Thin Layer Deposition Market Report

Published Date: 31 January 2026 | Report Code: thin-layer-deposition

Thin Layer Deposition Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Thin Layer Deposition market, including insights into market size, trends, and forecasts from 2023 to 2033. It covers various segments, regional performance, and key industry players shaping the market landscape.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

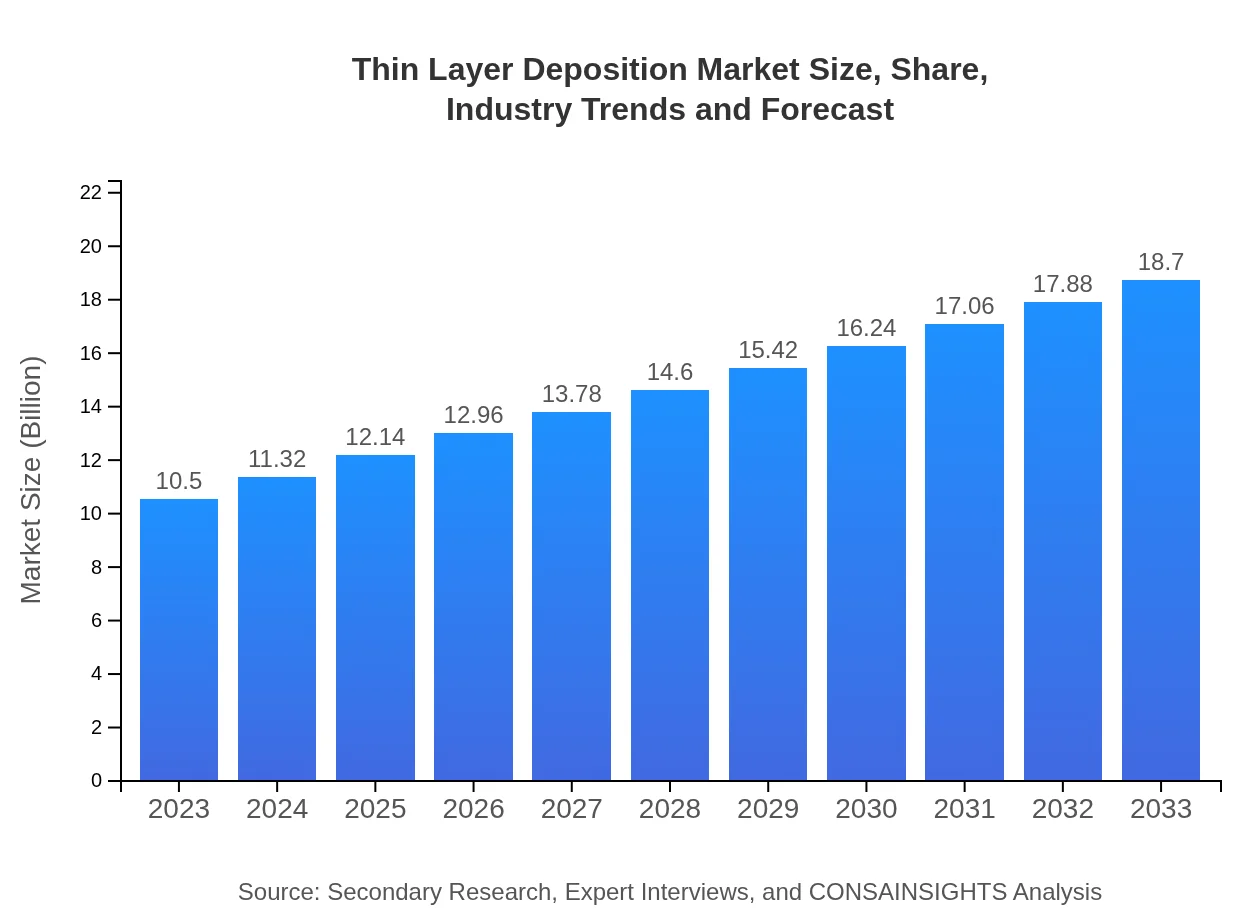

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 5.8% |

| 2033 Market Size | $18.70 Billion |

| Top Companies | Applied Materials, Inc., LAM Research Corporation, Tokyo Electron Limited, KLA Corporation |

| Last Modified Date | 31 January 2026 |

Thin Layer Deposition Market Overview

Customize Thin Layer Deposition Market Report market research report

- ✔ Get in-depth analysis of Thin Layer Deposition market size, growth, and forecasts.

- ✔ Understand Thin Layer Deposition's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Thin Layer Deposition

What is the Market Size & CAGR of Thin Layer Deposition market in 2023?

Thin Layer Deposition Industry Analysis

Thin Layer Deposition Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Thin Layer Deposition Market Analysis Report by Region

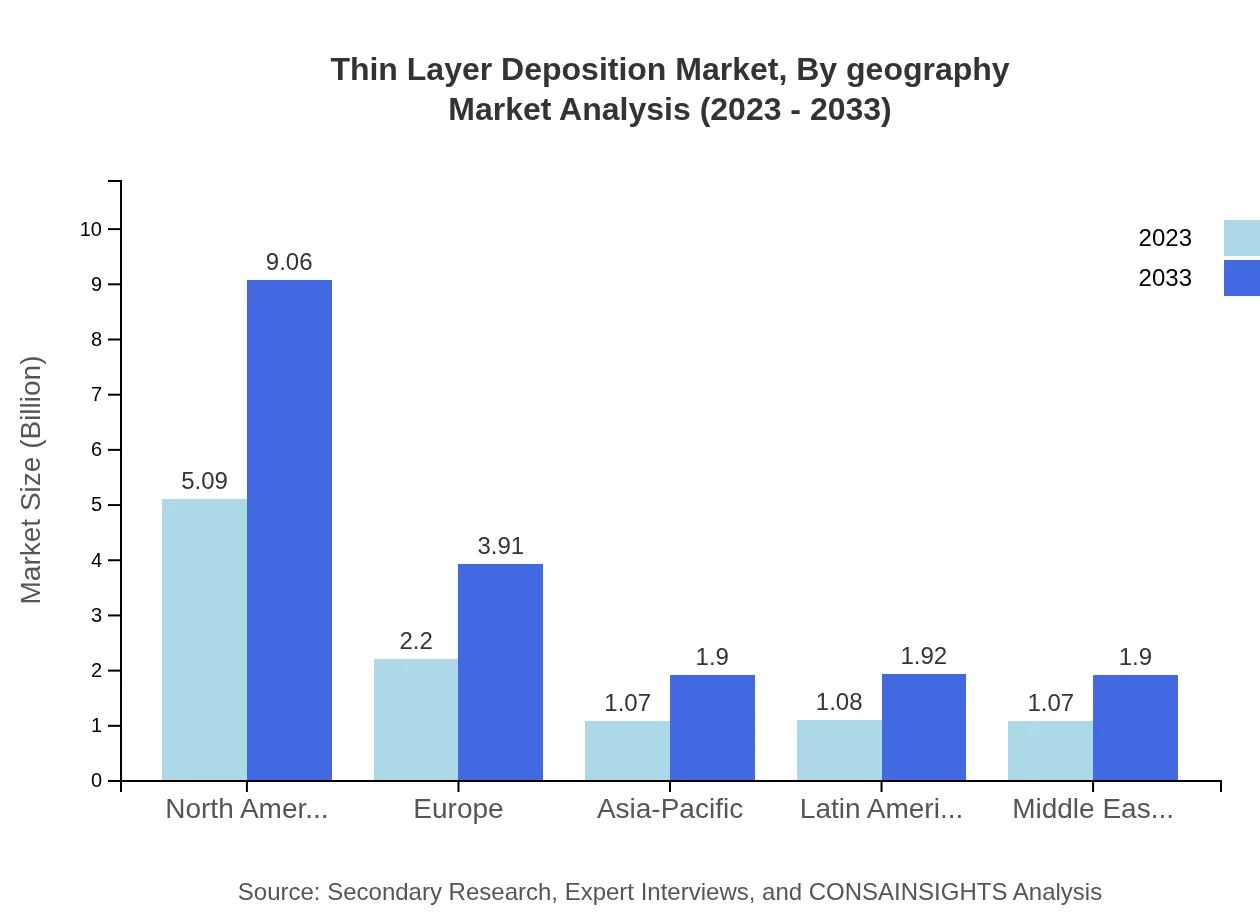

Europe Thin Layer Deposition Market Report:

Europe is positioned as a dominant player in the Thin Layer Deposition market due to the demand for high-quality coatings in automotive and aerospace sectors. The market is expected to increase from $2.85 billion in 2023 to $5.09 billion in 2033.Asia Pacific Thin Layer Deposition Market Report:

The Asia Pacific region is witnessing substantial growth in the Thin Layer Deposition market, fueled by rapid industrialization, increased semiconductor manufacturing in countries like China and Japan, and significant investments in R&D. The market is expected to grow from $2.05 billion in 2023 to $3.65 billion in 2033.North America Thin Layer Deposition Market Report:

North America holds a significant share of the Thin Layer Deposition market, attributed to the presence of leading technology companies and a strong focus on innovation. Market size is projected to escalate from $3.78 billion in 2023 to $6.74 billion in 2033.South America Thin Layer Deposition Market Report:

In South America, the Thin Layer Deposition market is poised for growth due to rising demand for electronics and energy-efficient products. The market size is anticipated to expand from $0.87 billion in 2023 to $1.55 billion by 2033.Middle East & Africa Thin Layer Deposition Market Report:

The Middle East and Africa region shows promise in the Thin Layer Deposition market, supported by growing industrial applications and improved manufacturing capabilities, with the market projected to rise from $0.94 billion in 2023 to $1.67 billion by 2033.Tell us your focus area and get a customized research report.

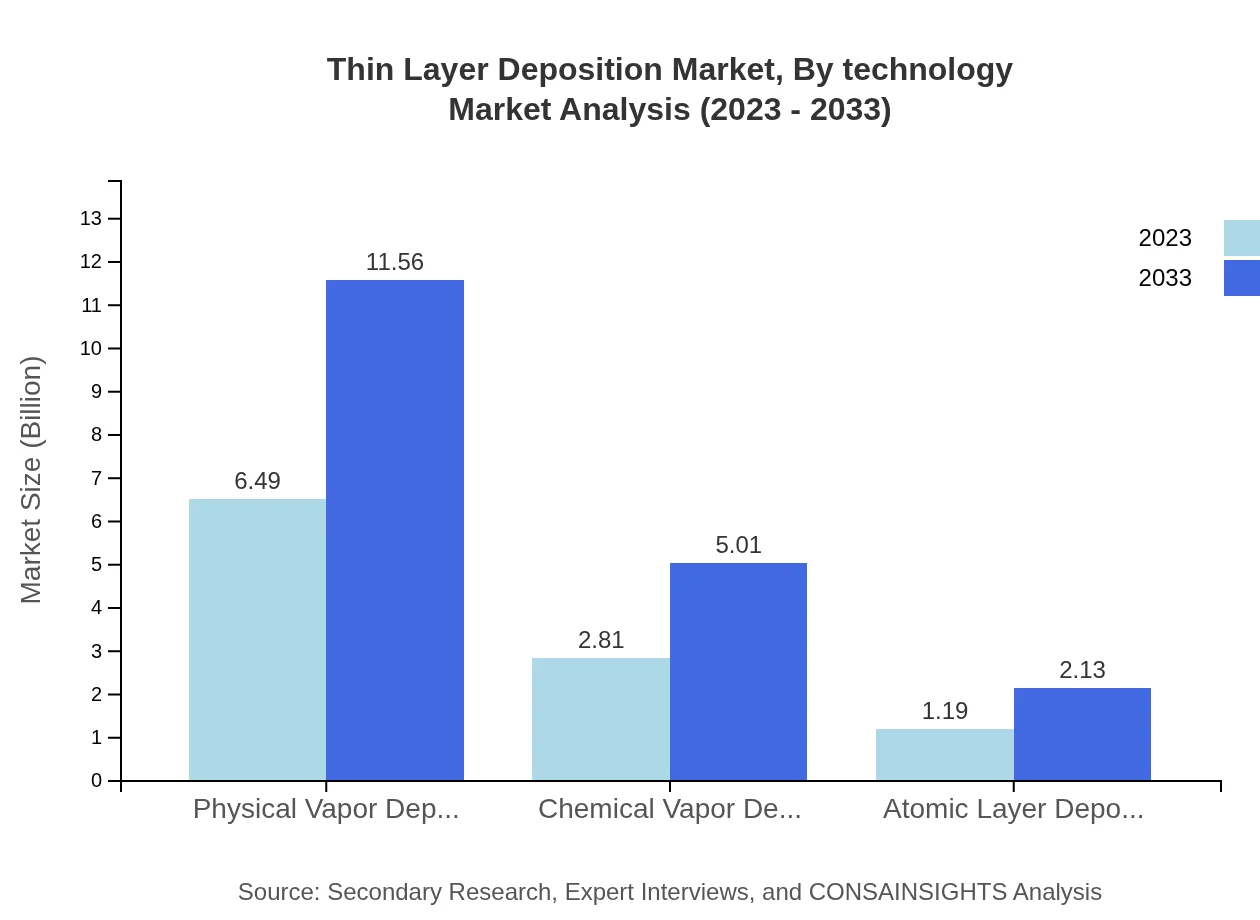

Thin Layer Deposition Market Analysis By Technology

The Thin-Layer Deposition market is dominated by Physical Vapor Deposition, which accounts for 61.83% of the market share in 2023. Chemical Vapor Deposition is significant as well, representing 26.8% of the market share. Both technologies are crucial for semiconductor fabrication, optics, and coatings for energy applications.

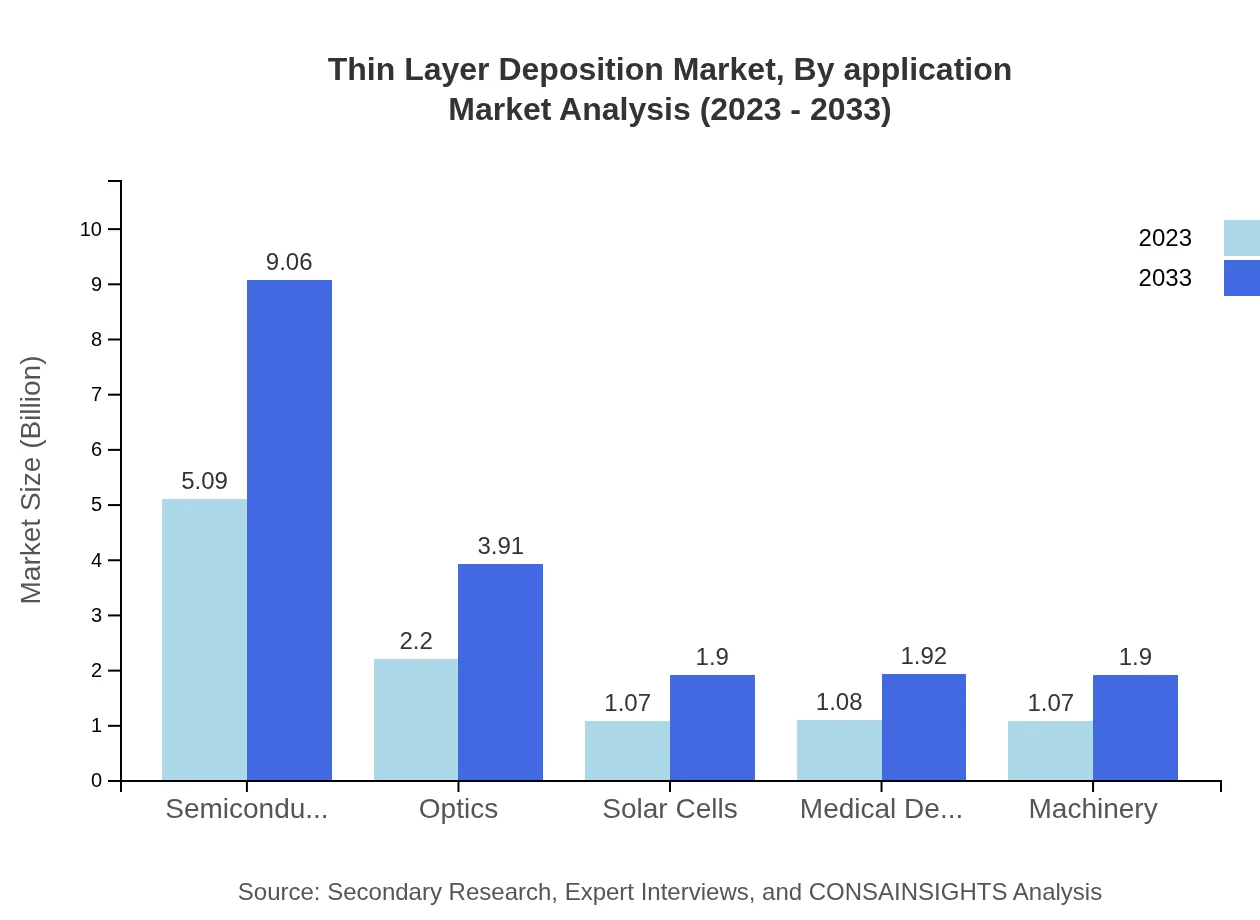

Thin Layer Deposition Market Analysis By Application

Semiconductors are the largest application segment, holding a 48.47% market share in 2023. Other relevant applications include optics and electronics, which demonstrate substantial growth and demand for precise thin coatings.

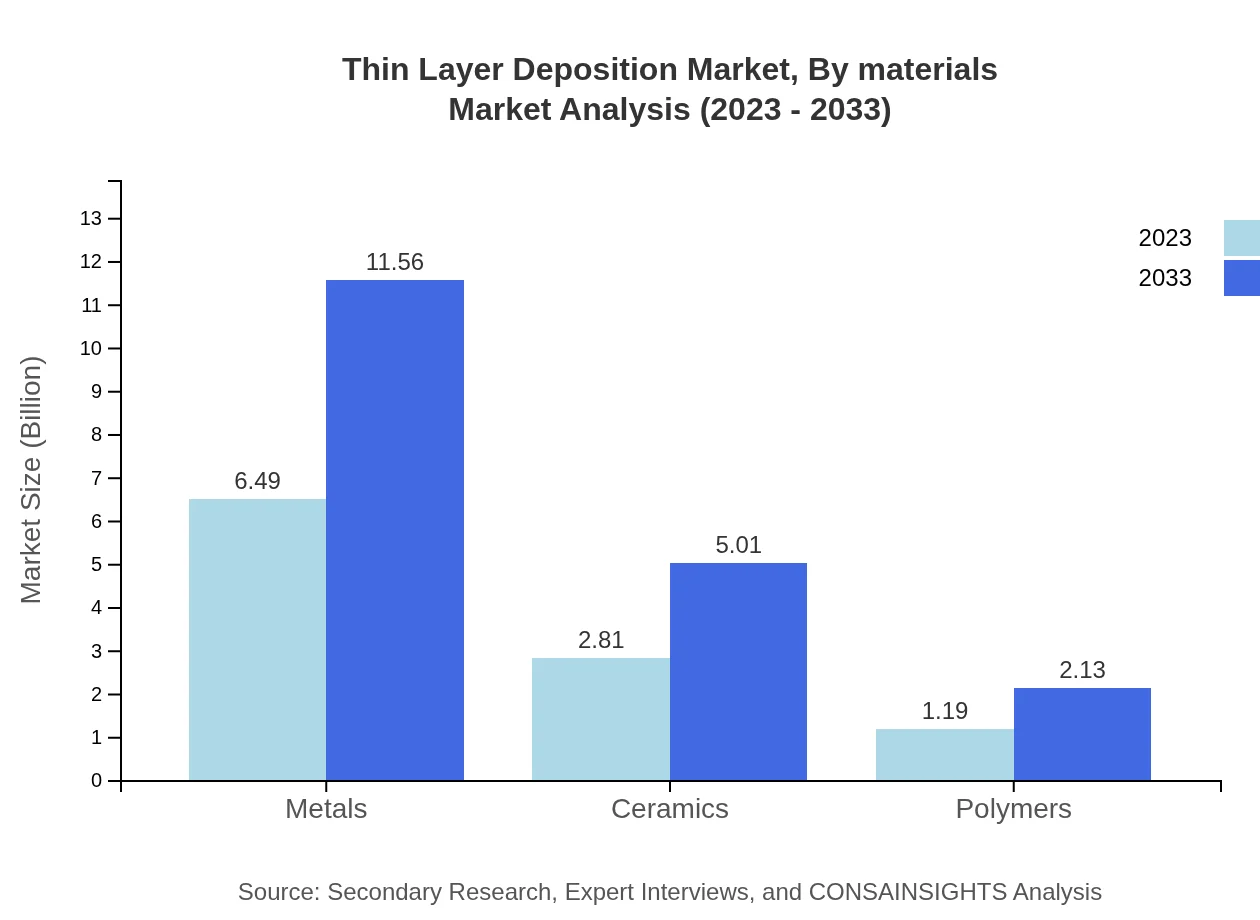

Thin Layer Deposition Market Analysis By Materials

Metals are the leading material in the Thin Layer Deposition industry, capturing 61.83% of the market share in 2023, followed by ceramics and polymers that are integral to various applications, ensuring durability and functionality.

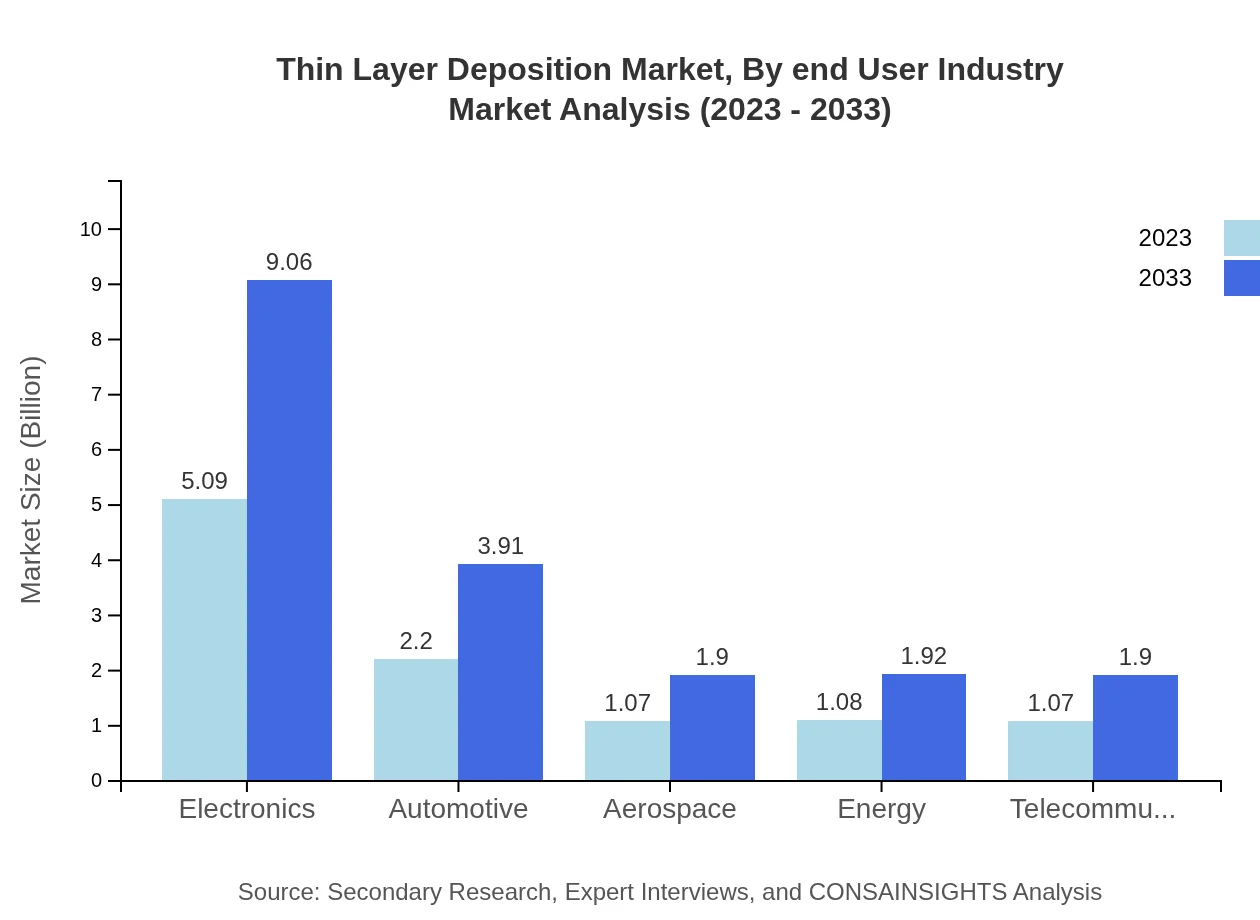

Thin Layer Deposition Market Analysis By End User Industry

The electronics sector dominates the end-user market with a 48.47% share in 2023. Other sectors such as automotive and aerospace follow closely, reflecting the comprehensive applicability of Thin Layer Deposition technologies in enhancing product value.

Thin Layer Deposition Market Analysis By Geography

Geographically, North America represents a major market share, with Europe and Asia Pacific following due to their high potentials in semiconductor manufacturing and various industrial applications, indicating a diverse and competitive landscape.

Thin Layer Deposition Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Thin Layer Deposition Industry

Applied Materials, Inc.:

A leader in materials engineering solutions, Applied Materials focuses on technologies for semiconductor and display manufacturing, providing various deposition systems integral to the TLD market.LAM Research Corporation:

LAM Research specializes in etch and deposition equipment used in semiconductor manufacturing, known for their innovative TLD technologies, enhancing production efficiency and device performance.Tokyo Electron Limited:

Tokyo Electron is a key player globally in the semiconductor production equipment sector, providing state-of-the-art deposition solutions that cater to the evolving demands of the TLD market.KLA Corporation:

KLA Corporation offers advanced process control and yield management systems. Their focus on deposition techniques is essential for manufacturers striving for higher quality and reliability.We're grateful to work with incredible clients.

FAQs

What is the market size of thin Layer Deposition?

The global thin-layer deposition market is currently valued at approximately $10.5 billion, with a projected CAGR of 5.8% through 2033, signaling robust growth driven by technological advancements and growing demand across various industries.

What are the key market players or companies in this thin Layer Deposition industry?

Key companies in the thin-layer deposition market include global giants such as Applied Materials, Lam Research, and Tokyo Electron. These players are integral to the advancement of deposition technologies, catering primarily to the semiconductor and electronics sectors.

What are the primary factors driving the growth in the thin Layer deposition industry?

Growth in the thin-layer deposition industry is driven by rising demand for semiconductors, advancements in nanotechnology, increasing applications in solar cells, and the need for miniaturization in electronics, which require precise coatings.

Which region is the fastest Growing in the thin Layer deposition?

The North America region is currently the fastest-growing market for thin-layer deposition, projected to reach $6.74 billion by 2033 from $3.78 billion in 2023, supported by technological innovations and a strong electronics manufacturing base.

Does ConsaInsights provide customized market report data for the thin Layer deposition industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the thin-layer deposition industry. Clients can request insights that align precisely with their strategic objectives and market evaluations.

What deliverables can I expect from this thin Layer deposition market research project?

Clients can expect comprehensive reports including market analysis, insights into key players, regional trends, segmentation data, and strategic recommendations, ensuring informed decision-making within the thin-layer deposition sector.

What are the market trends of thin Layer deposition?

Current trends in the thin-layer deposition market include an increased focus on environmental sustainability, the utilization of advanced materials, rapid technological integration in production processes, and accelerating adoption of IoT and AI in manufacturing.