Third Party Risk Management Market Report

Published Date: 02 February 2026 | Report Code: third-party-risk-management

Third Party Risk Management Market Size, Share, Industry Trends and Forecast to 2033

This market report provides a detailed analysis of the Third Party Risk Management sector, presenting insights on market size, regional dynamics, and growth trends from 2023 to 2033.

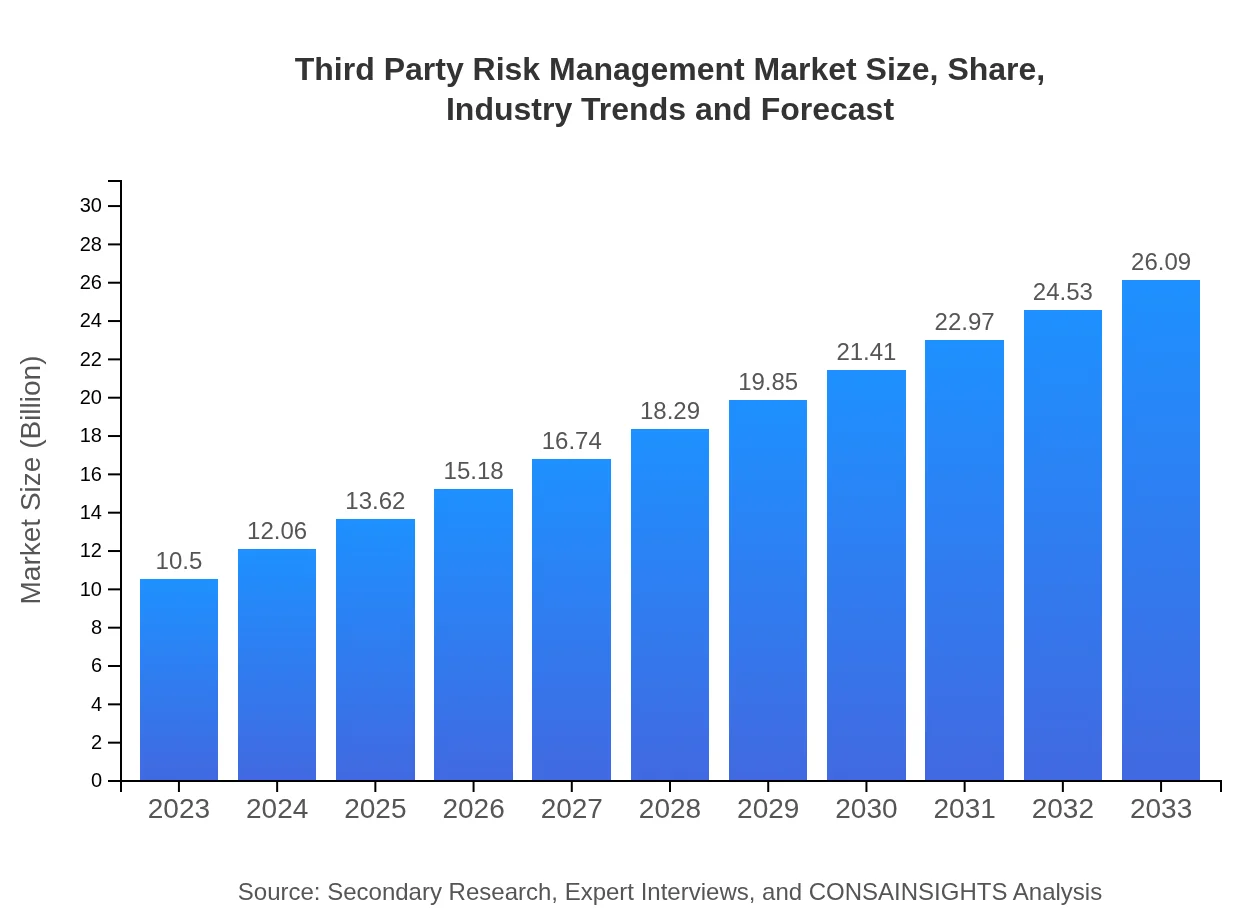

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 9.2% |

| 2033 Market Size | $26.09 Billion |

| Top Companies | RiskWatch International, Archer, MetricStream, SAS, RiskPoint |

| Last Modified Date | 02 February 2026 |

Third Party Risk Management Market Overview

Customize Third Party Risk Management Market Report market research report

- ✔ Get in-depth analysis of Third Party Risk Management market size, growth, and forecasts.

- ✔ Understand Third Party Risk Management's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Third Party Risk Management

What is the Market Size & CAGR of Third Party Risk Management market in 2023?

Third Party Risk Management Industry Analysis

Third Party Risk Management Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Third Party Risk Management Market Analysis Report by Region

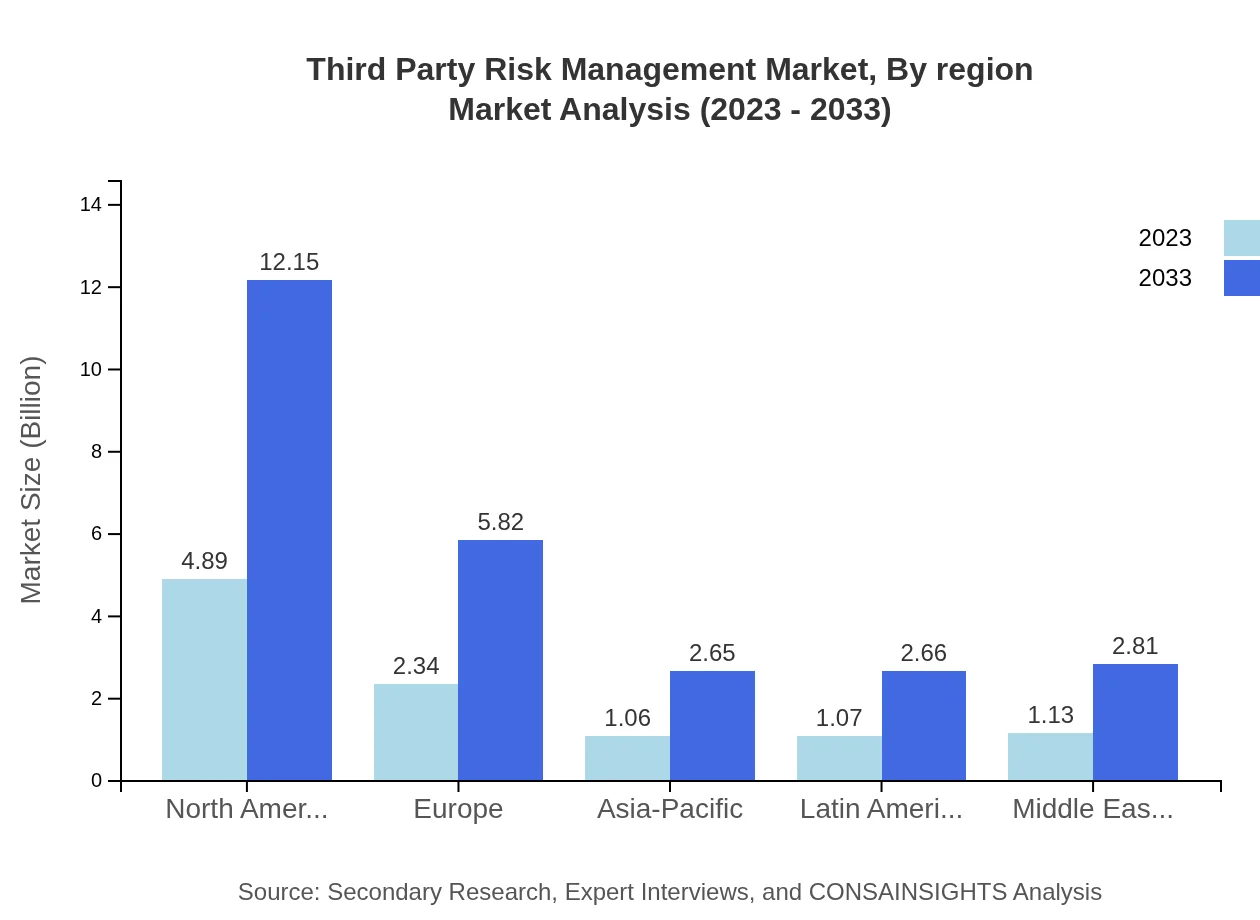

Europe Third Party Risk Management Market Report:

In Europe, the market size is expected to grow from $2.92 billion in 2023 to $7.25 billion by 2033, driven by prevailing data protection regulations like GDPR and an emphasis on robust risk management practices across all sectors.Asia Pacific Third Party Risk Management Market Report:

In the Asia Pacific region, the TPRM market is anticipated to grow from approximately $2.11 billion in 2023 to $5.24 billion by 2033. The rapid growth in this market is driven by increased digitization, regulatory pressures, and the rising number of third-party engagements as businesses expand internationally.North America Third Party Risk Management Market Report:

North America is projected to remain the largest market, with an anticipated increase from $3.59 billion in 2023 to $8.93 billion by 2033. This growth can be attributed to early adopters of risk management technologies and stringent regulatory requirements within industries like finance and healthcare.South America Third Party Risk Management Market Report:

The South American TPRM market is projected to grow from $0.68 billion in 2023 to $1.69 billion by 2033. Key drivers include the growing need for organizations to manage risks associated with local and international vendors and an increasing awareness of cybersecurity threats.Middle East & Africa Third Party Risk Management Market Report:

The Middle East and Africa are set to experience growth from $1.20 billion in 2023 to $2.98 billion by 2033. Increased investment in cybersecurity and risk management frameworks is expected to drive this expansion, along with greater adoption of digital solutions.Tell us your focus area and get a customized research report.

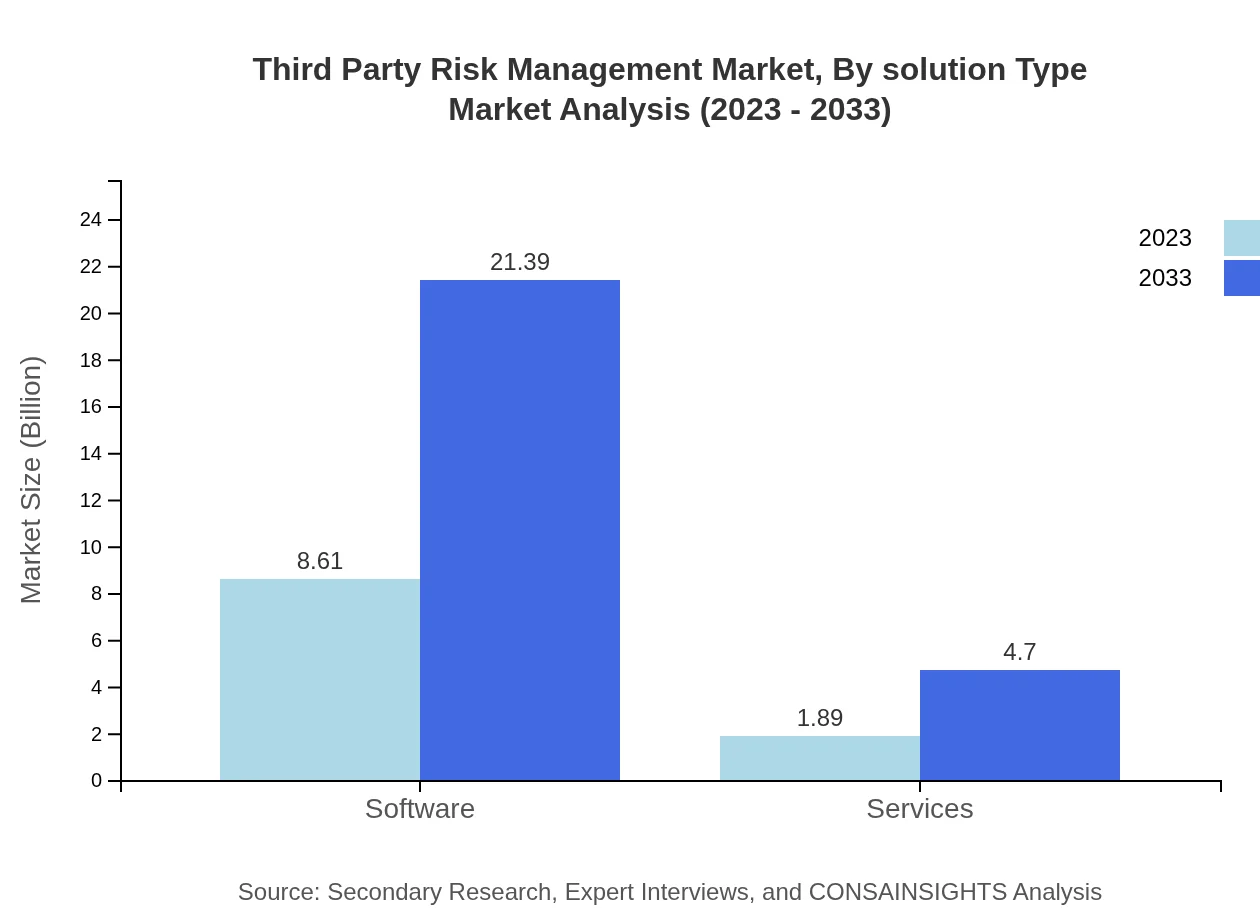

Third Party Risk Management Market Analysis By Solution Type

The market is heavily dominated by the software segment, which accounted for approximately 81.99% of the market share in 2023. This segment is forecasted to grow from $8.61 billion in 2023 to $21.39 billion by 2033. The services segment, while smaller, is also significant, projected to increase from $1.89 billion to $4.70 billion over the same period.

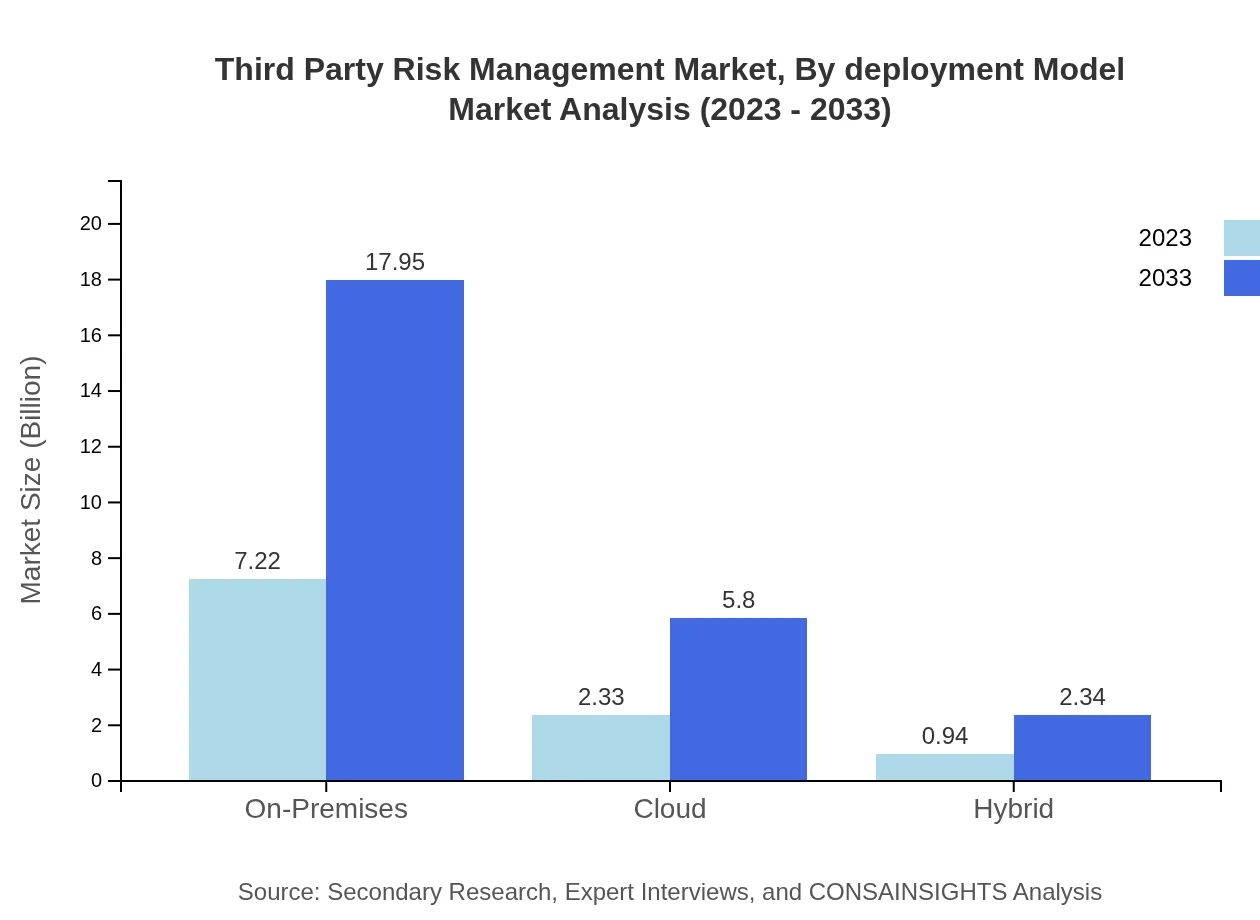

Third Party Risk Management Market Analysis By Deployment Model

On-premises solutions are leading the deployment model segment, comprising around 68.79% of the market share. This segment is expected to grow from $7.22 billion to $17.95 billion by 2033. In contrast, the cloud-based segment, currently holding 22.23% of the market, is also experiencing rapid growth as organizations seek more scalable and flexible deployment options.

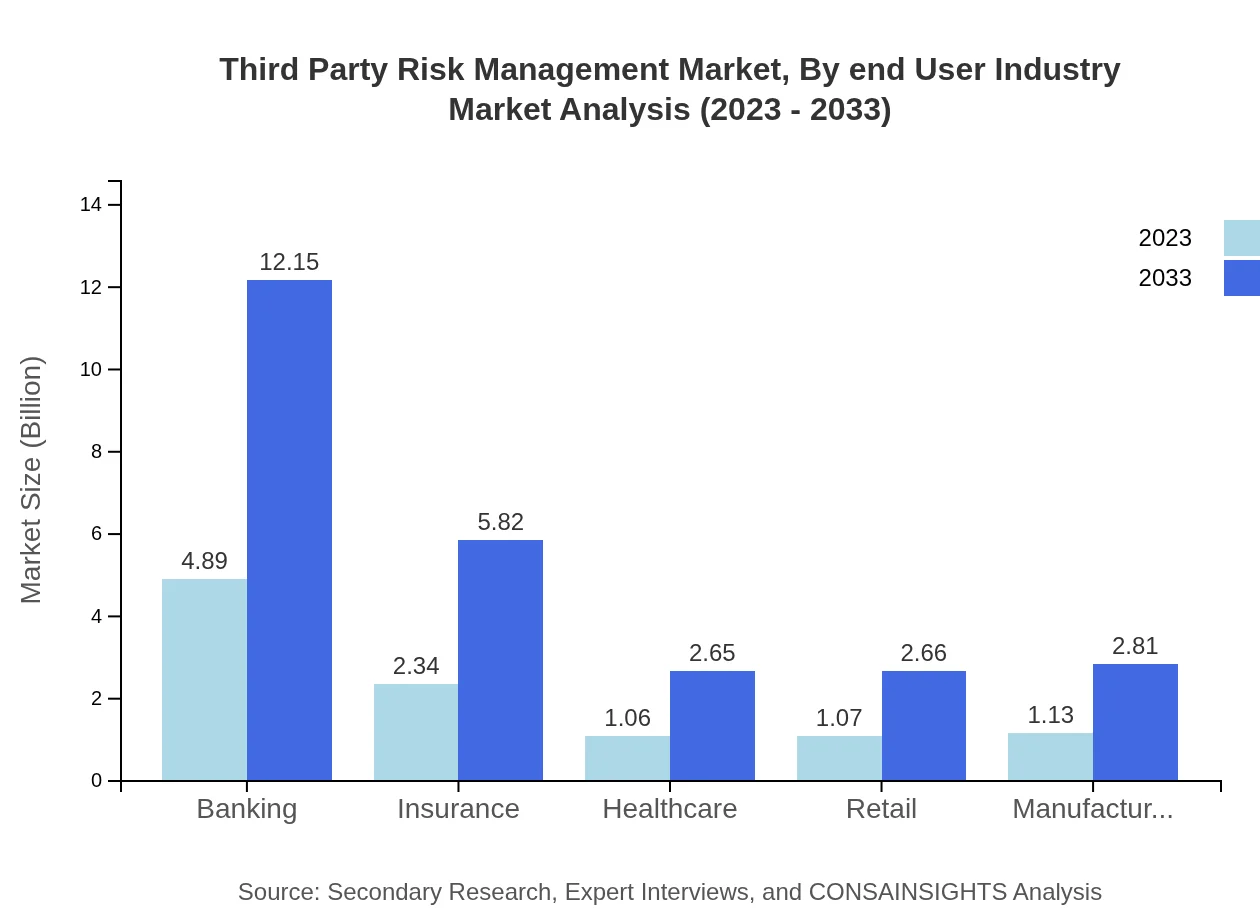

Third Party Risk Management Market Analysis By End User Industry

The banking sector is the largest segment within end-user industries, owning approximately 46.56% of the market share in 2023 and projected to grow from $4.89 billion to $12.15 billion. Following banking are insurance and healthcare, which are increasingly adopting TPRM solutions to meet regulatory demands and protect sensitive information.

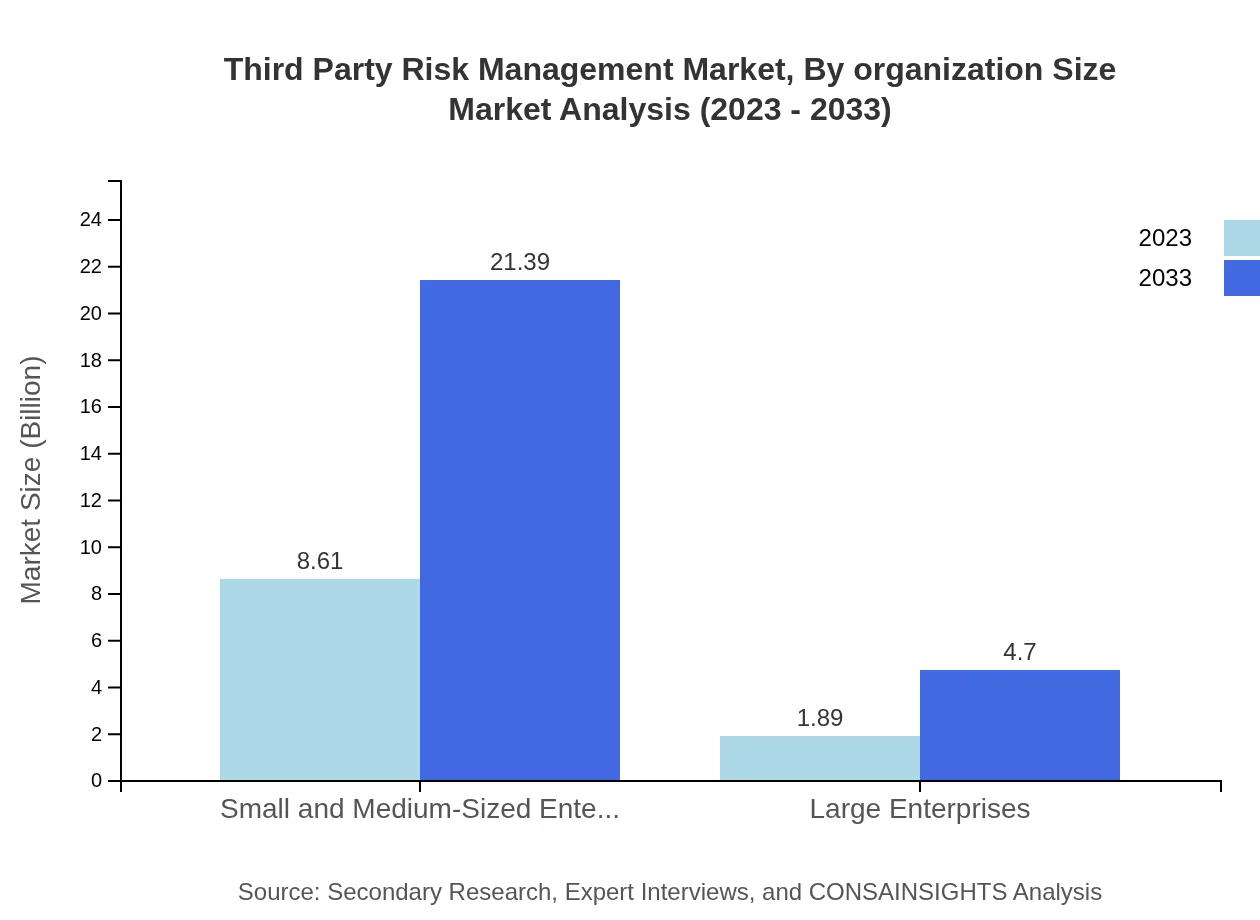

Third Party Risk Management Market Analysis By Organization Size

Small and medium-sized enterprises (SMEs) represent the largest segment within organization size, holding 81.99% of the market share. The SME sector's TPRM market size is expected to grow from $8.61 billion in 2023 to $21.39 billion by 2033. Large enterprises also have significant uptake, with an expected increase from $1.89 billion to $4.70 billion.

Third Party Risk Management Market Analysis By Region

Regional analysis shows North America is leading in market size and growth potential, followed closely by Europe and Asia Pacific. Each region presents unique challenges and opportunities, influenced by local regulations, market maturity, and demand for risk management solutions.

Third Party Risk Management Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Third Party Risk Management Industry

RiskWatch International:

A leader in risk management software solutions, providing comprehensive tools for organizations to assess and mitigate third-party risks effectively.Archer:

Known for its governance, risk, and compliance solutions, Archer offers robust capabilities for managing third-party risks across various industries.MetricStream:

Offers a platform that integrates risk management, compliance, and internal audit processes, empowering organizations to manage vendor risk holistically.SAS:

A key player in analytics and software, SAS provides advanced solutions for assessing and managing third-party risks effectively.RiskPoint:

Focuses on developing innovative solutions for vendor risk management, enabling organizations to streamline their third-party risk management processes.We're grateful to work with incredible clients.

FAQs

What is the market size of third Party Risk Management?

The third-party risk management market is currently valued at approximately $10.5 billion, projected to grow at a CAGR of 9.2% over the next decade, indicating significant expansion in demand and investment.

What are the key market players or companies in this third Party Risk Management industry?

Key players in the third-party risk management industry include renowned firms such as RiskDecision, MetricStream, and RSA Security, which drive innovation and set market standards with their comprehensive risk management solutions.

What are the primary factors driving the growth in the third Party Risk Management industry?

Key factors driving growth in this industry include increasing regulatory compliance requirements, rising cybersecurity concerns, and the growing need for organizations to mitigate risks associated with outsourcing and third-party engagements.

Which region is the fastest Growing in the third Party Risk Management?

Asia-Pacific is the fastest-growing region in third-party risk management, projected to increase from $2.11 billion in 2023 to $5.24 billion by 2033, reflecting a robust CAGR as organizations prioritize risk management.

Does ConsaInsights provide customized market report data for the third Party Risk Management industry?

Yes, Consainsights offers tailored market reports for third-party risk management, allowing clients to access customized data and insights that meet specific industry needs and strategic goals.

What deliverables can I expect from this third Party Risk Management market research project?

Deliverables from our third-party risk management market research project include detailed market analysis, competitive landscape insights, regional breakdowns, and projections for growth across various segments and demographics.

What are the market trends of third Party Risk Management?

Current trends in third-party risk management include increased adoption of automated risk assessment tools, a heightened focus on cybersecurity measures, and the integration of AI technologies to enhance predictive analytics capabilities.