth from $96.70 million in 2023 to $184.53 million by 2033, reflecting rising industrial and food processing activities.

Does ConsaInsights provide customized market report data for the thawing System industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the thawing-system industry, ensuring relevant and actionable insights for stakeholders.

What deliverables can I expect from this thawing System market research project?

Deliverables from the thawing-system market research project include comprehensive reports, market analysis, segmented insights, trends, and tailored recommendations for strategic planning.

What are the market trends of thawing System?

Current trends in the thawing-system market include a shift towards automated solutions, increased focus on food safety, and innovations in thawing technology catering to various industrial sectors.