Thin Wall Packaging Market Report

Published Date: 02 February 2026 | Report Code: thin-wall-packaging

Thin Wall Packaging Market Size, Share, Industry Trends and Forecast to 2033

This comprehensive market report analyzes the Thin Wall Packaging industry from 2023 to 2033, providing insights into market size, growth forecasts, segmentation, and leading players, alongside regional analyses and emerging trends affecting the market landscape.

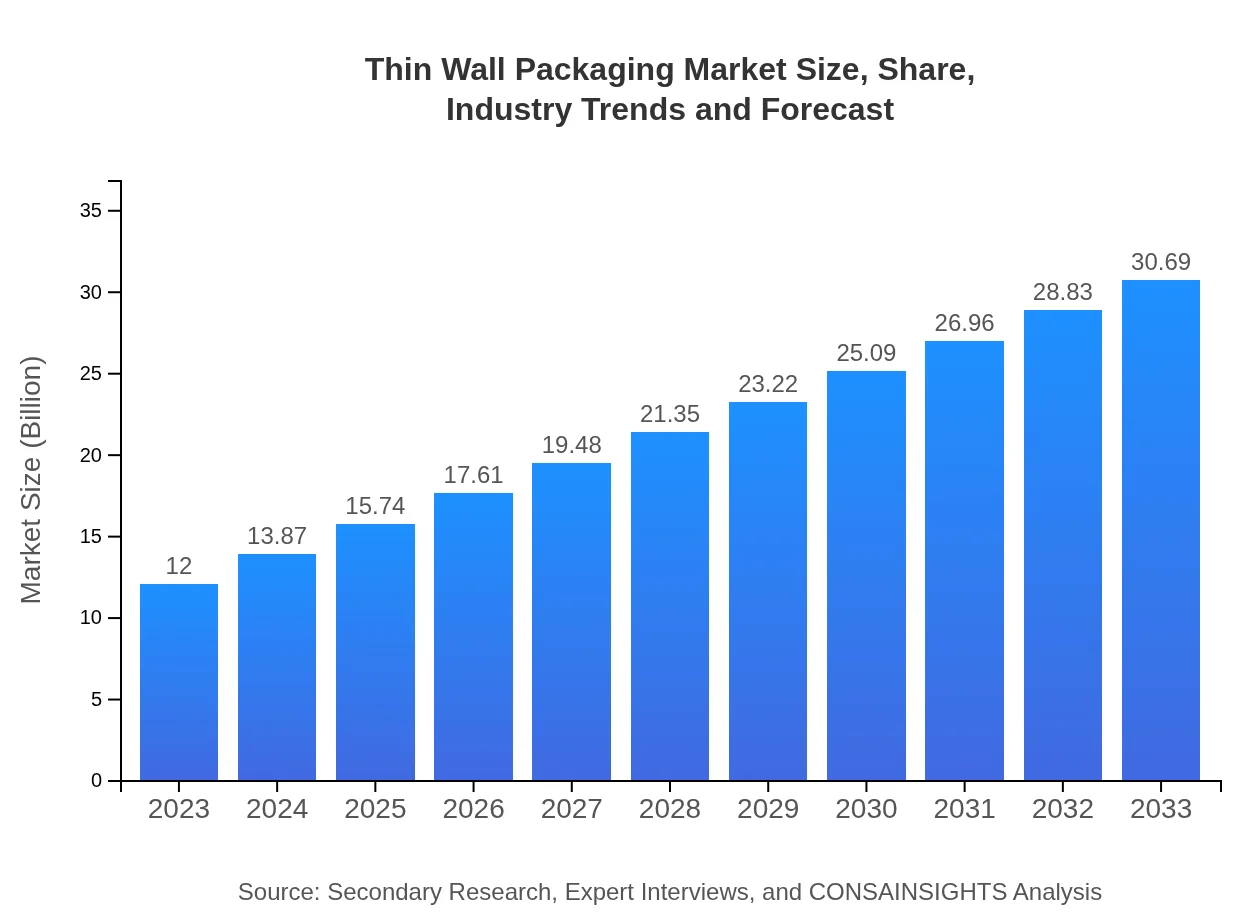

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $12.00 Billion |

| CAGR (2023-2033) | 9.5% |

| 2033 Market Size | $30.69 Billion |

| Top Companies | Amcor PLC, Berry Global, Inc., Sealed Air Corporation, Mondi Group, Huhtamaki Oyj |

| Last Modified Date | 02 February 2026 |

Thin Wall Packaging Market Overview

Customize Thin Wall Packaging Market Report market research report

- ✔ Get in-depth analysis of Thin Wall Packaging market size, growth, and forecasts.

- ✔ Understand Thin Wall Packaging's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Thin Wall Packaging

What is the Market Size & CAGR of Thin Wall Packaging market?

Thin Wall Packaging Industry Analysis

Thin Wall Packaging Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Thin Wall Packaging Market Analysis Report by Region

Europe Thin Wall Packaging Market Report:

Europe is poised to maintain a strong growth trajectory, with the market size expected to reach 8.01 billion USD by 2033 from 3.13 billion USD in 2023. The region's push towards eco-friendly packaging and innovations in thin wall technologies will drive market expansion, supported by consumer preferences for packaged food and healthcare products.Asia Pacific Thin Wall Packaging Market Report:

The Asia Pacific region is projected to exhibit considerable growth in the Thin Wall Packaging market, with an estimated market size of 6.40 billion USD by 2033, up from 2.50 billion USD in 2023. Rapid industrialization, urbanization, and changing consumer lifestyles are driving this demand. Countries like China and India are experiencing a surge in food service industries, further enhancing the adoption of thin wall packaging solutions to meet consumer needs.North America Thin Wall Packaging Market Report:

The North American market for Thin Wall Packaging is expected to grow significantly from 4.51 billion USD in 2023 to an estimated 11.53 billion USD by 2033. This growth is attributed to the increasing demand for convenient packaging solutions in the fast-paced food service environment, alongside stringent regulations promoting sustainable materials in the packaging industry.South America Thin Wall Packaging Market Report:

In South America, the Thin Wall Packaging market is anticipated to grow modestly, reaching approximately 0.54 billion USD by 2033, compared to 0.21 billion USD in 2023. Factors such as economic fluctuations and variable consumer spending power influence market growth. However, a rising focus on sustainable packaging practices is expected to aid in expanding the thin wall packaging industry in the region.Middle East & Africa Thin Wall Packaging Market Report:

In the Middle East and Africa, the Thin Wall Packaging market is projected to grow from 1.65 billion USD in 2023 to approximately 4.21 billion USD by 2033. This growth will be supported by a growing population and increasing investments in the food and beverage industry, coupled with rising demand for packaging solutions that enhance product shelf life.Tell us your focus area and get a customized research report.

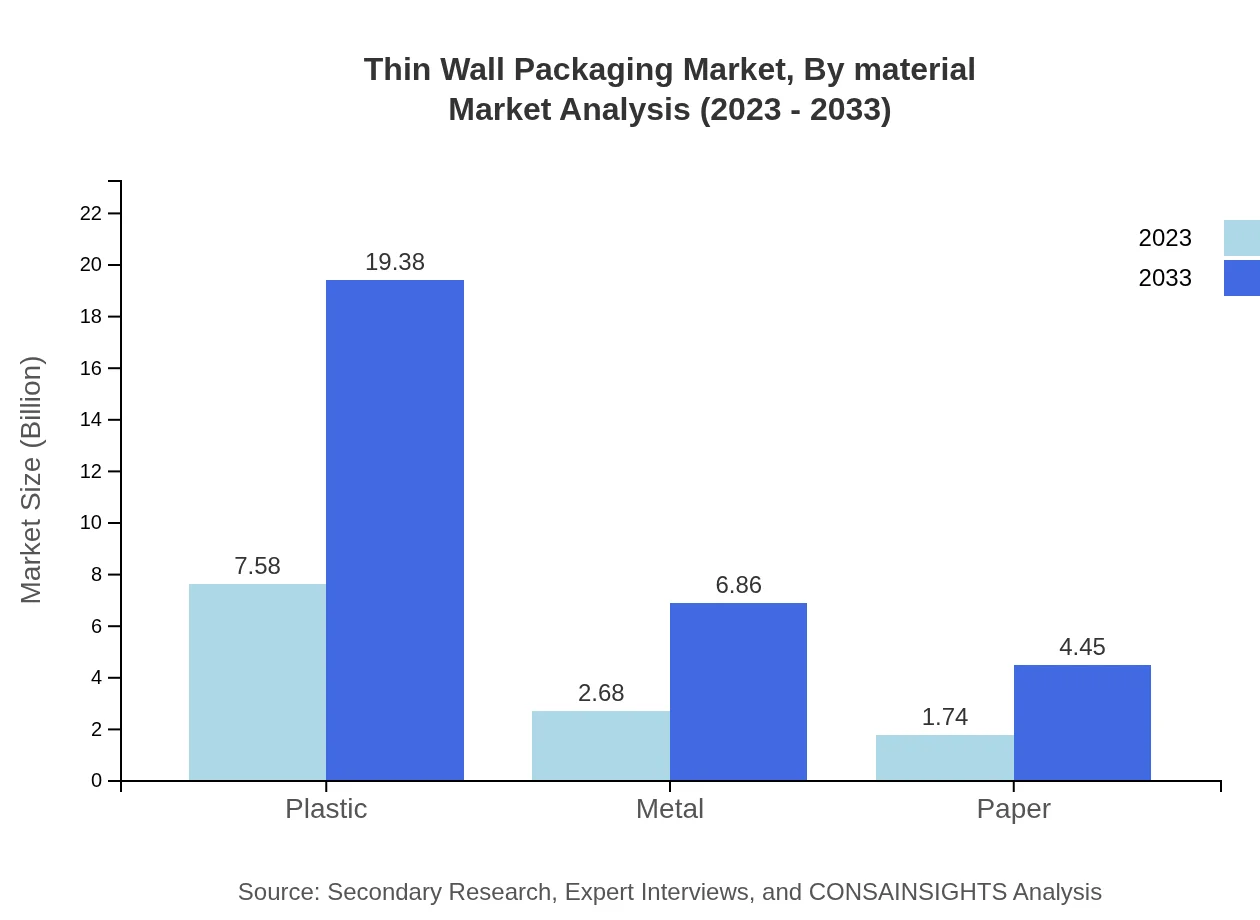

Thin Wall Packaging Market Analysis By Material

The primary material used in Thin Wall Packaging is plastic, accounting for approximately 63.13% of the market share in 2023, projected to grow to 63.13% in 2033. Other materials such as metal and paper follow, with respective shares of 22.36% and 14.51%. Advances in biodegradable plastics will further influence this segment, as manufacturers adapt to consumer demand for more sustainable materials.

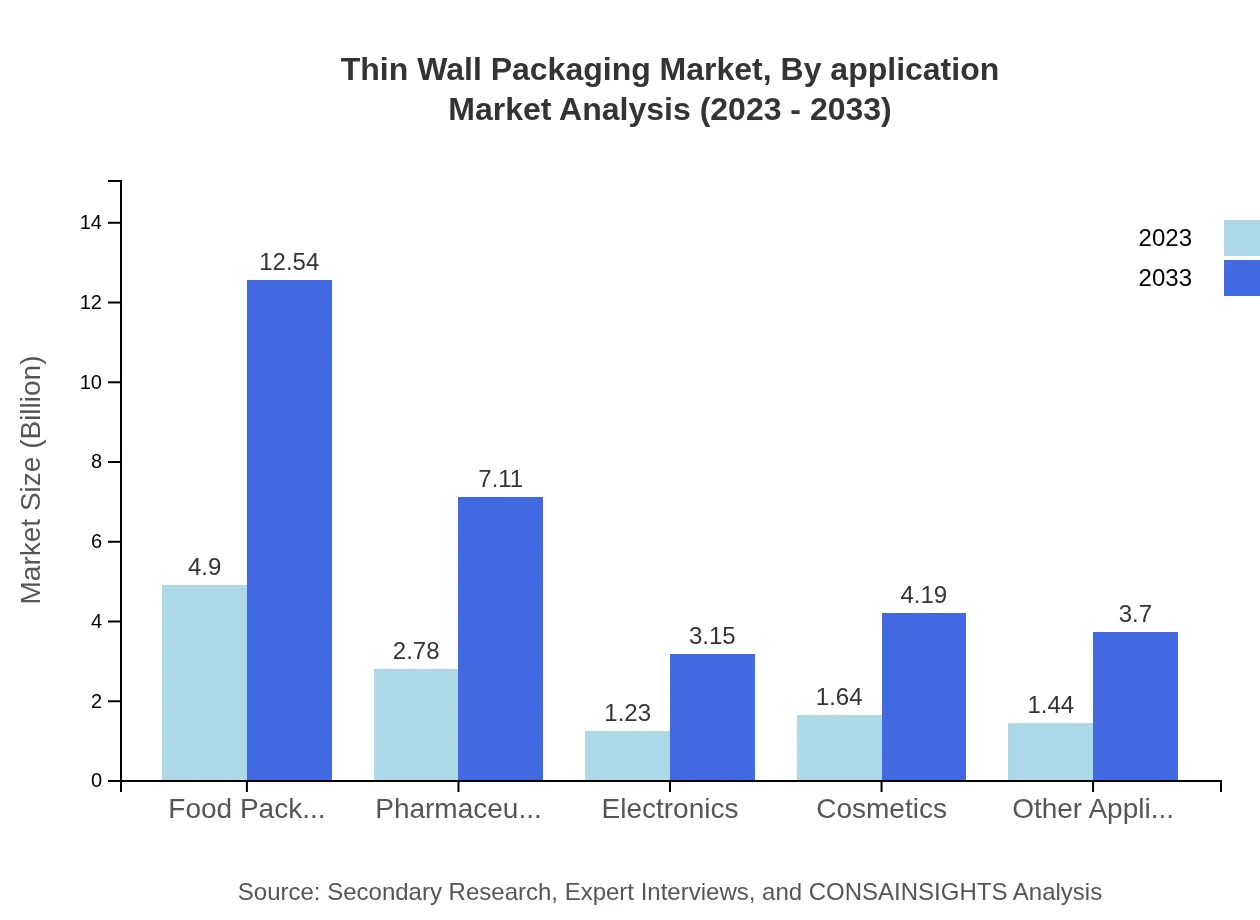

Thin Wall Packaging Market Analysis By Application

Applications for Thin Wall Packaging are dominated by the food industry, which holds a market size of 6.08 billion USD in 2023, expanding to 15.56 billion USD by 2033. This is followed by the healthcare industry, with a market size of 2.99 billion USD in 2023, increasing to 7.64 billion USD. These two sectors significantly influence overall market demand, driven by the need for effective and hygienic packaging solutions.

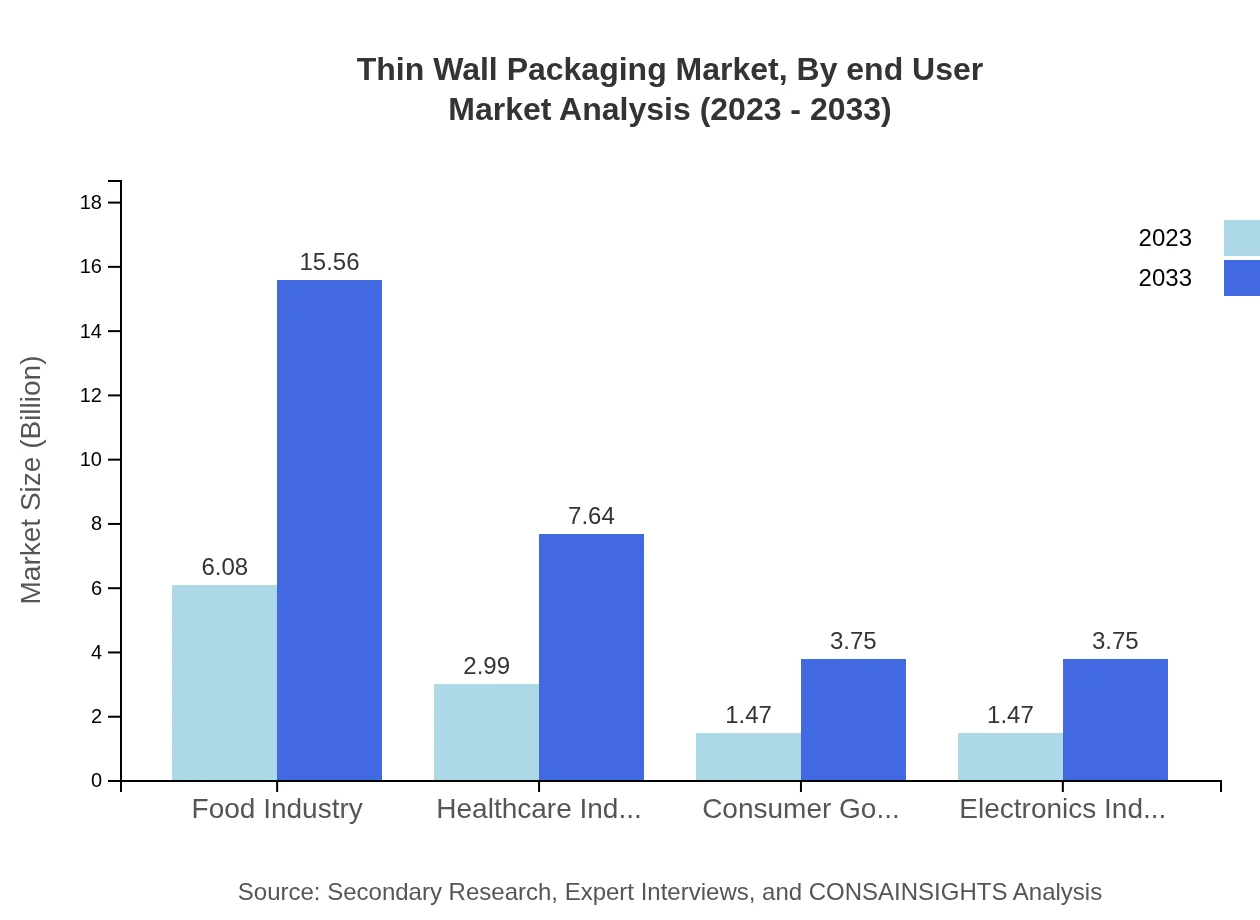

Thin Wall Packaging Market Analysis By End User

The end-user segments for Thin Wall Packaging include food, healthcare, consumer goods, and electronics. The food industry leads, with a market size of 6.08 billion USD in 2023 and expected growth to 15.56 billion USD by 2033, reflecting a consistent demand for ready-to-eat and on-the-go meal options. The healthcare sector is also significant, with its demand driven by stringent packaging standards and increasing health awareness.

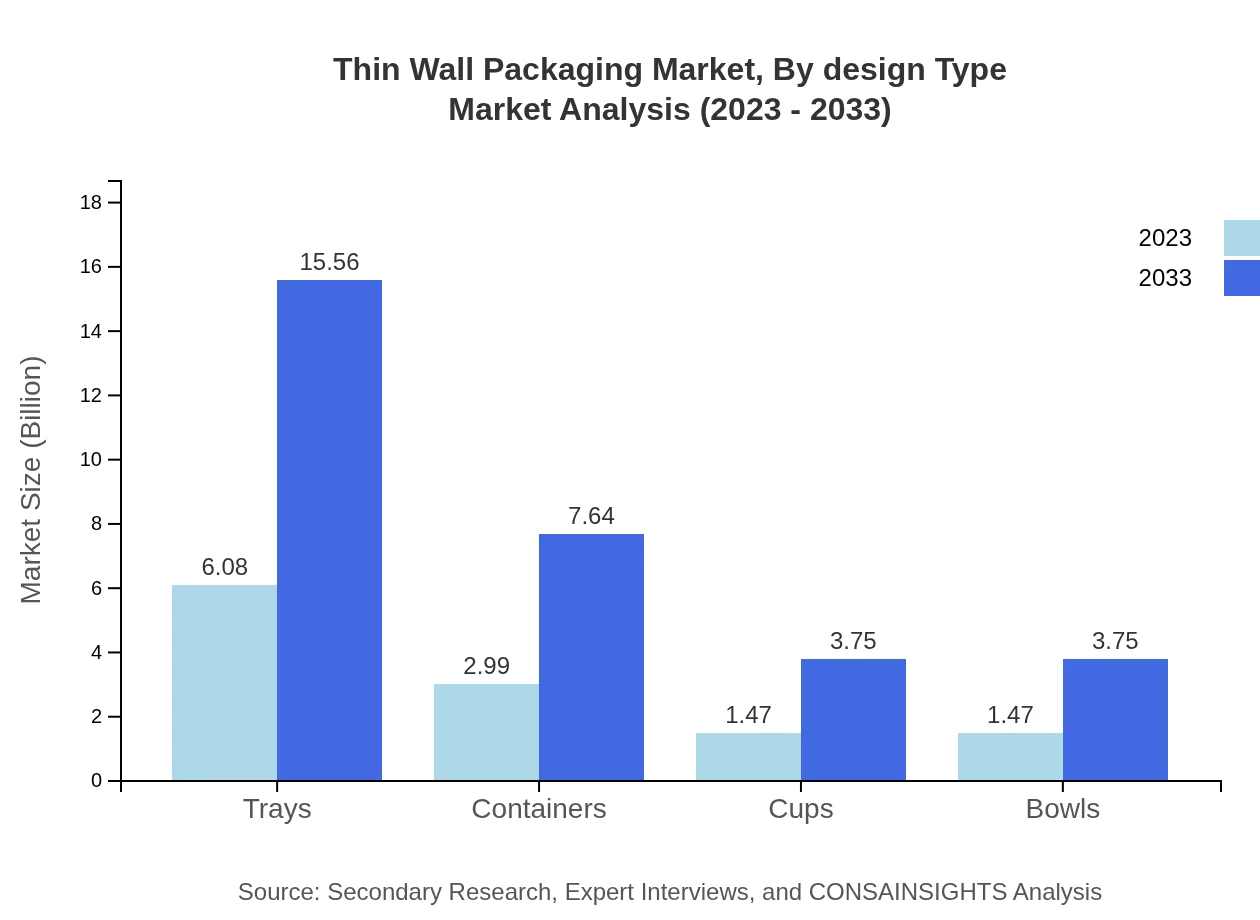

Thin Wall Packaging Market Analysis By Design Type

Various design types in the Thin Wall Packaging market include trays, containers, cups, and bowls. Trays represent the leading design type, with a size of 6.08 billion USD in 2023, forecasted to grow to 15.56 billion USD by 2033. This is due to their widespread usage in food service applications, especially for ready meals and snacks.

Thin Wall Packaging Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Thin Wall Packaging Industry

Amcor PLC:

Amcor is a global leader in responsible packaging solutions. The company's innovative thin wall packaging products cater to the food and healthcare sectors, focusing on sustainability and efficiency.Berry Global, Inc.:

Berry Global manufactures innovative packaging solutions in various sectors. Their emphasis on lightweight thin wall packaging enhances product safety and reduces waste.Sealed Air Corporation:

Known for their insights into creating a better automated packaging solution, Sealed Air Corporation emphasizes the importance of sustainable packaging through their thin wall offerings.Mondi Group:

Mondi is focused on sustainable packaging solutions that enhance product value while minimizing environmental impact, their thin wall packaging options reflect their commitment to innovation.Huhtamaki Oyj:

Huhtamaki specializes in food service packaging and related systems. Their thin wall products are designed to enhance the consumption experience while ensuring product integrity.We're grateful to work with incredible clients.

FAQs

What is the market size of thin Wall packaging?

The thin-wall packaging market is valued at approximately $12 billion in 2023, with a compound annual growth rate (CAGR) of 9.5%. This growth trajectory suggests a significant expansion, reaching potential value by 2033.

What are the key market players or companies in the thin Wall packaging industry?

Key market players include major packaging manufacturers and distributors specializing in innovative packaging solutions. These companies invest heavily in R&D and have established a solid presence in various sectors like food, healthcare, and consumer goods.

What are the primary factors driving the growth in the thin Wall packaging industry?

The growth in thin-wall packaging is driven by increasing demand for sustainable packaging solutions, convenience in handling and storage, advancements in technology leading to lightweight designs, and a rising trend towards on-the-go consumption in food and beverages.

Which region is the fastest Growing in the thin Wall packaging?

The fastest-growing region for thin-wall packaging is North America. The market size is projected to increase from $4.51 billion in 2023 to $11.53 billion by 2033, indicating robust growth opportunities in this area.

Does ConsaInsights provide customized market report data for the thin Wall packaging industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the thin-wall packaging industry. Clients can receive insights tailored to particular regions, segments, or trends they are interested in.

What deliverables can I expect from this thin Wall packaging market research project?

Deliverables from the thin-wall packaging market research project include comprehensive reports with market size, growth forecasts, competitive analysis, regional insights, and detailed segment breakdowns across various industries.

What are the market trends of thin Wall packaging?

Current market trends in thin-wall packaging include an increased focus on sustainability, rising demand for lightweight materials, expansion in the use of advanced polymer technologies, and greater customization to meet the specific needs of diverse industries.