Thin Film Encapsulation Market Report

Published Date: 31 January 2026 | Report Code: thin-film-encapsulation

Thin Film Encapsulation Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Thin Film Encapsulation market, covering market size, trends, and forecasts from 2023 to 2033. Insights on regional performances, technologies, and major players are included to guide stakeholders in decision-making.

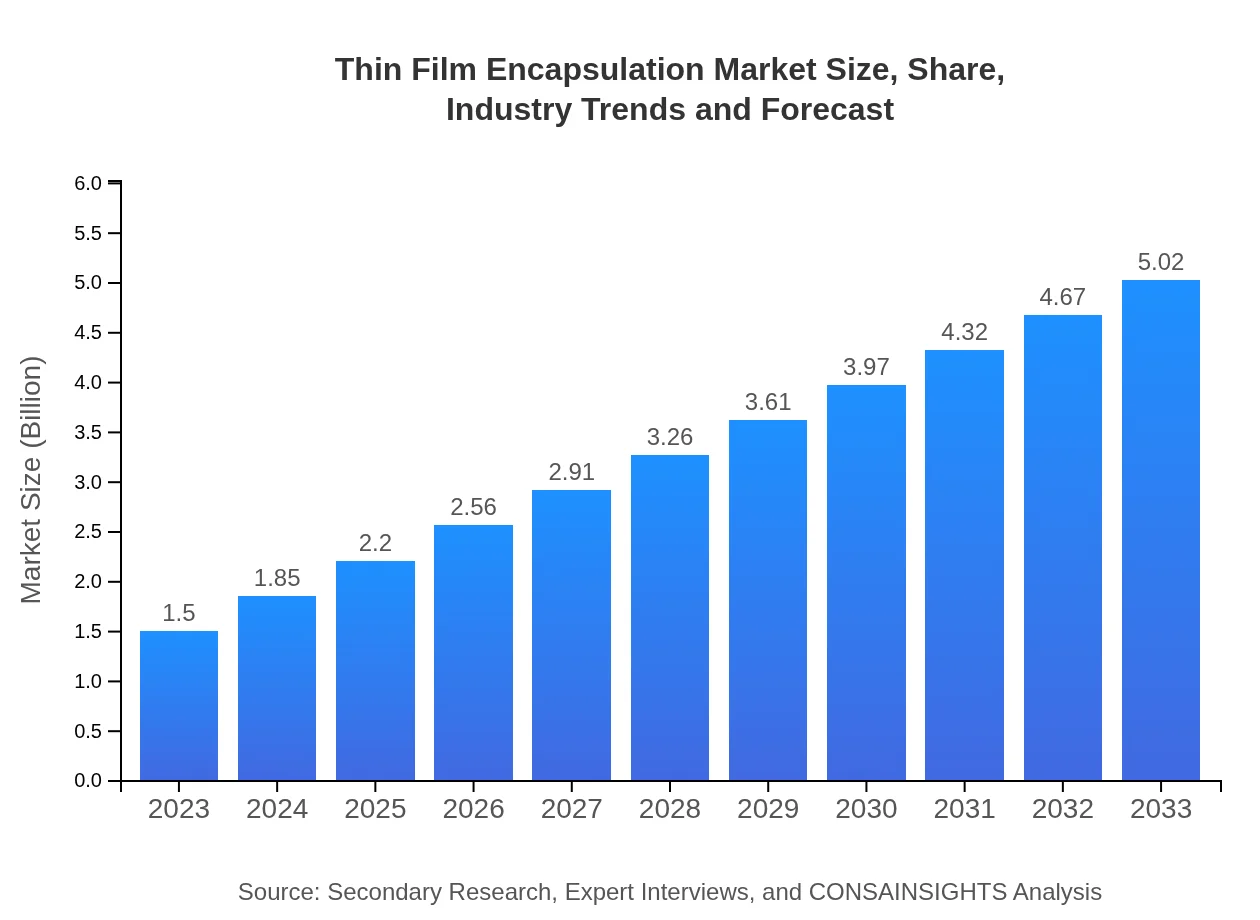

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.50 Billion |

| CAGR (2023-2033) | 12.3% |

| 2033 Market Size | $5.02 Billion |

| Top Companies | Nippon Electric Glass, Corning Incorporated, DuPont, Merck Group, Samsung Display |

| Last Modified Date | 31 January 2026 |

Thin Film Encapsulation Market Overview

Customize Thin Film Encapsulation Market Report market research report

- ✔ Get in-depth analysis of Thin Film Encapsulation market size, growth, and forecasts.

- ✔ Understand Thin Film Encapsulation's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Thin Film Encapsulation

What is the Market Size & CAGR of Thin Film Encapsulation market in 2023?

Thin Film Encapsulation Industry Analysis

Thin Film Encapsulation Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Thin Film Encapsulation Market Analysis Report by Region

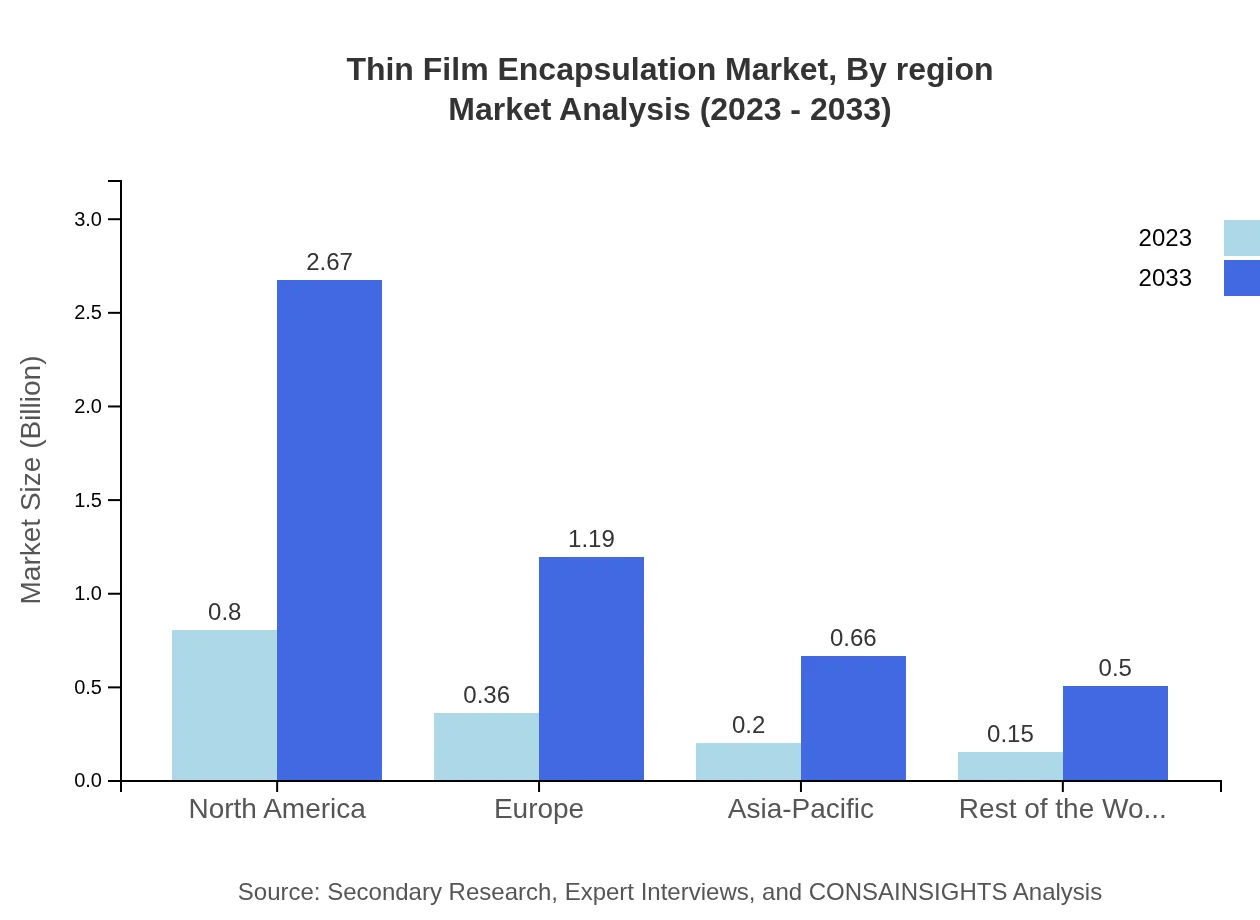

Europe Thin Film Encapsulation Market Report:

Europe is expected to increase from $0.47 billion in 2023 to $1.56 billion by 2033. This growth is fueled by stringent regulations on energy efficiency and environmental standards, pushing manufacturers to adopt innovative encapsulation solutions.Asia Pacific Thin Film Encapsulation Market Report:

In the Asia Pacific region, the market size is projected to grow from $0.28 billion in 2023 to $0.94 billion in 2033. The region is driven by rapid industrialization and growing demand for consumer electronics, particularly in countries like China, Japan, and South Korea, which are leading in technology adoption and innovation.North America Thin Film Encapsulation Market Report:

The North American market is forecasted to expand significantly from $0.53 billion in 2023 to $1.78 billion in 2033. The U.S. and Canada are focusing on advancing technologies in the automotive sector and high-end electronics, driving demand for TFE solutions.South America Thin Film Encapsulation Market Report:

South America presents a developing market with an increase in size from $0.07 billion in 2023 to $0.24 billion by 2033. The growth is attributed to rising investments in renewable energy projects and an increasing consumer base for electronics, particularly smartphones and tablets.Middle East & Africa Thin Film Encapsulation Market Report:

The Middle East and Africa market will see growth from $0.15 billion in 2023 to $0.50 billion by 2033, as countries in this region invest in solar energy technologies and improving their electronics manufacturing capabilities.Tell us your focus area and get a customized research report.

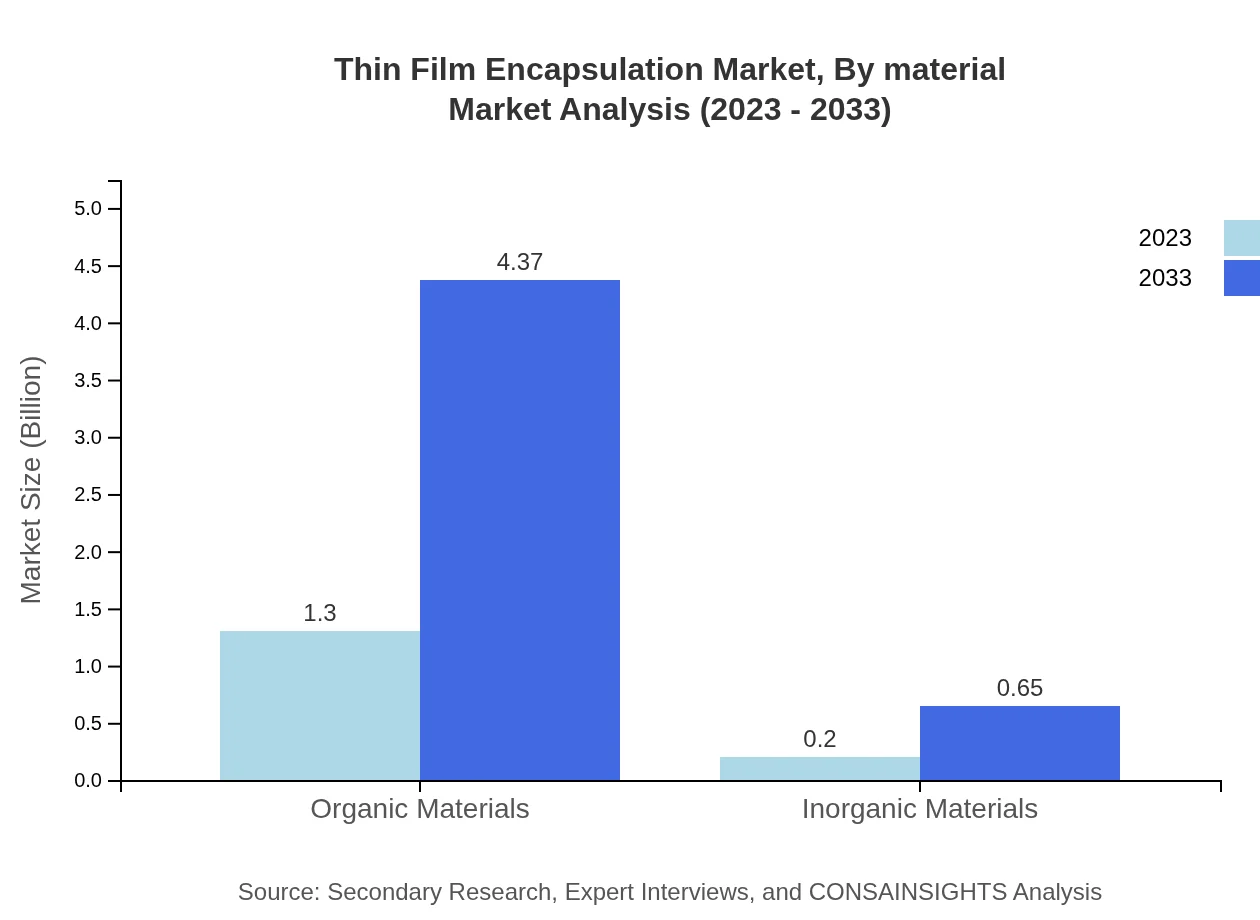

Thin Film Encapsulation Market Analysis By Material

The market is segmented into organic materials and inorganic materials. Organic materials dominate the market due to their flexibility and applicability in organic electronics, whereas inorganic materials are valued for their superior barrier properties, crucial for solar cells and OLED displays.

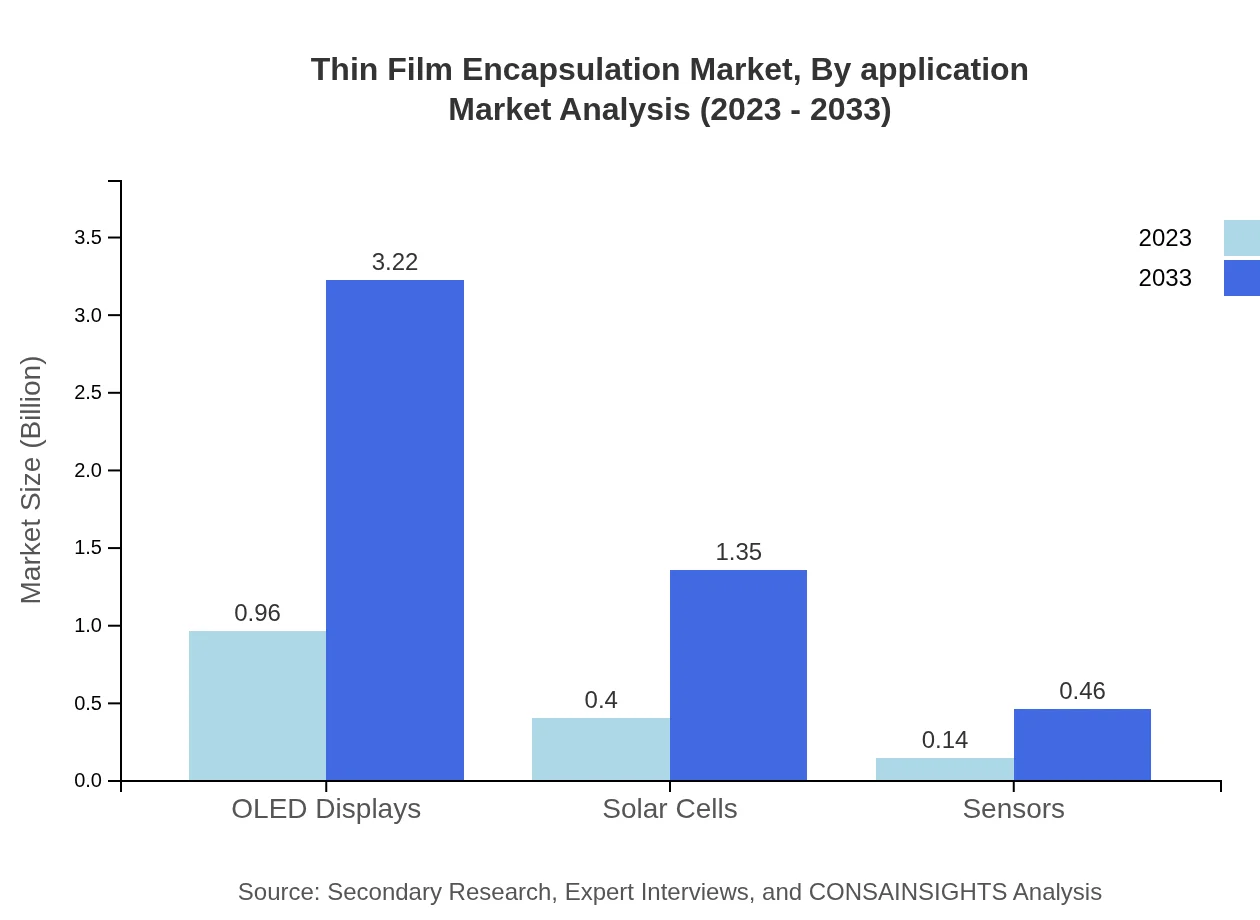

Thin Film Encapsulation Market Analysis By Application

Application segments include consumer electronics, automotive, and renewable energy. Consumer electronics lead the market due to the ubiquity of smartphones and televisions using TFE technology for display protection. The automotive sector is emerging rapidly, driven by electric vehicles requiring enhanced encapsulation.

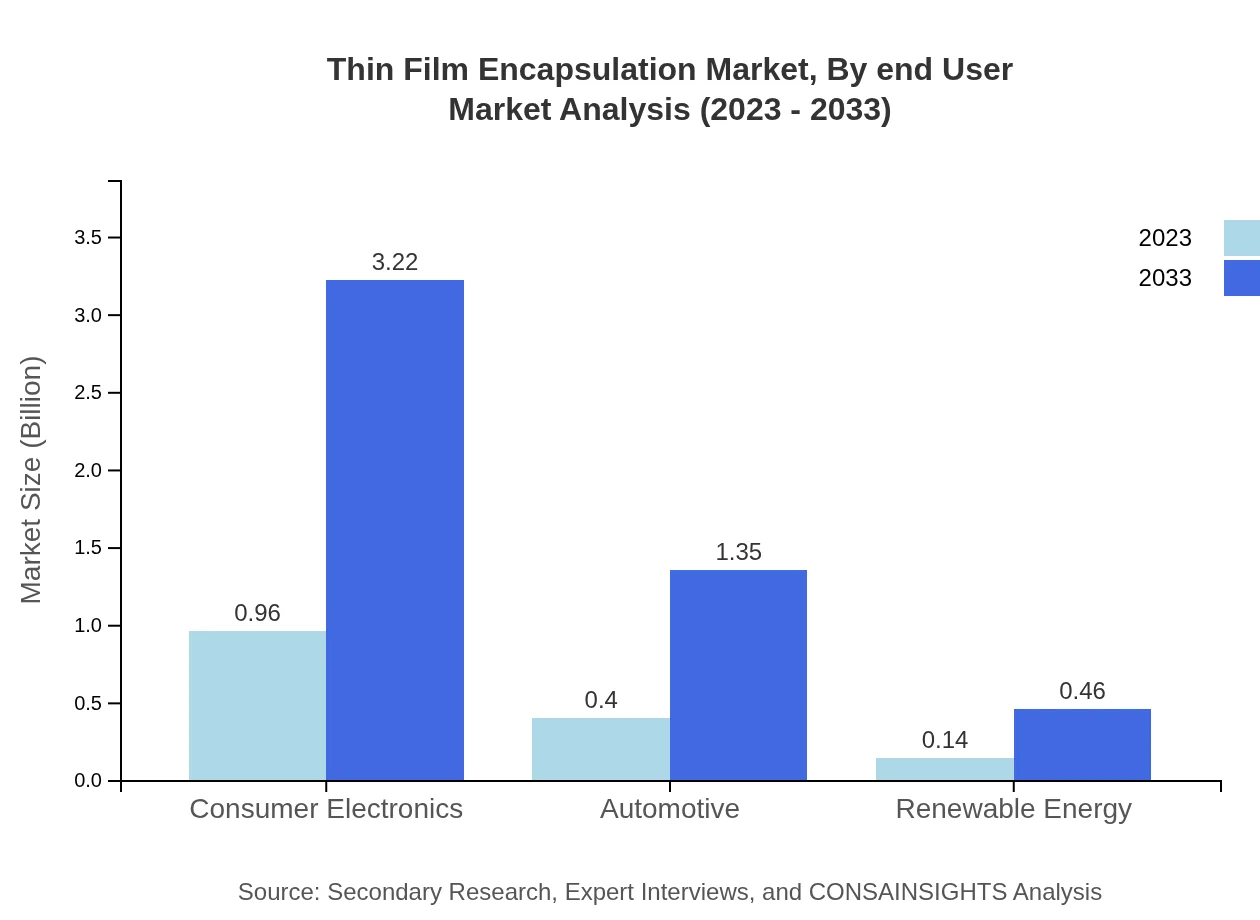

Thin Film Encapsulation Market Analysis By End User

Key end-user industries encompass consumer electronics, automotive, solar energy, and others. Consumer electronics hold the largest market share, followed by automotive, which is rapidly evolving with electric vehicle adoption requiring advanced encapsulation technologies.

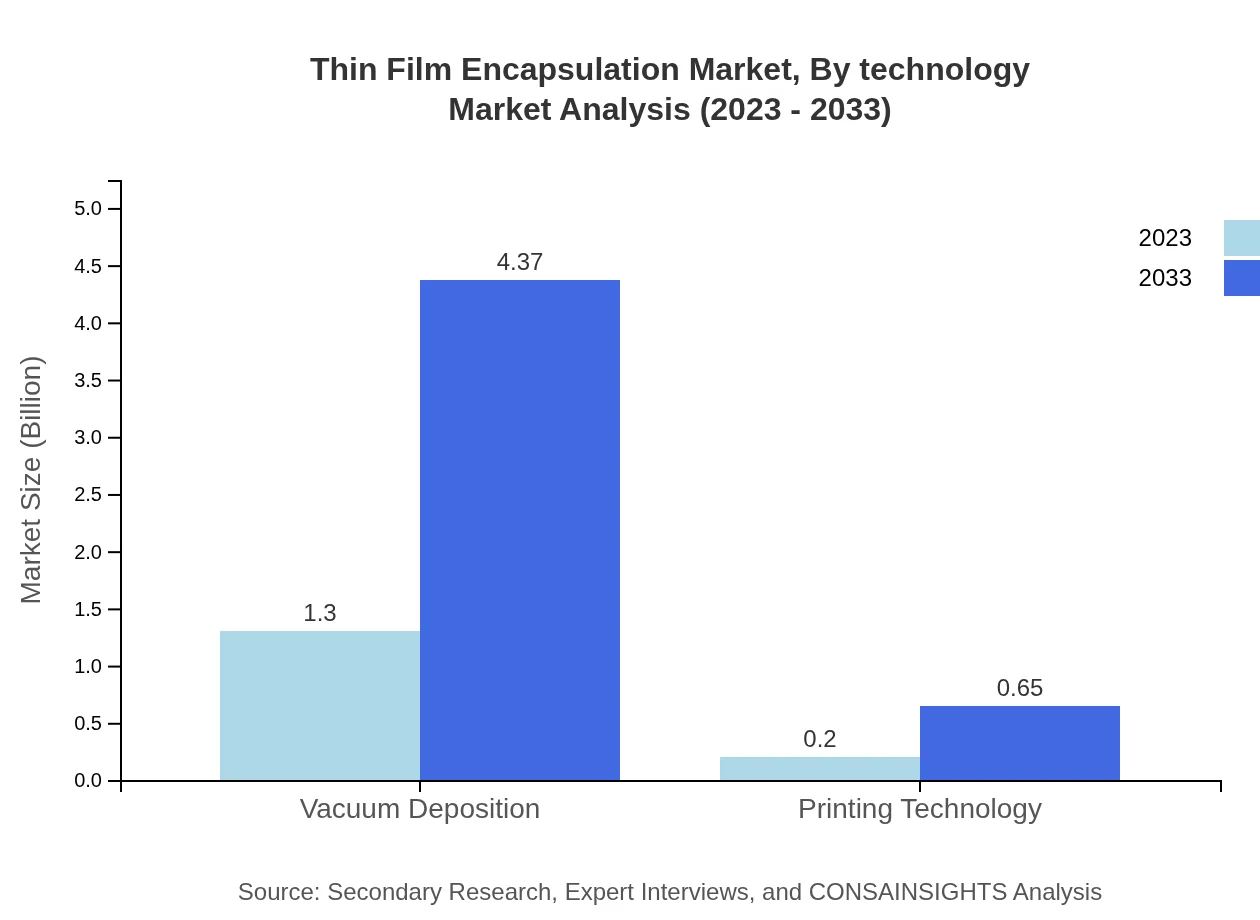

Thin Film Encapsulation Market Analysis By Technology

Technologies include vacuum deposition and printing technology. Vacuum deposition is the predominant method due to high precision and effectiveness, particularly in electronics. Printing technology, while less common, is gaining traction for its cost-effectiveness and adaptability.

Thin Film Encapsulation Market Analysis By Region

Regional analysis shows North America leading in market share, followed by Europe and Asia-Pacific, with each region exhibiting unique growth drivers and challenges reflective of their respective technological landscapes.

Thin Film Encapsulation Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Thin Film Encapsulation Industry

Nippon Electric Glass:

A leading manufacturer of glass substrates, Nippon Electric Glass develops advanced TFE materials for use in OLED displays and solar cells, contributing significantly to the market's growth.Corning Incorporated:

Corning is known for its innovative specialty glass and ceramics used in consumer electronics, where its TFE solutions enhance the durability and functionality of devices.DuPont:

DuPont offers a range of high-performance materials for TFE applications, focusing on sustainable and innovative solutions that cater to the evolving needs of the semiconductor and photovoltaic markets.Merck Group:

Merck provides cutting-edge materials designed for thin film application, especially in electronics. Their focus on R&D drives advancements in the TFE market.Samsung Display:

Samsung Display is a frontrunner in display technology, leveraging its expertise in TFE to enhance the performance and longevity of OLED screens.We're grateful to work with incredible clients.

FAQs

What is the market size of thin Film Encapsulation?

The thin-film encapsulation market is valued at approximately $1.5 billion in 2023, with an expected CAGR of 12.3% over the forecast period. By 2033, the market is anticipated to grow significantly, reflecting the increasing demand across various sectors.

What are the key market players or companies in this thin Film Encapsulation industry?

Key players in the thin-film encapsulation market include companies specializing in advanced materials and technology solutions, particularly in electronics and solar energy. Their innovations are crucial in leading market advancements and meeting industry demands.

What are the primary factors driving the growth in the thin Film Encapsulation industry?

The growth of the thin-film encapsulation industry is driven by increasing demand for lightweight and flexible electronic devices, advances in solar technologies, and the push for energy-efficient solutions in consumer electronics and automotive applications.

Which region is the fastest Growing in the thin Film Encapsulation?

The fastest-growing region for thin-film encapsulation is North America, with a market size projected to grow from $0.53 billion in 2023 to $1.78 billion by 2033. This growth is attributed to high consumer demand and technological advancements.

Does ConsaInsights provide customized market report data for the thin Film Encapsulation industry?

Yes, ConsaInsights offers customized market report data tailored to client needs within the thin-film encapsulation industry. This includes specific insights on regional markets, competitors, and emerging trends.

What deliverables can I expect from this thin Film Encapsulation market research project?

Clients can expect comprehensive market research reports that include data on market size, growth forecasts, competitor analyses, regional dynamics, and emerging trends, providing a well-rounded view of the thin-film encapsulation industry.

What are the market trends of thin Film Encapsulation?

Market trends in thin-film encapsulation include a focus on sustainable materials, integration into diverse sectors like renewable energy and consumer electronics, and increasing investment in R&D to enhance product efficiency and performance.