Thin Film Drugs Market Report

Published Date: 31 January 2026 | Report Code: thin-film-drugs

Thin Film Drugs Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Thin Film Drugs market, covering key insights, current trends, and forecasts from 2023 to 2033. It focuses on market size, segmentation, regional analysis, technology advancements, and leading players in the industry.

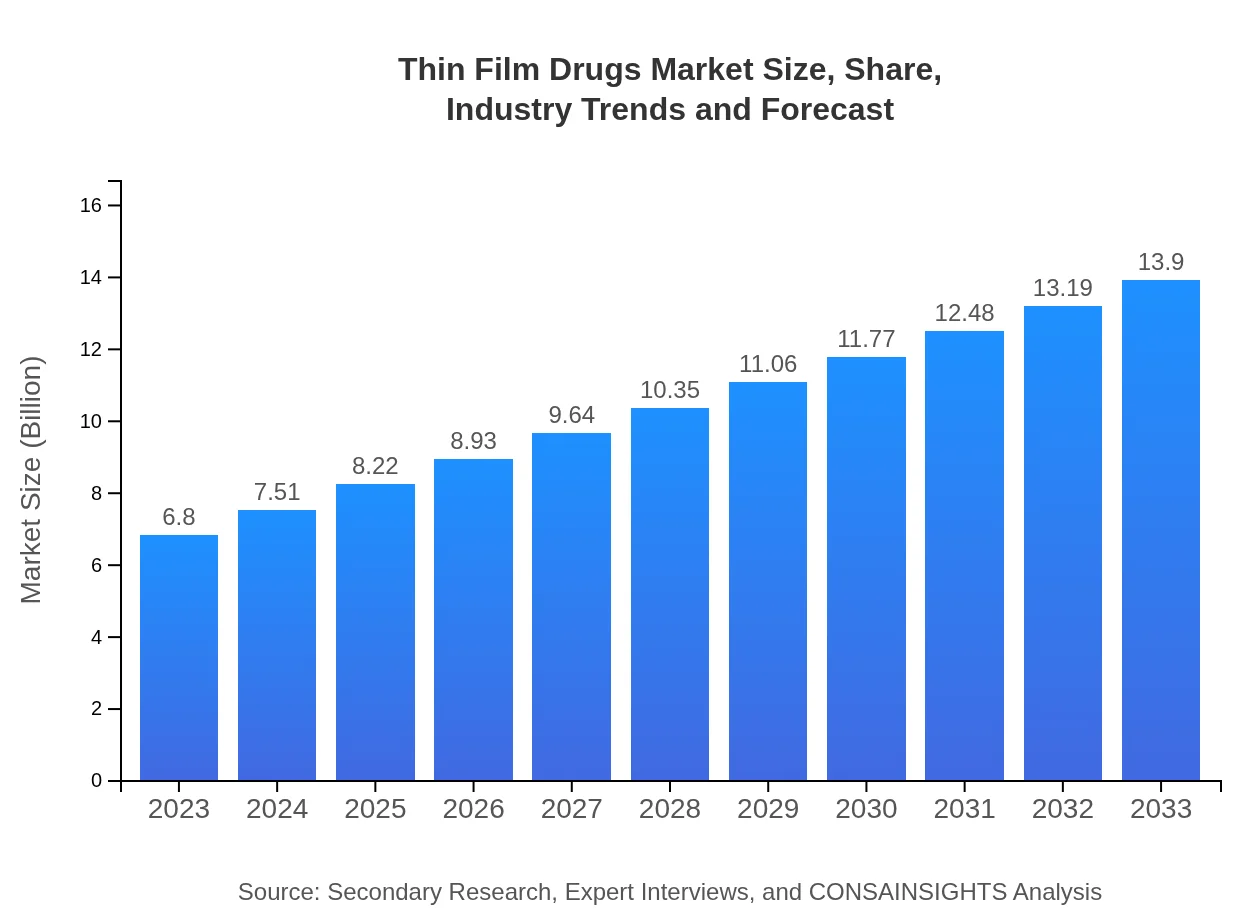

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $6.80 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $13.90 Billion |

| Top Companies | Mylan N.V., Dissolvable Films Group, IntelGenX Corp. |

| Last Modified Date | 31 January 2026 |

Thin Film Drugs Market Overview

Customize Thin Film Drugs Market Report market research report

- ✔ Get in-depth analysis of Thin Film Drugs market size, growth, and forecasts.

- ✔ Understand Thin Film Drugs's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Thin Film Drugs

What is the Market Size & CAGR of Thin Film Drugs market in 2023?

Thin Film Drugs Industry Analysis

Thin Film Drugs Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Thin Film Drugs Market Analysis Report by Region

Europe Thin Film Drugs Market Report:

In Europe, the Thin Film Drugs market is projected to increase from $1.86 billion in 2023 to $3.80 billion by 2033, reflecting a growing demand for effective treatment modalities and the strong regulatory framework supporting pharmaceutical innovations.Asia Pacific Thin Film Drugs Market Report:

In the Asia Pacific region, the Thin Film Drugs market is expected to reach $2.73 billion by 2033, up from $1.34 billion in 2023, fueled by increasing healthcare expenditures and a rising incidence of chronic diseases. The demand for innovative healthcare solutions is driving market growth as pharmaceutical companies invest in regional development.North America Thin Film Drugs Market Report:

North America remains the largest market for Thin Film Drugs, anticipated to grow from $2.58 billion in 2023 to $5.27 billion by 2033. The region's growth is driven by high healthcare spending, the presence of leading pharmaceutical companies, and a robust pipeline for innovative drug delivery systems.South America Thin Film Drugs Market Report:

The South American market for Thin Film Drugs is projected to grow from $0.24 billion in 2023 to $0.49 billion by 2033. This growth is attributed to increasing awareness of patient-centered care and advancements in drug formulation technologies that cater to local healthcare needs.Middle East & Africa Thin Film Drugs Market Report:

The Middle East and Africa market for Thin Film Drugs is expected to expand from $0.78 billion in 2023 to $1.60 billion by 2033. Increased healthcare investment and a focus on disease prevention are contributing to the growth of this dynamic market.Tell us your focus area and get a customized research report.

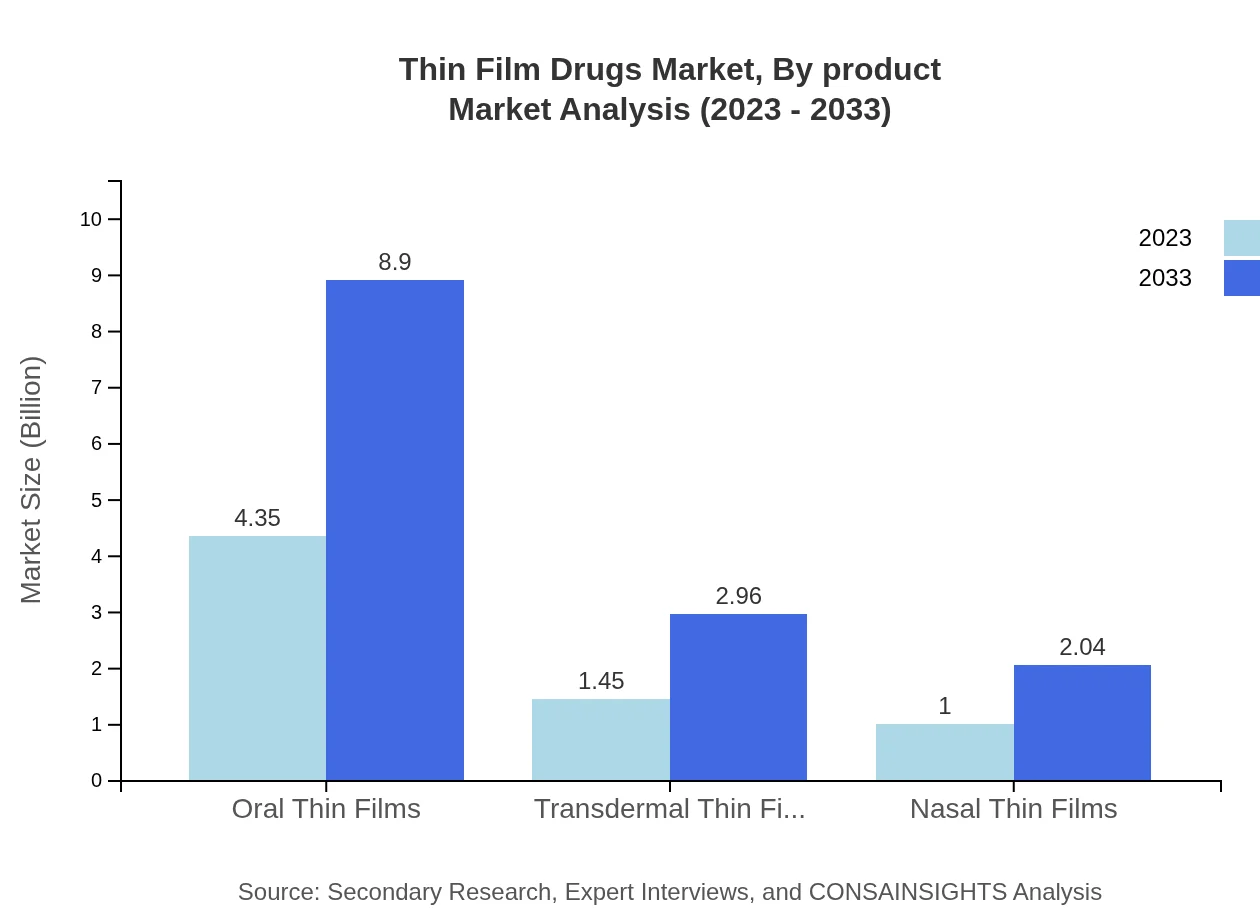

Thin Film Drugs Market Analysis By Product

The Thin-Film Drugs market is predominantly segmented into oral thin films, transdermal thin films, and nasal thin films. Oral thin films are expected to dominate with a market size reaching $8.90 billion by 2033, reflecting a share of 64.03%. Transdermal and nasal film segments are also growing, with projections of $2.96 billion and $2.04 billion respectively by 2033, addressing the diverse needs of patients through effective drug delivery routes.

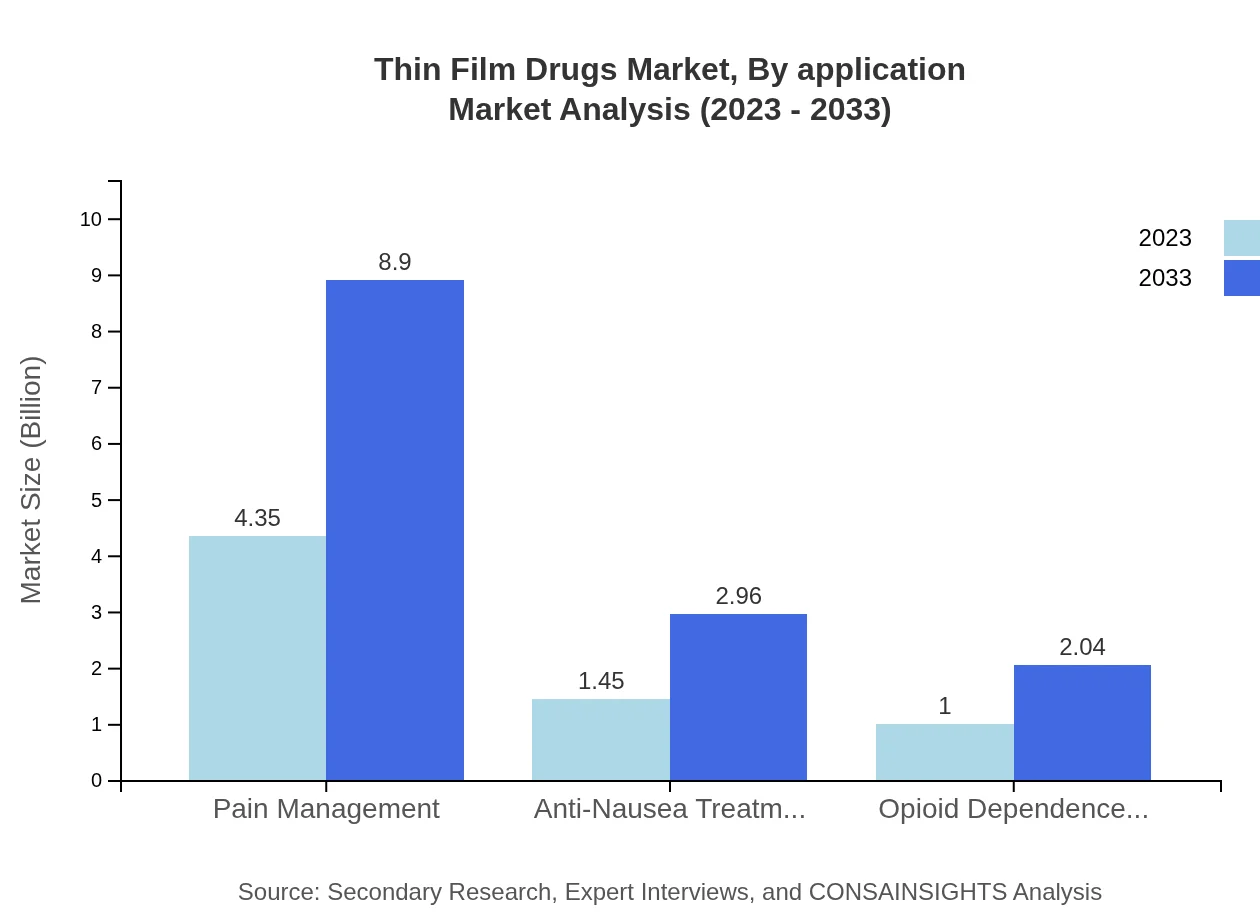

Thin Film Drugs Market Analysis By Application

Applications for Thin Film Drugs include pain management, anti-nausea treatments, and opioid dependence treatments. Pain management remains the largest application segment, estimated to reach $8.90 billion by 2033, accounting for 64.03% of the market. Other segments like anti-nausea and opioid dependence treatments are also growing significantly, reflecting the need for innovative therapeutics.

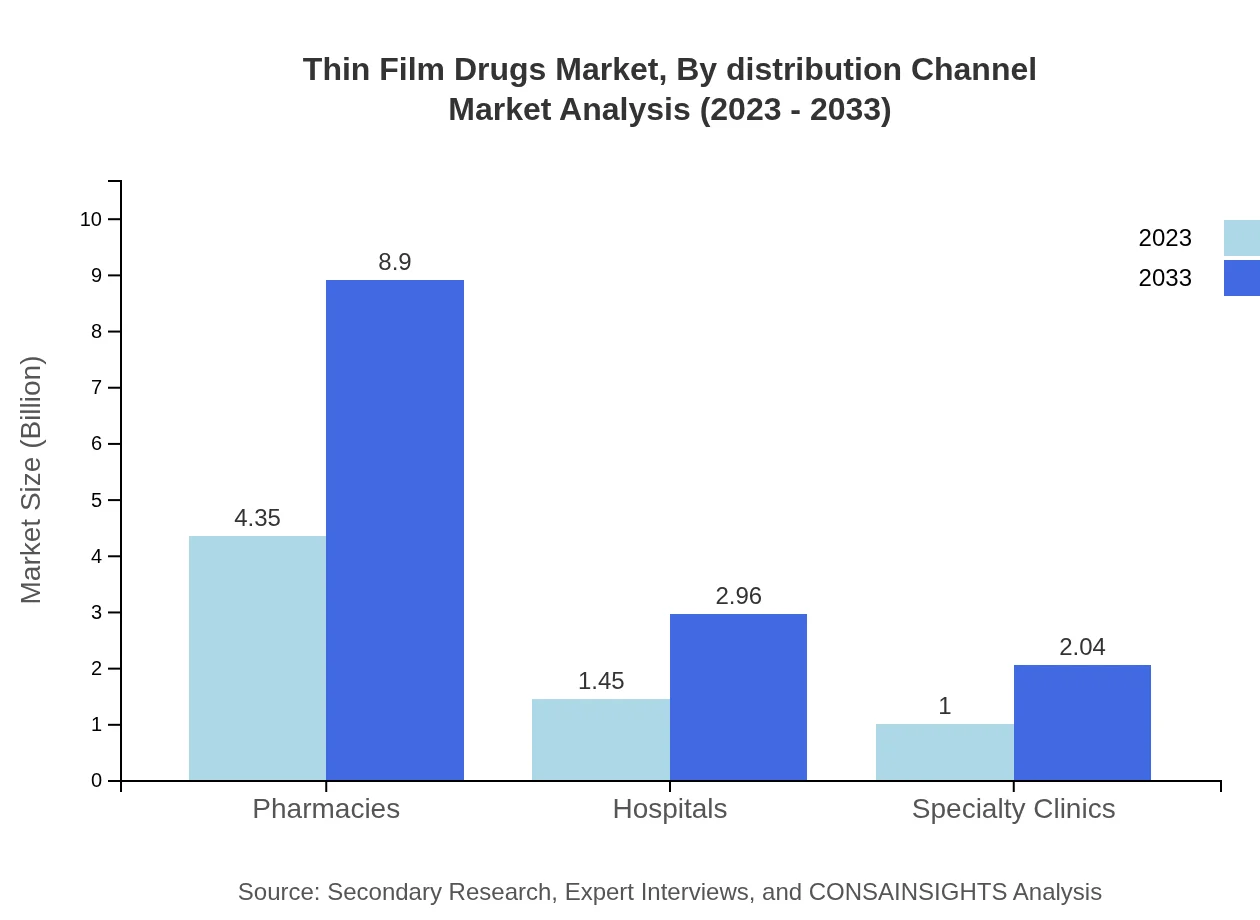

Thin Film Drugs Market Analysis By Distribution Channel

Distribution channels for Thin Film Drugs comprise hospitals, pharmacies, and home care settings. Hospitals and pharmacies account for the majority of distribution, with both expected to reach $8.90 billion and $2.96 billion in 2033 respectively, driven by their accessibility and the prevalence of chronic illnesses requiring ongoing medication.

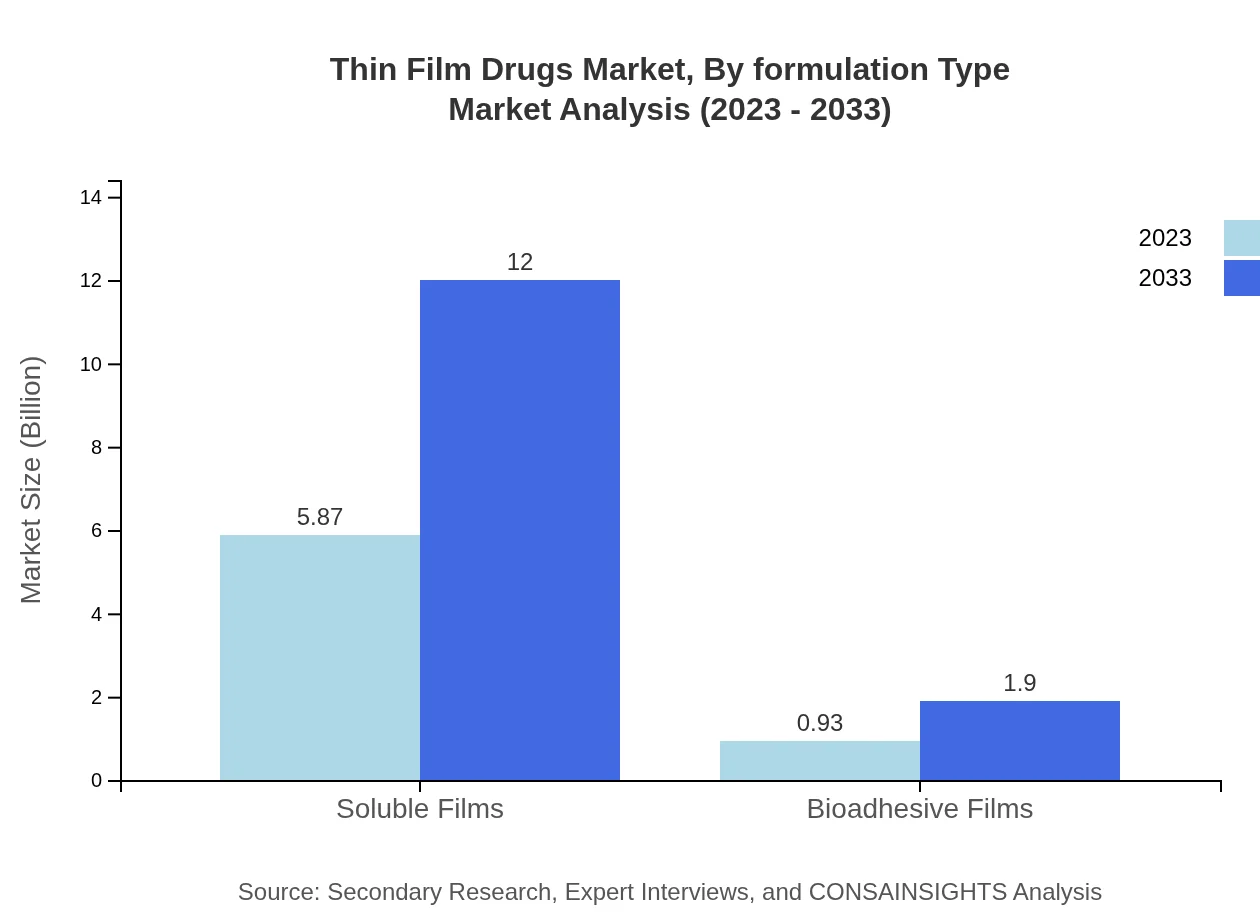

Thin Film Drugs Market Analysis By Formulation Type

The formulation types in the Thin Film Drugs market include soluble films and bioadhesive films. Soluble films dominate the market with a size projected to reach $12.00 billion by 2033, while bioadhesive films are expected to grow to $1.90 billion, offering distinctive advantages for localized therapy applications.

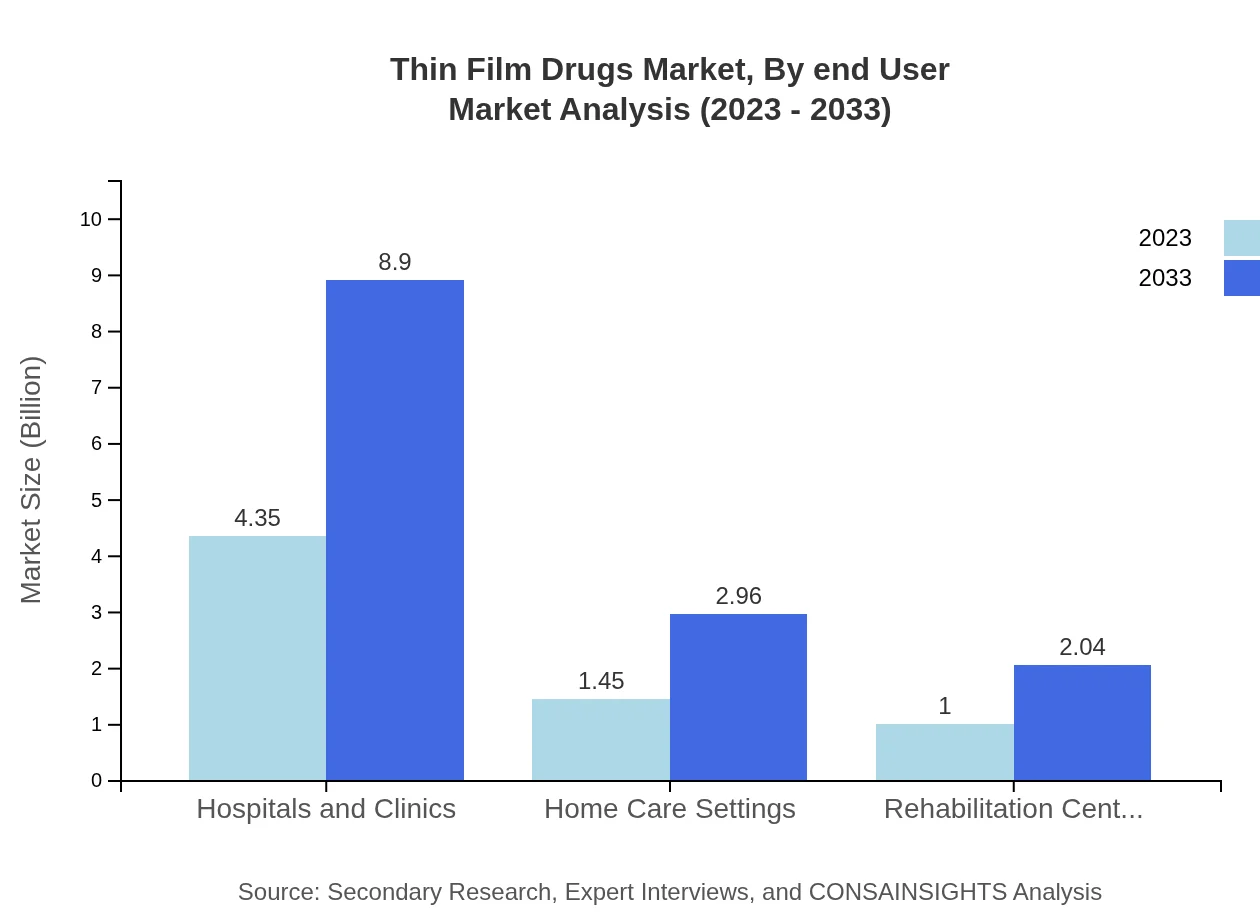

Thin Film Drugs Market Analysis By End User

End-user segments mainly include hospitals, specialty clinics, and pharmacies. Hospitals are predicted to remain at the forefront with an estimated market size of $2.96 billion by 2033, while pharmacies also play a vital role in distribution, reflecting their importance in patient care and accessibility.

Thin Film Drugs Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Thin Film Drugs Industry

Mylan N.V.:

A global pharmaceutical company known for its extensive portfolio of generic and specialty drugs, Mylan is a leader in the development of thin film delivery systems, enhancing patient access to innovative treatments.Dissolvable Films Group:

Specializing in dissolvable technology, this company focuses on improving drug pharmacokinetics through advanced thin-film applications, contributing significantly to the market.IntelGenX Corp.:

IntelGenX develops patented thin film technology that offers controlled release and oral bioavailability, leading advancements in therapeutic applications.We're grateful to work with incredible clients.

FAQs

What is the market size of thin Film Drugs?

As of 2023, the global thin-film drugs market is valued at approximately $6.8 billion, with a projected compound annual growth rate (CAGR) of 7.2% leading to an estimated size of $13.5 billion by 2033.

What are the key market players or companies in the thin Film Drugs industry?

Key players in the thin-film drugs industry include major pharmaceutical companies like Indivior PLC, Ironwood Pharmaceuticals, and Zogenix, which are known for their innovative drug delivery systems and continual advancements in thin-film technology.

What are the primary factors driving the growth in the thin Film Drugs industry?

The growth in the thin-film drugs market is primarily driven by increasing demand for pain management solutions, advancements in drug delivery technologies, and the rising prevalence of chronic illnesses which necessitate more effective treatment methods.

Which region is the fastest Growing in the thin Film Drugs market?

North America is the fastest-growing region in the thin-film drugs market, with market size increasing from $2.58 billion in 2023 to an expected $5.27 billion by 2033, driven by healthcare innovations and increased healthcare expenditures.

Does ConsaInsights provide customized market report data for the thin Film Drugs industry?

Yes, ConsaInsights offers customized market report data for the thin-film drugs industry, tailored to meet specific client needs and preferences, ensuring that all valuable insights are aligned with their business objectives.

What deliverables can I expect from this thin Film Drugs market research project?

From the thin-film drugs market research project, clients can expect detailed analysis reports, segmented market data, strategic recommendations, and forecasts on market size, trends, and key players to inform decision-making.

What are the market trends of thin Film Drugs?

Current market trends in thin-film drugs include increasing adoption of oral thin films, growth in transdermal solutions, rising investments in R&D for drug formulations, and expansion into emerging markets for better accessibility.