Tile Adhesives And Stone Adhesives Market Report

Published Date: 22 January 2026 | Report Code: tile-adhesives-and-stone-adhesives

Tile Adhesives And Stone Adhesives Market Size, Share, Industry Trends and Forecast to 2033

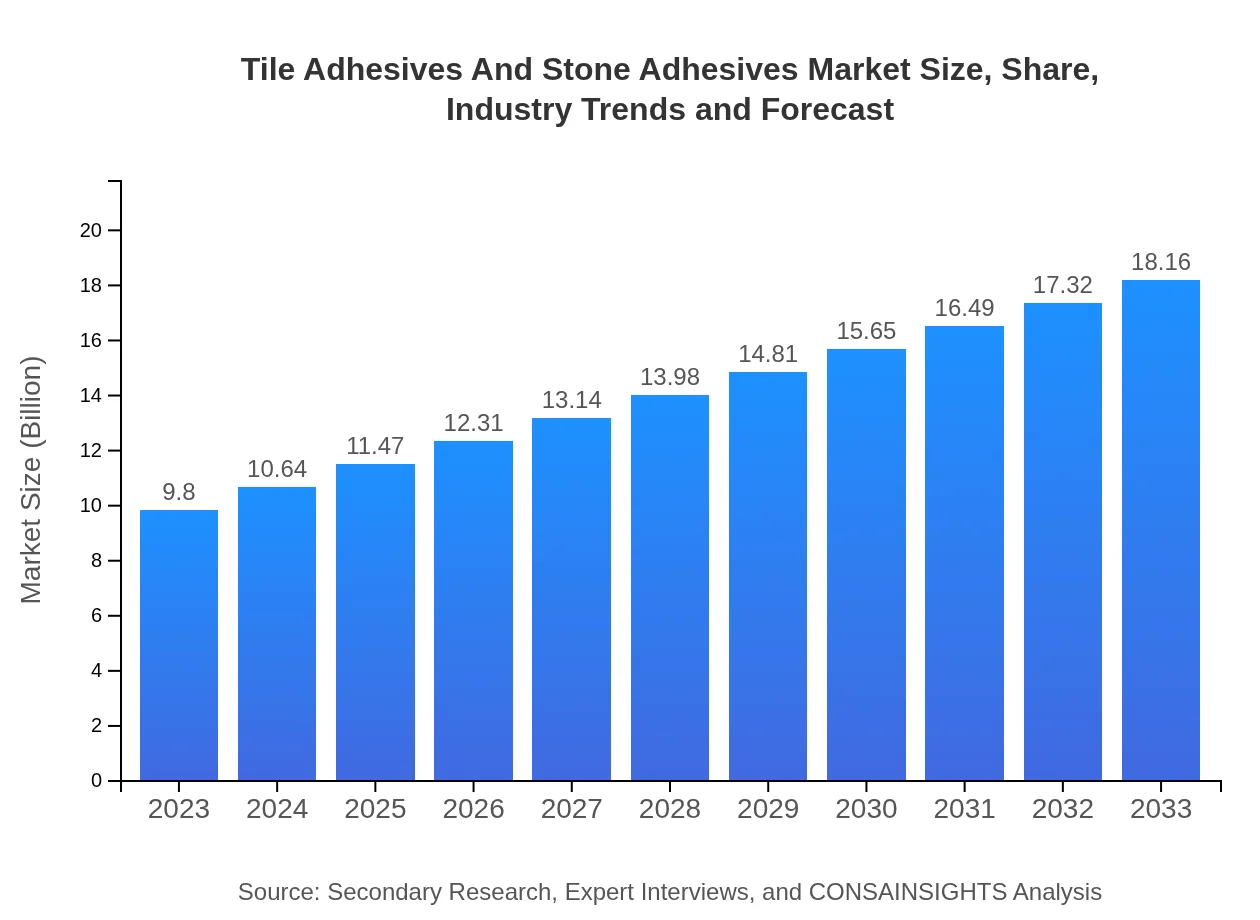

This report presents in-depth insights into the Tile Adhesives and Stone Adhesives market, examining its current state and growth potential from 2023 to 2033. Key data, market trends, segmentation analysis, and forecasted growth patterns are extensively covered.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $9.80 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $18.16 Billion |

| Top Companies | LATICRETE International, Inc., BASF SE, MAPEI S.p.A., Sika AG |

| Last Modified Date | 22 January 2026 |

Tile Adhesives And Stone Adhesives Market Overview

Customize Tile Adhesives And Stone Adhesives Market Report market research report

- ✔ Get in-depth analysis of Tile Adhesives And Stone Adhesives market size, growth, and forecasts.

- ✔ Understand Tile Adhesives And Stone Adhesives's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Tile Adhesives And Stone Adhesives

What is the Market Size & CAGR of Tile Adhesives And Stone Adhesives market in 2023?

Tile Adhesives And Stone Adhesives Industry Analysis

Tile Adhesives And Stone Adhesives Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Tile Adhesives And Stone Adhesives Market Analysis Report by Region

Europe Tile Adhesives And Stone Adhesives Market Report:

The European market is anticipated to grow from $3.09 billion in 2023 to $5.72 billion by 2033. The focus on sustainability in construction practices, combined with rising consumer awareness regarding eco-friendly products, drives the demand for innovative adhesives in this region.Asia Pacific Tile Adhesives And Stone Adhesives Market Report:

In the Asia Pacific region, the market size is expected to expand from $1.87 billion in 2023 to $3.46 billion by 2033. The growth is fueled by increasing urbanization, infrastructure development, and a booming real estate sector, along with the rising demand for advanced adhesive technologies.North America Tile Adhesives And Stone Adhesives Market Report:

North America is estimated to see a market growth from $3.35 billion in 2023 to $6.21 billion in 2033. The growth is driven by strong demand in residential renovation projects, especially in the United States, along with technological advancements in adhesive formulations that cater to diverse industrial needs.South America Tile Adhesives And Stone Adhesives Market Report:

The South American market is projected to grow from $0.90 billion in 2023 to $1.66 billion by 2033. Factors contributing to this growth include enhancing infrastructure projects and adoption of innovative tile and stone adhesive solutions as construction activities ramp up in various countries.Middle East & Africa Tile Adhesives And Stone Adhesives Market Report:

In the Middle East and Africa, the market is projected to expand from $0.60 billion in 2023 to $1.10 billion by 2033. Growth is primarily driven by ongoing infrastructure improvements and a rise in construction activities as countries invest in large-scale projects.Tell us your focus area and get a customized research report.

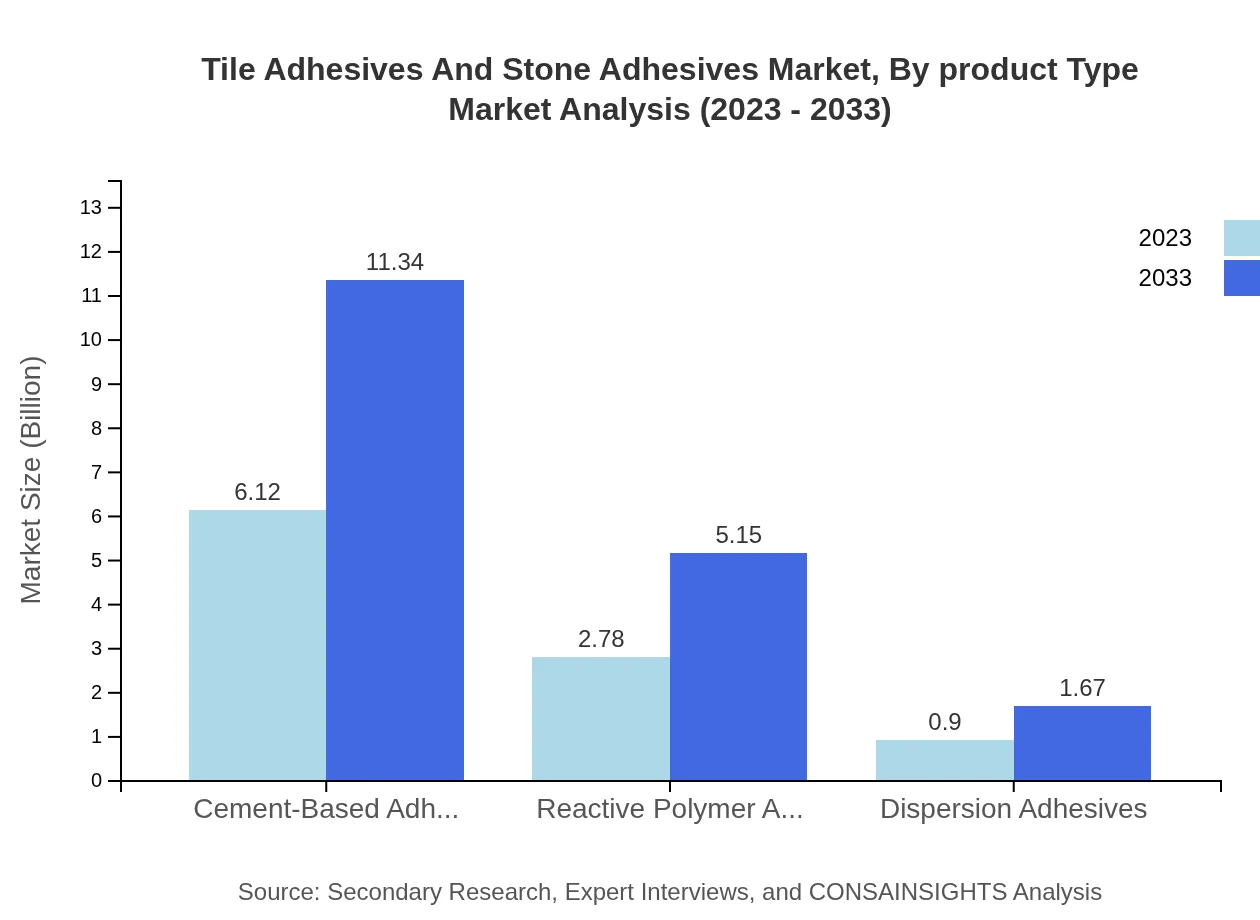

Tile Adhesives And Stone Adhesives Market Analysis By Product Type

In 2023, Cement-Based Adhesives dominate the market, valued at $6.12 billion, with a shared market significance of 62.45%. Reactive Polymer Adhesives follow at $2.78 billion, accounting for 28.38% of the market. Dispersion Adhesives contribute $0.90 billion with 9.17% market share. By 2033, Cement-Based Adhesives are projected to maintain their leading position, growing to $11.34 billion, while Reactive Polymer and Dispersion Adhesives are expected to reach $5.15 billion and $1.67 billion, respectively.

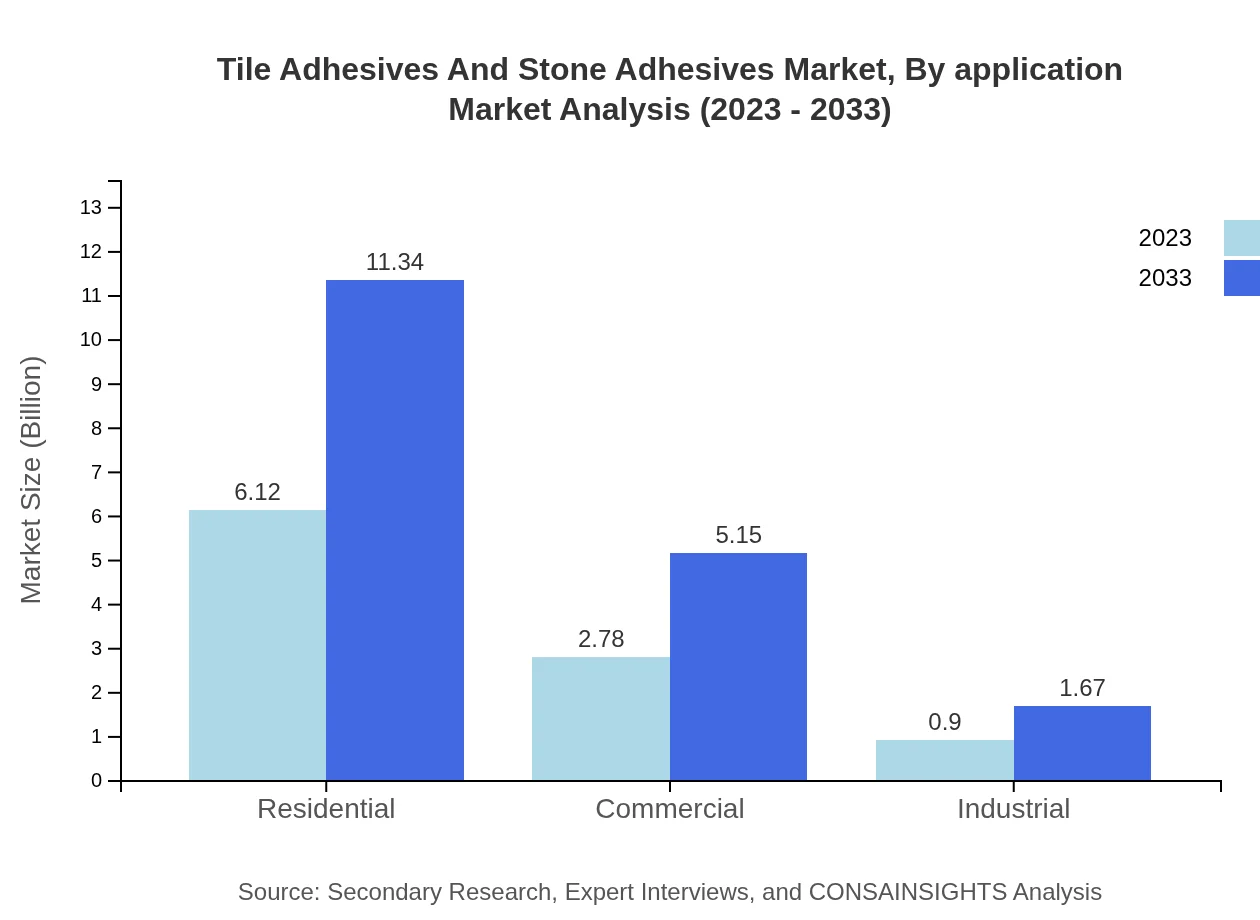

Tile Adhesives And Stone Adhesives Market Analysis By Application

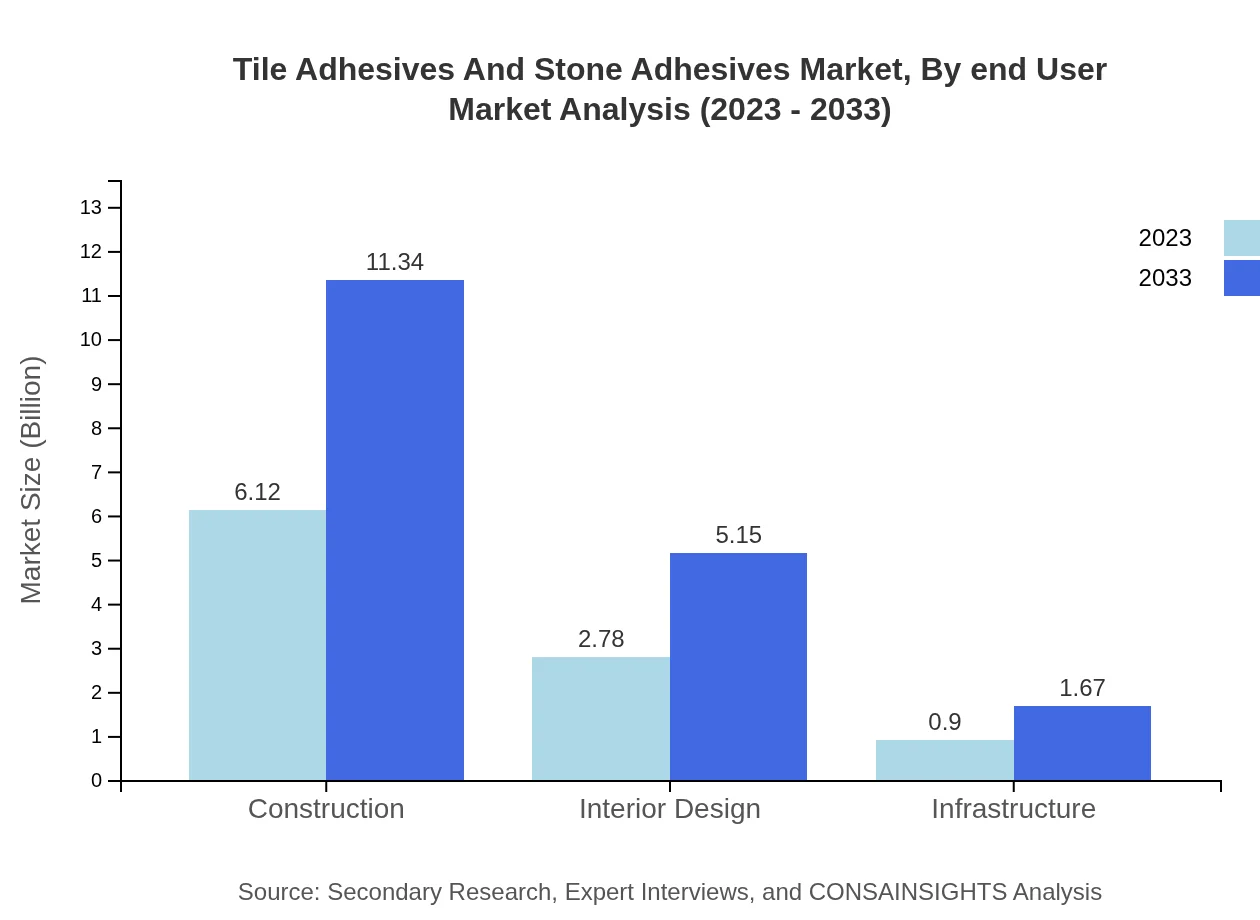

The Construction segment leads the market with a size of $6.12 billion in 2023, making up 62.45% of the share. Residential applications also reflect similar significance. The Interior Design segment is anticipated to grow from $2.78 billion in 2023 to $5.15 billion by 2033, driven by aesthetic considerations in renovation and new builds.

Tile Adhesives And Stone Adhesives Market Analysis By End User

The market landscape reflects heavy contributions from the residential sector, where Tile Adhesives and Stone Adhesives are integral for new constructions and renovations. The market size for the residential segment is projected to grow from $6.12 billion in 2023 to $11.34 billion by 2033, maintaining its share in the industry at 62.45%.

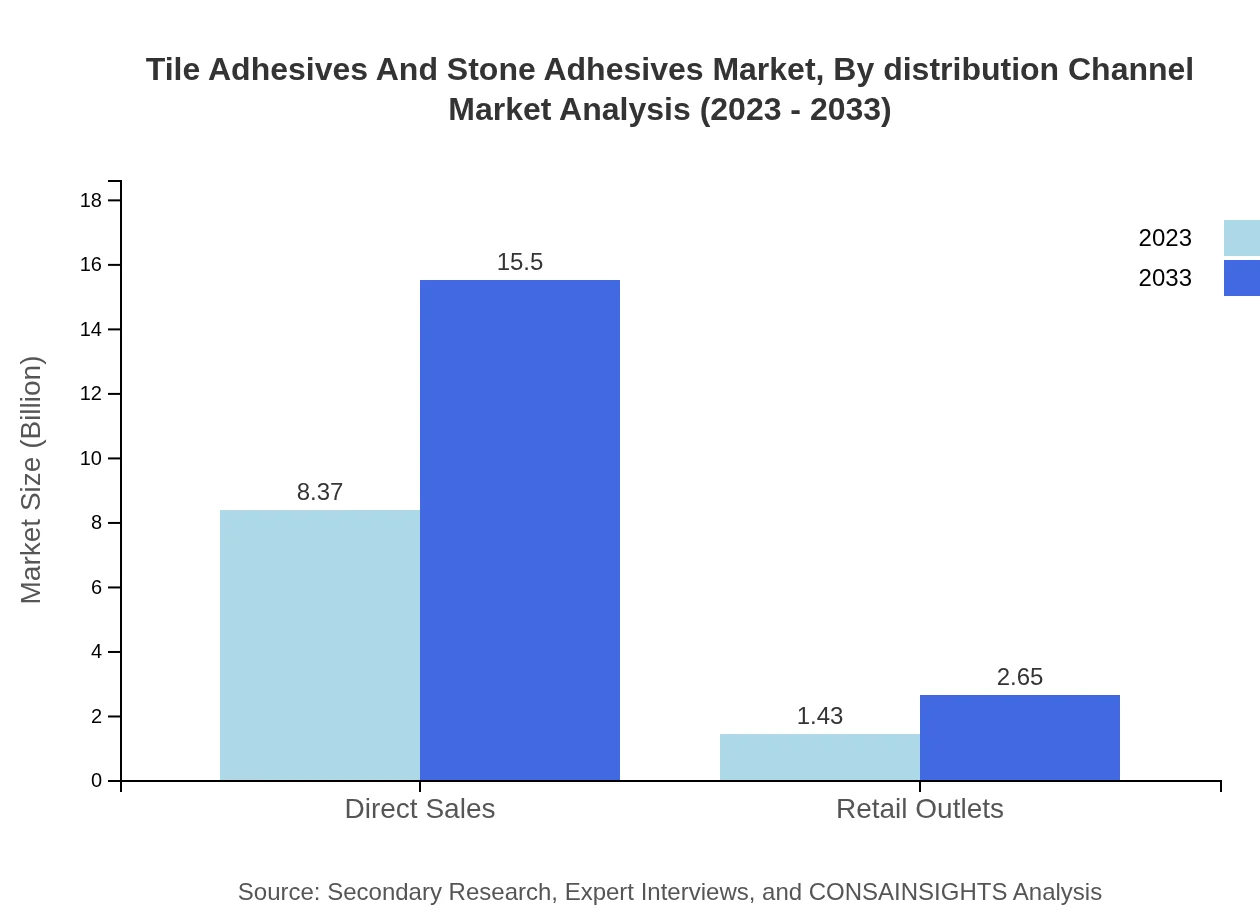

Tile Adhesives And Stone Adhesives Market Analysis By Distribution Channel

Direct sales channels dominate the market, holding a size of $8.37 billion in 2023 with an 85.39% market share. Retail outlets contribute a smaller portion, beginning at $1.43 billion but projected to grow gradually as consumer demand for convenient purchasing options rises.

Tile Adhesives And Stone Adhesives Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Tile Adhesives And Stone Adhesives Industry

LATICRETE International, Inc.:

A leading manufacturer of construction materials, LATICRETE specializes in innovative adhesives and sealants for tile and stone applications.BASF SE:

BASF SE is a global chemical company that delivers a comprehensive range of adhesives solutions for construction, including polymer-based adhesives.MAPEI S.p.A.:

MAPEI is known for its advanced tile and stone adhesive products and has a strong presence in various international markets.Sika AG:

Sika AG offers a wide array of bonding, sealing, and reinforcing solutions for construction and is a recognized leader in the adhesive market.We're grateful to work with incredible clients.

FAQs

What is the market size of tile Adhesives And Stone Adhesives?

The global tile and stone adhesives market is projected to reach $9.8 billion by 2033, growing at a CAGR of 6.2% from 2023. This growth is driven by the increasing demand in the construction and renovation sectors.

What are the key market players or companies in the tile Adhesives And Stone Adhesives industry?

Key players in the tile adhesives and stone adhesives market include companies such as MAPEI, Ardex, Bostik, and Sika. These companies are known for their strong product portfolios and innovative technologies to enhance adhesive performance.

What are the primary factors driving the growth in the tile Adhesives And Stone Adhesives industry?

The growth in this industry is driven by urbanization, rising construction activities, and increased investment in infrastructure development. Additionally, innovations in adhesive formulations contributing to better performance and environmental sustainability are significant growth factors.

Which region is the fastest Growing in the tile Adhesives And Stone Adhesives market?

Asia Pacific is the fastest-growing region in the tile adhesives and stone adhesives market. The market size is projected to increase from $1.87 billion in 2023 to $3.46 billion by 2033, driven by rapid urbanization and construction growth.

Does ConsaInsights provide customized market report data for the tile Adhesives And Stone Adhesives industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the tile adhesives and stone adhesives industry. This allows clients to focus on market segments or geographic areas of interest for precise insights.

What deliverables can I expect from this tile Adhesives And Stone Adhesives market research project?

Deliverables include comprehensive market analysis reports, data segmentation by region and application, growth forecasts, competitive landscape assessments, and insights into market trends, enabling informed strategic decisions.

What are the market trends of tile Adhesives And Stone Adhesives?

Current market trends include increased adoption of eco-friendly adhesives, growth in DIY renovations, and rising demand for high-performance adhesives. There is also a shift towards digital sales platforms, enhancing market accessibility.