Tissue Diagnostics Market Report

Published Date: 31 January 2026 | Report Code: tissue-diagnostics

Tissue Diagnostics Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Tissue Diagnostics market, covering insights on market size, trends, segmentation, and forecasts for the years 2023 to 2033.

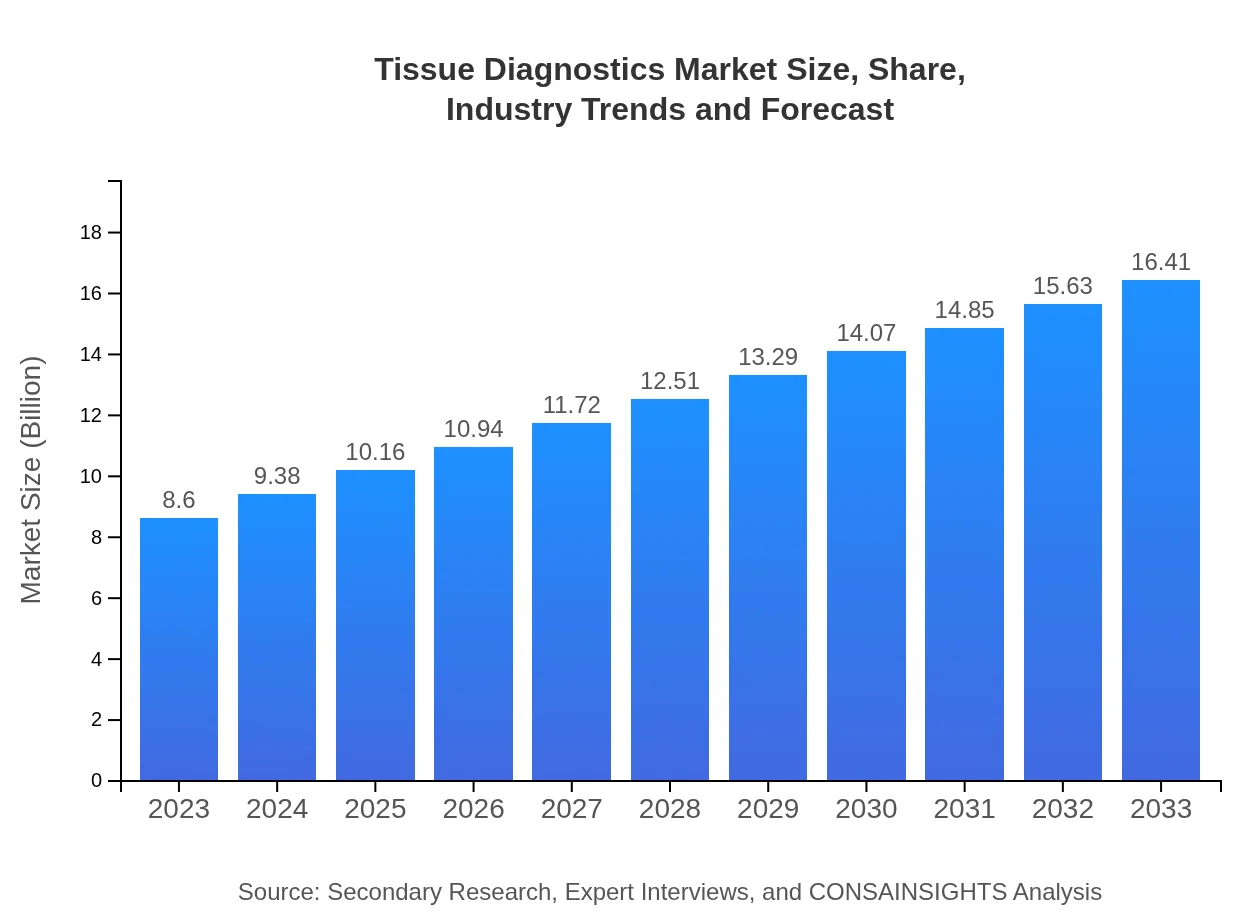

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $8.60 Billion |

| CAGR (2023-2033) | 6.5% |

| 2033 Market Size | $16.41 Billion |

| Top Companies | Roche Diagnostics, Thermo Fisher Scientific, Abbott Laboratories, Agilent Technologies |

| Last Modified Date | 31 January 2026 |

Tissue Diagnostics Market Overview

Customize Tissue Diagnostics Market Report market research report

- ✔ Get in-depth analysis of Tissue Diagnostics market size, growth, and forecasts.

- ✔ Understand Tissue Diagnostics's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Tissue Diagnostics

What is the Market Size & CAGR of Tissue Diagnostics market in 2023?

Tissue Diagnostics Industry Analysis

Tissue Diagnostics Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Tissue Diagnostics Market Analysis Report by Region

Europe Tissue Diagnostics Market Report:

In Europe, the market is anticipated to grow from USD 2.25 billion in 2023 to USD 4.29 billion by 2033. The advanced healthcare systems and a significant focus on personalized medicine are driving the demand for accurate and efficient diagnostic solutions.Asia Pacific Tissue Diagnostics Market Report:

In the Asia-Pacific region, the Tissue Diagnostics market is expected to grow from USD 1.66 billion in 2023 to USD 3.16 billion by 2033. This growth is driven by increasing healthcare expenditure, rising incidences of diseases, and an expanding geriatric population, paired with a greater adoption of advanced diagnostic technologies.North America Tissue Diagnostics Market Report:

North America holds the largest share of the market, valued at USD 3.10 billion in 2023, projected to reach USD 5.91 billion by 2033. The growth is attributed to high prevalence rates of cancer, robust healthcare infrastructure, and substantial investments in tissue diagnostics innovation.South America Tissue Diagnostics Market Report:

The South American market is forecasted to grow from USD 0.83 billion in 2023 to USD 1.58 billion by 2033. Key factors influencing this growth include enhanced healthcare infrastructure and increased awareness regarding early disease diagnosis among healthcare providers and patients.Middle East & Africa Tissue Diagnostics Market Report:

The Middle East and Africa market is expected to rise from USD 0.77 billion in 2023 to USD 1.47 billion by 2033. Increasing healthcare initiatives and growing investment in healthcare infrastructure are key drivers for market expansion in this region.Tell us your focus area and get a customized research report.

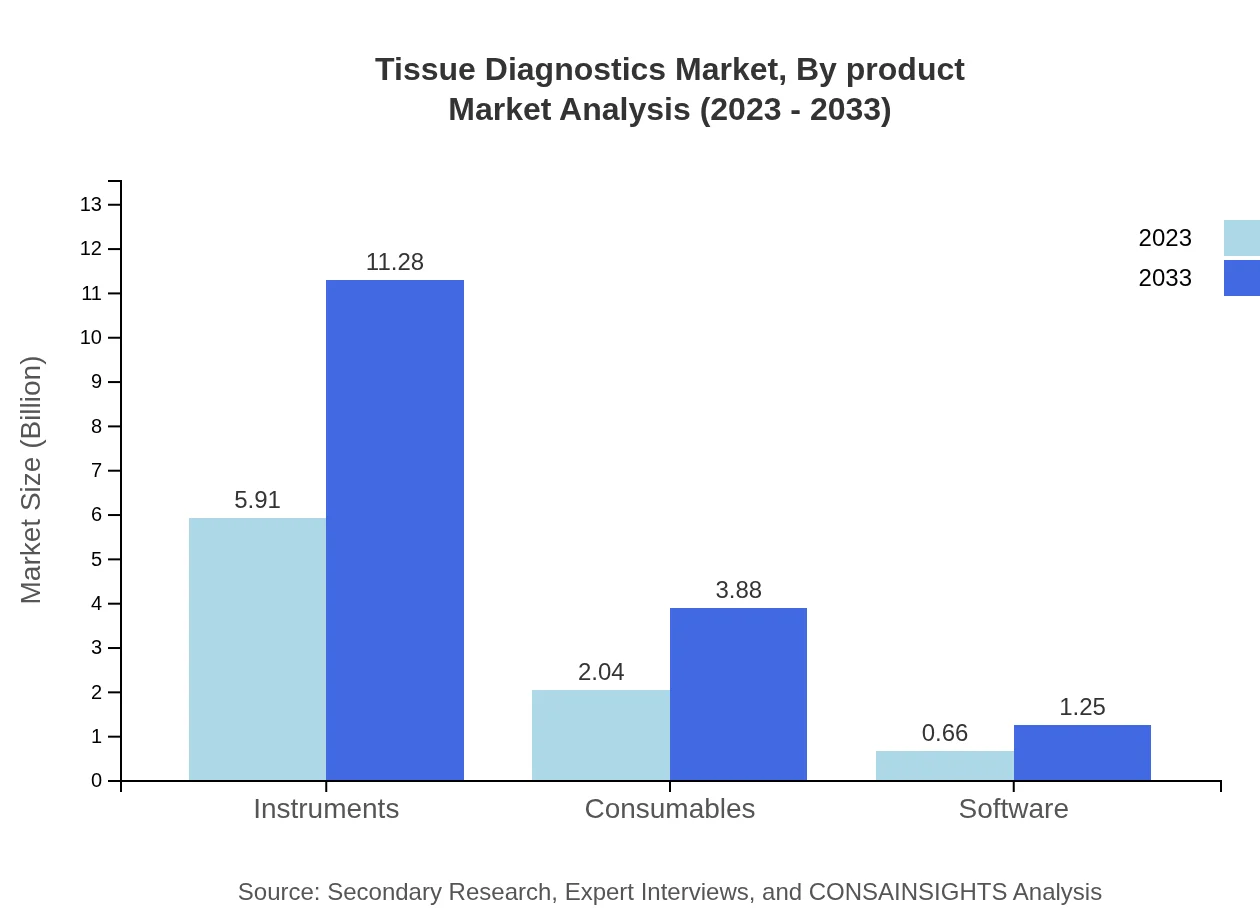

Tissue Diagnostics Market Analysis By Product

Instruments dominate the Tissue Diagnostics market, valued at USD 5.91 billion in 2023, rising to USD 11.28 billion by 2033. Consumables and software segments contribute significantly, with consumables at USD 2.04 billion and software at USD 0.66 billion in 2023, expected to grow to USD 3.88 billion and USD 1.25 billion, respectively, by 2033.

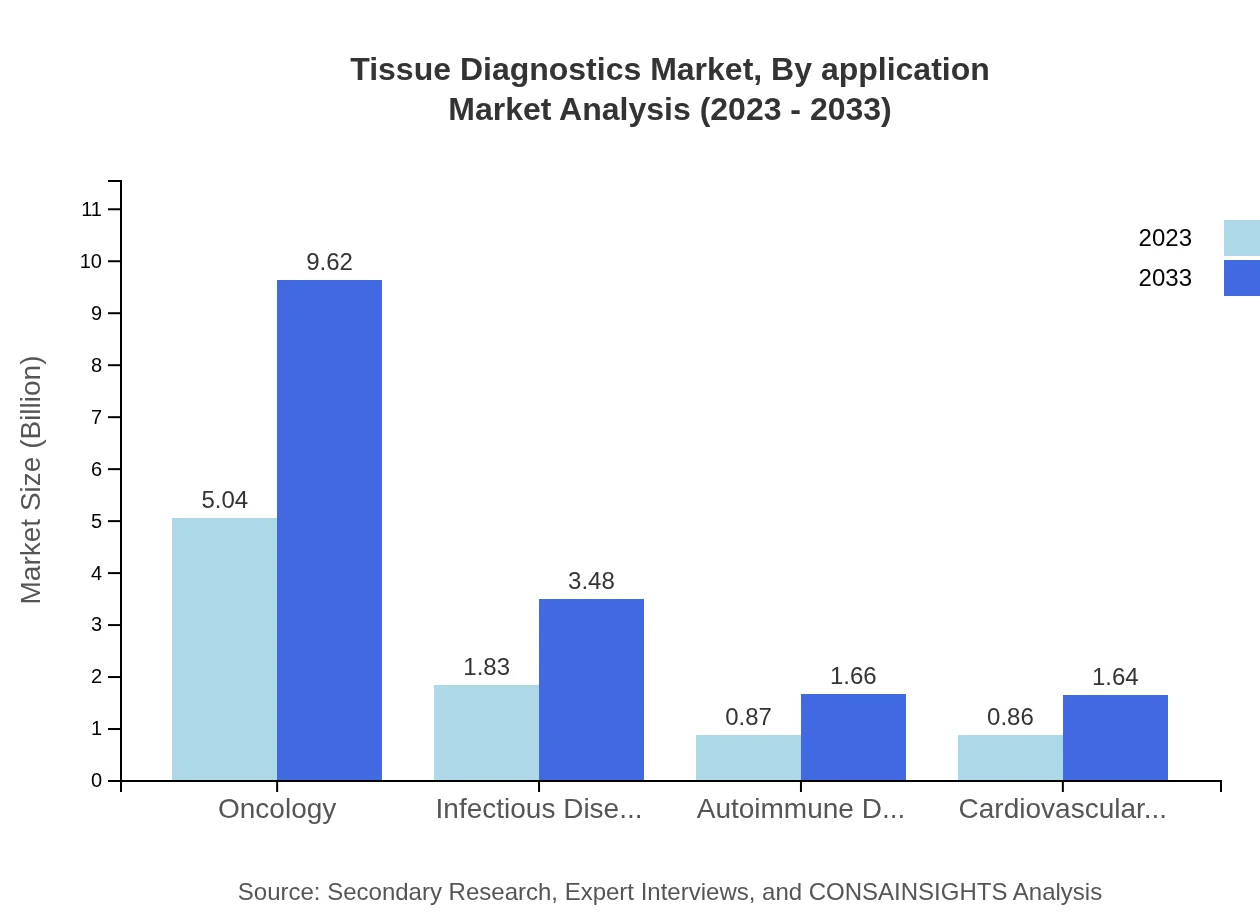

Tissue Diagnostics Market Analysis By Application

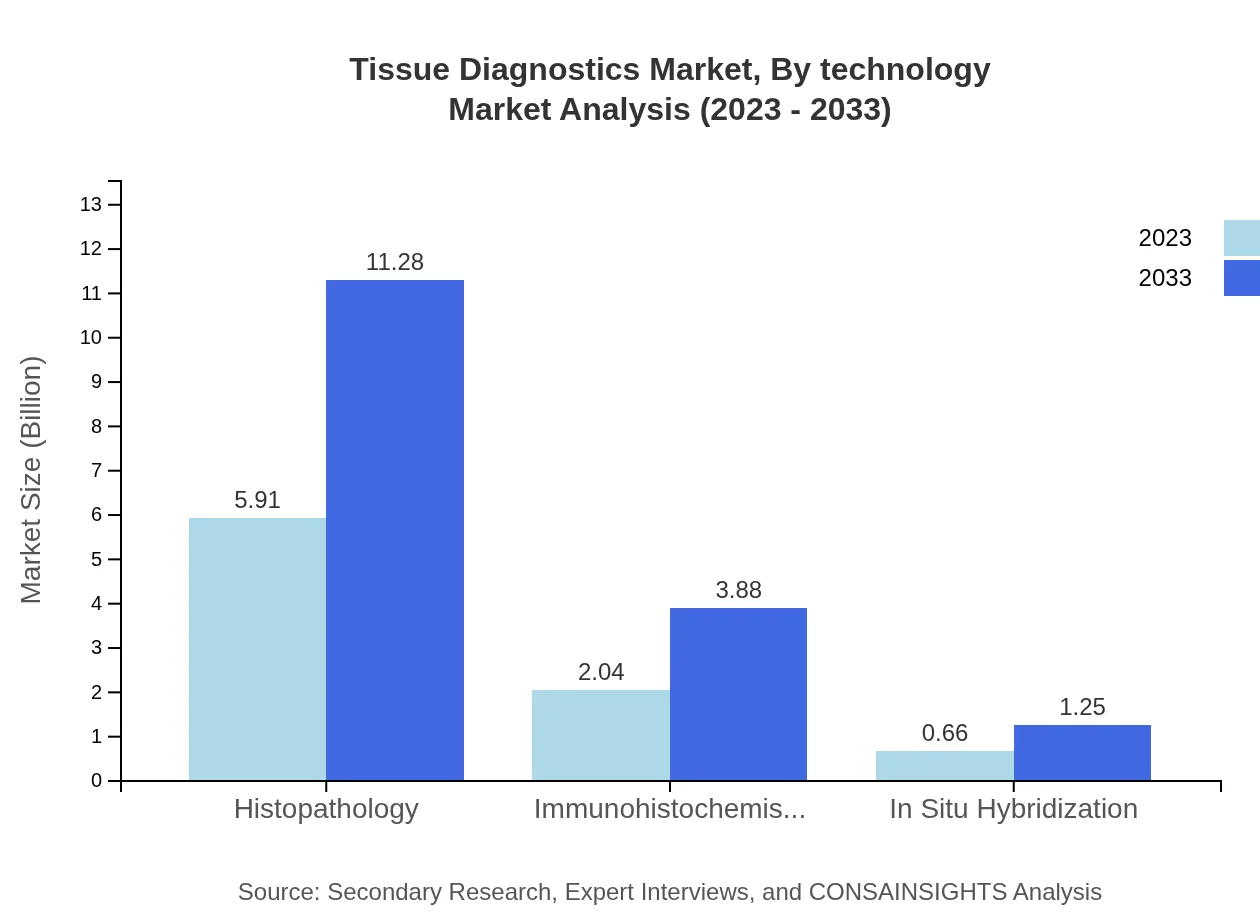

Key applications in the Tissue Diagnostics market include histopathology, which is projected to grow from USD 5.91 billion in 2023 to USD 11.28 billion by 2033, and immunohistochemistry, growing from USD 2.04 billion to USD 3.88 billion over the same period, underlining the sector's vital role in cancer diagnostics.

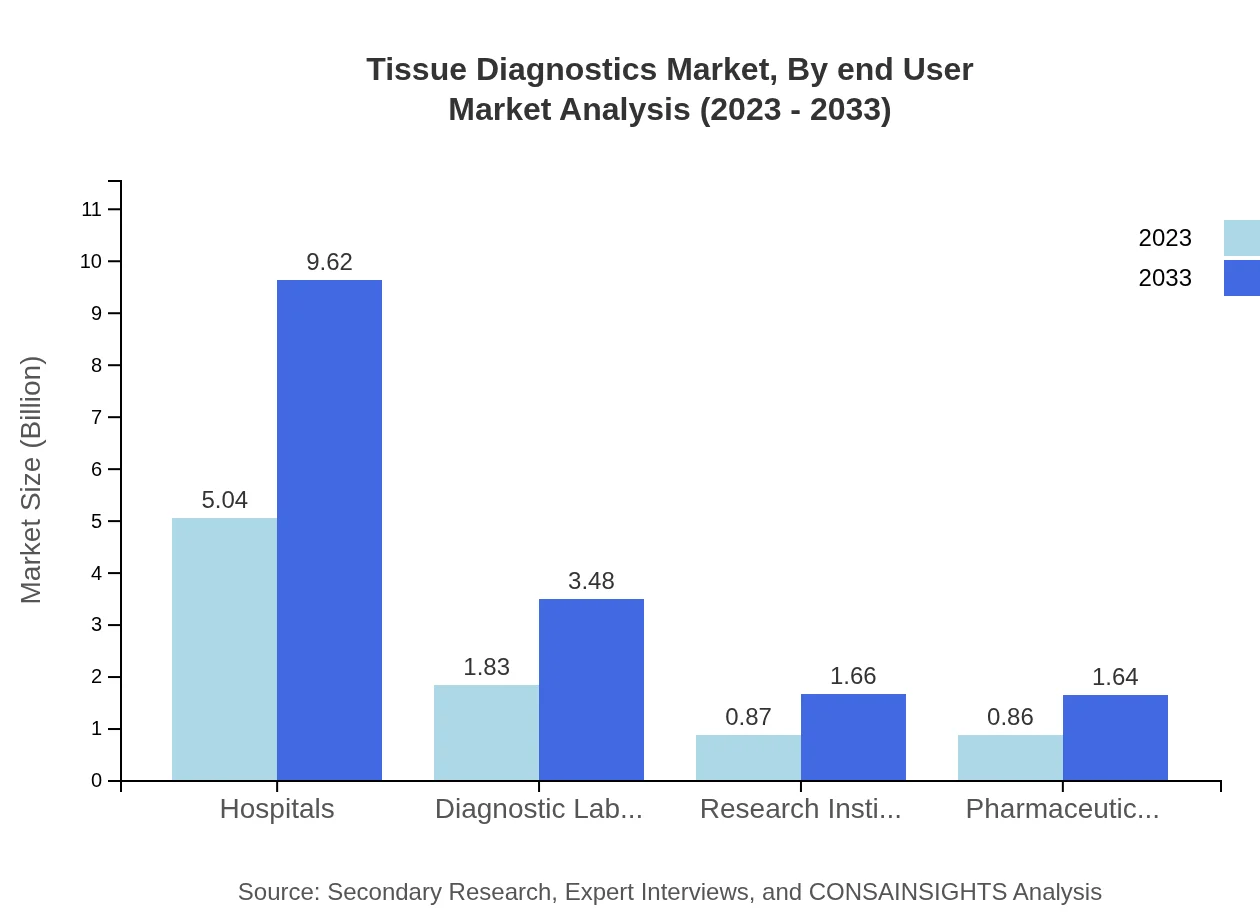

Tissue Diagnostics Market Analysis By End User

Hospitals account for a significant share of the market, valued at USD 5.04 billion in 2023 and expected to grow to USD 9.62 billion by 2033. Diagnostic laboratories and research institutes also play important roles, with forecasted growth from USD 1.83 billion to USD 3.48 billion, and from USD 0.87 billion to USD 1.66 billion, respectively.

Tissue Diagnostics Market Analysis By Technology

Innovative technologies such as AI and machine learning are increasingly making their way into the Tissue Diagnostics market, enhancing accuracy and efficiency in diagnostics. This segment reflects a growing trend towards automated and smart diagnostic solutions, addressing the needs for quicker and more reliable results.

Tissue Diagnostics Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Tissue Diagnostics Industry

Roche Diagnostics:

A leader in the diagnostics sector, providing a comprehensive portfolio of tissue diagnostics solutions across various applications.Thermo Fisher Scientific:

Known for offering a wide range of diagnostic instruments and consumables, contributing significantly to advancements in the Tissue Diagnostics industry.Abbott Laboratories:

Provides a diverse array of diagnostic products including those used in tissue diagnostics, reinforcing innovation in disease detection.Agilent Technologies:

Offers various solutions including high-quality tissue diagnostic instruments, with a focus on enhancing research capabilities.We're grateful to work with incredible clients.

FAQs

What is the market size of Tissue Diagnostics?

The global market size for Tissue Diagnostics is projected to reach approximately $8.6 billion by 2033, growing at a CAGR of 6.5% from 2023. This growth reflects increasing demand for diagnostic testing in healthcare.

What are the key market players or companies in the Tissue Diagnostics industry?

Key players in the Tissue Diagnostics industry include Roche Diagnostics, Agilent Technologies, Thermo Fisher Scientific, and Merck KGaA. These companies lead in innovative technologies and extensive product offerings, contributing significantly to market dynamics.

What are the primary factors driving the growth in the Tissue Diagnostics industry?

Growth in the Tissue Diagnostics industry is driven by technological advancements, rising incidence of chronic diseases, and increasing demand for personalized medicine. Furthermore, the integration of automation in diagnostics is enhancing efficiency and accuracy.

Which region is the fastest Growing in the Tissue Diagnostics?

The fastest-growing region in the Tissue Diagnostics market is North America, projected to grow from $3.10 billion in 2023 to $5.91 billion by 2033, driven by advanced healthcare infrastructure and high spending on healthcare services.

Does ConsaInsights provide customized market report data for the Tissue Diagnostics industry?

Yes, ConsaInsights offers customized market report data tailored to client specifications in the Tissue Diagnostics industry. This service ensures that specific insights and trends are addressed to meet unique business needs.

What deliverables can I expect from this Tissue Diagnostics market research project?

Deliverables include comprehensive market analysis reports, competitive landscape evaluations, market segmentation insights, and growth forecasts. Clients can expect actionable recommendations based on thorough data analysis.

What are the market trends of Tissue Diagnostics?

Current trends in the Tissue Diagnostics market include the rise of digital pathology, increasing adoption of advanced imaging technologies, and a growing focus on biomarkers for cancer diagnostics. Such trends enhance research capabilities and diagnostic accuracy.