Tire Material Market Report

Published Date: 02 February 2026 | Report Code: tire-material

Tire Material Market Size, Share, Industry Trends and Forecast to 2033

This report presents a comprehensive analysis of the Tire Material market from 2023 to 2033, offering insights into market size, segmentation, trends, and forecasts, along with a detailed regional breakdown and notable players in the industry.

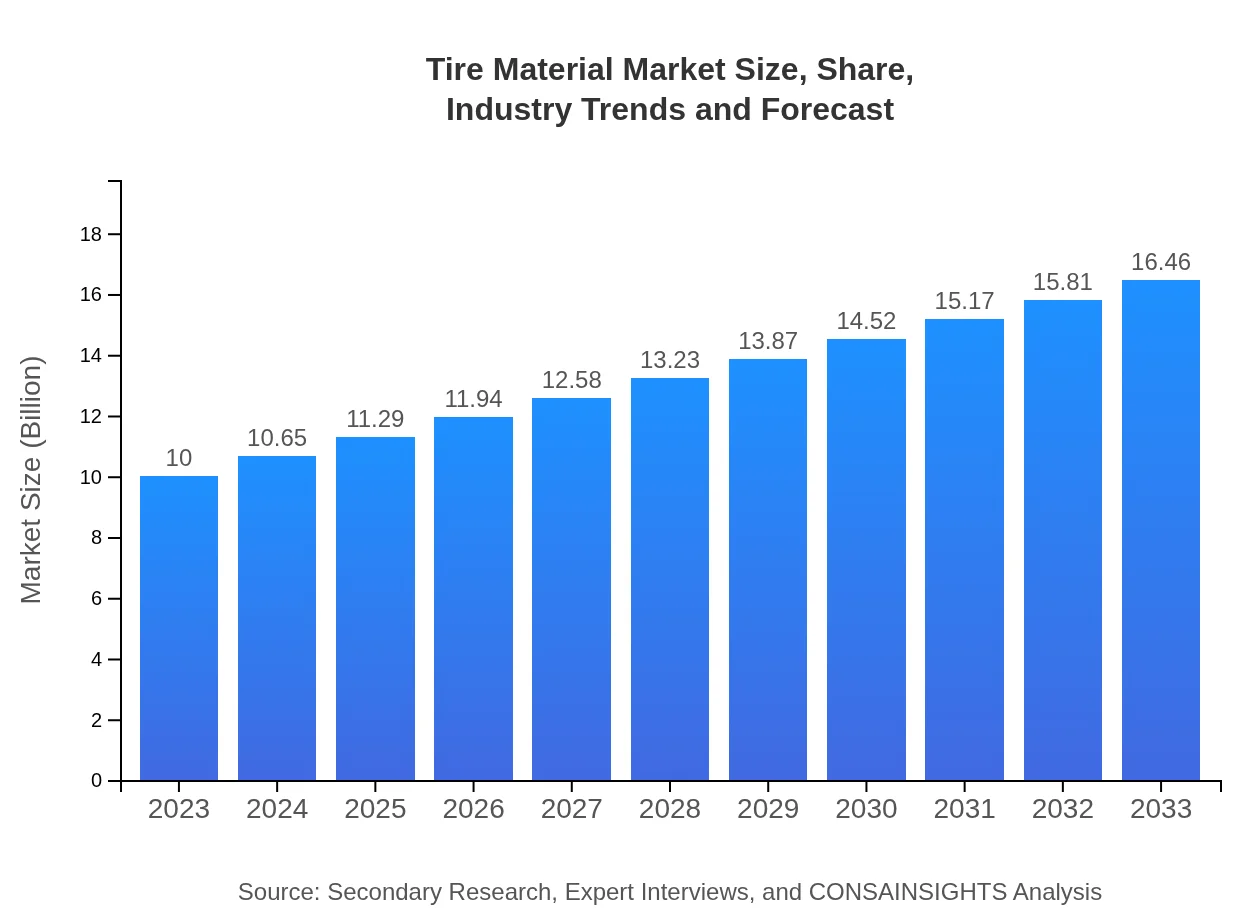

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.00 Billion |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $16.46 Billion |

| Top Companies | Bridgestone Corporation, Michelin, Goodyear Tire & Rubber Company, Continental AG |

| Last Modified Date | 02 February 2026 |

Tire Material Market Overview

Customize Tire Material Market Report market research report

- ✔ Get in-depth analysis of Tire Material market size, growth, and forecasts.

- ✔ Understand Tire Material's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Tire Material

What is the Market Size & CAGR of Tire Material market in 2023?

Tire Material Industry Analysis

Tire Material Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Tire Material Market Analysis Report by Region

Europe Tire Material Market Report:

Europe is one of the largest markets, with a size increasing from $2.76 billion in 2023 to $4.55 billion in 2033. Stricter environmental regulations and a focus on fuel efficiency are stimulating demand for innovative tire materials.Asia Pacific Tire Material Market Report:

The Asia Pacific region is projected to experience substantial growth, moving from a market size of $1.93 billion in 2023 to $3.17 billion in 2033. This growth is driven by the burgeoning automotive industry and increasing demand for tires in emerging markets like India and China, coupled with innovation in tire technology.North America Tire Material Market Report:

North America is anticipated to increase from $3.63 billion in 2023 to $5.97 billion in 2033. The region's growth is fueled by a strong automotive market, advancements in tire technology, and a shift towards eco-friendly materials.South America Tire Material Market Report:

South America’s Tire Material market, although smaller, is expected to grow from $0.36 billion in 2023 to $0.59 billion in 2033. This is due to improving automotive sectors and rising investment in infrastructure development that boosts demand for heavy-duty tires.Middle East & Africa Tire Material Market Report:

The Middle East and Africa market is projected to expand from $1.32 billion in 2023 to $2.17 billion in 2033. Growth factors include increasing vehicle sales and the development of local manufacturing facilities.Tell us your focus area and get a customized research report.

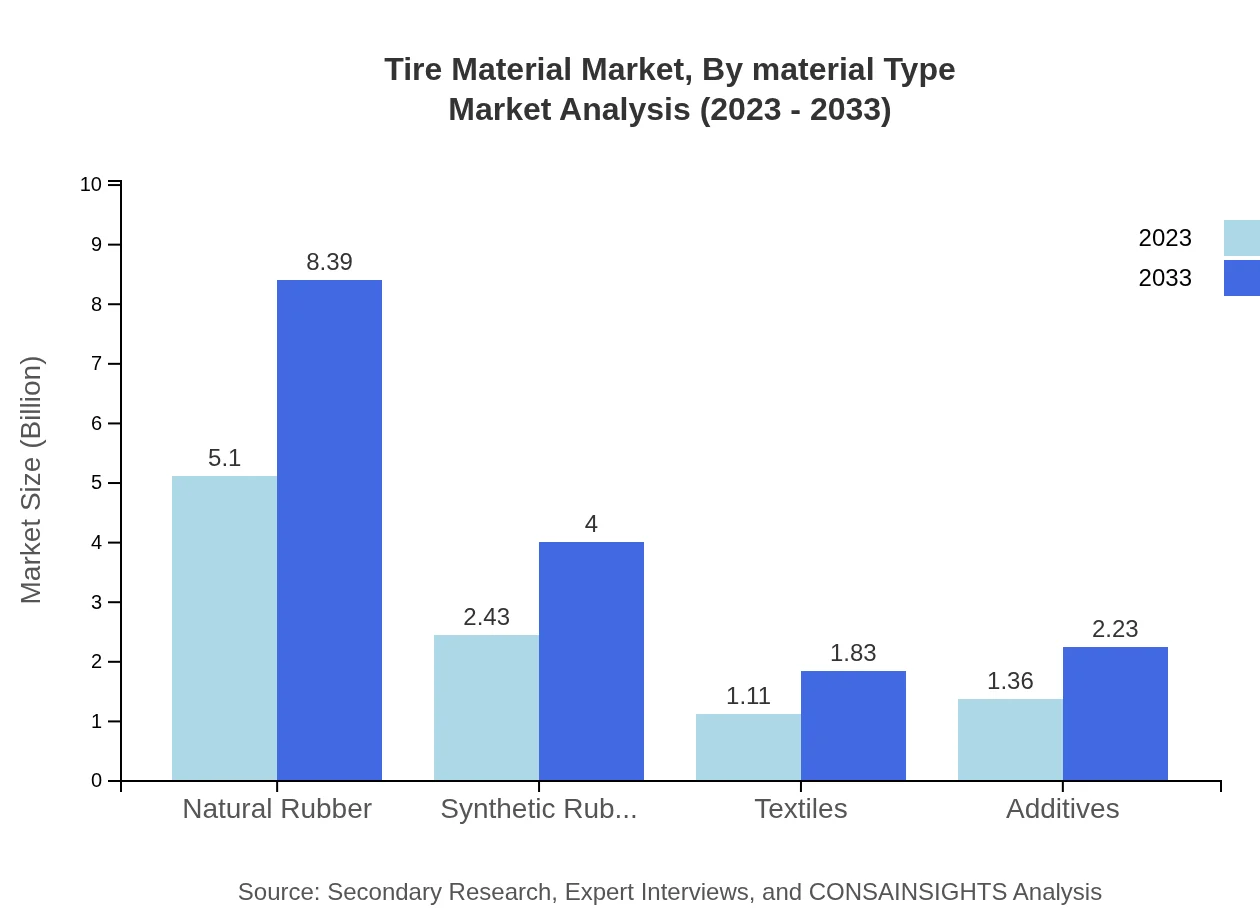

Tire Material Market Analysis By Material Type

The market is dominated by natural rubber, valued at $5.10 billion in 2023, expected to grow to $8.39 billion by 2033, holding a 50.97% market share. Synthetic rubber follows, projected to expand from $2.43 billion to $4.00 billion. Other materials include textiles and additives, which are increasingly important in enhancing performance and sustainability.

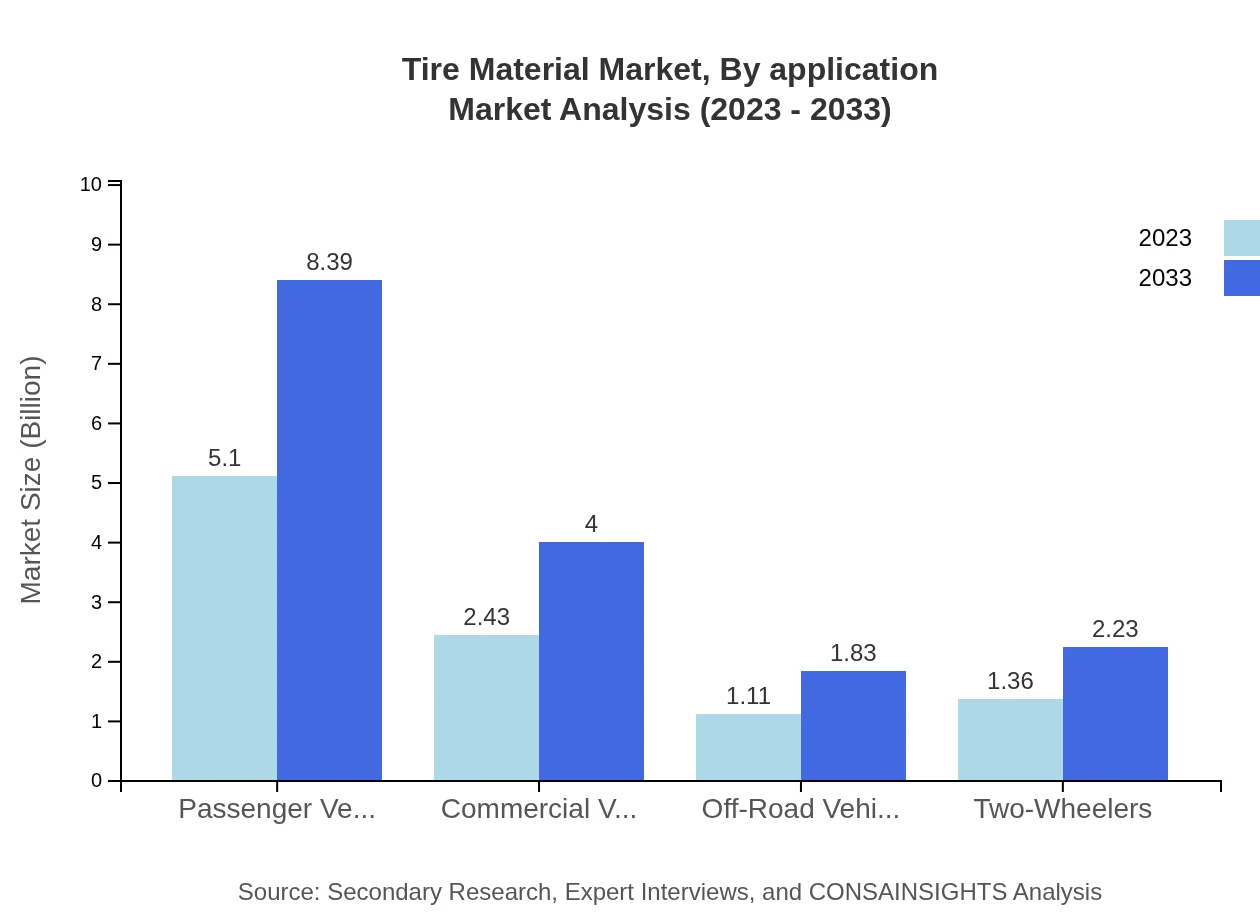

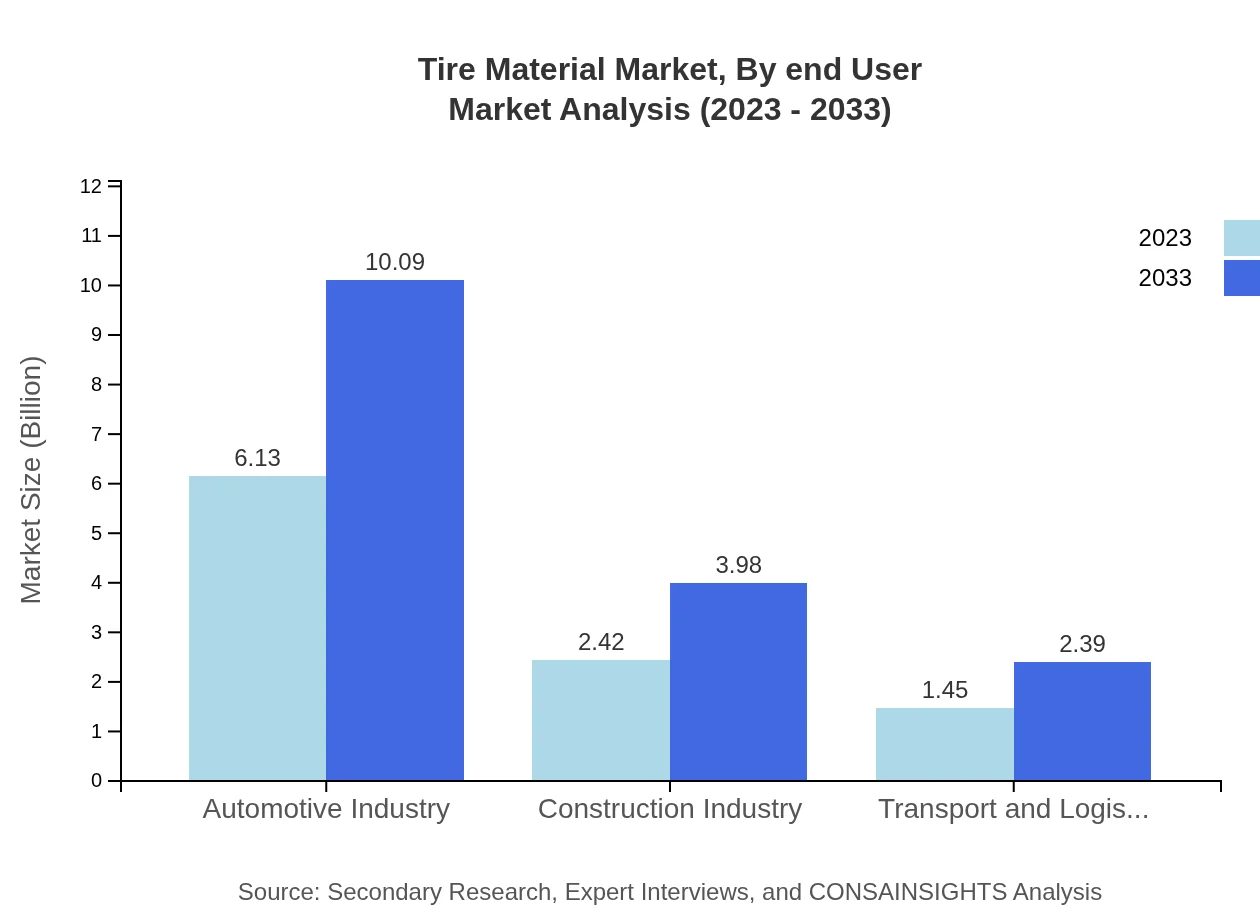

Tire Material Market Analysis By Application

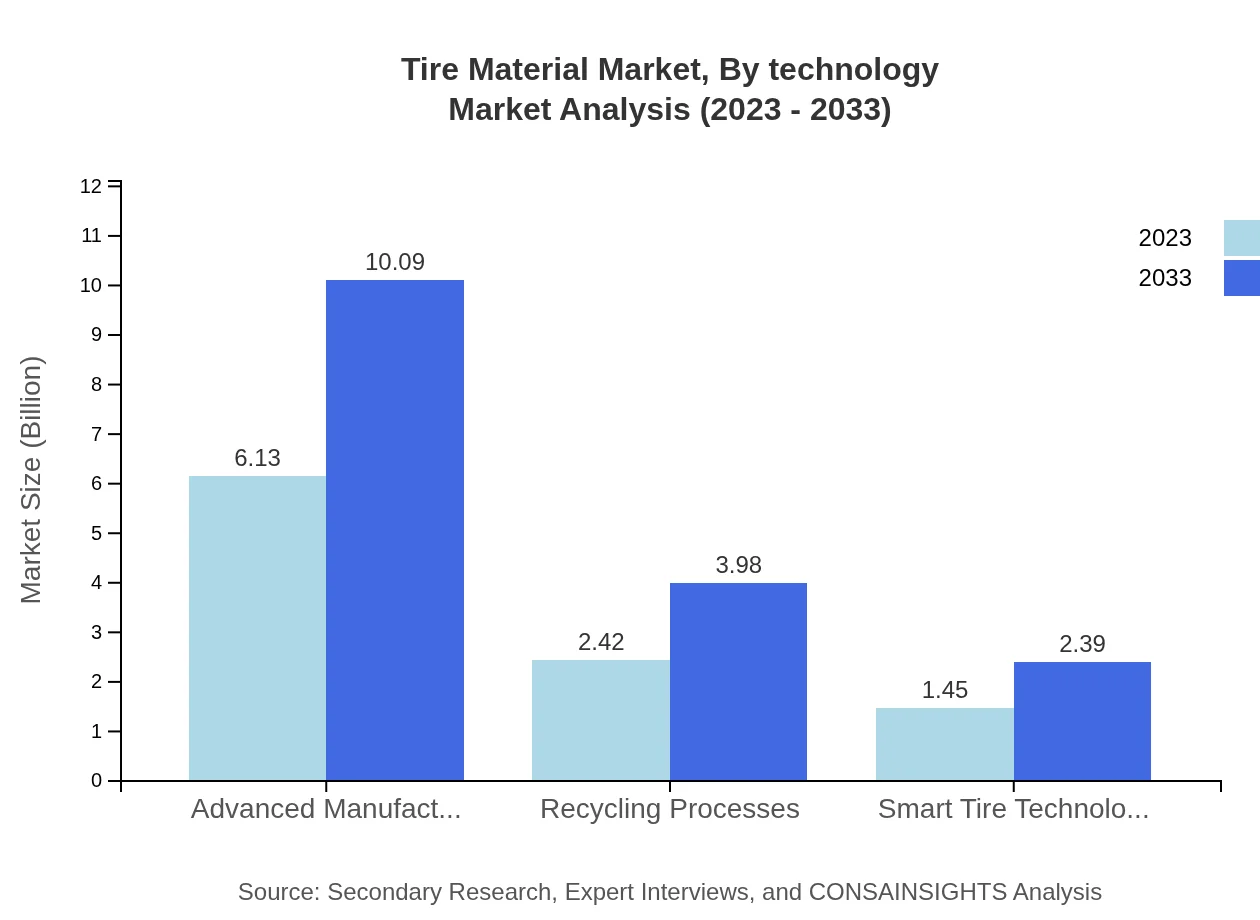

The Automotive industry is the largest application segment, with a market size of $6.13 billion in 2023, anticipated to grow to $10.09 billion by 2033, maintaining a 61.31% share. The Construction sector is also significant, projected to increase from $2.42 billion to $3.98 billion. Other notable applications include transport and logistics, smart technologies, and recycling processes.

Tire Material Market Analysis By Technology

Advancements in technology are drastically influencing market dynamics. Smart tire technologies are gaining traction, with market sizes expected to rise from $1.45 billion in 2023 to $2.39 billion by 2033. Innovations focus on real-time data and analytics, enhancing safety and performance.

Tire Material Market Analysis By End User

The Passenger Vehicles segment leads with a market size of $5.10 billion in 2023, expected to reach $8.39 billion. Commercial Vehicles and Off-Road Vehicles follow, indicating robust growth due to increasing logistics and recreational use respectively.

Tire Material Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Tire Material Industry

Bridgestone Corporation:

A global leader in tire manufacturing, Bridgestone is renowned for its innovative tire solutions that cater to both passenger and commercial vehicles.Michelin:

Michelin is noted for its technological advancements in tire design and a strong commitment to sustainability and performance.Goodyear Tire & Rubber Company:

Goodyear has a rich history in tire manufacturing, focusing on developing high-performance tires, including smart tire technologies.Continental AG:

Continental AG is known for producing high-quality tires and has made significant investments in tire technology innovations.We're grateful to work with incredible clients.

FAQs

What is the market size of tire Material?

The tire material market is currently valued at approximately $10 billion in 2023, with an expected CAGR of 5% through 2033. This growth reflects accelerating demand across automotive and commercial sectors.

What are the key market players or companies in this tire Material industry?

Key players in the tire material market include major manufacturers specializing in rubber processing and composite materials, contributing significantly to innovation and sustainability within the industry.

What are the primary factors driving the growth in the tire Material industry?

Growing automotive production, demand for eco-friendly materials, and advancements in tire technology are pivotal growth drivers for the tire material market, sustaining a competitive edge.

Which region is the fastest Growing in the tire material market?

The Asia Pacific region is poised for rapid growth in the tire material market, projected to increase from $1.93 billion in 2023 to $3.17 billion by 2033, driven by rising automotive manufacturing.

Does ConsaInsights provide customized market report data for the tire material industry?

Yes, ConsaInsights offers tailored market reports, providing in-depth analysis and data specific to your business needs within the tire material industry.

What deliverables can I expect from this tire material market research project?

Expect comprehensive deliverables including market analysis reports, segmentation data, competitive landscape insights, and trends over the forecast period for the tire material industry.

What are the market trends of tire material?

Market trends include a shift towards sustainable materials, enhancement in smart tire technologies, and increased demand in passenger vehicles contributing to significant market evolution.