Tire Retreading Market Report

Published Date: 02 February 2026 | Report Code: tire-retreading

Tire Retreading Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Tire Retreading market, offering insights into market size, growth projections, segment performance, and regional analysis from 2023 to 2033. It covers trends, industry dynamics, and assessments of key players shaping the landscape.

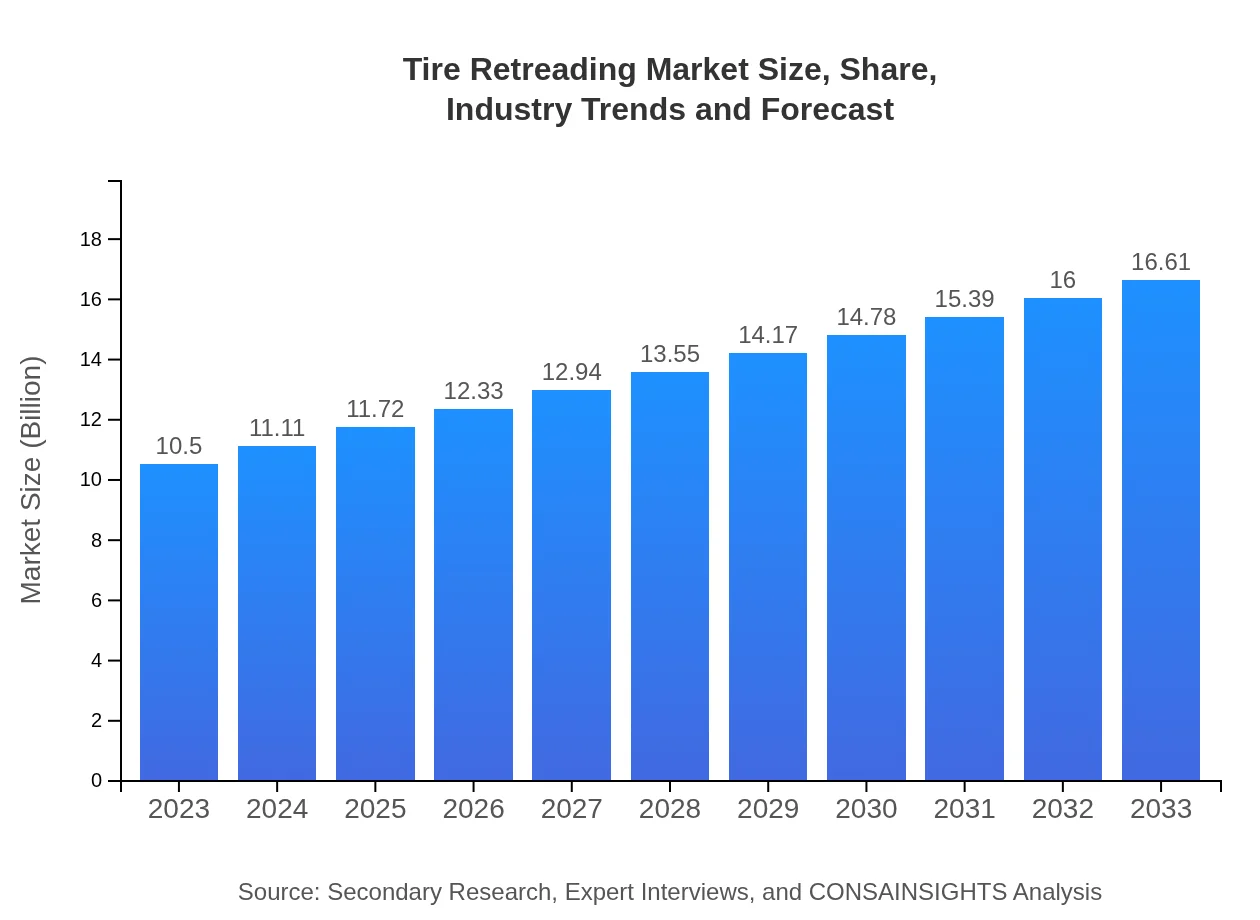

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 4.6% |

| 2033 Market Size | $16.61 Billion |

| Top Companies | Bridgestone Corporation, Michelin, Goodyear Tire & Rubber Company, Continental AG, Sumitomo Rubber Industries |

| Last Modified Date | 02 February 2026 |

Tire Retreading Market Overview

Customize Tire Retreading Market Report market research report

- ✔ Get in-depth analysis of Tire Retreading market size, growth, and forecasts.

- ✔ Understand Tire Retreading's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Tire Retreading

What is the Market Size & CAGR of Tire Retreading market in 2023 and 2033?

Tire Retreading Industry Analysis

Tire Retreading Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Tire Retreading Market Analysis Report by Region

Europe Tire Retreading Market Report:

Europe's tire retreading market was valued at 3.37 billion USD in 2023, with forecasts suggesting it will reach 5.32 billion USD by 2033. Here, stringent environmental regulations and a focus on sustainability are pushing up demand for retreading services, with significant investments in technological innovations improving retread quality.Asia Pacific Tire Retreading Market Report:

In 2023, the Asia Pacific tire retreading market stood at approximately 1.95 billion USD, projected to grow to 3.08 billion USD by 2033. This growth is driven by expanding automotive manufacturing bases and increasing tire demand, particularly in countries like China and India. The region is noted for its diverse vehicle segment offerings, creating a favorable environment for retreaded tire demands.North America Tire Retreading Market Report:

North America is expected to showcase significant growth, with a market size of 3.84 billion USD in 2023, increasing to 6.07 billion USD by 2033. The region’s high adoption rates for retreaded tires in commercial fleets due to regulatory incentives and cost savings primarily drive this increase.South America Tire Retreading Market Report:

The South American tire retreading market is estimated at 0.58 billion USD in 2023, expected to reach 0.92 billion USD by 2033. The growth indicates rising awareness around recycling and waste management, in conjunction with heightened regulatory measures prompting a shift towards sustainable practices within the automotive sector.Middle East & Africa Tire Retreading Market Report:

In the Middle East and Africa, the tire retreading market size was reported at 0.77 billion USD in 2023, with predictions of growing to 1.22 billion USD by 2033. The region is experiencing increasing vehicle use combined with a gradual regulatory shift towards waste management solutions, including retreading.Tell us your focus area and get a customized research report.

Tire Retreading Market Analysis By Material

The material segment of the tire retreading market includes natural rubber, synthetic rubber, and cushion gum, with natural rubber holding a significant market share due to its durability and performance characteristics. In 2023, natural rubber is estimated to represent a market size of 6.41 billion USD, expected to rise to 10.15 billion USD by 2033, maintaining a share of 61.09% throughout this period. Synthetic rubber, while smaller in proportion, is crucial for its versatility and cost-effectiveness, projected at 2.14 billion USD in 2023 and increasing to 3.38 billion USD by 2033. The cushion gum material, used mainly in stress relief retreading processes, is expected to see similar growth from 1.95 billion USD to 3.08 billion USD, maintaining an 18.54% market share.

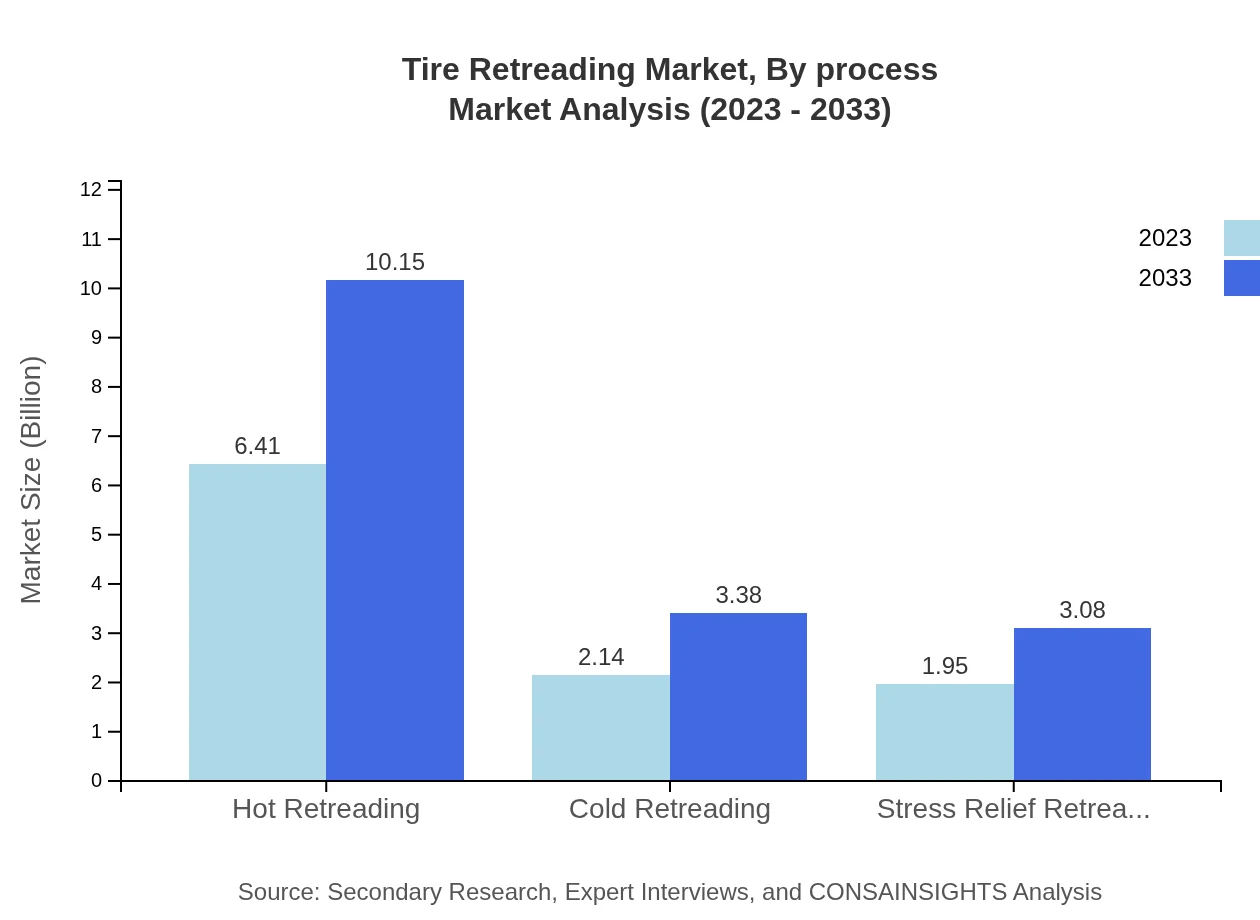

Tire Retreading Market Analysis By Process

The tire retreading market by process includes hot retreading, cold retreading, and stress relief retreading. Hot retreading dominates the market due to its efficiency, representing a size of 6.41 billion USD in 2023 and an expected rise to 10.15 billion USD by 2033, maintaining a share of 61.09%. Cold retreading, while used for lighter applications, shows strong growth from 2.14 billion USD to 3.38 billion USD, comprising approximately 20.37% of the market. Stress relief retreading captures a growing niche, starting at 1.95 billion USD in 2023, and moving up to 3.08 billion within the forecast period, maintaining an 18.54% market share.

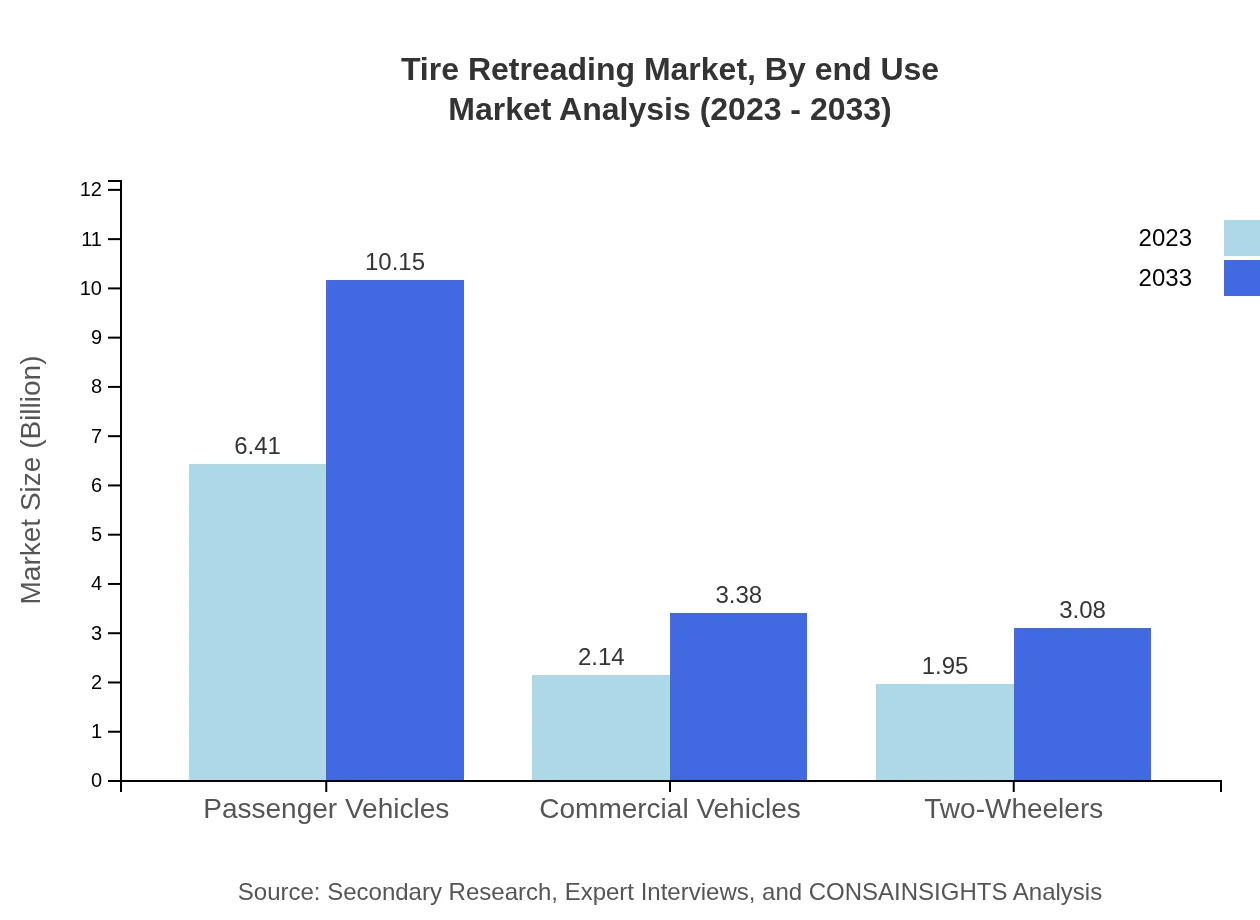

Tire Retreading Market Analysis By End Use

The by-end-use analysis presents insights into passenger vehicles, commercial vehicles, and two-wheelers. Passenger vehicles lead the segment with a size of 6.41 billion USD in 2023, expected to increase to 10.15 billion USD by 2033, governing a share of 61.09%. Commercial vehicles, although representing a smaller segment, show growth from 2.14 billion USD to 3.38 billion USD (20.37% share), primarily driven by fleet operations requiring cost-effective solutions. Two-wheelers account for 1.95 billion USD in 2023, projected to grow to 3.08 billion USD within the same timeframe, indicating an 18.54% share.

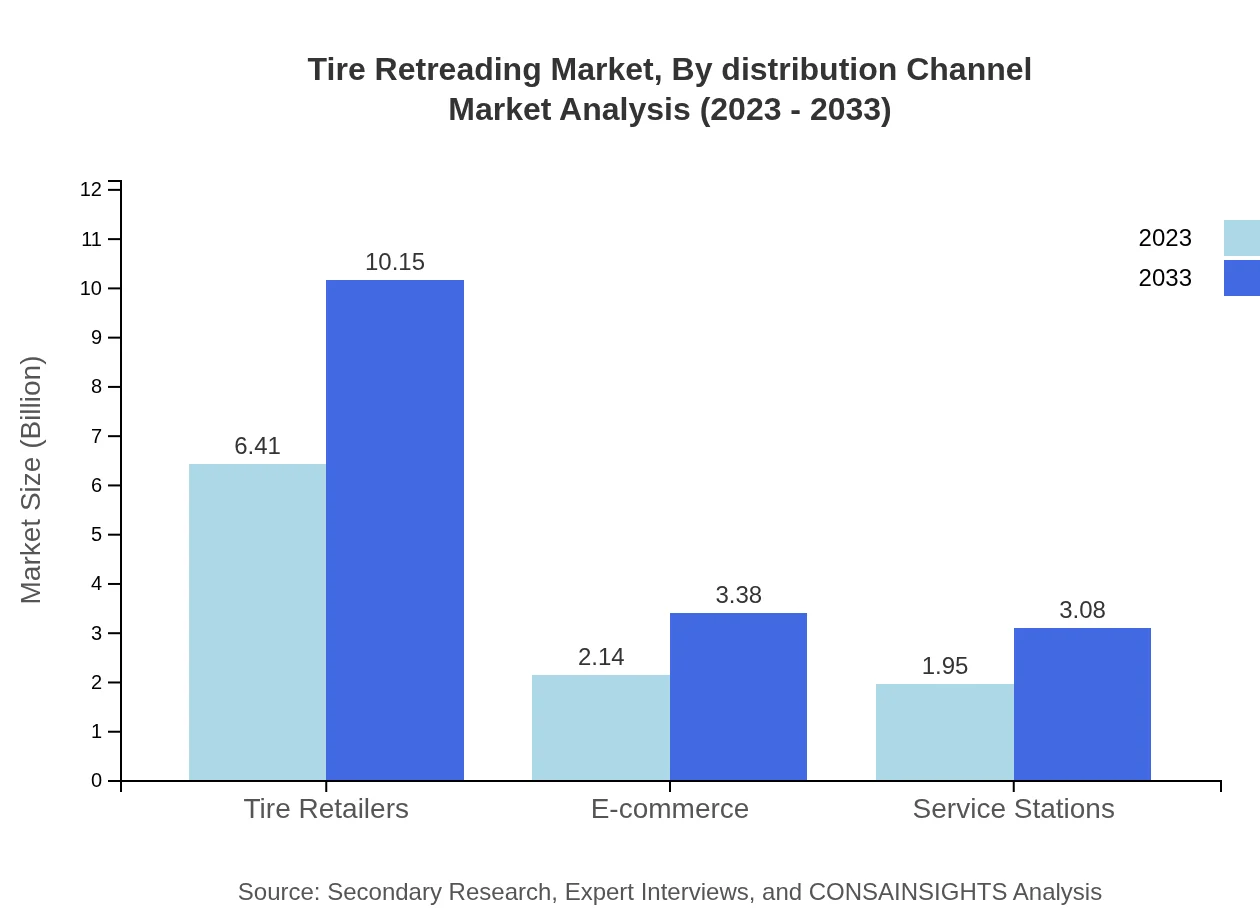

Tire Retreading Market Analysis By Distribution Channel

The tire retreading market through distribution channels includes tire retailers, e-commerce, and service stations. Tire retailers dominate the segment, accounting for 6.41 billion USD in 2023 and projected to ascend to 10.15 billion USD, maintaining a 61.09% share. E-commerce is rapidly growing and projected to grow from 2.14 billion USD to 3.38 billion USD (20.37% share), reflecting a shift in consumer buying behaviors. Service stations, while the smallest segment, are expected to grow from 1.95 billion USD to 3.08 billion USD, reflecting the increasing services offered for tire maintenance.

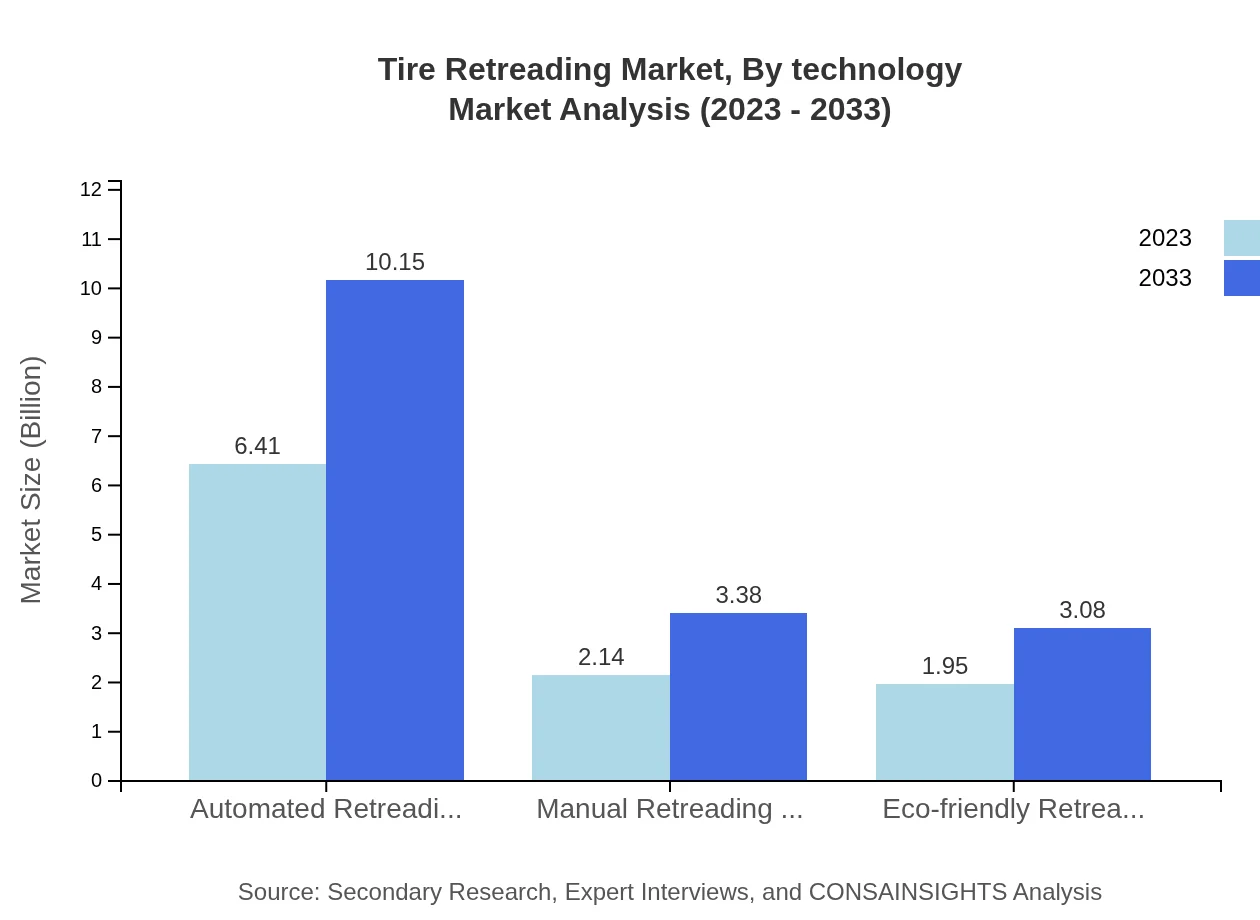

Tire Retreading Market Analysis By Technology

With advancements in tire retreading technologies taking center stage, this segment focuses on automated retreading systems, manual retreading technologies, and eco-friendly retreading technologies. Automated systems are set to dominate the market with a size of 6.41 billion USD in 2023 and expected to rise to 10.15 billion by 2033, maintaining a share of 61.09%. Manual technologies maintain a presence, growing from 2.14 billion USD to 3.38 billion USD (20.37% share), while eco-friendly technologies gain traction amid increasing sustainability trends, projected from 1.95 billion USD to 3.08 billion USD (18.54% share).

Tire Retreading Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Tire Retreading Industry

Bridgestone Corporation:

One of the largest tire manufacturers globally, Bridgestone is a leader in tire retreading technology and promotes sustainable tire management solutions.Michelin:

Known for its innovation, Michelin offers a variety of retreading services, focusing on performance and safety in all tire types.Goodyear Tire & Rubber Company:

Goodyear is a prominent player in tire retreading, providing diverse products and services, ensuring high-quality retreaded tires.Continental AG:

Continental specializes in mobility solutions and high-quality retreaded tires, focusing on comprehensive tire lifecycle management.Sumitomo Rubber Industries:

A key participant in the retreading market, Sumitomo focuses on innovative retreading processes, contributing to sustainability efforts.We're grateful to work with incredible clients.

FAQs

What is the market size of tire Retreading?

The global tire retreading market is valued at $10.5 billion in 2023, with an expected CAGR of 4.6%, indicating substantial growth potential through 2033.

What are the key market players or companies in the tire Retreading industry?

Key players in the tire retreading market include leading tire manufacturers, specialized retreading companies, and recycling firms that focus on innovative retreading technologies and sustainable practices.

What are the primary factors driving the growth in the tire Retreading industry?

Growth in the tire retreading industry is primarily driven by increasing demand for cost-effective, sustainable tire solutions, growing environmental awareness, and advancements in retreading technology that enhance retread quality.

Which region is the fastest Growing in the tire Retreading?

North America is currently the fastest-growing region in the tire retreading market, projected to grow from $3.84 billion in 2023 to $6.07 billion by 2033, reflecting its robust automotive and logistics sectors.

Does ConsaInsights provide customized market report data for the tire Retreading industry?

Yes, ConsaInsights offers customized market reports tailored to specific industry needs, including detailed insights and data on the tire retreading market, helping businesses make informed decisions.

What deliverables can I expect from this tire Retreading market research project?

From the tire-retreading market research project, expect comprehensive reports covering market size, trends, competitive landscape analysis, regional insights, and forecasts through 2033.

What are the market trends of tire Retreading?

Key trends in the tire retreading market include a shift towards eco-friendly materials and processes, increased adoption of automated retreading technologies, and the growing significance of e-commerce in tire retailing.