Thermal Spray Coatings Market Report

Published Date: 02 February 2026 | Report Code: thermal-spray-coatings

Thermal Spray Coatings Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Thermal Spray Coatings market from 2023 to 2033, focusing on market size, growth forecasts, segmentation, regional insights, and key industry players, supported by current data and trends in the sector.

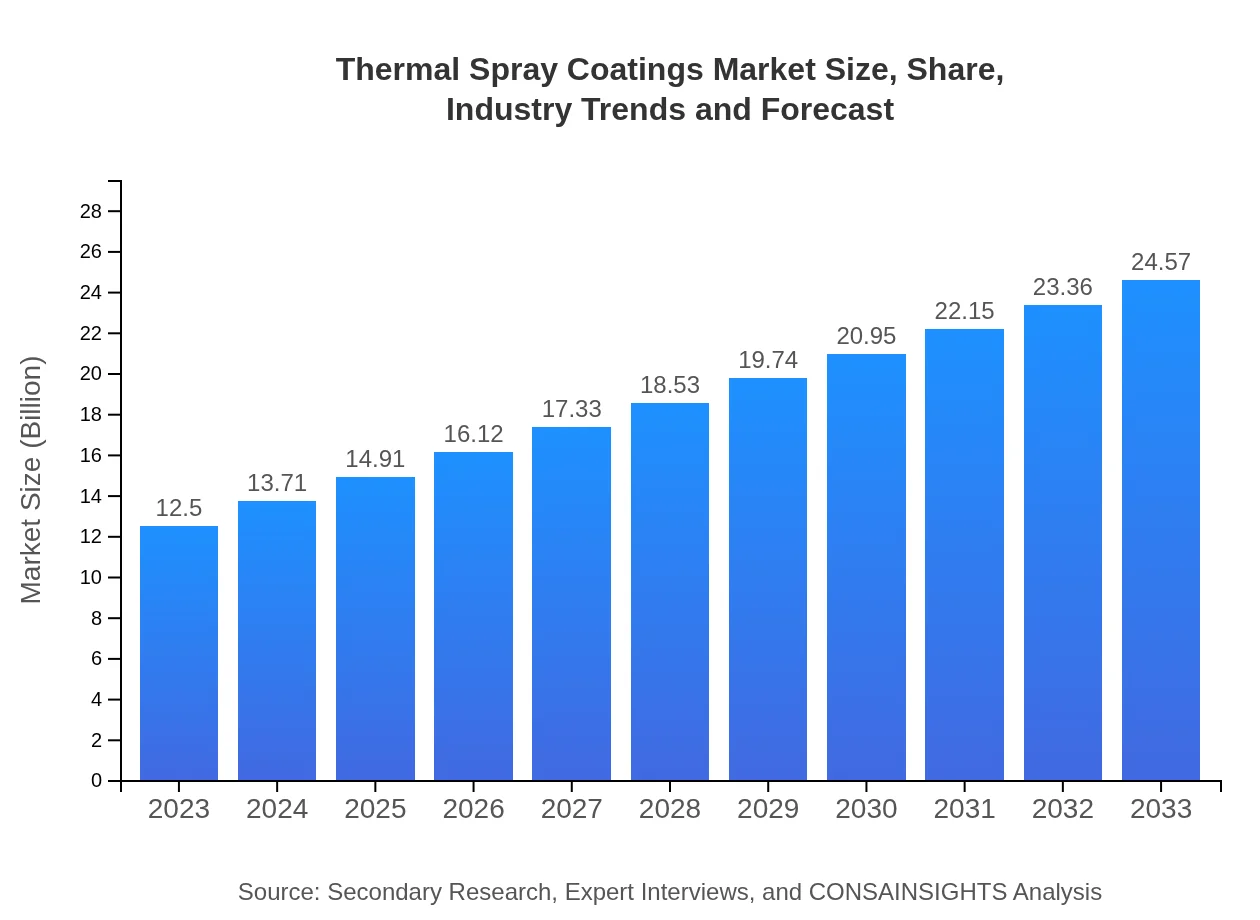

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $12.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $24.57 Billion |

| Top Companies | H.C. Starck GmbH, Metco, Bodycote, Praxis |

| Last Modified Date | 02 February 2026 |

Thermal Spray Coatings Market Overview

Customize Thermal Spray Coatings Market Report market research report

- ✔ Get in-depth analysis of Thermal Spray Coatings market size, growth, and forecasts.

- ✔ Understand Thermal Spray Coatings's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Thermal Spray Coatings

What is the Market Size & CAGR of Thermal Spray Coatings market in 2023?

Thermal Spray Coatings Industry Analysis

Thermal Spray Coatings Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Thermal Spray Coatings Market Analysis Report by Region

Europe Thermal Spray Coatings Market Report:

The European market for Thermal Spray Coatings stands at $4.03 billion in 2023, projected to grow to $7.92 billion by 2033. Germany and the UK are significant markets, driven by stringent regulatory frameworks that mandate the use of durable and efficient coatings in various sectors, including energy and transportation.Asia Pacific Thermal Spray Coatings Market Report:

In the Asia Pacific region, the Thermal Spray Coatings market witnessed a size of $2.16 billion in 2023, anticipated to reach $4.24 billion by 2033. Countries like China and India are ramping up their manufacturing sectors, contributing to significant demand growth for thermal spray solutions. The region's emphasis on industrial modernization and infrastructure development further accelerates market progress.North America Thermal Spray Coatings Market Report:

North America, valued at $4.50 billion in 2023, is expected to see growth to $8.83 billion by 2033. The region is characterized by technologically advanced manufacturing processes and strong demand from the aerospace sector, known for employing high-performance coatings to improve efficiency and component lifespan.South America Thermal Spray Coatings Market Report:

The South American market for Thermal Spray Coatings, with an initial size of $0.52 billion in 2023, is projected to grow to $1.02 billion by 2033. Brazil and Argentina are leading contributors, driven by developments in construction and automotive industries where protective coatings are essential to sustain harsh environments.Middle East & Africa Thermal Spray Coatings Market Report:

The Middle East and Africa market, with a size of $1.30 billion in 2023, is expected to reach $2.56 billion by 2033, propelled by increasing investment in the oil and gas sector and the growing construction industry, where thermal spray solutions enhance material longevity under challenging conditions.Tell us your focus area and get a customized research report.

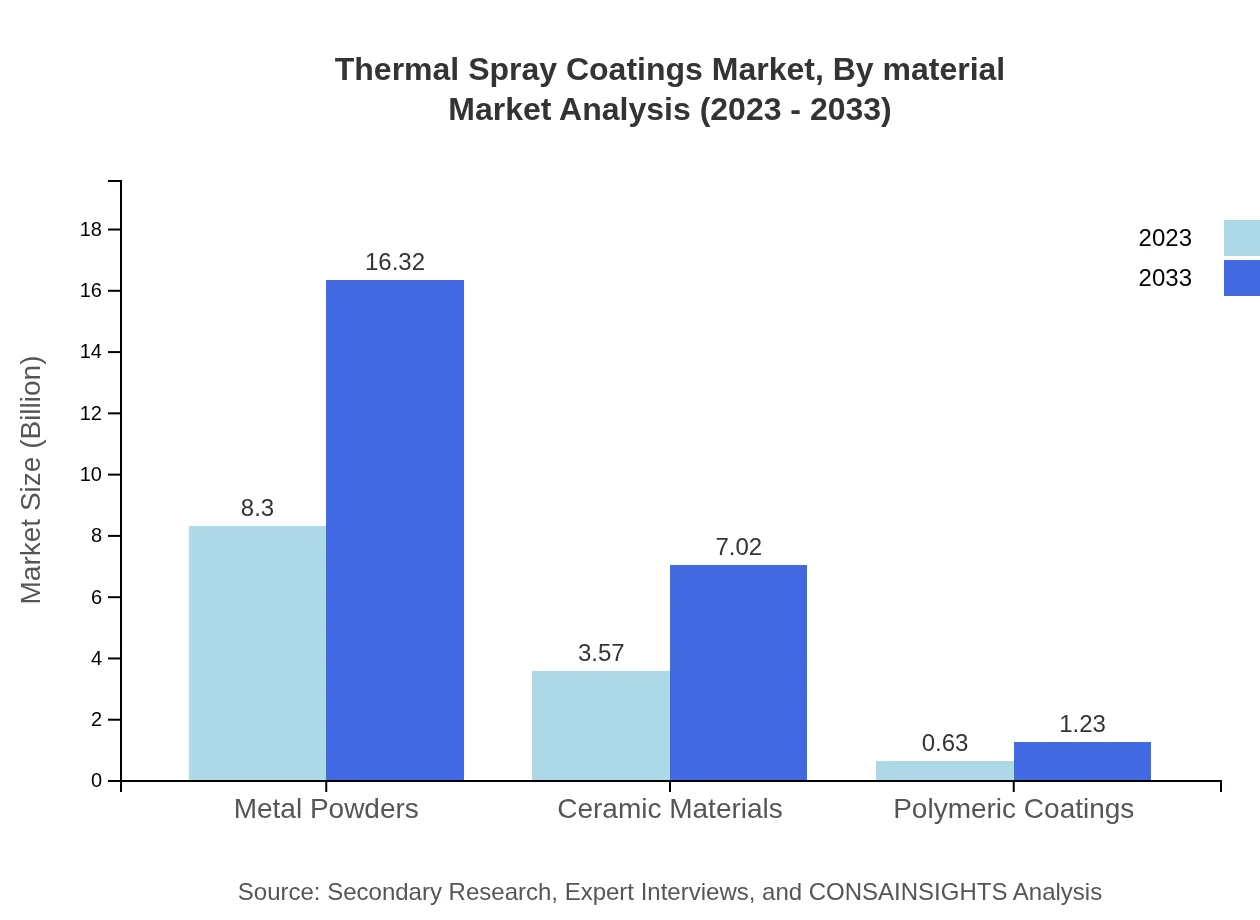

Thermal Spray Coatings Market Analysis By Material

The market for Thermal Spray Coatings, segmented by material type, is dominated by Metal Powders, valued at $8.30 billion in 2023 and expected to reach $16.32 billion by 2033, capturing 66.44% market share. Ceramic materials follow, starting at $3.57 billion in 2023, projected to grow to $7.02 billion, holding 28.56% share. Polymeric coatings, though smaller, are expected to expand from $0.63 billion to $1.23 billion, constituting 5% of the market share.

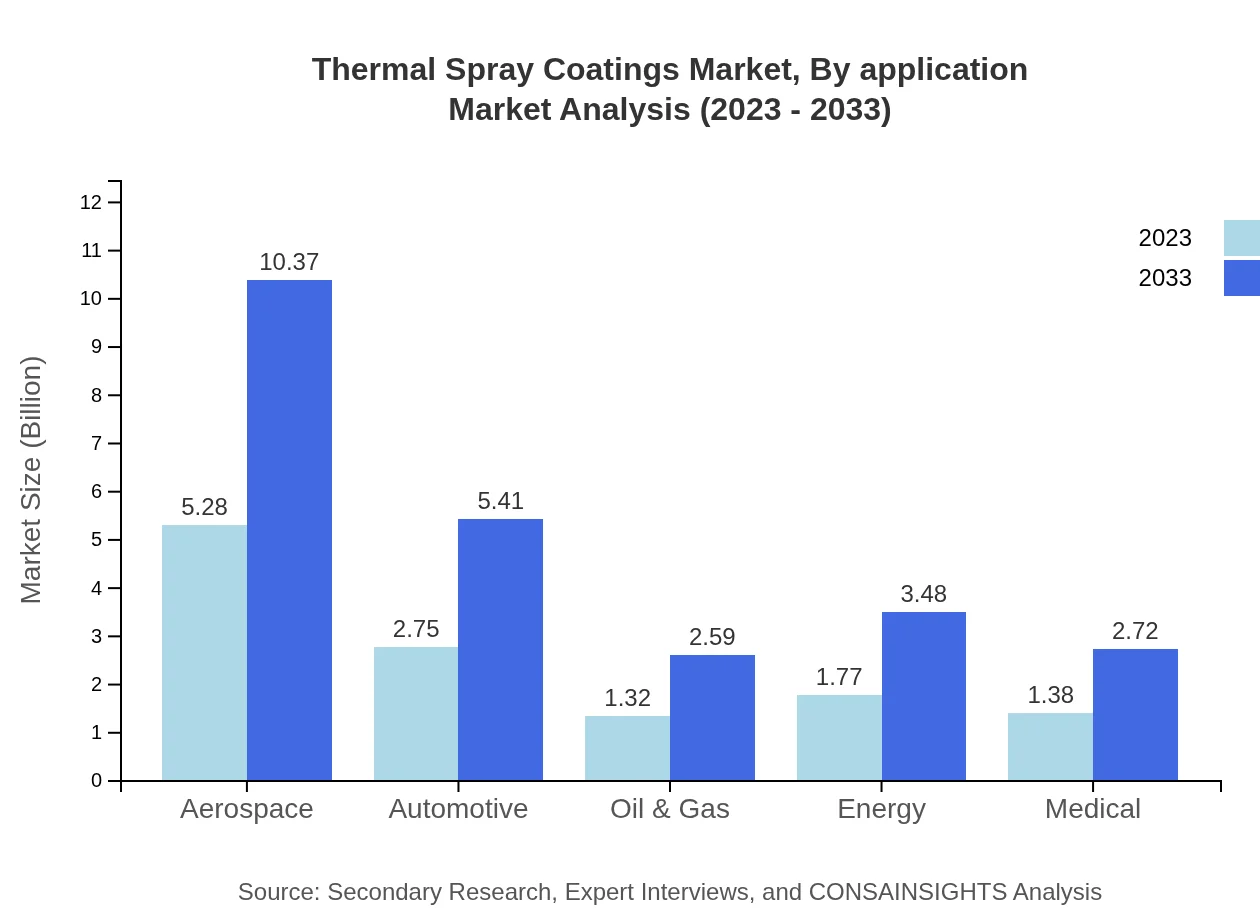

Thermal Spray Coatings Market Analysis By Application

Aerospace applications lead the market, with a size of $5.28 billion in 2023, projected to grow to $10.37 billion, representing a 42.21% share. The automotive sector is also significant, starting at $2.75 billion, expected to grow to $5.41 billion (22.01% share). Other industries like Oil & Gas, Energy, Medical, and Construction are gradually increasing their adoption of thermal spray solutions reflective of the rising demand for equipment longevity and performance sustainability.

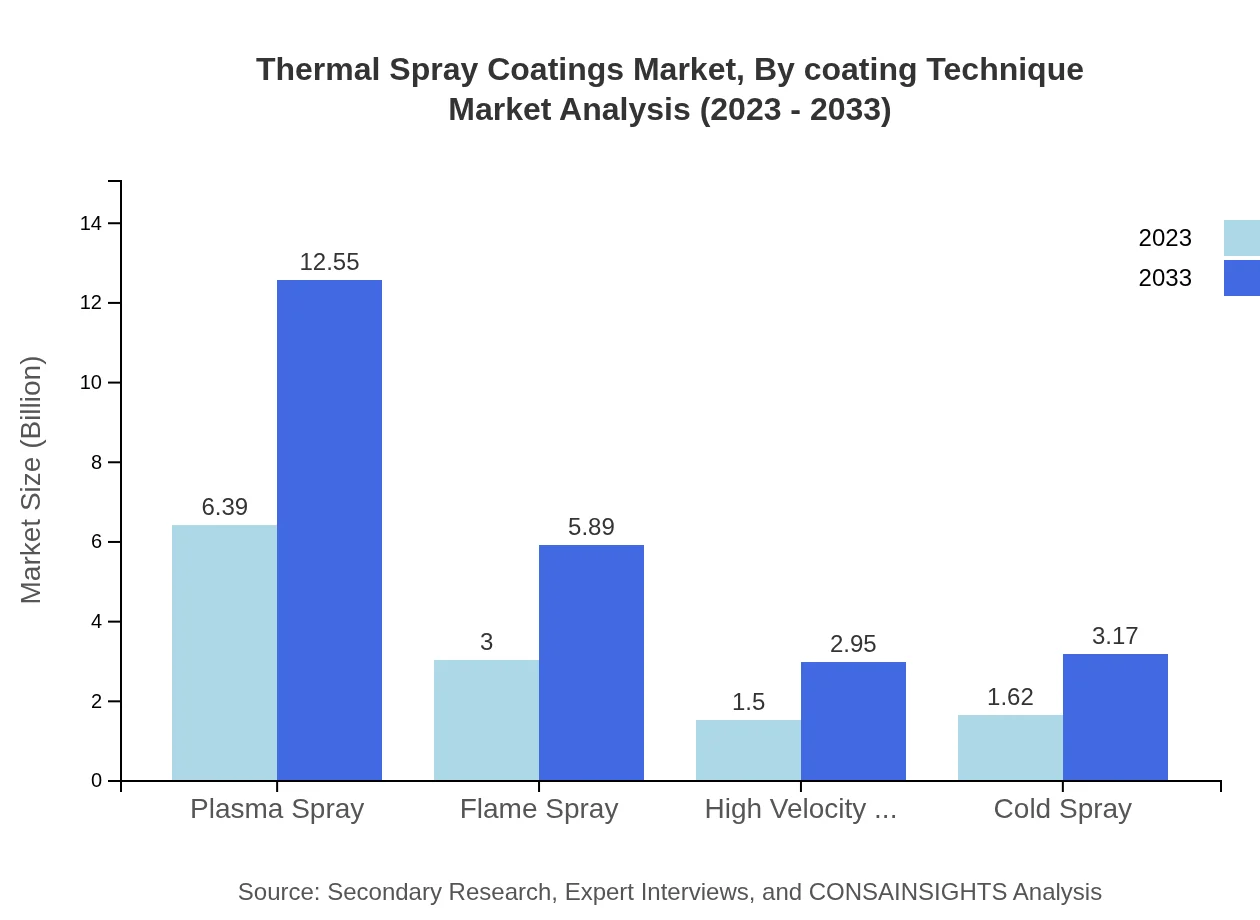

Thermal Spray Coatings Market Analysis By Coating Technique

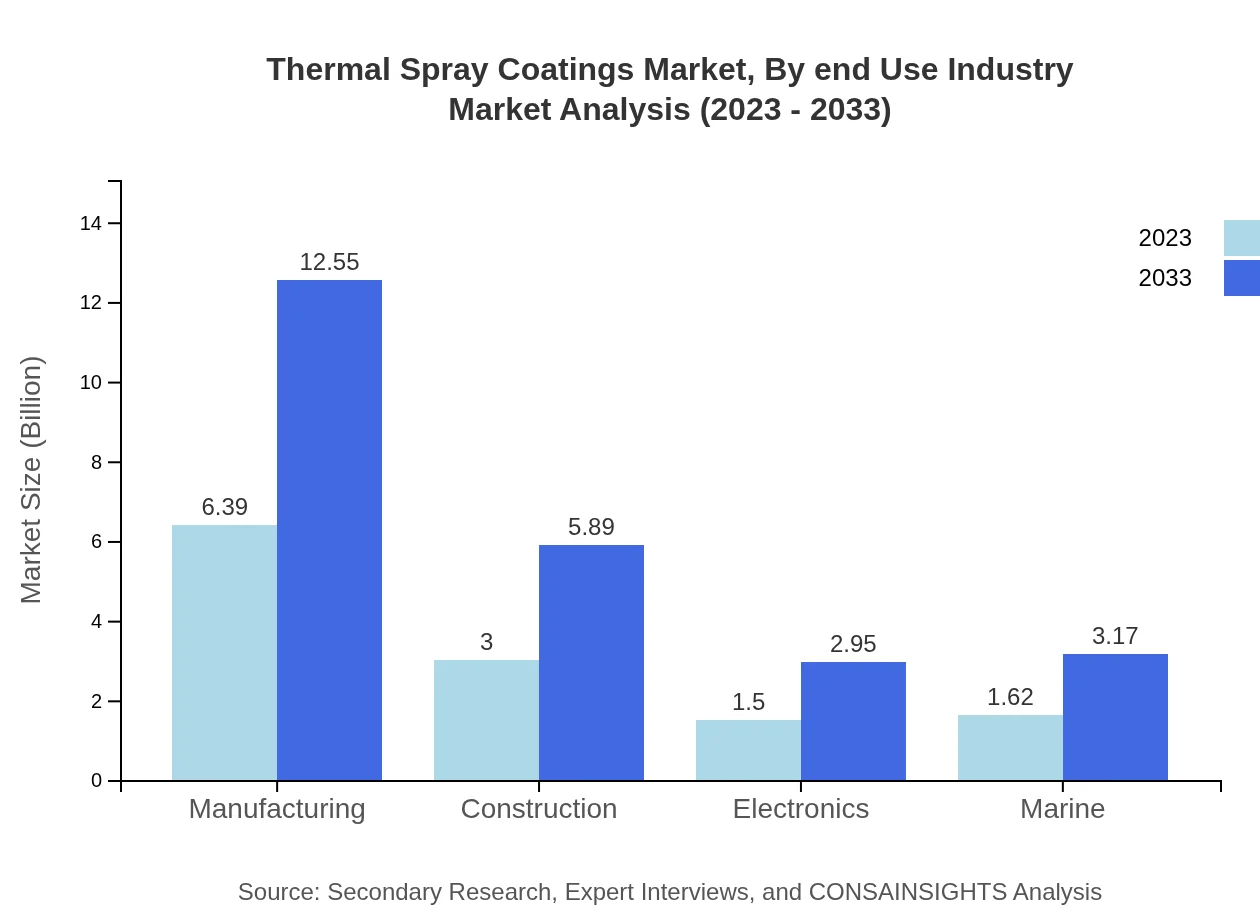

The Plasma Spray technique dominates the market, valued at $6.39 billion with a forecasted growth to $12.55 billion, capturing 51.08% share. Flame Spray is next, starting at $3.00 billion expected to rise to $5.89 billion (23.98% share). Other techniques such as HVOF and Cold Spray are projected to grow from $1.50 billion to $2.95 billion, and from $1.62 billion to $3.17 billion respectively, returning 12.02% and 12.92% shares.

Thermal Spray Coatings Market Analysis By End Use Industry

The Manufacturing sector represents the largest share with a market size of $6.39 billion, anticipated to reach $12.55 billion, making up 51.08% of the total. Sectors like Construction and Electronics are also relevant, beginning at $3.00 billion and $1.50 billion respectively, indicators of the diverse applications of thermal spray coatings across various industries driven by protective and efficiency-enhancing coatings.

Thermal Spray Coatings Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Thermal Spray Coatings Industry

H.C. Starck GmbH:

A leader in metal powder production and surface solutions, H.C. Starck offers a wide range of thermal spray coatings backed by advanced technologies and stringent quality standards.Metco:

A renowned provider of thermal spray coatings, Metco specializes in diverse applications, catering to industries such as aerospace and automotive with a focus on performance and reliability.Bodycote:

As one of the world's largest providers of thermal processing services, Bodycote offers thermal spray coating processes and innovative solutions to enhance component life and performance.Praxis:

Praxis is known for its advanced thermal spray processes, providing tailored coating solutions to meet the specific requirements of various industrial applications.We're grateful to work with incredible clients.

FAQs

What is the market size of thermal Spray Coatings?

The global thermal spray coatings market is valued at approximately $12.5 billion in 2023 and is projected to grow at a CAGR of 6.8%, reaching significant market size by 2033.

What are the key market players or companies in this thermal Spray Coatings industry?

Key players in the thermal spray coatings market include companies like Praxair Surface Technologies, Oerlikon Metco, and Sulzer, which are known for their innovative solutions and strong market presence.

What are the primary factors driving the growth in the thermal Spray Coatings industry?

Driving factors include increasing demand for advanced materials in aerospace and automotive sectors, the rise in manufacturing processes requiring surface protection, and technological advancements in coating applications.

Which region is the fastest Growing in the thermal Spray Coatings?

The fastest-growing region for thermal spray coatings is North America, projected to grow from $4.50 billion in 2023 to $8.83 billion by 2033, propelled by industrial growth and innovation.

Does ConsaInsights provide customized market report data for the thermal Spray Coatings industry?

Yes, ConsaInsights offers tailored market report data, allowing clients to obtain specific insights and trends relevant to their business needs within the thermal spray coatings industry.

What deliverables can I expect from this thermal Spray Coatings market research project?

Deliverables include comprehensive reports, data analysis on market size, segmentation, competitive landscape, and regional forecasts, ensuring valuable insights for decision-making.

What are the market trends of thermal Spray Coatings?

Key trends include increased adoption of eco-friendly coatings, ongoing technological developments in application methods, and expanding applications in emerging sectors like energy and medical industries.