Thermoset Molding Compound Market Report

Published Date: 02 February 2026 | Report Code: thermoset-molding-compound

Thermoset Molding Compound Market Size, Share, Industry Trends and Forecast to 2033

This report provides comprehensive insights into the Thermoset Molding Compound market, detailing market size, segments, regional analysis, and industry dynamics from 2023 to 2033.

| Metric | Value |

|---|---|

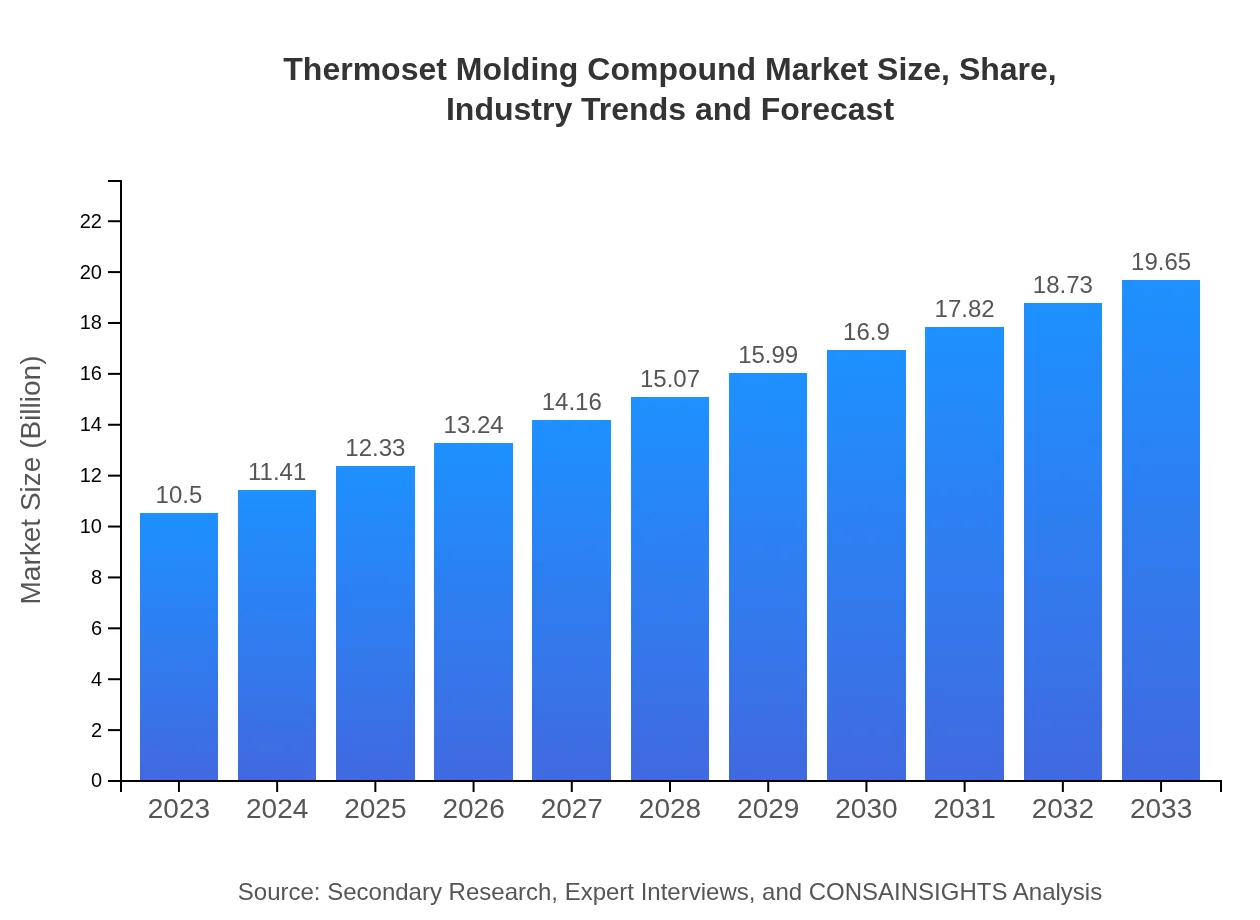

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 6.3% |

| 2033 Market Size | $19.65 Billion |

| Top Companies | Huntsman Corporation, BASF SE, DuPont, SABIC, Archroma |

| Last Modified Date | 02 February 2026 |

Thermoset Molding Compound Market Overview

Customize Thermoset Molding Compound Market Report market research report

- ✔ Get in-depth analysis of Thermoset Molding Compound market size, growth, and forecasts.

- ✔ Understand Thermoset Molding Compound's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Thermoset Molding Compound

What is the Market Size & CAGR of Thermoset Molding Compound market in 2023?

Thermoset Molding Compound Industry Analysis

Thermoset Molding Compound Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Thermoset Molding Compound Market Analysis Report by Region

Europe Thermoset Molding Compound Market Report:

Europe's market is estimated to expand from $3.17 billion in 2023 to $5.92 billion by 2033, with strong demand stemming from industries focused on energy efficiency and sustainable materials.Asia Pacific Thermoset Molding Compound Market Report:

The Asia Pacific region is projected to grow from $1.83 billion in 2023 to $3.43 billion by 2033, driven by rising manufacturing capacities in China and India, along with increasing automotive production.North America Thermoset Molding Compound Market Report:

North America holds a significant share of the market, expected to grow from $4.05 billion in 2023 to $7.58 billion by 2033, largely due to advanced aerospace and automotive sectors leveraging thermoset technology.South America Thermoset Molding Compound Market Report:

In South America, the market is anticipated to increase from $0.91 billion in 2023 to $1.69 billion by 2033, supported by developing industries, particularly in Brazil and Argentina.Middle East & Africa Thermoset Molding Compound Market Report:

The Middle East and Africa market is projected to double from $0.54 billion in 2023 to $1.02 billion by 2033, influenced by infrastructure developments and investments in renewable energy.Tell us your focus area and get a customized research report.

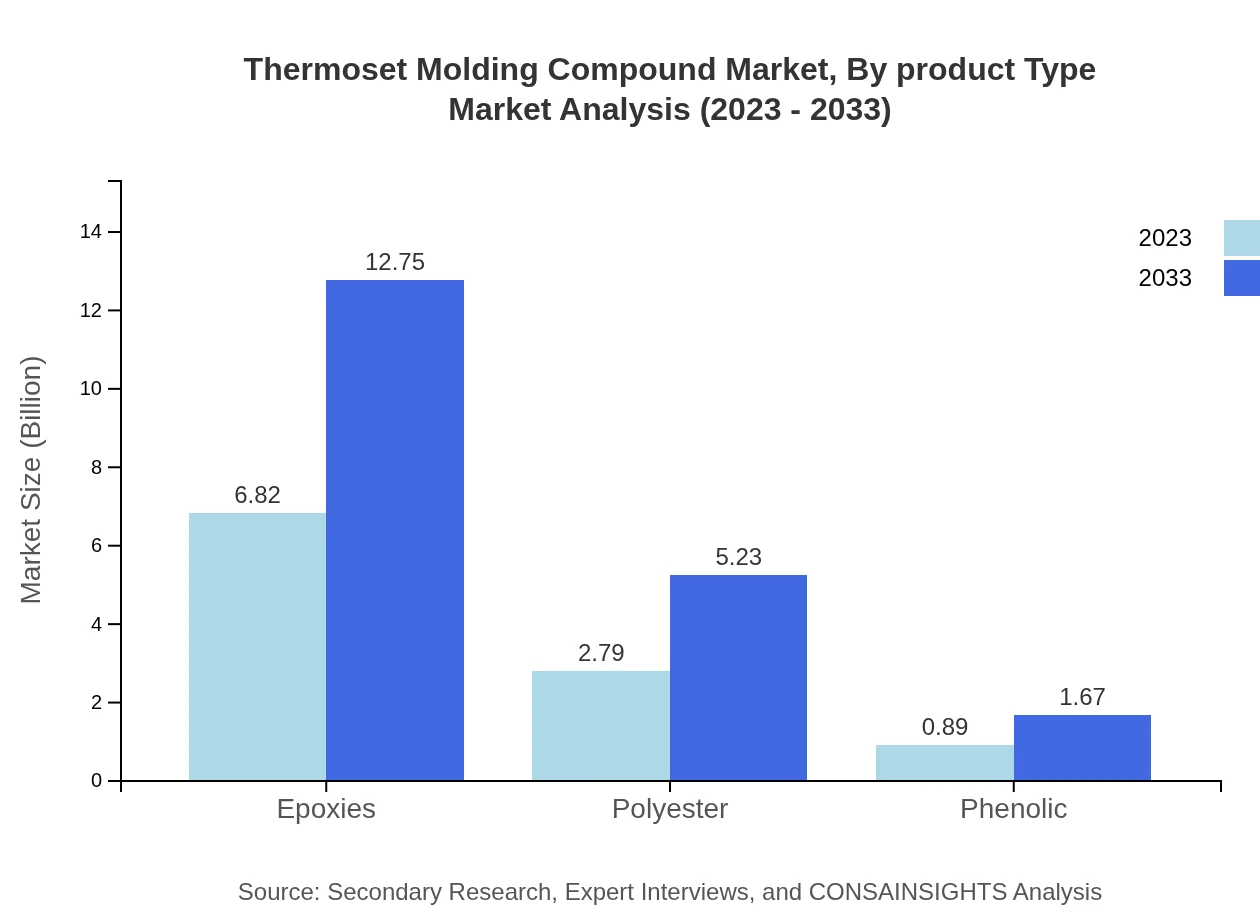

Thermoset Molding Compound Market Analysis By Product Type

The Thermoset Molding Compound Market is significantly driven by Epoxies, which dominate the market through user-friendly characteristics and versatility. Polyester and Phenolic compounds also hold notable shares, being extensively used across several sectors. Each product type caters to specific demands in performance and sustainability, making their contribution to the market vital.

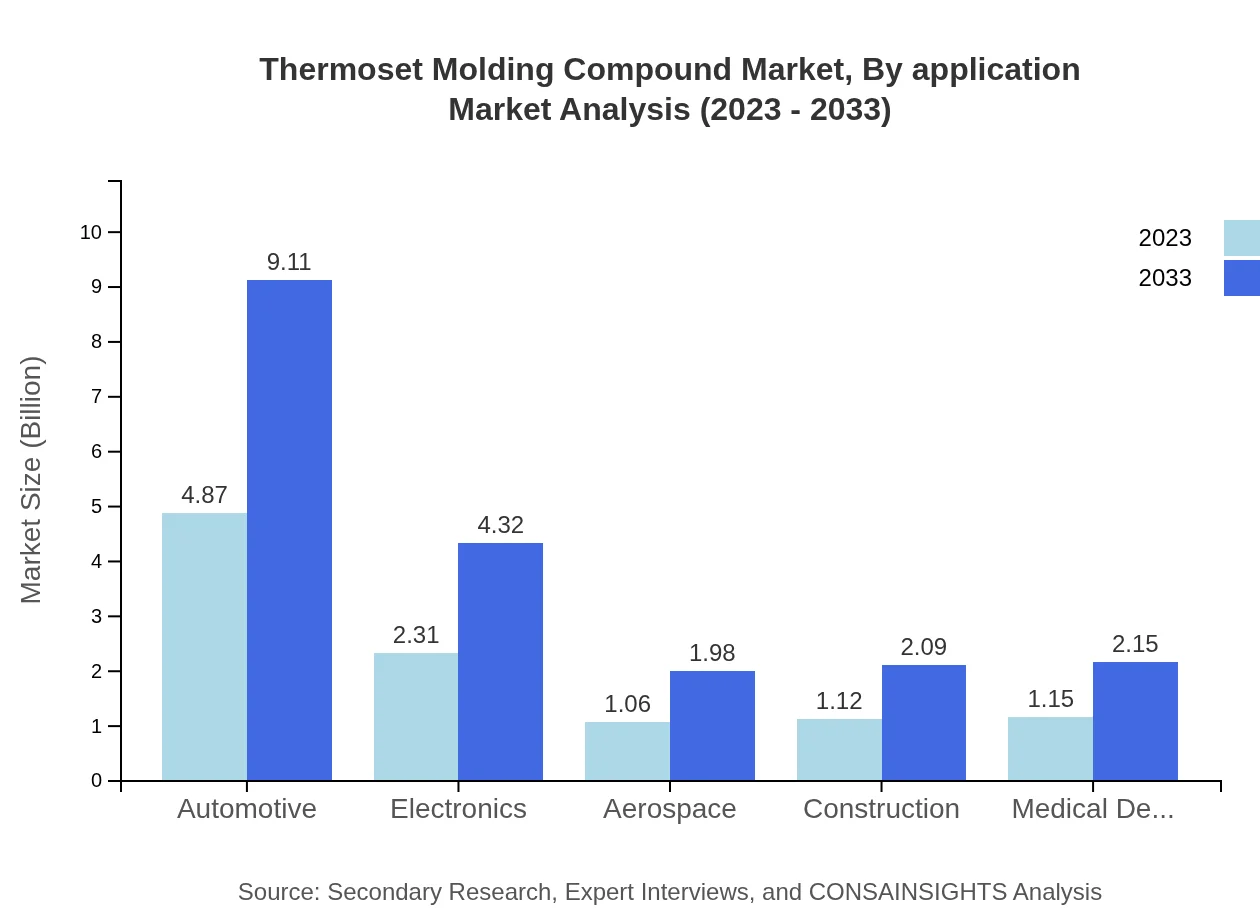

Thermoset Molding Compound Market Analysis By Application

In 2023, the automotive application leads market demand with $4.87 billion, maintaining a 46.35% market share. Other significant applications include consumer goods ($2.31 billion; 22% market share), and electronics providing innovative solutions through thermoset compounds, ensuring sustainable and efficient performance.

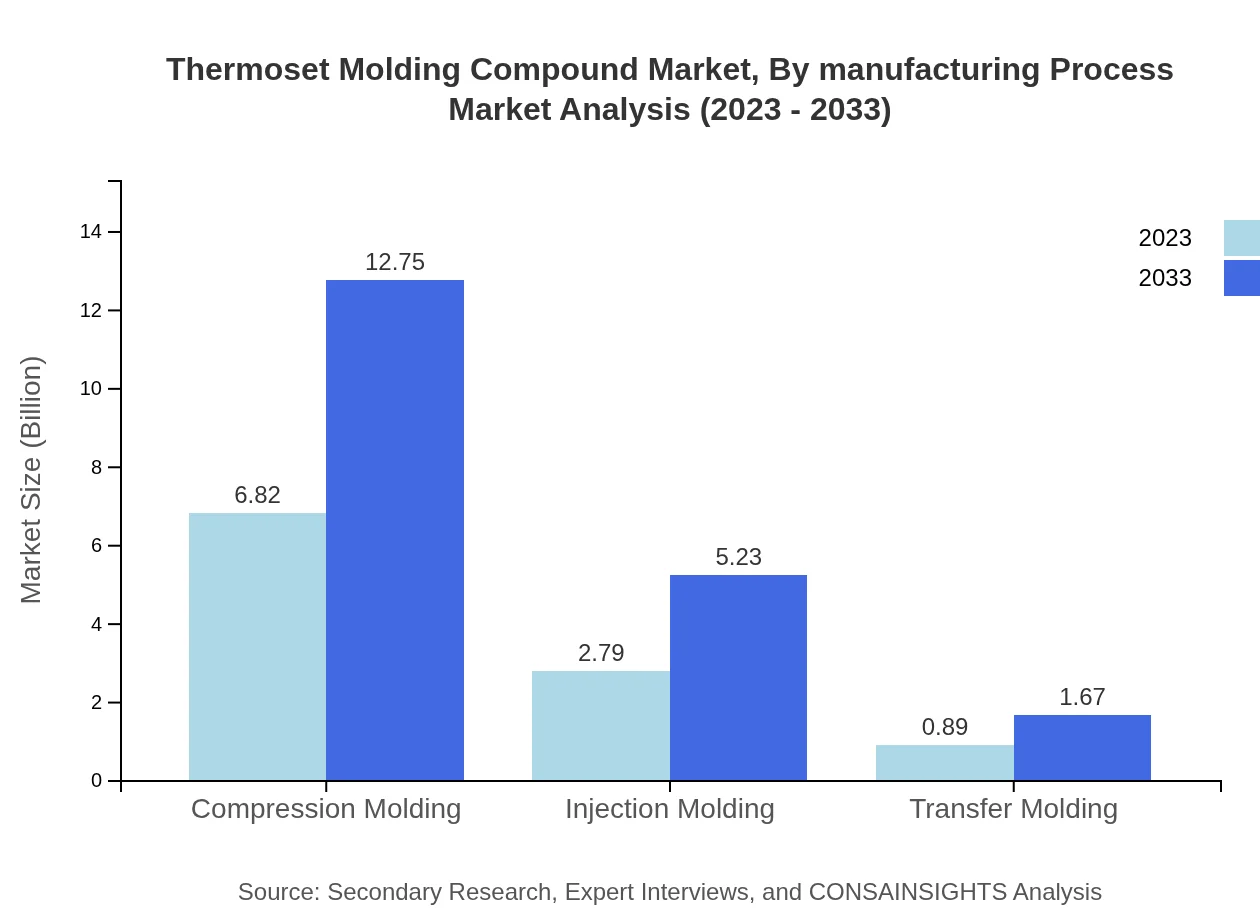

Thermoset Molding Compound Market Analysis By Manufacturing Process

Compression molding is the most utilized manufacturing process, accounting for $6.82 billion in 2023, with a share of 64.91%. Injection and transfer molding processes are also pivotal, supporting industries with precise molding and versatility in product shapes.

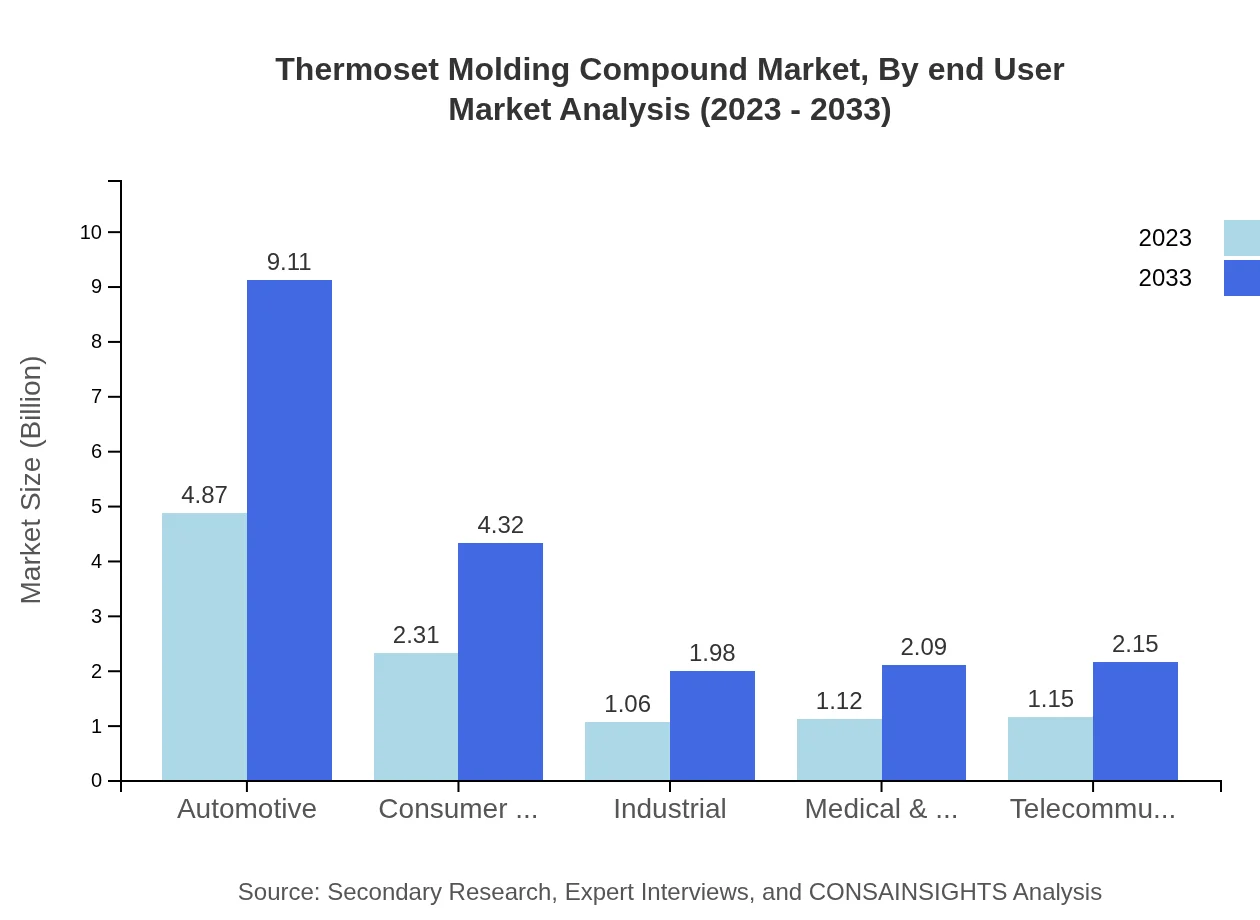

Thermoset Molding Compound Market Analysis By End User

The automotive sector remains the largest end-user for thermoset compounds, followed by the aerospace, medical, and telecommunications sectors, all benefiting from the unique properties of thermosets that support critical applications in harsh environments and high-performance scenarios.

Thermoset Molding Compound Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Thermoset Molding Compound Industry

Huntsman Corporation:

A leading manufacturer of pre-cured thermosets, specializing in advanced polymers that are extensively used in the automotive and aerospace sectors.BASF SE:

A global leader in chemical production, committed to sustainable solutions and innovating thermoset technologies for diverse industrial applications.DuPont:

Known for its cutting-edge research and development in polymers, DuPont provides solutions that optimize thermoset applications across various industries.SABIC:

A prominent player focusing on innovative and sustainable thermoset products that meet the growing demands of the electronics and automotive industries.Archroma:

Specializes in providing high-performance textile and coating solutions, including advanced thermoset materials for various applications.We're grateful to work with incredible clients.

FAQs

What is the market size of thermoset Molding Compound?

The thermoset molding compound market is valued at approximately $10.5 billion in 2023, with a projected compound annual growth rate (CAGR) of 6.3%. This growth is driven by increasing demand in various sectors.

What are the key market players or companies in this thermoset Molding Compound industry?

Key players in the thermoset molding compound industry include Huntsman Corporation, BASF SE, and Celanese Corporation, among others. These companies are significant due to their innovation and extensive distribution networks.

What are the primary factors driving the growth in the thermoset Molding Compound industry?

The growth of the thermoset molding compound industry is driven by factors such as the rising demand in automotive and electronics sectors, advancements in material technologies, and increasing applications in various industrial sectors.

Which region is the fastest Growing in the thermoset Molding Compound?

The fastest-growing region for thermoset molding compounds is North America, expected to grow from $4.05 billion in 2023 to $7.58 billion by 2033, driven by strong demand from automotive and industrial applications.

Does ConsaInsights provide customized market report data for the thermoset Molding Compound industry?

Yes, ConsaInsights offers customized market report data tailored to specific requirements in the thermoset molding compound industry. This includes detailed insights tailored to client needs.

What deliverables can I expect from this thermoset Molding Compound market research project?

Deliverables from the thermoset molding compound market research project typically include comprehensive market analysis, competitive landscape assessment, regional insights, and forecasts for various industry segments.

What are the market trends of thermoset Molding Compound?

Current market trends in thermoset molding compounds include increasing adoption in sustainable applications, advancements in composite materials, and the growth of smart manufacturing technologies across industries.