Tissue Sealants Market Report

Published Date: 31 January 2026 | Report Code: tissue-sealants

Tissue Sealants Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Tissue Sealants market, covering key insights, trends, and data for the forecast period from 2023 to 2033. It includes market size, growth rates, segmentation, regional analysis, and profiles of global market leaders.

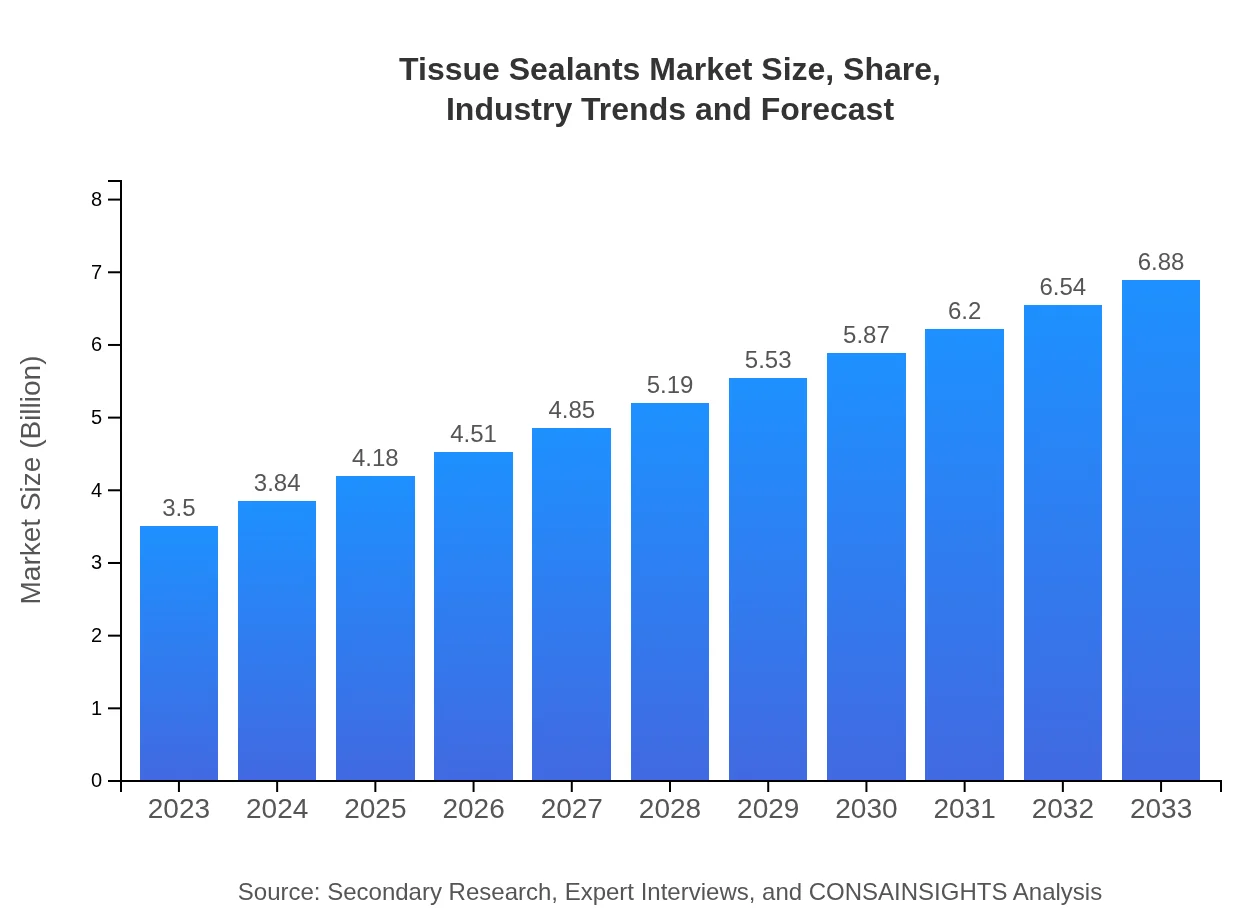

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $3.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $6.88 Billion |

| Top Companies | Johnson & Johnson, Medtronic , Baxter International, Biosynex |

| Last Modified Date | 31 January 2026 |

Tissue Sealants Market Overview

Customize Tissue Sealants Market Report market research report

- ✔ Get in-depth analysis of Tissue Sealants market size, growth, and forecasts.

- ✔ Understand Tissue Sealants's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Tissue Sealants

What is the Market Size & CAGR of Tissue Sealants market in 2023?

Tissue Sealants Industry Analysis

Tissue Sealants Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Tissue Sealants Market Analysis Report by Region

Europe Tissue Sealants Market Report:

Europe is estimated to progress from $0.92 billion in 2023 to $1.80 billion by 2033. Demand is driven by technological advancements in medical devices and an increasing focus on minimally invasive surgeries across countries such as Germany, France, and the UK.Asia Pacific Tissue Sealants Market Report:

In the Asia Pacific region, the Tissue Sealants market is anticipated to expand from $0.76 billion in 2023 to $1.49 billion by 2033. This growth is driven by increased healthcare spending, a rise in surgical procedures, and a growing elderly population, leading to higher demand for effective sealing solutions.North America Tissue Sealants Market Report:

North America remains a key market, projected to escalate from $1.28 billion in 2023 to $2.52 billion by 2033. The region benefits from advanced healthcare systems, high surgical procedure rates, and a strong presence of leading tissue sealant manufacturers.South America Tissue Sealants Market Report:

The South American market is expected to grow from $0.29 billion in 2023 to $0.57 billion in 2033. Factors influencing this market include rising healthcare awareness and improvement in medical infrastructure, particularly in Brazil and Argentina.Middle East & Africa Tissue Sealants Market Report:

The Middle East and Africa market is projected to grow from $0.25 billion in 2023 to $0.49 billion by 2033. Factors contributing to growth include improving healthcare infrastructure and rising awareness regarding advanced surgical techniques.Tell us your focus area and get a customized research report.

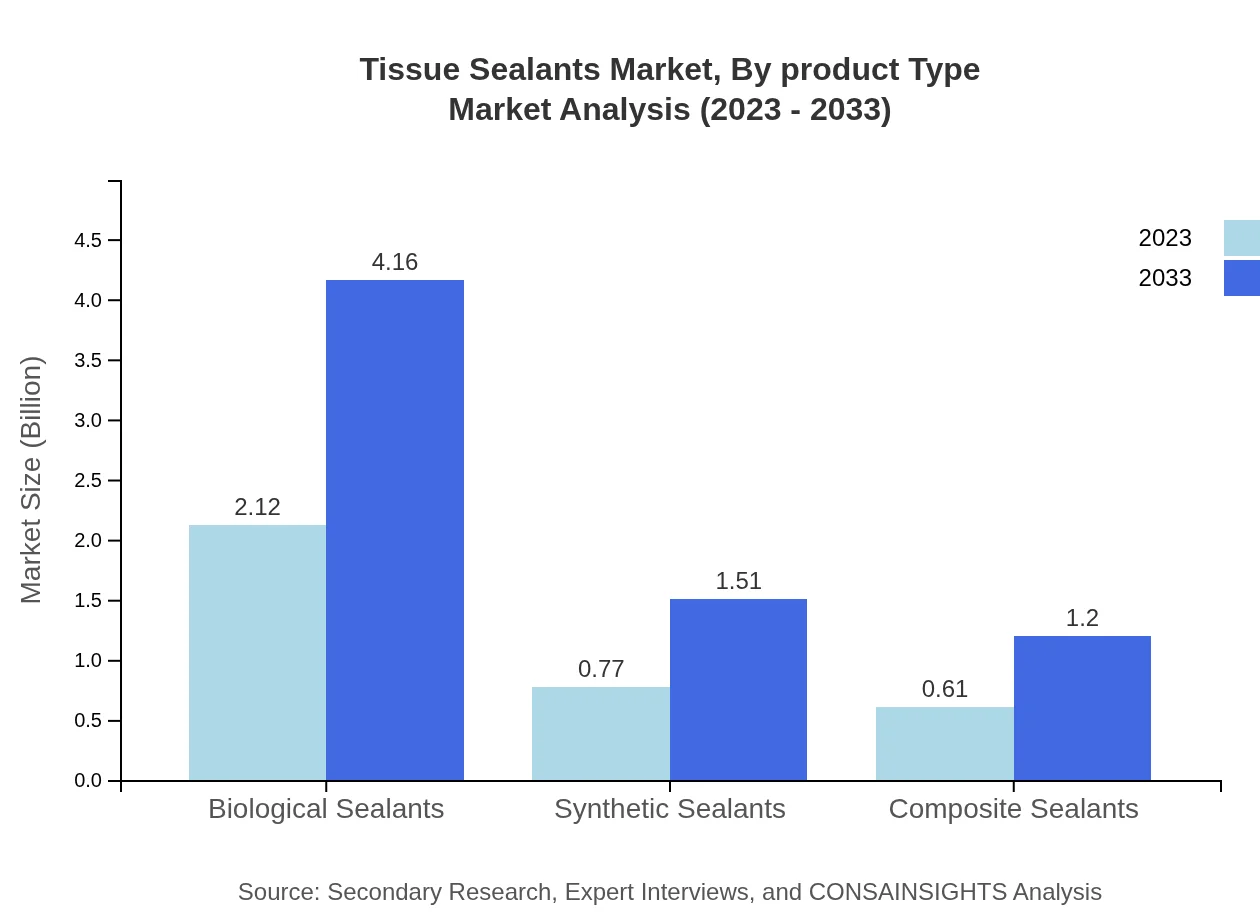

Tissue Sealants Market Analysis By Product Type

Biological sealants dominate the market with a size of $2.12 billion in 2023 and are expected to reach $4.16 billion by 2033, capturing a 60.53% market share. Synthetic sealants hold a segment size of $0.77 billion and are forecasted to grow to $1.51 billion, making up approximately 22% of the market. Composite sealants represent a smaller segment, expanding from $0.61 billion to $1.20 billion, accounting for about 17.47% of the total market.

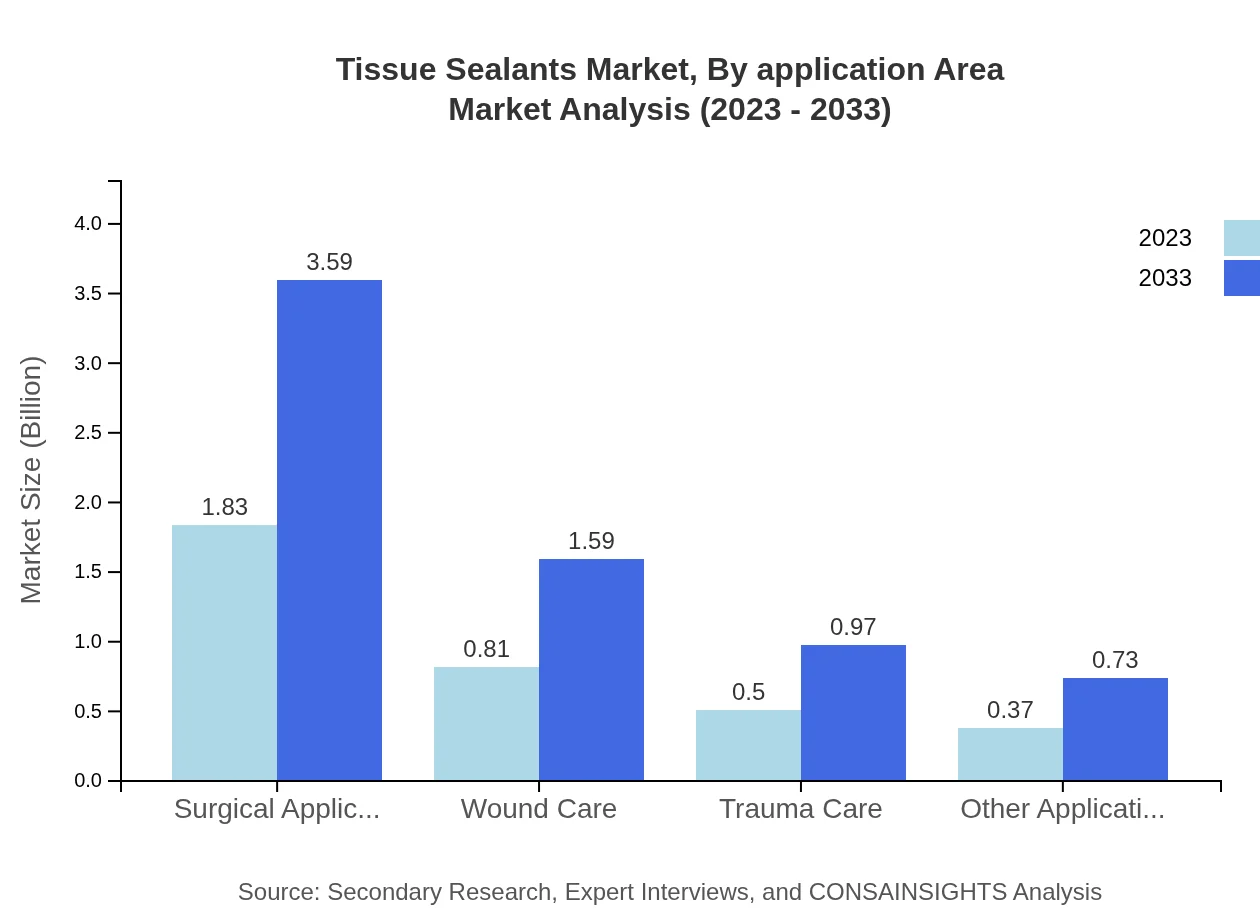

Tissue Sealants Market Analysis By Application Area

Surgical application is the most significant segment, with a market size of $1.83 billion in 2023, projected to expand to $3.59 billion by 2033, capturing a 52.16% share. Wound care applications follow closely, growing from $0.81 billion to $1.59 billion, contributing a share of 23.09%. Other applications, including trauma care and specialized care, also show promising growth in the coming years.

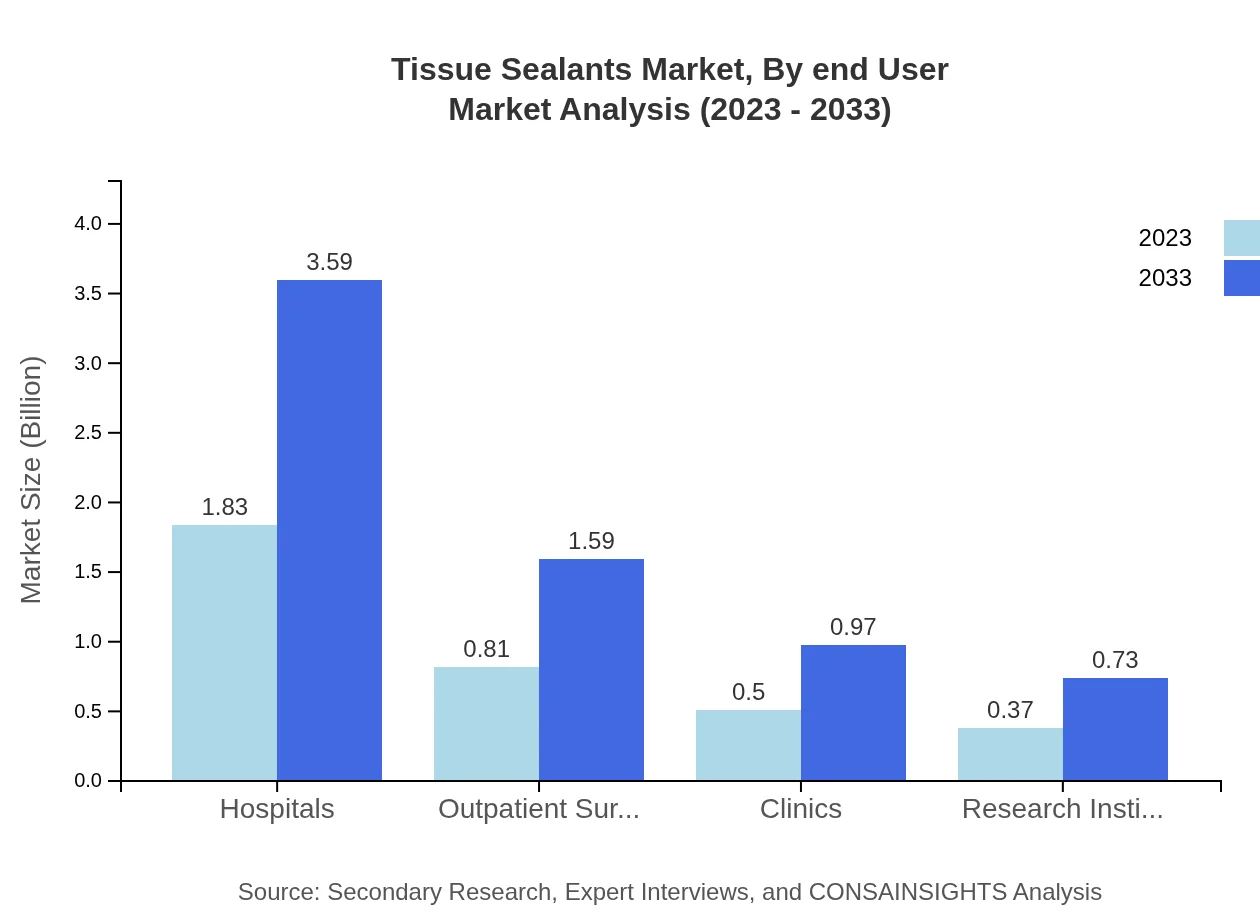

Tissue Sealants Market Analysis By End User

Hospitals are the largest end-users of tissue sealants, with a market size of $1.83 billion in 2023 and projecting to reach $3.59 billion by 2033, maintaining a share of 52.16%. Outpatient surgical centers and clinics are also significant users, expected to grow to $1.59 billion and $0.97 billion respectively by 2033. Research institutes also contribute to market growth, accelerating from $0.37 billion to $0.73 billion.

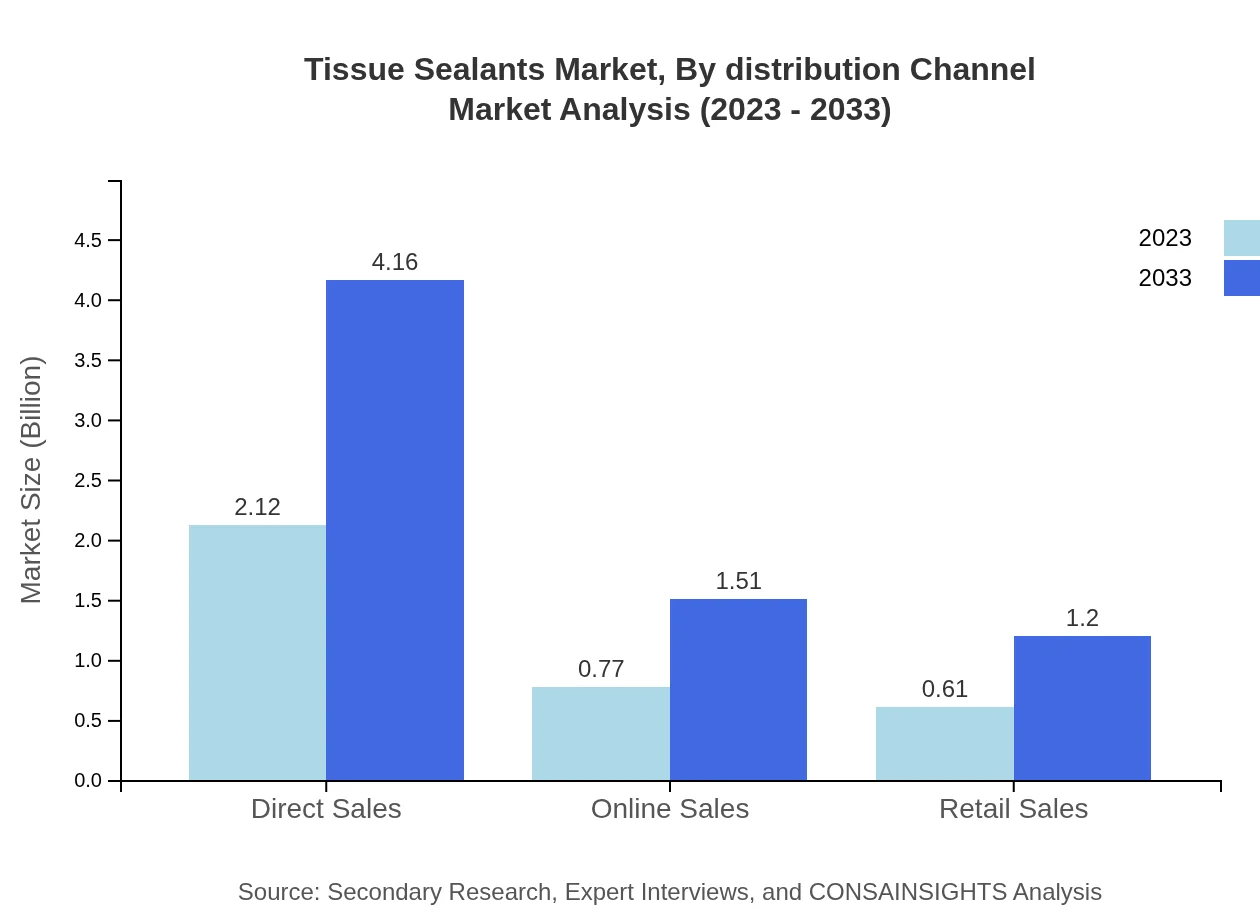

Tissue Sealants Market Analysis By Distribution Channel

The primary distribution channel for tissue sealants is direct sales, which currently holds a market size of $2.12 billion and is expected to reach $4.16 billion by 2033. Online sales and retail sales channels are also growing, with projected increases reflecting the overall growth of the market, from $0.77 billion to $1.51 billion and from $0.61 billion to $1.20 billion, respectively.

Tissue Sealants Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Tissue Sealants Industry

Johnson & Johnson:

A leader in the medical device sector, Johnson & Johnson provides a wide range of tissue sealants and has established a strong presence in surgical applications.Medtronic :

Medtronic is known for its innovative health solutions, including advanced tissue sealants, which enhance surgical outcomes and patient safety.Baxter International:

Baxter focuses on bio-surgery and offers a range of tissue sealants designed for effective adhesion and minimal reaction.Biosynex:

Biosynex develops innovative solutions in the medical field, including a variety of tissue sealant products aimed at various surgical applications.We're grateful to work with incredible clients.

FAQs

What is the market size of tissue Sealants?

The global tissue sealants market is valued at approximately $3.5 billion in 2023, with a projected CAGR of 6.8%. This growth is driven by increasing surgical procedures and advancements in medical technology, boosting demand for effective sealing solutions.

What are the key market players or companies in this tissue Sealants industry?

Key players in the tissue sealants market include Johnson & Johnson, B. Braun Melsungen AG, and Medtronic. These companies are leading the market by developing innovative products and expanding their global footprint to meet the increasing demand.

What are the primary factors driving the growth in the tissue Sealants industry?

The growth of the tissue sealants market is primarily driven by factors such as rising surgical volumes, advancements in surgical procedures, growing adoption of minimally invasive surgeries, and the increasing prevalence of chronic diseases that necessitate surgical interventions.

Which region is the fastest Growing in the tissue Sealants?

The Asia Pacific region is the fastest-growing market for tissue sealants, with a projected increase from $0.76 billion in 2023 to $1.49 billion by 2033. This growth is propelled by rising healthcare expenditure and expanding healthcare infrastructure.

Does ConsaInsights provide customized market report data for the tissue Sealants industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs of clients in the tissue-sealants industry, allowing for detailed insights into market dynamics, trends, and company benchmarking.

What deliverables can I expect from this tissue Sealants market research project?

Clients can expect comprehensive deliverables including market analysis reports, growth forecasts, competitive landscape assessments, and regional insights in the tissue sealants sector, facilitating informed decision-making.

What are the market trends of tissue sealants?

Key trends in the tissue sealants market include a shift towards biological sealants, increasing investments in R&D, growing demand in outpatient settings, and innovations in product formulations enhancing effectiveness and safety.