Thin Wafer Processing And Dicing Equipment Market Report

Published Date: 31 January 2026 | Report Code: thin-wafer-processing-and-dicing-equipment

Thin Wafer Processing And Dicing Equipment Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Thin Wafer Processing and Dicing Equipment market, covering market size, segmentation, regional insights, and industry trends. Forecasting from 2023 to 2033, the report aims to equip stakeholders with critical data for informed decision-making.

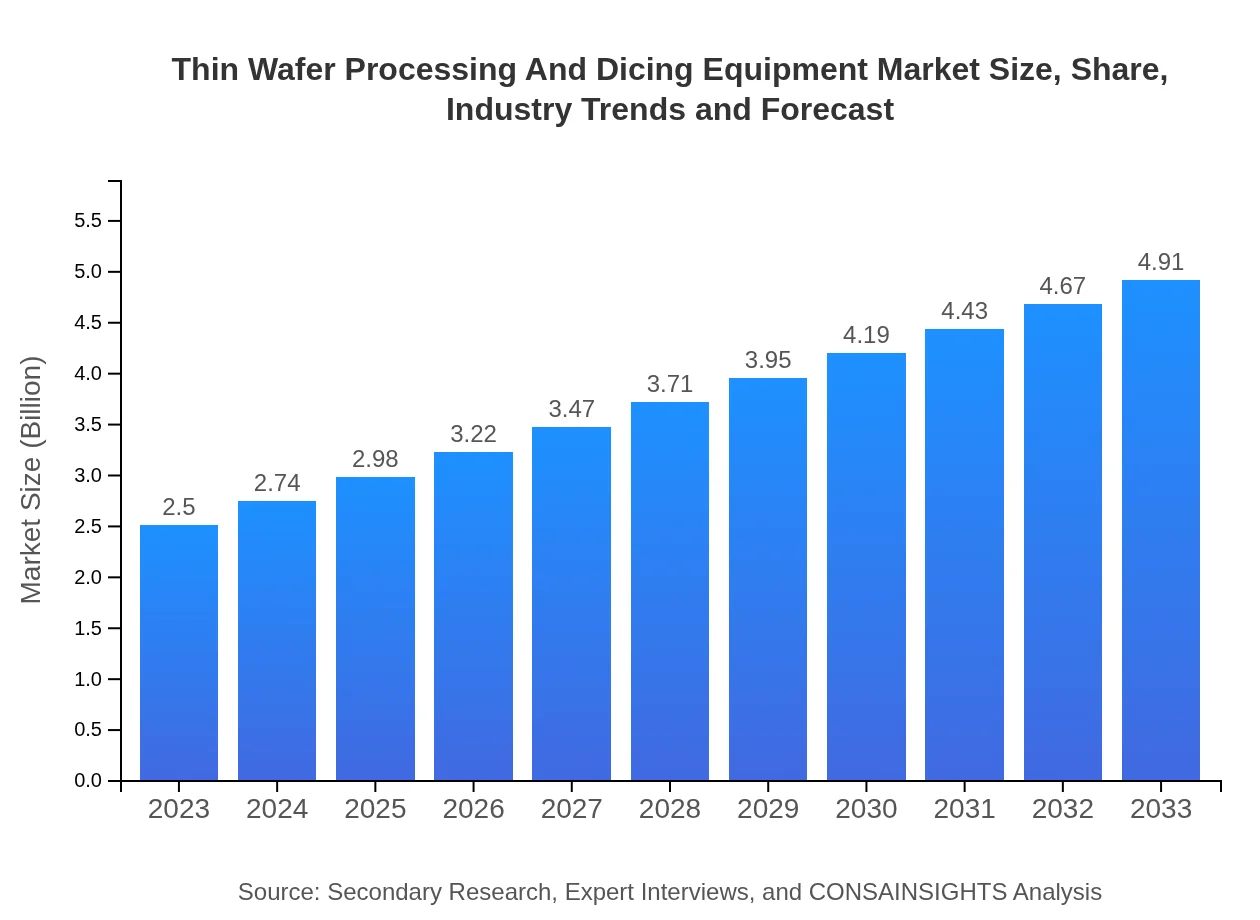

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $4.91 Billion |

| Top Companies | Tokyo Electron Limited, Applied Materials, KLA Corporation, DISCO Corporation |

| Last Modified Date | 31 January 2026 |

Thin Wafer Processing And Dicing Equipment Market Overview

Customize Thin Wafer Processing And Dicing Equipment Market Report market research report

- ✔ Get in-depth analysis of Thin Wafer Processing And Dicing Equipment market size, growth, and forecasts.

- ✔ Understand Thin Wafer Processing And Dicing Equipment's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Thin Wafer Processing And Dicing Equipment

What is the Market Size & CAGR of Thin Wafer Processing And Dicing Equipment market in 2023?

Thin Wafer Processing And Dicing Equipment Industry Analysis

Thin Wafer Processing And Dicing Equipment Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Thin Wafer Processing And Dicing Equipment Market Analysis Report by Region

Europe Thin Wafer Processing And Dicing Equipment Market Report:

The European market for Thin Wafer Processing and Dicing Equipment is expected to see significant growth, increasing from 0.73 billion USD in 2023 to approximately 1.43 billion USD by 2033. The focus on renewable energy applications and industrial automation is significantly impacting market dynamics in this region.Asia Pacific Thin Wafer Processing And Dicing Equipment Market Report:

The Asia Pacific region is expected to dominate the Thin Wafer Processing and Dicing Equipment market with a market size projected to grow from 0.47 billion USD in 2023 to 0.92 billion USD by 2033. The rise of semiconductor manufacturing in countries like China, Japan, and South Korea plays a critical role, along with increased investments in research and development.North America Thin Wafer Processing And Dicing Equipment Market Report:

The North American market is projected to grow significantly, with a market size expected to reach 1.87 billion USD by 2033, up from 0.95 billion USD in 2023. The region is home to many leading semiconductor manufacturers and ongoing technological advancements, which continue to boost demand for advanced wafer processing equipment.South America Thin Wafer Processing And Dicing Equipment Market Report:

The South American market is anticipated to see steady growth, with size estimates rising from 0.20 billion USD in 2023 to about 0.39 billion USD by 2033. The growth is primarily attributed to an increasing number of electronics manufacturers establishing operations in the region, supported by local governments seeking to attract foreign investment.Middle East & Africa Thin Wafer Processing And Dicing Equipment Market Report:

The Middle East and Africa are also poised to witness growth within this sector, projecting a market increase from 0.16 billion USD in 2023 to 0.31 billion USD by 2033. Efforts to expand technology infrastructure and improve manufacturing capabilities will be crucial drivers in this region.Tell us your focus area and get a customized research report.

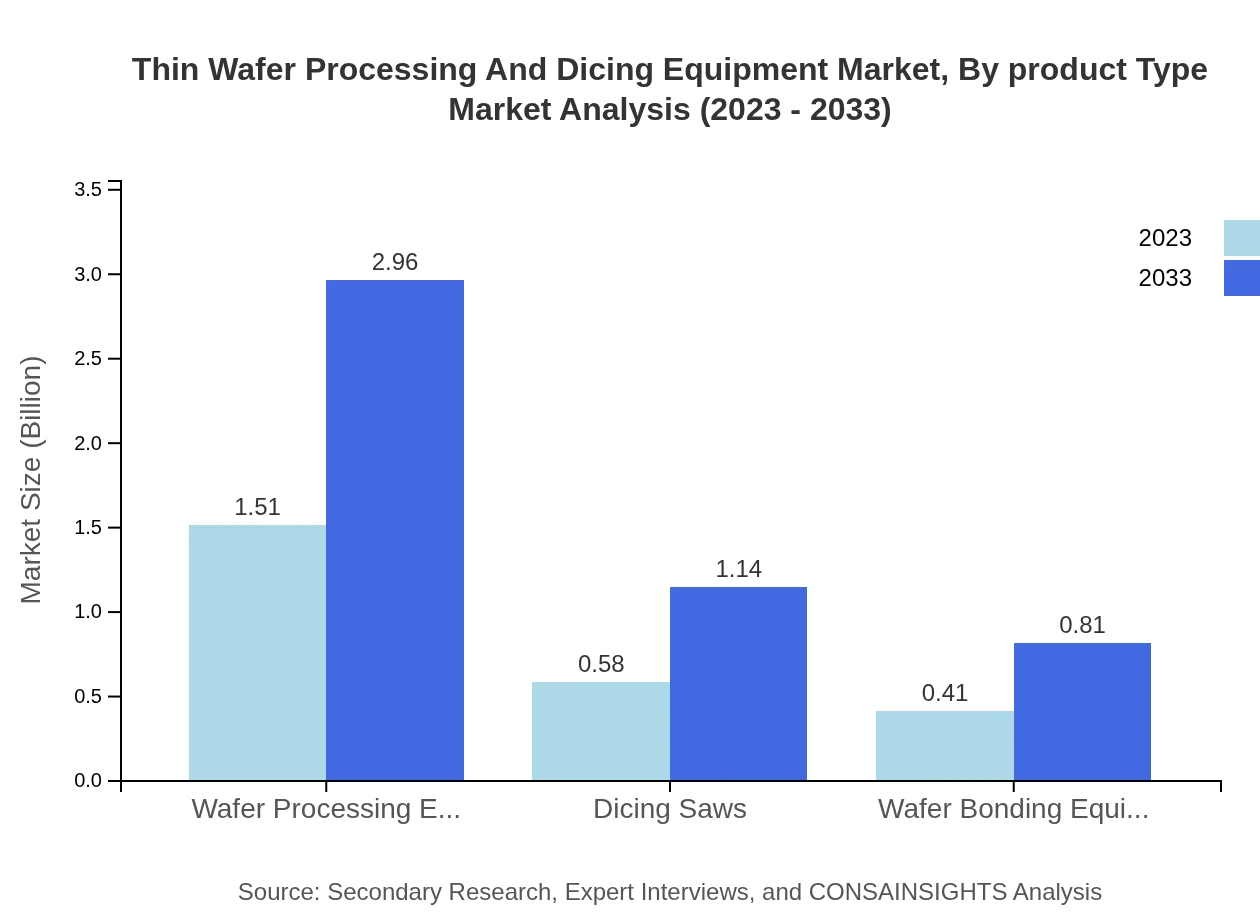

Thin Wafer Processing And Dicing Equipment Market Analysis By Product Type

The Thin Wafer Processing and Dicing Equipment market is primarily segmented into wafer processing equipment, dicing saws, and wafer bonding equipment, each contributing uniquely to the overall market. Wafer processing equipment holds the largest market share at 60.3%, reflecting its critical role in the initial phases of semiconductor fabrication. Dicing saws hold a 23.12% share, crucial for the separation of individual semiconductor dies post-wafer processing.

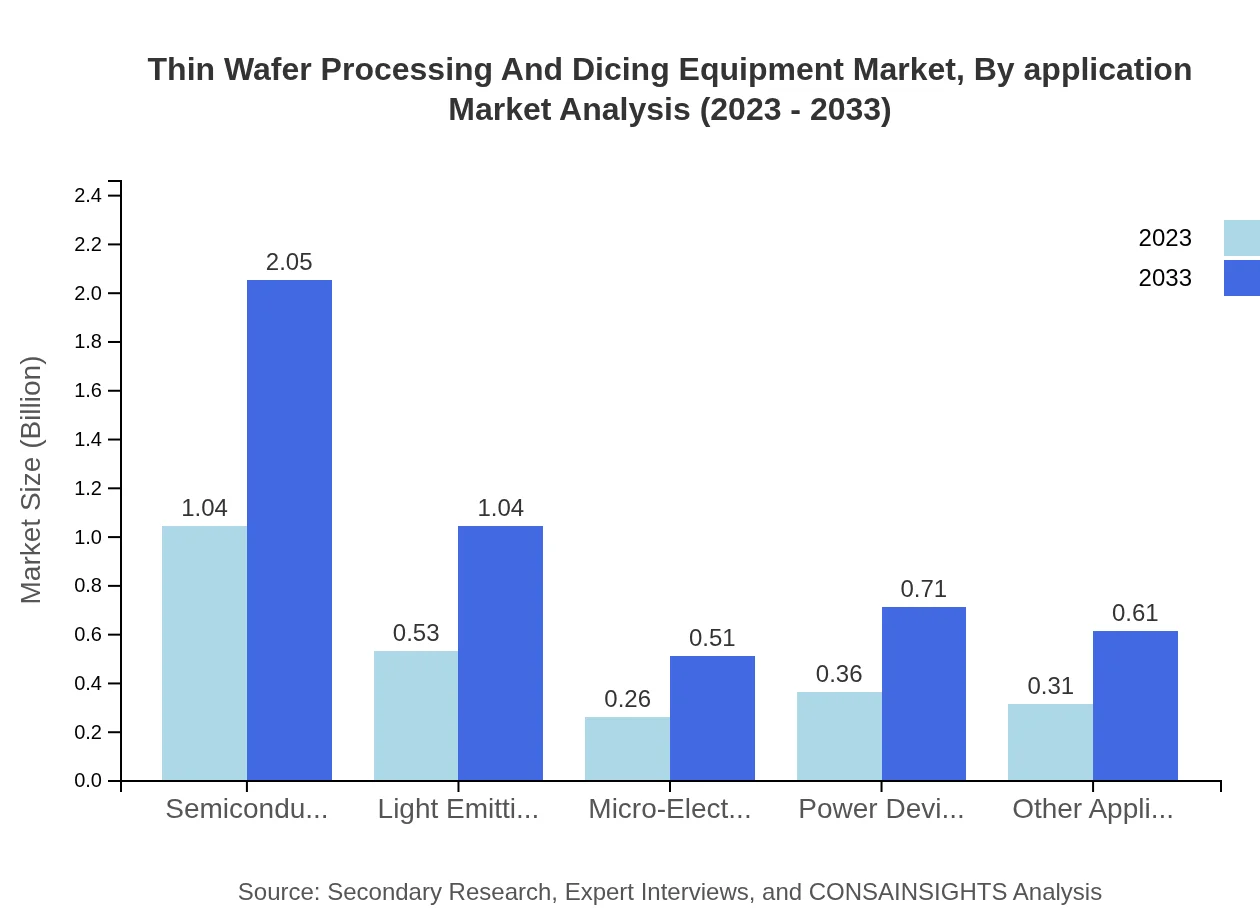

Thin Wafer Processing And Dicing Equipment Market Analysis By Application

Applications of Thin Wafer Processing and Dicing Equipment are seen predominantly in electronics, telecommunications, automotive, medical devices, and other sectors. The electronics sector is significant, accounting for a market size of 1.04 billion USD in 2023, expected to reach 2.05 billion USD by 2033, while telecommunications is projected to grow from 0.53 billion USD to 1.04 billion USD.

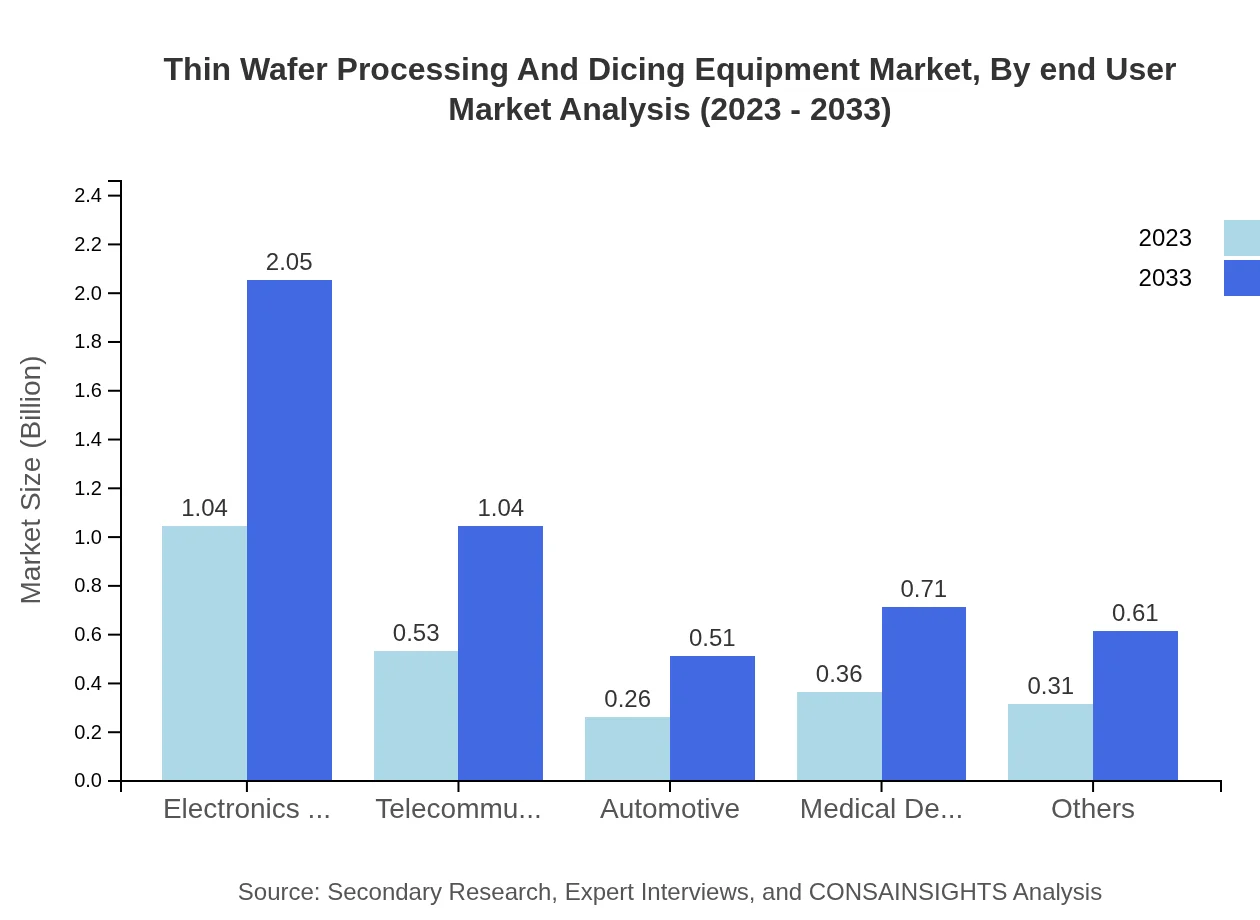

Thin Wafer Processing And Dicing Equipment Market Analysis By End User

The end-user industry shows a diverse range, with electronics manufacturers leading the way, accounting for 41.66% of the market share. Other key sectors include telecommunications (21.1%), automotive (10.42%), and medical devices (14.4%). The varied demand across these sectors suggests ample opportunities for manufacturers to diversify their product offerings.

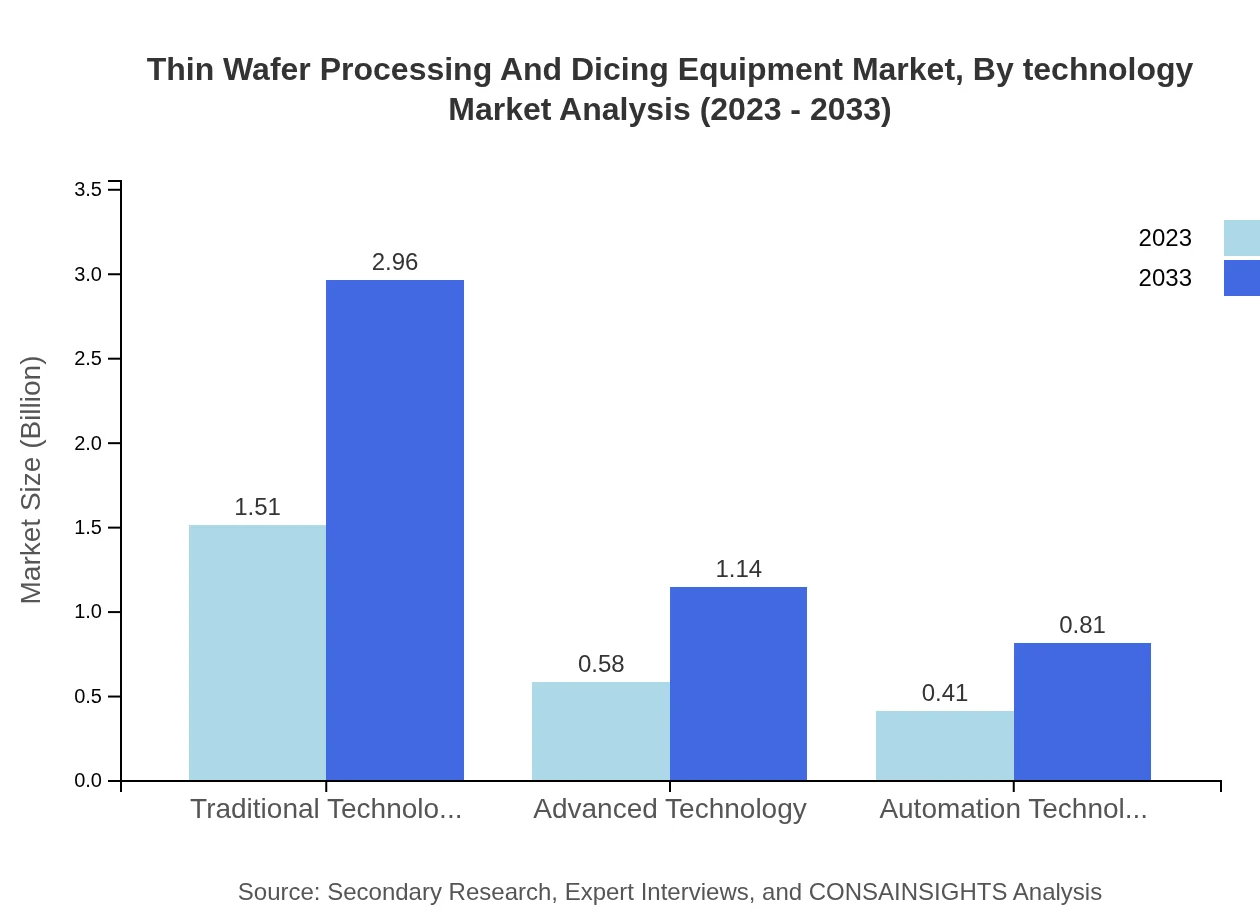

Thin Wafer Processing And Dicing Equipment Market Analysis By Technology

Technological advancements within the Thin Wafer Processing and Dicing Equipment market segment into traditional, advanced, and automation technologies. Traditional technology maintains a dominant share at 60.3%, while automation technology is gaining traction with a share of 16.58%. This trend indicates a shift towards more automated processing solutions driven by demand for efficiency.

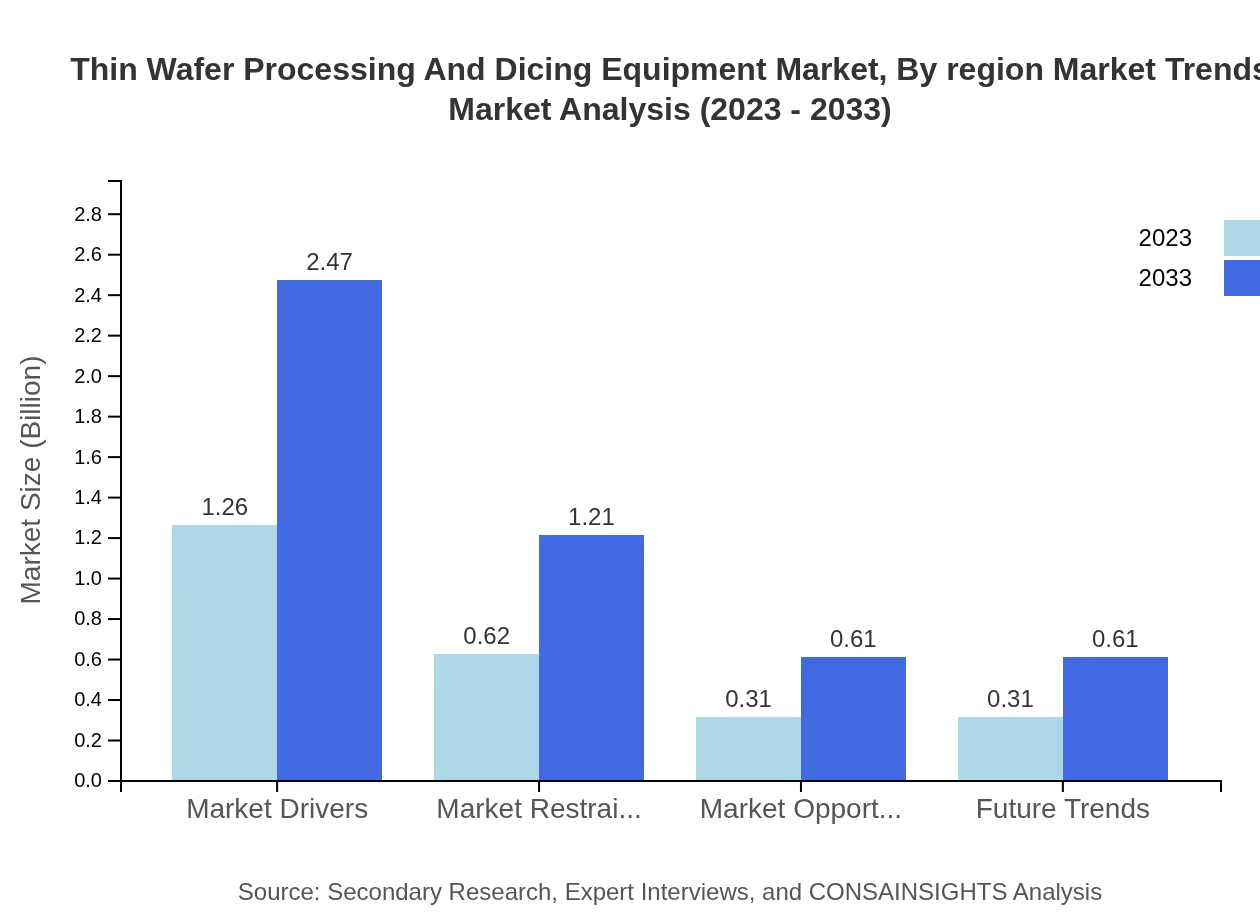

Thin Wafer Processing And Dicing Equipment Market Analysis By Region Market Trends

The market trends indicate a growing inclination towards automation and energy-efficient technologies across regions. The continuous development in semiconductor technology will propel future market growth, with expectations for enhanced collaboration between manufacturers and technology firms to innovate and refine product offerings.

Thin Wafer Processing And Dicing Equipment Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Thin Wafer Processing And Dicing Equipment Industry

Tokyo Electron Limited:

A leading manufacturer of semiconductor production equipment that has pioneered advancements in wafer processing technologies.Applied Materials:

A major player in the electronics manufacturing industry, specializing in wafer fabrication solutions and equipment.KLA Corporation:

Recognized for its innovation in inspection and metrology systems, KLA provides essential tools for the semiconductor and electronics industries.DISCO Corporation:

A prominent manufacturer of cutting and grinding equipment tailored for the semiconductor industry, known for its dicing saws and laser technology.We're grateful to work with incredible clients.

FAQs

What is the market size of thin Wafer Processing And Dicing Equipment?

The thin wafer processing and dicing equipment market is valued at approximately $2.5 billion in 2023, with a projected CAGR of 6.8% over the next decade, suggesting significant growth opportunities through 2033.

What are the key market players or companies in this thin Wafer Processing And Dicing Equipment industry?

Key players in the thin wafer processing and dicing equipment industry include prominent global manufacturers specializing in semiconductors, electronics, and advanced materials technologies, positioning themselves as innovators in this sector.

What are the primary factors driving the growth in the thin Wafer Processing And Dicing Equipment industry?

Factors fueling growth include increasing demand for miniaturized electronics, advancements in semiconductor manufacturing technologies, and a rising focus on energy-efficient devices that utilize thin wafer technology.

Which region is the fastest Growing in the thin Wafer Processing And Dicing Equipment?

The fastest-growing regions include Europe, projected to grow from $0.73 billion in 2023 to $1.43 billion by 2033, and Asia Pacific, expected to increase from $0.47 billion to $0.92 billion in the same period.

Does ConsaInsights provide customized market report data for the thin Wafer Processing And Dicing Equipment industry?

Yes, ConsaInsights offers tailored market report data to meet specific client needs within the thin wafer processing and dicing equipment sector, ensuring relevant insights and analysis are provided.

What deliverables can I expect from this thin Wafer Processing And Dicing Equipment market research project?

Expect comprehensive deliverables including detailed market analysis, forecasts, regional assessments, competitive landscape evaluations, and tailored insights aimed at supporting strategic decision-making.

What are the market trends of thin Wafer Processing And Dicing Equipment?

Current trends include a shift towards advanced technology in wafer processing, increased automation, a growing focus on sustainability, and rising applications in various sectors such as telecommunications and automotive.