Threat Detection Systems Market Report

Published Date: 03 February 2026 | Report Code: threat-detection-systems

Threat Detection Systems Market Size, Share, Industry Trends and Forecast to 2033

This comprehensive report analyzes the global Threat Detection Systems market, covering its growth trajectory, regional dynamics, and technological advancements from 2023 to 2033. It provides insights into market size, trends, segmentation, and the leading players shaping the industry landscape.

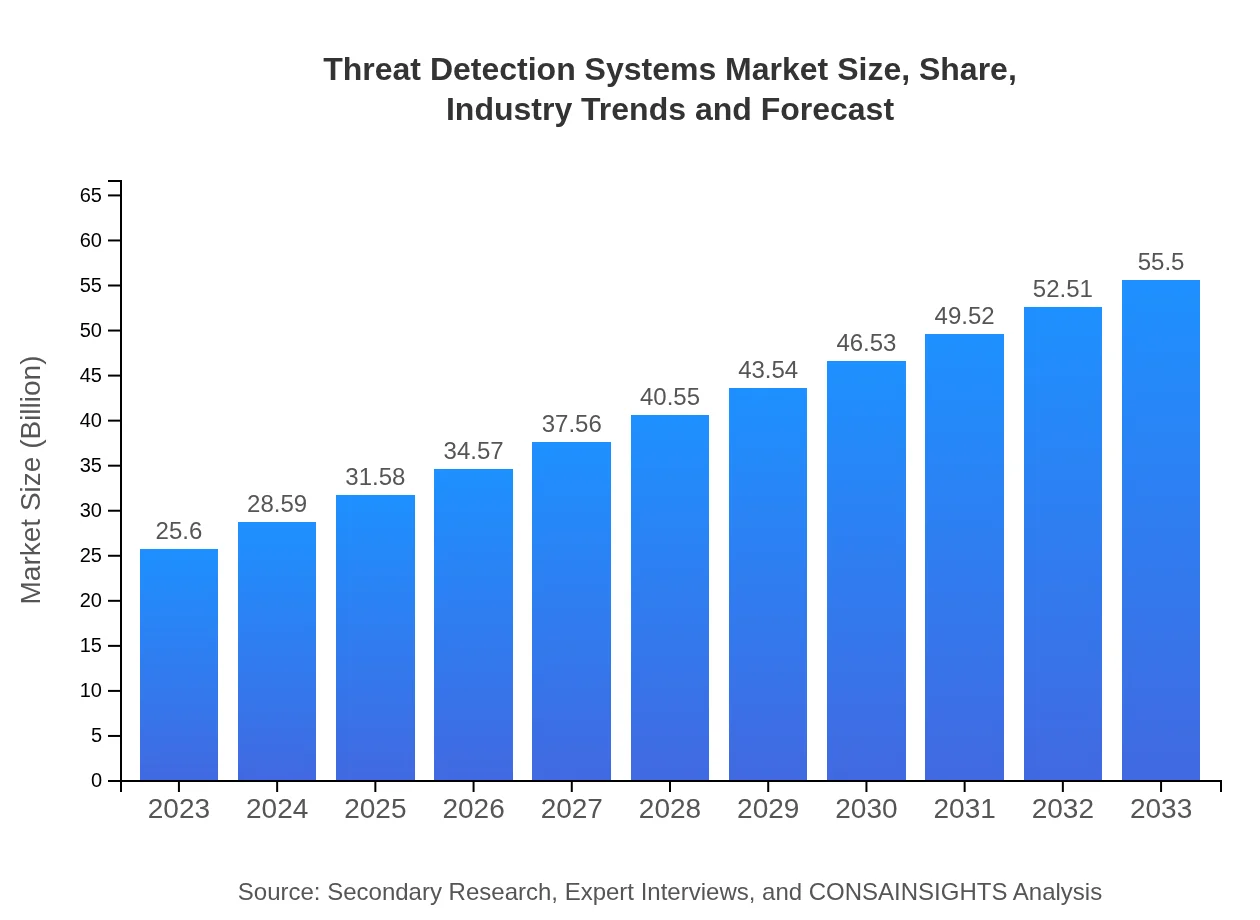

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $25.60 Billion |

| CAGR (2023-2033) | 7.8% |

| 2033 Market Size | $55.50 Billion |

| Top Companies | Cisco Systems, Inc., IBM Corporation, Symantec Corporation, Palo Alto Networks |

| Last Modified Date | 03 February 2026 |

Threat Detection Systems Market Overview

Customize Threat Detection Systems Market Report market research report

- ✔ Get in-depth analysis of Threat Detection Systems market size, growth, and forecasts.

- ✔ Understand Threat Detection Systems's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Threat Detection Systems

What is the Market Size & CAGR of Threat Detection Systems market in 2023?

Threat Detection Systems Industry Analysis

Threat Detection Systems Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Threat Detection Systems Market Analysis Report by Region

Europe Threat Detection Systems Market Report:

Europe’s Threat Detection Systems market, valued at $8.91 billion in 2023, is projected to surge to $19.31 billion by 2033. The presence of stringent data protection regulations, such as GDPR, and a proactive approach to cybersecurity strengthen market growth in this region.Asia Pacific Threat Detection Systems Market Report:

In 2023, the Asia Pacific market for Threat Detection Systems was valued at $4.82 billion and is expected to reach $10.44 billion by 2033. Factors like rapid digital transformation, increasing incidences of data breaches, and investments in smart city technologies contribute to this growth.North America Threat Detection Systems Market Report:

North America leads the Threat Detection Systems market with a value of $8.35 billion in 2023, anticipated to reach $18.10 billion by 2033. The region's robust regulatory requirements, high technology adoption rates, and significant investment by major companies drive this market's expansion.South America Threat Detection Systems Market Report:

The South American Threat Detection Systems market was valued at $2.12 billion in 2023, with an expectation to grow to $4.60 billion by 2033. Areas such as Brazil and Argentina are experiencing rising demand due to increasing cybersecurity awareness and market penetration of advanced technological solutions.Middle East & Africa Threat Detection Systems Market Report:

The Middle East and Africa Threat Detection Systems market is expected to increase from $1.41 billion in 2023 to $3.05 billion in 2033. Rising cyber threats and strategic government initiatives to enhance digital infrastructure significantly influence this growth.Tell us your focus area and get a customized research report.

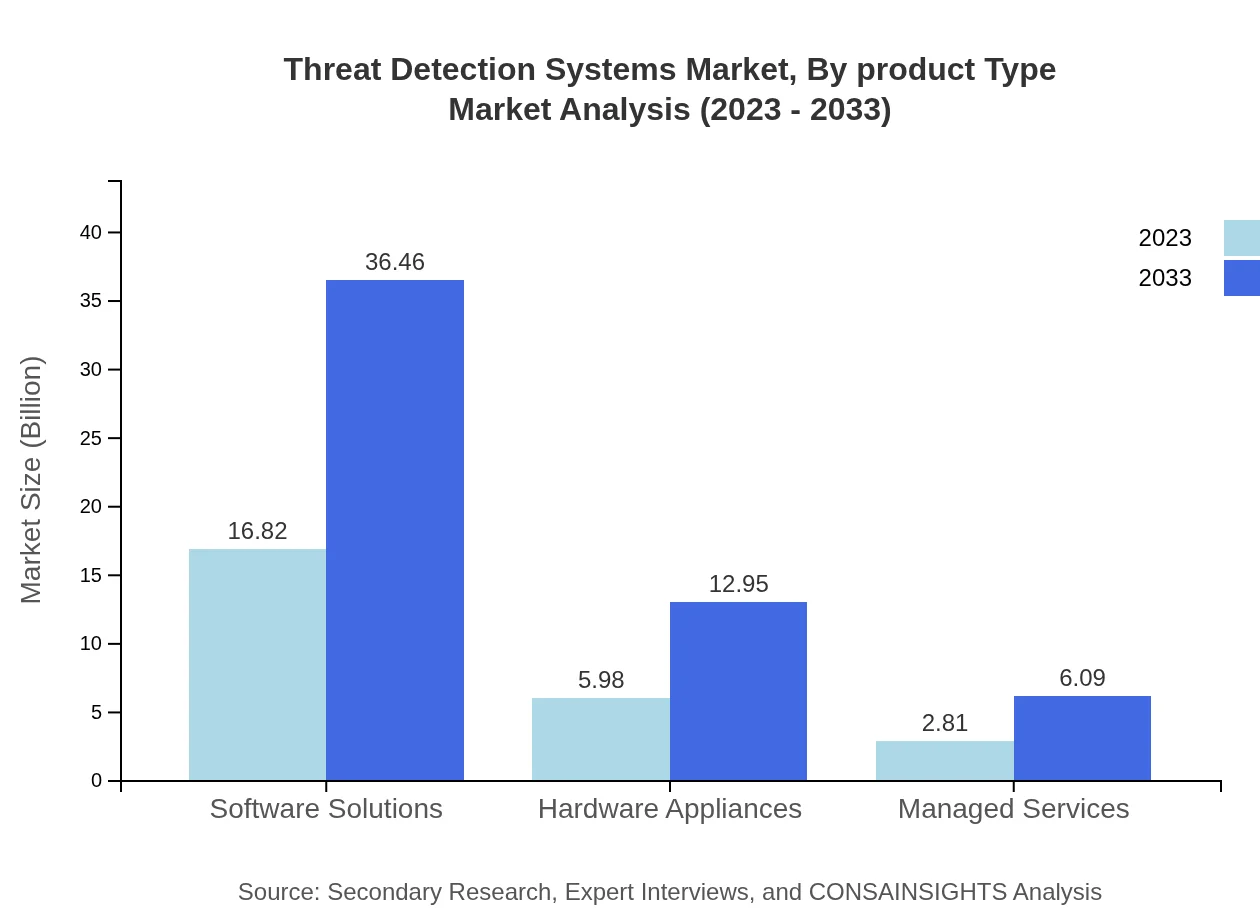

Threat Detection Systems Market Analysis By Product Type

In 2023, the Threat Detection Systems market by Product Type includes Software Solutions at $16.82 billion and Hardware Appliances at $5.98 billion, with anticipated growth up to $36.46 billion and $12.95 billion, respectively, by 2033. Managed Services also show a positive trend, expected to grow from $2.81 billion in 2023 to $6.09 billion by 2033.

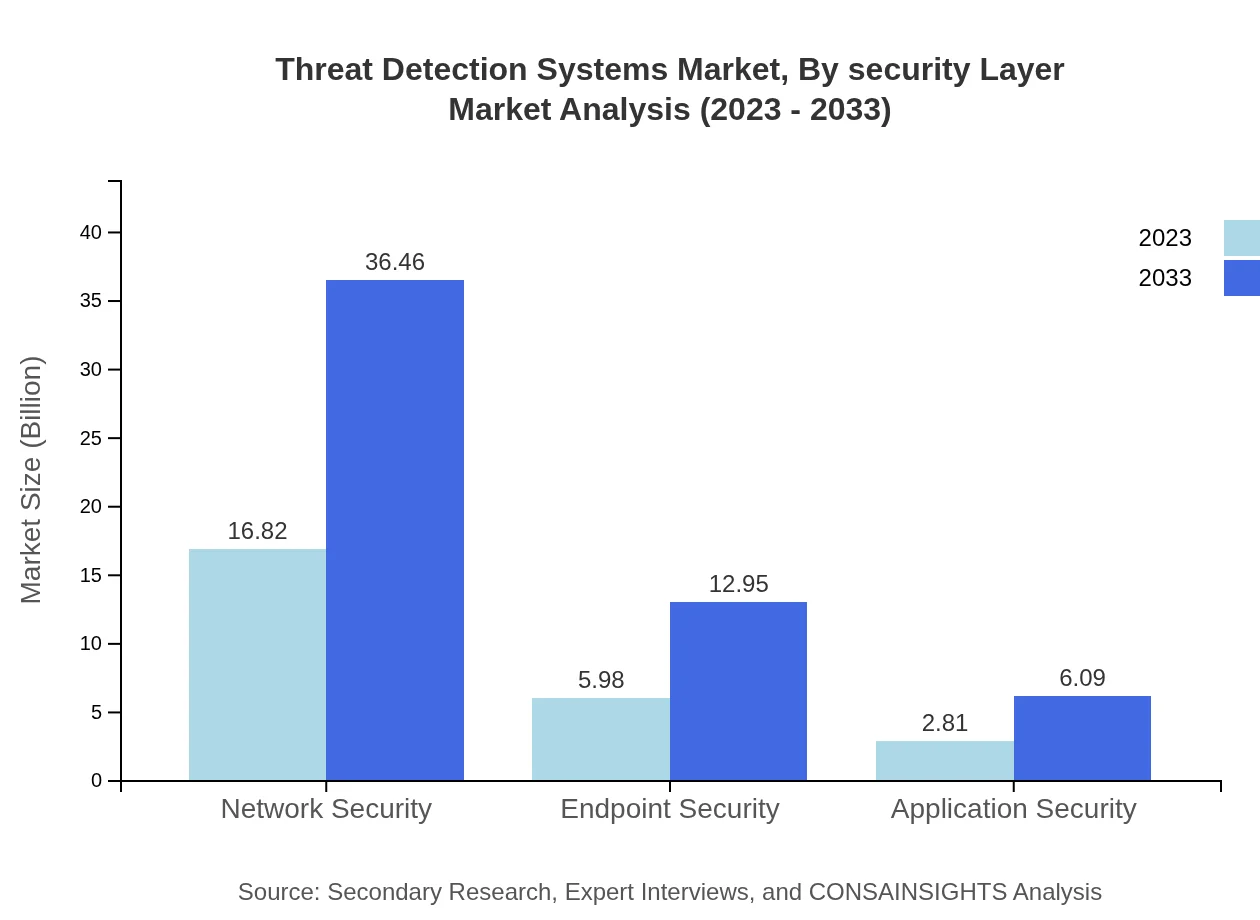

Threat Detection Systems Market Analysis By Security Layer

The market by Security Layer highlights Signature-Based Detection leading the segment at $16.82 billion in 2023 and expected to grow to $36.46 billion by 2033, retaining a market share of 65.69%. Anomaly Detection captures $5.98 billion in 2023, aiming for $12.95 billion by 2033, sustaining a share of 23.34%.

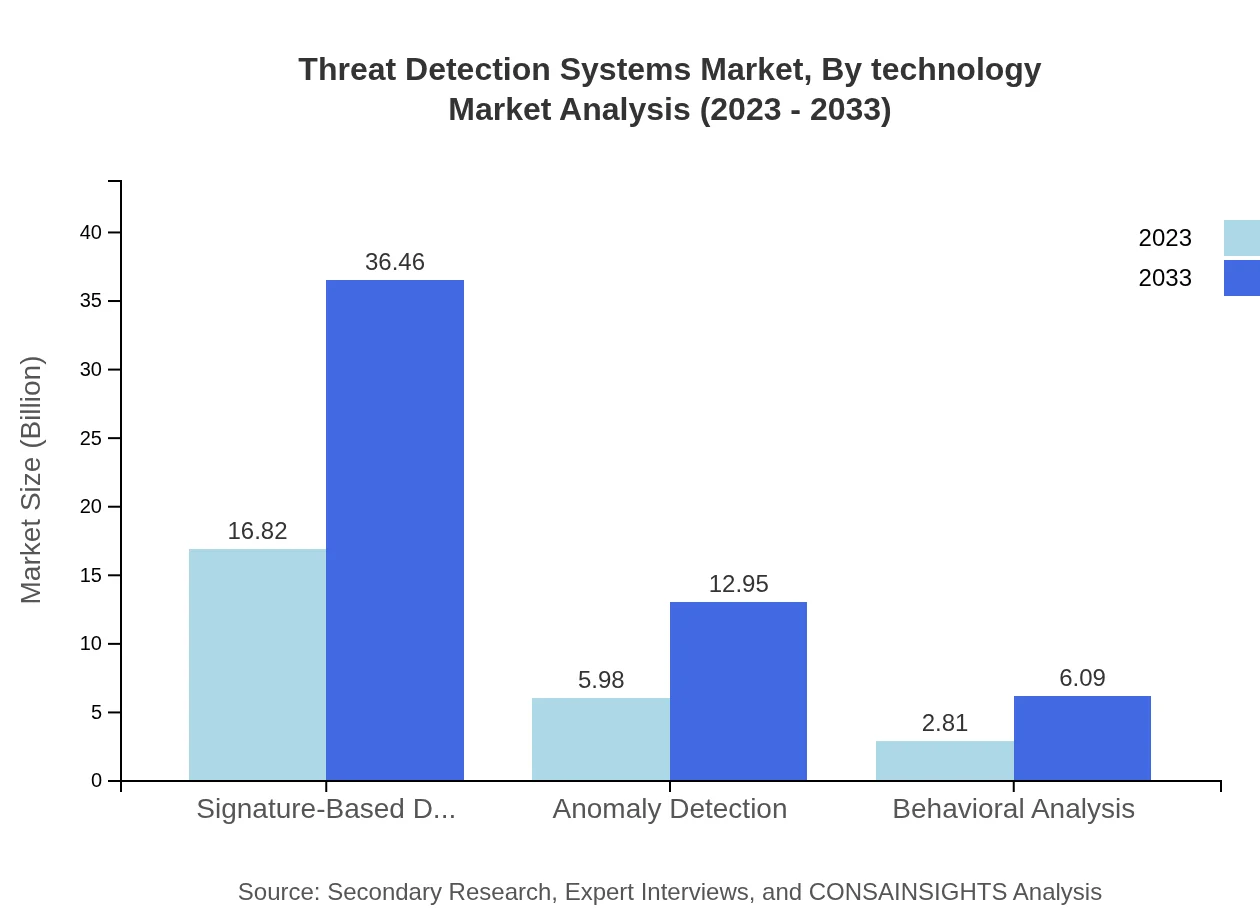

Threat Detection Systems Market Analysis By Technology

An emerging segment is the technology aspects impacting the Threat Detection Systems. Innovations such as AI and ML enhance the capability of Threat Detection Systems in recognizing and responding to threats. As organizations increasingly adopt cloud solutions and IoT technologies, the demand for advanced detection capabilities is forecasted to increase significantly over the decade.

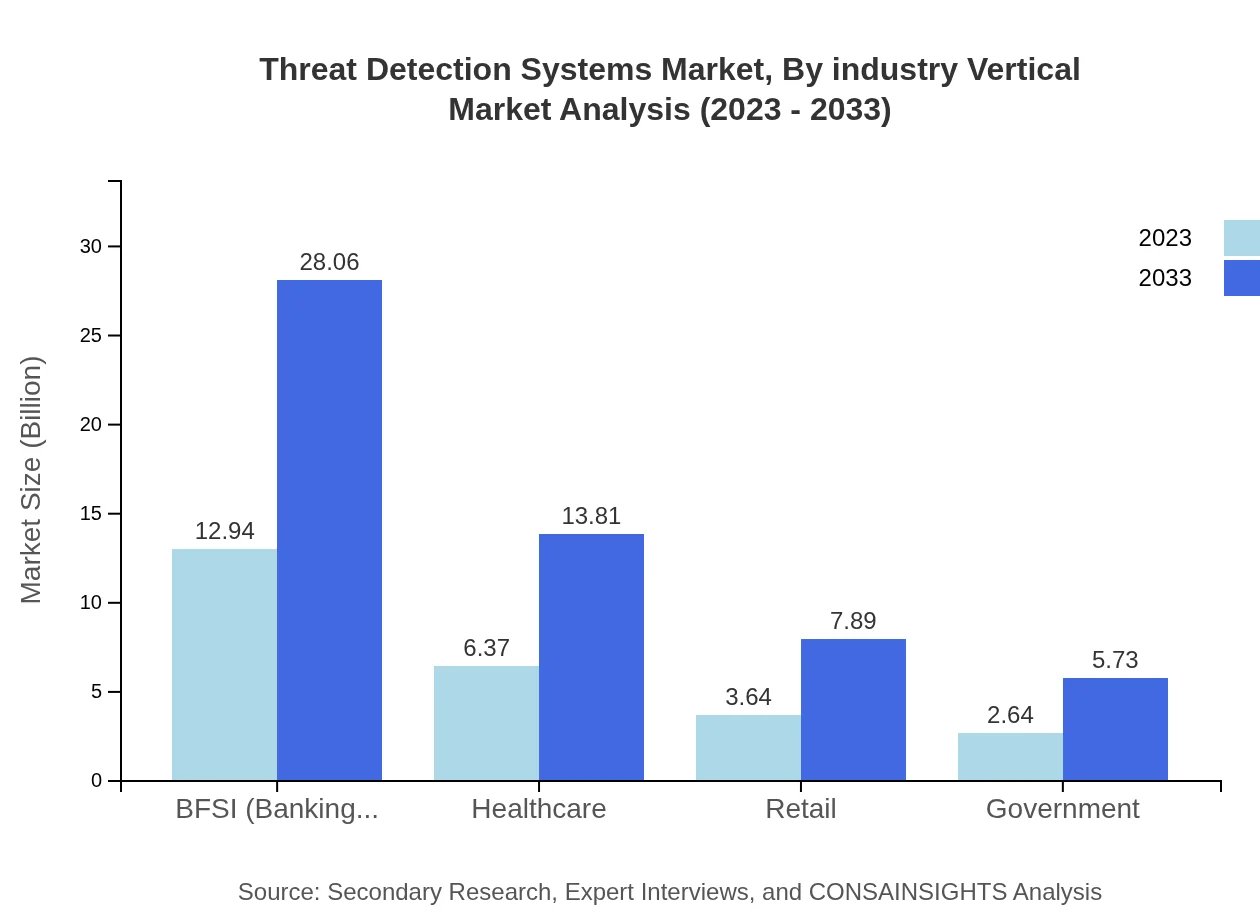

Threat Detection Systems Market Analysis By Industry Vertical

The BFSI sector takes a significant share of the Threat Detection Systems market, accounting for $12.94 billion in 2023 with an increasing market recognition of $28.06 billion by 2033. This dominance stems from high regulatory scrutiny and the need for safeguarding sensitive financial information.

Threat Detection Systems Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Threat Detection Systems Industry

Cisco Systems, Inc.:

A leader in cybersecurity solutions, Cisco provides a comprehensive range of threat detection systems helping organizations to safeguard their data against complex threats.IBM Corporation:

IBM's focus on AI-driven cybersecurity solutions positions it as a market leader, offering innovative threat detection platforms that enhance organizational defenses.Symantec Corporation:

Symantec specializes in endpoint security, providing advanced threat detection solutions that protect networks against a variety of cyber threats.Palo Alto Networks:

Recognized for pioneering next-gen firewalls, Palo Alto Networks delivers robust threat detection and response capabilities integrated across cloud, network, and endpoint.We're grateful to work with incredible clients.

FAQs

What is the market size of threat Detection Systems?

The threat detection systems market is currently valued at approximately $25.6 billion and is projected to grow at a CAGR of 7.8%, reaching robust market values through 2033.

What are the key market players or companies in this threat Detection Systems industry?

Key players in the threat detection systems industry include major technology firms such as IBM, Cisco, Palo Alto Networks, and FireEye, maintaining significant market shares through their innovative solutions and strategic partnerships.

What are the primary factors driving the growth in the threat Detection Systems industry?

The growth of the threat detection systems industry is primarily driven by increasing cyber threats, regulatory compliance requirements, and technological advancements, leading to a heightened demand for security solutions across various sectors.

Which region is the fastest Growing in the threat Detection Systems?

The fastest-growing region in the threat detection systems market is North America, with a projected market value rising from $8.35 billion in 2023 to $18.10 billion by 2033, driven by high cybersecurity investments.

Does ConsaInsights provide customized market report data for the threat Detection Systems industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs of clients in the threat detection systems industry, ensuring they receive relevant insights and analyses.

What deliverables can I expect from this threat Detection Systems market research project?

From this market research project, you can expect comprehensive deliverables including detailed market analysis, segment insights, competitive landscape assessments, and actionable recommendations based on the current trends.

What are the market trends of threat Detection Systems?

Key trends in the threat detection systems market include the shift towards artificial intelligence, increasing focus on cloud security solutions, and rising investment in integrated security frameworks, heralding a new era of proactive cybersecurity.