Thermosetting Plastics Market Report

Published Date: 02 February 2026 | Report Code: thermosetting-plastics

Thermosetting Plastics Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the thermosetting plastics market, covering insights into market size, segmentation, industry trends, regional dynamics, and forecasts from 2023 to 2033.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

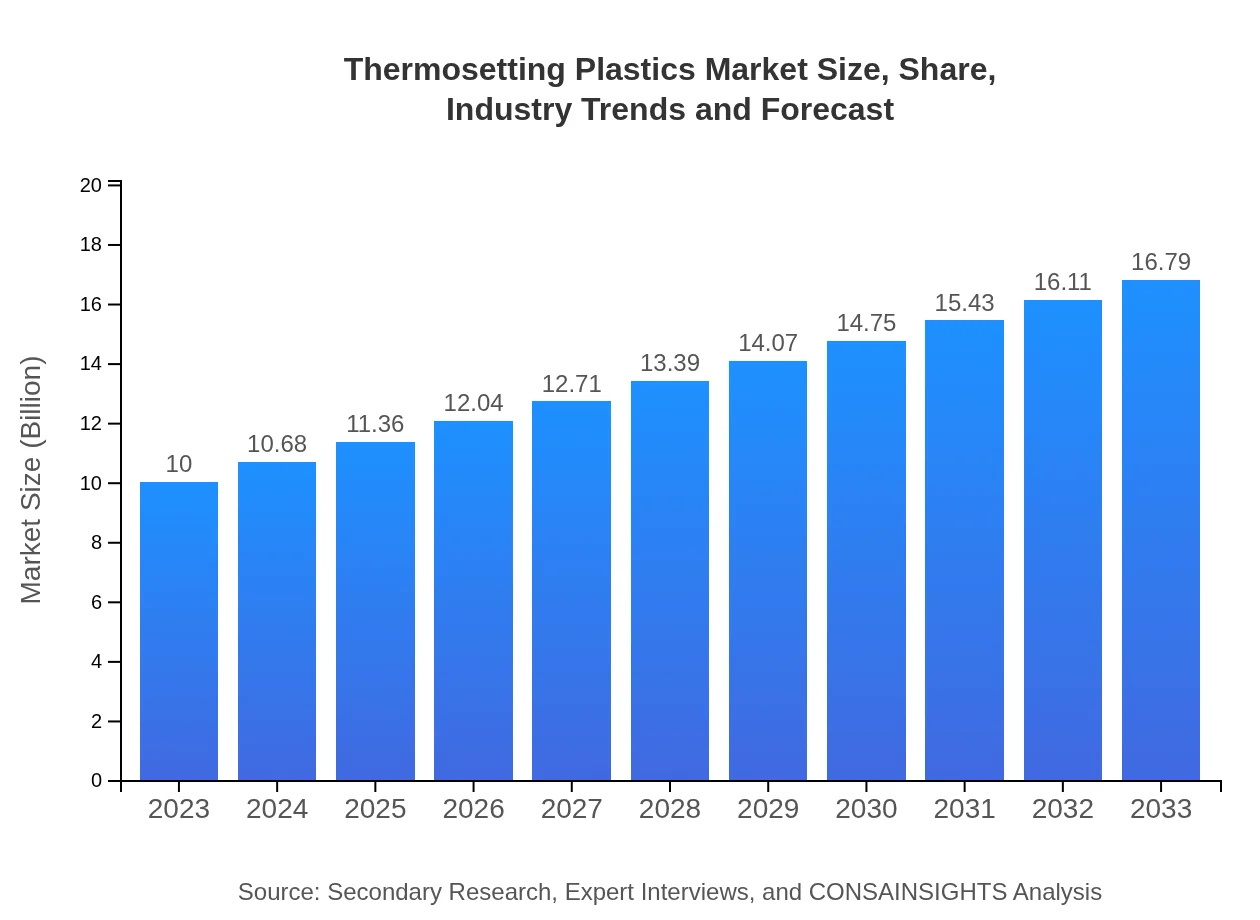

| 2023 Market Size | $10.00 Billion |

| CAGR (2023-2033) | 5.2% |

| 2033 Market Size | $16.79 Billion |

| Top Companies | BASF SE, Hexion Inc., DuPont, Momentive Performance Materials, Wacker Chemie AG |

| Last Modified Date | 02 February 2026 |

Thermosetting Plastics Market Overview

Customize Thermosetting Plastics Market Report market research report

- ✔ Get in-depth analysis of Thermosetting Plastics market size, growth, and forecasts.

- ✔ Understand Thermosetting Plastics's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Thermosetting Plastics

What is the Market Size & CAGR of Thermosetting Plastics market in 2023 and 2033?

Thermosetting Plastics Industry Analysis

Thermosetting Plastics Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Thermosetting Plastics Market Analysis Report by Region

Europe Thermosetting Plastics Market Report:

Europe will see its market size increase from $3.28 billion in 2023 to $5.50 billion in 2033, driven by stringent regulations mandating the use of durable materials and a growing focus on sustainability in manufacturing practices.Asia Pacific Thermosetting Plastics Market Report:

The Asia Pacific region is experiencing robust growth in the thermosetting plastics market, with a market size expected to rise from $1.90 billion in 2023 to $3.19 billion in 2033. This is driven by rapid industrialization, increased automotive production, and a growing electronics sector.North America Thermosetting Plastics Market Report:

North America is projected to witness strong growth in the thermosetting plastics market, expanding from $3.63 billion in 2023 to $6.09 billion by 2033. The region benefits from advanced technological infrastructures and significant automaker investments focusing on lightweight materials.South America Thermosetting Plastics Market Report:

In South America, the thermosetting plastics market is anticipated to grow modestly from $0.20 billion in 2023 to $0.33 billion in 2033. Economic development and rising investments in construction are key factors contributing to this growth.Middle East & Africa Thermosetting Plastics Market Report:

The Middle East and Africa present a steadily growing market for thermosetting plastics, expected to increase from $1.00 billion in 2023 to $1.68 billion by 2033, supported by developments in construction and automotive markets.Tell us your focus area and get a customized research report.

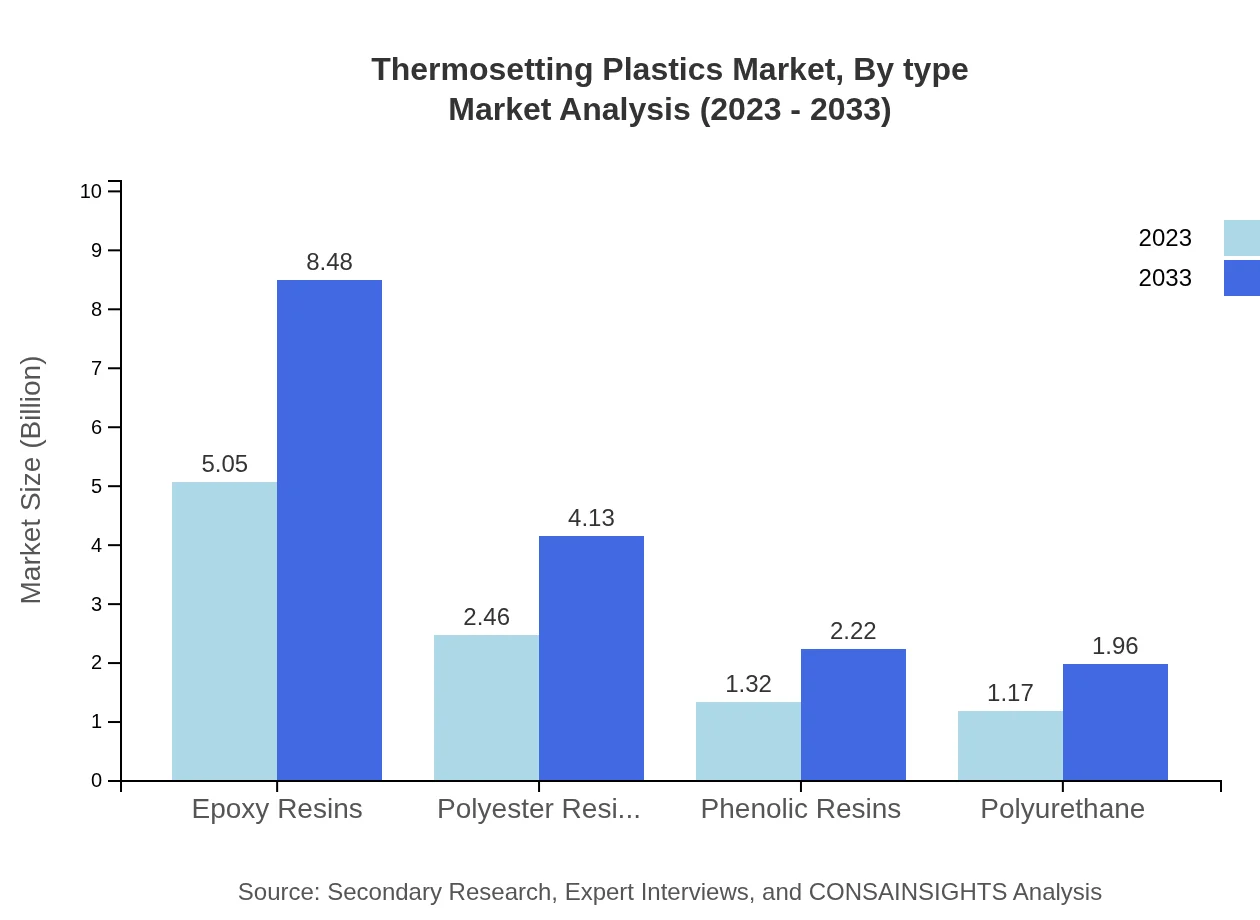

Thermosetting Plastics Market Analysis By Type

In the thermosetting plastics market by type, epoxy resins lead with a market size increasing from $5.05 billion in 2023 to $8.48 billion in 2033. Polyester resins follow with growth from $2.46 billion to $4.13 billion, while phenolic resins and polyurethane are also significant, with respective market sizes of $1.32 billion to $2.22 billion and $1.17 billion to $1.96 billion.

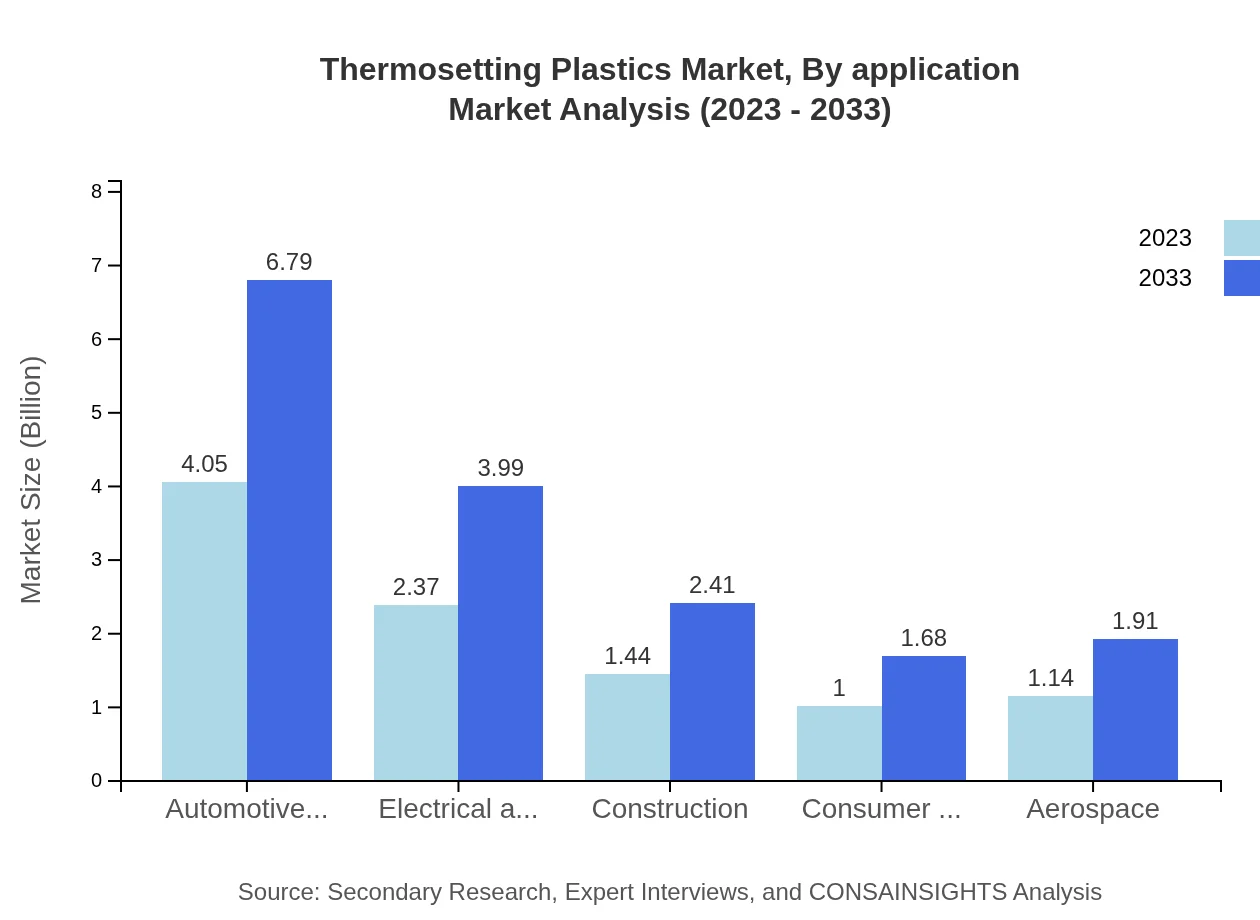

Thermosetting Plastics Market Analysis By Application

The major applications of thermosetting plastics include automotive components, electrical and electronics, construction, consumer goods, and aerospace. Automotive components dominate the application space, growing from $4.05 billion in 2023 to $6.79 billion in 2033. The electrical and electronics segment follows, expanding from $2.37 billion to $3.99 billion, along with notable contributions from construction and aerospace sectors.

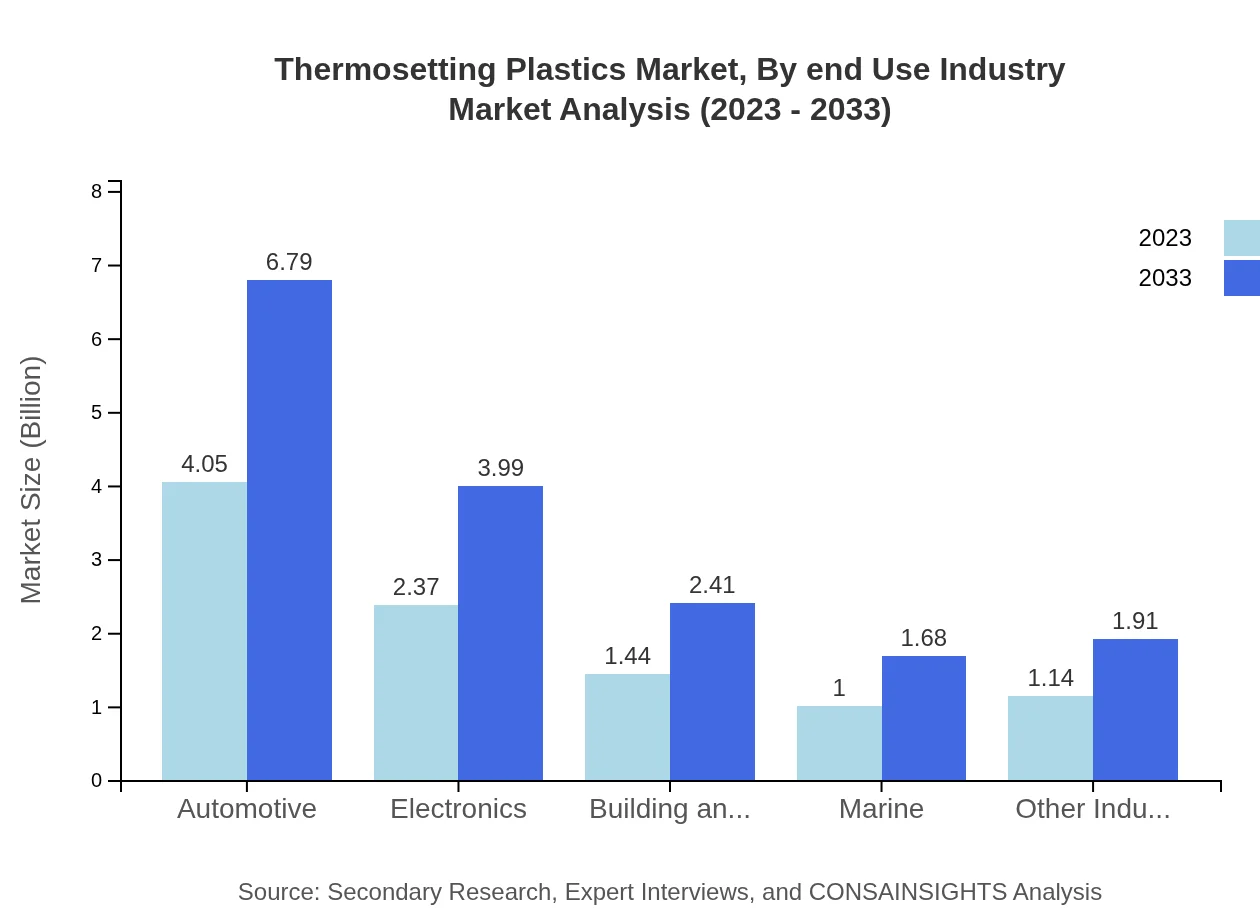

Thermosetting Plastics Market Analysis By End Use Industry

Key end-user industries for thermosetting plastics are automotive, electronics, building and construction, marine, and various other industries. The automotive sector leads with a substantial market share projected to retain around 40.46% throughout the forecast period, while building and construction is also significant, holding about 14.38% of the market.

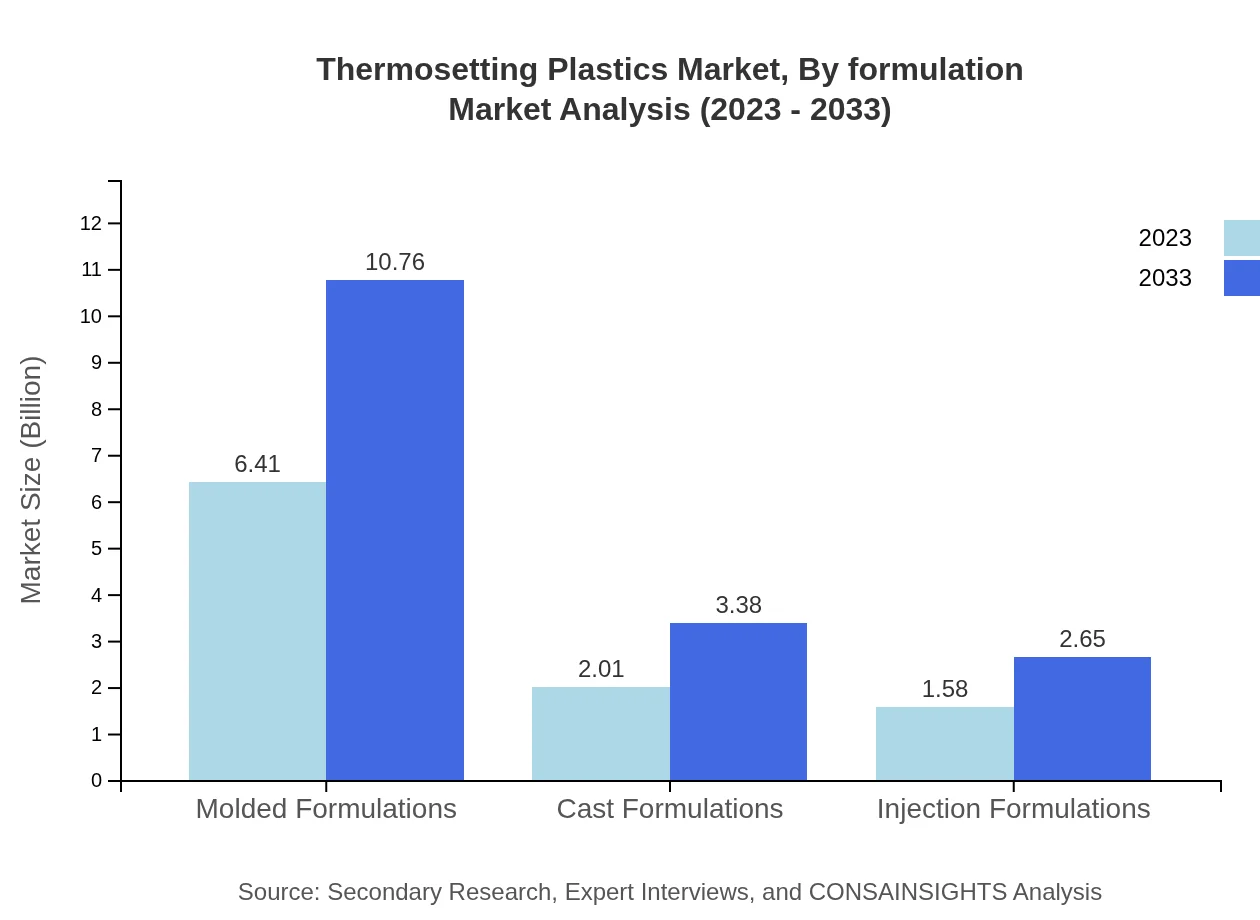

Thermosetting Plastics Market Analysis By Formulation

The market is further analyzed based on formulations including molded, cast, and injection formulations. Molded formulations are predominant, comprising approximately 64.07% of the market with sizes expected to grow significantly in the coming years. Injection formulations also hold a substantial share of around 15.8%, indicating diverse applications within manufacturing.

Thermosetting Plastics Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Thermosetting Plastics Industry

BASF SE:

BASF is a leading chemical company that manufactures a wide range of thermosetting plastics, focusing on innovation and sustainability across various markets.Hexion Inc.:

Hexion specializes in producing epoxy resins and thermosetting plastics, recognized for their quality and diverse applications in automotive and construction industries.DuPont:

DuPont is known for its advanced materials and chemical products, including thermosetting plastics, with a strong emphasis on R&D and sustainable solutions.Momentive Performance Materials:

Momentive is a global leader in silicone and specialty chemicals, providing advanced thermosetting materials used in various high-performance applications.Wacker Chemie AG:

Wacker Chemie offers a comprehensive range of thermosetting plastics, particularly in construction and electrical sectors, recognized for performance and reliability.We're grateful to work with incredible clients.

FAQs

What is the market size of thermosetting plastics?

The thermosetting plastics market has an estimated market size of $10 billion in 2023, with a projected compound annual growth rate (CAGR) of 5.2%. This growth reflects increasing applications across various industries.

What are the key market players or companies in the thermosetting plastics industry?

Key players in the thermosetting plastics market include companies like BASF SE, Huntsman International LLC, and Ashland Global Holdings Inc., which lead in innovation and market share within the industry.

What are the primary factors driving the growth in the thermosetting plastics industry?

Growth in the thermosetting plastics industry is primarily driven by expanding applications in automotive and aerospace sectors, advancements in material science, and increasing demand for lightweight and durable materials.

Which region is the fastest Growing in the thermosetting plastics?

The Asia Pacific region is the fastest-growing market for thermosetting plastics, projected to increase from $1.90 billion in 2023 to $3.19 billion by 2033, driven by industrial growth and rising demand for consumer electronics.

Does ConsaInsights provide customized market report data for the thermosetting plastics industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the thermosetting plastics industry, providing insights that help businesses make informed decisions.

What deliverables can I expect from this thermosetting plastics market research project?

Deliverables from the thermosetting plastics market research project include comprehensive industry reports, detailed analysis of market trends, growth forecasts, and competitive landscape reviews tailored to your needs.

What are the market trends of thermosetting plastics?

Current trends in the thermosetting plastics market include a shift towards eco-friendly materials, increased usage in electric vehicles, and innovations in processing techniques, driving efficiency and performance.