Thermoset Composites Market Report

Published Date: 02 February 2026 | Report Code: thermoset-composites

Thermoset Composites Market Size, Share, Industry Trends and Forecast to 2033

This report provides an extensive analysis of the Thermoset Composites market, covering key insights into market trends, size, and growth forecasts from 2023 to 2033. It aims to shed light on the industry dynamics and competitive landscape.

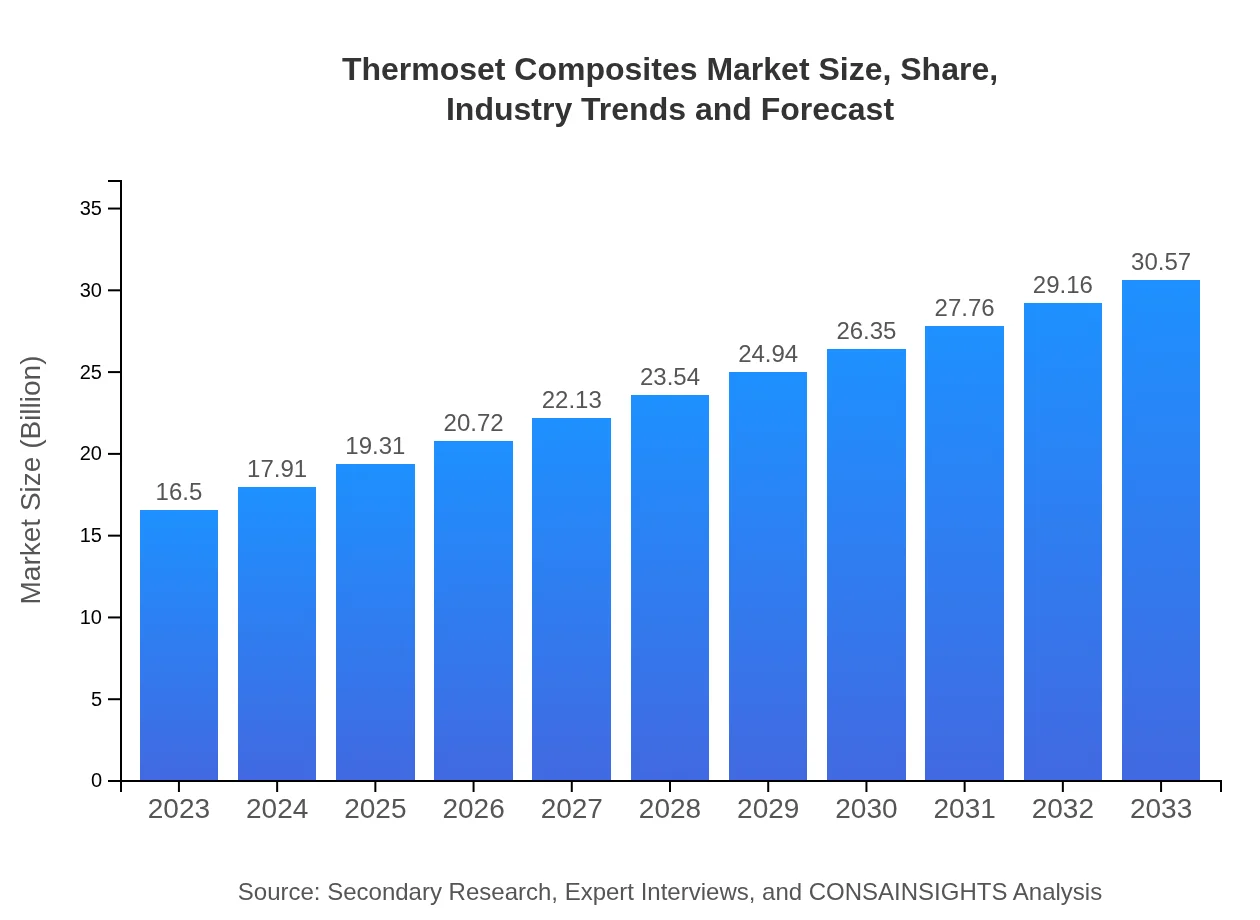

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $16.50 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $30.57 Billion |

| Top Companies | Hexcel Corporation, Mitsubishi Chemical Holdings Corporation, BASF SE |

| Last Modified Date | 02 February 2026 |

Thermoset Composites Market Overview

Customize Thermoset Composites Market Report market research report

- ✔ Get in-depth analysis of Thermoset Composites market size, growth, and forecasts.

- ✔ Understand Thermoset Composites's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Thermoset Composites

What is the Market Size & CAGR of Thermoset Composites market in 2023?

Thermoset Composites Industry Analysis

Thermoset Composites Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Thermoset Composites Market Analysis Report by Region

Europe Thermoset Composites Market Report:

The European Thermoset Composites market is expected to grow from $5.31 billion in 2023 to $9.83 billion by 2033. The growth is attributed to stringent regulatory standards and technological advancements in the automotive and aerospace industries across the region.Asia Pacific Thermoset Composites Market Report:

In 2023, the Thermoset Composites market in the Asia Pacific region is valued at $3.08 billion and is projected to reach $5.70 billion by 2033, growing due to increased infrastructure projects and automotive production in countries like China and India, making it a crucial region for market expansion.North America Thermoset Composites Market Report:

In North America, the market is valued at $5.79 billion in 2023, projected to increase to $10.72 billion by 2033. The growth is driven primarily by the aerospace and automotive sectors in the United States, along with robust defense spending.South America Thermoset Composites Market Report:

The South American market for Thermoset Composites is estimated at $1.16 billion in 2023, with growth expected to reach $2.15 billion by 2033. This growth is fueled by increased investments in renewable energy and construction sectors across Brazil and Argentina.Middle East & Africa Thermoset Composites Market Report:

In the Middle East and Africa, the market size is estimated at $1.17 billion in 2023, with projections to reach $2.16 billion by 2033. The market is experiencing growth driven by increased infrastructural developments and investments in renewable energy sectors.Tell us your focus area and get a customized research report.

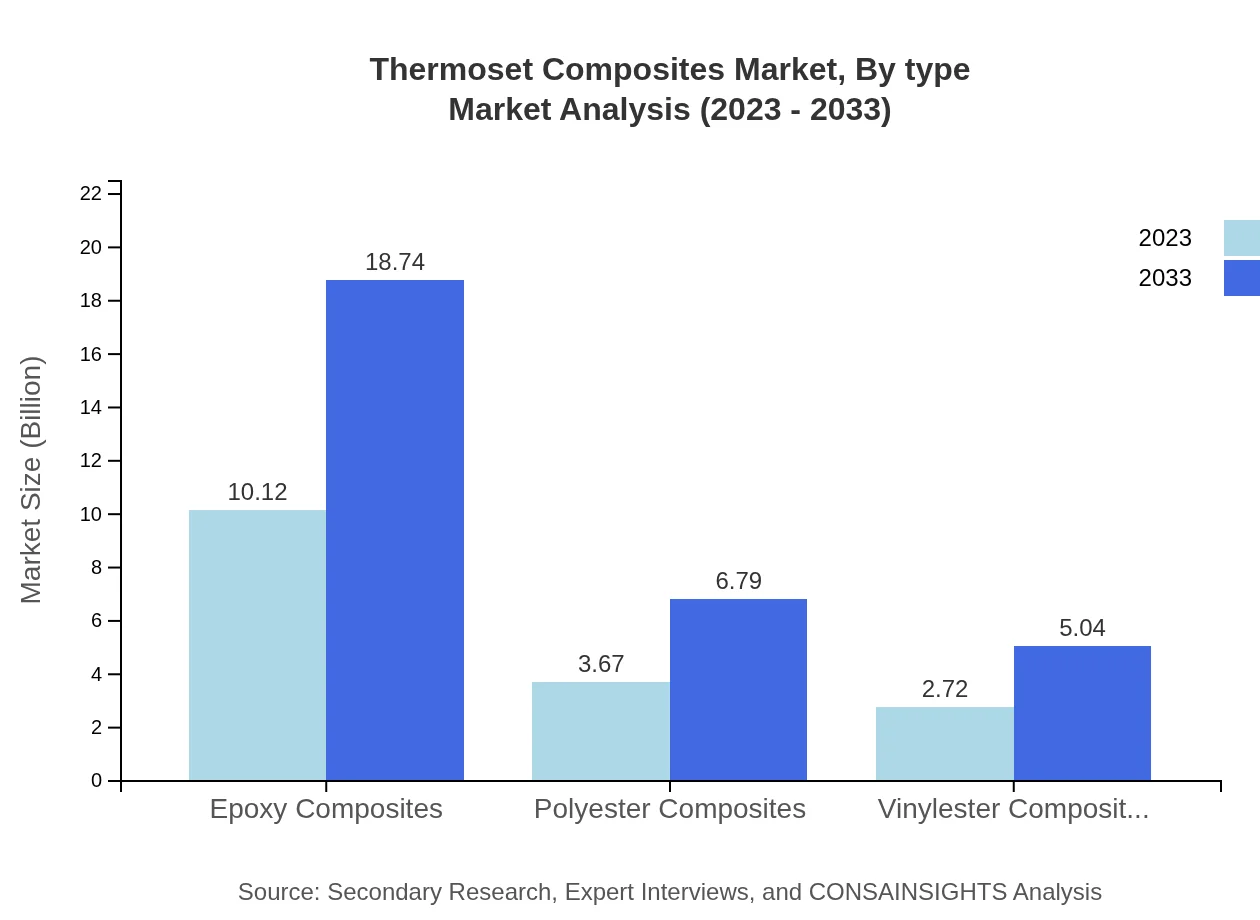

Thermoset Composites Market Analysis By Type

The Thermoset Composites market by type includes three major segments: epoxy composites, polyester composites, and vinylester composites. In 2023, epoxy composites dominate with a market size of $10.12 billion and a 61.31% share. Polyester composites follow with $3.67 billion and 22.22% share, while vinylester composites account for $2.72 billion and 16.47% share.

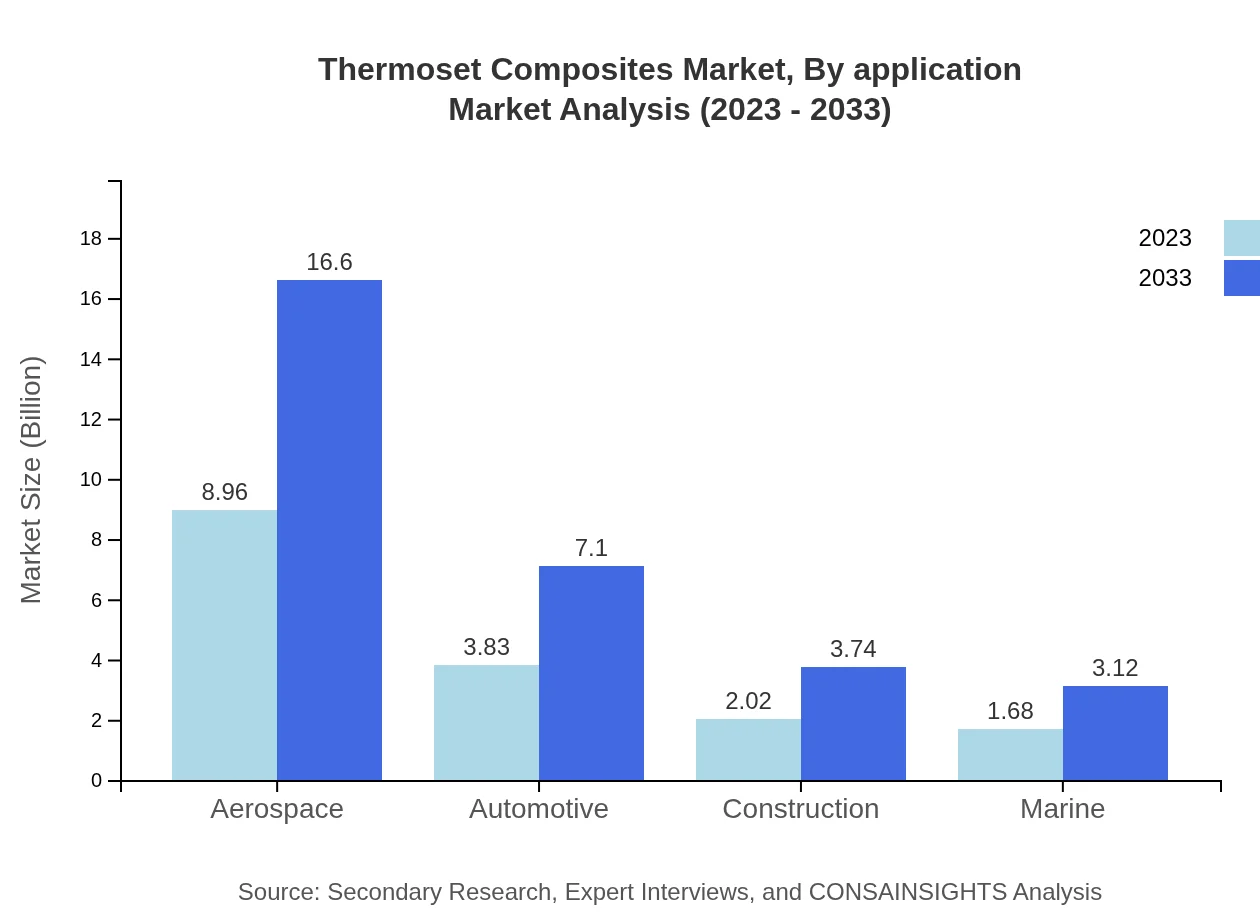

Thermoset Composites Market Analysis By Application

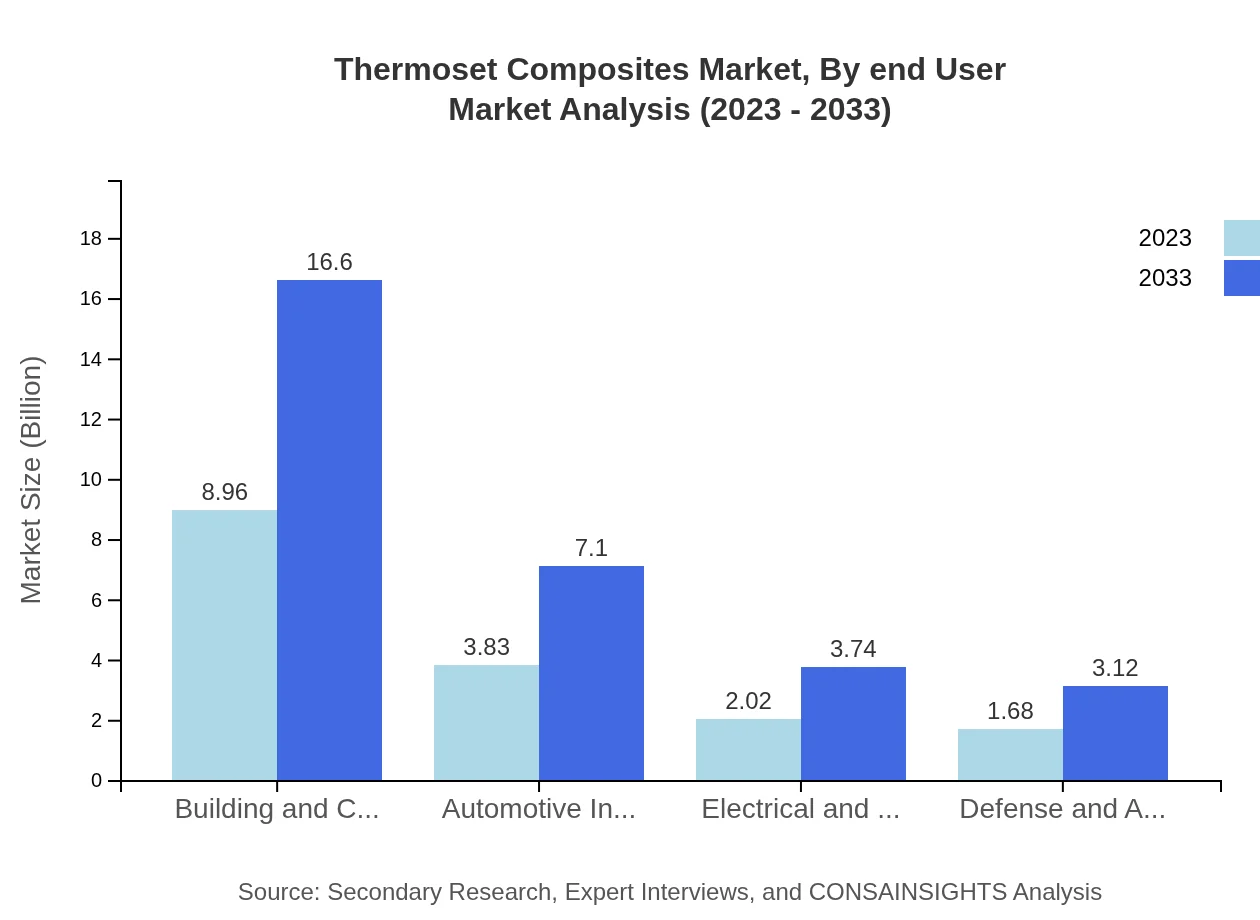

Applications of Thermoset Composites span various industries including building and construction, automotive, electrical and electronics, and aerospace. In 2023, building and construction holds a significant share, with $8.96 billion representing 54.31% of the market, while the automotive industry is valued at $3.83 billion with a 23.23% share.

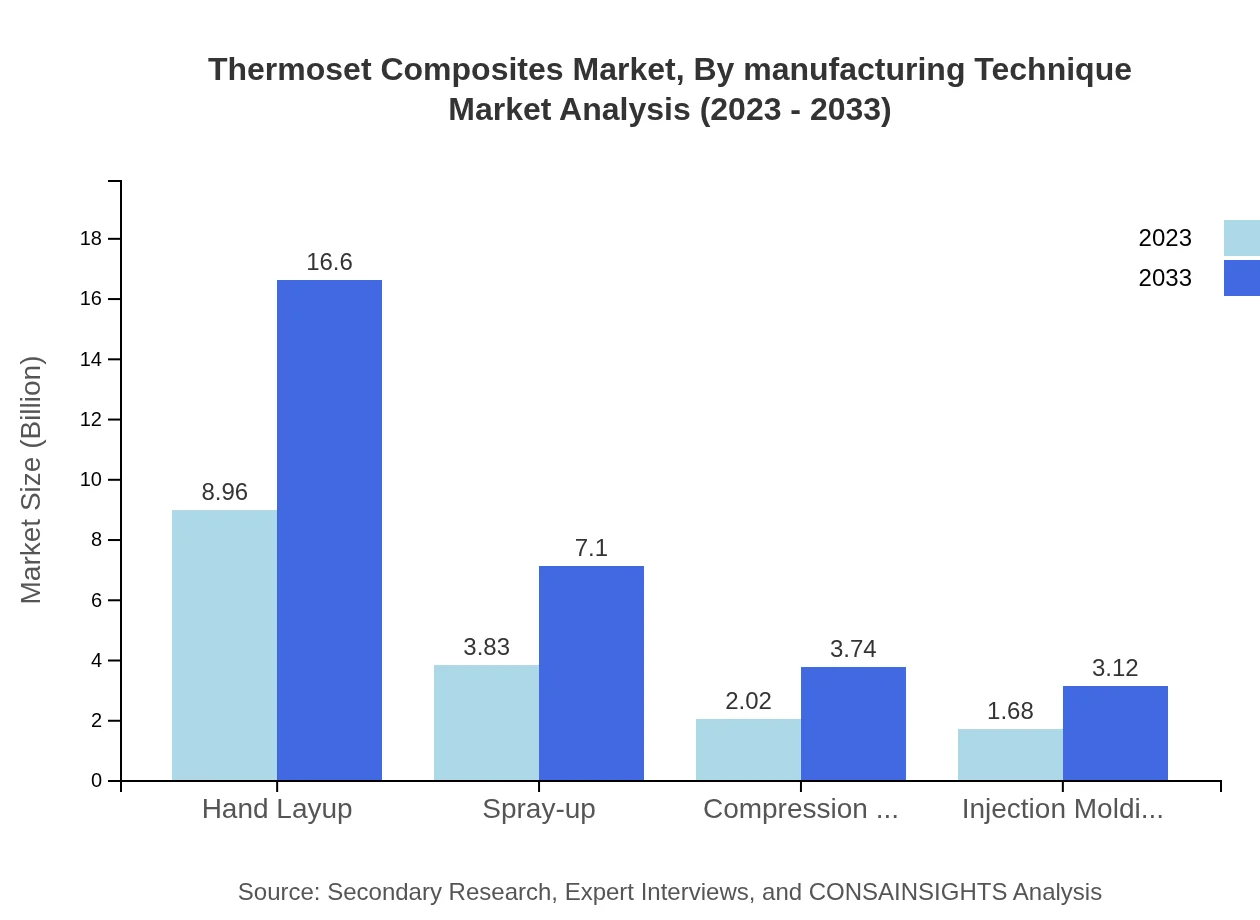

Thermoset Composites Market Analysis By Manufacturing Technique

Common manufacturing techniques for Thermoset Composites include hand layup, spray-up, injection molding, and compression molding. Each method has distinct impacts on cost, scalability, and quality of the final product. The hand layup technique remains predominant, with a market size of $8.96 billion in 2023, accounting for 54.31% of the market.

Thermoset Composites Market Analysis By End User

Key end-user industries utilizing Thermoset Composites include automotive, aerospace, and construction. The automotive sector is expected to witness growth from $3.83 billion in 2023 (23.23% market share) to increased adoption driven by demand for lightweight and high-performance materials.

Thermoset Composites Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Thermoset Composites Industry

Hexcel Corporation:

A leading global supplier of advanced composites technology, Hexcel specializes in lightweight materials for aerospace, automotive, and industrial applications.Mitsubishi Chemical Holdings Corporation:

A major player in the composites market, Mitsubishi Chemical focuses on innovative solutions in thermoset composites for automotive and industrial applications.BASF SE:

BASF is one of the world’s largest chemical producers and a key supplier of thermosetting resins, providing high-performance solutions for various industries.We're grateful to work with incredible clients.

FAQs

What is the market size of thermoset Composites?

The thermoset composites market is valued at approximately $16.5 billion in 2023, with a projected CAGR of 6.2% from 2023 to 2033. This growth underscores the increasing demand across various sectors that utilize these durable materials.

What are the key market players or companies in this thermoset Composites industry?

Key players in the thermoset composites industry include major manufacturers such as Hexcel Corporation, Toray Industries, and BASF. These companies are pivotal in driving innovation and expanding their product offerings in advanced composite materials.

What are the primary factors driving the growth in the thermoset Composites industry?

The growth of the thermoset composites industry is primarily driven by increased demand in sectors like aerospace, automotive, and construction. The material's superior strength-to-weight ratios and durability make it ideal for high-performance applications.

Which region is the fastest Growing in the thermoset Composites?

The Asia Pacific region is the fastest-growing market for thermoset composites, with growth from $3.08 billion in 2023 to $5.70 billion in 2033. This growth is fueled by rapid industrialization and demand in manufacturing.

Does ConsaInsights provide customized market report data for the thermoset Composites industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the thermoset composites industry. This ensures clients can obtain targeted insights to support strategic decisions.

What deliverables can I expect from this thermoset Composites market research project?

Clients can expect comprehensive deliverables, including detailed market analysis, competitive landscape assessments, and forecasts. Additionally, customized recommendations will be provided based on specific research objectives.

What are the market trends of thermoset Composites?

Current trends in the thermoset composites market include a growing focus on sustainability and the incorporation of recycled materials. Additionally, advancements in manufacturing technologies are enhancing the performance characteristics of these composites.