Third Party Payment Market Report

Published Date: 31 January 2026 | Report Code: third-party-payment

Third Party Payment Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Third Party Payment market, including market size, growth trends, segmentation, and insights from 2023 to 2033. We explore regional analysis, technological advancements, and trends, offering valuable data for stakeholders and investors.

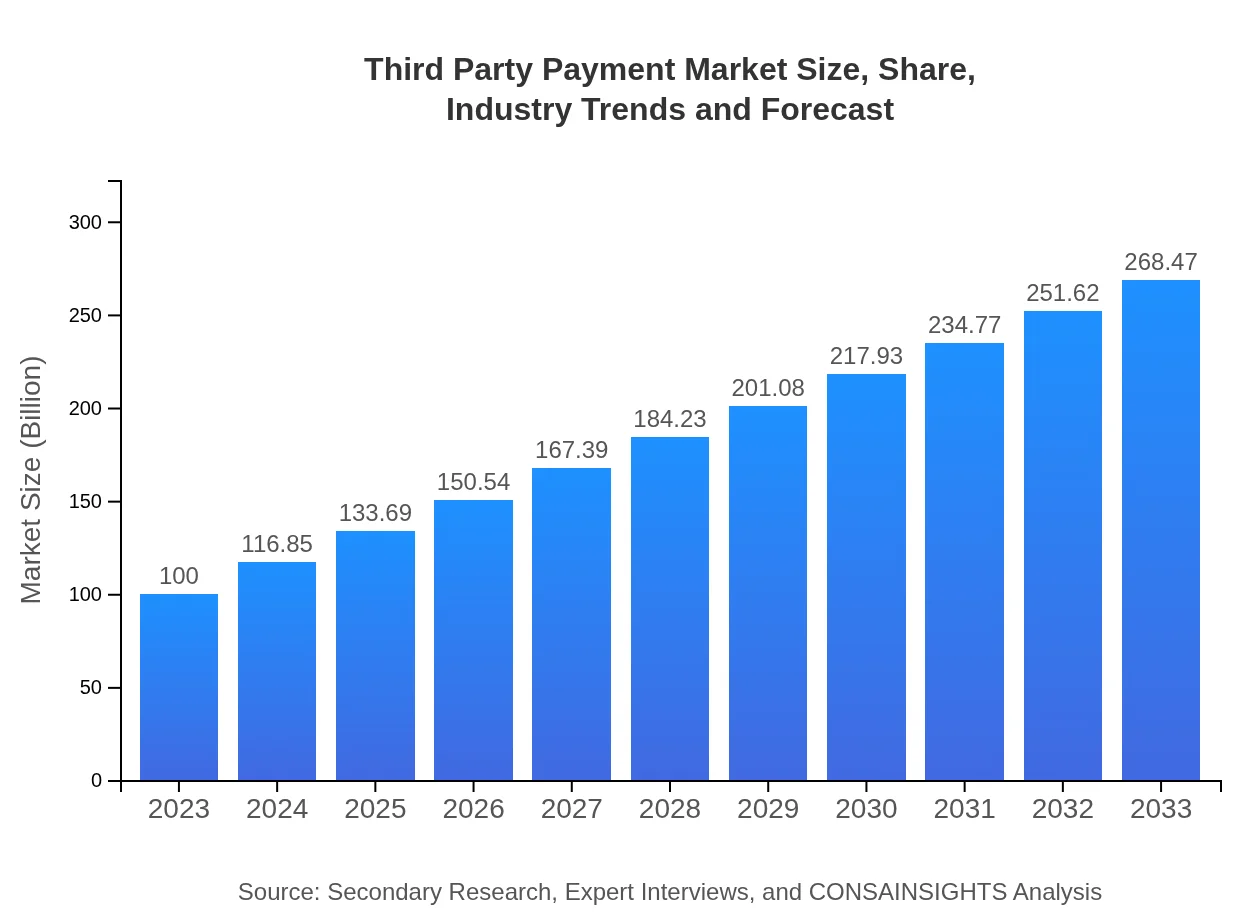

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $100.00 Billion |

| CAGR (2023-2033) | 10% |

| 2033 Market Size | $268.47 Billion |

| Top Companies | PayPal, Square, Inc., Stripe, Adyen, Apple Pay |

| Last Modified Date | 31 January 2026 |

Third Party Payment Market Overview

Customize Third Party Payment Market Report market research report

- ✔ Get in-depth analysis of Third Party Payment market size, growth, and forecasts.

- ✔ Understand Third Party Payment's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Third Party Payment

What is the Market Size & CAGR of Third Party Payment market in 2023 and 2033?

Third Party Payment Industry Analysis

Third Party Payment Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Third Party Payment Market Analysis Report by Region

Europe Third Party Payment Market Report:

The European Third Party Payment market is valued at roughly $28.76 billion in 2023, expected to expand to approximately $77.21 billion by 2033. The market's growth is driven by robust regulatory frameworks, increased consumer awareness regarding security, and the rising adoption of e-commerce. Significant investments in payment technologies further position Europe as a critical market for Third Party Payments.Asia Pacific Third Party Payment Market Report:

In 2023, the Asia Pacific region's Third Party Payment market is valued at approximately $19.14 billion and is projected to reach about $51.38 billion by 2033. This growth can be attributed to the rising smartphone penetration, increasing internet connectivity, and a burgeoning middle class with heightened spending power. Rapid urbanization and a shift towards cashless transactions further encourage market expansion.North America Third Party Payment Market Report:

North America dominates the Third Party Payment market, with an estimated value of $36.75 billion in 2023, set to reach approximately $98.66 billion by 2033. The advanced technological infrastructure, high internet penetration, and widespread acceptance of digital payment methods significantly drive this growth. The presence of key market players further foster a competitive landscape, promoting innovation and growth.South America Third Party Payment Market Report:

The South America Third Party Payment market was valued at around $9.16 billion in 2023 and is anticipated to grow to $24.59 billion by 2033. Factors such as increasing smartphone usage, improvements in fintech solutions, and a growing preference for online shopping contribute to this growth. Additionally, major players are expanding their operations in this region to cater to the evolving consumer landscape.Middle East & Africa Third Party Payment Market Report:

The Middle East and Africa (MEA) Third Party Payment market is estimated at $6.19 billion in 2023 and projected to grow to $16.62 billion by 2033. This is fueled by increasing internet adoption, the rise of fintech startups, and support from governments aiming to enhance digital payment solutions. The region sees a growing trend towards cashless transactions, especially in urban areas.Tell us your focus area and get a customized research report.

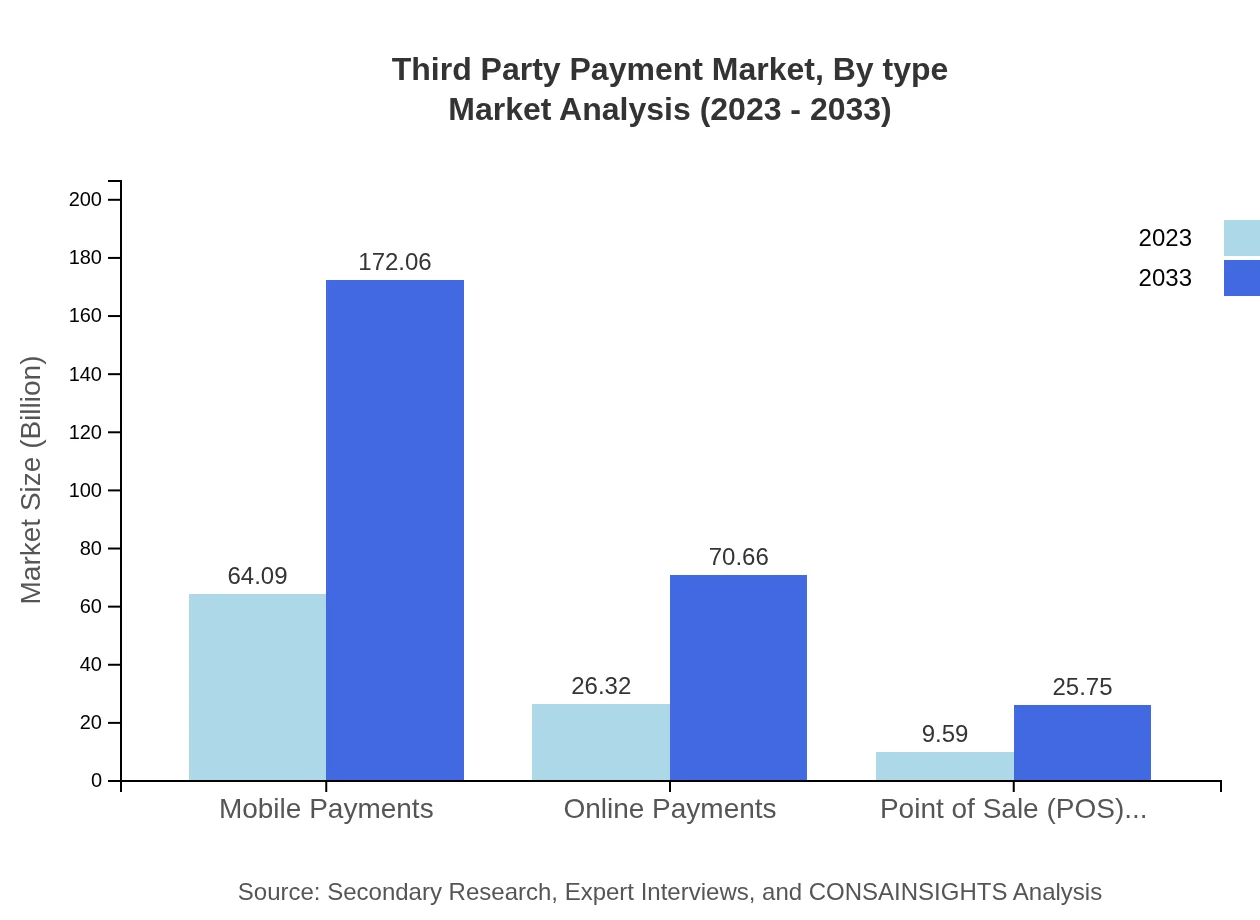

Third Party Payment Market Analysis By Type

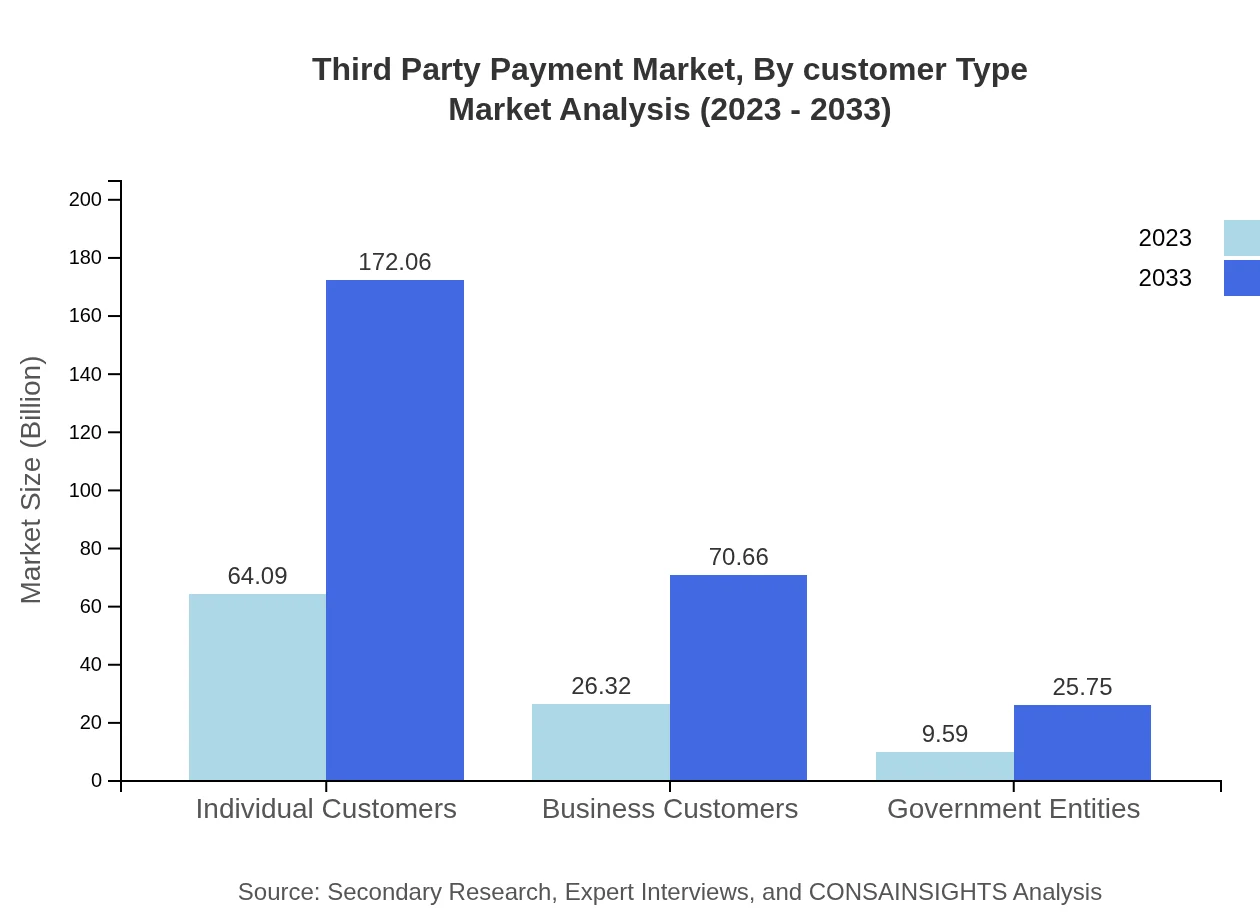

In the Third Party Payment segment, mobile payments dominate with a market size of approximately $64.09 billion in 2023, expected to rise to about $172.06 billion by 2033. Online payments also play a significant role, starting at around $26.32 billion in 2023 and projected to reach $70.66 billion by 2033. Point-of-sale solutions and e-commerce payments continue to gain traction, emphasized by the respective market sizes of $9.59 billion and $43.09 billion in 2023, advancing to $25.75 billion and $115.68 billion by 2033, showing substantial growth in payment technologies.

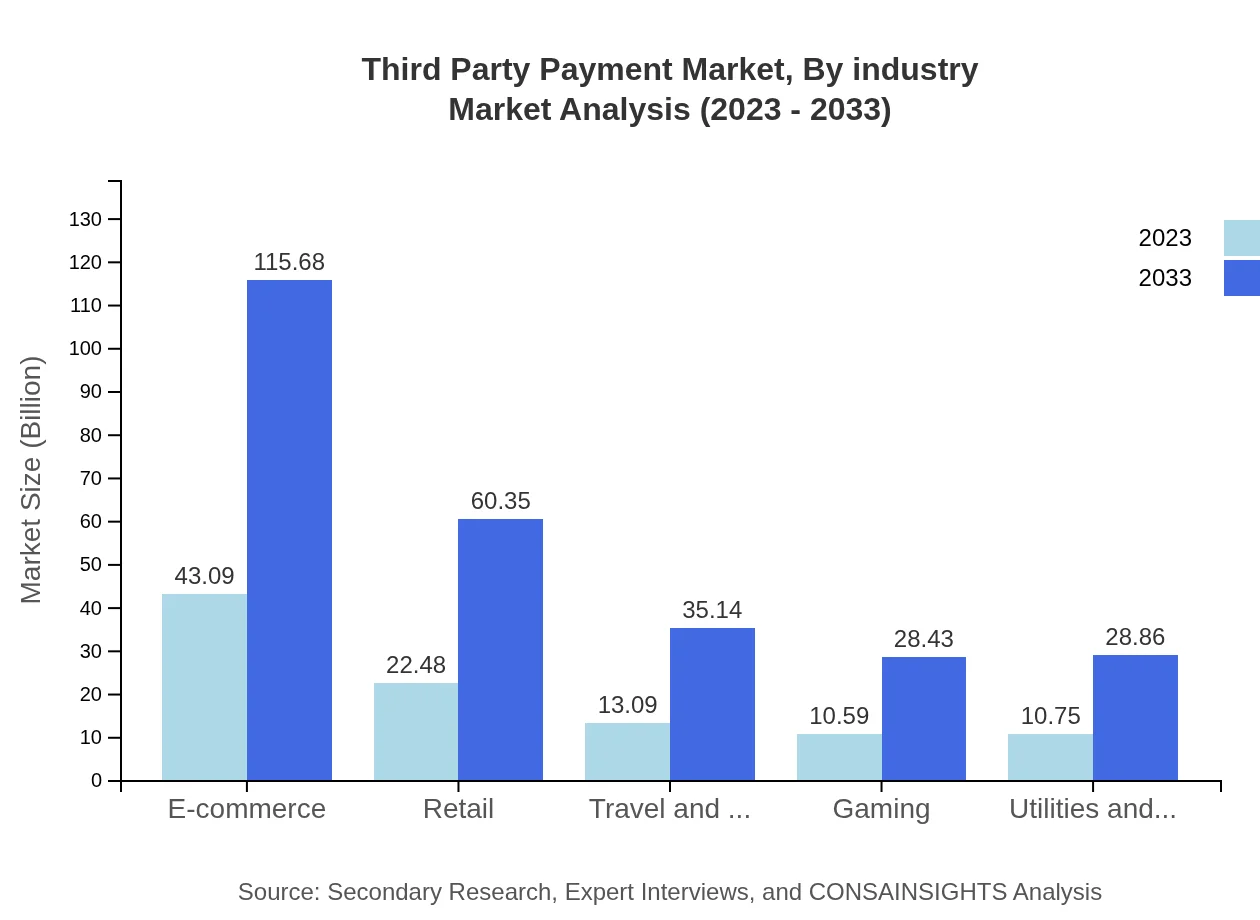

Third Party Payment Market Analysis By Industry

The Third Party Payment market is influenced significantly by various sectors. The retail industry, valued at $22.48 billion in 2023, is forecasted to grow to $60.35 billion by 2033. The travel and hospitality segment shows growth potential as well, with current values at $13.09 billion, aimed at reaching $35.14 billion. The gaming sector, utilities, and telecom industries also exhibit robust growth due to increased transactions and consumer spending in these areas.

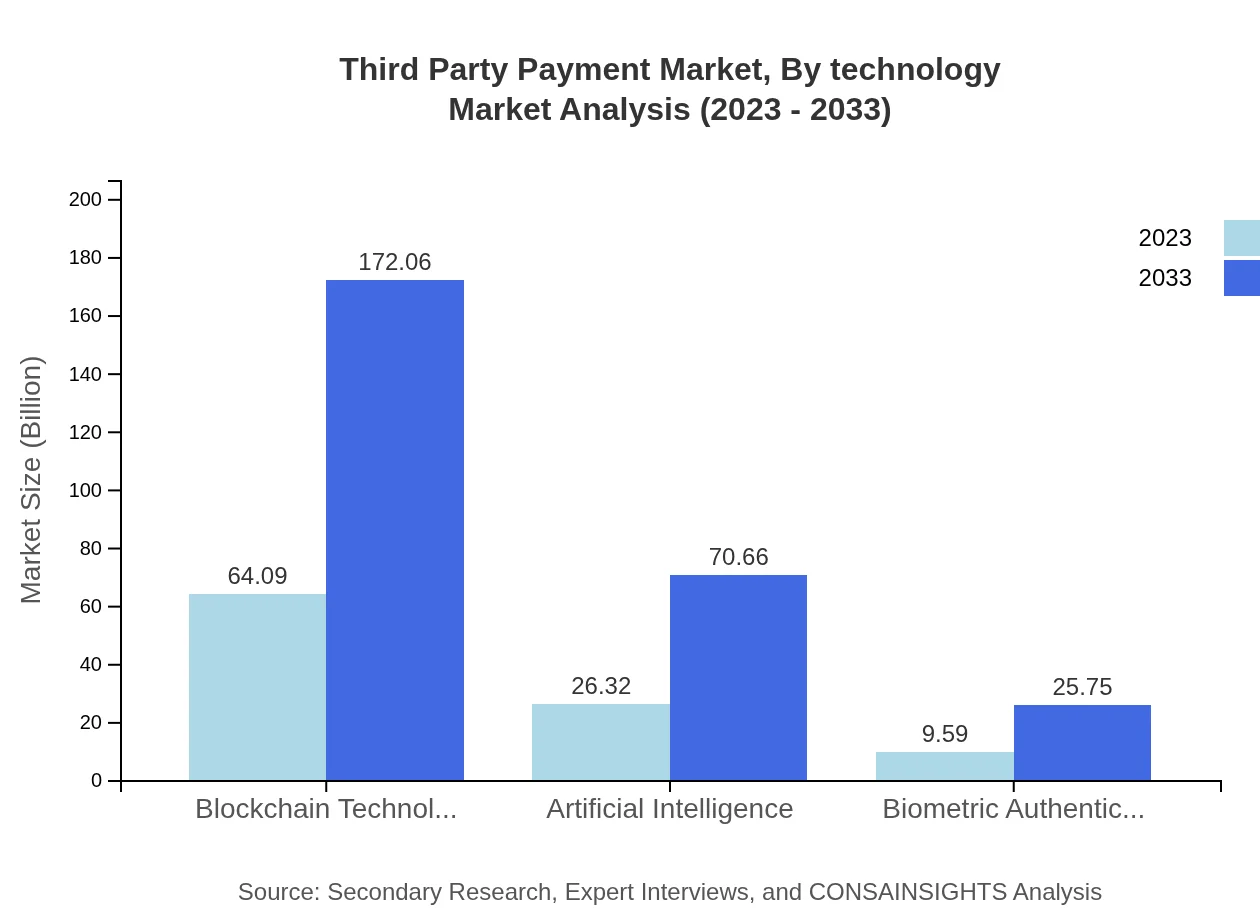

Third Party Payment Market Analysis By Technology

Technological advancements play a crucial role in shaping the Third Party Payment landscape. Innovations like biometrics, blockchain technology, and artificial intelligence are driving efficiency and security, with the market sizes for biometric authentication at $9.59 billion in 2023 (projected to reach $25.75 billion by 2033). Blockchain technology shows significant growth, from $64.09 billion to $172.06 billion, emphasizing its transformative impact on payment processing.

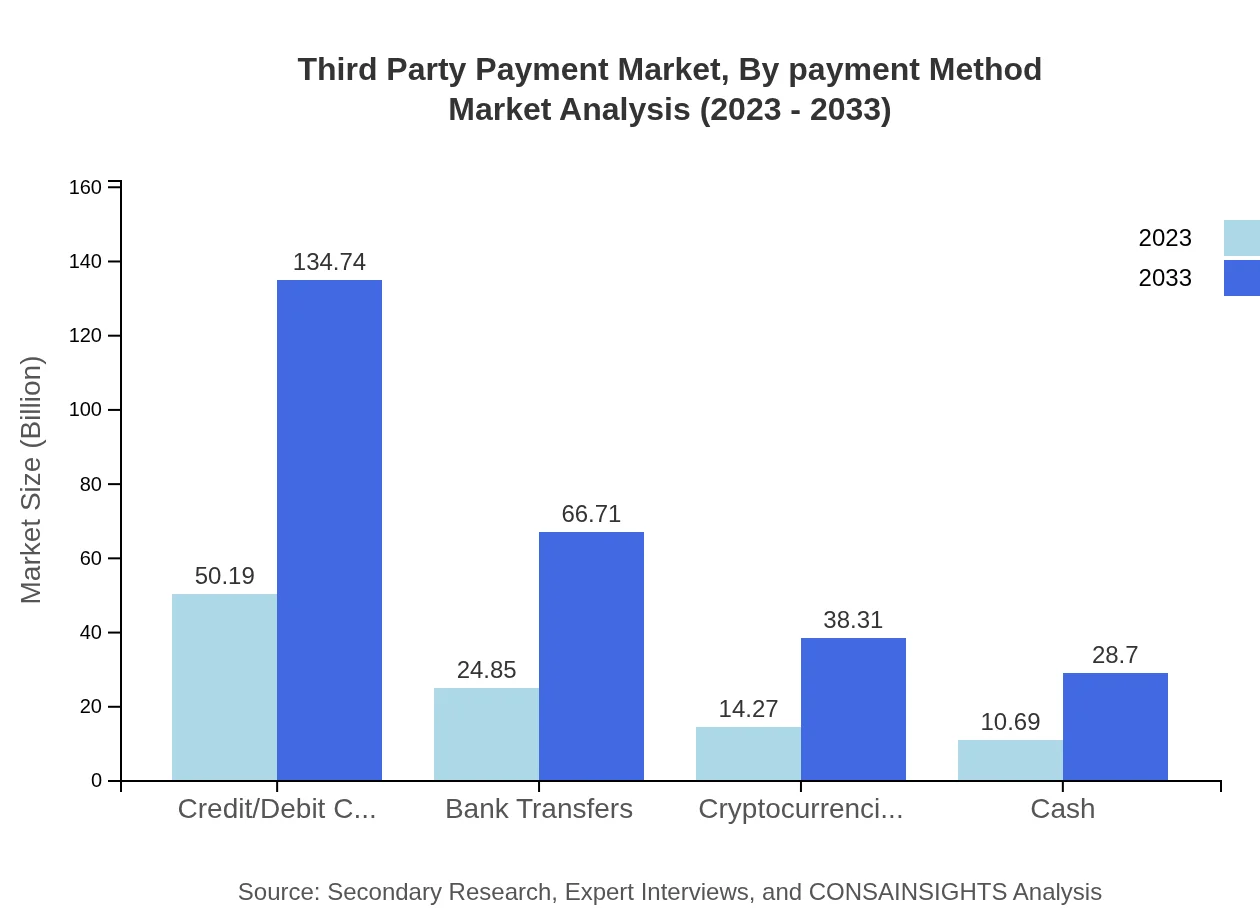

Third Party Payment Market Analysis By Payment Method

The market shows diverse payment method preferences with credit/debit card transactions taking the lead at $50.19 billion in 2023, expected to increase to around $134.74 billion by 2033. Bank transfers also remain essential within the market with current values at $24.85 billion growing to $66.71 billion. Cryptocurrencies, while emerging, are sharing growth potential, going from $14.27 billion to $38.31 billion, showcasing increasing consumer interest.

Third Party Payment Market Analysis By Customer Type

The customer type segmentation shows individual customers leading at $64.09 billion in 2023, predicted to grow to $172.06 billion in 2033. Business customers represent another essential segment, expected to grow from $26.32 billion to $70.66 billion, while government entities show a smaller but significant market size of $9.59 billion in 2023, advancing to $25.75 billion, indicating their increasing use of third-party payment solutions.

Third Party Payment Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Third Party Payment Industry

PayPal:

PayPal is a pioneer in web-based payment solutions, allowing users to send money using an email address. The company continues to lead in the digital payment landscape, especially in e-commerce transactions.Square, Inc.:

Square offers comprehensive payment processing solutions and hardware for businesses. Their focus on small and medium enterprises has enabled them to achieve significant market penetration.Stripe:

Stripe is a technology company that builds economic infrastructure for the internet, offering payment processing solutions for e-commerce and mobile commerce. Their robust API has attracted a wide user base.Adyen:

Adyen provides a payments platform that connects businesses with consumers across multiple channels. Their innovative technology supports various payment methods globally.Apple Pay:

Apple Pay is a digital wallet and mobile payment service that enables users to make payments using their iOS devices, showcasing convenience and security in mobile transactions.We're grateful to work with incredible clients.

FAQs

What is the market size of third Party payment?

The global third-party payment market is projected to reach approximately $100 billion by 2033, growing at a compound annual growth rate (CAGR) of 10% from its current size, as the demand for digital transaction solutions increases.

What are the key market players or companies in the third Party payment industry?

Key players in the third-party payment industry include PayPal, Stripe, Square, and Adyen. Each of these companies plays a significant role in facilitating online transactions and enhancing user experience in digital payments.

What are the primary factors driving the growth in the third Party payment industry?

Growth in the third-party payment industry is primarily driven by the surge in e-commerce, increased adoption of mobile payments, technological advancements in digital wallets, and a growing preference for secure, frictionless transactions among consumers.

Which region is the fastest Growing in the third Party payment market?

Asia Pacific is the fastest-growing region in the third-party payment market. By 2033, its market size is forecasted to grow to approximately $51.38 billion, highlighting the rapid digital transformation and increasing smartphone penetration in the region.

Does ConsaInsights provide customized market report data for the third Party payment industry?

Yes, ConsaInsights offers customized market report data tailored to client needs in the third-party payment industry. This includes specific insights on market trends, competitive analysis, and growth forecasts.

What deliverables can I expect from this third Party payment market research project?

From the third-party payment market research project, clients can expect comprehensive reports, detailed analyses of market trends, competitor profiling, and strategic recommendations to capitalize on growth opportunities.

What are the market trends of third Party payment?

Key trends in the third-party payment market include the rise of mobile payment solutions, increased integration of AI and biometric authentication, and the growing use of cryptocurrencies, reflecting a shift towards more innovative payment methods.